Cell Dissociation Market by Product (Trypsin, Papain, DNase, Hyaluronidase, Instruments), Tissue Type (Connective Tissue, Epithelial Tissue), End User (Pharma, Biopharma, Research Institutes) & Region - Global Forecasts to 2028

The global cell dissociation market in terms of revenue was estimated to be worth $0.6 billion in 2023 and is poised to reach $1.4 billion by 2028, growing at a CAGR of 17.8% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The new edition of the report provides updated financial information through 2022 (depending on availability) for each listed company in a graphical representation. This would help in the easy analysis of the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region or country, and business segment focus in terms of the highest revenue-generating segment. Key driving factors of the market include an increase in demand for personalized medicine, cGMP approvals each year for new production facilities developing cell therapies, and the growing use of cell dissociation products in mammalian cell culture to develop recombinant therapeutics. Additionally, advancements in non-enzymatic dissociation approaches are expected to offer lucrative opportunities for the end users of this market. Expensive cell-based research is a major hindrance to the market growth.

To know about the assumptions considered for the study, download the pdf brochure

Cell dissociation Market Dynamics

Driver: Increase in recombinant therapeutics sourced from mammalian cells

The biopharmaceutical industry has witnessed a considerable increase in the proportion of recombinant therapeutics sourced from mammalian cells since 2002. The number of approved recombinant products from mammalian cell culture increased by 8.5% annually from 2002 to 2022. As of June 2022, more than 300 recombinant products have been commercialized, indicating a rapid shift towards mammalian-based therapeutics, which nearly account for 67% of therapeutics in 2022. .Cell culture products, including cell dissociation form an integral part of developing mammalian-based recombinant therapeutics, propelling the industry growth.

Restraint: High cost of cell-based research

Isolation and purification of cell organelles integrates expensive products, additionally, automated/sem-automated benchtop instruments are more expensive than traditional methods. Despite significant benefits offered by automated instruments, high costs associated with these instruments may limit the adoption of products further restraining the market growth.

Opportunity: Advancements in non-enzymatic tissue dissociation

Companies operating in the market are introducing innovative and advanced products to overcome competition and generate more revenue. Most researchers in R&D institutes and biotechnology companies have primarily relied on traditional enzymatic dissociation products to separate cells from primary tissues. Although these traditional enzymatic dissociation products have advantages, such as better dissociation while performing research, they can sometimes be cytotoxic and damage viable cells. To overcome this issue and differentiate their product offerings, several companies are introducing non-enzymatic products that are non-cytotoxic. Owing to this advantage, the demand for non-enzymatic dissociation products is increasing among several end users.

Challenge: Limitations associated with dissociated cell culture

The key limitation of dissociated cultures is the small number of cells relative to immortalized cell lines. This makes it difficult to perform biochemical experiments requiring a high starting material volume. Additionally, most primary cell cultures are not homogeneous, which poses a challenging scenario for cell dissociation experiments. Neuronal cultures are often mixtures of both glia and neurons that respond to different neurotransmitters, so identifying an individual population of cells can be difficult.

The enzymatic dissociation segment accounted for the largest share of the cell dissociation industry in 2022

Based on the product, the cell dissociation market is segmented into non-enzymatic dissociation products, enzymatic dissociation products and instruments & accessories. Collagenase segment is the key contributor to the dominance of enzymatic dissociation products. More than 20 different types of collagenases exist, but only a handful are most suited for the enzyme dissociation of tissues. These suitable collagenases can maximize the number of viable, dissociated cells. Collagenase type 1 is typically recommended for liver, epithelial, adrenal, and adipocyte tissue dissociation.

The connective tissue segment of the cell dissociation industry is expected to grow at the highest CAGR during the forecast period

By tissue type, the cell dissociation market is segmented cell detachment and tissue dissociation. The tissue dissociation segment accounted for the largest market share in 2022. Collagen fibers are present in varying concentrations in almost all connective tissues. Elastic fibers are less abundant than the collagen varieties, somewhat similar to reticular fibers, wherein they form branching networks in connective tissues.

