Customer Engagement Solutions Market by Component (Solutions and Services), Deployment Type (Cloud and On-premises), Organization Size, Vertical (BFSI, Telecom & IT, and Retail & Consumer Goods) and Region - Global Forecast to 2027

Customer Engagement Solutions Market Forecast

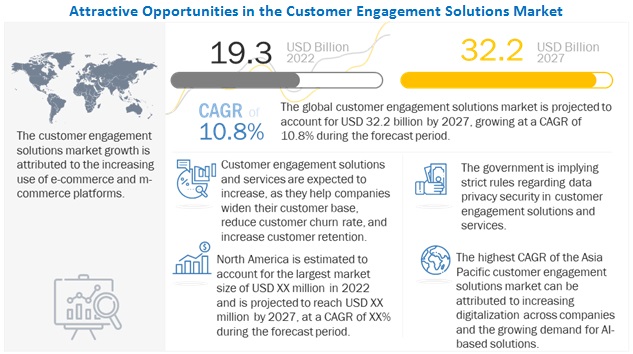

The global Customer Engagement Solutions Market is projected to expand at a CAGR of 10.8% during the forecast period to reach USD 32.2 billion by 2027, size was valued USD 19.3 billion in 2022. customer engagement solutions and services helping in reducing churn rate is one of primary factor driving an industry growth.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact Analysis

In a short time, the COVID-19 outbreak has affected markets and customer behaviors and substantially impacted economies and societies. With the pandemic eventually receding, sales and service organizations will have to continue accommodating new attitudes and behaviors and take immediate action to meet customer expectations in the post-crisis era. As digital channels spiked throughout the pandemic, the rules of engagement changed, and customer expectations for what constitutes basic digital capabilities have shifted. COVID-19 has exposed the insufficiency of traditional continuity plans. Enterprises that made investments in responsive human and digital workforce capabilities were able to navigate the crisis better than their counterparts.

Disruption of daily life due to COVID-19 stretched call centers and customer service operations to their limits with a reduced workforce. While call volumes rose sharply, call centers were encouraged to WFH as per government guidelines across the globe

Customer Engagement Solutions Market Dynamics

Driver: Rise in adoption of customer engagement solutions to reduce customer churn rate

According to HubSpot’s 2021 State of Inbound report, over 50% of companies have witnessed that generating leads. Increasing customer satisfaction is a top marketing priority in the coming years, which has stayed consistent over the last several years. The Harvard Business School report claims that, on average, a 5% increase in customer retention rates results in a 25–95% increase in profits. Poor customer experience is one of the key reasons for the increase in the churn rate of customers. With the help of customer engagement solutions, poor customer experience could transform into a positive brand image for the company. Customer engagement involves engaging customers through various touchpoints, such as social media, surveys, advertisement campaigns, and direct interaction. Customer analytics that forms a part of customer engagement solutions provides analytical insights regarding customer churn rate periodically as well as ensures effective relationship management between organizations and customers. Adopting customer engagement solutions helps organizations enhance customer retention and customer loyalty.

Restraint: Data synchronization between customer engagement solutions and other technologies

customer information is a critical component in customer engagement, as it helps facilitate interaction between customers and organizations. The complexity of touchpoints in the customer feedback process has helped businesses gather significant data related to customer behavior and expectations. customer contact centers generate a large volume of data; when this data is not synchronized with other technologies, organizations face issues in data synchronization. Data is collected from different touchpoints, and businesses are required to categorize them based on customer needs and expectations. Data collected from different touchpoints such as company websites, web, mobile phones, social media, and emails differ, making it difficult for organizations to organize it in different forms. A large amount of structured and unstructured data requires money, time, and expertise to analyze. This creates issues that prevent the optimum return on investment (RoI) from Customer engagement solutions market.

Opportunity: Growth in investments in Artificial Intelligence (AI)

Established companies, including Alibaba, BT Global Services, Lexus, Nubank, Uber, and Zurich Insurance, use AI technology for chatbots as well as to guide customer analytic capabilities in the customer engagement process. This indicates that engaging customers in every phase of their journey with the help of advanced technologies, such as AI, has always been a core growth strategy for established companies. These organizations have also noticed that automated AI-based tools are most effective when these tools supplement and extend the capabilities of their customer support team. Thus, a majority of the leading global brands are significantly investing in AI technology to enhance the level of customer engagement. In April 2021, Microsoft acquired speech recognition software maker Nuance Communications (NUAN), whose AI tools are widely used in the health care market. Alphabet, Microsoft, Facebook and Amazon are all spending big bucks on AI technology. These companies are deploying AI in consumer products and services, such as voice-activated smart home devices. Google and Facebook use AI tools in digital advertising. Companies are exploring ways to implement an effective mix of personnel and automated customer communication channels for enhanced customer engagement. Thus, increased investments in AI are providing lucrative growth opportunities to developers of customer engagement solutions.

Challenge: Managing security with multiple customer touchpoints

The increasing popularity of the web, mobile, cloud, and social media has raised concerns among organizations about managing customer data securely. The existence of multiple touchpoints increases customer data exposure to hostile unauthorized personnel. Organizations need to safeguard customer data from security breaches and hackers. As the implementation of customer engagement solutions involves dealing with a large volume of unstructured data, the need to ensure the secure management of customer data is acting as a key challenge to the growth of the Customer engagement solutions market.

Solution segment is expected to be the largest and fastest-growing during the forecast period

Enterprises are adopting customer engagement solutions to provide customers with connected personalized experiences across a wide range of physical, mobile, and web-based platforms. Organizations require Customer engagement solutions market that support them throughout the pre-sales, sales, and post-sales journey. Companies require automated engagement campaigns for higher productivity and in-depth customer analytics for facilitating relevant communications and solutions that offer a means for proactive engagement.

