TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 89)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.3.3 CURRENCY CONSIDERED

1.4 RESEARCH LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY (Page No. - 94)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

FIGURE 2 BIOMATERIALS MARKET: BREAKDOWN OF PRIMARIES

2.2 MARKET SIZE ESTIMATION

FIGURE 3 BIOMATERIALS INDUSTRY SIZE ESTIMATION (SUPPLY-SIDE ANALYSIS), 2023

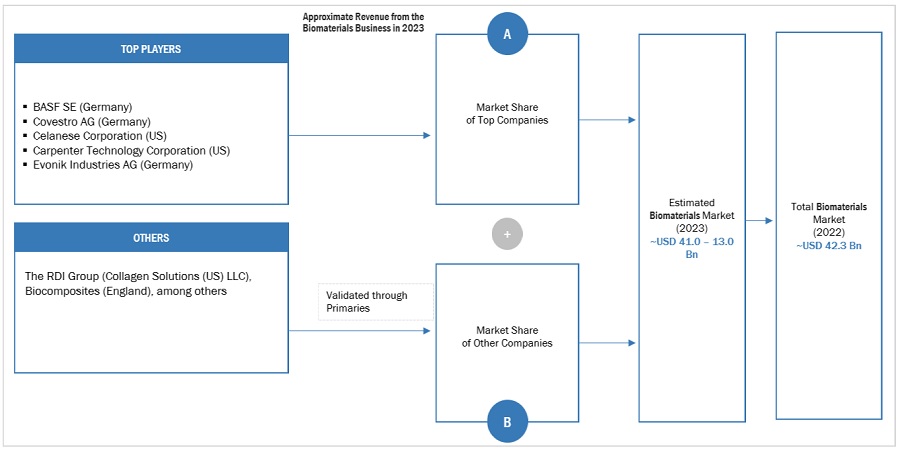

FIGURE 4 MARKET SIZE ESTIMATION: APPROACH 1 (REVENUE SHARE ANALYSIS), 2023

FIGURE 5 ILLUSTRATIVE EXAMPLE OF BASF SE: REVENUE SHARE ANALYSIS, 2023

2.2.1 INSIGHTS FROM PRIMARIES

FIGURE 6 MARKET VALIDATION FROM PRIMARY EXPERTS

2.2.2 SEGMENT ASSESSMENT (BY TYPE AND APPLICATION)

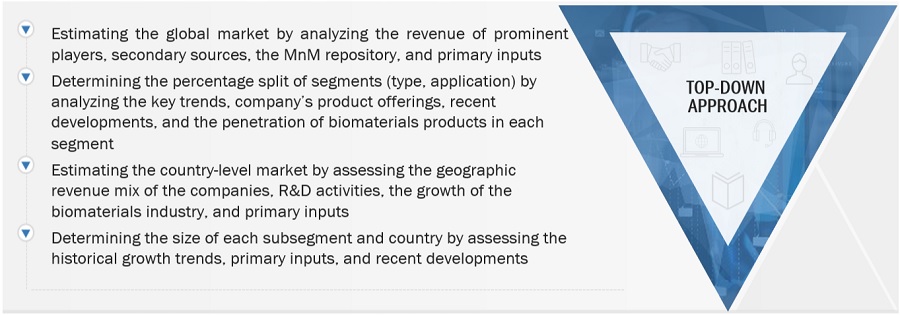

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 GROWTH RATE ASSUMPTIONS

FIGURE 8 BIOMATERIALS INDUSTRY: CAGR PROJECTIONS, 2024–2029

FIGURE 9 MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.5 STUDY ASSUMPTIONS

2.6 RISK ANALYSIS

2.7 IMPACT OF ECONOMIC RECESSION ON MARKET

TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2021–2028 (% GROWTH)

TABLE 2 US HEALTH EXPENDITURE, 2019–2022 (USD MILLION)

TABLE 3 US HEALTH EXPENDITURE, 2023–2027 (USD MILLION)

3 EXECUTIVE SUMMARY (Page No. - 106)

FIGURE 11 BIOMATERIALS MARKET, BY TYPE, 2024 VS 2029 (USD BILLION)

FIGURE 12 BIOMATERIALS INDUSTRY FOR METALLIC BIOMATERIALS, BY TYPE, 2024 VS. 2029 (USD MILLION)

FIGURE 13 MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2024 VS. 2029 (USD MILLION)

FIGURE 14 REGIONAL SNAPSHOT OF MARKET

4 PREMIUM INSIGHTS (Page No. - 110)

4.1 BIOMATERIALS MARKET OVERVIEW

FIGURE 15 INCREASING DEMAND FOR IMPLANTABLE DEVICES TO DRIVE MARKET

4.2 NORTH AMERICA: BIOMATERIALS INDUSTRY, BY TYPE AND COUNTRY (2023)

FIGURE 16 US AND METALLIC BIOMATERIALS COMMANDED LARGEST SHARE IN NORTH AMERICAN MARKET IN 2023

4.3 MARKET, BY TYPE

FIGURE 17 METALLIC BIOMATERIALS TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

4.4 MARKET, BY APPLICATION

FIGURE 18 ORTHOPEDIC SEGMENT TO GROW AT HIGHEST CAGR DURING STUDY PERIOD

5 MARKET OVERVIEW (Page No. - 114)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 BIOMATERIALS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing demand for biomaterials in wound healing and plastic surgery

5.2.1.2 Growing use of biomaterials in various therapeutic areas

5.2.1.3 Rising funding and investments in regenerative and personalized medicine

5.2.1.4 Growing demand for implantable devices

5.2.2 RESTRAINTS

5.2.2.1 Biocompatibility issues

5.2.3 OPPORTUNITIES

5.2.3.1 Growing interest in bioabsorbable biomaterials

5.2.3.2 Expanding healthcare market in emerging economies

5.2.3.3 Rising opportunities in personalized, smart, nanoengineered, and sustainable biomaterials

5.2.4 CHALLENGES

5.2.4.1 Durability and long-term performance issues

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 20 BIOMATERIALS INDUSTRY: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.4 PRICING ANALYSIS

5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT

TABLE 4 AVERAGE SELLING PRICE OF BIOMATERIAL PRODUCTS

TABLE 5 AVERAGE SELLING TREND OF BIOMATERIAL PRODUCTS, BY REGION

5.5 VALUE CHAIN ANALYSIS

FIGURE 21 MARKET: VALUE CHAIN ANALYSIS

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 22 MARKET: SUPPLY CHAIN ANALYSIS

TABLE 6 MARKET: SUPPLY CHAIN ANALYSIS

5.7 ECOSYSTEM ANALYSIS

FIGURE 23 MARKET: ECOSYSTEM/MARKET MAP

5.7.1 METALLIC BIOMATERIALS VENDORS

TABLE 7 METALLIC BIOMATERIALS VENDORS

5.7.2 CERAMIC BIOMATERIALS VENDORS

TABLE 8 CERAMIC BIOMATERIALS VENDORS

5.7.3 POLYMERIC BIOMATERIALS VENDORS

TABLE 9 POLYMERIC BIOMATERIALS VENDORS

5.7.4 NATURAL BIOMATERIALS VENDORS

TABLE 10 NATURAL BIOMATERIALS VENDORS

5.7.5 BIOMATERIALS END USERS

TABLE 11 BIOMATERIALS END USERS

5.7.6 BIOMATERIALS REGULATORY BODIES

TABLE 12 BIOMATERIALS REGULATORY BODIES

5.8 TECHNOLOGY ANALYSIS

5.9 PATENT ANALYSIS

5.9.1 METHODOLOGY

5.9.2 PATENTS FILED, BY DOCUMENT TYPE, 2014–2024

TABLE 13 PATENTS FILED, 2014–2024

5.9.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 24 TOTAL NUMBER OF PATENTS GRANTED, 2014–2023

