Biosimilars Market by Drug Class (Drug Class (Monoclonal Antibodies (Adalimumab, Infliximab, Rituximab, Trastuzumab), Insulin, Erythropoietin, Anticoagulants. rhGH), Indication, Region – Global Forecast to 2028

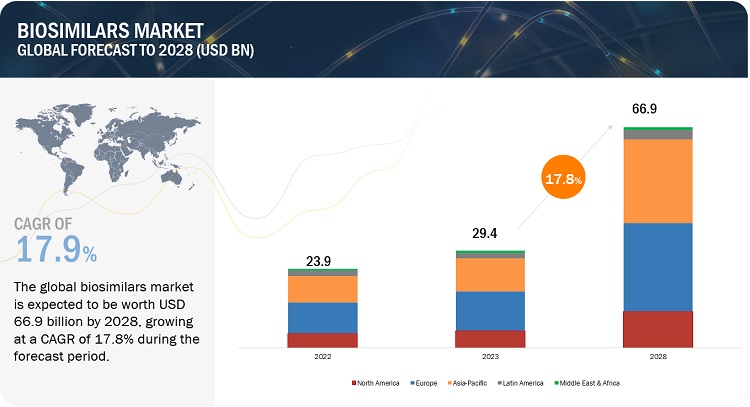

The global biosimilars market in terms of revenue was estimated to be worth $29.4 billion in 2023 and is poised to reach $66.9 billion by 2028, growing at a CAGR of 17.8% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Rising incidence of chronic diseases, increasing demand for biosimilars due to cost-effectiveness, increased number of product pipelines and loss of patent exclusivity of blockbuster drugs is driving the market growth.

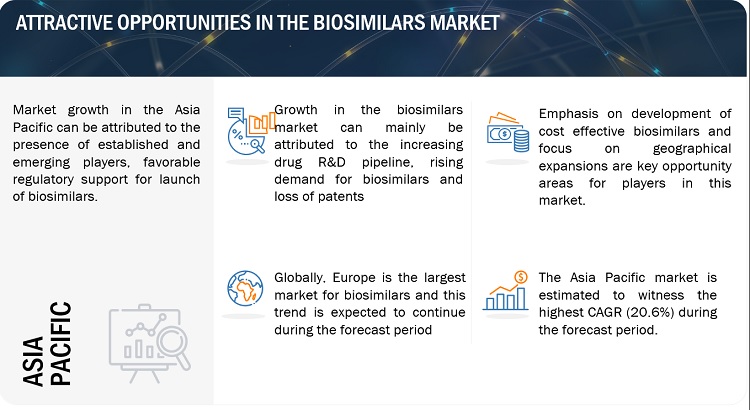

Attractive Opportunities in the biosimilars market

To know about the assumptions considered for the study, Request for Free Sample Report

Biosimilars Market Dynamics

DRIVER: Launch of novel biosimilars

Various key market players operating in the market have a strong emphasis on the development of biosimilars. As of December 2022, FDA has approved 40 biosimilars, and 25 have launched in the US. During the COVID-19 pandemic, FDA approvals slowed significantly; however, approvals rebounded in 2022, with seven new biosimilar approvals. All seven biosimilars approved in 2022 referenced products with previously approved biosimilars; no biosimilars were approved in 2022 referencing new reference products. 2022 also registered four new product launches, including the first two Lucentis (ranibizumab) biosimilars. Additionally, in 2022, FDA designated two new interchangeable biosimilars: Rezvoglar (referencing Lantus (insulin glargine)) and Cimerli (referencing Lucentis (ranibizumab)). Although there was an overall decline in approvals during the 2020 to 2021 timeframe, the number of development programs participating in the FDA’s Biosimilar Development Program has continued to rise. As of April 2023, there are around 60–70 biosimilars under pipeline studies. (Clinical.gov); half of them will be launched in three to four years. Growing approvals of biosimilars will ensure access to a greater pool of therapeutics and drive market growth.

RESTRAINT: Complexities in Manufacturing

Developing biosimilars is a highly complex and costly process that requires significant investments, technical capabilities, clinical trial expertise, scientific standards, and quality systems. Unlike the development of generic medicines, biosimilar manufacturers must invest in clinical trials and post-approval safety monitoring programs similar to that of the original innovator companies. Developing a biosimilar is a complex process. Biosimilars, like all biologics, are produced through an intricate, multistep process using living cells. However, the cell line and manufacturing process of the reference product are proprietary and belong to the original manufacturer.

