Medical Ceramics Market by Material (Bioinert (Zirconia, Aluminium), Bioactive (Glass, Hydroxyapatite), Bioresorbable Ceramics), Application (Dental Application, Orthopedic Application, Plastic Surgery, Surgical Instruments) - Global Forecast to 2027

Updated on : May 08, 2023

The global medical ceramics market in terms of revenue was estimated to be worth $2.6 billion in 2022 and is poised to reach $3.6 billion by 2027, growing at a CAGR of 6.6% from 2022 to 2027. The growing demand for medical ceramics in plastic surgeries and wound healing applications, the increasing demand for implantable devices, and the rising number of hip and knee replacement procedures are the major driving factors of this market.

To know about the assumptions considered for the study, Request for Free Sample Report

Medical Ceramics Market Dynamics

Driver: Rising number of hip and knee replacement procedures

The rising incidence of age-related disorders (such as rheumatoid arthritis, osteoarthritis, osteoporosis, and fractures) and sports injuries drives the demand for knee and hip replacement procedures worldwide. According to the WHO, osteoarthritis will be the world’s fourth-leading cause of disability by 2020. According to the American Academy of Orthopedic Surgeons (AAOS), by 2030, ~3.5 million knee replacement procedures will be performed annually in the US. Also, by 2030, it is estimated that more than 570,000 primary total hip replacement procedures will be performed annually in the US.

As per the American Joint Replacement Registry (AJRR) Report, as of July 2020, approximately 2 million joint replacement procedures were performed in the US. The increasing number of hip and knee replacement procedures is considered a positive indicator of market growth. Medical ceramics are widely used in manufacturing hip and knee replacement devices.

Restraint: Stringent clinical & regulatory processes

The development of medical ceramic products has time-consuming processes and expensive clinical trials. These products must be implanted inside the human body and comply with the ISO biocompatibility testing standards. The regulatory procedures are complicated, restrictive, and depend on the composition of ceramics and their future applications, making the approval process for medical ceramic products cumbersome, expensive, and time-consuming. This factor may act as a restraint in the medical ceramics market.

Opportunity: Gradual shift toward new materials and products

Dental restoration products are gradually shifting from traditional porcelain-fused-to-metal (PFM) products towards all-ceramic prosthetics and products made of biomaterials. Zirconium oxide is a tough ceramic biomaterial used in the preparation of prosthetics. Zirconium is not only aesthetically more appealing but is also found to be much stronger and more resistant to fractures. It also increases the ease of cementation compared to the adhesive bonding used in traditional prosthetics. With the advantages offered by Zirconium over traditional materials, many patients opt for zirconium crowns and bridges. Several companies in the medical ceramics market are coming up with modified and upgraded biomaterials with higher biocompatibility and material strength.

Challenge: Shortage of skilled surgeons and dental professionals

According to the Lancet Commission on Global Surgery, ~ 2.2 million more surgeons, anaesthetics, and obstetricians are required annually in low- and – middle-income countries (LMICs). Also, major healthcare markets such as the US , Germany, and the UK are witnessing a shortage of surgeons in their healthcare systems.

Bioinert ceramics segment accounted for the largest share of the medical ceramics market, by product

By material type, the market is segmented into bioinert ceramics, bioactive ceramics, and bioresorbable ceramics. The bioinert ceramics segment accounted for the largest share of the global medical ceramics market. The increasing number of dental procedures, the rising cases of periodontal disorders, and the increasing number of knee and hip replacement surgeries will boost market growth.

Hydroxyapatite dominated medical ceramics market

On the basis of type, the market is broadly segmented into hydroxyapatite and glass ceramics. The hydroxyapatite segment accounted for the largest share of the global bioactive ceramics market in 2021. The market growth can be attributed to the growing demand for medical implants and the growing plastic surgery and dental care industries.