Pharmaceutical and biotechnology companies are the dominant end user segment of the cell dissociation industry in 2022

Based on end-users, the cell dissociation market is segmented into pharmaceutical & biotechnology companies, research institutes & academic institutes, and other end users. Pharmaceutical & biotechnology companies utilize cell culture products, including cell dissociation products, to research various chronic diseases. Additionally, the R&D investments in these companies have been increasing over the last few years, which has contributed to the dominance of this segment.

Asia Pacific region is anticipated to grow at the fastest pace in the cell dissociation industry through the forecast period

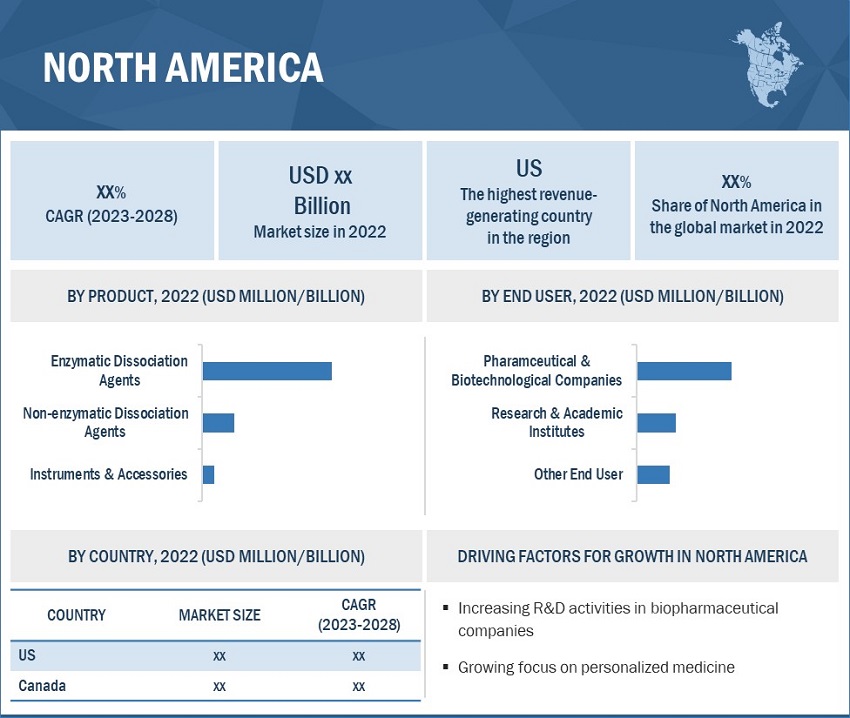

Based on the region, the cell dissociation market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific region is anticipated to grow at the fastest pace in the market through the forecast period. APAC’s pharmaceutical markets remain highly competitive and extremely fragmented, with thousands of small manufacturers competing for market shares. From an economic and policy standpoint, government support is expected to drive innovation in life sciences research and the growth of the pharmaceutical and biopharmaceutical sector.

The prominent players in the global cell dissociation market are Merck KGaA (Germany), Danaher Corporation (US), Thermo Fisher Scientific, Inc. (US), Corning Incorporated (US), Becton, Dickinson and Company (US), STEMCELL Technologies (Canada), PromoCell GmbH (Germany), Miltenyi Biotec (Germany), ATCC (US), HiMedia Laboratories (India), PAN-Biotech (Germany), CellSystems GmbH (Germany), AMSBIO (England), Neuromics (US), VitaCyte, LLC. (US), ALSTEM (US), Biological Industries (Israel), Gemini Bio (US), Innovative Cell Technologies, Inc. (US), Central Drug House (P) Ltd. (India), Worthington Biochemical Corporation (US), Capricorn Scientific (Germany), Abeomics (US), and Genlantis, Inc. (US).

