Borescope Market by Type (Video, Flexible, Endoscope, Semi-rigid, Rigid), Diameter (0 mm to 3 mm, 3 mm to 6 mm, 6 mm to 10 mm, Above 10 mm), Angle (0° to 90°, 90° to 180°, 180° to 360°), Industry, and Region - Global Forecast to 2024-2036

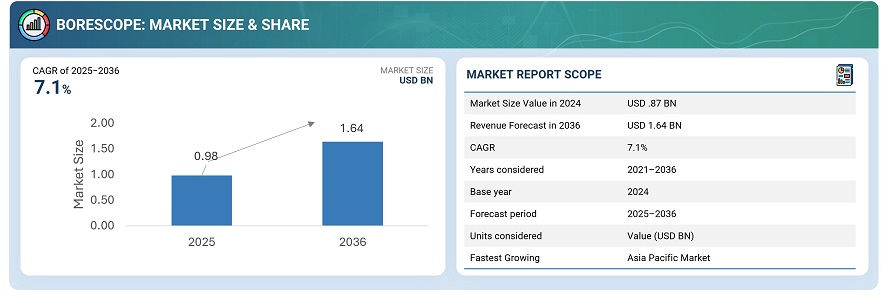

The global borescope market was valued at USD .87 billion in 2024 and is projected to reach USD 1.64 billion by 2036, growing at a CAGR of 7.1% between 2025 and 2036.

The borescope market is growing steadily due to increasing emphasis on precision inspection, preventive maintenance, and safety across various critical industries such as aerospace, automotive, oil and gas, and power generation. Industries are increasingly adopting non-destructive testing methods with advanced borescope tools to inspect hard-to-reach areas without disassembly, thereby minimizing downtime and reducing operational costs. Technological advancements in imaging quality, portability, and connectivity, such as high-definition video and flexible probe designs, are further expanding the applications of borescopes, making them essential in modern industrial inspections.

Growing awareness among industries about the cost benefits of early fault detection and efficient maintenance is accelerating the demand for borescopes. Regulatory inspection mandates and the push towards predictive maintenance in sectors like aviation and energy also contribute significantly to market growth. Emerging technologies such as AI-assisted defect recognition and cloud integration for data analysis enhance the efficiency and scope of borescopes, ensuring that the market will continue to expand as industries prioritize productivity, safety, and reliability through advanced inspection technologies.

Market by Type

Video Borescope

By type, video borescope holds the largest share of the borescope market, due to its advanced imaging capabilities and versatility across industries such as automotive, aerospace, and manufacturing. Video borescopes provide high-definition real-time visuals, which are critical for accurate inspection and maintenance of complex machinery and infrastructure. Their larger diameter and better range compared to other types make them suitable for inspecting pumps, turbines, generators, and pipelines. Technological advancements, such as wireless connectivity and cloud integration, have further accelerated their adoption, enabling remote monitoring and detailed documentation, which align with stringent regulatory requirements and quality control standards..

Flexible Borescope

The flexible borescope segment is expected to grow at a significant CAGR during the forecast period, because of its adaptability in navigating tight, complex, and hard-to-access areas that rigid or semi-rigid borescopes cannot reach. This flexibility makes them especially valuable in the aerospace and automotive sectors, where intricate geometries require detailed inspection without disassembly. Innovations in material science and miniaturized imaging technology are improving their maneuverability and image quality, expanding their use cases. Additionally, the increasing emphasis on predictive maintenance and preventive care in industrial applications is driving demand for flexible borescopes, as these tools help reduce downtime and maintenance costs through early fault detection.

Market by Diameter

3mm to 6mm

By diameter, the 3mm to 6mm segment is expected to hold the largest share of the borescope market, due to its optimal balance between flexibility and image clarity. This size range is versatile enough to be used across a wide array of industrial applications, from automotive to aerospace inspection, enabling detailed visual access to tight and moderately sized spaces without compromising maneuverability. Its broad applicability and effectiveness in delivering high-quality inspections make it the preferred choice for many industries that require routine maintenance and quality control.