For new entrants, the cost of developing biosimilars ranges from USD 100–250 million, including the cost of constructing a plant capable of producing biosimilars on a large scale. Besides this, the estimated timeframe for setting up a biosimilar/biological production capacity is anywhere from five to seven years; the cost can vary based on the location. The requirement for such high investments extends the time for companies to break even or to get sufficient returns on investment. In addition, companies with manufacturing experience (especially in biologics), such as Amgen and Biogen Idec, will have a considerable advantage over new companies with no such manufacturing experience. Hence, large pharmaceutical companies are expected to dominate the market as they bring marketing, sales, R&D, and manufacturing expertise.

OPPORTUNITY: Emerging markets

Markets across the Asia Pacific, Latin America (LATAM), and the Middle East offer significant growth opportunities to biosimilar manufacturers primarily due to the presence of less-stringent regulatory guidelines in developing countries. They differ from established markets regarding regulatory pathways, payer perceptions, pricing, affordability, and competitive landscapes. China and India are considered attractive destinations for R&D outsourcing for global biosimilar development and manufacturing companies, mainly due to their low labor & laboratory setup costs and the availability of skilled resources. This has drawn significant attention from key market players.

The market in Asia Pacific is a dynamic and rapidly evolving industry, with several key players leading the way: Celltrion (South Korea), Samsung Bioepis (South Korea), Dr. Reddy’s Laboratories (India), Biocon, and Shanghai Henlius Biotech (China). These companies have been instrumental in developing and commercializing biosimilars in the region and are expected to continue driving innovation and growth in the coming years..

CHALLENGE: Excess competition and regulatory challenges

Competition in the market is among biosimilar manufacturers and from originator biologic manufacturers. Upon the entry of new biosimilar products in the market, the originator biologic manufacturer may defend using various means such as the launch of second-generation products, reformulations, dosing improvements, supporting devices, and competing on prices.

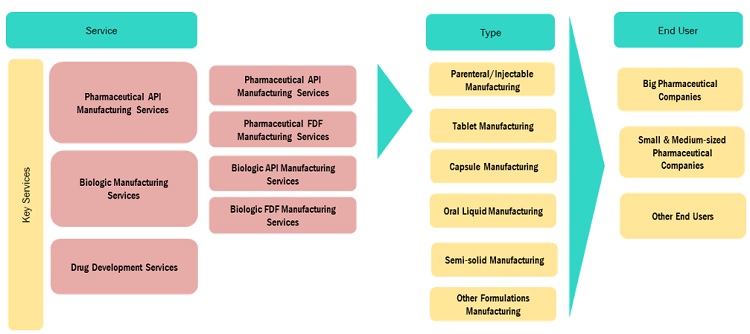

Biosimilars Market Ecosystem

The Oncology segment dominated the biosimilars industry in 2022.

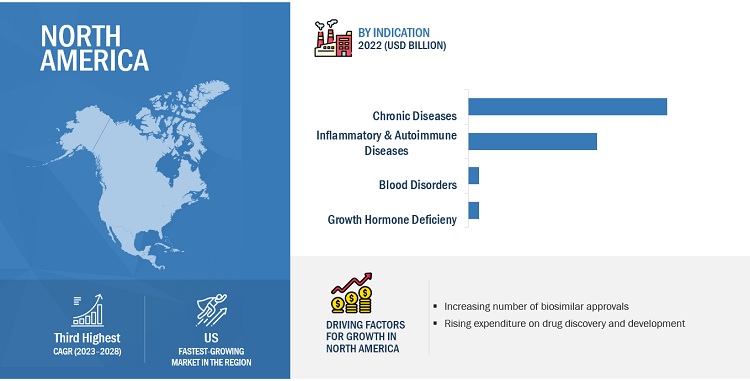

Based on the indication, the biosimilars market is segmented into oncology, inflammatory and autoimmune diseases, chronic diseases, blood disorders, growth hormone deficiency, infectious diseases, and other indications (infertility, hypoglycemia, myocardial infarction, postmenopausal osteoporosis, chronic kidney failure, and ophthalmic diseases). Oncology is the largest segment in this market owing to the availability of biosimilars at a lower price than innovative biologics and a large number of cancer patients. The availability of biosimilars in the field of oncology has lowered prices and made cancer treatment more affordable and accessible. Also, due to the high incidence and prevalence of cancer, healthcare systems across the globe are focusing on reducing the burden of cancer by adopting cost effective treatment options. In this scenario, biosimilar drugs might witness widespread adoption in major markets such as the US, Europe, and the Asia Pacific. Considering these factors and the upending competition from biosimilars, many major biologic pharmaceutical companies are making significant investments in the development and approval of biosimilar drugs.

Monoclonal antibodies segment dominated biosimilars industry in 2022

Based on the product, the biosimilars market is segmented into monoclonal antibodies; insulin; Granulocyte Colony-Stimulating Factor; Erythropoietin; Recombinant Human Growth Hormone; Etanercept; Follitropin; Teriparatide; Interferons; anticoagulants; other drug class. Monoclonal antibodies accounted for a share. Insulin is segment has gained momentum in last few years, approvals for interchangebility is likely to project the growth of the segment. Launch of novel mabs biosimialrs in various regions coupled with substantial number of products under pipeline studies is likely to have positive impact on the growth of the market.