Scope of the Cell Dissociation Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$0.6 billion |

|

Estimated Value by 2028 |

$1.4 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 17.8% |

|

Market Driver |

Increase in recombinant therapeutics sourced from mammalian cells |

|

Market Opportunity |

Advancements in non-enzymatic tissue dissociation |

This research report categorizes the cell dissociation market to forecast revenue and analyze trends in each of the following submarkets

By Product

-

Enzymatic Dissociation Products

- Collagenase

- Trypsin

- Papain

- Elastase

- DNase

- Hyaluronidase

- Other Enzymes

- Non-Enzymatic Dissociation Agents

- Instruments & Accessories

By Tissue Type

- Connective Tissues

- Epithelial Tissues

- Other tissues

By Application

- Tissue dissociation

- Cell detachment

By End User

- Pharmaceutical and Biotechnology companies

- Research and Academics

- other end users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- RoE

-

Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- RoAPAC

- Rest of the World

Recent Development of Cell Dissociation Industry

- In 2020, Miltenyi Biotec launched automated and closed adherent cell culture solutions on CliniMACS Prodigy.

- In 2020, Merck The company expanded its Life Sciences production facilities in Danvers, Massachusetts, and Jaffrey, New Hampshire (US).

- In 2020, STEMCELL Technologies partnered with CollPlant to secure CollPlant rhCollagen for STEMCELL’s use in cell culture applications.

- In 2021, Danaher (Cytiva) partnered with Diamyd Medical, wherein Diamyd selected Cytiva’s FlexFactory platform for making precision medicine type-1 diabetes vaccines.

- In 2021, Danaher (Cytiva) collaborated with the Government of Telangana (India) to strengthen the biopharma industry in India with new labs.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global cell dissociation market?

The global cell dissociation market boasts a total revenue value of $1.4 billion by 2028.

What is the estimated growth rate (CAGR) of the global cell dissociation market?

The global cell dissociation market has an estimated compound annual growth rate (CAGR) of 17.8% and a revenue size in the region of $0.6 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study involved four major activities in estimating the current size of the cell dissociation market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the cell dissociation market. The secondary sources used for this study include publications from government sources National Cancer Institute (NCI), Cancer Research UK, Israel Cancer Research Fund (ICRF), Department of Health and Social Care (DHSC), Global Cancer Observatory (GLOBOCAN), Breast Cancer Research Foundation (BCRF), Centre for Cellular and Molecular Biology (CCMB), Chinese Academy of Medical Sciences (CAMS), National Centre for Cell Science (NCCS), Annual Reports, SEC Fillings, Press Releases, Investor Presentation, Expert Interviews, and MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

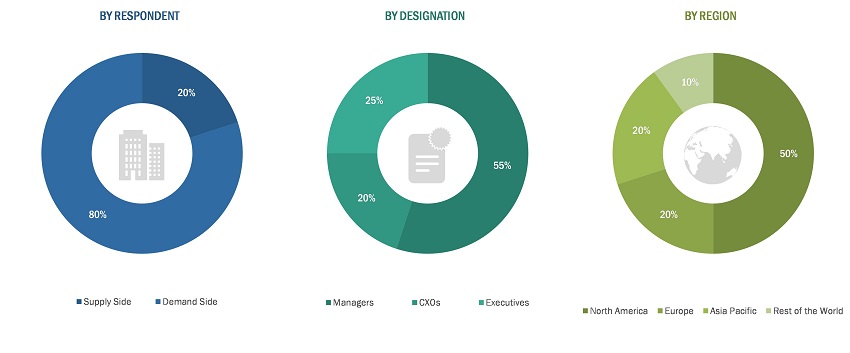

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cell dissociation market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the cell dissociation industry.

Report Objectives

- To define, describe, and forecast the global cell dissociation market based on product, tissue type, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments with respect to four main regions—North America, Europe, Asia Pacific, Latin America and the Middle East and Africa

- To strategically profile key players and comprehensively analyze their product portfolios, market shares, and core competencies

- To track and analyze competitive developments such as acquisitions, new product launches, expansions, regulatory approvals, and agreements in the cell dissociation market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis:

- Product matrix, which gives a detailed comparison of the product portfolios of each company

Geographic Analysis:

- Further breakdown of the Rest of the World cell dissociation market into Latin America, the Middle East, and Africa cell dissociation market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cell Dissociation Market