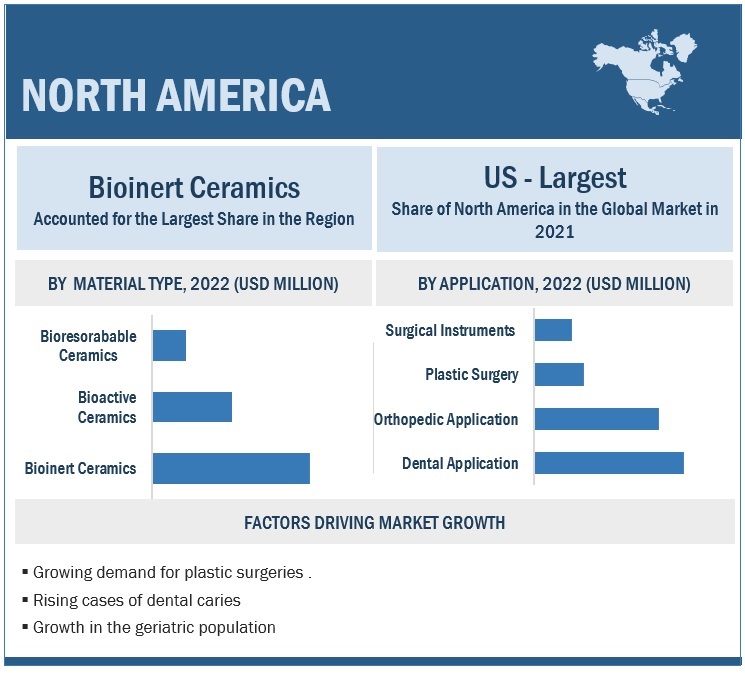

North America accounted for the largest share of the medical ceramics market

The market is segmented into four major regions namely, North America, Europe, the Asia Pacific, Latin America and Middle East & Africa. North America accounted for the largest share of the medical ceramics market. Factors such as the growing demand for plastic surgeries and rising cases of dental caries are contributing to the large share of this regional segment.

To know about the assumptions considered for the study, download the pdf brochure

The medical ceramics market is dominated by players such as CeramTec GmbH (Germany), KYOCERA Corporation (Japan), Morgan Advanced Materials (UK), 3M (US), and Royal DSM (DSM) (Netherlands).

Medical Ceramics Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$2.6 billion |

|

Projected Revenue by 2027 |

$3.6 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 6.6% |

|

Market Driver |

Rising number of hip and knee replacement procedures |

|

Market Opportunity |

Gradual shift toward new materials and products |

This research report categorises the medical ceramics market to forecast revenue and analyse trends in each of the following submarkets:

By Material Type

-

Bioinert Ceramics

- Zirconia

- Aluminium Oxide

- Other Bioinert Ceramics

-

Bioactive Ceramics

- Hydroxyapatite

- Glass Ceramics

- Bioresorbable Ceramics

By Application

- Dental Applications

- Dental Implants

- Dental Crowns & Bridges

- Braces

- Inlays and Onlays

- Dental Bone Grafts & Substitutes

- Orthopedic Applications

-

Joint Replacement

- Knee Replacement

- Hip Replacement

- Shoulder Replacement

- Others

- Fracture Fixation

- Synthetic Bone Grafts

- Surgical Instruments

- Plastic Surgery

- Craniomaxillofacial Implants

- Orbital/Ocular Implants

- Dermal Fillers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- RoE

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLA

- Middle East & Africa

Recent Developments

- In 2022, CeramTec received US FDA approval for novel ceramic total knee replacement device.

- In 2020, Institut Straumann AG (Switzerland) entered into a strategic partnership with XJet Ltd. (Israel) to develop Ceramic AM based dental implants. Straumann is utilizing XJet’s NanoParticle Jetting technology to develop dental implants.

- In 2019, KYOCERA Medical Technologies, Inc. (a subsidiary of KYOCERA Corporation) introduced the company’s novel products & technologies at the American Academy of Orthopedic Surgeons (AAOS) 2019 held in the US. The company has introduced Tesera Trabecular Technology, BIOCERAM AZUL Ceramic Heads, E-MAX Acetabular Liners, and Aquala Acetabular Liners.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the medical ceramics market?

