Blockchain Gaming Market by Game Type (Role Playing Games, Open World Games, Collectible Games), Platforms (ETH, BNB Chain, Polygon), and Region (North America, Europe, Asia Pacific, Rest of the World) - Global Forecast to 2027

Blockchain Gaming Market Analysis, Industry Size & Forecast

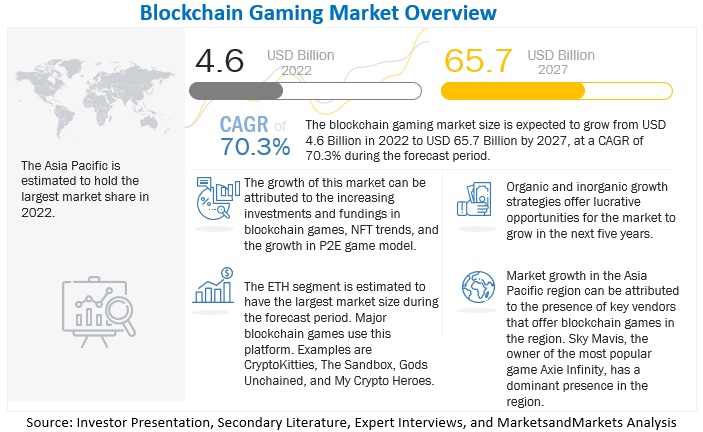

The global Blockchain Gaming Market size as per revenue was exceeded $4.6 billion in 2022 and is poised to hit around $65.7 billion by the end of 2027, records a CAGR of 70.3% for anticipated period, 2022-2027.

The rise in investments in blockchain games is driving the blockchain gaming industry growth. On the other hand, limited awareness about blockchain and NFTs may hinder the market's growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Blockchain Gaming Market Growth Dynamics

Driver: Shift from traditional games to blockchain-based games

Traditional games are centralized, which means all the items, including characters, skins, weapons, and even coding and experience gained while playing, cannot be used in other gaming projects. On the contrary, blockchain gaming enables players to own in-game digital assets. Gamers can now use rewards and in-game items across different crypto-gaming projects. Blockchain games offer various ways for gamers to earn real-world money. This concept is called a Play-To-Earn (P2E) model. For example, in Axie Infinity, one of the world's most famous P2E games, players can buy in-game characters called Axies, level them up, and sell them at a higher price. Gamers can also compete with other players to earn $SLP and $AXS, the project's native tokens. The benefits of using blockchain in gaming are making the game more secure, real-time ownership of items, and enabling gamers to earn real rewards. This is expected to boost the market growth.

Restraint: Regulatory challenges

The regulatory framework surrounding cryptocurrencies and NFTs might discourage gamers and developers from exploring blockchain games to their full potential. For example, the use of cryptocurrencies, such as MANA and Theta, poses a challenge as regulatory bodies are still trying to understand how they function and whether they should be used in blockchain gaming. In April 2022, the government of India introduced a 30% tax on the transfer of virtual digital assets or VDAs. As cryptos are classified as VDAs, players incur tax on crypto income. Crypto tax impacts people who earn reward points and make in-app purchases in crypto gaming. High tax levels could drive people out of blockchain gaming, affecting the industry.