6mm to 10 mm

The 6mm to 10mm segment is expected to grow at a significant CAGR during the forecast period, driven by demand from industries that involve larger machinery and equipment parts, such as heavy manufacturing, automotive engines, and industrial plant equipment. The larger diameter borescopes provide enhanced lighting and imaging capabilities suitable for inspecting sizeable structural components where access points accommodate bigger probes. This segment's growth is further supported by technological advancements that improve probe durability and imaging precision, allowing operators to conduct thorough inspections in challenging industrial environments.

Market by Geography

Geographically, the borescope market is expanding across North America, Europe, Asia Pacific, and the Rest of the World (ROW), including the Middle East, South America, and Africa. Asia Pacific is expected to grow at the highest CAGR, driven by rapid industrialization and expanding manufacturing activities in countries such as China, India, and Japan. This growth is supported by the increasing adoption of borescopes in critical sectors like automotive, power generation, aviation, and oil & gas, where high-precision inspection and maintenance are essential. Government investments in infrastructure development and regulatory emphasis on safety and quality further bolster market demand in this region. The expansion of automotive and aerospace industries, coupled with rising industrial automation, makes Asia Pacific a lucrative market for advanced borescope technologies.

Market Dynamics

Driver: High operational productivity

The high operational productivity is a key driving factor for the borescope market, as these devices enable efficient and rapid inspection of machinery and equipment without the need for dismantling. Borescopes help reduce downtime by allowing maintenance teams to detect issues early and schedule repairs during non-peak hours, which significantly cuts operational costs. This capability is especially valuable in industries such as aerospace, automotive, power generation, and oil & gas, where equipment uptime is critical. The use of borescopes contributes to maintaining continuous production processes, improving overall efficiency and productivity in industrial environments.

Restraint: Development of substitute technology

The development of substitute technologies represents a significant restraint for the borescope market. Emerging alternatives such as small robotic inspection systems and advanced imaging solutions offer potential substitutes, capable of accessing and analyzing critical components with less manual intervention. These technologies may provide enhanced automation, higher precision, and expanded capabilities, challenging traditional borescope applications. As these substitutes evolve and gain adoption, they could limit the growth potential of the borescope market. Additionally, the high costs and complexity of using borescopes compared to newer automated technologies further contribute to this restrain.

Opportunity: Large scale development of infrastructure

The large-scale development of infrastructure presents a significant opportunity for the borescope market. As countries worldwide invest heavily in building and upgrading critical infrastructure, such as pipelines, power plants, bridges, and transportation systems, the demand for efficient and non-destructive inspection tools like borescopes increases. Borescopes enable detailed internal inspections of structural components without the need for disassembly, which helps identify defects, corrosion, or blockages early, enhancing safety and durability. This capability supports timely maintenance, reduces downtime, and lowers repair costs, making borescopes indispensable in large infrastructure projects.

Challenge: Increasing training cost due to lack of skilled workforce

The increasing training cost due to the lack of a skilled workforce is a significant challenge hindering the growth of the borescope market. Operating advanced borescope equipment requires specialized knowledge and technical skills, which are currently in short supply, especially in emerging markets. This talent gap leads to higher expenses for companies as they invest in extensive training and certification programs to prepare operators. Additionally, the shortage of trained professionals slows down the adoption of sophisticated borescope technologies, limiting market expansion and reducing operational efficiency in industries reliant on precise inspections.

Future Outlook

This growth is driven by increasing demand for non-destructive testing and inspection in industries such as aerospace, automotive, oil and gas, and power generation. The adoption of advanced video borescopes with high-resolution imaging capabilities and real-time monitoring features is expanding the market landscape, enabling faster and more accurate inspections.

