Cell Lysis Market / Fractionation Market by Product (Consumables (Enzymes, Detergent), Instruments (Sonicators)), Cell Type (Mammalian), Application (Protein Purification), End User (Biopharmaceutical & Biotechnology Companies) & Region - Global Forecast to 2026

Market Growth Outlook Summary

The global cell lysis market growth forecasted to transform from $2.9 billion in 2021 to $4.1 billion by 2026, driven by a CAGR of 7.2%. The 2021 edition of the report provides market size and forecasts for each of the regions along with their countries. Pricing analysis, supply analysis, value chain analysis, ecosystem analysis of the cell lysis market, Porter's Five Forces analysis, trade analysis, patent analysis, technology analysis, and regulatory outlook have been added. Growth of the market is driven mainly by increasing government funding for research, the high prevalence of diseases, and a growing focus on personalised medicine.

Cell Lysis Market Trends

To know about the assumptions considered for the study, download the pdf brochure

Cell Lysis Market Dynamics

Driver: Increasing government funding for research

Researchers utilize disrupted cells to study an organelle's morphology and function and develop new cell therapies and other cell-based treatments. Due to the importance of cell-based research, various government bodies have increased their support for the growth of such studies. Many government organizations have extended their help in the form of investments, funds, and grants. For instance, in March 2020, the Government of Canada invested around $7.0 million through the Stem Cell Network's competitive research funding program to support stem cell research in Canada. In 2019, the Minister of Science and Sport (Canada) announced funding of USD 22.7 million, in addition to USD 33.4 million in funding by provincial governments, to support 36 research projects through Genome Canada. The projects include various sectors such as health, agriculture, natural resources, and the environment.

Opportunity: Growing opportunity in emerging markets

Emerging countries such as China, Brazil, Mexico, and India present significant opportunities for players in the cell lysis market. The major reasons for this are the increasing prevalence of chronic diseases, improvements in infrastructure facilities for research, and favorable legislation for cell-based research in emerging countries. Due to this, key industry players strengthen their presence in emerging countries like China by establishing new facilities and R&D and innovation centers in the region.

Challenge: Survival of small players and new entrants

The survival of small players and new entrants in the cell lysis market is a significant challenge. Huge investments are required for the R&D and launch of innovative products in the market. Thus, to remain competitive in the market, companies have to invest heavily. Moreover, market players have to reduce operational costs to successfully survive in the market, which is very difficult for small players and new entrants.

The consumables segment is expected to grow at the highest CAGR in the cell lysis industry during the forecast period.

Based on the product, the cell lysis market is segmented into consumables and instruments. The consumables segment is projected to witness the highest growth during the forecast period. The repeated purchase and high consumption, the high prevalence of diseases, and increasing funding for cell-based research are the major factors supporting the growth of this segment.

The mammalian cell segment accounted for the largest share of the cell lysis industry.

By cell type, the cell lysis market is segmented into mammalian, microbial, and other cells. The inframammary fold segment accounted for the largest market share in 2020. The large share of this segment can be attributed to Increasing investments in research activities to develop new disease treatments and industrial applications.

Research laboratories and institutes account for the largest share of the cell lysis industry.

Based on end-users, the cell lysis market is segmented into biopharmaceutical & biotechnology companies, research laboratories & institutes, and other end users. The research laboratories & institutes segment accounted for the largest share of the global market in 2020. The increasing rising government funding for cell-based research is one of the major driving factor for this market.

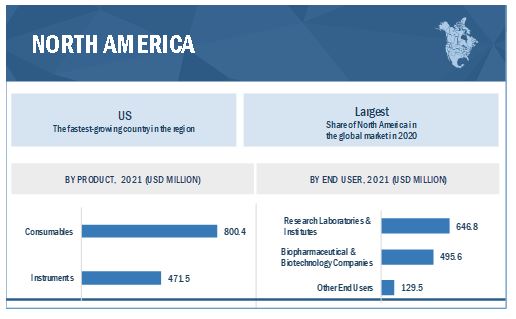

North America accounted for the largest share of the cell lysis industry.

