Interventional Cardiology Devices Market Size, Growth, Share & Trends Analysis

Interventional Cardiology Devices Market by Type [Stents (Drug-eluting Stent, Bare Metal Stent), Catheters (Angiography, Guiding, IVUS/OCT Catheter), Balloons, Plaque Modification Devices, Hemodynamic Flow Alteration], End User-Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global interventional cardiology devices market, valued at USD 29.41 billion in 2025, stood at USD 31.12 billion in 2026 and is projected to advance at a resilient CAGR of 6.4% from 2026 to 2031, culminating in a forecasted valuation of USD 42.39 billion by the end of the period. The global interventional cardiology devices market is primarily driven by the rising prevalence of cardiovascular diseases, including coronary artery disease and structural heart disorders, due to population aging, sedentary lifestyles, and the ongoing increases in diabetes and obesity. Minimally invasive catheter procedures are gradually replacing traditional open-heart surgeries, and device adoption is rising because these interventions are associated with shorter hospital stays, faster recovery, and lower complication rates. Moreover, rapid technological advancements, including new-generation drug-eluting stents, transcatheter heart valves, intravascular imaging (IVUS/OCT), physiology-guided diagnostic tools, and bioresorbable technologies, are contributing to procedural success and broadening the indications for treatment. In addition, increased government healthcare spending, the establishment of catheterization labs, and improved access to cardiac care in emerging markets play a major role in boosting the market. Together with favorable reimbursement policies in developed countries, growing patient awareness of early diagnosis and interventional treatment are among the factors that keep the global interventional cardiology devices market expanding.

KEY TAKEAWAYS

-

By Angioplasty Stent MarketBy the angioplasty stent market, the drug-eluting stents segment is expected to register the highest CAGR of 7.6% during the forecast period.

-

By Structural Heart Devices MarketBy the structural heart devices market, the other therapy devices segment is expected to dominate the market, with a share of 57.3% in 2025.

-

Catheters MarketBy the catheter market, the IVUS/OCT catheter segment is expected to register the highest CAGR of 6.7% during the forecast period.

-

Angioplasty Balloons MarketBy angioplasty balloons market, the old/normal balloons segment is expected to dominate the market, with a share of 64.2% in 2025.

-

Plaque Modification Devices MarketBy plaque modification devices market, the thrombectomy devices segment is expected to dominate the market, with a share of 64.1% in 2025.

-

Hemodynamic Flow Alteration Devices MarketBy the hemodynamic flow alteration devices market, the embolic protection devices segment is expected to register the highest CAGR of 6.4% during the forecast period.

-

Other Intercentional Cardiology Devices MarketBy other intercentional cardiology devices market, the guidewires segment is expected to register the highest CAGR of 5.4% during the forecast period.

-

By End userBy end user, the hospitals segment is expected to dominate the market, with a share of 83.1% in 2025.

-

Competitive Landscape - Key PlayersEdwards Lifesciences Corporation (US), Boston Scientific Corporation (US), Medtronic (US), Abbott (US), B. Braun SE (Germany), Terumo Corporation (Japan) were identified as some of the star players in the US interventional cardiology devices market, given their extensive reach in US and comprehensive product portfolios.

-

Competitive Landscape - StartupsInSitu Technologies Inc. (United States), Intravascular Imaging Incorporated (i3) (US), Agile Devices Inc. (US), Evident Vascular, Inc. (US) have distinguished themselves among startups and SMEs due to their specialized veterinary expertise and focused service capabilities.

