Captive Portal Market by Offering (Platform and Services), End-use (Travel & Transportation, Hospitality & Leisure, Coworking Spaces, Shopping Malls & Retail Outlets, Entertainment, ISPs) and Region - Global Forecast to 2028

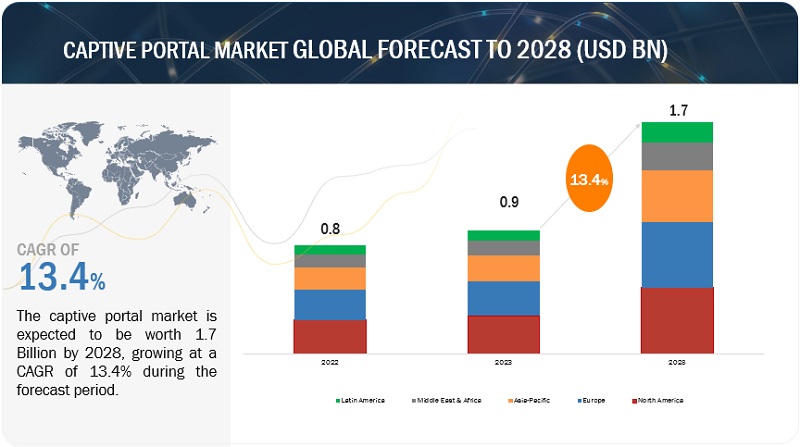

The global captive portal market size was valued at USD 0.9 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 13.4% from 2023 to 2028. The market is forecast to reach USD 1.7 billion by 2028.

The growing need to monetize public Wi-Fi services is driving the growth of the captive portal market. Captive portal systems can be utilized by businesses for Wi-Fi monetization, allowing them to generate revenue through various methods. Certain Captive Portal solutions enable customers to customize session durations and set bandwidth limitations based on preferences. Businesses can charge users for Wi-Fi access, display ads on the captive portal, collect user data for marketing purposes, offer premium services or bundled packages, and establish partnerships for mutual benefits.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Captive Portal Market Dynamics

Driver: To boost marketing efforts through the captive portal will drive the market growth.

Captive portals can be used as a powerful tool to boost marketing efforts by collecting customer data, displaying targeted advertisements, promoting special deals, conducting surveys, integrating with social media, and implementing loyalty programs. By leveraging these capabilities, businesses can enhance brand awareness, customer engagement, and revenue growth through their captive portal strategies. Captive portals enable businesses to create a branded and immersive user experience by incorporating company logos, colors, and messaging. This helps reinforce brand identity and ensures a consistent and memorable encounter for users. Furthermore, captive portals offer the advantage of delivering targeted messages to users.

Restraint: Ensure compliance with privacy regulations can be a restraint in the captive portal market

During the authentication process, capture portals usually gather user data, including email addresses and demographic information. It is essential to prioritize compliance with privacy regulations, such as the General Data Protection Regulation (GDPR) in the European Union. Businesses must obtain proper consent from users, handle and safeguard their data securely, and offer clear and transparent information regarding how the data is processed. Meeting these requirements is crucial to ensure privacy compliance and protect user data effectively.

Opportunity: Captive portal will help Wi-Fi analytics to get more customer insights

Businesses utilize Wi-Fi analytics to gather and analyze guest data obtained from Wi-Fi access points, enabling them to uncover key performance indicators (KPIs) like guest traffic, dwell times, and churn likelihood. Wi-Fi analytics serve as a tool to enhance operational efficiency, initiate targeted marketing efforts, and monitor the outcomes of marketing campaigns. Captive portals offer significant opportunities for Wi-Fi analytics by capturing user data during the authentication process. This data provides valuable insights into user behavior, footfall analysis, demographics, customer engagement, location-based analytics, and network performance monitoring.

