Medical Image Analysis Software Market by Type (Integrated), Images (2D, 3D, 4D), Modality (CT, MRI, PET, Ultrasound), Application (Orthopedic, Oncology, Neurology, Mammography, Dental), End User (Hospital, Diagnostic Center) & Region - Global Forecast to 2027

Market Growth Outlook Summary

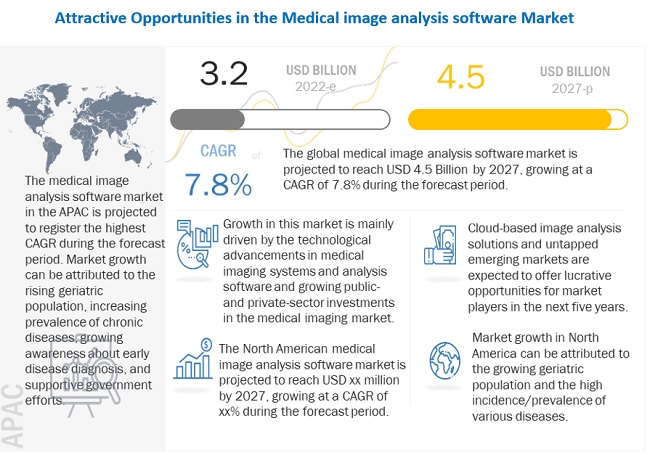

The global medical image analysis software market growth forecasted to transform from $3.2 billion in 2022 to $4.5 billion by 2027, driven by a CAGR of 7.8%. The market is mainly driven by factors such as the technological advancements in medical imaging systems and analysis software, growing public- and private-sector investments in the medical imaging market, the rising prevalence of chronic diseases, and the growing applications of computer-aided diagnosis. On the contrary, budgetary restraints are factors expected to restrain market growth to a certain extent.

Medical Image Analysis Software Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Medical Image Analysis Software Market Dynamics

Driver: Rising prevalence of chronic diseases

The rising prevalence of chronic diseases such as cancer, cardiac disorders, diabetes, and others is one of the major factors driving the growth of the global market. The increasing number of geriatric population and the growing demand for minimally invasive procedures are further contributing to the growth of the market. In addition, the increasing demand for advanced imaging techniques, such as positron emission tomography (PET), magnetic resonance imaging (MRI), and computed tomography (CT), is propelling the growth of the market. Furthermore, the rising demand from healthcare providers for accurate and detailed diagnostic imaging is also driving the growth of the market.

Restraint: Budgetary constraints

Budgetary constraints are one of the major restraints hampering the growth of the global market. The cost of the software, hardware components, and maintenance required to install and run the software is a major factor limiting the adoption of medical image analysis software among small healthcare providers. Moreover, the lack of skilled personnel to operate the software is also a major factor limiting the growth of the market. Additionally, the high cost of medical image analysis software restricts the adoption of such software, especially in the developing countries of the world.

Opportunity: Untapped emerging markets

Emerging markets such as India, China, and Brazil are expected to offer significant growth opportunities for players operating in the market. This can majorly be attributed to the rising patient population in these countries. According to a 2021 report by the Institute for Health Metrics and Evaluation (IHME), cancer cases in India increased at an average annual rate of 1.1-2% from 2010 to 2019. Deaths from cancer in the country also increased at an average rate of 0.1-1% in the same period. Similarly, China accounted for 24% of newly diagnosed cases and 30% of cancer-related deaths worldwide in 2020. In Asia, Japan has the highest number of PET-CT systems and other nuclear medicine resources. Other Asian countries, such as South Korea and China, are also relatively advanced in terms of available nuclear medicine infrastructure.

This significant growth in cancer prevalence is a major indicator of the requirement for advanced imaging technologies in these countries. Furthermore, the adoption of digital imaging for diagnostic applications has increased in these countries. For instance, radiographers and radiologists in China and India are increasingly opting for digital radiography (DR) technologies over computed radiography (CR) systems, which offer higher image resolution and a wider range of contrast detectability.

Challenge: Software security and compliance issues

Software security and compliance issues are a major challenge facing the market. Security breaches can cause a significant financial and reputational damage to medical image analysis vendors. To ensure the safety of patient data and to comply with the regulations of the healthcare industry, vendors must make sure that their software is compliant with the applicable laws and regulations. They must also focus on incorporating data security mechanisms such as encryption and access control to prevent unauthorized access to patient information. Additionally, vendors must make sure that their software is designed to adhere to the guidelines of the Health Insurance Portability and Accountability Act (HIPAA) and other relevant legislations. This is necessary to ensure that the patient data remains private and secure. Compliance with the healthcare industry standards is also necessary to ensure that the software meets the requirements for data integrity and accuracy.

Integrated software is expected to be the fastest-growing segment in the medical image analysis software industry.

The integrated software segment held the largest share of the medical image analysis software market along with being the fastest growing segment in the forecast period due to the increase in adoption of diagnostic imaging, and the several benefits of integrated software, including centralized data storage and cost-effectiveness.

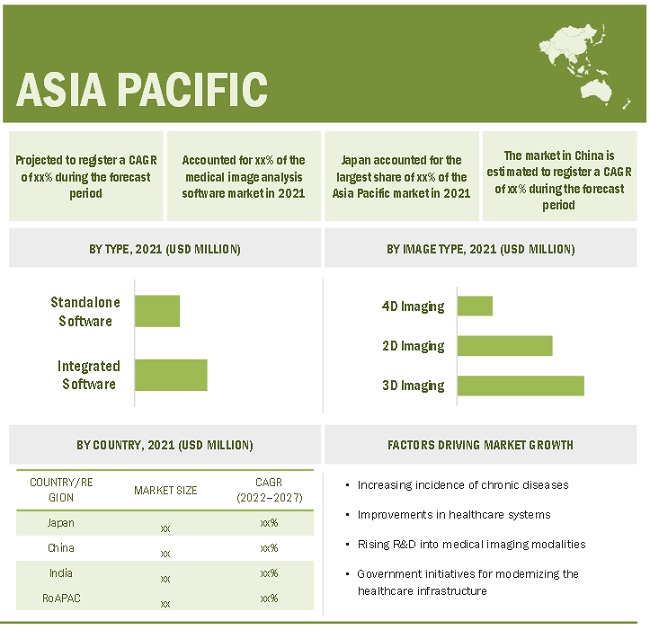

The Asia Pacific region is expected to grow at the highest CAGR in the medical image analysis software industry during the forecast period.

Factors like presence of key market players, and high incidence/prevalence of various diseases contribute to the growth of medical image analysis software market in this region.

Additionally, the fastest growing region in the global market during the forecast period is the Asia Pacific. This growth is driven by factors such as the growing medical imaging research, and the rising geriatric population.