The medical ceramics market boasts a total revenue value of $3.6 billion by 2027.

What is the estimated growth rate (CAGR) of the medical ceramics market?

The global medical ceramics market has an estimated compound annual growth rate (CAGR) of 6.6% and a revenue size in the region of $2.6 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

TABLE 1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

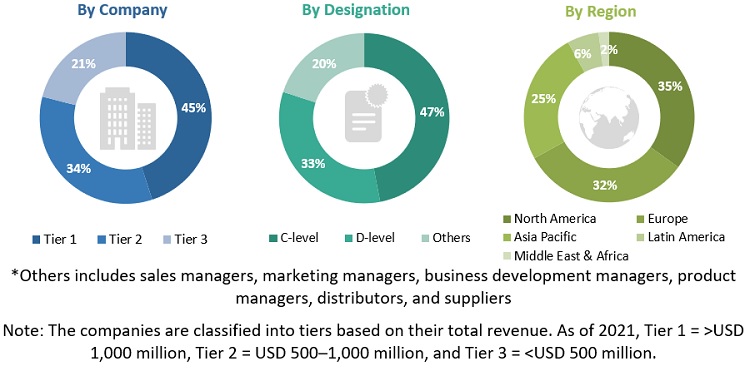

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 APPLICATION-BASED MARKET ESTIMATION

FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 6 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS

2.6 RISK ASSESSMENT/FACTOR ANALYSIS

TABLE 2 RISK ASSESSMENT/FACTOR ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 8 MARKET, BY MATERIAL TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 9 ZIRCONIA, BY TYPE, IS EXPECTED TO COMMAND LARGEST MARKET SHARE FROM 2022 TO 2027

FIGURE 10 HYDROXYAPATITE SEGMENT TO COMMAND LARGEST MARKET SHARE FROM 2022 TO 2027

FIGURE 11 DENTAL APPLICATIONS SEGMENT TO DOMINATE MEDICAL CERAMICS MARKET DURING FORECAST PERIOD

FIGURE 12 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 MEDICAL CERAMICS MARKET OVERVIEW

FIGURE 13 RISING NUMBER OF HIP & KNEE REPLACEMENT SURGERIES AND GROWING AWARENESS OF DENTAL CARE DRIVE MARKET GROWTH

4.2 GEOGRAPHIC ANALYSIS: MARKET, BY MATERIAL TYPE AND REGION

FIGURE 14 BIOINERT CERAMICS SEGMENT DOMINATED MARKET IN NORTH AMERICA IN 2021

4.3 GEOGRAPHICAL SNAPSHOT OF MARKET

FIGURE 15 CHINA REGISTERS HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 MEDICAL CERAMICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing demand for implantable devices

TABLE 3 INCREASING GERIATRIC POPULATION, BY REGION, 2022 VS. 2050

5.2.1.2 Increasing demand for medical ceramics in plastic surgeries and wound healing applications

5.2.1.3 Rising number of hip & knee replacement procedures

FIGURE 17 TOTAL NUMBER OF REPLACEMENT PROCEDURES PERFORMED IN THE US FROM 2012 TO 2019

5.2.2 RESTRAINTS

5.2.2.1 Stringent clinical & regulatory processes

5.2.3 OPPORTUNITIES

5.2.3.1 Growing healthcare industry in emerging economies

5.2.3.2 3D printed ceramics

5.2.3.3 Gradual shift toward new materials & products

5.2.3.4 Growing research activities for nanotechnology applications

5.2.4 CHALLENGES

5.2.4.1 Issues related to reparability & recycling

5.2.4.2 Shortage of skilled surgeons and dental professionals

5.3 REGULATORY ANALYSIS

5.3.1 NORTH AMERICA

5.3.1.1 US

5.3.1.1.1 FDA device classification

FIGURE 18 US: REGULATORY APPROVAL PROCESS

TABLE 4 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.3.1.2 Canada

TABLE 5 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

FIGURE 19 CANADA: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES

5.3.2 EUROPE

5.3.2.1 European regulatory process

FIGURE 20 EUROPE: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES (MDR)

