Cardiology Information System Market by System (Standalone, Integrated System, Cardiology Information System, Cardiology PACS), Component (Software, Services, Hardware), & End User (L3A Hospital, L3B and L2 Hospital) - Forecasts to 2024

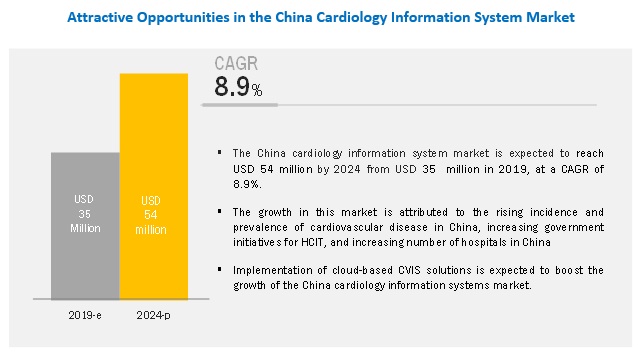

The cardiology information system market size is projected to reach USD 54 million by 2024, at a CAGR of 8.9%. Growth in this market is mainly driven by the increasing incidence and prevalence of cardiovascular disease, government initiatives in China, and the increasing number of hospitals.

The integrated systems segment is expected to grow at the highest CAGR during the forecast period

Based on system, the market is segmented into integrated and standalone systems. The integrated systems segment is projected to witness the highest growth during the forecast period. The increasing adoption of integrated systems by healthcare providers is the major factor supporting the growth of this segment.

The software segment accounted for the largest share of the China cardiology information system market in 2018

By component, the market is segmented into software, services, and hardware. The software segment accounted for the largest market share in 2018. The large share of this segment can be attributed to the growing need to integrate CVIS with C-PACS, EMRs, and other cardiology modules.

L3A hospitals accounted for the largest share of the China cardiology information system market in 2018

Based on end user, the market is segmented into L3A hospitals and L3B & L2 Hospitals. The L3A hospitals segment accounted for the largest share of the market in 2018. The increasing number of L3A hospitals in China and growing disease prevalence are responsible for the large share of this market segment.

Key Market Players

Key players in the China cardiology information system market are Philips Healthcare (Netherlands), CREALIFE Medical Technology (China), Central Data Network (Australia), Infinitt Healthcare (South Korea) and Esaote (Italy).

In 2018, CREALIFE Medical Technology held the leading position in the market. The company has good relations with government bodies, distributors, and hospitals in the market, which is its key strength. Philips Healthcare held the second position in the market in 2018.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

|

|

Companies covered |

Major players covered, including Philips Healthcare (Netherland), CREALIFE Medical Technology (China), Central Data Network (Australia), Infinitt Healthcare (South Korea), and Esaote (Italy). |

This research report categorizes the market into the following segments and subsegments:

China Cardiology Information System Market, by System

- Integrated Systems

- Standalone Systems

China Cardiology Information System Market, by Component

- Software

- Services

- Hardware

China Cardiology Information System Market, by End User

- L3A Hospitals

- L3B and L2 Hospitals

Key Questions Addressed in the Report:

- What are the growth opportunities offered by the market in the next five years?

- How will advancements in products offered by various companies affect the market scenario in the mid- to long-term?

- What are the trends and advancements in the China cardiology information system market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Introduction