Regional growth is also positive, with North America expected to maintain a dominant market share due to robust industrial infrastructure and stringent inspection regulations, while Asia Pacific is the fastest-growing market region supported by rapid industrialization, increasing manufacturing activities, and adoption of automation technologies. Key challenges include high equipment costs and the need for skilled operators, but ongoing technological advancements such as AI-assisted defect detection and wireless connectivity are expected to mitigate these barriers, supporting continued market expansion in the coming decade.

Key Market Players

Top borescope companies Olympus Corporation (Japan) SKF (Sweden), Fluke Corporation (US), Baker Hughes Company (US), and Teledyne FLIR LLC (US).

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 15)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Introduction

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

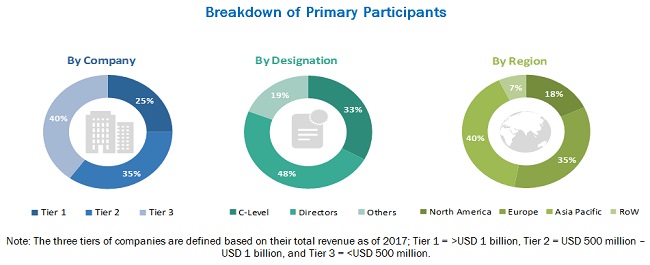

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Arriving at Market Size Using Bottom-Up Analysis

2.2.2 Top-Down Approach

2.2.2.1 Approach for Arriving at Market Size Using Bottom-Up Analysis

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Market, 2019–2024 (USD Million)