5.3.3 ASIA PACIFIC

5.3.3.1 Japan

TABLE 6 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

5.3.3.2 China

TABLE 7 CHINA: CLASSIFICATION OF MEDICAL DEVICES

5.3.3.3 India

5.4 ECOSYSTEM COVERAGE

5.5 VALUE CHAIN ANALYSIS

FIGURE 21 MARKET: VALUE CHAIN ANALYSIS

6 MARKET, BY MATERIAL TYPE (Page No. - 68)

6.1 INTRODUCTION

TABLE 8 MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

6.2 BIOINERT CERAMICS

TABLE 9 MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 10 MARKET FOR BIOINERT CERAMICS, BY REGION, 2020–2027 (USD MILLION)

6.2.1 ZIRCONIA

6.2.1.1 High resistance to corrosion to drive market growth

TABLE 11 MARKET FOR ZIRCONIA, BY REGION, 2020–2027 (USD MILLION)

6.2.2 ALUMINUM OXIDE

6.2.2.1 Increasing use of aluminum oxide in hip replacements and dental implants to drive market growth

TABLE 12 MEDICAL CERAMICS MARKET FOR ALUMINUM OXIDE, BY REGION, 2020–2027 (USD MILLION)

6.2.3 OTHER BIOINERT CERAMICS

TABLE 13 OTHER BIOINERT CERAMICS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 BIOACTIVE CERAMICS

TABLE 14 MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 15 MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY REGION, 2020–2027 (USD MILLION)

6.3.1 HYDROXYAPATITE

6.3.1.1 Increasing R&D activities to support adoption of hydroxyapatite applications in medical care

TABLE 16 MEDICAL CERAMICS MARKET FOR HYDROXYAPATITE, BY REGION, 2020–2027 (USD MILLION)

6.3.2 GLASS CERAMICS

6.3.2.1 Rising number of orthopedic & dental procedures to drive demand for glass ceramics

TABLE 17 MEDICAL CERAMICS MARKET FOR GLASS CERAMICS, BY REGION, 2020–2027 (USD MILLION)

6.4 BIORESORBABLE CERAMICS

6.4.1 INCREASING R&D ACTIVITIES IN FUNCTIONAL REGENERATION OF TISSUES TO DRIVE SEGMENT GROWTH

TABLE 18 MEDICAL CERAMICS MARKET FOR BIORESORBABLE CERAMICS, BY REGION, 2020–2027 (USD MILLION)

7 MARKET, BY APPLICATION (Page No. - 78)

7.1 INTRODUCTION

TABLE 19 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

7.2 DENTAL APPLICATIONS

TABLE 20 MARKET FOR DENTAL APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

7.2.1 DENTAL IMPLANTS

7.2.1.1 Increasing cases of dental caries to drive market growth

TABLE 21 MARKET FOR DENTAL IMPLANTS, BY REGION, 2020–2027 (USD MILLION)

7.2.2 DENTAL CROWNS & BRIDGES

7.2.2.1 Long lasting properties of dental crowns- key factor expected to support market growth

TABLE 22 MARKET FOR DENTAL CROWNS & BRIDGES, BY REGION, 2020–2027 (USD MILLION)

7.2.3 BRACES

7.2.3.1 Increasing demand for invisible ceramic braces due to esthetic concerns to drive market growth

TABLE 23 MARKET FOR BRACES, BY REGION, 2020–2027 (USD MILLION)

7.2.4 INLAYS & ONLAYS

7.2.4.1 Usage of CAD-CAM fabricated inlays & onlays to support market growth

TABLE 24 MARKET FOR INLAYS AND ONLAYS, BY REGION, 2020–2027 (USD MILLION)

7.2.5 DENTAL BONE GRAFTS & SUBSTITUTES

7.2.5.1 Increasing use of bone grafts in dental implant procedures is expected to drive market growth

TABLE 25 MARKET FOR DENTAL BONE GRAFTS & SUBSTITUTES, BY REGION, 2020–2027 (USD MILLION)