Cloud deployment mode is expected to account for a higher CAGR during the forecast period

The Cloud-based customer engagement solutions offers new cloud-only specific features that are available to try as soon as they are offered. Cloud-based solutions provide future growth, flexibility, and mobility. Cloud-based security management is much better and more trusted when handled by one big, experienced vendor rather than several small ones.

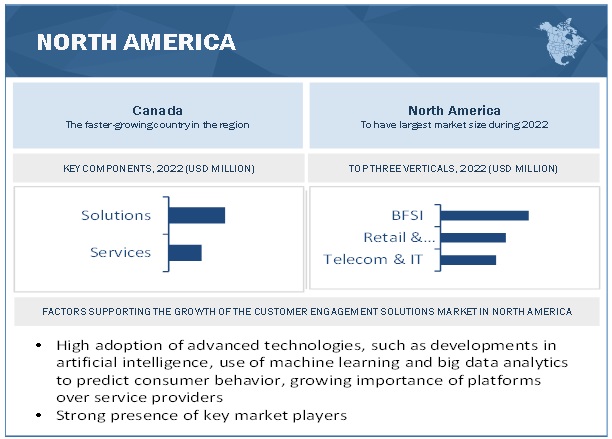

North America to account for the largest market share during the forecast period

North America is estimated to capture the largest share of the overall Customer engagement solutions market. The US holds a major portion of the market in this region. North America leads the global market in terms of the usage of customer engagement solutions based solutions and services. The US and Canada are prominent countries contributing to technology development in this region; The presence of major market players in the region, such as IBM Corporation, Microsoft Corporation, Nuance Communications, Oracle Corporation, and Salesforce.com Inc, has been the key factor that has driven the market expansion in the region. There is wide adoption of customer engagement solutions in the region, particularly in the US, as the country has been the earliest adopter of Social, Mobile, Analytics, and Cloud (SMAC) technologies.

To know about the assumptions considered for the study, download the pdf brochure

Market Players

The customer engagement solutions market vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global Customer engagement solutions market include Avaya (US), IBM (US), Microsoft (US), NICE Systems (Israel), Oracle (US), Salesforce (US), SAP (Germany), Zendesk (US), Pegasystems (US), ServiceNow (US), Open Text (Canada), Precisely (US), Verint Systems (US), eGain Corporation (US), Enghouse Systems (US), Alvaria (US), Genesys (US), Freshworks (California), IFS-mplsystems (Sweden), Calabrio (US), Khoros (US), Creatio (US), CRMNEXT (California), SugarCRM (Canada), WebEngage (India), Upshot (Texas), MoEngage (US), ChurnZero (US), and Sentimeter (US).

The study includes an in-depth competitive analysis of these key players in the market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 19.3 billion |

|

Revenue forecast in 2027 |

USD 32.2 billion |

|

Growth Rate |

CAGR of 10.8% |

|

Forecast units |

Value (USD Billion) |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Segments covered |

By component, organization size, deployment mode, verticals and region |

|

Regions covered |

North America, Europe, APAC, MEA, Latin America |

|

Top Key Players |

Avaya (US), IBM (US), Microsoft (US), NICE Systems (Israel), Oracle (US), Salesforce (US), SAP (Germany), Zendesk (US), Pegasystems (US), ServiceNow (US), Open Text (Canada), Precisely (US), Verint Systems (US), eGain Corporation (US), Enghouse Systems (US) |

This research report categorizes the customer engagement solutions market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

-

Solutions

- Omnichannel

- Workforce optimization

- Robotic process optimization

- Analytics and reporting

-

Services

-

Professional services

- Integration and deployment services

- Support and maintenance services

- Consulting services

- Managed services

-

Professional services

By Organization Size:

- Small and medium sized enterprises

- Large enterprises

By Deployment Mode:

- Cloud

- On-premises

By Verticals:

- Banking, Finance services, and Insurance (BFSI)

- Healthcare and Life Sciences

- Telecom and IT

- Automotive

- Transportation and Logistics

- Retail and Consumer Goods

- Media and Entertainment

- Travel and Hospitality

- Other Verticles (energy and utilities, and education)

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

APAC

- India

- China

- Japan

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In March 2022, Avaya announced a strategic partnership with Alcatel-Lucent Enterprise that extends the availability of Avaya’s OneCloud CCaaS (Contact Center as a Service) composable solutions to ALE’s global base of customers while also making ALE’s digital networking solutions available on a global basis to Avaya customers.

- In March 2022, Microsoft acquired Nuance Communications, Inc., With this acquisition, Microsoft and Nuance will enable organizations across industries to accelerate their business goals with its security-focused, cloud-based solutions infused with powerful, vertically optimized AI. Customers will benefit from enhanced consumer, patient, clinician, and employee experiences, and, ultimately, improved productivity and financial performance.

- In July 2021, Salesforce acquired Slack, With this acquisition, Salesforce will deliver the Slack-first Customer 360 that gives companies a single source of truth for their business, and a single platform for connecting employees, customers, and partners with each other and the apps they use every day, all within their existing workflows

Frequently Asked Questions (FAQ):

What is the projected market value of the global customer engagement solutions market?

The global market of customer engagement solutions is projected to reach USD 32.2 billion

What is the estimated growth rate (CAGR) of the global customer engagement solutions market for the next five years?

The global customer engagement solutions market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.8% from 2022 to 2027.

What are the major revenue pockets in the customer engagement solutions market currently?