North America dominated the biosimilars industry in 2022.

To know about the assumptions considered for the study, download the pdf brochure

Geographically, the biosimilars market is segmented Europe, the Asia Pacific, North America, Latin America and Middle East and Africa. In 2022, Europe accounted for the largest share of the market, followed by Asia Pacific & North America. Growth in these markets is primarily driven by several factors, such as the impending patent expiry of biologic products and the launch of new biosimilars, the rising incidence of chronic disorders, the emergence of new players and early entry into the market.

Key players in the biosimilars market include Novartis AG (Switzerland), Pfizer, Inc. (US), Dr. Reddy’s Laboratories Ltd. (India), Amgen, Inc. (US) and Eli Lilly and Company (US).

Scope of the Biosimilars Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$29.4 billion |

|

Projected Revenue by 2028 |

$66.9 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 17.8% |

|

Market Driver |

Launch of novel biosimilars |

|

Market Opportunity |

Emerging markets |

This report categorizes the biosimilars market to forecast revenue and analyze trends in each of the following submarkets:

By Drug Class

-

Monoclonal Antibodies

- Infliximab

- Trastuzumab

- Rituximab

- Adalimumab

- Other monoclonal antibodies

- Insulin

- Granulocyte Colony-Stimulating Factor

- Erythropoietin

- Recombinant Human Growth Hormone

- Etanercept

- Follitropin

- Teriparatide

- Interferons

- Anticoagulants

- Other drug class

By Indication

- Oncology

- Inflammatory & Autoimmune Disorders

- Chronic Diseases

- Blood Disorders

- Growth Hormone Deficiency

- Infectious Diseases

- Other Indications

By Region

-

Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- India

- China

- South Korea

- Japan

- Australia

- Rest of Asia Pacific (RoAPAC)

-

North America

- US

- Canada

- Latin America

- Middle East and Africa

Recent Developments of Biosimilars Industry

- In January 2023, Amgen Inc. launched AMJEVITA (adalimumab-atto), a biosimilar to Humira (adalimumab) in United States

- In October 2022, Biocon and Yoshindo Inc., entered into an agreement for commercializing Biocon’s pipeline products ustekinumab and bDenosumab in Japan

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global biosimilars market?

The global biosimilars market boasts a total revenue value of $66.9 billion by 2028.

What is the estimated growth rate (CAGR) of the global biosimilars market?

The global biosimilars market has an estimated compound annual growth rate (CAGR) of 17.8% and a revenue size in the region of $29.4 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

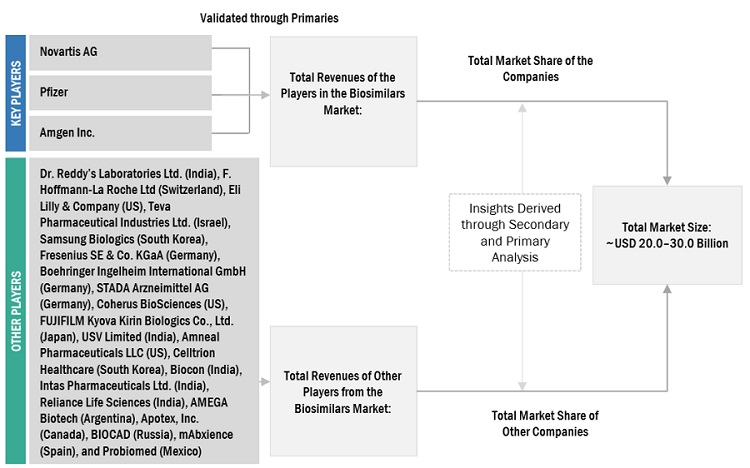

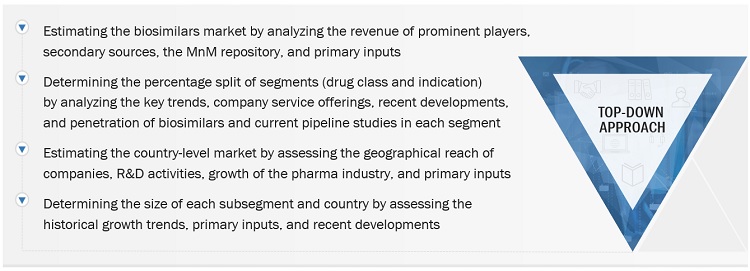

This study involved four major activities in estimating the current size of the biosimilars market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and other approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the biosimilars market. The secondary sources referred to for this research study include publications from government sources, such as the US Food and Drug Administration (FDA), the European Medicines Agency (EMA), the World Health Organization (WHO), the National Institute for Health and Care Excellence (NICE), Health Canada, the Australian Government Department of Health, Ministry of Food and Drug Safety of the Republic of Korea(MFDS), the Brazilian Health Regulatory Agency (ANVISA), the Health Products Regulatory Authority (HPRA), the Japan Ministry of Health, Labour and Welfare, the Central Drugs Standard Control Organization (CDSCO), and the China National Medical Products Administration (NMPA). Secondary sources include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global biosimilars market, which was validated through primary research.