Challenge: Bandwidth hogging can impact the demand for captive portal

Captive portals can face challenges related to users who excessively utilize the network for downloading large files, potentially engaging in illegal activities. This issue, known as bandwidth hogging, can be mitigated through additional programming within the captive portal. Captive portals may encounter challenges related to bandwidth hogging, which refers to the excessive network bandwidth consumption by specific users who continuously download large files.

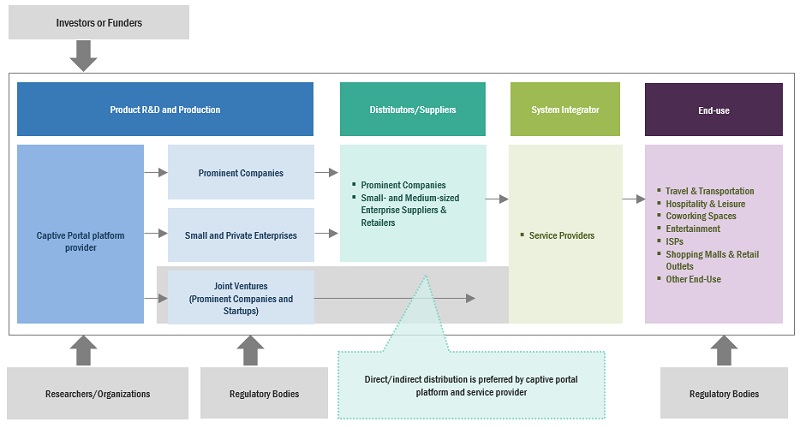

Captive portal Market Ecosystem

Prominent companies in this market include a well-established, financially stable provider of the captive portal market. These companies have innovated their offerings and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Cisco (US), Extreme Networks (US), Aruba (US), Juniper (US), and Arista Networks (US).

By travel & transportation, the airport segment holds the largest market size during the forecast period

Captive portals are in high demand at airports due to several factors. These portals offer Wi-Fi access to passengers, allowing them to stay connected, browse the internet, and access important information at the airport. They also serve as a platform to provide passengers with essential airport details such as flight schedules, gate changes, and terminal maps. Additionally, captive portals present opportunities for targeted marketing campaigns, allowing businesses to reach a captive audience and potentially drive sales or increase brand awareness.

By Hospitality & Leisure, the restaurants and cafes segment is expected to grow with the highest CAGR during the forecast period.

The captivating applications of the captive portal have led to a growing number of hotels, chains, and independent properties opting to implement it for guest Wi-Fi connections. Guests often request internet access during their stay, either for entertainment purposes or due to business needs if they are traveling for work. By implementing a captive portal, hotels can provide access to their network exclusively for in-house guests. Guests can log in to the hotel’s network using their details or their booking code, depending on the configuration preferences of the property.

Based on the end-use segment, the travel & transportation segment is to hold the largest market size during the forecast period.

Captive portals are widely employed in public locations like airports, train stations, bus terminals, and transportation hubs to offer Wi-Fi connectivity to travelers. A captive portal's primary goal is to verify users' identity and regulate their internet access. Upon connecting to a Wi-Fi network with a captive portal, users' web traffic is automatically directed to a dedicated webpage known as the captive portal page. This page presents users with different choices, including logging in with their credentials, accepting the terms and conditions, or providing any necessary information.

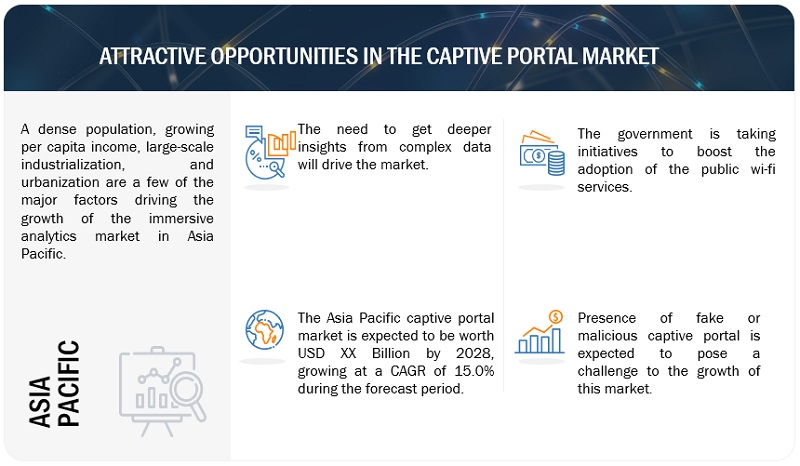

Based on region Asia Pacific is expected to grow with the highest CAGR during the forecast period.

