Cast Acrylic Sheet Market by Type (Cell, and Continuous), Application (Sanitary Ware, Signage & Display, Architecture & Interior Design, Transportation, Medical, Food &Catering), and Region (APAC, Europe, NA, ME&A, and SA) - Global Forecast to 2024

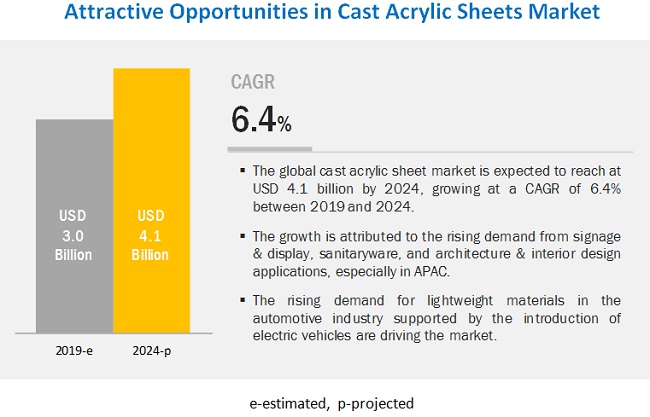

[137 Pages Report] The cast acrylic sheet market size is expected to grow from USD 3.0 billion in 2019 to USD 4.1 billion at a CAGR of 6.4% during the period 2019 to 2024. Cast acrylic sheet has higher impact resistance and optical clarity than glass and is lightweight and customizable to various color and design combinations. Cast acrylic sheet has a wide range of applications, which include signage, POP (Point of Purchase) display, large-screen LCDs, interactive screens, display cases, skylights, furniture, aquariums, mirrors, office stationery, shelf panels, partitions, solar panels, and transportation. The demand in these applications is driving the growth for cast acrylic sheet industry.

Improved optical clarity and greater surface hardness properties are driving the demand for cell cast acrylic sheet.

The superior optical clarity, better machinability, and color compatibility have resulted in cell cast acrylic sheet to be the preferred process type. This is also preferred over continuous cell process type as it provides better surface strength, and manufacturers bear less cost in setting up the plant. These factors have led to the rapid growth of the cell cast process type market during the forecast period.

Cell cast acrylic sheet type is predominantly used in the industry as it provides best optical clarity, greater surface hardness, and higher molecular weight. Owing to the higher molecular weight, it is cleaner to cut, drill, and rout. Customized colors and special effects are easily available in cell cast acrylic sheets.

Increasing demand for display screens, cover panels, and touchscreens will drive the market in this segment.

The use of cast acrylic sheet in signage & display application is expected to be the largest and fastest-growing segment, due to its availability in different colors and strength. Cast acrylic sheet is increasingly being used for out-of-home advertising applications. Various designs can easily be printed over a cast acrylic sheet, making it best suited for architecture and design applications as well. The need for lightweight material in automotive and development of high transportation infrastructures such as bus stands, modernization of railway station and airports have resulted in the growth in demand for cast acrylic sheet in transportation application as well.

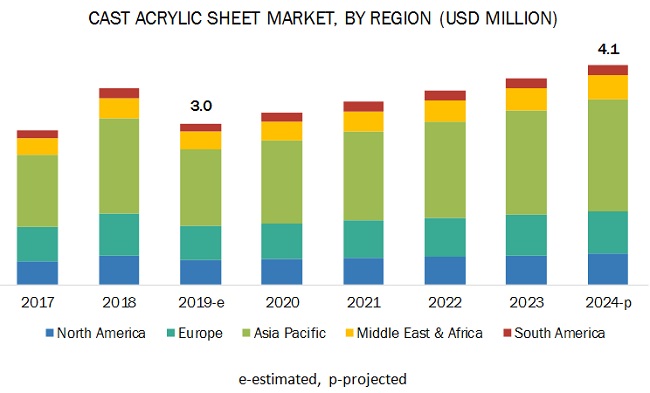

APAC is expected to be the largest and fastest-growing region during the forecast period.