The global interventional cardiology devices market is primarily driven by the rising worldwide prevalence of cardiovascular diseases, particularly coronary artery disease and other heart conditions requiring surgical intervention. These trends are linked to population aging, reduced physical activity, and higher rates of diabetes and obesity. The growing preference for minimally invasive catheter-based procedures over conventional open-heart surgeries is further boosting the market, owing to advantages such as shorter hospital stays, faster recovery, and lower procedural risk. Technological innovations, including next-generation drug-eluting stents, transcatheter heart valves, intravascular imaging and physiology-guided systems, and bioresorbable technologies, are raising the bar for accuracy and the range of treatable conditions. In addition, improvements in healthcare infrastructure in developing countries, the expansion of catheterization laboratories, and better access to advanced cardiac care in developing economies are supporting market growth. Meanwhile, developed regions benefit from favorable reimbursement policies, and rising awareness of early diagnosis and interventional treatment is helping the global interventional cardiology devices market continue its upward trend.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The global interventional cardiology devices market is experiencing a significant growth trend, driven by the convergence of clinical, technological, and care delivery sectors. The strong global movement toward less-invasive procedures performed via the radial artery—supported by patient benefits, faster recovery times, and lower overall healthcare costs—is guiding innovations in catheters, guidewires, stents, and vascular closure devices with smaller profiles. Rapid adoption of state-of-the-art intravascular imaging and physiology-guided assessment technologies, such as IVUS, OCT, and pressure-based diagnostics, is improving procedural accuracy and advancing the expansion of complex PCI and structural heart interventions into different parts of the world. The shift of selected procedures to outpatient and ambulatory care settings in developed markets, coupled with increased catheterization lab capacity in emerging economies, is fueling demand for efficient, cost-effective interventional devices. Additionally, the transformation of cath labs into digital environments—through AI-enabled imaging, workflow automation, and data-driven clinical decision support—is proving to be a major driver of growth. Meanwhile, value-based care models, pricing pressures, and evolving regulatory and clinical evidence requirements are intensifying competition; thus, medical device manufacturers will need to innovate, differentiate their portfolios, and pursue global partnerships and acquisitions at a faster pace.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing prevalence of cardiovascular diseases

-

Technological advancements in interventional cardiology procedures

Level

-

Availability of alternative treatments

-

Recall of products by industry participants

Level

-

Growing coronary stent demand in developing countries

-

Growing product launches by leading players in emerging economies

Level

-

Stringent regulatory requirements delaying approval of cardiac devices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing prevalence of cardiovascular diseases

The market for interventional cardiology devices is driven significantly by the rising occurrence of cardiovascular diseases globally. Conditions such as coronary artery disease, peripheral artery disease, and structural heart disorders are increasingly prevalent among aging populations and in those with unhealthy lifestyles, overweight, diabetes, and hypertension. Cardiovascular disease is the primary cause of illness and death in the United States. As a result, the country is witnessing a steady flow of diagnostic angiography and interventional procedures, including percutaneous coronary interventions and treatments for structural heart disorders, among others. The increase in disease complexity and coexisting medical conditions globally has led to greater use of advanced catheter-based therapies that are safe for high-risk and elderly patients. The continuous clinical demand, along with the preference of medical professionals for less invasive interventions and the well-established cath lab infrastructure, has been the driving force behind the acceptance of interventional cardiology devices, supporting market growth in both hospitals and outpatient care facilities.

Restraint: Availability of alternative treatments

The existence of different treatment alternatives is a major factor that hinders the Interventional cardiology device market growth is constrained because certain patient groups can be adequately treated with non-invasive therapies or surgery. Changes in drug therapies, including antiplatelet agents, lipid-lowering drugs, and new heart failure and antihypertensive drugs, may allow selection of patients with stable cardiovascular disease to postpone or reduce the need for catheter-based interventions. Moreover, in some cases, coronary artery bypass grafting (CABG) remains a more favorable option than interventional devices for treating complex multivessel or left main disease, limiting the use of these devices. Additionally, the combination of advanced non-invasive diagnostic and therapeutic technologies with improved preventive care and early disease detection is transforming procedural volumes in certain segments. Furthermore, the implementation of stricter clinical guidelines, cost-containment pressures from payers, and careful patient selection based on risk-benefit considerations continue to slow the adoption of interventional cardiology devices in the global market.