To know about the assumptions considered for the study, download the pdf brochure

The new edition of the report includes profiles for key players in the medical image analysis software market, including GE Healthcare (US), Koninklijke Philips N.V. (Netherlands), Siemens Healthineers (Germany), Canon Inc. (Japan), Agfa HealthCare (Belgium), International Business Machines Corporation (US), Carestream Health, Inc. (US), AQUILAB SAS (France), Esaote S.p.A. (Italy), MIM Software, Inc. (US), Image Analysis Ltd. (UK), and ScienceSoft USA Corporation (US).

Scope of the Medical Image Analysis Software Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$3.2 billion |

|

Projected Revenue Size by 2027 |

$4.5 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 7.8% |

|

Market Driver |

Rising prevalence of chronic diseases |

|

Market Opportunity |

Untapped emerging markets |

The research report categorizes the medical image analysis software market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Integrated Software

- Standalone Software

By Image Type

- 2D imaging

- 3D imaging

- 4D imaging

By Modality

-

Tomography

-

Computed Tomography

- High-end slice CT

- Mid-end slice CT

- Low-end slice CT

-

Magnetic Resonance Imaging

- Closed MRI

- Open MRI

- Positron Emission Tomography

- Single-photon Emission Computed Tomography

-

Computed Tomography

- Radiographic Imaging

-

Ultrasound Imaging

- 2D Ultrasound Systems

- 3D & 4D Ultrasound Systems

- Doppler Imaging

- Mammography

-

Combined Modalities

- PET/MR

- SPECT/CT

- PET/MR

By Application

- Cardiology

- Orthopedics

- Oncology

- Neurology

- Obstetrics and Genecology

- Mammography

- Dental

- Respiratory

- Urology & Nephrology

By End User

- Hospitals

- Diagnostic Imaging Centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- France

- Germany

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of Medical Image Analysis Software Industry

- In March 2022, Koninklijke Philips N.V. (Netherlands) launched Cloud-enabled Enterprise Imaging Informatics and Analytics Solutions, namely, HealthSuite Interoperability and Enterprise Performance Analytics – PerformanceBridge, to meet diverse workflow needs across the imaging enterprise.

- In February 2022, IBM (US) acquired Neudesic, LLC (US) which was aimed at expanding IBM’s portfolio of hybrid multi-cloud services and further advancing the company’s hybrid cloud and AI strategy.

- In February 2022, Siemens Healthineers (Germany) collaborated with Universal Medical Imaging (US) to help primary healthcare institutions in China improve the efficiency of their image screening and disease diagnosis using advanced imaging diagnostic equipment and remote scanning assistant tools from Siemens Healthineers and nationwide medical imaging experts at Universal Medical Imaging.

- In January 2022, IBM (US) acquired ENVIZI (Australia) which was aimed at building on IBM's growing investments in AI-powered software.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the medical image analysis software market?

The medical image analysis software market boasts a total revenue value of USD 4.5 billion by 2027.

What is the estimated growth rate (CAGR) of the medical image analysis software market?

The global market for medical image analysis software has an estimated compound annual growth rate (CAGR) of 7.8% and a revenue size in the region of USD 3.2 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH APPROACH

2.2 RESEARCH METHODOLOGY DESIGN

2.2.1 SECONDARY RESEARCH

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Insights from primary experts

2.3 MARKET SIZE ESTIMATION: MEDICAL IMAGE ANALYSIS SOFTWARE MARKET

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

2.5 MARKET SHARE ESTIMATION

2.6 ASSUMPTIONS FOR THE STUDY

2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 50)

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 MEDICAL IMAGE ANALYSIS SOFTWARE MARKET OVERVIEW

4.2 MARKET: GEOGRAPHICAL GROWTH OPPORTUNITIES

4.3 NORTH AMERICA: MARKET, BY TYPE AND COUNTRY (2021)

4.4 ASIA PACIFIC: MARKET, BY MODALITY AND COUNTRY (2021)

4.5 REGIONAL MIX: MARKET (2022–2027)

4.6 GLOBAL MARKET: DEVELOPED VS. DEVELOPING MARKETS

5 MARKET OVERVIEW (Page No. - 62)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Technological advancements in medical imaging systems and analysis software

5.2.1.2 Growing public- and private-sector investments in medical imaging market

5.2.1.3 Rising prevalence of chronic diseases

5.2.1.4 Growing applications of computer-aided diagnosis

5.2.2 RESTRAINTS

5.2.2.1 Budgetary constraints

5.2.3 OPPORTUNITIES

5.2.3.1 Cloud-based image analysis solutions

5.2.3.2 Untapped emerging markets

5.2.4 CHALLENGES

5.2.4.1 Market penetration of standalone software vendors

5.2.4.2 Software security and compliance issues

5.2.4.3 Shortage of radiologists

5.3 KEY CONFERENCES & EVENTS IN 2022–2023

5.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 INDUSTRY INSIGHTS (Page No. - 78)