The growth of the customer engagement solutions market in Asia Pacific is highly driven by the rapid digitalization of enterprises across the region. According to the Computer Weekly/TechTarget IT Priorities survey of 2019, 42% of nearly 1,000 IT decision-makers in Asia Pacific revealed that they are looking to upgrade their IT infrastructure to support digital transformation initiatives, while 35% expect to harness technologies that improve employee experience and productivity. This indicates spending on software is also expected to grow to keep up with rising customer demands in terms of online accessibility of services from enterprises. Hence, this rapid investment in technologies and providing online services to the customer is expected to drive the growth of the customer engagement solutions market in Asia Pacific.

Who are the key vendors in the customer engagement solutions market?

Avaya (US), IBM (US), Microsoft (US), NICE Systems (Israel), Oracle (US), Salesforce (US), SAP (Germany), Zendesk (US), Pegasystems (US), ServiceNow (US), Open Text (Canada), Precisely (US), Verint Systems (US), eGain Corporation (US), Enghouse Systems (US), Alvaria (US), Genesys (US)

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 CUSTOMER ENGAGEMENT SOLUTIONS MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

FIGURE 2 CUSTOMER ENGAGEMENT SOLUTIONS MARKET: GEOGRAPHIC SCOPE

1.3.3 INCLUSIONS AND EXCLUSIONS

1.3.4 YEARS CONSIDERED

1.4 CURRENCY

TABLE 1 USD EXCHANGE RATES, 2019–2021

1.5 LIMITATIONS

1.6 SUMMARY OF CHANGES

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 3 CUSTOMER ENGAGEMENT SOLUTIONS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Breakdown of primaries

2.1.2.4 Primary sources

2.1.2.5 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF MARKET

2.2.2 TOP-DOWN APPROACH

FIGURE 6 TOP-DOWN APPROACH

2.2.3 CUSTOMER ENGAGEMENT SOLUTIONS MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

2.2.4 MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

2.2.5 GROWTH FORECAST ASSUMPTIONS

TABLE 2 MARKET GROWTH ASSUMPTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.4.1 RISK ASSESSMENT

TABLE 3 RISK ASSESSMENT: MARKET

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 10 CUSTOMER ENGAGEMENT SOLUTIONS MARKET, 2022–2027 (USD MILLION)

FIGURE 11 MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET, BY DEPLOYMENT MODE, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET, BY ORGANIZATION SIZE, 2022 VS. 2027 (USD MILLION)

FIGURE 14 MARKET, BY VERTICAL, 2022 VS. 2027 (USD MILLION)

FIGURE 15 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 CUSTOMER ENGAGEMENT SOLUTIONS MARKET OVERVIEW

FIGURE 16 INCREASING USE OF E-COMMERCE AND M-COMMERCE PLATFORMS TO DRIVE MARKET GROWTH

4.2 NORTH AMERICA: MARKET, BY SOLUTIONS AND SERVICES (2022)

FIGURE 17 OMNICHANNEL SOLUTIONS SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

4.3 GEOGRAPHICAL SNAPSHOT OF THE MARKET

FIGURE 18 ASIA PACIFIC EXPECTED TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CUSTOMER ENGAGEMENT SOLUTIONS MARKET

5.2.1 DRIVERS

5.2.1.1 Rise in adoption of customer engagement solutions to reduce customer churn rate

FIGURE 20 MOST SIGNIFICANT RETAIL REVENUE DRIVERS, 2021

5.2.1.2 Increase in use of eCommerce and mCommerce platforms

5.2.1.3 Greater focus on delivering enhanced omnichannel customer engagement

FIGURE 21 COMMUNICATION CHANNELS USED TO INITIATE CUSTOMER ENGAGEMENT, 2021

5.2.1.4 Shift toward providing exclusive virtual experiences in the post-COVID-19 era

5.2.2 RESTRAINTS

5.2.2.1 Data synchronization between customer engagement solutions and other technologies

5.2.2.2 Personalized expectations of customers

5.2.3 OPPORTUNITIES

5.2.3.1 Increased applicability of Big Data and Machine Learning

5.2.3.2 Growth in investments in Artificial Intelligence (AI)

5.2.3.3 Surge in cross-selling and upselling activities

5.2.3.4 End-to-end business reorientation catalyzed by COVID-19

5.2.4 CHALLENGES

5.2.4.1 Managing security with multiple customer touchpoints

5.2.4.2 Choosing the proper mix of technology and personnel

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.3 CUMULATIVE GROWTH ANALYSIS

5.4 CUSTOMER ENGAGEMENT SOLUTIONS MARKET: SUPPLY CHAIN ANALYSIS

FIGURE 22 MARKET: SUPPLY CHAIN

5.5 ECOSYSTEM

FIGURE 23 MARKET: ECOSYSTEM

TABLE 4 MARKET: ECOSYSTEM

5.6 PRICING MODEL OF MARKET PLAYERS

TABLE 5 PRICING MODELS AND INDICATIVE PRICE POINTS, 2021–2022

5.7 TECHNOLOGY ANALYSIS

5.7.1 INTRODUCTION

5.7.2 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.7.3 BLOCKCHAIN

5.7.4 AUGMENTED/VIRTUAL REALITY

5.7.5 INTERNET OF THINGS

5.8 CASE STUDY ANALYSIS

5.8.1 CASE STUDY 1: PETRIC USED AVAYA’S SOLUTION TO ENHANCE CUSTOMER SATISFACTION AND BUSINESS

5.8.2 CASE STUDY 2: WITH CONVERSATION INTELLIGENCE IN DYNAMICS 365 SALES, INVESTEC ENHANCED SALES CALLS

5.8.3 CASE STUDY 3: BANCO SANTANDER BRASIL DELIVERED EXCEPTIONAL CLIENT SERVICE AT SPEED WITH THE PEGA PLATFORM

5.8.4 CASE STUDY 4: CISCO DELIVERED STRONG DIGITAL CUSTOMER ENGAGEMENT WITH PEGA

5.8.5 CASE STUDY 5: THE CITY OF MESA OPTED FOR ASPECT UNIFIED IP SOLUTIONS FROM ALVARIA TO OFFER STRONG INTERACTION CHOICES