Based on the region, the cell lysis market is segmented into North America, Europe, Asia Pacific, and the Rest of the World (RoW). In 2020, North America accounted for the largest share of the global market. The large share of North America can be attributed to factors such as growing stem cell and cancer research activities and the expanding biotechnology & pharmaceutical industries

Some of the major players operating in the cell lysis market are Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), and Becton, Dickinson, and Company (US). In 2020, Thermo Fisher Scientific Inc. held the leading position in the market. The The company has a strong geographic presence across the US, China, Germany, and the UK. Moreover, the company's strong brand recognition and comprehensive product portfolio in the cell lysis market are its key strengths. In 2020, Merck held the second-largest market share.

Scope of the Cell Lysis Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$ 2.9 billion |

|

Projected Revenue Size by 2026 |

$4.1 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 7.2% |

|

Market Driver |

Increasing government funding for research |

|

Market Opportunity |

Growing opportunity in emerging markets |

This research report categorizes the cell lysis market to forecast revenue and analyze trends in each of the following submarkets

By Product

-

Consumables

-

Kits and Reagents

- Enzymes

- Detergent Solutions

- Others

-

Kits and Reagents

-

Instruments .

- Sonicators

- Homogenizers

- Other Instruments

By Cell Type

- Mammalian Cells

- Microbial Cells

- Other Cells

By Application

- Protein Purification and Isolation

- Nucleic Acid Isolation and Purification

- Other Application

By End User

- Research Laboratories and Institutes

- Biopharmaceutical and Biotechnology Companies

- Other End User

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- RoE

-

Asia Pacific

- China

- India

- Japan

- RoAPAC

- Rest of the World

Recent Developments of Cell Lysis Industry

- In 2020, Thermo Fisher Scientific entered into collaboration with Northeastern University To advance analytical capabilities and accelerate innovation across the biopharmaceutical industry in personalized medicine, monoclonal antibodies, and gene & cell therapies

- In 2020, Danaher Corporation acquired biopharma business from GE Company’s life science segment.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global cell lysis market?

The global cell lysis market boasts a total revenue value of $4.1 billion by 2026.

What is the estimated growth rate (CAGR) of the global cell lysis market?

The global cell lysis market has an estimated compound annual growth rate (CAGR) of 7.2% and a revenue size in the region of $2.9 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

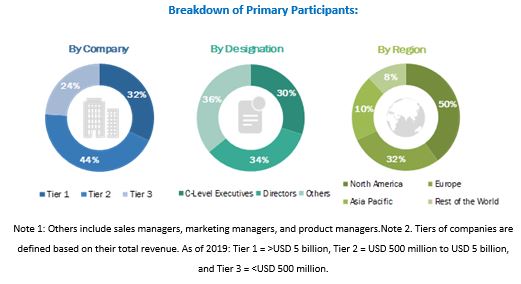

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (APPLICATION-BASED)

FIGURE 6 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 8 CELL LYSIS MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 9 GLOBAL MARKET, BY CELL TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 10 GLOBAL MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 11 GLOBAL MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 12 GLOBAL CELL LYSIS INDUSTRY, BY REGION, 2021 VS. 2026 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 CELL LYSIS MARKET OVERVIEW

FIGURE 13 INCREASING FOCUS ON PERSONALIZED MEDICINE DRIVES THE GROWTH OF THE MARKET

4.2 GLOBAL MARKET, BY PRODUCT

FIGURE 14 CONSUMABLES DOMINATE THE PRODUCTS MARKET

4.3 NORTH AMERICA: MARKET, BY PRODUCT, 2020

FIGURE 15 US DOMINATED THE GLOBAL MARKET IN 2020

4.4 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

FIGURE 16 CHINA TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 CELL LYSIS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing government funding for research

FIGURE 18 NIH FUNDING, BY RESEARCH AREA, 2016–2021 (USD MILLION)