Opportunity: Unique active wallet trends

The standard measurement for the DappRadar (DappRadar is the number one platform for dApp discovery, which gives users access to applications across blockchain ecosystems. For each dApp, DappRadar tracks the unique Active Wallets (UAWs), the number of transactions, and the volume of those transactions) Rankings are the UAW. This key metric shows which app has the most user wallets interacting with it and therefore sits on top of the charts. The growing number of UAWs is expected to hold immense opportunities for the market to grow in the future. As per findings from DappRadar, blockchain games registered 912,000 (8% month-on-month) Unique Active Wallets (UAWs) interacting with games' smart contracts in the quarter that ended in September 2022, which represented 48% of all blockchain-industry UAWs. In-game NFTs generated sales of USD 2.32 billion during that same period, which represents 22% of total NFT trading industry-wide. Alien Worlds and Splinterlands remain the two most played Web3 games. In Q3 September 2022, Alien Worlds became the most played blockchain game with 190,770 average daily UAWs, an increase of 14% from Q2. Splinterlands is the second most played blockchain game this quarter, with 159,522 average daily UAW, a 47% decrease from Q2. Similarly, due to a P2E gaming tournament featuring significant in-game NFTs for winners, the Polygon-based Benji Bananas, a game produced by Animoca Brands, climbed the rankings during the same quarter attracting over 29,000 daily UAWs, a rise UAWs of over 2,400% in September.

Challenge: Limited awareness of blockchain and NFT technologies

The major challenge for the mainstream acceptance and adoption of blockchain gaming is the lack of knowledge of its underlying technology: the blockchain. Blockchain technology is currently one of the hottest and most intriguing technologies in the market. However, end users are still facing some challenges in understanding the technicalities of the blockchain concept. This technology provides enormous benefits; however, even after many blockchain solution vendors have entered the market, the adoption of blockchain solutions is still not up to the mark. Enterprises adopting this technology need skilled staff that has in-depth knowledge of blockchain networks and blockchain applications. While people might have heard about blockchain and NFT technologies, they are not quite aware of their benefits of these. Blockchain awareness needs to grow before a larger number of gamers will want to jump in. 40% of gamers across the US, the UK., and Indonesia are interested in blockchain games. As a result, blockchain-based games and their unique benefits do not get the kind the attention they deserve.

By platform, ETH to account for the largest market share during the forecast period

ETH dominates the blockchain gaming market, with the largest market share in 2022. Game developers rely on ETH platform as it dramatically reduces security issues and enables companies to ensure that clients' money and data are kept safe. CryptoKitties was the first NFT project on ETH. In this, players were enabled to collect digital cat collectibles backed using NFTs. After this, many games are developed on the Ethereum platform. Axie Infinity, Gods Unchained, The Sandbox, Decentraland, and CryptoKitties are among the popular games that use the ETH blockchain platform. ETH, as it is a public blockchain, has its own challenges. Hence, blockchain game developers are moving toward the adoption of other blockchain platforms to resolve any scalability or processing power issues. Hence, the ETH market is expected to grow at a slower rate as compared to other blockchain platforms, such as BNB Chain, Polygon, and Solana, in the future.