5.8.6 CASE STUDY 6: THE UNIVERSITY OF CALIFORNIA AT BERKELEY OFFERED EXCELLENT STUDENT SERVICES WITH SALESFORCE SERVICE CLOUD SOLUTION

5.8.7 CASE STUDY 7: SYNERGY ENTERPRISE ADOPTED THE FRESHSALES’ SOLUTION TO ENHANCE CUSTOMER ENGAGEMENT

5.9 REVENUE SHIFT FOR THE CUSTOMER ENGAGEMENT SOLUTIONS MARKET

FIGURE 24 REVENUE IMPACT ON THE MARKET

5.10 PATENT ANALYSIS

5.10.1 METHODOLOGY

5.10.2 DOCUMENT TYPES OF PATENTS

TABLE 6 PATENTS FILED, 2019–2022

5.10.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 25 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2019–2021

5.10.3.1 Top applicants

FIGURE 26 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2019–2021

TABLE 7 US: TOP TEN PATENT OWNERS IN THE MARKET, 2019–2021

TABLE 8 LIST OF A FEW PATENTS IN THE MARKET, 2020–2021

5.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 CUSTOMER ENGAGEMENT SOLUTIONS MARKET: PORTER’S FIVE FORCES MODEL

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF BUYERS

5.11.4 BARGAINING POWER OF SUPPLIERS

5.11.5 DEGREE OF COMPETITION

5.12 REGULATORY LANDSCAPE

5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12.1.1 North America

5.12.1.1.1 US

5.12.1.1.2 Canada

5.12.1.2 Europe

5.12.1.3 Asia Pacific

5.12.1.3.1 China

5.12.1.3.2 India

5.12.1.3.3 Australia

5.12.1.3.4 Japan

5.12.1.4 Middle East & Africa

5.12.1.4.1 Middle East

5.12.1.4.2 South Africa

5.12.1.5 Latin America

5.12.1.5.1 Brazil

5.12.1.5.2 Mexico

5.13 KEY STAKEHOLDERS & BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 27 INFLUENCE OF STAKEHOLDERS IN THE BUYING PROCESS FOR THE TOP THREE END-USERS

TABLE 15 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR THE TOP THREE END-USERS

5.13.2 BUYING CRITERIA

FIGURE 28 KEY BUYING CRITERIA FOR THE TOP THREE END-USERS

TABLE 16 KEY BUYING CRITERIA FOR THE TOP 3 END USERS

5.14 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 17 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6 CUSTOMER ENGAGEMENT SOLUTIONS MARKET, BY COMPONENT (Page No. - 87)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

FIGURE 29 SOLUTIONS SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 18 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 19 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

FIGURE 30 ANALYTICS & REPORTING SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 20 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 21 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 22 MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 23 MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

6.2.1 OMNICHANNEL

6.2.1.1 Customer engagement solutions for seamless customer experience with an omnichannel approach

TABLE 24 OMNICHANNEL: CUSTOMER ENGAGEMENT SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 25 OMNICHANNEL: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2 WORKFORCE OPTIMIZATION

6.2.2.1 Increased employee efficiency maintaining the lowest possible operational cost

TABLE 26 WORKFORCE OPTIMIZATION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 27 WORKFORCE OPTIMIZATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.3 ROBOTIC PROCESS OPTIMIZATION

6.2.3.1 Automation of business processes to increase productivity and enhance customer experience

TABLE 28 ROBOTIC PROCESS OPTIMIZATION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 29 ROBOTIC PROCESS OPTIMIZATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.4 ANALYTICS AND REPORTING

6.2.4.1 In-depth insights into customer activities to gain a competitive edge

TABLE 30 ANALYTICS AND REPORTING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 31 ANALYTICS AND REPORTING: CUSTOMER ENGAGEMENT SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

FIGURE 31 MANAGED SERVICES SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 32 MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 33 MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 34 SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 35 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

TABLE 36 PROFESSIONAL SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 37 PROFESSIONAL SERVICES: CUSTOMER ENGAGEMENT SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1.1 Integration and deployment services

6.3.1.1.1 Integration services aiding the smooth functioning of customer engagement solutions in highly complex network infrastructures

6.3.1.2 Support and maintenance services

6.3.1.2.1 Timely support and effective maintenance services to achieve business goals and objectives

6.3.1.3 Consulting services

6.3.1.3.1 To enhance performance, reduce risks, and achieve customer satisfaction

6.3.2 MANAGED SERVICES

6.3.2.1 Improve the efficiency of inbound and outbound operations cost-effectively

TABLE 38 MANAGED SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 39 MANAGED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 CUSTOMER ENGAGEMENT SOLUTIONS MARKET, BY ORGANIZATION SIZE (Page No. - 101)

7.1 INTRODUCTION

7.1.1 ORGANIZATION SIZE: MARKET DRIVERS

7.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 32 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 40 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 41 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

7.2 SMALL AND MEDIUM-SIZED ENTERPRISES

7.2.1 ADOPTION OF DIGITAL SOLUTIONS TO AUTOMATE SEVERAL INTERNAL PROCESSES

TABLE 42 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 43 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 LARGE ENTERPRISES

7.3.1 CUSTOMER ENGAGEMENT SOLUTIONS FOR CONTINUING A DISTINGUISHABLE BRAND IDENTITY

TABLE 44 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 45 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 CUSTOMER ENGAGEMENT SOLUTIONS MARKET, BY DEPLOYMENT MODE (Page No. - 106)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODE: MARKET DRIVERS

8.1.2 DEPLOYMENT MODE: COVID-19 IMPACT

FIGURE 33 CLOUD SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 46 MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 47 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