7.3 ORTHOPEDIC APPLICATIONS

TABLE 26 MARKET FOR ORTHOPEDIC APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

7.3.1 JOINT REPLACEMENT SURGERIES

7.3.1.1 Rising volume of joint replacement procedures to drive market growth

TABLE 27 MARKET FOR JOINT REPLACEMENT SURGERIES, BY REGION, 2020–2027 (USD MILLION)

7.3.1.2 Knee replacement

7.3.1.2.1 Growing number of knee replacement procedures to drive market growth

FIGURE 22 KNEE REPLACEMENT SURGERIES, 2015–2019 (PER 100,000)

7.3.1.3 Hip replacement

7.3.1.3.1 Use of ceramic materials in hip implants to drive market growth

FIGURE 23 HIP REPLACEMENT SURGERIES, 2015–2019 (PER 100,000)

7.3.1.4 Shoulder replacement surgery

7.3.1.4.1 Increasing incidence of shoulder injuries to drive market growth

7.3.1.5 Other joint replacement applications

7.3.2 FRACTURE FIXATION

7.3.2.1 Increasing demand for medical ceramics in constructing fracture fixation devices to support market growth

TABLE 28 MARKET FOR FRACTURE FIXATION, BY REGION, 2020–2027 (USD MILLION)

7.3.3 SYNTHETIC BONE GRAFTS

7.3.3.1 Advantages of synthetic bone grafts over autografts & allografts to drive market growth

TABLE 29 MARKET FOR SYNTHETIC BONE GRAFTS, BY REGION, 2020–2027 (USD MILLION)

7.4 CARDIOVASCULAR IMPLANTS

7.4.1 RISING ADOPTION OF HYDROXYAPATITE FOR COATING OF CARDIOVASCULAR IMPLANTS TO DRIVE MARKET GROWTH

TABLE 30 MARKET FOR CARDIOVASCULAR APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

7.5 SURGICAL INSTRUMENTS

7.5.1 INCREASING NUMBER OF SURGICAL PROCEDURES WORLDWIDE TO DRIVE MARKET GROWTH

TABLE 31 MARKET FOR SURGICAL INSTRUMENTS, BY REGION, 2020–2027 (USD MILLION)

7.6 DIAGNOSTIC INSTRUMENTS

7.6.1 GROWING AWARENESS AMONG PATIENTS ON EARLY DISEASE DIAGNOSIS TO SUPPORT MARKET GROWTH

TABLE 32 MARKET FOR DIAGNOSTIC INSTRUMENTS, BY REGION, 2020–2027 (USD MILLION)

7.7 PLASTIC SURGERY

TABLE 33 MARKET FOR PLASTIC SURGERY, BY REGION, 2020–2027 (USD MILLION)

7.7.1 CRANIOMAXILLOFACIAL IMPLANTS

7.7.1.1 Utilization of hydroxyapatite in craniomaxillofacial surgery for restorative purposes to support market growth

TABLE 34 MARKET FOR CRANIOMAXILLOFACIAL IMPLANTS, BY REGION, 2020–2027 (USD MILLION)

7.7.2 ORBITAL/OCULAR IMPLANTS

7.7.2.1 Increasing prevalence of eye diseases to drive market growth

TABLE 35 MARKET FOR ORBITAL/OCULAR IMPLANTS, BY REGION, 2020–2027 (USD MILLION)

7.7.3 DERMAL FILLERS

7.7.3.1 Usage of calcium hydroxyapatite in dermal fillers to support market growth

TABLE 36 MARKET FOR DERMAL FILLERS, BY REGION, 2020–2027 (USD MILLION)

7.8 OTHER APPLICATIONS

TABLE 37 MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

8 GLOBAL MARKET, BY REGION (Page No. - 99)

8.1 INTRODUCTION

TABLE 38 MARKET, BY REGION, 2020–2027 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 24 NORTH AMERICA: MEDICAL CERAMICS MARKET SNAPSHOT