6.1 INTRODUCTION

6.2 INDUSTRY TRENDS

6.2.1 ADOPTION OF HYBRID MEDICAL IMAGING MODALITIES

6.2.2 SHIFT TO 3D IMAGING

6.2.3 CLOUD COMPUTING

6.2.4 ARTIFICIAL INTELLIGENCE (AI)

6.3 TECHNOLOGY TRENDS

6.3.1 MACHINE LEARNING, ARTIFICIAL INTELLIGENCE, AND COMPUTER-AIDED DESIGN IN MEDICAL IMAGE ANALYSIS

6.4 SUPPLY CHAIN ANALYSIS

6.5 ECOSYSTEM MAPPING

6.6 PORTER’S FIVE FORCES ANALYSIS

6.6.1 THREAT OF NEW ENTRANTS

6.6.1.1 Capital requirement

6.6.1.2 High preference for products from well-established brands

6.6.2 THREAT OF SUBSTITUTES

6.6.2.1 Substitutes for medical image analysis software

6.6.3 BARGAINING POWER OF SUPPLIERS

6.6.3.1 Presence of several raw material suppliers

6.6.3.2 Supplier switching costs

6.6.4 BARGAINING POWER OF BUYERS

6.6.4.1 Few companies offer premium products at global level

6.6.5 INTENSITY OF COMPETITIVE RIVALRY

6.6.5.1 Increasing demand for high-quality and innovative products

6.6.5.2 Lucrative growth potential in emerging markets

6.7 PATENT ANALYSIS

6.7.1 PATENT PUBLICATION TRENDS FOR MEDICAL IMAGE ANALYSIS SOFTWARE

6.7.2 TOP APPLICANTS (COMPANIES) FOR MEDICAL IMAGE ANALYSIS SOFTWARE PATENTS

6.7.3 JURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR PATENTS IN GLOBAL MARKET

6.8 REGULATORY ANALYSIS

6.8.1 NORTH AMERICA

6.8.2 EUROPE

6.8.3 ASIA PACIFIC

6.8.4 MIDDLE EAST & AFRICA

6.8.5 LATIN AMERICA

6.9 PRICING ANALYSIS

6.10 TRADE ANALYSIS

6.10.1 TRADE ANALYSIS FOR COMPUTED TOMOGRAPHY SYSTEMS

6.10.2 TRADE ANALYSIS FOR ULTRASOUND SYSTEMS

6.10.3 TRADE ANALYSIS FOR MAGNETIC RESONANCE IMAGING SYSTEMS

6.10.4 TRADE ANALYSIS FOR X-RAY SYSTEMS

6.11 IMPACT OF COVID-19 ON MEDICAL IMAGE ANALYSIS MARKET

7 MEDICAL IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE (Page No. - 96)

7.1 INTRODUCTION

7.2 INTEGRATED SOFTWARE

7.2.1 INTEGRATED SOFTWARE IS LARGEST & FASTEST-GROWING SEGMENT OF MARKET

7.3 STANDALONE SOFTWARE

7.3.1 STANDALONE SOFTWARE OFFERS HIGHER FLEXIBILITY WITH NUMEROUS FEATURES

8 MEDICAL IMAGE ANALYSIS SOFTWARE MARKET, BY IMAGE TYPE (Page No. - 103)

8.1 INTRODUCTION

8.2 3D IMAGING

8.2.1 GROWING ACCEPTANCE AND RISING ADVANTAGES OF THIS TECHNIQUE ARE SUPPORTING MARKET GROWTH

8.3 4D IMAGING

8.3.1 4D MEDICAL IMAGING IS REPLACING TRADITIONAL SURGICAL INTERVENTIONS BY PROVIDING MINIMALLY INVASIVE ALTERNATIVES

8.4 2D IMAGING

8.4.1 2D IMAGING IS COST-EFFECTIVE, SIMPLER, FASTER, AND EASIER TO PERFORM

9 MEDICAL IMAGE ANALYSIS SOFTWARE MARKET, BY MODALITY (Page No. - 111)

9.1 INTRODUCTION

9.2 TOMOGRAPHY

9.2.1 COMPUTED TOMOGRAPHY (CT)

9.2.1.1 High-end slice CT

9.2.1.1.1 Increasing R&D investments by market players to drive market growth

9.2.1.2 Mid-end slice CT

9.2.1.2.1 Uncertain reimbursements and insurance coverage in developing countries to restrain market growth

9.2.1.3 Low-end slice CT

9.2.1.3.1 Low cost and significant demand in emerging markets will drive market

9.2.2 MAGNETIC RESONANCE IMAGING (MRI)

9.2.2.1 Closed MRI systems

9.2.2.1.1 Increasing prevalence of brain-related disorders/diseases is propelling market growth

9.2.2.2 Open MRI systems

9.2.2.2.1 Open MRI systems work on same principle as traditional MRI systems

9.2.3 POSITRON EMISSION TOMOGRAPHY (PET)

9.2.3.1 There has been shift from standalone PET scans to combined modalities like PET/CT and PET/MR

9.2.4 SINGLE-PHOTON EMISSION COMPUTED TOMOGRAPHY (SPECT)

9.2.4.1 Growing prevalence of chronic neurological disorders will increase usage of SPECT scans

9.3 ULTRASOUND IMAGING

9.3.1 2D ULTRASOUND SYSTEMS

9.3.1.1 Higher resolution of 2D imaging systems to increase their adoption

9.3.2 3D AND 4D ULTRASOUND SYSTEMS

9.3.2.1 Growing number of new products launches with technological and software modifications are propelling market growth