5.2.1.2 High prevalence of diseases

TABLE 1 RISING INCIDENCES OF DISEASES

5.2.1.3 Growing focus on personalized medicine

FIGURE 19 RISING NUMBER OF PERSONALIZED MEDICINES, 2008–2020

5.2.2 RESTRAINTS

5.2.2.1 High cost of cell-based research and instruments

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging countries

5.2.4 CHALLENGES

5.2.4.1 Survival of small players and new entrants

5.3 COVID-19 IMPACT ANALYSIS

5.4 VALUE CHAIN ANALYSIS

FIGURE 20 MAJOR VALUE IS ADDED DURING THE MANUFACTURING & ASSEMBLY PHASE

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 21 DISTRIBUTION—A STRATEGY PREFERRED BY PROMINENT COMPANIES

5.6 ECOSYSTEM ANALYSIS OF THE CELL LYSIS MARKET

FIGURE 22 ECOSYSTEM ANALYSIS OF THE CELL LYSIS FRACTIONATION MARKET

5.7 PRICING ANALYSIS

TABLE 2 PRICES OF CELL LYSIS PRODUCTS

5.8 PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT FROM NEW ENTRANTS

5.8.2 INTENSITY OF COMPETITIVE RIVALRY

5.8.3 BARGAINING POWER OF BUYERS

5.8.4 BARGAINING POWER OF SUPPLIERS

5.8.5 THREAT FROM SUBSTITUTES

5.9 TECHNOLOGY ANALYSIS

5.10 PATENT ANALYSIS

5.11 REGULATORY OUTLOOK

5.12 TRADE ANALYSIS

TABLE 3 EXPORT DATA FOR HOMOGENIZERS, BY COUNTRY, 2016—2020 (USD MILLION)

TABLE 4 IMPORT DATA FOR HOMOGENIZERS, BY COUNTRY, 2016—2020 (USD MILLION)

6 CELL LYSIS MARKET, BY PRODUCT (Page No. - 55)

6.1 INTRODUCTION

TABLE 5 CELL LYSIS INDUSTRY, BY PRODUCT, 2019–2026 (USD MILLION)

6.2 CONSUMABLES

TABLE 6 CELL LYSIS CONSUMABLES MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 7 CELL LYSIS CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.2.1 REAGENTS & KITS

TABLE 8 CELL LYSIS REAGENTS & KITS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 9 CELL LYSIS REAGENTS & KITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.2.1.1 Enzymes

6.2.1.1.1 Enzymes dominated the reagents & kits market in 2020

TABLE 10 CELL LYSIS ENZYMES MARKET, BY REGION, 2019–2026 (USD MILLION)

6.2.1.2 Detergent solutions

6.2.1.2.1 Growing research in cell biology is a key factor driving market growth

TABLE 11 CELL LYSIS DETERGENT SOLUTIONS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.2.1.3 Other reagents & kits

TABLE 12 OTHER CELL LYSIS REAGENTS & KITS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.2.2 BEADS

6.2.2.1 Increasing investments in cell-based research form a major growth factor in this market

TABLE 13 CELL LYSIS BEADS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.2.3 DISPOSABLES

6.2.3.1 North America to show the highest demand for cell lysis disposables

TABLE 14 CELL LYSIS DISPOSABLES MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3 INSTRUMENTS

TABLE 15 CELL LYSIS INSTRUMENTS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 16 CELL LYSIS INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.3.1 SONICATORS

6.3.1.1 Sonicators accounted for the largest share of the instruments market in 2020

TABLE 17 CELL LYSIS SONICATORS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3.2 HOMOGENIZERS

6.3.2.1 Investments in research and technological advancements drive market growth

TABLE 18 CELL LYSIS HOMOGENIZERS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3.3 OTHER INSTRUMENTS

TABLE 19 OTHER CELL LYSIS INSTRUMENTS MARKET, BY REGION, 2019–2026 (USD MILLION)