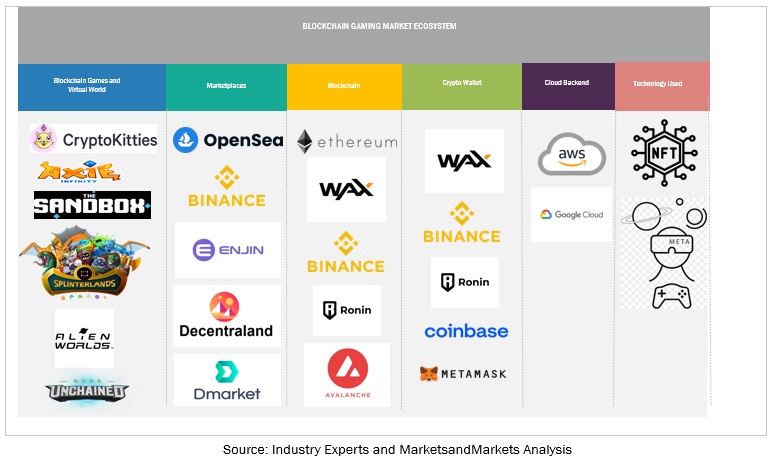

Blockchain Gaming Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

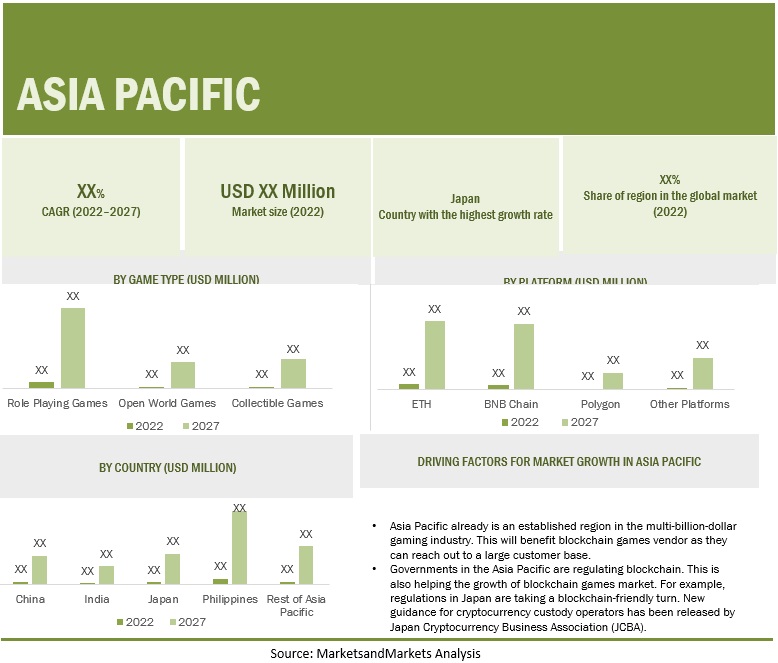

By region, Asia Pacific to account for the largest market share during the forecast period

To promote blockchain gaming in Asia, the Asia Blockchain Gaming Alliance (ABGA) was launched in November of 2021. ABGA helped in building the ecology of the industry and striving to invest in it. ABGA Shares industry knowledge, provides guidance to investors, and incubates and accelerates startups to drive the market. With a huge gamers base residing in the region, gaming is already a multi-billion-dollar industry across the Asia Pacific. This will benefit blockchain game vendors as they can reach out to a large customer base. Government regulations about blockchain are also helping the blockchain gaming market. For example, regulations in Japan are taking a blockchain-friendly turn. New guidance for cryptocurrency custody operators has been released by Japan Cryptocurrency Business Association (JCBA). These new guidelines will help developers comply with regulations while coming up with blockchain-based games that enable players to have greater control of in-game assets.

Key Market Players:

The key players in the global blockchain gaming market include Sky Mavis (Vietnam), Splinterlands (US), Animoca Brands (Hong Kong), Wemade (South Korea), Dacoco (Switzerland), Dapper Labs (Canada), Immutable (Australia), Uplandme (US), AlwaysGeeky Games (Canada), Decentraland Foundation (China), Mythical Games (US), Illuvium (Australia), Sorare (France), PopCap Games (US), G.JIT Japan (Japan), Double Jump.Tokyo (Japan), Gala Games (US), Lucid Sight (US), Rokosoft (Istanbul), Horizon Blockchain Games (Canada), Xaya (Malta), Planetarium (South Korea), Binamon (Argentina), and Codebit Labs (Australia).

Scope of the Report

|

Report Metrics |

Details |

|

Market size in 2022 |

$4.6 billion |

|

Revenue forecast for 2027 |

$65.7 billion |

|

CAGR (2022-2027) |

70.3% |

|

Forecast units |

Value (USD Billion) |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Segments covered |

By Game Type, By Platform

|

|

Geographies covered |

North America, Europe, Asia Pacific, Rest of the World

|

| Major companies covered | Sky Mavis (Vietnam), Splinterlands (US), Animoca Brands (Hong Kong), Wemade (South Korea), Dacoco (Switzerland), Dapper Labs (Canada), Immutable (Australia), Uplandme (US), AlwaysGeeky Games (Canada), Decentraland Foundation (China), Mythical Games (US), Illuvium (Australia), Sorare (France) |

Market Segmentation:

Recent Developments:

- In October 2022, Cool Cats Group announced that it received a strategic investment from Animoca Brands. In this partnership, Animoca Brands will help Cool Cats to become a global NFT brand.