5.9.4 TOP APPLICANTS

FIGURE 25 TOP TEN PLAYERS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2014–2024

FIGURE 26 REGIONAL ANALYSIS OF PATENTS GRANTED, 2014–2024

TABLE 14 TOP 12 PATENT OWNERS IN BIOMATERIALS INDUSTRY, 2014–2024

TABLE 15 PATENTS IN MARKET, 2023

5.10 TRADE DATA

5.10.1 STAINLESS STEEL

TABLE 16 IMPORT VALUE FOR STAINLESS STEEL, 2018–2022 (USD)

TABLE 17 EXPORT VALUE FOR STAINLESS STEEL, 2018–2022 (USD)

TABLE 18 IMPORT VOLUME FOR STAINLESS STEEL, 2018–2022 (TONS)

TABLE 19 EXPORT VOLUME FOR STAINLESS STEEL, 2018–2022 (TONS)

5.10.2 SILVER

TABLE 20 IMPORT VALUE FOR SILVER, 2018–2022 (USD)

TABLE 21 EXPORT VALUE FOR SILVER, 2018–2022 (USD)

TABLE 22 IMPORT VOLUME FOR SILVER, 2018–2022 (TONS)

TABLE 23 EXPORT VOLUME FOR SILVER, 2018–2022 (TONS)

5.10.3 ALUMINUM OXIDE

TABLE 24 IMPORT VALUE FOR ALUMINUM OXIDE, 2018–2022 (USD)

TABLE 25 EXPORT VALUE FOR ALUMINUM OXIDE, 2018–2022 (USD)

TABLE 26 IMPORT VOLUME FOR ALUMINUM OXIDE, 2018–2022 (TONS)

TABLE 27 EXPORT VOLUME FOR ALUMINUM OXIDE, 2018–2022 (TONS)

5.10.4 SILICONE

TABLE 28 IMPORT VALUE FOR SILICONE, 2018–2022 (USD)

TABLE 29 EXPORT VALUE FOR SILICONE, 2018–2022 (USD)

TABLE 30 IMPORT VOLUME FOR SILICONE, 2018–2022 (TONS)

TABLE 31 EXPORT VOLUME FOR SILICONE, 2018–2022 (TONS)

5.10.5 CELLULOSE

TABLE 32 IMPORT VALUE FOR CELLULOSE, 2018–2022 (USD)

TABLE 33 EXPORT VALUE FOR CELLULOSE, 2018–2022 (USD)

TABLE 34 IMPORT VOLUME FOR CELLULOSE, 2018–2022 (TONS)

TABLE 35 EXPORT VOLUME FOR CELLULOSE, 2018–2022 (TONS)

5.10.6 GELATIN

TABLE 36 IMPORT VALUE FOR GELATIN, 2018–2022 (USD)

TABLE 37 EXPORT VALUE FOR GELATIN, 2018–2022 (USD)

TABLE 38 IMPORT VOLUME FOR GELATIN, 2018–2022 (TONS)

TABLE 39 EXPORT VOLUME FOR GELATIN, 2018–2022 (TONS)

5.11 KEY CONFERENCES & EVENTS IN 2024–2025

TABLE 40 BIOMATERIALS CONFERENCES IN 2024–2025

5.12 REGULATORY LANDSCAPE

5.12.1 FDA REGULATIONS ON BIOMATERIALS

5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 41 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 42 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 43 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 44 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 45 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.13.1 THREAT OF NEW ENTRANTS

5.13.2 THREAT OF SUBSTITUTES

5.13.3 BARGAINING POWER OF BUYERS

5.13.4 BARGAINING POWER OF SUPPLIERS

5.13.5 DEGREE OF COMPETITION

5.14 KEY STAKEHOLDERS & BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 46 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

5.14.2 BUYING CRITERIA FOR BIOMATERIAL PRODUCTS

FIGURE 27 KEY BUYING CRITERIA FOR END USERS

TABLE 47 KEY BUYING CRITERIA FOR TOP THREE END USERS

6 BIOMATERIALS MARKET, BY TYPE (Page No. - 161)

6.1 INTRODUCTION

TABLE 48 IMPORTANT PROPERTIES OF BIOMATERIALS, BY APPLICATION

TABLE 49 BIOMATERIALS INDUSTRY, BY TYPE, 2022–2029 (USD MILLION)

6.2 METALLIC BIOMATERIALS

TABLE 50 MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 51 MARKET FOR METALLIC BIOMATERIALS, BY REGION, 2022–2029 (USD MILLION)

6.2.1 STAINLESS STEEL

6.2.1.1 Stainless steel to command largest share in metallic biomaterials segment during forecast period

TABLE 52 STAINLESS STEEL MARKET, BY REGION, 2022–2029 (USD MILLION)

6.2.2 TITANIUM & TITANIUM ALLOYS

6.2.2.1 Growing number of joint replacement procedures to aid segment growth

TABLE 53 TITANIUM & TITANIUM ALLOYS MARKET, BY REGION, 2022–2029 (USD MILLION)

6.2.3 COBALT-CHROME ALLOYS

6.2.3.1 Low cost and high corrosion resistance to propel segment growth

TABLE 54 COBALT-CHROME ALLOYS MARKET, BY REGION, 2022–2029 (USD MILLION)

6.2.4 SILVER

6.2.4.1 Toxic properties and low aesthetic appeal to limit segment growth

TABLE 55 SILVER MARKET, BY REGION, 2022–2029 (USD MILLION)

6.2.5 GOLD

6.2.5.1 Increasing use in drug delivery, gene therapy, diagnosis, and tissue regeneration to drive segment

TABLE 56 GOLD MARKET, BY REGION, 2022–2029 (USD MILLION)

6.2.6 MAGNESIUM

6.2.6.1 High biocompatibility and low weight to support market growth

TABLE 57 MAGNESIUM MARKET, BY REGION, 2022–2029 (USD MILLION)

6.2.7 OTHER METALLIC BIOMATERIALS

TABLE 58 OTHER METALLIC BIOMATERIALS MARKET, BY REGION, 2022–2029 (USD MILLION)

6.3 POLYMERIC BIOMATERIALS

TABLE 59 APPLICATIONS OF SYNTHETIC POLYMERS

TABLE 60 MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 61 MARKET FOR POLYMERIC BIOMATERIALS, BY REGION, 2022–2029 (USD MILLION)

6.3.1 POLYMETHYLMETHACRYLATE

6.3.1.1 Better biocompatibility and improved safety to drive segment

TABLE 62 POLYMETHYLMETHACRYLATE MARKET, BY REGION, 2022–2029 (USD MILLION)

6.3.2 POLYETHYLENE

6.3.2.1 Better wear and tear resistance to boost segment growth

TABLE 63 POLYETHYLENE MARKET, BY REGION, 2022–2029 (USD MILLION)

6.3.3 POLYESTER

6.3.3.1 Better biodegradability and biocompatibility to propel segment growth

TABLE 64 POLYESTER MARKET, BY REGION, 2022–2029 (USD MILLION)

6.3.4 POLYVINYLCHLORIDE

6.3.4.1 Affordability, high tensile strength, and ease of processing to drive segment growth

TABLE 65 POLYVINYLCHLORIDE MARKET, BY REGION, 2022–2029 (USD MILLION)

6.3.5 SILICONE RUBBER

6.3.5.1 Non-reactivity, stability, and better resistance to extreme environments and temperatures to aid segment growth

TABLE 66 SILICONE RUBBER MARKET, BY REGION, 2022–2029 (USD MILLION)

6.3.6 NYLON

6.3.6.1 Increased use in biological applications and gastrointestinal surgeries to aid segment growth

TABLE 67 NYLON MARKET, BY REGION, 2022–2029 (USD MILLION)