7 CELL LYSIS MARKET, BY CELL TYPE (Page No. - 64)

7.1 INTRODUCTION

TABLE 20 CELL LYSIS INDUSTRY, BY CELL TYPE, 2019–2026 (USD MILLION)

7.2 MAMMALIAN CELLS

7.2.1 MAMMALIAN CELLS TO DOMINATE THE GLOBAL MARKET

TABLE 21 GLOBAL MARKET FOR MAMMALIAN CELLS, BY REGION, 2019–2026 (USD MILLION)

7.3 MICROBIAL CELLS

7.3.1 INCREASING INVESTMENT ON BIOPHARMACEUTICAL R&D TO DRIVE MARKET GROWTH

TABLE 22 GLOBAL MARKET FOR MICROBIAL CELLS, BY REGION, 2019–2026 (USD MILLION)

7.4 OTHER CELLS

TABLE 23 GLOBAL MARKET FOR OTHER CELLS, BY REGION, 2019–2026 (USD MILLION)

8 CELL LYSIS MARKET, BY APPLICATION (Page No. - 68)

8.1 INTRODUCTION

TABLE 24 GLOBAL CELL LYSIS INDUSTRY, BY APPLICATION, 2019–2026 (USD MILLION)

8.2 PROTEIN PURIFICATION & ISOLATION

8.2.1 PROTEIN PURIFICATION AND ISOLATION TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

TABLE 25 GLOBAL MARKET FOR PROTEIN PURIFICATION & ISOLATION, BY REGION, 2019–2026 (USD MILLION)

8.3 NUCLEIC ACID PURIFICATION & ISOLATION

8.3.1 INCREASING INVESTMENT IN BIOPHARMACEUTICAL R&D TO DRIVE MARKET GROWTH

TABLE 26 GLOBAL MARKET FOR NUCLEIC ACID ISOLATION & PURIFICATION, BY REGION, 2019–2026 (USD MILLION)

8.4 OTHER APPLICATIONS

TABLE 27 GLOBAL MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

9 CELL LYSIS MARKET, BY END USER (Page No. - 72)

9.1 INTRODUCTION

TABLE 28 GLOBAL CELL LYSIS INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.2 RESEARCH LABORATORIES & INSTITUTES

9.2.1 RISING RESEARCH FUNDING SUPPORTS MARKET GROWTH

TABLE 29 GLOBAL MARKET FOR RESEARCH LABORATORIES & INSTITUTES, BY REGION, 2019–2026 (USD MILLION)

9.3 BIOPHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

9.3.1 RISING INVESTMENTS IN CELL-BASED RESEARCH AND THERAPY DEVELOPMENT WILL DRIVE MARKET GROWTH

TABLE 30 GLOBAL MARKET FOR BIOPHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2019–2026 (USD MILLION)

9.4 OTHER END USERS 75

TABLE 31 GLOBAL MARKET FOR OTHER END USERS, BY REGION, 2019–2026 (USD MILLION)

10 CELL LYSIS MARKET, BY REGION (Page No. - 76)

10.1 INTRODUCTION

TABLE 32 CELL LYSIS FRACTIONATION MARKET, BY REGION, 2019–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 23 NORTH AMERICA: MARKET SNAPSHOT

TABLE 33 NORTH AMERICA: CELL LYSIS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 35 NORTH AMERICA: CELL LYSIS CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 36 NORTH AMERICA: CELL LYSIS REAGENTS & KITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: CELL LYSIS INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET, BY CELL TYPE, 2019–2026 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 40 NORTH AMERICA: CELL LYSIS FRACTIONATION MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.1 US

10.2.1.1 The US dominates the market for cell lysis

TABLE 41 US: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 42 US: CELL LYSIS CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 43 US: CELL LYSIS REAGENTS & KITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 44 US: CELL LYSIS INSTRUMENTS MARKET, BY TYPE,2019–2026 (USD MILLION)

TABLE 45 US: CELL LYSIS FRACTIONATION MARKET, BY CELL TYPE, 2019–2026 (USD MILLION)