8.2 CLOUD

8.2.1 CLOUD DEPLOYMENT OFFERS RISK MANAGEMENT AND SECURITY OPERATIONS THROUGH A SINGLE PROVIDER

TABLE 48 CLOUD: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 49 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 ON-PREMISES

8.3.1 ON-PREMISES DEPLOYMENT OFFERS EFFICIENT CUSTOMER SERVICE

TABLE 50 ON-PREMISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 51 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 CUSTOMER ENGAGEMENT SOLUTIONS MARKET, BY VERTICAL (Page No. - 112)

9.1 INTRODUCTION

9.1.1 VERTICAL: MARKET DRIVERS

9.1.2 VERTICAL: COVID-19 IMPACT

FIGURE 34 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL EXPECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

TABLE 52 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 53 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

9.2.1 AUTOMATED CUSTOMER ONBOARDING AND AI-ENABLED CHATBOTS

TABLE 54 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 55 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 RETAIL & CONSUMER GOODS

9.3.1 INCREASE IN DIGITAL TRANSFORMATION AND CUSTOMER-CENTRIC APPROACH IN RETAIL

TABLE 56 RETAIL & CONSUMER GOODS: CUSTOMER ENGAGEMENT SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 57 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 TELECOM & IT

9.4.1 NEED TO ENHANCE CUSTOMER EXPERIENCE TO GAIN A COMPETITIVE EDGE

TABLE 58 TELECOM & IT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 59 TELECOM & IT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 AUTOMOTIVE

9.5.1 ENHANCED CUSTOMER EXPERIENCE BY PROVIDING PERSONALIZED SOLUTIONS

TABLE 60 AUTOMOTIVE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 61 AUTOMOTIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 TRANSPORTATION & LOGISTICS

9.6.1 NEED TO PROVIDE QUICK SOLUTIONS TO CUSTOMERS’ QUERIES WITH MODERN CUSTOMER ENGAGEMENT SOLUTIONS

TABLE 62 TRANSPORTATION & LOGISTICS: CUSTOMER ENGAGEMENT SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 63 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 TRAVEL & HOSPITALITY

9.7.1 ADOPTION OF ARTIFICIAL INTELLIGENCE AND CHATBOTS FOR SMART ROOMS AND ROBOTS FOR HOUSEKEEPING PROMOTE TRAVEL & HOSPITALITY

TABLE 64 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 65 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 MEDIA & ENTERTAINMENT

9.8.1 MEDIA QUEST FOR ADVANCED ANALYTICS AND PERSONALIZED CONTENT

TABLE 66 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 67 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 HEALTHCARE & LIFESCIENCES

9.9.1 INTELLIGENT OMNICHANNEL INTERACTIONS TO DRIVE HEALTHCARE & LIFESCIENCES VERTICAL

TABLE 68 HEALTHCARE & LIFESCIENCES: CUSTOMER ENGAGEMENT SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 69 HEALTHCARE & LIFESCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.10 MANUFACTURING

9.10.1 SHIFTING FROM MANUAL TO DIGITAL END-TO-END SOLUTIONS TO BENEFIT MANUFACTURING VERTICAL

TABLE 70 MANUFACTURING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 71 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.11 OTHER VERTICALS

TABLE 72 OTHER VERTICALS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 73 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 CUSTOMER ENGAGEMENT SOLUTIONS MARKET, BY REGION (Page No. - 127)

10.1 INTRODUCTION

10.1.1 COVID-19 IMPACT ON THE MARKET

TABLE 74 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 75 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

TABLE 76 NORTH AMERICA: CUSTOMER ENGAGEMENT SOLUTIONS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.2 UNITED STATES

10.2.2.1 Presence of major players in the US to drive market growth

TABLE 90 UNITED STATES: CUSTOMER ENGAGEMENT SOLUTIONS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 91 UNITED STATES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 92 UNITED STATES: MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 93 UNITED STATES: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 94 UNITED STATES: MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 95 UNITED STATES: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 96 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 97 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 98 UNITED STATES: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

TABLE 99 UNITED STATES: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 100 UNITED STATES: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 101 UNITED STATES: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2.3 CANADA

10.2.3.1 Adoption of technologies such as AI and 5G increases customer engagement in Canada

TABLE 102 CANADA: CUSTOMER ENGAGEMENT SOLUTIONS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 103 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 104 CANADA: MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 105 CANADA: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 106 CANADA: MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 107 CANADA: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 108 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 109 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 110 CANADA: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

TABLE 111 CANADA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 112 CANADA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 113 CANADA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3 EUROPE

10.3.1 PESTLE ANALYSIS: EUROPE

TABLE 114 EUROPE: CUSTOMER ENGAGEMENT SOLUTIONS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 115 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 116 EUROPE: MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 117 EUROPE: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 118 EUROPE: MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 119 EUROPE: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 120 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 121 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 122 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

TABLE 123 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 124 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 125 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 126 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 127 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.2 UNITED KINGDOM

10.3.2.1 Adoption of a cloud-based platform in the UK to drive the customer engagement solutions market growth

TABLE 128 UNITED KINGDOM: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 129 UNITED KINGDOM: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 130 UNITED KINGDOM: MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 131 UNITED KINGDOM: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 132 UNITED KINGDOM: MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 133 UNITED KINGDOM: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 134 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 135 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 136 UNITED KINGDOM: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

TABLE 137 UNITED KINGDOM: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 138 UNITED KINGDOM: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 139 UNITED KINGDOM: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.3 GERMANY

10.3.3.1 Omnichannel customer engagement strategy to drive the market growth in Germany

10.3.4 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 140 ASIA PACIFIC: CUSTOMER ENGAGEMENT SOLUTIONS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.2 INDIA