6.3.7 POLYETHERETHERKETONE

6.3.7.1 High resistanace to thermal degradation and aqueous environments to support segment growth

TABLE 68 POLYETHERETHERKETONE MARKET, BY REGION, 2022–2029 (USD MILLION)

6.3.8 OTHER POLYMERIC BIOMATERIALS

TABLE 69 OTHER POLYMERIC MARKET, BY REGION, 2022–2029 (USD MILLION)

6.4 CERAMIC BIOMATERIALS

TABLE 70 MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 71 MARKET FOR CERAMIC BIOMATERIALS, BY REGION, 2022–2029 (USD MILLION)

6.4.1 CALCIUM PHOSPHATE

6.4.1.1 Better affinity to human body and higher bioresorbability to drive segment

TABLE 72 CALCIUM PHOSPHATE MARKET, BY REGION, 2022–2029 (USD MILLION)

6.4.2 ZIRCONIA

6.4.2.1 Bio-inertness and low wear rate to aid market growth

TABLE 73 ZIRCONIA MARKET, BY REGION, 2022–2029 (USD MILLION)

6.4.3 ALUMINUM OXIDE

6.4.3.1 Increasing use in hip replacements and dental implants to drive segment

TABLE 74 ALUMINUM OXIDE MARKET, BY REGION, 2022–2029 (USD MILLION)

6.4.4 CALCIUM SULFATE

6.4.4.1 Increased popularity and adoption of tissue regeneration products to limit segment growth

TABLE 75 CALCIUM SULFATE MARKET, BY REGION, 2022–2029 (USD MILLION)

6.4.5 CARBON

6.4.5.1 Increasing use in regenerative medicine and cancer treatment to drive segment

TABLE 76 CARBON MARKET, BY REGION, 2022–2029 (USD MILLION)

6.4.6 GLASS

6.4.6.1 Rising number of orthopedic and dental procedures to boost segment growth

TABLE 77 GLASS MARKET, BY REGION, 2022–2029 (USD MILLION)

6.5 NATURAL BIOMATERIALS

TABLE 78 APPLICATIONS OF NATURAL BIOMATERIALS

TABLE 79 MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 80 MARKET FOR NATURAL BIOMATERIALS, BY REGION, 2022–2029 (USD MILLION)

6.5.1 HYALURONIC ACID

6.5.1.1 Rising prevalence of osteoarthritis among geriatric population to drive segment

TABLE 81 HYALURONIC ACID MARKET, BY REGION, 2022–2029 (USD MILLION)

6.5.2 COLLAGEN

6.5.2.1 Biocompatibility, biodegradability, accessibility, and efficient production processes to drive market

TABLE 82 COLLAGEN MARKET, BY REGION, 2022–2029 (USD MILLION)

6.5.3 FIBRIN

6.5.3.1 High utilization in wound healing and blood clotting to aid market growth

TABLE 83 FIBRIN MARKET, BY REGION, 2022–2029 (USD MILLION)

6.5.4 CELLULOSE

6.5.4.1 Better biodegradability, water-retention capability, and renewability to propel market growth

TABLE 84 CELLULOSE MARKET, BY REGION, 2022–2029 (USD MILLION)

6.5.5 CHITIN

6.5.5.1 Increased use in biomedical sector for wound dressings, drug delivery, and bone repair to drive market

TABLE 85 CHITIN MARKET, BY REGION, 2022–2029 (USD MILLION)

6.5.6 ALGINATES

6.5.6.1 Increased use in gastric reflux treatment to propel market growth

TABLE 86 ALGINATES MARKET, BY REGION, 2022–2029 (USD MILLION)

6.5.7 GELATIN

6.5.7.1 Cost-effectiveness and easy manufacturing process to drive segment growth

TABLE 87 GELATIN MARKET, BY REGION, 2022–2029 (USD MILLION)

6.5.8 CHITOSAN

6.5.8.1 Non-toxicity, antimicrobial attributes, and functional versatility to aid market growth

TABLE 88 CHITOSAN MARKET, BY REGION, 2022–2029 (USD MILLION)

6.5.9 SILK

6.5.9.1 Flexibility, glossiness, and adhesive abilities to boost market growth

TABLE 89 SILK MARKET, BY REGION, 2022–2029 (USD MILLION)

6.5.10 OTHER NATURAL BIOMATERIALS

TABLE 90 OTHER NATURAL MARKET, BY REGION, 2022–2029 (USD MILLION)

7 BIOMATERIALS MARKET, BY APPLICATION (Page No. - 199)

7.1 INTRODUCTION

TABLE 91 BIOMATERIALS INDUSTRY, BY APPLICATION, 2022–2029 (USD MILLION)

7.2 ORTHOPEDIC

TABLE 92 MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 93 MARKET FOR ORTHOPEDIC APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.2.1 JOINT REPLACEMENT

TABLE 94 MARKET FOR JOINT REPLACEMENT APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 95 MARKET FOR JOINT REPLACEMENT APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.2.1.1 Knee replacement

7.2.1.1.1 Growing number of knee replacement procedures to drive market growth

TABLE 96 MARKET FOR KNEE REPLACEMENT APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.2.1.2 Hip replacement

7.2.1.2.1 Large number of procedures performed to support market growth

TABLE 97 MARKET FOR HIP REPLACEMENT APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.2.1.3 Shoulder replacement

7.2.1.3.1 Extensive use of biomaterials in shoulder replacement procedures to boost market

TABLE 98 BIOMATERIALS INDUSTRY FOR SHOULDER REPLACEMENT APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.2.1.4 Other joint replacement procedures

TABLE 99 MARKET FOR OTHER JOINT REPLACEMENT PROCEDURES, BY REGION, 2022–2029 (USD MILLION)

7.2.2 BIORESORBABLE TISSUE FIXATION

TABLE 100 MARKET FOR BIORESORBABLE TISSUE FIXATION APPLICATIONS, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 101 MARKET FOR BIORESORBABLE TISSUE FIXATION APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.2.2.1 Suture anchors

7.2.2.1.1 Growing awareness about suture anchor devices to drive market growth

TABLE 102 MARKET FOR SUTURE ANCHORS, BY REGION, 2022–2029 (USD MILLION)

7.2.2.2 Interference screws

7.2.2.2.1 Increasing awareness about ACL to contribute to market growth

TABLE 103 MARKET FOR INTERFERENCE SCREWS, BY REGION, 2022–2029 (USD MILLION)

7.2.2.3 Meniscal repair tacks

7.2.2.3.1 Rising sports injuries to drive growth

TABLE 104 BIOMATERIALS MARKET FOR MENISCAL REPAIR TACKS, BY REGION, 2022–2029 (USD MILLION)

7.2.2.4 Meshes

7.2.2.4.1 Wear resistance, proper shaping, and holding capacity of bioresorbable implants to increase demand for meshes

TABLE 105 MARKET FOR MESHES, BY REGION, 2022–2029 (USD MILLION)

7.2.3 SPINE SURGERY

TABLE 106 MARKET FOR SPINE SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 107 MARKET FOR SPINE SURGERY APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.2.3.1 Spinal fusion

7.2.3.1.1 Introduction of minimally invasive spinal fusion procedures and better clinical outcomes to drive market growth

TABLE 108 MARKET FOR SPINAL FUSION APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.2.3.2 Minimally invasive fusion

7.2.3.2.1 Faster recovery associated with minimally invasive fusion procedures to drive demand

TABLE 109 MARKET FOR MINIMALLY INVASIVE FUSION APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.2.3.3 Motion preservation & dynamic stabilization