TABLE 46 US: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 47 US: CELL LYSIS INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 The strong and growing biopharmaceutical and biotechnology sector indicates a favorable outlook for cell lysis

TABLE 48 CANADA: CELL LYSIS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 49 CANADA: CELL LYSIS CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 50 CANADA: CELL LYSIS REAGENTS & KITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 51 CANADA: CELL LYSIS INSTRUMENTS MARKET, BY TYPE,2019–2026 (USD MILLION)

TABLE 52 CANADA: CELL LYSIS FRACTIONATION MARKET, BY CELL TYPE, 2019–2026 (USD MILLION)

TABLE 53 CANADA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 54 CANADA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3 EUROPE

TABLE 55 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 56 EUROPE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 57 EUROPE: CELL LYSIS CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 58 EUROPE: CELL LYSIS REAGENTS & KITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 59 EUROPE: CELL LYSIS INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 60 EUROPE: CELL LYSIS FRACTIONATION MARKET, BY CELL TYPE, 2019–2026 (USD MILLION)

TABLE 61 EUROPE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 62 EUROPE: CELL LYSIS INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Germany dominated the European market in 2020

TABLE 63 GERMANY: CELL LYSIS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 64 GERMANY: CELL LYSIS CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 65 GERMANY: CELL LYSIS REAGENTS & KITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 66 GERMANY: CELL LYSIS INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 67 GERMANY: CELL LYSIS FRACTIONATION MARKET, BY CELL TYPE, 2019–2026 (USD MILLION)

TABLE 68 GERMANY: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 69 GERMANY: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.2 UK

10.3.2.1 Government initiatives to support market growth

TABLE 70 UK: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 71 UK: CELL LYSIS CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 72 UK: CELL LYSIS REAGENTS & KITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 73 UK: CELL LYSIS INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 74 UK: CELL LYSIS FRACTIONATION MARKET, BY CELL TYPE, 2019–2026 (USD MILLION)

TABLE 75 UK: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 76 UK: CELL LYSIS INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Increasing R&D investment by players to support market growth

TABLE 77 FRANCE: CELL LYSIS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 78 FRANCE: CELL LYSIS CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 79 FRANCE: CELL LYSIS REAGENTS & KITS MARKET, BY TYPE,2019–2026 (USD MILLION)

TABLE 80 FRANCE: CELL LYSIS INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 81 FRANCE: CELL LYSIS FRACTIONATION MARKET, BY CELL TYPE, 2019–2026 (USD MILLION)

TABLE 82 FRANCE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 83 FRANCE: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Large life science research base and rising awareness support the market in Italy

TABLE 84 ITALY: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 85 ITALY: CELL LYSIS CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 86 ITALY: CELL LYSIS REAGENTS & KITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 ITALY: CELL LYSIS INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 88 ITALY: MARKET, BY CELL TYPE, 2019–2026 (USD MILLION)

TABLE 89 ITALY: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 90 ITALY: CELL LYSIS INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Increasing private and public funding to boost the market growth

TABLE 91 SPAIN: CELL LYSIS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 92 SPAIN: CELL LYSIS CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 93 SPAIN: CELL LYSIS REAGENTS & KITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 94 SPAIN: CELL LYSIS INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 95 SPAIN: MARKET, BY CELL TYPE, 2019–2026 (USD MILLION)

TABLE 96 SPAIN: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 97 SPAIN: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 98 ROE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 99 ROE: CELL LYSIS CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 100 ROE: CELL LYSIS REAGENTS & KITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 ROE: CELL LYSIS INSTRUMENTS MARKET, BY TYPE,2019–2026 (USD MILLION)

TABLE 102 ROE: CELL LYSIS FRACTIONATION MARKET, BY CELL TYPE, 2019–2026 (USD MILLION)

TABLE 103 ROE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 104 ROE: CELL LYSIS INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 24 ASIA PACIFIC: CELL LYSIS MARKET SNAPSHOT