Opportunity: Growing coronary stent demand in developing countries

The upward trend in coronary stents usage is giving rise to substantial prospects for the interventional cardiology devices market which is mainly caused by the high incidence rate of coronary artery disease and the growing number of percutaneous coronary interventions carried out globally. The drug-eluting stents are still put in place as a treatment for most PCI procedures since they have been shown to be effective in reducing restenosis and repeat revascularization which promotes the demand for the existing products. Stent design innovation is going on unabated; for example thinner struts, advanced polymer coatings, bioresorbable and biodegradable materials, and improved drug delivery technologies are some of the factors that are turning the application of stents more widely to complex lesions and high-risk patient populations. Furthermore, strong physician familiarity, large amounts of clinical evidence, and positive reimbursement for stent-based interventions are all factors that have been encouraging the wider adoption of stents. The increasing number of geriatric patients being treated, those with multiple comorbidities, and continuous investments by the major players in the industry made in the development of next-generation coronary stent platforms and clinical trials, have all together been creating growth opportunities in the global interventional cardiology devices market.

Challenge: Stringent regulatory requirements delaying approval of cardiac devices

The strict regulatory approvals in the globally are to a large extent, responsible for the interventional cardiology devices market faces several challenges. These factors are indirectly lengthening the product development period and delaying the market introduction of new technologies. One of the key requirements the U.S. Food and Drug Administration (FDA) demands is that researchers conduct costly preclinical studies, followed by large clinical trials, and monitor the product in the market. These practices increase development budgets and constrain manufacturers' operations, making it take longer to bring new products to market. The requirements also slow the commercialization of next-generation stents, drug-eluting balloons, and advanced imaging catheters, and make clinical trials with patients and doctors very slow. Smaller and newer companies suffer the most from this scenario, as they possess limited financial and clinical resources. This may lower the level of competition and, consequently, reduce innovation. Thus, the constant cycle of long and complicated approval processes, high compliance costs, and unclear regulatory pathways is stalling product launches in the global market for interventional cardiology devices, which ultimately continues to create entry barriers.

INTERVENTIONAL CARDIOLOGY DEVICES MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Boston Scientific has, through its extensive interventional cardiology devices portfolio, got a footprint globally comprising coronary, peripheral, and structural heart procedures in the cath labs. Drug-eluting stents, angioplasty balloons, guidewires and structural heart solutions of the company are meant for the workshop of minimally invasive treatment of the most complex cardiovascular conditions which even include high-risk PCI and left atrial appendage closure. Not only has the company been putting in resources for device innovation and clinical trials globally to widen the area of applications and indications, but it also has plans for the same in future too. | Devices from Boston Scientific guarantee accurate procedures, lower rates of restenosis, and facilitate treatment of difficult lesions, thus helping to produce better long-term results and quicker patient recovery. Sturdy clinical proofs, doctor confidence, and the harmony with current cath lab infrastructure aid in the use of the product in hospitals and in the centers of ambulatory surgery. |

|

Abbott offers interventional cardiology options that include coronary stents, intravascular imaging, and physiologic assessment tools that help lead PCI procedures globally. Its combined platforms enable doctors to determine lesion seriousness, decide on stent location, and track results of the procedure during the operation. The technologies of Abbott are accepted broadly in the case of both standard and intricate coronary interventions. | The integration of imaging and physiology improves diagnostic accuracy and procedural decision-making, reducing unnecessary interventions and repeat procedures. This leads to improved patient outcomes, greater procedural efficiency, and strong alignment with value-based care initiatives in healthcare system. |

|

Medtronic's interventional cardiology products provide support for coronary and peripheral interventions by means of advanced stents, drug-coated balloons, and catheter-based delivery systems. They are developed not only for high-volume hospital cath labs but also for outpatient facilities, thus, covering a vast range of cardiovascular disease severity. | Medtronic's innovative technologies not only enhance the process of revascularization but also make it more secure and easier to carry out. As a result, these devices can be used even in tricky cases and with patients considered to be at high risk. The vastness of the company, its training programs, and its strong commitment to clinical research all contribute to securing the same level of procedural success across the board and gaining a wide acceptance in the global market. |

|

Through its pioneering in structural heart and transcatheter valve therapies, Edwards Lifesciences is firmly placed in the interventional cardiology market globally. The development of such devices for the treatment of the heart has been extremely successful. Their portfolio of new products, which includes the transcatheter aortic valve replacement (TAVR) procedure, is being applied in the U.S. cath labs and hybrid operating rooms for the least invasive treatment of complex valvular heart diseases, particularly in aortic and mitral valves. Moreover, the company’s TAVR systems, catheter-based delivery platforms, and hemodynamic monitoring solutions serve high-risk and intermediate-risk patient populations who are not candidates for open-heart surgery. | Valve interventions that are precise and minimally invasive are made possible by the devices from Edwards Lifesciences, which also lead to a lower risk of the procedure, shorter hospital stay, and quicker recovery time for the patient. Through clinical and long-term outcome data, the support for consistent hemodynamic performance, improved survival rates, and better quality of life is associated with them. |