9.3.3 DOPPLER IMAGING

9.3.3.1 Technological developments by market players in Doppler imaging to aid market growth

9.4 RADIOGRAPHIC IMAGING

9.4.1 INCREASED ADOPTION OF RADIOGRAPHIC IMAGING TECHNIQUES DUE TO COVID-19 PANDEMIC TO DRIVE MARKET

9.5 COMBINED MODALITIES

9.5.1 PET/CT

9.5.1.1 PET/CT is more powerful than standalone PET systems

9.5.2 SPECT/CT

9.5.2.1 Growing number of new product launches to drive market

9.5.3 PET/MR

9.5.3.1 PET/MR is more effective than PET/CT as it offers less radiation exposure and higher contrast

9.6 MAMMOGRAPHY

9.6.1 INCREASING INCIDENCE OF BREAST CANCER TO DRIVE MARKET

10 MEDICAL IMAGE ANALYSIS SOFTWARE MARKET, BY APPLICATION (Page No. - 148)

10.1 INTRODUCTION

10.2 CARDIOLOGY

10.2.1 RISING INCIDENCE OF CARDIAC DISORDERS TO DRIVE MARKET

10.3 ORTHOPEDICS

10.3.1 RISING ARTHRITIS CASES ARE SUPPORTING MARKET GROWTH

10.4 ONCOLOGY

10.4.1 GROWING NUMBER OF CANCER CASES TO DRIVE MARKET

10.5 NEUROLOGY

10.5.1 INCREASING DEMAND FOR ADVANCED NEUROLOGICAL IMAGING TECHNOLOGIES IS DRIVING GROWTH OF THIS SEGMENT

10.6 OBSTETRICS AND GYNECOLOGY

10.6.1 MRI IS WIDELY USED IMAGING TECHNIQUE IN OBSTETRICS AND GYNECOLOGY

10.7 MAMMOGRAPHY

10.7.1 INCREASING DEMAND FOR EFFICIENCY IN BREAST IMAGING TO DRIVE MARKET

10.8 DENTAL

10.8.1 INCREASING PREVALENCE OF OROPHARYNGEAL CANCER TO SUPPORT MARKET GROWTH

10.9 RESPIRATORY

10.9.1 COVID-19 PANDEMIC HAS INCREASED DEMAND FOR X-RAY IMAGING

10.10 UROLOGY AND NEPHROLOGY

10.10.1 RISING INCIDENCE OF KIDNEY DISEASE IS DRIVING UROLOGY AND NEPHROLOGY MEDICAL IMAGE ANALYSIS SOFTWARE MARKET

10.11 VASCULAR

10.11.1 RISING INCIDENCE OF VASCULAR DISORDERS TO PROPEL MARKET GROWTH

11 MEDICAL IMAGE ANALYSIS SOFTWARE MARKET, BY END USER (Page No. - 169)

11.1 INTRODUCTION

11.2 HOSPITALS

11.2.1 HIGH ADOPTION OF ADVANCED TECHNOLOGIES TO DRIVE MARKET

11.3 DIAGNOSTIC IMAGING CENTERS

11.3.1 LOWER WAITING PERIODS IN DIAGNOSTIC IMAGING CENTERS AND QUICKER RESULTS ARE SUPPORTING GROWTH OF THIS SEGMENT

11.4 OTHER END USERS

12 MEDICAL IMAGE ANALYSIS SOFTWARE MARKET, BY REGION (Page No. - 176)

12.1 INTRODUCTION

12.2 NORTH AMERICA

12.2.1 US

12.2.1.1 Growth of medical technologies industry to support market growth

12.2.2 CANADA

12.2.2.1 Growing investments in medical imaging field to drive market

12.3 EUROPE

12.3.1 GERMANY

12.3.1.1 High adoption of diagnostic imaging systems and strong healthcare infrastructure to drive market in Germany

12.3.2 FRANCE

12.3.2.1 Growing public-private investments and rising number of imaging centers to support market growth

12.3.3 UK

12.3.3.1 Rising demand for medical imaging procedures to support market growth

12.3.4 SPAIN

12.3.4.1 Favorable regulatory scenario and rising geriatric population are key growth drivers

12.3.5 ITALY

12.3.5.1 Well-established healthcare infrastructure to support overall market growth

12.3.6 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 JAPAN

12.4.1.1 Technological advancements to aid market growth

12.4.2 CHINA

12.4.2.1 Strong government support for healthcare reforms and increasing number of medical imaging procedures to drive market

12.4.3 INDIA

12.4.3.1 Improving healthcare infrastructure to support growth of market in India

12.4.4 REST OF ASIA PACIFIC

12.5 LATIN AMERICA

12.5.1 BRAZIL

12.5.1.1 Growing disease burden and rising awareness to drive market for medical image analysis software

12.5.2 MEXICO

12.5.2.1 Government initiatives to boost adoption of medical image analysis software solutions

12.5.3 REST OF LATIN AMERICA

12.6 MIDDLE EAST & AFRICA

12.6.1 INCREASING INVESTMENTS IN MODERNIZING HEALTHCARE SYSTEMS TO BOOST MARKET GROWTH

13 COMPETITIVE LANDSCAPE (Page No. - 279)

13.1 OVERVIEW

13.2 KEY PLAYER STRATEGIES/RIGHT-TO-WIN

13.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN MEDICAL IMAGE ANALYSIS MARKET

13.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

13.4 COMPETITIVE BENCHMARKING OF TOP 26 PLAYERS

13.5 COMPANY EVALUATION QUADRANT

13.5.1 STARS

13.5.2 EMERGING LEADERS

13.5.3 PERVASIVE PLAYERS

13.5.4 PARTICIPANTS

13.6 START-UP/SME EVALUATION QUADRANT

13.6.1 PROGRESSIVE COMPANIES

13.6.2 DYNAMIC COMPANIES

13.6.3 STARTING BLOCKS

13.6.4 RESPONSIVE COMPANIES

13.7 KEY STAKEHOLDERS & BUYING CRITERIA

13.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

13.7.2 BUYING CRITERIA

13.8 MARKET RANKING ANALYSIS

13.9 COMPETITIVE SCENARIO

13.9.1 PRODUCT LAUNCHES & APPROVALS

13.9.2 DEALS

14 COMPANY PROFILES (Page No. - 299)

14.1 KEY PLAYERS

14.1.1 GE HEALTHCARE

14.1.1.1 Business overview

14.1.1.2 Products offered

14.1.1.3 Recent developments

14.1.1.4 MnM view

14.1.1.4.1 Right to win

14.1.1.4.2 Strategic choices

14.1.1.4.3 Weaknesses and competitive threats

14.1.2 KONINKLIJKE PHILIPS N.V.

14.1.2.1 Business overview

14.1.2.2 Products offered

14.1.2.3 Recent developments

14.1.2.4 MnM view

14.1.2.4.1 Right to win

14.1.2.4.2 Strategic choices

14.1.2.4.3 Weaknesses and competitive threats

14.1.3 SIEMENS HEALTHINEERS

14.1.3.1 Business overview

14.1.3.2 Products offered

14.1.3.3 Recent developments

14.1.3.4 MnM view

14.1.3.4.1 Right to win

14.1.3.4.2 Strategic choices

14.1.3.4.3 Weaknesses and competitive threats

14.1.4 CANON INC.

14.1.4.1 Business overview

14.1.4.2 Products offered

14.1.4.3 Recent developments

14.1.5 AGFA HEALTHCARE (AGFA-GEVAERT GROUP)

14.1.5.1 Business overview

14.1.5.2 Products offered

14.1.5.3 Recent developments

14.1.5.4 MnM view

14.1.5.4.1 Right to win

14.1.5.4.2 Strategic choices

14.1.5.4.3 Weaknesses and competitive threats

14.1.6 INTERNATIONAL BUSINESS MACHINES (IBM) CORPORATION

14.1.6.1 Business overview

14.1.6.2 Products offered

14.1.6.3 Recent developments

14.1.6.4 MnM view

14.1.6.4.1 Right to win

14.1.6.4.2 Strategic choices

14.1.6.4.3 Weaknesses and competitive threats

14.1.7 CARESTREAM HEALTH

14.1.7.1 Business overview

14.1.7.2 Products offered

14.1.7.3 Recent developments

14.1.8 AQUILAB SAS

14.1.8.1 Business overview

14.1.8.2 Products offered

14.1.8.3 Recent developments

14.1.9 ESAOTE S.P.A.

14.1.9.1 Business overview

14.1.9.2 Products offered

14.1.9.3 Recent developments

14.1.10 MIM SOFTWARE INC.

14.1.10.1 Business overview

14.1.10.2 Products offered

14.1.11 IMAGE ANALYSIS, LTD.

14.1.11.1 Business overview

14.1.11.2 Products offered

14.1.11.3 Recent developments

14.1.12 SCIENCESOFT USA CORPORATION

14.1.12.1 Business overview

14.1.12.2 Products offered

14.1.12.3 Recent developments

14.1.13 XINAPSE SYSTEMS LTD

14.1.13.1 Business overview

14.1.13.2 Products offered

14.1.14 INFINITT HEALTHCARE CO., LTD.

14.1.14.1 Business overview

14.1.14.2 Products offered

14.1.14.3 Recent developments

14.1.15 DENTSPLY SIRONA

14.1.15.1 Business overview

14.1.15.2 Products offered

14.1.16 MEDIS MEDICAL IMAGING SYSTEMS BV

14.1.16.1 Business overview

14.1.16.2 Products offered

14.1.16.3 Recent developments

14.1.17 NEUSOFT MEDICAL SYSTEMS CO., LTD.

14.1.17.1 Business overview

14.1.17.2 Products offered

14.1.17.3 Recent developments

14.1.18 PLANMECA OY

14.1.18.1 Business overview

14.1.18.2 Products offered

14.1.18.3 Recent developments

14.1.19 ANALYZEDIRECT, INC.

14.1.19.1 Business overview

14.1.19.2 Products offered

14.1.20 ARTERYS INC.

14.1.20.1 Business overview

14.1.20.2 Products offered

14.1.20.3 Recent developments

14.1.21 MEDIA CYBERNETICS, INC.

14.1.21.1 Business overview

14.1.21.2 Products offered

14.1.21.3 Recent developments

14.2 OTHER PLAYERS

14.2.1 QMENTA

14.2.2 CEFLA MEDICAL EQUIPMENT (CEFLA S.C.)

14.2.3 ZIOSOFT

14.2.4 KITWARE, INC.

14.2.5 LUNIT INC.

15 APPENDIX (Page No. - 352)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

LIST OF TABLES (342 TABLES)