TABLE 105 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 107 ASIA PACIFIC: CELL LYSIS CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 108 ASIA PACIFIC: CELL LYSIS REAGENTS & KITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 109 ASIA PACIFIC: CELL LYSIS INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY CELL TYPE, 2019–2026 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 112 ASIA PACIFIC: CELL LYSIS FRACTIONATION MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China to grow at the highest CAGR in the market

TABLE 113 CHINA: CELL LYSIS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 114 CHINA: CELL LYSIS CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 115 CHINA: CELL LYSIS REAGENTS & KITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 116 CHINA: CELL LYSIS INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 117 CHINA: CELL LYSIS FRACTIONATION MARKET, BY CELL TYPE, 2019–2026 (USD MILLION)

TABLE 118 CHINA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 119 CHINA: CELL LYSIS FRACTIONATION MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Rising geriatric population and support for research drive market growth in Japan

TABLE 120 JAPAN: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 121 JAPAN: CELL LYSIS CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 122 JAPAN: CELL LYSIS REAGENTS & KITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 123 JAPAN: CELL LYSIS INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 124 JAPAN: CELL LYSIS FRACTIONATION MARKET, BY CELL TYPE, 2019–2026 (USD MILLION)

TABLE 125 JAPAN: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 126 JAPAN: CELL LYSIS INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Increasing government initiatives on precision medicine will boost the market growth

TABLE 127 INDIA: CELL LYSIS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 128 INDIA: CELL LYSIS CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 129 INDIA: CELL LYSIS REAGENTS & KITS MARKET, BY TYPE,2019–2026 (USD MILLION)

TABLE 130 INDIA: CELL LYSIS INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 131 INDIA: CELL LYSIS FRACTIONATION MARKET, BY CELL TYPE, 2019–2026 (USD MILLION)

TABLE 132 INDIA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 133 INDIA: CELL LYSIS FRACTIONATION MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.4 ROAPAC

TABLE 134 ROAPAC: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 135 ROAPAC: CELL LYSIS CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 136 ROAPAC: CELL LYSIS REAGENTS & KITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 137 ROAPAC: CELL LYSIS INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 138 ROAPAC: CELL LYSIS FRACTIONATION MARKET, BY CELL TYPE, 2019–2026 (USD MILLION)

TABLE 139 ROAPAC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 140 ROAPAC: CELL LYSIS INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

10.5 ROW

TABLE 141 ROW: CELL LYSIS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 142 ROW: CELL LYSIS CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 143 ROW: CELL LYSIS REAGENTS & KITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 144 ROW: CELL LYSIS INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 145 ROW: CELL LYSIS FRACTIONATION MARKET, BY CELL TYPE, 2019–2026 (USD MILLION)

TABLE 146 ROW: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 147 ROW: MARKET, BY END USER, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 122)