|

Terumo holds a noteworthy position in the interventional cardiology market with a comprehensive range of access and PCI essentials — mainly radial access sheaths and introducers, guidewires, balloon angioplasty catheters, microcatheters, and contrast/flush systems used in catheterization labs. Its products are the primary choice for everyday percutaneous coronary interventions, radial-first programs, and complex lesion work where device trackability and support are critical. | The equipment of Terumo provides dependable deliverability, great torque response, and compact profiles that make it easier for the vessel to be navigated and accessed smoothly—particularly in radial interventions. They have made a commitment to radial-compatible systems which consequently leads to a decline in vascular complications, an increase in patient and hospital comfort, and decreased bed-stays. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The global market for interventional cardiology devices is a complex ecosystem comprising major players such as device manufacturers, hospitals, health care authorities, insurance firms, and clinical trial sites. However, all of these stakeholders support catheter-based cardiovascular treatments that are performed in large volumes across every region. Among the global players are Edwards Lifesciences, Boston Scientific, Medtronic, Abbott, Terumo, and others, which provide core products such as stents, balloon catheters, guidewires, atherectomy systems, and related devices. Production, quality control, and regulatory compliance across global markets involve contract manufacturers, component suppliers, sterilization providers, and packaging vendors. Hospitals, academic medical centers, and ambulatory and outpatient cardiac care facilities remain the primary end users of these products, and slow adoption is attributed to a lack of clinical evidence, inadequate physician training, insufficient reimbursement coverage, and incompatibility with existing catheterization laboratory infrastructure. Authorities and health technology assessment bodies from North America, Europe, and Asia-Pacific influence product approvals, pricing, and market access timelines, while professional communities and global clinical trial networks support the development of guidelines and the generation of evidence. Together, these forces create a market characterized by strong innovation pipelines, ongoing consolidation among major players, the spread of less invasive and radial-access procedures, and a rising focus on value-based care and long-term patient care outcomes.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Angioplasty Stent Market

In 2025, drug-eluting stents are dominating the angioplasty stents market. The interventional cardiology devices market has seen increasing use of drug-eluting stents (DES), driven by high and rising rates of coronary artery disease and a strong clinical preference for DES because of their lower rates of restenosis and revascularization compared with bare-metal stents. Continuous technological innovations—thinner struts, improved polymer coatings, and next-generation antiproliferative drugs—have made the procedure safer and yielded superior long-term results, encouraging the use of these stents in complex and high-risk PCI cases. Furthermore, favorable reimbursement policies, strong clinical evidence from large U.S. trials, and well-established cath lab infrastructure contribute to the rapid growth of DES use in hospitals and outpatient cardiac facilities.

Structural Heart Devices Market

In 2025, the aortic heart valve device dominated the structural heart valve devices market. The expansion of aortic heart valve devices is the main driver of growth in the structural heart devices market. Rising cases of aortic stenosis, especially among the elderly, are driving the adoption of transcatheter aortic valve replacement (TAVR) as a standard minimally invasive procedure, thereby reducing the relative importance of open-heart surgery. Strong clinical trial results demonstrating improved survival rates, shorter hospital stays, and faster recovery have led to TAVR's acceptance among intermediate- and low-risk patient groups. In addition, ongoing innovation and improvements in devices, an increasing number of skilled doctors, favorable reimbursement policies in developed countries, and patients' growing preference for less invasive procedures are all helping to accelerate market growth.

Catheters Market

In 2025, angiography catheters dominated the catheter market. The rising prevalence of cardiovascular diseases, a major driver of demand for diagnostic and interventional angiographic procedures, is a key factor behind the growth of the angiography catheters market. Innovations in catheter design, materials, and coating technologies have improved trackability, torque control, and patient safety, supporting broader clinical adoption. Additionally, the growing popularity of less invasive procedures, rising procedure volumes in hospitals and cath labs, and better access to modern imaging facilities are also contributing to higher demand for angiography catheters.