1.2 Objectives of the Study

2 Research Methodology

3 Market Overview

3.1 Introduction

3.2 Drivers

3.2.1 Rising Incidence and Prevalence of Cardiovascular Disease in China

3.2.2 Increasing Number of Hospitals in China

3.2.3 Favorable Government Initiatives

3.3 Opportunities

3.3.1 Use of Cloud-Based Solutions

3.4 Challenges

3.4.1 Integration and Interoperability

4 China Cardiology Information System Market, By System

4.1 Integrated Systems

4.2 Standalone Systems

5 China Cardiology Information System Market, By Component

5.1 Software

5.2 Services

5.3 Hardware

6 China Cardiology Information System Market, By End User Analysis

6.1 Introduction

6.2 L3A Hospitals

6.3 L3B & L2 Hospitals

6.4 Level 1 Hospitals

7 China Cardiology Information System Market, By End User Analysis

7.1 Market Share Analysis, 2018

7.2 China: Cardiology Information Technology Market Share Analysis for Individual Players, By Hospital Type (2018)

8 China Cardiology Information System Market, Company Profiles

8.1 Philips Healthcare

8.1.1 Company Overview

8.1.2 Products Offered in China

8.1.3 Business Overview

8.1.4 SWOT Analysis

8.1.5 Strategy

8.2 Crealife Medical Technology

8.2.1 Company Overview

8.2.2 Products Offered in China

8.2.3 SWOT Analysis

8.2.4 Strategy

8.3 Central Data Networks

8.3.1 Company Overview

8.3.2 Products Offered in China

8.3.3 SWOT Analysis

8.3.4 Strategy

8.4 Esaote China Ltd.

8.4.1 Company Overview

8.4.2 Products Offered in China

8.5 Infinitt Healthcare Co., Ltd.

8.5.1 Company Overview

8.5.2 Products Offered in China

9 Key Insights From Industry Participants

10 Appendix

10.1 Discussion Guide

10.2 Knowledge Store: Marketssandmarkets’ Subscription Portal

10.3 Related Reports

10.4 Authors Details

List of Tables (7 Tables)

Table 1 China: Cardiology Information Technology Market, By System, 2017–2024 (USD Million)

Table 2 China: Cardiology Information Technology Market, By Component, 2017–2024 (USD Million)

Table 3 Number of Hospitals in China, 2009–2024

Table 4 China: Cardiology Information Technology Market, By End User, 2017–2024 (USD Million)

Table 5 Increasing Number of L3A Hospitals in China, 2009–2024

Table 6 Increasing Number of L3B & L2 Hospitals in China, 2009–2024

Table 7 China: Average Selling Price of Cardiovascular Information Technology, By End User (USD Million)

List of Figures (8 Figures)

Figure 1 Data Triangulation Methodology

Figure 2 Mortlity Rate Due to Heart Disease in China

Figure 3 Number of Hospitals in China (In Thousand)

Figure 4 Private vs Public Hospitals in China (In Thousand)

Figure 5 Healthcare Expenditure in China (In USD)

Figure 6 China Cardiology Information Technology Market Share Analysis By Key Players, 2018

Figure 7 China Cardiology Information Technology Market Share Analysis for Individual Players By Hospital Type, 2018

Figure 8 Philips Healthcare: Company Snapshot (2018)

The study involved four major activities in estimating the current market size of the China cardiology information system market. Exhaustive secondary research was conducted to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Then, both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg, and Factiva) were referred to identify and collect information for this study.

Primary Research

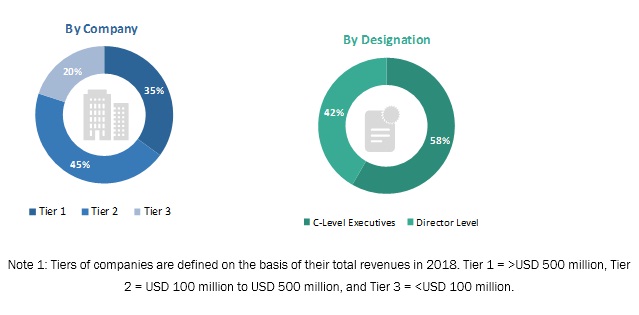

The market comprises several stakeholders, such as cardiology information system manufacturers, vendors, and distributors. The demand side of this market is characterized by the significant use of cardiology information systems. Advancements in technology characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. A breakdown of primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the China cardiology information system market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the China cardiology information system market on the basis of system, component, and end user

- To provide detailed information regarding major factors influencing the growth of the market (drivers, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to China

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as product launches, collaborations, acquisitions, and R&D activities in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Product Analysis: Product matrix, which gives a detailed comparison of the product portfolios of each company

- Company Information: Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cardiology Information System Market