This research study extensively used secondary sources, directories, and databases to identify and collect valuable information to analyze the global collagen & gelatin market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the growth prospects of the market. The global market size estimated through secondary research was then triangulated with inputs from primary research to determine the final market size.

Secondary Research

The market for the companies offering collagen & gelatin was evaluated by secondary data available through paid and unpaid sources, analyzing the product and service portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives. Secondary data was analyzed to determine the overall size of the global collagen & gelatin market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global collagen and gelatin market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side, such as pharmaceutical and biotechnology companies, and experts from the supply side, such as C-level and D-level executives and managers. These interviews were conducted across major regions, namely, North America, Europe, the Asia Pacific, and the Rest of the World (including Latin America, the Middle East, and Africa). The primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

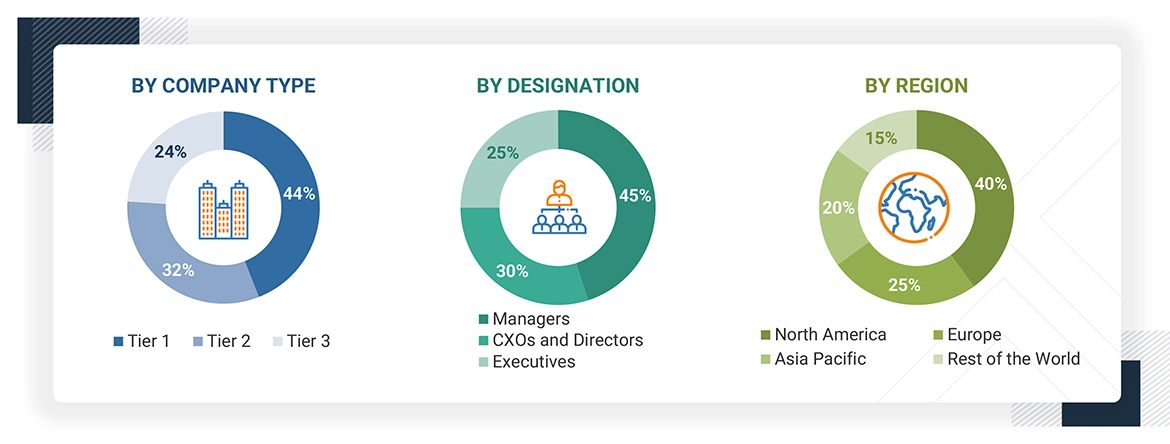

A breakdown of the primary respondents is given below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The global size of the collagen and gelatin market was estimated and validated through multiple approaches, such as the top-down and bottom-up approaches. These methods were also used extensively to estimate the size of various subsegments in the markets.

Data Triangulation

After determining the market size from the estimation process explained above, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition

Collagen is a fibrous structural protein of connective tissue. It is rich in proline and glycine and yields gelatin on hydrolysis. Gelatin is a partially hydrolyzed protein of collagen. Collagen and gelatin are natural biomaterials and are mainly used in wound care and orthopedic applications.

The report covers collagen and gelatin derived from bovine, porcine, and other sources (marine collagen; collagen obtained from chicken, rats, duck, and equine tendons; and recombinant collagen). The report’s scope is restricted to collagen and gelatin end products used for medical applications only. The use of collagen and gelatin as an intermediate product/raw material for pharmaceutical development and manufacturing (to produce hard capsules, softgel capsules, tablet binding or coating, components, or vaccines) and biotechnology applications (such as biomaterials, bioprinting) are not considered in the scope of this report.

Stakeholders

-

Biomaterial manufacturing companies

-

Original equipment manufacturing companies

-

Biomaterial suppliers and distributors

-

Medical research institutes

-

Government bodies

-

Corporate entities

-

Market research and consulting firms

Report Objectives

-

To define, describe, and forecast the collagen & gelatin market based on product type, source, application, end user, and region

-

To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

-

To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall collagen & gelatin market

-

To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

-

To forecast the market size of the segments in four regions: North America, Europe, the Asia Pacific, Latin America, and Middle East & Africa

-

To profile the key players and analyze their market shares and core competencies2

-

To track and analyze competitive developments, such as acquisitions, product launches, expansions, agreements, partnerships, and collaborations

-

To benchmark players within the market using the proprietary “Company Evaluation Matrix” framework, which analyzes market players on various parameters within the broad categories of business and product excellence strategies

-

To study trends & disruptions impacting business; apply pricing analysis, supply/value chain analysis, ecosystem analysis, technology analysis, patent analysis, and trade analysis; and identify key conferences & events in 2025–2026, key stakeholders & buying criteria, and the investment & funding scenario

-

To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook for each region.

Growth opportunities and latent adjacency in Collagen & Gelatin Market