10.4.2.1 Adoption of the mobile phone-led consumer market to boost customer engagement solutions market in India

TABLE 154 INDIA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 155 INDIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 156 INDIA: MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 157 INDIA: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 158 INDIA: MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 159 INDIA: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 160 INDIA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 161 INDIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 162 INDIA: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

TABLE 163 INDIA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 164 INDIA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 165 INDIA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.3 CHINA

10.4.3.1 Adoption of digitalization solutions to cut costs, improve client relations, and prolong a client life cycle in China

10.4.4 JAPAN

10.4.4.1 R&D capabilities and regulatory reforms by the government to drive growth in Japan

10.4.5 REST OF ASIA PACIFIC

10.5 MIDDLE EAST & AFRICA

10.5.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

TABLE 166 MIDDLE EAST & AFRICA: CUSTOMER ENGAGEMENT SOLUTIONS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 167 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 168 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 169 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 176 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 177 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 178 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 179 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.2 KINGDOM OF SAUDI ARABIA

10.5.2.1 Vision 2030 to create huge opportunities in the customer engagement solutions market

TABLE 180 KINGDOM OF SAUDI ARABIA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 181 KINGDOM OF SAUDI ARABIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 182 KINGDOM OF SAUDI ARABIA: MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 183 KINGDOM OF SAUDI ARABIA: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 184 KINGDOM OF SAUDI ARABIA: MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 185 KINGDOM OF SAUDI ARABIA: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 186 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 187 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 188 KINGDOM OF SAUDI ARABIA: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

TABLE 189 KINGDOM OF SAUDI ARABIA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 190 KINGDOM OF SAUDI ARABIA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 191 KINGDOM OF SAUDI ARABIA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.5.3 SOUTH AFRICA

10.5.3.1 Mobile-based subscriptions and computing deployments to bring growth to the market

10.5.4 REST OF THE MIDDLE EAST & AFRICA

10.6 LATIN AMERICA

10.6.1 PESTLE ANALYSIS: LATIN AMERICA

TABLE 192 LATIN AMERICA: CUSTOMER ENGAGEMENT SOLUTIONS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.2 MEXICO

10.6.2.1 Digital transformation and adoption of mobile applications to drive growth in Mexico

TABLE 206 MEXICO: CUSTOMER ENGAGEMENT SOLUTIONS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 207 MEXICO: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 208 MEXICO: MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 209 MEXICO: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 210 MEXICO: MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 211 MEXICO: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 212 MEXICO: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 213 MEXICO: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 214 MEXICO: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

TABLE 215 MEXICO: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 216 MEXICO: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 217 MEXICO: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.6.3 BRAZIL

10.6.3.1 Higher use of the Internet and smartphones to drive market growth in Brazil

10.6.4 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 186)

11.1 INTRODUCTION

11.2 RANKING OF LEADING PLAYERS

FIGURE 37 RANKING OF LEADING PLAYERS IN THE CUSTOMER ENGAGEMENT SOLUTIONS MARKET, 2022

11.3 HISTORICAL REVENUE ANALYSIS

FIGURE 38 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2019–2021 (USD MILLION)

11.4 COMPETITIVE OVERVIEW

TABLE 218 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE MARKET

11.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 219 COMPANY PRODUCT FOOTPRINT

TABLE 220 COMPANY SOLUTION FOOTPRINT

TABLE 221 COMPANY VERTICAL FOOTPRINT

TABLE 222 COMPANY REGION FOOTPRINT

11.6 COMPANY EVALUATION QUADRANT

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE PLAYERS

11.6.4 PARTICIPANTS

FIGURE 39 KEY CUSTOMER ENGAGEMENT SOLUTIONS MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2022

11.7 STARTUP/SME EVALUATION QUADRANT

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 40 STARTUP/SME MARKET EVALUATION MATRIX, 2022

11.8 COMPETITIVE SCENARIO

11.8.1 PRODUCT LAUNCHES

TABLE 223 PRODUCT LAUNCHES, 2020–2021

11.8.2 DEALS

TABLE 224 DEALS, 2020–2022

11.8.3 OTHERS

TABLE 225 OTHERS, 2020–2021

12 COMPANY PROFILES (Page No. - 200)

12.1 MAJOR PLAYERS

(Business Overview, Products, Key Insights, Recent Developments, Response to COVID-19, MnM View)*