4.2 Market, By Type

4.3 Market, By Diameter

4.4 Market, By Angle

4.5 Market, By Industry and Region

4.6 Market, By Geography

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Operational Productivity

5.2.1.2 Power Generation Plant Maintenance

5.2.2 Restraints

5.2.2.1 Development of Substitute Technology

5.2.3 Opportunities

5.2.3.1 Large Scale Development of Infrastructure

5.2.3.2 Emergence of Electric Vehicles

5.2.4 Challenges

5.2.4.1 Increasing Training Cost Due to Lack of Skilled Workforce

5.3 Value Chain Analysis

6 Borescope Market, By Type (Page No. - 39)

6.1 Introduction

6.2 Video Borescopes

6.2.1 Video Borescopes to Lead Market During Forecast Period

6.3 Flexible Borescopes

6.3.1 Market for Flexible Borescopes With Diameters Ranging From 3mm to 6mm to Hold Largest Size During Forecast Period

6.4 Endoscopes

6.4.1 Market for Endoscopes With Diameters Ranging From 3mm to 6mm to Grow at Highest Rate During Forecast Period

6.5 Semi-Rigid Borescopes

6.5.1 Semi-Rigid Borescopes With Diameters Ranging From 0 mm to 3 mm to Hold Second-Largest Share During Forecast Period

6.6 Rigid Borescopes

6.6.1 High Resolution and Easy Operation of Rigid Borescopes Makes Them Popular Type of Borescopes

7 Borescope Market, By Diameter (Page No. - 59)

7.1 Introduction

7.2 Borescopes With Diameters Ranging From 0 mm to 3 mm

7.2.1 Market for Video Borescopes With Diameters Ranging From 0 mm to 3 mm to Hold Largest Size During Forecast Period

7.3 Borescopes With Diameters Ranging From 3 mm to 6 mm

7.3.1 Market for Borescopes With Diameters Ranging From 3 mm to 6 mm Held Largest Size of Overall Market in 2018

7.4 Borescopes With Diameters Ranging From 6 mm to 10 mm

7.4.1 Market for Video Borescopes With Diameters Ranging From 6 mm to 10 mm to Grow at Highest CAGR From 2019 to 2024

7.5 Borescopes With Diameters Above 10 mm

7.5.1 Market for Flexible Borescopes With Diameters Above 10 mm to Grow at Highest CAGR During Forecast Period

8 Borescope Market, By Angle (Page No. - 66)

8.1 Introduction

8.2 0° to 90°

8.2.1 Borescopes With Viewing Angles 0° to 90° to Hold Largest Market Share During Forecast Period

8.3 90° to 180°

8.3.1 Borescopes With Viewing Angles 90° to 180° Offer Flexibility

8.4 180° to 360°

8.4.1 Borescopes With Viewing Angles 180° to 360° Articulate in All Directions

9 Borescope Market, By Industry (Page No. - 70)

9.1 Introduction

9.2 Automotive

9.2.1 Adoption of Video Borescopes for Regular Automotive Maintenance

9.3 Aviation

9.3.1 Use of Borescopes for Inspecting Engines, Brakes, and Wings of Aircraft

9.4 Power Generation

9.4.1 Implementation of Borescopes for Inspecting Corrosion, Erosion, Welding, and Other Defects in Power Equipment

9.5 Oil & Gas

9.5.1 Use of Borescopes for Inspection of Storage Tanks, Flares, Crude Units, and Many Other Components

9.6 Manufacturing

9.6.1 Borescopes Ensure Maximum Efficiency of Machinery During Production

9.7 Chemicals

9.7.1 Utilization of Borescopes for Inspecting Processing Equipment Such as Filters, Heat Exchangers, Pumps, and Mixers

9.8 Food & Beverages

9.8.1 Adoption of Borescopes for Testing Common Problems Related to Cleanliness and Contamination

9.9 Pharmaceuticals

9.9.1 Requirement of Borescopes for Non-Destructive Testing to Ensure Quality of Pipelines

9.10 Others

10 Geographic Analysis (Page No. - 85)

10.1 Introduction

10.2 North America

10.2.1 Us

10.2.1.1 US to Hold Largest Market Size of Market in North America During Forecast Period

10.2.2 Canada

10.2.2.1 Canada to Be Fastest-Growing Country in North American Market

10.2.3 Mexico

10.2.3.1 Mexican Market to Be Driven By Growing Food & Beverages and Automotive Industries

10.3 Europe

10.3.1 Germany

10.3.1.1 Increasing Vehicle Production to Drive Market in Germany

10.3.2 UK

10.3.2.1 Rising Demand for Renewable Energy to Create Demand for Borescopes in Uk

10.3.3 France

10.3.3.1 Growing Power and Aviation Industries to Boost Demand for Borescopes in France

10.3.4 Rest of Europe

10.3.4.1 Expanding Manufacturing Capabilities in Rest of European Countries to Create Demand for Borescopes