APAC is the largest and the fastest-growing market for cast acrylic sheet. China, India, and Japan are the key markets in APAC, accounting for more than half of the regional market share. Increasing per capita income, rising purchasing power along with the increasing urbanization are expected to drive the cast acrylic sheet market in applications, such as medical, food & catering, sanitaryware, architecture & interior design, and signage & display. Significant growth in the retail industry and increased advertising spending in India, Indonesia, China, and other countries, are likely to propel the market in the signage & display application segment in APAC.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

20172024 |

|

Base year |

2018 |

|

Forecast period |

20192024 |

|

Units considered |

Volume (Kiloton), Value (Value) |

|

Segments |

Process Type, Application, and Region |

|

Regions |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies profiled |

Mitsubishi Chemical Corporation (Japan), 3A Composites (Switzerland), Altuglas International (France), Aristech Acrylics (US), Madreperla (Italy), Gevacril (US), Margacipta Wirasentosa (Indonesia), Astari Niagra (Indonesia), Spartech (US), Asia Poly (Malaysia), Ray Chung Acrylic Enterprise (Taiwan), GRUPO IRPEN (Spain), Polyplastic (Netherland), Jokema Industry (Taiwan), Acrilex (US), Shanghai Acrylic (Cast) Chemical Corporation (China), Limacryl (Belgium), Lei Mei Acrylic (Dongguan) Co., Ltd. (China), Nitto Jushi Kogyo Co., Ltd (Japan), and UB Acrylics (Indonesia) |

This research report categorizes the global cast acrylic sheet market based on process type, application, and region.

Based on Process Type:

- Cell cast acrylic sheet

- Continuous cast acrylic sheet

Based on Application

- Signage & display

- Sanitaryware

- Architecture & Interior Design

- Transportation

- Medical

- Food &Catering

- Others

Based on the Region:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

The market is analyzed further for the key countries in each of these regions.

The major market players include Mitsubishi Chemical Corporation (Japan), 3A Composites (Switzerland), Altuglas International (France), Aristech Acrylics (US), Madreperla (Italy), Gevacril (US), Margacipta Wirasentosa (Indonesia), Astari Niagra (Indonesia), Spartech (US), and Asia Poly (Malaysia).

Key Questions addressed by the report.

- What was the market size of cast acrylic sheet and the estimated share of each region in 2018, in terms of volume?

- What will be the CAGR of the cast acrylic sheet market in all the key regions during the forecast period?

- Do you expect to see any changes in the demand pattern of cast acrylic sheet in your industry, during the forecast period?

- Which type of cast acrylics sheet is preferred most? (Cell cast or Continuous cast)

- What is the estimated demand for continuous cast acrylic sheet in various applications?

Frequently Asked Questions (FAQ):

What are growth influencing factors for cast acrylic sheets?

How cast acrylic sheet differs from extruded acrylic sheets?

What are the different process type for production of cast acrylic sheet?

What are the major applications for cast acrylic sheets?

How is the cast acrylic sheet industry consolidated?

What are the emerging application areas for cast acrylic sheet?

Who are the major manufacturers for cast acrylic sheets?

What is the biggest restraint for cast acrylic sheets market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Cast Acrylic Sheet Market Segmentation

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Supply-Side Analysis

2.2.2 Demand-Side Analysis

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Cast Acrylic Sheet Market

4.2 APAC Cast Acrylic Sheet Market, By Application and Country, 2018

4.3 Cast Acrylic Sheet Market, By Process Type

4.4 Cast Acrylic Sheet Market, By Application

4.5 Cast Acrylic Sheet Market, By Major Countries

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Better Chemical and Mechanical Properties as Compared to Glass