TABLE 39 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET FOR PLASTIC SURGERY, BY TYPE, 2020–2027(USD MILLION)

8.2.1 US

8.2.1.1 Increasing elderly population & rising need for dental procedures to drive market growth

FIGURE 25 AGING POPULATION IN THE US, 2014–2060

TABLE 47 US: MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 48 US: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 49 US: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Rising geriatric population to drive market growth for medical ceramics

TABLE 50 CANADA: MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 51 CANADA: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 52 CANADA: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

8.3 EUROPE

TABLE 53 CONFERENCES AND SYMPOSIUMS ON MEDICAL CERAMICS IN EUROPE (2018–2020)

TABLE 54 EUROPE: MEDICAL CERAMICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 55 EUROPE: MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 56 EUROPE: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 57 EUROPE: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 58 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 59 EUROPE: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 60 EUROPE: MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 61 EUROPE: MARKET FOR PLASTIC SURGERY, BY TYPE, 2020–2027 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 Rising geriatric population and medical tourism to support market growth for medical ceramics

FIGURE 26 GERMANY: AGING POPULATION AGED 65 AND ABOVE, 2015–2021 (MILLION)

FIGURE 27 GERMANY: HIP REPLACEMENT SURGERIES, 2015–2019 (PER 100,000 POPULATION)

TABLE 62 GERMANY: MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 63 GERMANY: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 64 GERMANY: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

8.3.2 FRANCE

8.3.2.1 Growing awareness of dental care & rising surgical procedures to support market growth

FIGURE 28 FRANCE: KNEE REPLACEMENT SURGERIES, 2015–2019 (PER 100,000 POPULATION)

TABLE 65 FRANCE: MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 66 FRANCE: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 67 FRANCE: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

8.3.3 UK

8.3.3.1 Growing orthopedic & dental industry-key factor expected to drive adoption of medical ceramic products

TABLE 68 UK: MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 69 UK: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 70 UK: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

8.3.4 ITALY

8.3.4.1 Growing demand for medical ceramics in plastic surgeries to support market growth

TABLE 71 ITALY: NUMBER OF KNEE AND HIP REPLACEMENT SURGERIES, 2015–2020 (PER 100,000)

TABLE 72 ITALY: MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 73 ITALY: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 74 ITALY: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

8.3.5 SPAIN

8.3.5.1 Growing demand for cosmetic dentistry to support uptake of medical ceramics

TABLE 75 SPAIN: MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 76 SPAIN: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 77 SPAIN: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

8.3.6 REST OF EUROPE

TABLE 78 REST OF EUROPE: MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 79 REST OF EUROPE: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 80 REST OF EUROPE: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

8.4 ASIA PACIFIC

FIGURE 29 ASIA PACIFIC: MEDICAL CERAMICS MARKET SNAPSHOT (2021)

TABLE 81 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 82 ASIA PACIFIC: MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 84 ASIA PACIFIC: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 85 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 86 ASIA PACIFIC: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 ASIA PACIFIC: MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 88 ASIA PACIFIC: MARKET FOR PLASTIC SURGERY, BY TYPE, 2020–2027 (USD MILLION)

8.4.1 CHINA

8.4.1.1 Increasing awareness of oral healthcare & presence of specialized dental hospitals to drive market growth

TABLE 89 CHINA: MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 90 CHINA: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 91 CHINA: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

8.4.2 JAPAN

8.4.2.1 Rising prevalence of age-related illnesses to drive market uptake of medical ceramics

TABLE 92 JAPAN: MARKET, BY MATERIAL TYPE , 2020–2027 (USD MILLION)

TABLE 93 JAPAN: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 94 JAPAN: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

8.4.3 INDIA

8.4.3.1 Creation of medical device cluster projects to drive demand for medical ceramics

TABLE 95 INDIA: MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 96 INDIA: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 97 INDIA: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

8.4.4 AUSTRALIA

8.4.4.1 Growing target disease burden to support market growth

TABLE 98 AUSTRALIA: MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 99 AUSTRALIA: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 AUSTRALIA: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