TABLE 110 MARKET FOR MOTION PRESERVATION & DYNAMIC STABILIZATION APPLICATIONS, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 111 MARKET FOR MOTION PRESERVATION & DYNAMIC STABILIZATION APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.2.3.3.1 Pedicle-based rod systems

7.2.3.3.1.1 Rising geriatric population to favor market growth

TABLE 112 BIOMATERIALS INDUSTRY FOR PEDICLE-BASED ROD SYSTEMS, BY REGION, 2022–2029 (USD MILLION)

7.2.3.3.2 Interspinous spacers

7.2.3.3.2.1 High prevalence of degenerative spinal conditions to contribute to growth

TABLE 113 MARKET FOR INTERSPINOUS SPACERS, BY REGION, 2022–2029 (USD MILLION)

7.2.3.3.3 Artificial discs

7.2.3.3.3.1 High biocompatibility to increase use of artificial discs

TABLE 114 MARKET FOR ARTIFICIAL DISCS, BY REGION, 2022–2029 (USD MILLION)

7.2.4 FRACTURE FIXATION

TABLE 115 MARKET FOR FRACTURE FIXATION APPLICATIONS, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 116 MARKET FOR FRACTURE FIXATION APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.2.4.1 Bone plates

7.2.4.1.1 Growing use of biomaterials in bone plates to aid growth

TABLE 117 MARKET FOR BONE PLATES, BY REGION, 2022–2029 (USD MILLION)

7.2.4.2 Screws

7.2.4.2.1 Extensive use of screws in orthopedic procedures to boost market

TABLE 118 MARKET FOR SCREWS, BY REGION, 2022–2029 (USD MILLION)

7.2.4.3 Pins

7.2.4.3.1 Growing use of metallic biomaterials in pins to propel growth

TABLE 119 BIOMATERIALS MARKET FOR PINS, BY REGION, 2022–2029 (USD MILLION)

7.2.4.4 Rods

7.2.4.4.1 Growing preference for rods for fracture treatment to fuel growth

TABLE 120 MARKET FOR RODS, BY REGION, 2022–2029 (USD MILLION)

7.2.4.5 Wires

7.2.4.5.1 Extensive use of wires to treat fractures of small bones to aid growth

TABLE 121 MARKET FOR WIRES, BY REGION, 2022–2029 (USD MILLION)

7.2.5 ORTHOBIOLOGICS

7.2.5.1 Rising cases of osteoarthritis to drive growth

TABLE 122 MARKET FOR ORTHOBIOLOGICS APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.3 CARDIOVASCULAR

TABLE 123 MARKET FOR CARDIOVASCULAR APPLICATIONS, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 124 MARKET FOR CARDIOVASCULAR APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.3.1 CATHETERS

7.3.1.1 Shift in patient preference from traditional open surgeries to minimally invasive surgeries to drive market

TABLE 125 MARKET FOR CATHETERS, BY REGION, 2022–2029 (USD MILLION)

7.3.2 STENTS

7.3.2.1 Increasing number of coronary intervention procedures to boost demand for implantable stents

TABLE 126 BIOMATERIALS INDUSTRY FOR STENTS, BY REGION, 2022–2029 (USD MILLION)

7.3.3 IMPLAN TABLE CARDIAC DEFIBRILLATORS

7.3.3.1 Growing geriatric population to increase demand for implantable cardiac defibrillators

TABLE 127 MARKET FOR IMPLANTABLE CARDIAC DEFIBRILLATORS, BY REGION, 2022–2029 (USD MILLION)

7.3.4 PACEMAKERS

7.3.4.1 High prevalence of bradycardia to drive demand for pacemakers

TABLE 128 MARKET FOR PACEMAKERS, BY REGION, 2022–2029 (USD MILLION)

7.3.5 SENSORS

7.3.5.1 Increasing prevalence of cardiac disorders to boost demand for cardiovascular sensors

TABLE 129 MARKET FOR SENSORS, BY REGION, 2022–2029 (USD MILLION)

7.3.6 HEART VALVES

7.3.6.1 Growing geriatric population to increase demand for prosthetic valves

TABLE 130 BIOMATERIALS USED FOR DIFFERENT VALVE COMPONENTS

TABLE 131 MARKET FOR HEART VALVES, BY REGION, 2022–2029 (USD MILLION)

7.3.7 VASCULAR GRAFTS

7.3.7.1 Growing number of research studies to open opportunities for growth

TABLE 132 MARKET FOR VASCULAR GRAFTS, BY REGION, 2022–2029 (USD MILLION)

7.3.8 GUIDEWIRES

7.3.8.1 Extensive use of guidewires for guiding catheters and placing stents to boost market

TABLE 133 BIOMATERIALS MARKET FOR GUIDEWIRES, BY REGION, 2022–2029 (USD MILLION)

7.3.9 OTHER CARDIOVASCULAR PRODUCTS

TABLE 134 MARKET FOR OTHER CARDIOVASCULAR PRODUCTS, BY REGION, 2022–2029 (USD MILLION)

7.4 OPHTHALMOLOGY

TABLE 135 MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 136 MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.4.1 CONTACT LENSES

7.4.1.1 High cases of refractive errors and preference for contact lenses over spectacles to drive market

TABLE 137 MARKET FOR CONTACT LENSES, BY REGION, 2022–2029 (USD MILLION)

7.4.2 INTRAOCULAR LENSES

7.4.2.1 Increasing prevalence of cataracts to drive number of cataract surgeries performed

TABLE 138 MARKET FOR INTRAOCULAR LENSES, BY REGION, 2022–2029 (USD MILLION)

7.4.3 FUNCTIONAL REPLACEMENT OF OCULAR TISSUE

7.4.3.1 Increasing funding and research activities for development of bionic eyes to drive market

TABLE 139 MARKET FOR FUNCTIONAL REPLACEMENT OF OCULAR TISSUE, BY REGION, 2022–2029 (USD MILLION)

7.4.4 SYNTHETIC CORNEAS

7.4.4.1 Growing number of corneal blindness cases worldwide to boost demand for synthetic collagen biomaterials

TABLE 140 BIOMATERIALS INDUSTRY FOR SYNTHETIC CORNEAS, BY REGION, 2022–2029 (USD MILLION)

7.4.5 OTHER OPHTHALMOLOGY PRODUCTS

TABLE 141 MARKET FOR OTHER OPHTHALMOLOGY PRODUCTS, BY REGION, 2022–2029 (USD MILLION)

7.5 DENTAL

TABLE 142 MARKET FOR DENTAL APPLICATIONS, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 143 MARKET FOR DENTAL APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.5.1 DENTAL IMPLANTS

7.5.1.1 Increasing awareness of dental services and improving quality of dental products to boost growth

TABLE 144 PERCENTAGE OF INDIVIDUALS WITH UNTREATED DENTAL CARIES IN US (2016)

TABLE 145 MARKET FOR DENTAL IMPLANTS, BY REGION, 2022–2029 (USD MILLION)

7.5.2 DENTAL BONE GRAFTS & SUBSTITUTES

7.5.2.1 Growing demand for dental implants among people opting for cosmetic dentistry to drive market growth

TABLE 146 MARKET FOR DENTAL BONE GRAFTS & SUBSTITUTES, BY REGION, 2022–2029 (USD MILLION)

7.5.3 DENTAL MEMBRANES

7.5.3.1 Growing use of dental membranes in oral and periodontal surgery to favor market growth

TABLE 147 MARKET FOR DENTAL MEMBRANES, BY REGION, 2022–2029 (USD MILLION)

7.5.4 TISSUE REGENERATION MATERIALS

7.5.4.1 Increasing prevalence of periodontal disease to support growth

TABLE 148 BIOMATERIALS MARKET FOR TISSUE REGENERATION MATERIALS, BY REGION, 2022–2029 (USD MILLION)