5.2.1.2 Wide Range of Applications

5.2.1.3 Growing Demand for Lightweight Materials in End-Use Industries

5.2.2 Restraints

5.2.2.1 Low Melting Point and Health Hazards From Burning Or Heating of Cast Acrylic Sheet

5.2.3 Opportunities

5.2.3.1 Replacement of Traditional Glass Screens With Cast Acrylic Sheet

5.2.3.2 Growing Retail Market in Developing Countries

5.2.4 Challenges

5.2.4.1 Drop in Raw Material Production

5.2.4.2 Presence of A Large Number of Substitutes

5.3 Porters Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.2 Threat of New Entrants

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Pricing Analysis

5.5 YC, YCC Drivers

6 Cast Acrylic Sheet Market, By Process Type (Page No. - 45)

6.1 Introduction

6.2 Continuous Cast Acrylic Sheet

6.2.1 Less Labor-Intensive and Competitive Price of the Sheet are Expected to Boost Its Demand

6.3 Cell Cast Acrylic Sheet

6.3.1 Better Optical Clarity and Greater Surface Hardness are Driving the Demand for Cell Cast Acrylic Sheet

7 Cast Acrylic Sheet Market, By Application (Page No. - 50)

7.1 Introduction

7.2 Signage & Display

7.2.1 Increasing Demand for Display Screens, Cover Panels, and Touchscreens Will Drive the Market in This Segment

7.3 Sanitaryware

7.3.1 Better Combination of Properties is Driving the Demand for Cast Acrylic Sheets in Sanitaryware

7.4 Architecture & Interior Design

7.4.1 Weather Resistance Capability Along With Lightweight and Easy Fabrication Boosting the Demand for Cast Acrylic Sheet

7.5 Transportation

7.5.1 Increasing Focus on Reducing Vehicle Weight Will Spur the Demand for Cast Acrylic Sheet

7.6 Medical

7.6.1 Excellent Light Permeability of Cast Acrylic Sheet Driving Its Use in Medical Application

7.7 Food & Catering

7.7.1 Increasing Demand for Processed Food Will Drive the Market in the Segment

7.8 Others

8 Cast Acrylic Sheet Market, By Region (Page No. - 60)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 Increasing Investments in OOH Advertising Will Drive the Demand for Cast Acrylic Sheets

8.2.2 Canada

8.2.2.1 Growth in Digital Outdoor Display and Transportation Sectors Will Drive the Demand

8.2.3 Mexico

8.2.3.1 Increase in Manufacturing Activities and Digital Advertisement to Boost the Market Growth

8.3 APAC

8.3.1 China

8.3.1.1 Increasing Display Production in the Country Will Drive the Market

8.3.2 Japan

8.3.2.1 Strong Presence of High-Tech Electronic Product Manufacturing Will Fuel the Market

8.3.3 India

8.3.3.1 Growing Economy and Increasing Fdi in the Country Will Foster the Market Growth

8.3.4 South Korea

8.3.4.1 Growing Market for Lcd and Led Displays to Drive the Demand for Cast Acrylic Sheets

8.3.5 Indonesia

8.3.5.1 Booming Tourism Industry to Drive the Cast Acrylic Sheet Market

8.3.6 Thailand

8.3.7 Rest of APAC

8.4 Europe

8.4.1 UK

8.4.1.1 Increasing Popularity of High-Tech Toilets and Ultra-Modern Bathrooms Concept to Drive the Market

8.4.2 Germany

8.4.2.1 Growth in Digitalization and Automation Will Drive the Market

8.4.3 France

8.4.3.1 Increasing Demand for Aircraft and Investment in Renewable and Sustainable Energy Infrastructure Will Fuel the Growth

8.4.4 Italy

8.4.4.1 Significant Production of Sanitaryware Will Drive the Consumption of Cast Acrylic Sheet

8.4.5 Rest of Europe

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.1.1 Sanitaryware is the Largest and Fastest-Growing Application of Cast Acrylic Sheet in Saudi Arabia

8.5.2 UAE

8.5.2.1 Demand for Architectural Glazing and Increasing Tourism Will Fuel the Market Growth

8.5.3 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.1.1 Modernization of Healthcare Facilities and Usage of High-Quality Equipment Spurring the Demand for Cast Acrylic Sheet