12.1.1 AVAYA

TABLE 226 AVAYA: BUSINESS OVERVIEW

FIGURE 41 AVAYA: FINANCIAL OVERVIEW

TABLE 227 AVAYA: PRODUCTS OFFERED

TABLE 228 AVAYA: PRODUCT LAUNCHES

TABLE 229 AVAYA: DEALS

12.1.2 NICE SYSTEMS

TABLE 230 NICE SYSTEMS: BUSINESS OVERVIEW

FIGURE 42 NICE SYSTEMS: FINANCIAL OVERVIEW

TABLE 231 NICE SYSTEMS: PRODUCTS OFFERED

TABLE 232 NICE SYSTEMS: PRODUCT LAUNCHES

TABLE 233 NICE SYSTEMS: DEALS

TABLE 234 NICE SYSTEMS: OTHERS

12.1.3 ORACLE

TABLE 235 ORACLE: BUSINESS OVERVIEW

FIGURE 43 ORACLE: FINANCIAL OVERVIEW

TABLE 236 ORACLE: PRODUCTS OFFERED

TABLE 237 ORACLE: DEALS

12.1.4 SALESFORCE

TABLE 238 SALESFORCE: BUSINESS OVERVIEW

FIGURE 44 SALESFORCE: FINANCIAL OVERVIEW

TABLE 239 SALESFORCE: PRODUCTS OFFERED

TABLE 240 SALESFORCE: DEALS

TABLE 241 SALESFORCE: OTHERS

12.1.5 SAP

TABLE 242 SAP: BUSINESS OVERVIEW

FIGURE 45 SAP: FINANCIAL OVERVIEW

TABLE 243 SAP: PRODUCTS OFFERED

TABLE 244 SAP: DEALS

12.1.6 IBM

TABLE 245 IBM: BUSINESS OVERVIEW

FIGURE 46 IBM: FINANCIAL OVERVIEW

TABLE 246 IBM: PRODUCTS OFFERED

TABLE 247 IBM: DEALS

12.1.7 MICROSOFT

TABLE 248 MICROSOFT: BUSINESS OVERVIEW

FIGURE 47 MICROSOFT: FINANCIAL OVERVIEW

TABLE 249 MICROSOFT: PRODUCTS OFFERED

TABLE 250 MICROSOFT: DEALS

12.1.8 ZENDESK

TABLE 251 ZENDESK: BUSINESS OVERVIEW

FIGURE 48 ZENDESK: FINANCIAL OVERVIEW

TABLE 252 ZENDESK: PRODUCTS OFFERED

TABLE 253 ZENDESK: DEALS

12.1.9 PEGASYSTEMS

TABLE 254 PEGASYSTEMS: BUSINESS OVERVIEW

FIGURE 49 PEGASYSTEMS: FINANCIAL OVERVIEW

TABLE 255 PEGASYSTEMS: PRODUCTS OFFERED

TABLE 256 PEGASYSTEMS: DEALS

12.1.10 SERVICENOW

TABLE 257 SERVICENOW: BUSINESS OVERVIEW

FIGURE 50 SERVICENOW: FINANCIAL OVERVIEW

TABLE 258 SERVICENOW: PRODUCTS OFFERED

TABLE 259 SERVICENOW: PRODUCT LAUNCHES

TABLE 260 SERVICENOW: DEALS

12.1.11 OPENTEXT

TABLE 261 OPENTEXT: BUSINESS OVERVIEW

FIGURE 51 OPENTEXT: FINANCIAL OVERVIEW

TABLE 262 OPENTEXT: PRODUCTS OFFERED

TABLE 263 OPENTEXT: DEALS

12.1.12 VERINT SYSTEMS

TABLE 264 VERINT SYSTEMS: BUSINESS OVERVIEW

FIGURE 52 VERINT SYSTEMS: FINANCIAL OVERVIEW

TABLE 265 VERINT SYSTEMS: PRODUCTS OFFERED

TABLE 266 VERINT SYSTEMS: DEALS

TABLE 267 VERINT SYSTEMS: OTHERS

12.1.13 EGAIN CORPORATION

TABLE 268 EGAIN CORPORATION: BUSINESS OVERVIEW

FIGURE 53 EGAIN CORPORATION: FINANCIAL OVERVIEW

TABLE 269 EGAIN CORPORATION: PRODUCTS OFFERED

TABLE 270 EGAIN CORPORATION: PRODUCT LAUNCHES

TABLE 271 EGAIN CORPORATION: DEALS

12.1.14 ENGHOUSE SYSTEMS

TABLE 272 ENGHOUSE SYSTEMS: BUSINESS OVERVIEW

FIGURE 54 ENGHOUSE SYSTEMS: FINANCIAL OVERVIEW

TABLE 273 ENGHOUSE SYSTEMS: PRODUCTS OFFERED

TABLE 274 ENGHOUSE SYSTEMS: DEALS

12.1.15 ALVARIA

12.1.16 GENESYS

12.1.17 FRESHWORKS

12.1.18 IFS-MPLSYSTEMS

12.1.19 CALABRIO

12.1.20 KHOROS

12.1.21 PRECISELY

12.2 STARTUPS/SMES

12.2.1 CREATIO

12.2.2 CRMNEXT

12.2.3 SUGARCRM

12.2.4 WEBENGAGE

12.2.5 UPSHOT

12.2.6 MOENGAGE

12.2.7 CHURNZERO

12.2.8 SENTIMETER

*Details on Business Overview, Products, Key Insights, Recent Developments, Response to COVID-19, MnM View might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKETS (Page No. - 272)

13.1 CUSTOMER EXPERIENCE MANAGEMENT MARKET

13.1.1 MARKET DEFINITION

13.1.2 MARKET OVERVIEW

13.1.3 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY COMPONENT

TABLE 275 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 276 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 277 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 278 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2021–2026 (USD MILLION)

13.1.4 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE

TABLE 279 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2015–2020 (USD MILLION)

TABLE 280 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

13.1.5 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE

TABLE 281 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 282 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

13.1.6 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL

TABLE 283 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 284 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

13.1.7 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION

TABLE 285 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 286 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

13.2 CUSTOMER ANALYTICS MARKET

13.2.1 MARKET DEFINITION

13.2.2 MARKET OVERVIEW

13.2.3 CUSTOMER ANALYTICS MARKET, BY COMPONENT

TABLE 287 CUSTOMER ANALYTICS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 288 SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 289 SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 290 PROFESSIONAL SERVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

13.2.4 CUSTOMER ANALYTICS MARKET, BY DEPLOYMENT MODE

TABLE 291 CUSTOMER ANALYTICS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

13.2.5 CUSTOMER ANALYTICS MARKET, BY ORGANIZATION SIZE

TABLE 292 CUSTOMER ANALYTICS MARKET, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

13.2.6 CUSTOMER ANALYTICS MARKET, BY APPLICATION

TABLE 293 CUSTOMER ANALYTICS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

13.2.7 CUSTOMER ANALYTICS MARKET, BY DATA SOURCE

TABLE 294 CUSTOMER ANALYTICS MARKET, BY DATA SOURCE, 2018–2025 (USD MILLION)