The increasing internet penetration, the hospitality and tourism industry, the retail sector, educational institutions, public venues, business environments, managed service providers, and government institutions drive the demand for captive portal solutions in the Asia Pacific region. Captive portals provide secure and controlled access to Wi-Fi networks, authenticate users, manage network resources, gather customer data, and comply with regulations. Companies operating in this region will benefit from flexible economic conditions, the industrialization-and globalization-motivated policies of governments, and the expanding digitalization and technological adoption, all of which are expected to have a huge impact on the business community in the region. The growth of the captive portal market is anticipated to be fueled by the region's urbanization surge. Asia Pacific has a significant technology adoption rate and is expected to record the highest growth rate in the captive portal market over the next few years.

Market Players:

The major players in the captive portal market are Cisco (US), Aruba (US), Juniper (US), Extreme Network (US), Arista (US), Purple (UK), Enea (Sweden), Boingo (US), Netgear (US), IronWifi (US), GlobalReach (UK), Cloud4Wi (US), Skyfii (Australia), GoZone (US), Adentro (US), Anuvu (US), Spotipo (US), Nexnet Solutions (UAE), Performance Network (UK), Cloudi-Fi (France), WifiGem (Italy), Satcom Direct (US), Intelsat (US), Ray (Singapore), WatchGuard (US), Grandstream (US), and Keenetic (Germany). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, product enhancements, and acquisitions to expand their footprint in the captive portal market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

Offering and End-Use |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies covered |

Cisco (US), Aruba (US), Extreme Network (US), Arista (US), Purple (UK), Enea (Sweden), Boingo (US), Netgear (US), IronWifi (US), GlobalReach (UK), Cloud4Wi (US), Skyfii (Australia), GoZone (US), Adentro (US), Anuvu (US), Spotipo (US), Nexnet Solutions (UAE), Performance Network (UK), Cloudi-Fi (France), WifiGem (Italy), Satcom Direct (US), Intelsat (US), Ray (Singapore), WatchGuard (US), Grandstream (US), Keenetic (Germany), Juniper (US). |

This research report categorizes the captive portal market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

- Platform

- Services

Based on End-Use:

- Travel & Transportation

- Hospitality & Leisure

- Coworking Spaces

- Shopping Malls & Retail Outlets

- Entertainment

- ISPs

- Other End-Use

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- Italy

- Spain

- France

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- Japan

- ANZ

- Southeast Asia

- India

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- KSA

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In December 2022, Purple announced a strategic partnership with PBI (the airport's name) to gather feedback from travelers. This feedback will provide valuable insights into travelers' preferences for new amenities and services at the airport and their reasons for travel. By leveraging Purple's real-time analytics platform, PBI aims to capture unique and valuable data to improve the overall traveler experience. This collaboration will enable the airport to create innovative options and meet visitors' expectations in a more informed and targeted manner in the future.

- In November 2022, Purple and Dallas Area Rapid Transit (DART) announced a long-term business relationship to obtain key contacts and demographic information to understand their customers better and enable effective future communication. DART has selected Purple's top-tier Guest Wi-Fi solution for implementation in their Dallas transport venue, covering 300 access points. Using Purple's solution, DART will gain valuable insights into their customers' behavior and demographics, facilitating targeted and personalized communication strategies.

- In February 2019, AT&T expanded its roaming agreement with Boingo Wireless to provide subscribers with enhanced Wi-Fi connectivity at over 80 venues, which include major airports, military bases, and other locations featuring Boingo’s Passpoint-certified networks. Passpoint is a standardized hotspot technology that facilitates seamless and secure roaming between AT&T cellular networks and Boingo Wi-Fi networks, ensuring an improved connected experience for users.