8.6.2 Argentina

8.6.2.1 Rise in Investments in Oil & Gas and Wind Power Industries to Drive the Market for Cast Acrylic Sheet

8.6.3 Rest of South America

9 Competitive Landscape (Page No. - 109)

9.1 Introduction

9.2 Competitive Scenario

9.2.1 Expansion

9.2.2 Merger & Acquisition

9.2.3 New Product Launch

10 Company Profiles (Page No. - 112)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

10.1 Mitsubishi Chemical Corporation

10.2 Altuglas International

10.3 3A Composites

10.4 Aristech Acrylics

10.5 Madreperla

10.6 Gevacril

10.7 Margacipta Wirasentosa

10.8 Astari Niagra

10.9 Spartech

10.10 Asia Poly

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

10.11 Other Key Players

10.11.1 Ray Chung Acrylic Enterprise

10.11.2 Grupo Irpen

10.11.3 Polyplastic

10.11.4 Jokema Industry

10.11.5 Acrilex

10.11.6 Shanghai Acrylic (Cast) Chemical Corporation

10.11.7 Limacryl

10.11.8 LEI MEI Acrylic (Dongguan)

10.11.9 Nitto Jushi Kogyo

10.11.10 UB Acrylics

11 Appendix (Page No. - 132)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (145 Tables)

Table 1 Cast Acrylic Sheet vs Substitutes

Table 2 Planned and Unplanned Mma Plants Maintenance in Us

Table 3 Planned and Unplanned Mma Plants Maintenance in APAC

Table 4 Cell Cast Acrylic Sheet vs Continuous Cast Acrylic Sheet

Table 5 Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 6 Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 7 Continuous Cast Acrylic Sheet Market Size, By Region, 20172024 (Kiloton)

Table 8 Continuous Cast Acrylic Sheet Market Size, By Region, 20172024 (USD Million)

Table 9 Cell Cast Acrylic Sheet Market Size, By Region, 20172024 (Kiloton)

Table 10 Cell Cast Acrylic Sheet Market Size, By Region, 20172024 (USD Million)

Table 11 Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 12 Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 13 Cast Acrylic Sheet Market Size in Signage & Display Application, By Region, 20172024 (Kiloton)

Table 14 Cast Acrylic Sheet Market Size in Signage & Display Application, By Region, 20172024 (USD Million)

Table 15 Cast Acrylic Sheet Market Size in Sanitaryware Application, By Region, 20172024 (Kiloton)

Table 16 Cast Acrylic Sheet Market Size in Sanitaryware Application, By Region, 20172024 (USD Million)

Table 17 Cast Acrylic Sheet Market Size in Architecture & Interior Design Application, By Region, 20172024 (Kiloton)

Table 18 Cast Acrylic Sheet Market Size in Architecture & Interior Design Application, By Region, 20172024 (USD Million)

Table 19 Cast Acrylic Sheet Market Size in Transportation Application, By Region, 20172024 (Kiloton)

Table 20 Cast Acrylic Sheet Market Size in Transportation Application, By Region, 20172024 (USD Million)

Table 21 Cast Acrylic Sheet Market Size in Medical Application, By Region, 20172024 (Kiloton)

Table 22 Cast Acrylic Sheet Market Size in Medical Application, By Region, 20172024 (USD Million)

Table 23 Cast Acrylic Sheet Market Size in Food & Catering Application, By Region, 20172024 (Kiloton)

Table 24 Cast Acrylic Sheet Market Size in Food & Catering Application, By Region, 20172024 (USD Million)

Table 25 Cast Acrylic Sheet Market Size in Other Applications, By Region, 20172024 (Kiloton)

Table 26 Cast Acrylic Sheet Market Size in Other Applications, By Region, 20172024 (USD Million)

Table 27 Cast Acrylic Sheet Market Size, By Region, 20172024 (Kiloton)

Table 28 Cast Acrylic Sheet Market Size, By Region, 20172024 (USD Million)

Table 29 North America: Cast Acrylic Sheet Market Size, By Country, 20172024 (Kiloton)

Table 30 North America: Cast Acrylic Sheet Market Size, By Country, 20172024 (USD Million)

Table 31 North America: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 32 North America: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 33 North America: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 34 North America: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 35 US: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 36 US: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 37 US: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 38 US: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 39 Canada: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 40 Canada: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 41 Canada: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 42 Canada: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 43 Mexico: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 44 Mexico: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 45 Mexico: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 46 Mexico: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 47 APAC: Cast Acrylic Sheet Market Size, By Country, 20172024 (Kiloton)