13.2.8 CUSTOMER ANALYTICS MARKET, BY VERTICAL

TABLE 295 CUSTOMER ANALYTICS MARKET, BY VERTICAL, 2018–2025 (USD MILLION)

13.2.9 CUSTOMER ANALYTICS MARKET, BY REGION

TABLE 296 CUSTOMER ANALYTICS MARKET, BY REGION, 2018–2025 (USD MILLION)

13.3 CUSTOMER SUCCESS PLATFORMS MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.3.3 CUSTOMER SUCCESS PLATFORMS MARKET, BY COMPONENT

TABLE 297 CUSTOMER SUCCESS PLATFORMS MARKET, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 298 CUSTOMER SUCCESS PLATFORMS MARKET, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 299 CUSTOMER SUCCESS PLATFORMS MARKET, BY SERVICE, 2015–2019 (USD MILLION)

TABLE 300 CUSTOMER SUCCESS PLATFORMS MARKET, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 301 PROFESSIONAL SERVICES MARKET, BY TYPE, 2015–2019 (USD MILLION)

TABLE 302 PROFESSIONAL SERVICES, BY TYPE, 2019–2025 (USD MILLION)

13.3.4 CUSTOMER SUCCESS PLATFORMS MARKET, BY APPLICATION

TABLE 303 CUSTOMER SUCCESS PLATFORMS MARKET, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 304 CUSTOMER SUCCESS PLATFORMS MARKET, BY APPLICATION, 2019–2025 (USD MILLION)

13.3.5 CUSTOMER SUCCESS PLATFORMS MARKET, BY DEPLOYMENT MODE

TABLE 305 CUSTOMER SUCCESS PLATFORMS MARKET, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 306 CUSTOMER SUCCESS PLATFORMS MARKET, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

13.3.6 CUSTOMER SUCCESS PLATFORMS MARKET, BY ORGANIZATION SIZE

TABLE 307 CUSTOMER SUCCESS PLATFORMS MARKET, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 308 CUSTOMER SUCCESS PLATFORMS MARKET, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

13.3.7 CUSTOMER SUCCESS PLATFORMS MARKET, BY VERTICAL

TABLE 309 CUSTOMER SUCCESS PLATFORMS MARKET, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 310 CUSTOMER SUCCESS PLATFORMS MARKET, BY VERTICAL, 2019–2025 (USD MILLION)

13.3.8 CUSTOMER SUCCESS PLATFORMS MARKET, BY REGION

TABLE 311 CUSTOMER SUCCESS PLATFORMS MARKET, BY REGION, 2015–2019 (USD MILLION)

TABLE 312 CUSTOMER SUCCESS PLATFORMS MARKET, BY REGION, 2019–2025 (USD MILLION)

14 APPENDIX (Page No. - 292)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

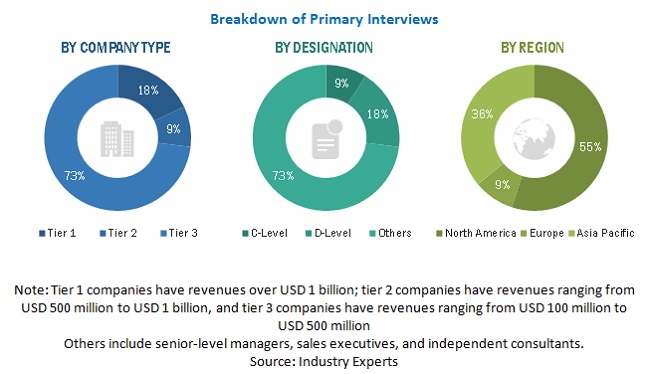

The study involved four major activities in estimating the current size of the customer engagement solutions market. Exhaustive secondary research was done to collect information on all industries. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the customer engagement solutions market.

Secondary Research

In the secondary research process, various secondary sources were referred to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation, and key developments in the market. The secondary sources included annual reports, press releases of various companies Avaya, NICE Systems, Zendesk, Pegasystems among others, white papers, journals, and certified publications and articles from recognized authors, directories, and databases, such as Trusted Magazine (by Trusted Advisors Group), Customer Experience Magazine, and The European Magazine, investor presentations of companies, associations, and government publishing sources.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the customer engagement solutions market scenario through secondary research. Several primary interviews have been conducted with market experts from both demand side and supply side players across five major regions, namely North America, Europe, Asia Pacific, Middle East and Africa and Latin America. Approximately 70% and 30% of primary interviews have been conducted from demand and supply side, respectively. Primary data has been collected through questionnaires email, and telephonic interviews. In the canvassing of primaries, various organizations, such as sales. Operations, and administration, were covered to provide holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global customer engagement solutions market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors offering solutions and services in the customer engagement solutions market was prepared while using the top-down approach. The market share for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its offering (solutions and services). The aggregate of all companies’ revenues was extrapolated to reach the overall market size.

Customer engagement solutions market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global customer engagement solutions market based on component, deployment mode, organization size, verticals, and regions from 2022 to 2027, and analyze various macro and microeconomic factors that affect the market growth.

- To forecast the size of the market’s segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA).

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the customer engagement solutions market.

- To analyze the impact of COVID-19 on the customer engagement solutions market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the total customer engagement solutions market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the customer engagement solutions market.

- To profile key market players (top vendors and startups); provide a comparative analysis based on their business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments, such as mergers and acquisitions, a new product launched and product developments, partnerships, agreements, and collaborations, business expansions, and Research & Development (R&D) activities, in the market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Customer Engagement Solutions Market

There are several key challenges that customer engagement solutions may face in the future market. Some of these challenges include: • Increasing Competition • Evolving Customer Expectations • Data Privacy and Security • Integration with Existing Systems • Managing Complexity

What will be key challenges for growing customer engagement solutions in the future market?