Frequently Asked Questions (FAQ):

How big is the Captive Portal Market?

What is the Captive Portal Market growth?

What is the future of Captive Portal Market?

Who are the key players in Captive Portal Market?

Who will be the leading hub for Captive Portal Market?

What are the benefits of Captive Portal Market?

- Travel & Transportation

- Hospitality & Leisure

- Coworking Spaces

- Shopping Malls & Retail Outlets

- Entertainment

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

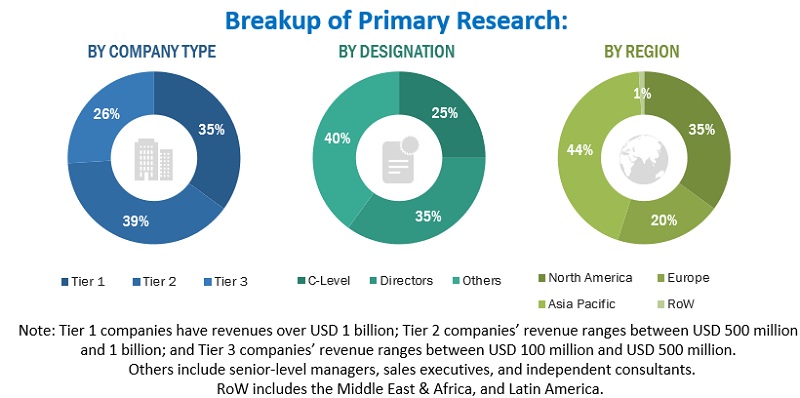

The captive portal market study extensively used secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva. Other market-related sources, such as journals and white papers from industry associations, were also considered while conducting the secondary research. Primary sources were mainly industry experts from core and related industries, preferred system developers, service providers, System Integrators (SIs), resellers, partners, and organizations related to the various segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents to obtain and verify critical qualitative and quantitative information and assess the market’s prospects. These respondents included key industry participants, subject matter experts, C-level executives of key market players, and industry consultants.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals, such as the Institute of Electrical and Electronics Engineers (IEEE), ScienceDirect, ResearchGate, Academic Journals, and Scientific.Net, were also referred to. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both markets and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the captive portal market. The primary sources from the demand side included captive portal end users, network administrators/consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations.

|

Company Name |

Designation |

|

Aruba |

Senior Manager |

|

RAY |

Director |

|

Gozone Wifi |

CEO |

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the market size of the captive portal market. The first approach involves estimating market size by summing up the revenue companies generate through the sale of captive portal offerings, such as hardware, solutions, and services.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the captive portal market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Analyzing the size of the global Captive Portal market by identifying segment and subsegment revenue related to the market

- Estimating ASP of Captive Portal

- Estimating the size of the Captive Portal market

Captive portal Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Captive portal Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the captive portal market was divided into several segments and subsegments. A data triangulation procedure was used wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

A captive portal is a webpage displayed to users when connecting to a Wi-Fi network. A captive portal’s primary purpose is to make sure that only authorized users may access a particular network and to give new users a way to authenticate. This usually appears as a password prompt or a login page. After authenticating, a user is given access to the network and is allowed to browse the internet.

Key Stakeholders

- Captive Portal Platform and Service Providers

- Technology Vendors

- Telecom Providers

- Mobile Network Operators (MNOs)

- System Integrators (SIs)

- Resellers

- Value-added Resellers (VARs)

- Managed Service Providers (MSPs)

- Compliance Regulatory Authorities

- Government Authorities

- Original Equipment Manufacturers (OEMs)

Report Objectives

- To determine, segment, and forecast the global Captive Portal market by offering, location type, application, vertical, and region in terms of value

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, and Rest of the World

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze the macro and micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the Captive Portal market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies2

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Captive Portal Market