TABLE 1 LIMITATIONS & ASSOCIATED RISKS

TABLE 2 KEY INVESTMENTS BY GOVERNMENT BODIES IN DIAGNOSTIC IMAGING MARKET

TABLE 3 INSTALLED BASE OF CT, MRI, AND PET-CT IN ASIAN COUNTRIES (2015)

TABLE 4 NUCLEAR MEDICINE INFRASTRUCTURE IN ASIAN AND MIDDLE EASTERN COUNTRIES (2015)

TABLE 5 LARGEST HEALTHCARE DATA BREACHES IN THE WORLD (2020-2021)

TABLE 6 MEDICAL IMAGE ANALYSIS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 MEDICAL IMAGE ANALYSIS MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 13 COMMERCIAL PRICING (USD)

TABLE 14 ACADEMIC PRICING (USD)

TABLE 15 REGIONAL PRICING ANALYSIS OF KEY DIAGNOSTIC IMAGING MODALITIES, 2020 (USD)

TABLE 16 IMPORT DATA FOR COMPUTED TOMOGRAPHY SYSTEMS, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 17 EXPORT DATA FOR COMPUTED TOMOGRAPHY SYSTEMS, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 18 IMPORT DATA FOR ULTRASOUND SYSTEMS, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 19 EXPORT DATA FOR ULTRASOUND SYSTEMS, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 20 IMPORT DATA FOR MAGNETIC RESONANCE IMAGING SYSTEMS, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 21 EXPORT DATA FOR MAGNETIC RESONANCE IMAGING SYSTEMS, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 22 IMPORT DATA FOR X-RAY SYSTEMS, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 23 EXPORT DATA FOR X-RAY SYSTEMS, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 24 MEDICAL IMAGE ANALYSIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 25 MEDICAL IMAGE ANALYSIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 26 INTEGRATED MEDICAL IMAGE ANALYSIS SOFTWARE VENDORS

TABLE 27 INTEGRATED IMAGE ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 28 STANDALONE MEDICAL IMAGE ANALYSIS SOFTWARE VENDORS

TABLE 29 STANDALONE IMAGE ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 30 MEDICAL IMAGE ANALYSIS MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 31 3D IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 32 3D IMAGE ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 33 4D IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 34 4D IMAGE ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 35 2D IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 36 2D IMAGE ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 37 MEDICAL IMAGE ANALYSIS MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 38 TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 39 TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 40 CT IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 41 COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 42 COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 43 HIGH-END SLICE CT IMAGE ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 44 MID-END SLICE CT IMAGE ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 45 LOW-END SLICE CT IMAGE ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 46 MAGNETIC RESONANCE IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 47 MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 48 MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 49 CLOSED MRI IMAGE ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 50 OPEN MRI IMAGE ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 51 PET IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 52 POSITRON EMISSION TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 53 SPECT IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 54 SINGLE-PHOTON EMISSION COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 55 ULTRASOUND IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 56 ULTRASOUND IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 57 ULTRASOUND IMAGING ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 58 ULTRASOUND 2D IMAGING ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 59 ULTRASOUND 3D AND 4D IMAGING ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 60 DOPPLER IMAGING ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 61 RADIOGRAPHIC IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 62 RADIOGRAPHIC IMAGING ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 63 COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 64 COMBINED MODALITY IMAGING ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 65 PET/CT IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 66 PET/CT IMAGE ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 67 SPECT/CT IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 68 SPECT/CT IMAGE ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 69 PET/MR IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 70 PET/MR IMAGE ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 71 MAMMOGRAPHY IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 72 MAMMOGRAPHY IMAGING ANALYSIS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 73 MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 74 CARDIOLOGY IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 75 MARKET FOR CARDIOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 76 ORTHOPEDICS IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 77 MARKET FOR ORTHOPEDICS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 78 ONCOLOGY IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 79 MARKET FOR ONCOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 80 NEUROLOGY IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 81 MARKET FOR NEUROLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 82 MARKET FOR OBSTETRICS AND GYNECOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 83 MAMMOGRAPHY IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 84 MARKET FOR MAMMOGRAPHY, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 85 DENTAL IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 86 MARKET FOR DENTAL APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 87 RESPIRATORY IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 88 MARKET FOR RESPIRATORY APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 89 UROLOGY AND NEPHROLOGY IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 90 MARKET FOR UROLOGY AND NEPHROLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 91 VASCULAR IMAGE ANALYSIS SOFTWARE OFFERED BY KEY PLAYERS

TABLE 92 MARKET FOR VASCULAR APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 93 MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 94 MARKET FOR HOSPITALS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 95 MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 96 MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 97 MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 102 NORTH AMERICA: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 103 NORTH AMERICA: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 104 NORTH AMERICA: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 105 NORTH AMERICA: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 106 NORTH AMERICA: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 107 NORTH AMERICA: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 109 US: KEY MACROINDICATORS

TABLE 110 US: MEDICAL IMAGE ANALYSIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 111 US: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 112 US: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 113 US: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 114 US: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 115 US: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 116 US: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 117 US: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 118 US: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 119 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 120 CANADA: KEY MACROINDICATORS

TABLE 121 CANADA: MEDICAL IMAGE ANALYSIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 122 CANADA: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 123 CANADA: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 124 CANADA: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 125 CANADA: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 126 CANADA: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 127 CANADA: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 128 CANADA: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 129 CANADA: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 130 CANADA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 131 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 132 EUROPE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 133 EUROPE: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 134 EUROPE: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 135 EUROPE: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 136 EUROPE: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 137 EUROPE: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 138 EUROPE: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 139 EUROPE: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 140 EUROPE: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 141 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 142 GERMANY: KEY MACROINDICATORS

TABLE 143 GERMANY: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 144 GERMANY: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 145 GERMANY: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 146 GERMANY: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 147 GERMANY: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 148 GERMANY: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 149 GERMANY: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 150 GERMANY: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 151 GERMANY: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 152 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 153 FRANCE: KEY MACROINDICATORS

TABLE 154 FRANCE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 155 FRANCE: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 156 FRANCE: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 157 FRANCE: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 158 FRANCE: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 159 FRANCE: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 160 FRANCE: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 161 FRANCE: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 162 FRANCE: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 163 FRANCE: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 164 UK: KEY MACROINDICATORS