7.6 PLASTIC SURGERY

TABLE 149 MARKET FOR PLASTIC SURGERY APPLICATIONS, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 150 MARKET FOR PLASTIC SURGERY APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.6.1 SOFT TISSUE FILLERS

7.6.1.1 Advantages such as long-lasting capacity and less allergic reactions to drive demand for soft tissue fillers

TABLE 151 MARKET FOR SOFT TISSUE FILLERS, BY REGION, 2022–2029 (USD MILLION)

7.6.2 CRANIOFACIAL SURGERY PRODUCTS

7.6.2.1 Increasing incidence of trauma cases and head & neck cancer to increase number of craniofacial surgeries

TABLE 152 MARKET FOR CRANIOFACIAL SURGERY PRODUCTS, BY REGION, 2022–2029 (USD MILLION)

7.6.3 FACIAL WRINKLE TREATMENT DEVICES

7.6.3.1 Increase in demand for non-surgical treatments to drive market growth

TABLE 153 MARKET FOR FACIAL WRINKLE TREATMENT DEVICES, BY REGION, 2022–2029 (USD MILLION)

7.6.4 BIOENGINEERED SKINS

7.6.4.1 Growing applications of bioengineered skins to boost market

TABLE 154 BIOMATERIALS INDUSTRY FOR BIOENGINEERED SKINS, BY REGION, 2022–2029 (USD MILLION)

7.6.5 PERIPHERAL NERVE REPAIR DEVICES

7.6.5.1 Increasing incidence of trauma cases to support growth

TABLE 155 MARKET FOR PERIPHERAL NERVE REPAIR DEVICES, BY REGION, 2022–2029 (USD MILLION)

7.6.6 ACELLULAR DERMAL MATRICES

7.6.6.1 Ability of ADMs to provide mechanical support to boost demand

TABLE 156 MARKET FOR ACELLULAR DERMAL MATRICES, BY REGION, 2022–2029 (USD MILLION)

7.7 WOUND HEALING

TABLE 157 MARKET FOR WOUND HEALING APPLICATIONS, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 158 MARKET FOR WOUND HEALING APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.7.1 WOUND CLOSURE DEVICES

TABLE 159 MARKET FOR WOUND CLOSURE DEVICES, BY TYPE, 2022–2029 (USD MILLION)

TABLE 160 MARKET FOR WOUND CLOSURE DEVICES, BY REGION, 2022–2029 (USD MILLION)

7.7.1.1 Sutures

7.7.1.1.1 Ability to use sutures as advanced biologically active components to drive demand

TABLE 161 MARKET FOR WOUND CLOSURE SUTURES, BY REGION, 2022–2029 (USD MILLION)

7.7.1.2 Staples

7.7.1.2.1 Ability of staples to shorten closure by 70–80% compared to sutures to drive adoption

TABLE 162 BIOMATERIALS MARKET FOR WOUND CLOSURE STAPLES, BY REGION, 2022–2029 (USD MILLION)

7.7.2 SURGICAL HEMOSTATS

7.7.2.1 Ability of surgical hemostats to control bleeding and reduce need for frequent blood transfusions to boost market

TABLE 163 MARKET FOR SURGICAL HEMOSTATS, BY REGION, 2022–2029 (USD MILLION)

7.7.3 INTERNAL TISSUE SEALANTS

7.7.3.1 Ability of internal tissue sealants to control bleeding and hemorrhages to fuel growth

TABLE 164 MARKET FOR INTERNAL TISSUE SEALANTS, BY REGION, 2022–2029 (USD MILLION)

7.7.4 ADHESION BARRIERS

7.7.4.1 Ability of adhesion barriers to promote inflammatory healing process to propel growth

TABLE 165 MARKET FOR ADHESION BARRIERS, BY REGION, 2022–2029 (USD MILLION)

7.7.5 HERNIA MESHES

7.7.5.1 Growing use of meshes in hernia repair to boost market

TABLE 166 MARKET FOR HERNIA MESHES, BY REGION, 2022–2029 (USD MILLION)

7.7.6 SKIN SUBSTITUTES

7.7.6.1 Diverse range of combinations of skin substitutes to boost demand

TABLE 167 BIOMATERIALS INDUSTRY FOR SKIN SUBSTITUTES, BY REGION, 2022–2029 (USD MILLION)

7.8 TISSUE ENGINEERING

TABLE 168 MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 169 MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.8.1 SCAFFOLDS

7.8.1.1 Rise in organ transplantation procedures to drive market

TABLE 170 MARKET FOR SCAFFOLDS, BY REGION, 2022–2029 (USD MILLION)

7.8.2 NANOMATERIALS

7.8.2.1 Rising research on nanotechnology to drive growth

TABLE 171 MARKET FOR NANOMATERIALS, BY REGION, 2022–2029 (USD MILLION)

7.8.3 INORGANIC NANOPARTICLES

7.8.3.1 Growing demand for nanotechnological medical products to propel market

TABLE 172 MARKET FOR INORGANIC NANOPARTICLES, BY REGION, 2022–2029 (USD MILLION)

7.9 NEUROLOGICAL/CENTRAL NERVOUS SYSTEM

TABLE 173 MARKET FOR NEUROLOGICAL/CENTRAL NERVOUS SYSTEM APPLICATIONS, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 174 MARKET FOR NEUROLOGICAL/CENTRAL NERVOUS SYSTEM APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.9.1 SHUNTING SYSTEMS

7.9.1.1 Rising cases of hydrocephalus to boost market growth

TABLE 175 BIOMATERIALS MARKET FOR SHUNTING SYSTEMS, BY REGION, 2022–2029 (USD MILLION)

7.9.2 CORTICAL NEURAL PROSTHETICS

7.9.2.1 Growing use of CNPs to treat paralyzed patients to drive growth

TABLE 176 MARKET FOR CORTICAL NEURAL PROSTHETICS, BY REGION, 2022–2029 (USD MILLION)

7.9.3 HYDROGEL SCAFFOLDS

7.9.3.1 Increasing incidence of spinal cord surgeries to drive demand for hydrogel scaffolds

TABLE 177 MARKET FOR HYDROGEL SCAFFOLDS, BY REGION, 2022–2029 (USD MILLION)

7.9.4 NEURAL STEM CELL ENCAPSULATION PRODUCTS

7.9.4.1 Lack of substitutes for treatment of neurotrauma to boost market growth

TABLE 178 MARKET FOR NEURAL STEM CELL ENCAPSULATION PRODUCTS, BY REGION, 2022–2029 (USD MILLION)

7.10 URINARY

TABLE 179 MARKET FOR URINARY APPLICATIONS, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 180 MARKET FOR URINARY APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.10.1 URINARY CATHETERS

7.10.1.1 Development of novel coatings for urinary catheters to boost market

TABLE 181 MARKET FOR URINARY CATHETERS, BY REGION, 2022–2029 (USD MILLION)

7.10.2 URETHRAL STENTS

7.10.2.1 Complications associated with urethral stents to limit market growth

TABLE 182 BIOMATERIALS INDUSTRY FOR URETHRAL STENTS, BY REGION, 2022–2029 (USD MILLION)

7.10.3 OTHER URINARY PRODUCTS

TABLE 183 MARKET FOR OTHER URINARY PRODUCTS, BY REGION, 2022–2029 (USD MILLION)

7.11 OTHER APPLICATIONS

TABLE 184 MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 185 MARKET FOR OTHER APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.11.1 DRUG DELIVERY SYSTEMS

7.11.1.1 Dependence of drug delivery systems on biomaterials due to biocompatibility to boost growth

TABLE 186 MARKET FOR DRUG DELIVERY SYSTEMS, BY REGION, 2022–2029 (USD MILLION)