Table 48 APAC: Cast Acrylic Sheet Market Size, By Country, 20172024 (USD Million)

Table 49 APAC: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 50 APAC: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 51 APAC: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 52 APAC: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 53 China: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 54 China: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 55 China: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 56 China: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 57 Japan: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 58 Japan: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 59 Japan: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 60 Japan: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 61 India: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 62 India: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 63 India: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 64 India: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 65 South Korea: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 66 South Korea: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 67 South Korea: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 68 South Korea: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 69 Indonesia: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 70 Indonesia: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 71 Indonesia: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 72 Indonesia: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 73 Thailand: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 74 Thailand: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 75 Thailand: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 76 Thailand: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 77 Rest of APAC: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 78 Rest of APAC: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 79 Rest of APAC: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 80 Rest of APAC: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 81 Europe: Cast Acrylic Sheet Market Size, By Country, 20172024 (Kiloton)

Table 82 Europe: Cast Acrylic Sheet Market Size, By Country, 20172024 (USD Million)

Table 83 Europe: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 84 Europe: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 85 Europe: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 86 Europe: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 87 UK: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 88 UK: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 89 UK: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 90 UK: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 91 Germany: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 92 Germany: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 93 Germany: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 94 Germany: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 95 France: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 96 France: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 97 France: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 98 France: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 99 Italy: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 100 Italy: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 101 Italy: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 102 Italy: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 103 Rest of Europe: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 104 Rest of Europe: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 105 Rest of Europe: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 106 Rest of Europe: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 107 Middle East & Africa: Cast Acrylic Sheet Market Size, By Country, 20172024 (Kiloton)

Table 108 Middle East & Africa: Cast Acrylic Sheet Market Size, By Country, 20172024 (USD Million)

Table 109 Middle East & Africa: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 110 Middle East & Africa: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 111 Middle East & Africa: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 112 Middle East & Africa: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 113 Saudi Arabia: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 114 Saudi Arabia: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 115 Saudi Arabia: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 116 Saudi Arabia: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 117 UAE: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 118 UAE: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 119 UAE: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 120 UAE: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 121 Rest of Middle East & Africa: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 122 Rest of Middle East & Africa: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 123 Rest of Middle East & Africa: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 124 Rest of Middle East & Africa: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 125 Cast Acrylic Sheet Market Size, By Country, 20172024 (Kiloton)

Table 126 Cast Acrylic Sheet Market Size, By Country, 20172024 (USD Million)

Table 127 South America: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 128 South America: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 129 South America: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 130 South America: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 131 Brazil: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 132 Brazil: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 133 Brazil: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 134 Brazil: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 135 Argentina: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 136 Argentina: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 137 Argentina: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 138 Argentina: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 139 Rest of South America: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (Kiloton)

Table 140 Rest of South America: Cast Acrylic Sheet Market Size, By Process Type, 20172024 (USD Million)

Table 141 Rest of South America: Cast Acrylic Sheet Market Size, By Application, 20172024 (Kiloton)

Table 142 Rest of South America: Cast Acrylic Sheet Market Size, By Application, 20172024 (USD Million)

Table 143 Expansion, 20152018

Table 144 Merger & Acquisition, 20152018

Table 145 New Product Launch, 20152018

List of Figures (31 Figures)

Figure 1 Cast Acrylic Sheet Market: Research Design

Figure 2 Market Size Estimation: Supply Side

Figure 3 Market Size Estimation: Demand-Side Analysis

Figure 4 Cast Acrylic Sheet Market: Data Triangulation

Figure 5 Cell Cast Acrylic Sheet Accounted for the Larger Share in 2018

Figure 6 Signage & Display to Be the Fastest-Growing Application of Cast Acrylic Sheet

Figure 7 APAC to Be the Fastest-Growing Market

Figure 8 Increasing Urbanization and Spending in Advertising in APAC to Drive the Market Between 2019 and 2024