10.4 APAC

10.4.1 China

10.4.1.1 China to Be Leading and Fastest-Growing Market in APAC

10.4.2 Japan

10.4.2.1 Increasing Growth in Automotive and Aviation Sectors to Boost Market for Non-Destructive Testing

10.4.3 India

10.4.3.1 Rising Fdi to Grow Industrial and Manufacturing Sectors of India

10.4.4 Rest of APAC

10.4.4.1 Growing Mining Industry in Australia to Drive Demand for Borescopes

10.5 RoW

10.5.1 South America

10.5.1.1 Leading Emerging Economies to Account for Largest Market Share of South America

10.5.2 Africa

10.5.2.1 Growing Transportation and Construction Sectors to Create Demand for Borescopes in Africa

10.5.3 Middle East

10.5.3.1 Rising Investments in Oil & Gas Sector to Drive Market in Middle East

11 Competitive Landscape (Page No. - 108)

11.1 Overview

11.2 Ranking of Players in Market

11.3 Competitive Leadership Mapping, 2019

11.3.1 Visionaries

11.3.2 Innovators

11.3.3 Dynamic Differentiators

11.3.4 Emerging Companies

11.4 Competitive Situations & Trends

11.4.1 Product Launches

11.4.2 Collaborations, Expansions, and Partnerships, 2017-2019

12 Company Profiles (Page No. - 115)

12.1 Key Players

12.1.1 Baker Hughes

12.1.1.1 Business Overview

12.1.1.2 Products Offered

12.1.1.3 SWOT Analysis

12.1.2 Flir

12.1.2.1 Business Overview

12.1.2.2 Products Offered

12.1.2.3 SWOT Analysis

12.1.3 Fluke

12.1.3.1 Business Overview

12.1.3.2 Product Offered

12.1.3.3 Recent Developments

12.1.3.4 SWOT Analysis

12.1.4 Olympus

12.1.4.1 Business Overview

12.1.4.2 Products Offered

12.1.4.3 Recent Developments

12.1.4.4 SWOT Analysis

12.1.5 SKF

12.1.5.1 Business Overview

12.1.5.2 Products Offered

12.1.5.3 Recent Developments

12.1.5.4 SWOT Analysis

12.1.6 Advance Inspection Technologies

12.1.6.1 Business Overview

12.1.6.2 Products Offered

12.1.7 Gradient Lens Corporation

12.1.7.1 Business Overview

12.1.7.2 Products Offered

12.1.8 Jme Technologies

12.1.8.1 Business Overview

12.1.8.2 Products Offered

12.1.9 Stanlay

12.1.9.1 Business Overview

12.1.9.2 Product Offered

12.1.10 Vizaar

12.1.10.1 Business Overview

12.1.10.2 Products Offered

12.1.10.3 Recent Developments

12.2 Other Key Players

12.2.1 Lenox

12.2.2 Moritex

12.2.3 Nexxis

12.2.4 PCE Instruments

12.2.5 RF Systems

12.2.6 SPI Engineering

12.2.7 Storz

12.2.8 Teslong

12.2.9 USA Borescope

12.2.10 Yateks

13 Appendix (Page No. - 136)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (106 Tables)

Table 1 Market, By Type, 2016–2024 (USD Million)

Table 2 Market, By Diameter, 2016–2024 (USD Million)

Table 3 Video Borescope, By Angle, 2016–2024 (USD Million)

Table 4 Video Borescope, By Industry, 2016–2024 (USD Million)

Table 5 Video Borescope, By Region, 2016–2024 (USD Million)

Table 6 Video Borescope in North America, By Country, 2016–2024 (USD Million)

Table 7 Video Borescope in Europe, By Country, 2016–2024 (USD Million)

Table 8 Video Borescope in APAC, By Country, 2016–2024 (USD Million)

Table 9 Video Borescope in RoW, By Region, 2016–2024 (USD Million)

Table 10 Flexible Borescope, By Diameter, 2016–2024 (USD Million)

Table 11 Flexible Borescope, By Angle, 2016–2024 (USD Million)

Table 12 Flexible Borescope, By Industry, 2016–2024 (USD Million)

Table 13 Flexible Borescope, By Region, 2016–2024 (USD Million)

Table 14 Flexible Borescope in North America, By Country, 2016–2024 (USD Million)

Table 15 Flexible Borescope in Europe, By Country, 2016–2024 (USD Million)

Table 16 Flexible Borescope in APAC, By Country, 2016–2024 (USD Million)

Table 17 Flexible Borescope in RoW, By Region, 2016–2024 (USD Million)

Table 18 Endoscope Market, By Diameter, 2016–2024 (USD Million)

Table 19 Endoscope Market, By Angle, 2016–2024 (USD Million)

Table 20 Endoscope Market, By Industry, 2016–2024 (USD Million)

Table 21 Endoscope Market, By Region, 2016–2024 (USD Million)

Table 22 Endoscope Market in North America, By Country, 2016–2024 (USD Million)

Table 23 Endoscope Market in Europe, By Country, 2016–2024 (USD Million)

Table 24 Endoscope Market in APAC, By Country, 2016–2024 (USD Million)