8.4.5 SOUTH KOREA

8.4.5.1 Increasing dental care and plastic surgery procedures expected to support market growth

TABLE 101 SOUTH KOREA: MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 102 SOUTH KOREA: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 103 SOUTH KOREA: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

8.4.6 REST OF ASIA PACIFIC

TABLE 104 RISING GERIATRIC POPULATION (65 YEARS AND ABOVE), 2015–2021

TABLE 105 REST OF ASIA PACIFIC: MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 106 REST OF ASIA PACIFIC: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 107 REST OF ASIA PACIFIC: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

8.5 LATIN AMERICA

TABLE 108 LATIN AMERICA: MEDICAL CERAMICS MARKET, BY COUNTRY, 2020–2027(USD MILLION)

TABLE 109 LATIN AMERICA: MARKET FOR BIOINERT CERAMICS, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 110 LATIN AMERICA: BIOINERT CERAMICS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 111 LATIN AMERICA: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027(USD MILLION)

TABLE 112 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 113 LATIN AMERICA: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 114 LATIN AMERICA: MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2020–2027(USD MILLION)

TABLE 115 LATIN AMERICA: MARKET FOR PLASTIC SURGERY, BY TYPE, 2020–2027 (USD MILLION)

8.5.1 BRAZIL

8.5.1.1 Key market for medical ceramics owing to modernization of healthcare facilities

TABLE 116 BRAZIL: MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 117 BRAZIL: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 118 BRAZIL: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

8.5.2 MEXICO

8.5.2.1 Favorable investment scenario for medical device manufacturers to drive market growth

TABLE 119 MEXICO: MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 120 MEXICO: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 121 MEXICO: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

8.5.3 REST OF LATIN AMERICA

TABLE 122 REST OF LATIN AMERICA: MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 123 REST OF LATIN AMERICA: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 124 REST OF LATIN AMERICA: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

8.6 MIDDLE EAST & AFRICA

8.6.1 INCREASING AWARENESS OF DENTAL TREATMENT TO DRIVE MARKET GROWTH

TABLE 125 MIDDLE EAST & AFRICA: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

TABLE 126 MIDDLE EAST & AFRICA: MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020–2027(USD MILLION)

TABLE 127 MIDDLE EAST & AFRICA: MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 128 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 129 MIDDLE EAST & AFRICA: MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 130 MIDDLE EAST & AFRICA: MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 131 MIDDLE EAST & AFRICA: MARKET FOR PLASTIC SURGERY, BY TYPE, 2020–2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 143)

9.1 INTRODUCTION

9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 132 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN THE MEDICAL CERAMICS MARKET

9.3 MARKET SHARE ANALYSIS

TABLE 133 MARKET: DEGREE OF COMPETITION

9.4 COMPANY EVALUATION MATRIX

9.4.1 STARS

9.4.2 EMERGING LEADERS

9.4.3 PERVASIVE PLAYERS

9.4.4 PARTICIPANTS

FIGURE 30 MARKET: COMPETITIVE LEADERSHIP MAPPING (2021)

9.5 COMPETITIVE SITUATIONS & TRENDS

9.5.1 PRODUCT LAUNCHES (2019–2022)

9.5.2 EXPANSIONS (2019–2022)

9.5.3 PARTNERSHIPS AND COLLABORATIONS (2019–2022)

9.5.4 ACQUISITIONS (2019–2022)

10 COMPANY PROFILES (Page No. - 149)

10.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

10.1.1 INSTITUT STRAUMANN AG

TABLE 134 INSTITUT STRAUMANN AG: BUSINESS OVERVIEW

FIGURE 31 INSTITUT STRAUMANN AG: COMPANY SNAPSHOT (2021)

10.1.2 3M

TABLE 135 3M: BUSINESS OVERVIEW

FIGURE 32 3M: COMPANY SNAPSHOT (2021)

10.1.3 ROYAL DSM

TABLE 136 ROYAL DSM: BUSINESS OVERVIEW

FIGURE 33 ROYAL DSM: COMPANY SNAPSHOT (2021)