11.1 OVERVIEW

FIGURE 25 KEY DEVELOPMENTS IN THE GLOBAL MARKET, JANUARY 2018– FEBRUARY 2021

FIGURE 26 MARKET EVOLUTION MATRIX: JANUARY 2018 TO JANUARY 2021

11.2 MARKET SHARE ANALYSIS

FIGURE 27 GLOBAL MARKET SHARE ANALYSIS, 2019

11.3 COMPANY EVALUATION MATRIX

11.3.1 STARS

11.3.2 EMERGING LEADERS

11.3.3 PERVASIVE PLAYERS

11.3.4 PARTICIPANTS

FIGURE 28 VENDOR DIVE: CELL LYSIS FRACTIONATION MARKET

11.4 COMPETITIVE LEADERSHIP MAPPING (SMES/ START-UPS)

11.4.1 PROGRESSIVE COMPANIES

11.4.2 STARTING BLOCKS

11.4.3 RESPONSIVE COMPANIES

11.4.4 DYNAMIC COMPANIES

FIGURE 29 VENDOR DIVE MATRIX FOR SMES & START-UPS: CELL LYSIS MARKET

11.5 COMPETITIVE SCENARIO

11.5.1 EXPANSIONS

TABLE 148 KEY EXPANSIONS, JANUARY 2018–FEBRUARY 2021

11.5.2 DEALS

TABLE 149 KEY DEALS, JANUARY 2018–FEBRUARY 2021

11.5.3 OTHER DEVELOPMENTS

TABLE 150 OTHER KEY DEVELOPMENTS, JANUARY 2018–FEBRUARY 2021

11.6 COMPANY PRODUCT FOOTPRINT

FIGURE 30 PRODUCT PORTFOLIO ANALYSIS: CELL LYSIS MARKET

11.7 COMPANY GEOGRAPHIC FOOTPRINT

FIGURE 31 GEOGRAPHIC ASSESSMENT: CELL LYSIS FRACTIONATION MARKET

12 COMPANY PROFILES (Page No. - 130)

(Business Overview, Products Offered, Recent Developments, and MnM View)*

12.1 KEY PLAYERS

12.1.1 THERMO FISHER SCIENTIFIC

FIGURE 32 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT (2019)

12.1.2 MERCK

FIGURE 33 MERCK KGAA: COMPANY SNAPSHOT (2019)

12.1.3 BIO-RAD LABORATORIES

FIGURE 34 BIO-RAD LABORATORIES: COMPANY SNAPSHOT (2019)

12.1.4 BECKMAN COULTER

FIGURE 35 DANAHER CORPORATION: COMPANY SNAPSHOT (2019)

12.1.5 BECTON, DICKINSON AND COMPANY

FIGURE 36 BD: COMPANY SNAPSHOT (2020)

12.1.6 CELL SIGNALING TECHNOLOGY

12.1.7 MILTENYI BIOTEC

12.1.8 ROCHE DIAGNOSTICS

FIGURE 37 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2019)

12.1.9 QIAGEN

FIGURE 38 QIAGEN: COMPANY SNAPSHOT (2019)

12.1.10 QSONICA

12.1.11 STEMCELL TECHNOLOGIES

12.1.12 PROMOCELL

12.1.13 AGILENT TECHNOLOGIES

FIGURE 39 AGILENT TECHNOLOGIES: COMPANY SNAPSHOT (2019)

12.1.14 PROMEGA CORPORATION

12.2 OTHER PLAYERS

12.2.1 NZYTECH

12.2.2 TAKARA BIO

FIGURE 40 TAKARA BIO: COMPANY SNAPSHOT (2020)

12.2.3 LABFREEZ INSTRUMENTS GROUP

12.2.4 G-BIOSCIENCES (GENO TECHNOLOGY)

12.2.5 COVARIS

12.2.6 CLAREMONT BIOSOLUTIONS

12.2.7 MICROFLUIDICS INTERNATIONAL CORPORATION

12.2.8 PARR INSTRUMENT COMPANY

12.2.9 BIOVISION

12.2.10 NORGEN BIOTEK CORP.

*Details on Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 165)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the cell lysis market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (research laboratories & institutes, biopharmaceutical & biotechnology companies) and supply sides (cell lysis manufacturers and distributors).

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cell lysis market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size-using the market size estimation processes the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the cell lysis industry.

Report Objectives

- To define, describe, and forecast the cell lysis market by product, cell type, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall cell lysis market

- To analyze the opportunities in the market for stakeholders and to provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as collaboration, acquisitions and expansions in the cell lysis market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

-

Product Analysis:

- Product matrix, which gives a detailed comparison of the product portfolios of each company

-

Geographic Analysis:

- Further breakdown of the Rest of the World cell lysis market into Latin America, the Middle East, and Africa cell lysis market into specific countries and further breakdown of the European cell lysis market into specific countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cell Lysis Market

Which factors are majorly restraining the global growth of Cell Lysis Market?

I want more detailed overview of how the global growth of Cell Lysis Market is impacted by COVID19. Thank you

Which of the key players will hold the major share of the global Cell Lysis Market by 2030?