Angioplsty Balloons Market

In 2025, the old/normal balloons dominated the angioplasty balloons market. The growth of traditional (plain old balloon) angioplasty balloons is mainly attributed to their economic viability, universal applicability in clinics, and continued use in lesion preparation and post-dilatation procedures across routine PCI cases. These balloons remain the most attractive option in developing regions and other areas where price is a major factor, as well as in complex cases that require vessel sizing, stent optimization, or pre-stent dilatation. Moreover, their ease of handling, compatibility with various guidewires and catheters, and a performance record that assures consistency create continued demand, even as drug-coated and specialty balloons become more available.

Plaque Modification Devices Market

In 2025, Thrombectomy Devices dominated the plaque modification devices market. The rapid growth of thrombectomy devices in the plaque modification devices market has been driven mainly by the increasing occurrence of acute coronary syndromes and thrombus-rich lesions, which are common, especially in high-risk and complex PCI procedures. Rising acceptance of less invasive catheter-based treatments, along with increasing awareness among doctors of the advantages of thrombus removal in terms of better distal flow and fewer complications during the procedure, also supports demand. Moreover, the development of new technologies in aspiration and mechanical thrombectomy systems, the growing use of these systems in adjunctive PCI strategies, and the continued high volume of procedures in established cath lab infrastructures are some of the factors pushing the consumption of thrombectomy devices.

Hemodynamic Flow Alteration Devices Market

In 2025, Embolic Protection Devices dominated the Hemodynamic flow alteration devices market. The hemodynamic flow alteration devices market has been growing, driven by embolic protection devices (EPDs), as the number of complex interventional treatments, especially TAVR, carotid artery stenting, and high-risk PCI, increases, where the risk of distal embolization is high. Clinical efforts in stroke prevention and neuroprotection are intensifying, and wider adoption is being encouraged by growing procedural evidence and guideline awareness. Moreover, breakthroughs in filter and deflection technologies have expanded the use of EPDs into more structural heart interventions, so that, at times, even cardiac arrhythmia correction that is not part of the original procedure is performed with EPDs. The steady hospital focus on improving the safety and outcomes of procedures is also a fluctuating demand factor for embolic protection devices.

Other Interventional Cardiology Devices Market

In 2025, guidewires dominated the other interventional cardiology devices market. The other interventional cardiology devices market has seen the guidewires sector grow due to the volume of percutaneous coronary interventions remaining high and constant, with guidewires being necessary in almost all procedures. Moreover, the treatment of complex and chronic total occlusion (CTO) lesions is on the rise, and greater acceptance of radial access methods are together increasing the demand for sophisticated guidewires with excellent torque control, flexibility, and support. Also, factors such as continuous product innovation, frequent replacement of single-use products, strong cath lab infrastructure, and wider application in coronary and structural heart interventions are among the major reasons that have led to the market's growth.

End user

In 2025, hospitals dominated the interventional cardiology devices market by end user. They are the primary and major players in this market globally. Their growth is driven by high-volume, complex cardiac interventions, including PCI and structural heart procedures. This growth is further supported by rising cardiovascular disease prevalence, the adoption of advanced minimally invasive therapies such as TAVR and complex coronary interventions, and the presence of well-established cath lab infrastructure and skilled interventional cardiologists working in hospitals. Hospitals also benefit from good reimbursement for inpatient cardiac procedures, access to advanced imaging and hybrid operating rooms, and participation in clinical trials and physician training programs, which further accelerate market growth.