10.1.4 CERAMTEC

TABLE 137 CERAMTEC: BUSINESS OVERVIEW

FIGURE 34 CERAMTEC: COMPANY SNAPSHOT (2021)

10.1.5 KYOCERA CORPORATION

TABLE 138 KYOCERA: BUSINESS OVERVIEW

FIGURE 35 KYOCERA CORPORATION: COMPANY SNAPSHOT (2021)

10.1.6 COORSTEK INC.

TABLE 139 COORSTEK INC.: BUSINESS OVERVIEW

10.1.7 MORGAN ADVANCED MATERIALS PLC

TABLE 140 MORGAN ADVANCED MATERIALS PLC.: BUSINESS OVERVIEW

FIGURE 36 MORGAN ADVANCED MATERIALS PLC: COMPANY SNAPSHOT (2021)

10.1.8 NGK SPARK PLUG CO., LTD.

TABLE 141 NGK SPARK PLUG CO. LTD: BUSINESS OVERVIEW

FIGURE 37 NGK SPARK PLUG CO., LTD: COMPANY SNAPSHOT (2021)

10.1.9 TOSOH CORPORATION

TABLE 142 TOSOH CORPORATION: BUSINESS OVERVIEW

FIGURE 38 TOSOH CORPORATION: COMPANY SNAPSHOT (2021)

10.1.10 SUPERIOR TECHNICAL CERAMICS

TABLE 143 SUPERIOR TECHNICAL CERAMICS: BUSINESS OVERVIEW

10.1.11 RAUSCHERT GMBH

TABLE 144 RAUSCHERT GMBH: BUSINESS OVERVIEW

10.1.12 H.C. STARCK GMBH

TABLE 145 H.C. STARCK GMBH: BUSINESS OVERVIEW

10.1.13 NOBEL BIOCARE SERVICES AG

TABLE 146 NOBEL BIOCARE SERVICES AG: BUSINESS OVERVIEW

10.1.14 BERKELEY ADVANCED BIOMATERIALS

TABLE 147 BERKELEY ADVANCED BIOMATERIALS: BUSINESS OVERVIEW

10.1.15 BAKONY TECHNICAL CERAMICS LTD.

TABLE 148 BAKONY TECHNICAL CERAMICS LTD: BUSINESS OVERVIEW

10.2 OTHER COMPANIES

10.2.1 KURARAY NORITAKE DENTAL INC.

10.2.2 QSIL CERAMICS GMBH

10.2.3 FERRO CORPORATION

10.2.4 ELAN TECHNOLOGY

10.2.5 NISHIMURA ADVANCED CERAMICS

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 184)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 CUSTOMIZATION OPTIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the medical ceramics market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the medical ceramics market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such hospitals, specialty clinics, dentists, dermatology clinics, and long term care centers) and supply-side (such as product manufacturers, wholesalers, channel partners, and distributors). Approximately 31% of the primary interviews were conducted with stakeholders from the demand side while those from the supply side accounted for the remaining 69%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

All major product manufacturers offering various medical ceramics were identified at the global/regional level. Revenue mapping was done for the major players (who contribute at least 30-35% of the overall market share at the global level) and was extrapolated to arrive at the global market value of each type segment. The market value of medical ceramics was also split into various segments and subsegments at the region and country-level based on:

- Product mapping of various manufacturers for each type of medical ceramic at the regional and country-level

- Relative adoption pattern of each medical ceramic among key application segments at the regional and/or country-level

- Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country-level

- Detailed secondary research to gauge the prevailing market trends at the regional and/or country-level

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the medical ceramics industry.

Report Objectives

- To define, describe, and forecast the medical ceramics market based on the material type, application, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micro markets with respect to their growth trends, prospects, and contributions to the total market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the revenue of market segments with respect to five regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific), Latin America (Brazil, Mexico, and RoLA), and the Middle East & Africa

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as collaborations, partnerships, acquisitions, expansions, and product launches in the medical ceramics market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global medical ceramics market report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Ceramics Market