7.11.2 GASTROINTESTINAL

7.11.2.1 Wide usage of biomaterials in treatment of gastrointestinal diseases to drive market

TABLE 187 MARKET FOR GASTROINTESTINAL APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

7.11.3 BARIATRIC SURGERY

7.11.3.1 Limited number of biomaterials used for bariatric surgery to hamper growth

TABLE 188 MARKET FOR BARIATRIC SURGERY, BY REGION, 2022–2029 (USD MILLION)

8 BIOMATERIALS MARKET, BY REGION (Page No. - 274)

8.1 INTRODUCTION

TABLE 189 BIOMATERIALS INDUSTRY, BY REGION, 2022–2029 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 28 NORTH AMERICA: BIOMATERIALS MARKET SNAPSHOT

TABLE 190 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 191 NORTH AMERICA: MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 192 NORTH AMERICA: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 193 NORTH AMERICA: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 194 NORTH AMERICA: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 195 NORTH AMERICA: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 196 NORTH AMERICA: BIOMATERIALS INDUSTRY, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 197 NORTH AMERICA: MARKET FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 198 NORTH AMERICA: BIOMATERIALS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 199 NORTH AMERICA: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 200 NORTH AMERICA: SPINE SURGERIES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 201 NORTH AMERICA: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 202 NORTH AMERICA: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 203 NORTH AMERICA: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 204 NORTH AMERICA: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 205 NORTH AMERICA: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 206 NORTH AMERICA: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 207 NORTH AMERICA: BIOMATERIALS MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 208 NORTH AMERICA: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 209 NORTH AMERICA: MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 210 NORTH AMERICA: MARKET FOR NEUROLOGICAL/CENTRAL NERVOUS SYSTEM APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 211 NORTH AMERICA: MARKET FOR URINARY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 212 NORTH AMERICA: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.2.1 NORTH AMERICA: RECESSION IMPACT

8.2.2 US

8.2.2.1 Rising incidence of cancer and ongoing research in developing biocompatible materials to drive market

TABLE 213 US: BIOMATERIALS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 214 US: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 215 US: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 216 US: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 217 US: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 218 US: BIOMATERIALS INDUSTRY, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 219 US: MARKET FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 220 US: BIOMATERIALS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 221 US: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 222 US: SPINE SURGERIES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 223 US: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 224 US: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 225 US: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 226 US: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 227 US: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 228 US: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 229 US: BIOMATERIALS MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 230 US: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 231 US: MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 232 US: MARKET FOR NEUROLOGICAL/ CENTRAL NERVOUS SYSTEM APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 233 US: MARKET FOR URINARY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 234 US: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.2.3 CANADA

8.2.3.1 Growing incidence of cardiovascular diseases to propel market growth

TABLE 235 CANADA: BIOMATERIALS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 236 CANADA: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 237 CANADA: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 238 CANADA: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 239 CANADA: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 240 CANADA: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 241 CANADA: BIOMATERIALS INDUSTRY FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 242 CANADA: BIOMATERIALS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 243 CANADA: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 244 CANADA: SPINE SURGERIES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 245 CANADA: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 246 CANADA: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 247 CANADA: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 248 CANADA: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 249 CANADA: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 250 CANADA: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 251 CANADA: BIOMATERIALS MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 252 CANADA: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 253 CANADA: MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 254 CANADA: MARKET FOR NEUROLOGICAL/ CENTRAL NERVOUS SYSTEM APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 255 CANADA: MARKET FOR URINARY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 256 CANADA: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.3 EUROPE

TABLE 257 EUROPE: BIOMATERIALS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 258 EUROPE: MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 259 EUROPE: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 260 EUROPE: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 261 EUROPE: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 262 EUROPE: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 263 EUROPE: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 264 EUROPE: MARKET FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 265 EUROPE: BIOMATERIALS INDUSTRY FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 266 EUROPE: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 267 EUROPE: SPINE SURGERIES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 268 EUROPE: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 269 EUROPE: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 270 EUROPE: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 271 EUROPE: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 272 EUROPE: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 273 EUROPE: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 274 EUROPE: BIOMATERIALS MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 275 EUROPE: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 276 EUROPE: BIOMATERIALS MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 277 EUROPE: MARKET FOR NEUROLOGICAL/ CENTRAL NERVOUS SYSTEM APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 278 EUROPE: MARKET FOR URINARY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 279 EUROPE: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.3.1 EUROPE: RECESSION IMPACT

8.3.2 GERMANY

8.3.2.1 Rising focus on clinical research and patent approvals to aid market growth

TABLE 280 GERMANY: BIOMATERIALS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 281 GERMANY: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 282 GERMANY: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 283 GERMANY: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 284 GERMANY: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 285 GERMANY: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 286 GERMANY: MARKET FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 287 GERMANY: BIOMATERIALS INDUSTRY FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 288 GERMANY: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 289 GERMANY: SPINE SURGERIES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 290 GERMANY: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 291 GERMANY: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 292 GERMANY: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 293 GERMANY: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 294 GERMANY: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 295 GERMANY: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 296 GERMANY: BIOMATERIALS MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 297 GERMANY: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 298 GERMANY: BIOMATERIALS MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 299 GERMANY: MARKET FOR NEUROLOGICAL/ CENTRAL NERVOUS SYSTEM APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 300 GERMANY: MARKET FOR URINARY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 301 GERMANY: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.3.3 UK

8.3.3.1 Increasing availability of funds and rising number of cardiovascular procedures to support market growth

TABLE 302 UK: BIOMATERIALS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 303 UK: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 304 UK: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 305 UK: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 306 UK: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 307 UK: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 308 UK: BIOMATERIALS INDUSTRY FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 309 UK: BIOMATERIALS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 310 UK: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 311 UK: SPINE SURGERY APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 312 UK: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 313 UK: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 314 UK: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 315 UK: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 316 UK: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 317 UK: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 318 UK: MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 319 UK: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 320 UK: BIOMATERIALS MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 321 UK: MARKET FOR NEUROLOGICAL/ CENTRAL NERVOUS SYSTEM APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 322 UK: MARKET FOR URINARY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 323 UK: MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.3.4 FRANCE

8.3.4.1 Increased healthcare expenditure and structured regulatory framework to drive market

TABLE 324 FRANCE: BIOMATERIALS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 325 FRANCE: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 326 FRANCE: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 327 FRANCE: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 328 FRANCE: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 329 FRANCE: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 330 FRANCE: BIOMATERIALS INDUSTRY FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 331 FRANCE: BIOMATERIALS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 332 FRANCE: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 333 FRANCE: SPINE SURGERY APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 334 FRANCE: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 335 FRANCE: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 336 FRANCE: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 337 FRANCE: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 338 FRANCE: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 339 FRANCE: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 340 FRANCE: BIOMATERIALS MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 341 FRANCE: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 342 FRANCE: MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 343 FRANCE: MARKET FOR NEUROLOGICAL/ CENTRAL NERVOUS SYSTEM APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 344 FRANCE: MARKET FOR URINARY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 345 FRANCE: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.3.5 ITALY

8.3.5.1 Rising prevalence of neurological and cardiovascular disorders to boost market growth

TABLE 346 ITALY: BIOMATERIALS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 347 ITALY: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 348 ITALY: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 349 ITALY: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 350 ITALY: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 351 ITALY: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 352 ITALY: BIOMATERIALS INDUSTRY FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 353 ITALY: BIOMATERIALS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 354 ITALY: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 355 ITALY: SPINE SURGERY APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 356 ITALY: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 357 ITALY: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 358 ITALY: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 359 ITALY: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 360 ITALY: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 361 ITALY: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 362 ITALY: BIOMATERIALS MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 363 ITALY: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 364 ITALY: MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 365 ITALY: MARKET FOR NEUROLOGICAL/ CENTRAL NERVOUS SYSTEM APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 366 ITALY: MARKET FOR URINARY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 367 ITALY: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.3.6 SPAIN