TABLE 165 UK: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 166 UK: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 167 UK: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 168 UK: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 169 UK: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 170 UK: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 171 UK: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 172 UK: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 173 UK: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 174 UK: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 175 SPAIN: KEY MACROINDICATORS

TABLE 176 SPAIN: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 177 SPAIN: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 178 SPAIN: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 179 SPAIN: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 180 SPAIN: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 181 SPAIN: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 182 SPAIN: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 183 SPAIN: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 184 SPAIN: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 185 SPAIN: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 186 ITALY: KEY MACROINDICATORS

TABLE 187 ITALY: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 188 ITALY: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 189 ITALY: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 190 ITALY: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 191 ITALY: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 192 ITALY: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 193 ITALY: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 194 ITALY: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 195 ITALY: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 196 ITALY: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 197 ROE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 198 ROE: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 199 ROE: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 200 ROE: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 201 ROE: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 202 ROE: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 203 ROE: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 204 ROE: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 205 ROE: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 206 ROE: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 207 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 208 ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 209 ASIA PACIFIC: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 210 ASIA PACIFIC: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 211 ASIA PACIFIC: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 212 ASIA PACIFIC: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 213 ASIA PACIFIC: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 214 ASIA PACIFIC: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 215 ASIA PACIFIC: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 216 ASIA PACIFIC: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 217 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 218 JAPAN: KEY MACROINDICATORS

TABLE 219 JAPAN: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 220 JAPAN: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 221 JAPAN: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 222 JAPAN: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 223 JAPAN: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 224 JAPAN: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 225 JAPAN: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 226 JAPAN: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 227 JAPAN: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 228 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 229 CHINA: KEY MACROINDICATORS

TABLE 230 CHINA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 231 CHINA: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 232 CHINA: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 233 CHINA: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 234 CHINA: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 235 CHINA: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 236 CHINA: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 237 CHINA: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 238 CHINA: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 239 CHINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 240 INDIA: KEY MACROINDICATORS

TABLE 241 INDIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 242 INDIA: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 243 INDIA: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 244 INDIA: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 245 INDIA: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 246 INDIA: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 247 INDIA: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 248 INDIA: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 249 INDIA: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 250 INDIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 251 ROAPAC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 252 ROAPAC: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 253 ROAPAC: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 254 ROAPAC: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 255 ROAPAC: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 256 ROAPAC: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 257 ROAPAC: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 258 ROAPAC: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 259 ROAPAC: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 260 ROAPAC: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 261 LATIN AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 262 LATIN AMERICA: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 263 LATIN AMERICA: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 264 LATIN AMERICA: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 265 LATIN AMERICA: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 266 LATIN AMERICA: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 267 LATIN AMERICA: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 268 LATIN AMERICA: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 269 LATIN AMERICA: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 270 LATIN AMERICA: MEDICAL IMAGE ANALYSIS MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 271 BRAZIL: KEY MACROINDICATORS

TABLE 272 BRAZIL: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 273 BRAZIL: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 274 BRAZIL: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 275 BRAZIL: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 276 BRAZIL: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 277 BRAZIL: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 278 BRAZIL: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 279 BRAZIL: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 280 BRAZIL: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 281 BRAZIL: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 282 MEXICO: KEY MACROINDICATORS

TABLE 283 MEXICO: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 284 MEXICO: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 285 MEXICO: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 286 MEXICO: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 287 MEXICO: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 288 MEXICO: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 289 MEXICO: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 290 MEXICO: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 291 MEXICO: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 292 MEXICO: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 293 ROLATAM: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 294 ROLATAM: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 295 ROLATAM: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 296 ROLATAM: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 297 ROLATAM: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 298 ROLATAM: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 299 ROLATAM: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 300 ROLATAM: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 301 ROLATAM: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 302 ROLATAM: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 303 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 304 MIDDLE EAST & AFRICA: MARKET, BY IMAGE TYPE, 2020–2027 (USD MILLION)

TABLE 305 MIDDLE EAST & AFRICA: MARKET, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 306 MIDDLE EAST & AFRICA: TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 307 MIDDLE EAST & AFRICA: COMPUTED TOMOGRAPHY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 308 MIDDLE EAST & AFRICA: MAGNETIC RESONANCE IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 309 MIDDLE EAST & AFRICA: ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 310 MIDDLE EAST & AFRICA: COMBINED MODALITY IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 311 MIDDLE EAST & AFRICA: MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 312 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 313 OVERALL FOOTPRINT OF COMPANIES

TABLE 314 PRODUCT FOOTPRINT OF COMPANIES (26 COMPANIES)

TABLE 315 END-USER FOOTPRINT OF COMPANIES (26 COMPANIES)

TABLE 316 REGIONAL FOOTPRINT OF COMPANIES (26 COMPANIES)

TABLE 317 MEDICAL IMAGE ANALYSIS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 318 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR MEDICAL IMAGE ANALYSIS SOFTWARE

TABLE 319 KEY BUYING CRITERIA FOR MEDICAL IMAGE ANALYSIS SOFTWARE

TABLE 320 PRODUCT LAUNCHES AND APPROVALS, JANUARY 2018–MAY 2022

TABLE 321 DEALS, JANUARY 2018–MAY 2022

TABLE 322 GE HEALTHCARE: BUSINESS OVERVIEW

TABLE 323 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

TABLE 324 SIEMENS HEALTHINEERS: BUSINESS OVERVIEW

TABLE 325 CANON INC.: BUSINESS OVERVIEW

TABLE 326 AGFA HEALTHCARE (AGFA-GEVAERT GROUP): BUSINESS OVERVIEW

TABLE 327 IBM: BUSINESS OVERVIEW

TABLE 328 CARESTREAM HEALTH: BUSINESS OVERVIEW

TABLE 329 AQUILAB SAS: BUSINESS OVERVIEW

TABLE 330 ESAOTE S.P.A.: BUSINESS OVERVIEW

TABLE 331 MIM SOFTWARE INC.: BUSINESS OVERVIEW

TABLE 332 IMAGE ANALYSIS, LTD.: BUSINESS OVERVIEW

TABLE 333 SCIENCESOFT USA CORPORATION: BUSINESS OVERVIEW

TABLE 334 XINAPSE SYSTEMS LTD: BUSINESS OVERVIEW

TABLE 335 INFINITT HEALTHCARE CO. LTD.: BUSINESS OVERVIEW

TABLE 336 DENTSPLY SIRONA: BUSINESS OVERVIEW

TABLE 337 MEDIS MEDICAL IMAGING SYSTEMS BV: BUSINESS OVERVIEW

TABLE 338 NEUSOFT MEDICAL SYSTEMS CO., LTD.: BUSINESS OVERVIEW

TABLE 339 PLANMECA OY: BUSINESS OVERVIEW

TABLE 340 ANALYZEDIRECT, INC.: BUSINESS OVERVIEW

TABLE 341 ARTERYS, INC.: BUSINESS OVERVIEW

TABLE 342 MEDIA CYBERNETICS: BUSINESS OVERVIEW

LIST OF FIGURES (56 FIGURES)