- In August 2022, Splinterlands announced its partnership with MLSPA. These companies will work together to create and develop a Play-to-Earn (P2E) blockchain soccer-based game.

- In July 2022, Dacoco's Alien Worlds partnered with Zilliqa. Alien Worlds will integrate with Zilliqa for new features by bringing competitive gaming and blockchain gaming together through Zilliqa's eSports partners.

- In March 2022, Wemade announced its partnership with mobile ad firm YouAppi. With this partnership, Wemade will market games for its WEMIX platform.

- In November 2021, Community Gaming, a tournament organizer, announced a partnership with Sky Mavis to produce the Axie Infinity Fall Showcase. This will help Sky Mavis to reach out to a larger player base.

Frequently Asked Questions (FAQ):

How big is the Blockchain Gaming Market?

What is growth rate of the Blockchain Gaming market?

What are the key trends in the global Blockchain Gaming market?

- Increasing fundings and investments in blockchain gaming

- Shift from traditional games to blockchain games

- Increased awareness of NFTs and Play-to-Earn games

- Unique wallet trends

- Initial investments and complexities associated with playing blockchain games

Who are the key players in Blockchain Gaming market?

Who will be the leading hub for Blockchain Gaming market?

What is the Blockchain Gaming market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

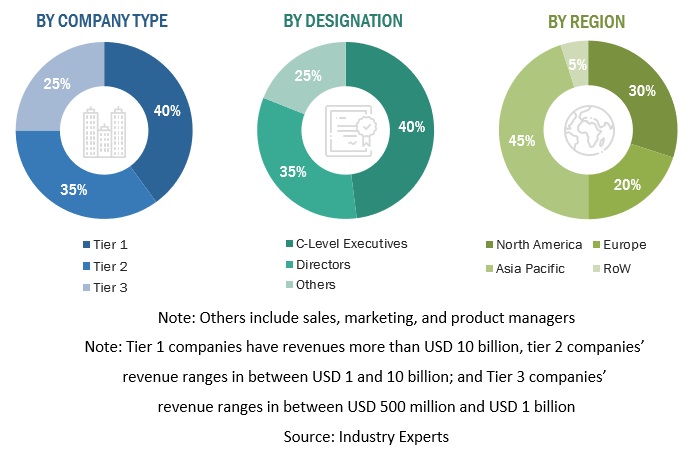

The study involved major activities in estimating the current market size for the blockchain gaming market. Exhaustive secondary research was done to collect information on the blockchain gaming industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the blockchain gaming market.

Secondary Research

The market for the companies offering blockchain gaming solutions for various verticals is arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolio of major companies in the ecosystem and rating them based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, investor presentations of companies; white papers, journals, certified publications; and articles from recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report in the primary research process. The primary sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), marketing directors, technology and innovation directors, investors, and related key executives from organizations operating in the blockchain gaming market.

In the market engineering process, top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. The complete market engineering process was extensive qualitative and quantitative analysis to list key information/insights throughout the report.

After the complete market engineering process (calculations for market statistics, market breakups, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research was also conducted to identify the segmentation types; industry trends; the competitive landscape of the blockchain gaming market players; and the key market dynamics, such as drivers, restraints, opportunities, challenges, and key strategies.

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After completing the market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research was also conducted to identify the segmentation types; industry trends; the competitive landscape of blockchain gaming market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Report Objectives

- To define, describe, and forecast the blockchain gaming market by game type, platform, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, and the Rest of the World

- To analyze subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as product enhancements and new product launches; acquisitions; and partnerships and collaborations, in the blockchain gaming market globally

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

- Further breakup of the rest of the world market into countries contributing 75% to the regional market size

Company information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Blockchain Gaming Market