8.3.6.1 Increased focus on research for biomaterial development to propel market growth

TABLE 368 SPAIN: BIOMATERIALS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 369 SPAIN: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 370 SPAIN: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 371 SPAIN: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 372 SPAIN: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 373 SPAIN: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 374 SPAIN: BIOMATERIALS INDUSTRY FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 375 SPAIN: BIOMATERIALS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 376 SPAIN: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 377 SPAIN: SPINE SURGERY APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 378 SPAIN: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 379 SPAIN: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 380 SPAIN: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 381 SPAIN: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 382 SPAIN: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 383 SPAIN: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 384 SPAIN: BIOMATERIALS MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 385 SPAIN: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 386 SPAIN: MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 387 SPAIN: MARKET FOR NEUROLOGICAL/ CENTRAL NERVOUS SYSTEM APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 388 SPAIN: MARKET FOR URINARY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 389 SPAIN: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.3.7 REST OF EUROPE

TABLE 390 REST OF EUROPE: BIOMATERIALS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 391 REST OF EUROPE: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 392 REST OF EUROPE: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 393 REST OF EUROPE: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 394 REST OF EUROPE: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 395 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 396 REST OF EUROPE: BIOMATERIALS INDUSTRY FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 397 REST OF EUROPE: BIOMATERIALS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 398 REST OF EUROPE: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 399 REST OF EUROPE: SPINE SURGERY APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 400 REST OF EUROPE: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 401 REST OF EUROPE: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 402 REST OF EUROPE: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 403 REST OF EUROPE: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 404 REST OF EUROPE: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 405 REST OF EUROPE: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 406 REST OF EUROPE: BIOMATERIALS MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 407 REST OF EUROPE: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 408 REST OF EUROPE: MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 409 REST OF EUROPE: MARKET FOR NEUROLOGICAL/CENTRAL NERVOUS SYSTEM APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 410 REST OF EUROPE: MARKET FOR URINARY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 411 REST OF EUROPE: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.4 ASIA PACIFIC

FIGURE 29 ASIA PACIFIC: BIOMATERIALS MARKET SNAPSHOT

TABLE 412 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 413 ASIA PACIFIC: MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 414 ASIA PACIFIC: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 415 ASIA PACIFIC: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 416 ASIA PACIFIC: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 417 ASIA PACIFIC: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 418 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 419 ASIA PACIFIC: MARKET FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 420 ASIA PACIFIC: BIOMATERIALS INDUSTRY FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 421 ASIA PACIFIC: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 422 ASIA PACIFIC: SPINE SURGERIES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 423 ASIA PACIFIC: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 424 ASIA PACIFIC: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 425 ASIA PACIFIC: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 426 ASIA PACIFIC: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 427 ASIA PACIFIC: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 428 ASIA PACIFIC: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 429 ASIA PACIFIC: BIOMATERIALS MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 430 ASIA PACIFIC: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 431 ASIA PACIFIC: BIOMATERIALS MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 432 ASIA PACIFIC: MARKET FOR NEUROLOGICAL/ CENTRAL NERVOUS SYSTEM APPLICATIONS APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 433 ASIA PACIFIC: MARKET FOR URINARY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 434 ASIA PACIFIC: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.4.1 ASIA PACIFIC: RECESSION IMPACT

8.4.2 CHINA

8.4.2.1 Lucrative medical devices industry and large geriatric population to drive market

TABLE 435 CHINA: BIOMATERIALS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 436 CHINA: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 437 CHINA: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 438 CHINA: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 439 CHINA: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 440 CHINA: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 441 CHINA: BIOMATERIALS INDUSTRY FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 442 CHINA: BIOMATERIALS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 443 CHINA: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 444 CHINA: SPINE SURGERIES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 445 CHINA: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 446 CHINA: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 447 CHINA: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 448 CHINA: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 449 CHINA: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 450 CHINA: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 451 CHINA: BIOMATERIALS MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 452 CHINA: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 453 CHINA: MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 454 CHINA: MARKET FOR NEUROLOGICAL/ CENTRAL NERVOUS SYSTEM APPLICATIONS APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 455 CHINA: MARKET FOR URINARY APPLICATIONS APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 456 CHINA: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.4.3 JAPAN

8.4.3.1 Growing medical devices industry and rising aging population to support market growth

TABLE 457 JAPAN: BIOMATERIALS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 458 JAPAN: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 459 JAPAN: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 460 JAPAN: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 461 JAPAN: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 462 JAPAN: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 463 JAPAN: BIOMATERIALS INDUSTRY FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 464 JAPAN: BIOMATERIALS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 465 JAPAN: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 466 JAPAN: SPINE SURGERIES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 467 JAPAN: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 468 JAPAN: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 469 JAPAN: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 470 JAPAN: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 471 JAPAN: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 472 JAPAN: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 473 JAPAN: BIOMATERIALS MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 474 JAPAN: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 475 JAPAN: MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 476 JAPAN: MARKET FOR NEUROLOGICAL/ CENTRAL NERVOUS SYSTEM APPLICATIONS APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 477 JAPAN: MARKET FOR URINARY APPLICATIONS APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 478 JAPAN: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.4.4 INDIA

8.4.4.1 Large population base and growing focus on medical tourism to aid market growth

TABLE 479 INDIA: BIOMATERIALS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 480 INDIA: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 481 INDIA: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 482 INDIA: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 483 INDIA: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 484 INDIA: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 485 INDIA: MARKET FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 486 INDIA: BIOMATERIALS INDUSTRY FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 487 INDIA: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 488 INDIA: SPINE SURGERIES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 489 INDIA: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 490 INDIA: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 491 INDIA: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 492 INDIA: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 493 INDIA: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 494 INDIA: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 495 INDIA: BIOMATERIALS MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 496 INDIA: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 497 INDIA: BIOMATERIALS MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 498 INDIA: MARKET FOR NEUROLOGICAL/ CENTRAL NERVOUS SYSTEM APPLICATIONS APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 499 INDIA: MARKET FOR URINARY APPLICATIONS APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 500 INDIA: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.4.5 SOUTH KOREA

8.4.5.1 High demand for healthcare services and treatments to support market growth

TABLE 501 SOUTH KOREA: BIOMATERIALS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 502 SOUTH KOREA: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 503 SOUTH KOREA: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 504 SOUTH KOREA: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 505 SOUTH KOREA: FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 506 SOUTH KOREA: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 507 SOUTH KOREA: BIOMATERIALS INDUSTRY FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 508 SOUTH KOREA: BIOMATERIALS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 509 SOUTH KOREA: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 510 SOUTH KOREA: SPINE SURGERIES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 511 SOUTH KOREA: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 512 SOUTH KOREA: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 513 SOUTH KOREA: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 514 SOUTH KOREA: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 515 SOUTH KOREA: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 516 SOUTH KOREA: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 517 SOUTH KOREA: BIOMATERIALS MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 518 SOUTH KOREA: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 519 SOUTH KOREA: BIOMATERIALS MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 520 SOUTH KOREA: MARKET FOR NEUROLOGICAL/CENTRAL NERVOUS SYSTEM APPLICATIONS APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 521 SOUTH KOREA: MARKET FOR URINARY APPLICATIONS APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 522 SOUTH KOREA: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.4.6 AUSTRALIA