Figure 9 China Accounted for the Largest Market Share

Figure 10 Cell Cast Acrylic Sheet to Register the Higher CAGR

Figure 11 Signage & Display to Be the Fastest-Growing Application

Figure 12 China to Be the Fastest-Growing Market

Figure 13 Drivers, Restraints, Opportunities, and Challenges in the Cast Acrylic Sheet Market

Figure 14 Cast Acrylic Sheet Market: Porters Five Forces Analysis

Figure 15 Cast Acrylic Sheet Price Trend

Figure 16 Supply-Demand Trend of Cast Acrylic Sheet

Figure 17 Market Forecast Curve for Cast Acrylic Sheet, USD Million

Figure 18 YC, YCC Shift

Figure 19 Continuous Cast Acrylic Sheet Was the Dominant Process Type in 2018 (Kiloton)

Figure 20 China to Be the Fastest-Growing Cast Acrylic Sheet Market

Figure 21 North America: Cast Acrylic Sheet Market Snapshot

Figure 22 APAC: Cast Acrylic Sheet Market Snapshot

Figure 23 Europe: Cast Acrylic Sheet Market Snapshot

Figure 24 Companies Majorly Adopted Organic Growth Strategies Between 2015 to 2018

Figure 25 Market Evaluation Framework

Figure 26 Mitsubishi Chemical Corporation: Company Snapshot

Figure 27 Mitsubishi Chemical Corporation: SWOT Analysis

Figure 28 Altuglas International: SWOT Analysis

Figure 29 3A Composites: SWOT Analysis

Figure 30 Aristech Acrylics: SWOT Analysis

Figure 31 Asia Poly: Company Snapshot

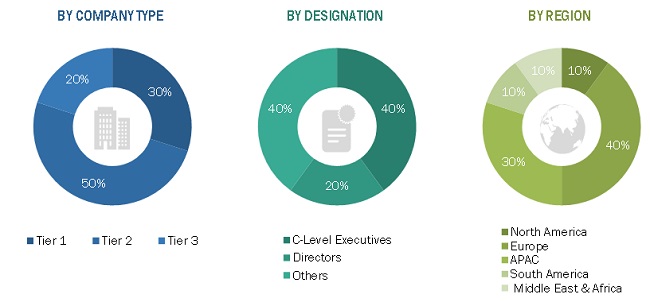

This study involved four major activities in estimating the current market size of cast acrylic sheet market. Exhaustive secondary research was carried out to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; publications by recognized websites; and databases were referred to for identifying and collecting information. Secondary research was used to obtain key information about the supply chain of the industry, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both, the market- and technology-oriented perspectives.

Primary Research

The cast acrylic sheet market comprises several stakeholders such as raw material suppliers, processors, fabricators, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the advertising industry, food & catering, LED and LCD screens, medical architecture, and transportation industry. The supply side is characterized by advancements in technology and diverse end-use industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents-

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global cast acrylic market and to estimate the sizes of various other dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of volume, were determined through primary and secondary research.

- All percentage shares were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials such as directors and marketing executives.

Data Triangulation

After arriving at the total market size through the estimation process, the overall market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market size estimation process and arrive at the exact statistics for all segments and sub-segments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Also, the market size was validated by using the top-down and bottom-up approaches. Then, it was verified through primary interviews. Thus, for every data segment, there were three sourcestop-down approach, bottom-up approach, and expert interviews. The data was assumed to be correct when the values arrived at from the three sources matched.

Objectives of the study

- To define, describe, and forecast the size of the global cast acrylic sheet market in terms of value and volume

- To provide insights regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To estimate and forecast the market based on process type and application

- To analyze and forecast the market size based on major regionsNorth America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa, and the key countries

- To analyze opportunities in the market for stakeholders and present a competitive landscape for market leaders

- To analyze competitive developments such as new product launches, divestments, expansions, and merger & acquisitions in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Geographical Analysis:

- Country-level analysis of the global cast acrylic sheet market

Company Information:

- Detailed analysis and profiles of additional market players

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Growth opportunities and latent adjacency in Cast Acrylic Sheet Market