REGION

Heading

Paragraph Content

INTERVENTIONAL CARDIOLOGY DEVICES MARKET: COMPANY EVALUATION MATRIX

A matrix of the interventional cardiology devices market shows that the major players include Edwards Lifesciences, Medtronic, Boston Scientific, Abbott, and Terumo. These companies hold substantial market share across coronary, peripheral, and structural heart interventions, which they share among themselves. They have extensive clinical knowledge, broad and integrated device portfolios, strong relationships with physicians, and experience with global regulatory and reimbursement issues. Their leadership is complemented by continuous innovation in drug-eluting stents, balloon and guidewire technologies, intravascular imaging, embolic protection, and transcatheter valve systems. These innovations are backed by strong clinical trial pipelines and long-term outcome data. Additionally, large-scale manufacturing capacity, established compatibility with cath labs, and comprehensive physician training programs further strengthen their positions in the market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Boston Scientific Corporation (US)

- Medtronic (US)

- Abbott (US)

- Edwards Lifesciences Corporation (US)

- Terumo Corporation (US)

- Integer Holdings Corporation (US)

- Teleflex Incorporated (US)

- Penumbra, Inc. (US)

- Cook (US)

- Cordis (US)

- iVascular S.L.U (Spain)

- Biosensors International Group, Ltd (Singapore)

- Koninklijke Philips N.V. (Netherlands)

- InSitu Technologies, Inc. (US)

- Meril Life Sciences (India)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 29.41 BN |

| Market Forecast in 2031 (Value) | USD 42.39 BN |

| Growth Rate | CAGR of 6.4% from 2026–2031 |

| Years Considered | 2024–2031 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD Billion), Volume (Thousand/Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America and Middle East & Africa |

| Related Segment & Geographic Reports | US Interventional Cardiology Devices Market |

WHAT IS IN IT FOR YOU: INTERVENTIONAL CARDIOLOGY DEVICES MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | A thorough comparison of major interventional cardiology device categories was completed in the global market where coronary stents (DES, BMS, and bioresorbable scaffolds), balloon catheters (PTCA, cutting, and drug-coated balloons), guidewires, atherectomy devices (rotational, orbital, and laser), intravascular imaging systems (IVUS, and OCT), hemodynamic support devices, and structural heart intervention tools were included. Technological improvements like, thinner strut DES, polymer-free and biodegradable coatings, next-generation drug-elution technologies, image-guided PCI, and AI-enabled cath lab integration were evaluated. In addition, the regulatory pathways (FDA PMA and 510(k)), reimbursement dynamics, clinical outcomes, safety profiles, and the differentiation strategies adopted by leading manufacturers were all analyzed in depth. | The approach allowed the customers to determine which interventional cardiology technologies were most effective clinically and, at the same time, were the most profitable ones commercially through the analysis of procedural outcomes, physician's preference, and patient risk profiles. Imaging-guided PCI, drug-coated balloons, and complex lesion management tools were the main topics in the decision-making process regarding the adoption of new technologies. Product development and portfolio expansion strategies were helped to be aligned with changing trends such as less invasive procedures, more complicated coronary interventions, and demand for better long-term restenosis reduction through alignment. |

| Company Information | Created detailed profiles of the leading players, among which are the US and global companies, that are active in the US market of interventional cardiology devices such as Edwards Lifesciences, Boston Scientific, Medtronic, Terumo Corporation, Philips, GE HealthCare, Abbott and Johnson & Johnson (Cordis). Evaluated the product offerings of each company, their proprietary technologies, R&D pipelines, clinical trials, manufacturing presence, regulatory approvals, and alliances. Analyzed each company's competitive position in stents, atherectomy systems, and structural heart solutions, as well as the recent mergers and acquisitions and co-development partnerships that the industry has seen. | Gave a lucid perception of the competitive positioning, technological leadership, and ecosystem partnerships throughout the interventional cardiology domain. Helped customers in evaluating vendors and possible allies for stents, catheters, imaging systems, and combination technologies. Backed up strategic decisions regarding licensing, co-development, distribution partnerships, and acquisition targeting while making explicit the long-term growth strategies and the differentiation in the high-growth segments like complex PCI and structural heart interventions. |

| Geographic Analysis | Interventional cardiology devices market was analyzed by regional dynamics with a focus on high-procedure-volume regions and hubs including North America, Europe and Asia Pacific. The study took into account various factors such as adoption trends in hospitals and ambulatory surgical centers (ASC), reimbursement differences, physician density, cath lab infrastructure, and the role of value-based care models. It also looked into the presence of regional centers of excellence, innovation clusters, and manufacturing or R&D footprints. Moreover, adaptability for region-specific or global comparisons across Europe, APAC, LATAM, and MEA is offered upon client request. | Strategic market planning was upgraded with the identification of high-growth areas, procedure hotspots, and reimbursement environments globally. Market entrance, the qualities of the sales team, the selection of clinical trial sites, and the alliances with the best hospitals were supported decisions. The clients were helped to take advantage of the trends that the outpatient PCI growth, ASC expansion, and increasing demand for advanced imaging and structural heart procedures brought about, thereby strengthening their capability to scale or expand not only in the US but also worldwide. |