8.4.6.1 Increasing incidence of sports injuries and growing government investment in research to aid market growth

TABLE 523 AUSTRALIA: BIOMATERIALS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 524 AUSTRALIA: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 525 AUSTRALIA: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 526 AUSTRALIA: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 527 AUSTRALIA: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 528 AUSTRALIA: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 529 AUSTRALIA: BIOMATERIALS INDUSTRY FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 530 AUSTRALIA: BIOMATERIALS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 531 AUSTRALIA: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 532 AUSTRALIA: SPINE SURGERIES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 533 AUSTRALIA: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 534 AUSTRALIA: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 535 AUSTRALIA: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 536 AUSTRALIA: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 537 AUSTRALIA: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 538 AUSTRALIA: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 539 AUSTRALIA: BIOMATERIALS MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 540 AUSTRALIA: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 541 AUSTRALIA: MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 542 AUSTRALIA: MARKET FOR NEUROLOGICAL/ CENTRAL NERVOUS SYSTEM APPLICATIONS APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 543 AUSTRALIA: MARKET FOR URINARY APPLICATIONS APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 544 AUSTRALIA: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.4.7 REST OF ASIA PACIFIC

TABLE 545 REST OF ASIA PACIFIC: BIOMATERIALS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 546 REST OF ASIA PACIFIC: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 547 REST OF ASIA PACIFIC: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 548 REST OF ASIA PACIFIC: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 549 REST OF ASIA PACIFIC: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 550 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 551 REST OF ASIA PACIFIC: BIOMATERIALS INDUSTRY FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 552 REST OF ASIA PACIFIC: BIOMATERIALS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 553 REST OF ASIA PACIFIC: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 554 REST OF ASIA PACIFIC: SPINE SURGERIES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 555 REST OF ASIA PACIFIC: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 556 REST OF ASIA PACIFIC: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 557 REST OF ASIA PACIFIC: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 558 REST OF ASIA PACIFIC: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 559 REST OF ASIA PACIFIC: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 560 REST OF ASIA PACIFIC: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 561 REST OF ASIA PACIFIC: BIOMATERIALS MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 562 REST OF ASIA PACIFIC: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 563 REST OF ASIA PACIFIC: MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 564 REST OF ASIA PACIFIC: MARKET FOR NEUROLOGICAL/CENTRAL NERVOUS SYSTEM APPLICATIONS APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 565 REST OF ASIA PACIFIC: MARKET FOR URINARY APPLICATIONS APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 566 REST OF ASIA PACIFIC: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.5 LATIN AMERICA

TABLE 567 LATIN AMERICA: BIOMATERIALS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 568 LATIN AMERICA: MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 569 LATIN AMERICA: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 570 LATIN AMERICA: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 571 LATIN AMERICA: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 572 LATIN AMERICA: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 573 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 574 LATIN AMERICA: BIOMATERIALS INDUSTRY FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 575 LATIN AMERICA: BIOMATERIALS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 576 LATIN AMERICA: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 577 LATIN AMERICA: SPINE SURGERIES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 578 LATIN AMERICA: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 579 LATIN AMERICA: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 580 LATIN AMERICA: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 581 LATIN AMERICA: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 582 LATIN AMERICA: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 583 LATIN AMERICA: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 584 LATIN AMERICA: MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 585 LATIN AMERICA: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 586 LATIN AMERICA: BIOMATERIALS MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 587 LATIN AMERICA: MARKET FOR NEUROLOGICAL/CENTRAL NERVOUS SYSTEM APPLICATIONS APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 588 LATIN AMERICA: MARKET FOR URINARY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 589 LATIN AMERICA: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.5.1 LATIN AMERICA: RECESSION IMPACT

8.5.2 BRAZIL

8.5.2.1 Gradual increase in pharmaceutical R&D to support market growth

TABLE 590 BRAZIL: BIOMATERIALS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 591 BRAZIL: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 592 BRAZIL: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 593 BRAZIL: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 594 BRAZIL: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 595 BRAZIL: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 596 BRAZIL: BIOMATERIALS INDUSTRY FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 597 BRAZIL: BIOMATERIALS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 598 BRAZIL: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 599 BRAZIL: SPINE SURGERIES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 600 BRAZIL: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 601 BRAZIL: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 602 BRAZIL: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 603 BRAZIL: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 604 BRAZIL: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 605 BRAZIL: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 606 BRAZIL: BIOMATERIALS MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 607 BRAZIL: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 608 BRAZIL: MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 609 BRAZIL: MARKET FOR NEUROLOGICAL/ CENTRAL NERVOUS SYSTEM APPLICATIONS APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 610 BRAZIL: MARKET FOR URINARY APPLICATIONS APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 611 BRAZIL: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.5.3 MEXICO

8.5.3.1 Increasing incidence of diabetes and growing geriatric population to aid market growth

TABLE 612 MEXICO: BIOMATERIALS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 613 MEXICO: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 614 MEXICO: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 615 MEXICO: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 616 MEXICO: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 617 MEXICO: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 618 MEXICO: MARKET FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 619 MEXICO: BIOMATERIALS INDUSTRY FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 620 MEXICO: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 621 MEXICO: SPINE SURGERIES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 622 MEXICO: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 623 MEXICO: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 624 MEXICO: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 625 MEXICO: BIOMATERIALS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 626 MEXICO: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 627 MEXICO: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 628 MEXICO: BIOMATERIALS MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 629 MEXICO: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 630 MEXICO: BIOMATERIALS MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 631 MEXICO: MARKET FOR NEUROLOGICAL/CENTRAL NERVOUS SYSTEM APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 632 MEXICO: MARKET FOR URINARY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 633 MEXICO: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.5.4 ARGENTINA

8.5.4.1 Increased incidence of cardiovascular diseases to aid market growth

TABLE 634 ARGENTINA: BIOMATERIALS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 635 ARGENTINA: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 636 ARGENTINA: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 637 ARGENTINA: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 638 ARGENTINA: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 639 ARGENTINA: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 640 ARGENTINA: MARKET FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 641 ARGENTINA: BIOMATERIALS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 642 ARGENTINA: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 643 ARGENTINA: SPINE SURGERIES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 644 ARGENTINA: MOTION PRESERVATION & DYNAMIC STABILIZATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 645 ARGENTINA: BIORESORBABLE TISSUE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 646 ARGENTINA: FRACTURE FIXATION MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 647 ARGENTINA: MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 648 ARGENTINA: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 649 ARGENTINA: MARKET FOR PLASTIC SURGERY APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 650 ARGENTINA: BIOMATERIALS MARKET FOR WOUND HEALING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 651 ARGENTINA: WOUND CLOSURE DEVICES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 652 ARGENTINA: BIOMATERIALS MARKET FOR TISSUE ENGINEERING APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 653 ARGENTINA: MARKET FOR NEUROLOGICAL/CENTRAL NERVOUS SYSTEM APPLICATIONS APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 654 ARGENTINA: MARKET FOR URINARY APPLICATIONS APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 655 ARGENTINA: BIOMATERIALS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

8.5.5 REST OF LATIN AMERICA

TABLE 656 REST OF LATIN AMERICA: BIOMATERIALS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 657 REST OF LATIN AMERICA: MARKET FOR METALLIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 658 REST OF LATIN AMERICA: MARKET FOR CERAMIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 659 REST OF LATIN AMERICA: MARKET FOR POLYMERIC BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 660 REST OF LATIN AMERICA: MARKET FOR NATURAL BIOMATERIALS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 661 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 662 REST OF LATIN AMERICA: MARKET FOR CARDIOVASCULAR APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 663 REST OF LATIN AMERICA: BIOMATERIALS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2022–2029 (USD MILLION)

TABLE 664 REST OF LATIN AMERICA: JOINT REPLACEMENT MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 665 REST OF LATIN AMERICA: SPINE SURGERIES MARKET, BY TYPE, 2022–2029 (USD MILLION)