Table 25 Endoscope Market in RoW, By Region, 2016–2024 (USD Million)

Table 26 Semi-Rigid Borescope, By Diameter, 2016–2024 (USD Million)

Table 27 Semi-Rigid Borescope, By Angle, 2016–2024 (USD Million)

Table 28 Semi-Rigid Borescope, By Industry, 2016–2024 (USD Million)

Table 29 Semi-Rigid Borescope, By Region, 2016–2024 (USD Million)

Table 30 Semi-Rigid Borescope in North America, By Country, 2016–2024 (USD Million)

Table 31 Semi-Rigid Borescope in Europe, By Country, 2016–2024 (USD Million)

Table 32 Semi-Rigid Borescope in APAC, By Country, 2016–2024 (USD Million)

Table 33 Semi-Rigid Borescope in RoW, By Region, 2016–2024 (USD Million)

Table 34 Rigid Borescope, By Diameter, 2016–2024 (USD Million)

Table 35 Rigid Borescope, By Angle, 2016–2024 (USD Million)

Table 36 Rigid Borescope, By Industry, 2016–2024 (USD Million)

Table 37 Rigid Borescope, By Region, 2016–2024 (USD Million)

Table 38 Rigid Borescope in North America, By Country, 2016–2024 (USD Million)

Table 39 Rigid Borescope in Europe, By Country, 2016–2024 (USD Million)

Table 40 Rigid Borescope in APAC, By Country, 2016–2024 (USD Million)

Table 41 Rigid Borescope in RoW, By Region, 2016–2024 (USD Million)

Table 42 Borescope, By Diameter, 2016–2024 (USD Million)

Table 43 Market for Borescopes With Diameters Ranging From 0 mm to 3 mm, By Type, 2016–2024 (USD Million)

Table 44 Market for Borescopes With Diameters Ranging From 0 mm to 3 mm, By Region, 2016–2024 (USD Million)

Table 45 Market for Borescopes With Diameters Ranging From 3 mm to 6 mm, By Type, 2016–2024 (USD Million)

Table 46 Market for Borescopes With Diameters Ranging From 3 mm to 6 mm, By Region, 2016–2024 (USD Million)

Table 47 Market for Borescopes With Diameters Ranging From 6 mm to 10 mm, By Type, 2016–2024 (USD Million)

Table 48 Market for Borescopes With Diameters Ranging From 6 mm to 10 mm, By Region, 2016–2024 (USD Million)

Table 49 Market for Borescopes With Diameters Above 10 mm, By Type, 2016–2024 (USD Million)

Table 50 Market for Borescopes With Diameters Above 10 mm, By Region, 2016–2024 (USD Million)

Table 51 Market, By Angle, 2016–2024 (USD Million)

Table 52 Market for 0° to 90°, By Type, 2016–2024 (USD Million)

Table 53 Market for 90° to 180°, By Type, 2016–2024 (USD Million)

Table 54 Market for 180° to 360°, By Type, 2016–2024 (USD Million)

Table 55 Market, By Industry, 2016–2024 (USD Million)

Table 56 Market for Automotive, By Type, 2016–2024 (USD Million)

Table 57 Market for Automotive, By Region, 2016–2024 (USD Million)

Table 58 Market for Aviation, By Type, 2016–2024 (USD Million)

Table 59 Market for Aviation, By Region, 2016–2024 (USD Million)

Table 60 Market for Power Generation, By Type, 2016–2024 (USD Million)

Table 61 Market for Power Generation, By Region, 2016–2024 (USD Million)

Table 62 Market for Oil & Gas, By Type, 2016–2024 (USD Million)

Table 63 Market for Oil & Gas, By Region, 2016–2024 (USD Million)

Table 64 Market for Manufacturing, By Type, 2016–2024 (USD Million)

Table 65 Market for Manufacturing, By Region, 2016–2024 (USD Million)

Table 66 Market for Chemicals, By Type, 2016–2024 (USD Million)