RECENT DEVELOPMENTS

- July 2025 : Medtronic announced it has entered into an exclusive U.S. distribution agreement with Japan-based Future Medical Design Co., Ltd. (FMD) to sell specialty and workhorse peripheral guidewires. This agreement includes the first 400 cm, 0.018" peripheral guidewire available in the U.S, expanding the Medtronic portfolio for transradial access for the treatment of peripheral arterial disease (PAD).

- March 2024 : Boston Scientific Corporation announced it has received U.S. Food and Drug Administration (FDA) approval for the AGENT Drug-Coated Balloon (DCB), which is indicated to treat coronary in-stent restenosis (ISR) in patients with coronary artery disease. ISR is the obstruction or narrowing of a stented vessel by plaque or scar tissue.

- April 2023 : Abbott completed the acquisition of Cardiovascular Systems, Inc. (CSI), a medical device company with an innovative atherectomy system used in treating peripheral and coronary artery disease.

Table of Contents

Methodology

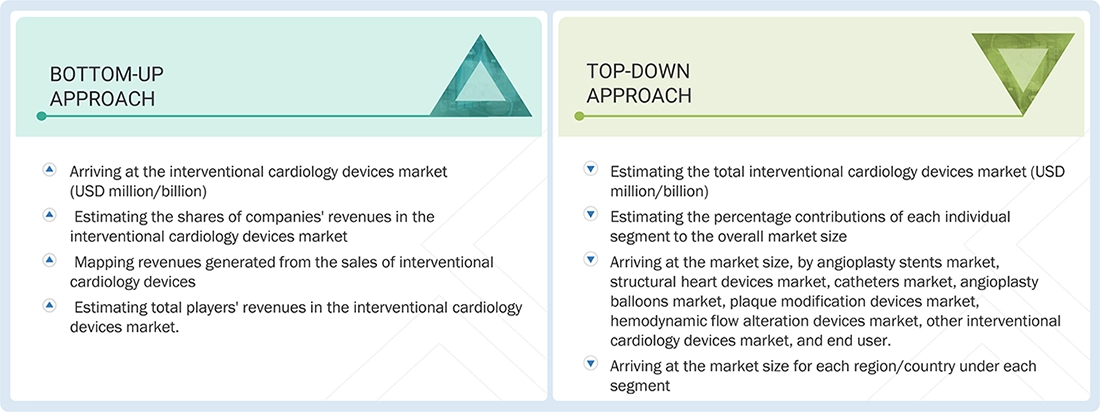

This study involved four major activities to estimate the size of the interventional cardiology devices market. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. A bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

The secondary research process relied extensively on secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the interventional cardiology devices market. It was also used to obtain important information about the key players, market classification, and segmentation according to industry trends down to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