Primary Research

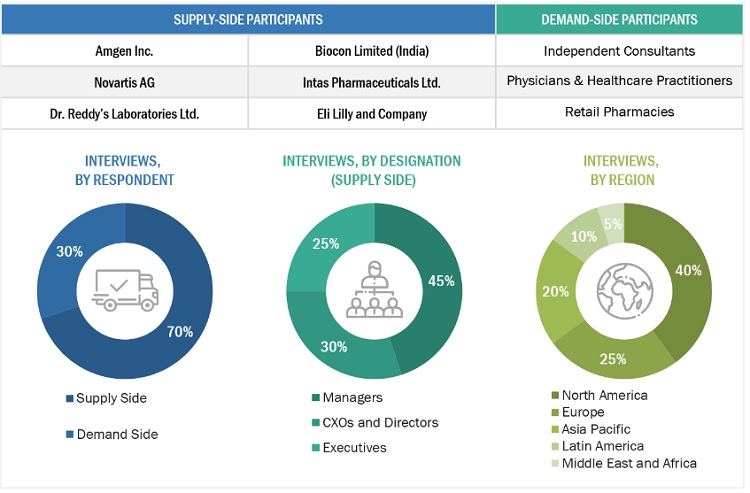

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down approach was used to estimate and validate the total size of the biosimilars market. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the biosimilars business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Global Biosimilars market size: Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Biosimilars market size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

A biosimilar is a biological medicine highly similar to another already approved biological medicine (the 'reference medicine'). Biosimilars are approved according to the same standards of pharmaceutical quality, safety and efficacy that apply to all biological medicine. They are the approved forms of original products and can be manufactured and marketed after the patent expiry of original biologics.

Key Stakeholders

- Biopharmaceutical drug (biosimilars and biologics) manufacturers

- Private equity companies and venture capital firms

- Healthcare service providers (hospitals and independent physicians)

- Health insurance payers

- Research and consulting service firms

- Contract research organizations (CROs)

- Contract manufacturing organizations (CMOs)

- Pharmaceutical and medical associations

Report Objectives

- To define, describe, and forecast the global biosimilars market based on the drug class, indication and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall biosimilars market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as service launched, acquisitions, expansions, agreements, collaborations, and R&D activities in the biosimilars market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of the Rest of Europe biosimilars market into respective countries

- Further breakdown of the Rest of Asia Pacific biosimilars market into respective countries

- Further breakdown of the Rest of Latin America biosimilars market into respective countries

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Company Information

- An additional five company profiles

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Biosimilars Market

I would like to know how much Covid-19 impacted the global revenue growth of the Biosimilars Market.

According to your study, what are some of the significant factors driving the growth of the biosimilars market?

There are a number of investment opportunities in the biosimilars industry in Saudi Arabia. These include:

Manufacturing: There is a growing demand for biosimilars in Saudi Arabia, and there is a limited supply of these products domestically. This creates an opportunity for investors to establish biosimilar manufacturing facilities in the country.

Research and development: Biosimilars are a relatively new field, and there is still much research and development that needs to be done. Investors can support this research by investing in biosimilar companies or by funding research projects at universities or research institutes.

Marketing and distribution: Biosimilars are still a relatively new product category, and there is a need for education and marketing to raise awareness of these products among healthcare professionals and patients. Investors can support this effort by investing in biosimilar marketing and distribution companies.

In addition to these opportunities, the Saudi government is also supportive of the biosimilars industry. The government has implemented a number of policies to promote the development and use of biosimilars, including:

Waiving import duties on biosimilars: This makes biosimilars more affordable for patients and healthcare providers.

Providing financial incentives for biosimilar manufacturers: This helps to offset the high costs of developing and manufacturing biosimilars.

Working with international organizations to promote the use of biosimilars: This helps to ensure that Saudi Arabia is aligned with global standards for the use of biosimilars.

The size of the market: The Saudi Arabian market for biosimilars is expected to grow significantly in the coming years.

The regulatory environment: The Saudi government is supportive of the biosimilars industry and has implemented a number of policies to promote its development. The competition: The biosimilars industry is still relatively new, but there are a number of companies that are already active in this sector.

The technology: Biosimilars are a complex product, and investors should carefully consider the technology involved in their development.

Where are investment opportunities in biosimilars industry in saudi arabia