Table 67 Market for Chemicals, By Region, 2016–2024 (USD Million)

Table 68 Market for Food & Beverages, By Type, 2016–2024 (USD Million)

Table 69 Market for Food & Beverages, By Region, 2016–2024 (USD Million)

Table 70 Market for Pharmaceuticals, By Type, 2016–2024 (USD Million)

Table 71 Market for Pharmaceuticals, By Region, 2016–2024 (USD Million)

Table 72 Market for Other Industries, By Type, 2016–2024 (USD Million)

Table 73 Market for Other Industries, By Region, 2016–2024 (USD Million)

Table 74 Market, By Region, 2016–2024 (USD Million)

Table 75 Market in North America, By Country, 2016–2024 (USD Million)

Table 76 Market in North America, By Type, 2016–2024 (USD Million)

Table 77 Market in US, By Type, 2016–2024 (USD Million)

Table 78 Market in Canada, By Type, 2016–2024 (USD Million)

Table 79 Market in Mexico, By Type, 2016–2024 (USD Million)

Table 80 Market in North America, By Diameter, 2016–2024 (USD Million)

Table 81 Market in North America, By Industry, 2016–2024 (USD Million)

Table 82 Market in Europe, By Country, 2016–2024 (USD Million)

Table 83 Market in Europe, By Type, 2016–2024 (USD Million)

Table 84 Market in Germany, By Type, 2016–2024 (USD Million)

Table 85 Market in UK, By Type, 2016–2024 (USD Million)

Table 86 Market in France, By Type, 2016–2024 (USD Million)

Table 87 Market in Rest of Europe, By Type, 2016–2024 (USD Million)

Table 88 Market in Europe, By Diameter, 2016–2024 (USD Million)

Table 89 Market in Europe, By Industry, 2016–2024 (USD Million)

Table 90 Market in APAC, By Country, 2016–2024 (USD Million)

Table 91 Market in APAC, By Type, 2016–2024 (USD Million)

Table 92 Market in China, By Type, 2016–2024 (USD Million)

Table 93 Market in Japan, By Type, 2016–2024 (USD Million)

Table 94 Market in India, By Type, 2016–2024 (USD Million)

Table 95 Market in Rest of APAC, By Type, 2016–2024 (USD Million)

Table 96 Market in APAC, By Diameter, 2016–2024 (USD Million)

Table 97 Market in APAC, By Industry, 2016–2024 (USD Million)

Table 98 Market in RoW, By Region, 2016–2024 (USD Million)

Table 99 Market in RoW, By Type, 2016–2024 (USD Million)

Table 100 Market in South America, By Type, 2016–2024 (USD Million)

Table 101 Market in Middle East, By Type, 2016–2024 (USD Million)

Table 102 Market in Africa, By Type, 2016–2024 (USD Million)

Table 103 Market in RoW, By Diameter, 2016–2024 (USD Million)

Table 104 Market in RoW, By Industry, 2016–2024 (USD Million)

Table 105 Product Launches, 2017–2019

Table 106 Collaborations, Expansions, and Partnerships, 2017–2019

List of Figures (50 Figures)

Figure 1 Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Market Breakdown and Data Triangulation

Figure 5 Assumption for Research Study

Figure 6 Borescope Market Segmentation

Figure 7 Video Borescopes Accounted for Largest Share of Market in 2018

Figure 8 Borescopes With Diameters Ranging From 3 mm to 6 mm Accounted for Largest Share of Overall Market in 2018

Figure 9 Borescopes With Angles Ranging From 0° to 90° Held Largest Share of Overall Market in 2018

Figure 10 Automotive to Register Highest CAGR Market During Forecast Period

Figure 11 APAC to Witness Highest CAGR in Market During Forecast Period

Figure 12 Growing Demand for Machinery Inspection to Boost Market

Figure 13 Video Borescopes to Account for Largest Size of Market From 2019 to 2024