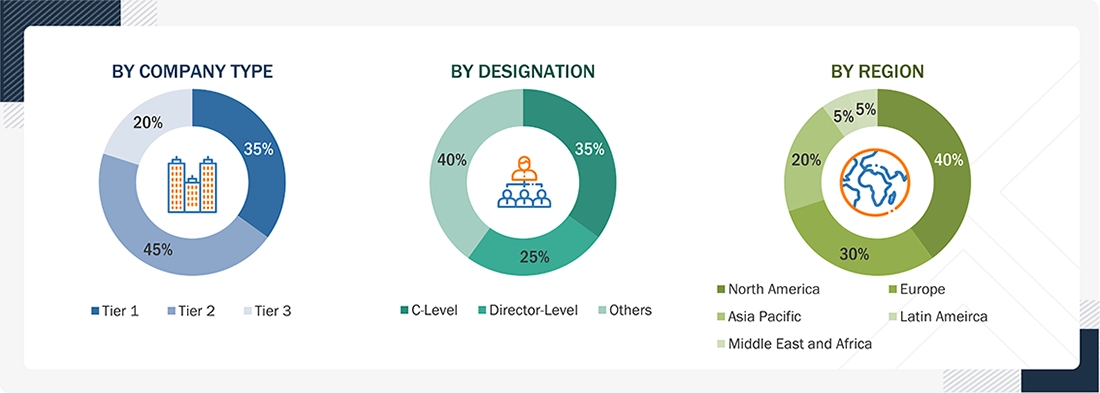

Primary Research

In the primary research process, interviews were conducted with sources from both the supply and demand sides to gather qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and other key executives from various companies and organizations operating in the interventional cardiology devices market. The primary sources from the demand side included industry experts, purchasing & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players, and gather insights into key industry trends and market dynamics.

Breakdown of Primary Interview

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2025: Tier 1= > USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3= < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the interventional cardiology devices market includes the following details.

The market sizing was undertaken globally.

Country-level Analysis: The size of the interventional cardiology devices market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products and services in the overall interventional cardiology devices market was obtained from secondary data and validated by primary participants to arrive at the total interventional cardiology devices market. Primary participants further validated the numbers.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end user and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated with industry experts contacted during primary research. Given the limitations of data available from secondary research, revenue estimates for individual companies (for the overall interventional cardiology devices market and geographic market assessment) were derived from a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of leading players in a particular region or country.

Interventional Cardiology Devices Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size—using the market size estimation processes explained above—the market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for each market segment and subsegment, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by analyzing various factors and trends from both the demand and supply sides.

Market Definition

The interventional cardiology devices market comprises medical devices used in minimally invasive procedures to diagnose and treat cardiovascular conditions, particularly those involving the coronary arteries and heart valves. This market includes a range of devices such as stents, balloons, catheters, guidewires, and other adjunctive equipment essential for procedures like angioplasty, atherectomy, and transcatheter valve replacements.

Key Stakeholders

- Manufacturers of interventional cardiology devices

- Interventional cardiology device distributors

- Healthcare service providers

- Various research associations related to interventional cardiology devices

- Research institutes

- Venture capitalists and investors

- Various research and consulting companies

- World Health Organization (WHO)

- Organization for Economic Co-operation and Development (OECD)

- National Institutes of Health (NIH)

- Centers for Disease Control and Prevention (CDC)

- Annual Reports/SEC Filings, Investor Presentations, and Press Releases of Key Players

- White Papers, Journals/Magazines, and News Articles

- Paid Databases, such as Factiva, D&B Hoovers, and Bloomberg Business

Report Objectives

- To define, describe, segment, and forecast the interventional cardiology devices market by angioplasty stents, structural heart devices, catheters, angioplasty balloons, plaque modification devices, hemodynamic flow alteration devices, other devices & end user, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall interventional cardiology devices market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the interventional cardiology devices market in five main regions (along with their respective key countries), namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the interventional cardiology devices market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions, product launches, expansions, collaborations, agreements, partnerships, and R&D activities of the leading players in the interventional cardiology devices market

- To benchmark players within the interventional cardiology devices market using the competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available customizations:

Based on the given market data, MarketsandMarkets offers customizations tailored to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of the Rest of Asia Pacific interventional cardiology devices market into Thailand, Indonesia, Philippines, Vietnam, Hong Kong, and other countries

- Further breakdown of the Rest of Europe interventional cardiology devices market into Belgium, Russia, the Netherlands, Switzerland, and other countries.

- Further breakdown of the Rest of Latin America interventional cardiology devices market into Argentina, Peru, and other countries

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Interventional Cardiology Devices Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Interventional Cardiology Devices Market

Siri

May, 2022

what are the growth opportunities in interventional cardiovascular devices market.

Benjamin

Mar, 2022

Looking forward to gain more insights on the global Interventional Cardiology Devices Market.

Samuel

Mar, 2022

Can you enlighten us on geographical growth analysis in Interventional Cardiology Devices Market?.