FIGURE 1 MEDICAL IMAGE ANALYSIS SOFTWARE MARKET SEGMENTATION

FIGURE 2 MARKET: RESEARCH DESIGN

FIGURE 3 PRIMARY SOURCES

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 6 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: MEDICAL IMAGE ANALYSIS MARKET (2021)

FIGURE 8 TOP-DOWN APPROACH

FIGURE 9 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MEDICAL IMAGE ANALYSIS MARKET (2022–2027)

FIGURE 10 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 11 DATA TRIANGULATION METHODOLOGY

FIGURE 12 MEDICAL IMAGE ANALYSIS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET, BY IMAGE TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 14 MARKET, BY MODALITY, 2022 VS. 2027 (USD MILLION)

FIGURE 15 TOMOGRAPHIC IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 16 ULTRASOUND IMAGE ANALYSIS SOFTWARE MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 17 COMBINED MODALITY IMAGING ANALYSIS SOFTWARE MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 18 MEDICAL IMAGE ANALYSIS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 19 MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 20 GEOGRAPHICAL SNAPSHOT OF MARKET

FIGURE 21 TECHNOLOGICAL ADVANCEMENTS IN MEDICAL IMAGING SYSTEMS AND ANALYSIS SOFTWARE TO DRIVE MARKET GROWTH

FIGURE 22 CHINA TO WITNESS HIGHEST GROWTH IN MEDICAL IMAGE ANALYSIS SOFTWARE MARKET DURING FORECAST PERIOD

FIGURE 23 INTEGRATED SOFTWARE SEGMENT ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN MARKET IN 2021

FIGURE 24 TOMOGRAPHY SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MEDICAL IMAGE ANALYSIS SOFTWARE MARKET IN 2021

FIGURE 25 ASIA PACIFIC REGION TO WITNESS HIGHEST GROWTH BETWEEN 2022 AND 2027

FIGURE 26 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

FIGURE 27 MARKET DYNAMICS: MEDICAL IMAGE ANALYSIS MARKET

FIGURE 28 PREVALENCE OF CHRONIC DISEASE-RELATED DEATHS IN DEVELOPED AND DEVELOPING COUNTRIES WORLDWIDE (2020)

FIGURE 29 NUMBER OF CT AND MRI SCANNERS PER MILLION POPULATION, BY COUNTRY (2019)

FIGURE 30 NUMBER OF DATA BREACHES IN THE US (2010–2020)

FIGURE 31 MEDICAL IMAGE ANALYSIS SOFTWARE MARKET: STAKEHOLDERS IN SUPPLY CHAIN

FIGURE 32 MEDICAL IMAGE ANALYSIS MARKET: ECOSYSTEM ANALYSIS

FIGURE 33 GLOBAL PATENT PUBLICATION TRENDS IN MEDICAL IMAGE ANALYSIS SOFTWARE MARKET, 2018–2022

FIGURE 34 TOP COMPANIES THAT APPLIED FOR MEDICAL IMAGE ANALYSIS SOFTWARE PATENTS, 2018–2022

FIGURE 35 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR MEDICAL IMAGE ANALYSIS SOFTWARE PATENTS, 2018–2022

FIGURE 36 COMBINED PET SCANNERS PER MILLION POPULATION, BY COUNTRY (2019)

FIGURE 37 NUMBER OF HOSPITALS, BY COUNTRY (2019)

FIGURE 38 US: NUMBER OF AMBULATORY SURGERY CENTERS (2012–2022)

FIGURE 39 CHINA TO WITNESS HIGHEST GROWTH IN MEDICAL IMAGE ANALYSIS SOFTWARE MARKET DURING FORECAST PERIOD

FIGURE 40 NORTH AMERICA: MEDICAL IMAGE ANALYSIS MARKET SNAPSHOT

FIGURE 41 ASIA PACIFIC: MEDICAL IMAGE ANALYSIS SOFTWARE MARKET SNAPSHOT

FIGURE 42 REVENUE ANALYSIS OF KEY PLAYERS IN MEDICAL IMAGE ANALYSIS MARKET

FIGURE 43 MEDICAL IMAGE ANALYSIS SOFTWARE MARKET: COMPETITIVE LEADERSHIP MAPPING (2021)

FIGURE 44 MEDICAL IMAGE ANALYSIS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR STARTUP COMPANIES (2021)

FIGURE 45 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR MEDICAL IMAGE ANALYSIS SOFTWARE

FIGURE 46 KEY BUYING CRITERIA FOR MEDICAL IMAGE ANALYSIS SOFTWARE

FIGURE 47 LEADING PLAYERS IN MEDICAL IMAGE ANALYSIS MARKET (2021)

FIGURE 48 GE HEALTHCARE: COMPANY SNAPSHOT (2021)

FIGURE 49 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2021)

FIGURE 50 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT (2021)

FIGURE 51 CANON INC.: COMPANY SNAPSHOT (2021)

FIGURE 52 AGFA-GEVAERT GROUP: COMPANY SNAPSHOT (2021)

FIGURE 53 IBM: COMPANY SNAPSHOT (2021)

FIGURE 54 ONEX CORPORATION: COMPANY SNAPSHOT (2021)

FIGURE 55 DENTSPLY SIRONA: COMPANY SNAPSHOT (2021)

FIGURE 56 NEUSOFT CORPORATION: COMPANY SNAPSHOT (2021)

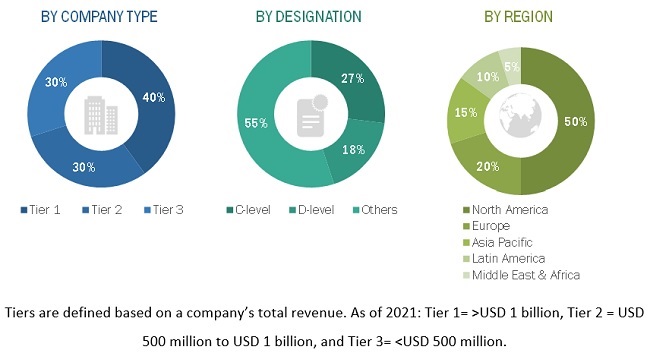

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the Medical image analysis software market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the Medical image analysis software market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the Medical image analysis software market was arrived at after data triangulation from two different approaches, as mentioned below.

Approach to calculate the revenue of different players in the Medical image analysis software market

The size of the global Medical image analysis software market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the global medical image analysis software market by type, image type, modality, application, end user, and region, in terms of value

- To forecast the size of the global market with respect to five regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape

- To profile key players in the global market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as agreements, partnerships, collaborations, product/technology developments, and R&D activities of leading players in the global market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific market into Singapore, Australia, South Korea, New Zealand, and other countries

- Further breakdown of the Rest of Europe market into Belgium, Russia, the Netherlands, Switzerland, and other countries

- Further breakdown of the Rest of Latin America market into the Argentina, Peru, Columbia, Ecuador, and other countries.