Figure 14 Borescopes With Diameters Ranging From 3 mm to 6 mm to Hold Largest Market Size From 2019 to 2024

Figure 15 Borescopes With Angles Ranging From 0° to 90° to Hold Largest Size of Overall Market From 2019 to 2024

Figure 16 Automotive and North America Were Largest Shareholders of Market in 2018

Figure 17 US to Hold Largest Share of Market By 2019

Figure 18 DROC: Borescope Market, 2019

Figure 19 Value Chain Analysis: Market

Figure 20 Borescope Market, By Type

Figure 21 Automotive Industry to Hold Largest Size of Video Market During Forecast Period

Figure 22 Flexible Market for Automotive Industry to Grow at Highest CAGR During Forecast Period

Figure 23 Endoscope Market for Automotive to Hold Largest Size During Forecast Period

Figure 24 Semi-Rigid Market for Automotive to Hold Largest Market Size During Forecast Period

Figure 25 Rigid Market for Automotive to Hold Largest Market Size During Forecast Period

Figure 26 Market Segmentation, By Diameter

Figure 27 Video Borescopes With Diameters Ranging From 3 mm to 6 mm to Hold Largest Market Size From 2019 to 2024

Figure 28 Video Borescopes With Diameters Above 10 mm to Hold Largest Market Size From 2019 to 2024

Figure 29 Market Segmentation, By Angle

Figure 30 Market, By Industry

Figure 31 Video Borescopes to Hold Largest Market Size of Automotive Industry From 2019 to 2024

Figure 32 Video Borescopes to Hold Largest Market Size F Power Generation Industry From 2019 to 2024

Figure 33 Video Borescopes to Hold Largest Market Size From 2019 to 2024

Figure 34 Video Borescopes to Hold Largest Market Size of Pharmaceuticals Industry From 2019 to 2024

Figure 35 China to Register Highest CAGR in Overall Market During Forecast Period

Figure 36 North America: Market Snapshot

Figure 37 Video Borescopes to Lead Mexican Market During Forecast Period

Figure 38 Europe: Borescope Market Snapshot

Figure 39 Market for Video Borescopes to Grow at Highest CAGR in France During Forecast Period

Figure 40 APAC: Market Snapshot

Figure 41 Automotive Industry to Account for Largest Size of Market in APAC During Forecast Period

Figure 42 RoW: Borescope Market Snapshot

Figure 43 Product Launches Emerged as A Key Growth Strategy Adopted By Players in Market From 2017 to 2019

Figure 44 Ranking of Top 5 Players in Market, 2018

Figure 45 Borescope Market (Global) Competitive Leadership Mapping, 2018

Figure 46 Product Launches Was the Key Strategy Adopted From 2017 to 2019

Figure 47 Baker Hughes: Company Snapshot

Figure 48 Flir: Company Snapshot

Figure 49 Olympus: Company Snapshot

Figure 50 SKF: Company Snapshot

The study involves major activities for estimating the current size of the borescope market. Exhaustive secondary research was carried out to collect information on the market. The next step involved the validation of these findings, assumptions, and sizing with industry experts, identified in the value chain, through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as encyclopedias, directories, and databases [American Society of NDT, British Institute of NDT, Investor Presentations, OneSource, and Factiva] have been used to identify and collect information for an extensive technical and commercial study of the borescope market.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information as well as to assess prospects. Key players in the borescope market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as CEOs, directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the borescope market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size through the estimation process, the total market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

The objectives of the study are as follows:

- To describe and forecast the borescope market, in terms of value, by type, diameter, angle, and industry

- To forecast market size, in terms of value, by region - North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To provide a comprehensive overview of the value chain of the borescope ecosystem

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as contracts, acquisitions, product launches, and expansions and partnerships in the borescope market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific need. The following customization options are available for the report.

Company information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Borescope Market