Global market share of medical image processing software industry and its growth use-cases

According to a market research report by MarketsandMarkets, the global medical image processing software market size is expected to reach USD 4.5 billion by 2027, at a CAGR of 7.8% during the forecast period. The market growth is driven by factors such as the increasing demand for imaging modalities, the growing need for advanced diagnostic tools, and the rising incidence of chronic diseases.

Here are the top 10 growth use-cases for medical image processing software:

Diagnostics: Medical image processing software is widely used for diagnostic purposes, enabling healthcare professionals to identify and diagnose diseases accurately and efficiently. This includes various imaging modalities such as X-ray, CT scan, MRI, and ultrasound.

Radiation therapy planning: Medical image processing software is used to plan radiation therapy treatments, helping healthcare professionals to determine the precise location and intensity of radiation to be delivered to cancerous tissues, while minimizing damage to healthy tissues.

Surgical planning: Medical image processing software is used to plan surgical procedures, allowing healthcare professionals to visualize and analyze the anatomy of a patient's body, and plan surgical approaches and techniques accordingly.

Interventional radiology: Medical image processing software is used in interventional radiology procedures, allowing healthcare professionals to guide minimally invasive procedures using real-time imaging.

Cardiology: Medical image processing software is used in cardiology to analyze and interpret medical images of the heart and blood vessels, enabling healthcare professionals to diagnose and treat cardiovascular diseases more accurately and effectively.

Neurology: Medical image processing software is used in neurology to analyze and interpret medical images of the brain and nervous system, enabling healthcare professionals to diagnose and treat neurological disorders more accurately and effectively.

Orthopedics: Medical image processing software is used in orthopedics to analyze and interpret medical images of the bones and joints, enabling healthcare professionals to diagnose and treat orthopedic conditions more accurately and effectively.

Oncology: Medical image processing software is used in oncology to analyze and interpret medical images of tumors, enabling healthcare professionals to diagnose and treat cancer more accurately and effectively.

Research: Medical image processing software is used in medical research to analyze and interpret medical images, allowing researchers to gain insights into various medical conditions and develop new treatments and therapies.

Training and education: Medical image processing software is used in medical training and education to help students and healthcare professionals learn and practice medical imaging techniques, enabling them to develop the skills necessary for accurate and efficient diagnosis and treatment.

Hypothetical challenges in the Medical Image Processing Software Market

The medical image processing software market is a rapidly growing industry, but like any other industry, it faces several hypothetical challenges that could impact its growth and development. Here are some of the potential challenges that the medical image processing software market may face in the future:

Privacy and Security Concerns: The use of medical image processing software raises concerns about privacy and security. As medical images contain sensitive patient information, any data breaches or misuse of patient information could damage the reputation of medical image processing software vendors and impact their growth.

Regulatory Compliance: The medical image processing software market is subject to strict regulatory requirements, including FDA regulations, HIPAA regulations, and GDPR regulations. Compliance with these regulations can be costly and time-consuming, and non-compliance can result in fines and legal consequences.

High Development Costs: Developing advanced medical image processing software requires significant investment in research and development, which can be a significant barrier to entry for small and medium-sized vendors. High development costs can also limit the scope of innovation and reduce the number of new products and features entering the market.

Limited Interoperability: The lack of interoperability between different medical image processing software platforms can limit the exchange and sharing of medical images, reducing the effectiveness of medical image analysis and diagnosis.

Complexity of Medical Images: Medical images can be complex and heterogeneous, making it difficult for medical image processing software to accurately interpret and analyze them. This can lead to errors and misdiagnosis, impacting the effectiveness of medical image processing software and its adoption by healthcare professionals.

Limited Access to Advanced Technology: Access to advanced medical image processing technology can be limited for healthcare professionals in certain regions, limiting the adoption and growth of medical image processing software in those regions.

Competition from Traditional Methods: Traditional methods of medical image analysis, such as manual review by radiologists, still play a significant role in healthcare. The competition from these traditional methods can limit the adoption and growth of medical image processing software, particularly in regions with limited access to technology.

Industry impact of Medical Image Processing Software Market

The medical image processing software market has the potential to impact several industries in the future, especially the healthcare industry. Here are some specific examples of industries that are likely to be heavily impacted by medical image processing software:

Radiology: Radiology is one of the main users of medical image processing software. Radiologists use this software to analyze and interpret medical images, enabling them to identify abnormalities and diagnose diseases. The use of medical image processing software has significantly improved the accuracy and efficiency of radiology, making it an indispensable tool in this field.

Oncology: Medical image processing software is becoming increasingly important in oncology, as it enables healthcare professionals to accurately identify and diagnose tumors, track their growth, and assess treatment effectiveness. This software is also used to plan radiation therapy and surgery, improving the precision of these treatments and reducing the risk of complications.

Cardiology: Cardiology is another field that is likely to benefit significantly from medical image processing software. This software can be used to analyze and interpret medical images of the heart and blood vessels, enabling healthcare professionals to diagnose and treat cardiovascular diseases more accurately and effectively.

Neurology: Medical image processing software is also becoming increasingly important in neurology, as it enables healthcare professionals to analyze and interpret medical images of the brain and nervous system. This software can be used to diagnose and treat neurological disorders, such as Alzheimer's disease, Parkinson's disease, and multiple sclerosis.

Orthopedics: Medical image processing software is also used in orthopedics, where it can be used to analyze and interpret medical images of the bones and joints. This software can be used to diagnose and treat orthopedic conditions, such as fractures, arthritis, and spinal disorders.

Top 10 companies in the Medical Image Processing Software Market by Region:

-

North America:

- GE Healthcare

- Philips Healthcare

- Siemens Healthineers

- Agfa-Gevaert Group

- Merge Healthcare (IBM Watson Health)

- McKesson Corporation

- Fujifilm Holdings Corporation

- Carestream Health

- MIM Software Inc.

- Hologic, Inc.

-

Europe:

- Siemens Healthineers

- Philips Healthcare

- GE Healthcare

- Agfa-Gevaert Group

- Merge Healthcare (IBM Watson Health)

- Esaote SpA

- Sectra AB

- Brainlab AG

- Carestream Health

- Koninklijke Philips N.V.

-

Asia-Pacific:

- Fujifilm Holdings Corporation

- Hitachi Medical Corporation

- Canon Medical Systems Corporation

- Koninklijke Philips N.V.

- Shanghai United Imaging Healthcare Co., Ltd.

- Beijing Wandong Medical Technology Co., Ltd.

- Samsung Medison Co., Ltd.

- Carestream Health

- Infinitt Healthcare Co., Ltd.

- Neusoft Medical Systems Co., Ltd.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Image Analysis Software Market