Cell & Gene Therapy Manufacturing Services Market Size, Share & Trends by Type (Allogeneic, Autologous, Viral Vector, Non-viral vector), Indication (Oncology, Orthopedic, Ophthalmology), Application (Clinical, Commercial), End User (Pharma, Biotech) - Global Forecast to 2027

Cell & Gene Therapy Manufacturing Services Market Size, Share & Trends

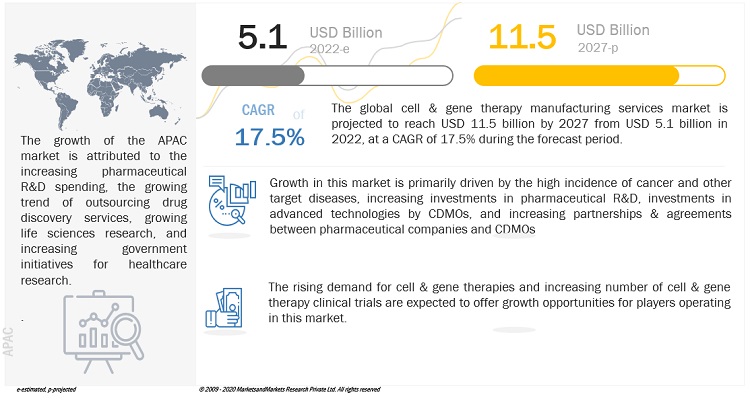

The size of global cell & gene therapy manufacturing services market in terms of revenue was estimated to be worth $5.1 billion in 2022 and is poised to reach $11.5 billion by 2027, growing at a CAGR of 17.5% from 2022 to 2027. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics. Growing prevalence of cancer and other other diseases, the surge in pharmaceutical R&D spending along with partnerships and agreements between pharmaceutical companies and CDMOs are some of the factors driving the market growth. On the contrary, the significant operational costs associated with cell and gene therapy manufacturing is expected to negatively impact the cell & gene therapy manufacturing market during the forecast period.

Cell & Gene Therapy Manufacturing Services Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Cell & Gene Therapy Manufacturing Services Market Dynamics

Increasing private and public investments in cell and gene therapy industry

Despite the limited number of approvals, cell and gene therapy companies are attracting an increasing amount of private and public investment. Private equity and capital investment in life sciences have increased rapidly over the last decade. Similarly, the growth of investment in cell and gene therapy companies is also significant. For instance, there is a steep rise in investment from USD 362 million in 2020 to nearly USD 68 billion in 2021. This is expected to increase the demand for outsourcing, thereby increasing the growth of cell and gene therapy manufacturing services.

High operational costs associated with cell & gene therapy manufacturing

Due to the complexity of both the cells (product) and treatment logistics, relatively low production volumes and the large number of manual manipulations involved with current methods, cell therapies are expensive to produce. The manufacturing costs of cell therapy treatments are estimated to be more than USD 100,000 per patient whereas the cost of manufacturing for gene therapy can be between USD 500,000 and USD 1 million, excluding the costs for R&D. Thus, the affordability of cell and gene therapy products will be an important issue and challenge for both manufacturers and healthcare providers..

Expansion of cell and gene therapy manufacturing capacities by CDMOs

Cell and gene therapy manufacturing has evolved rapidly owing to the surge in demand for cell and gene therapies. The wider application of these therapies (for example, to more common diseases) necessitates higher yields and lower product costs (COGs). Large contract development and manufacturing organizations (CDMOs) have made significant investments in this space in recent years, with a number of large acquisitions and geographic expansions by installing production capacities. These expansions will support the manufacturing of cell and gene therapies and provide growth opportunities for CDMOs providing these services.

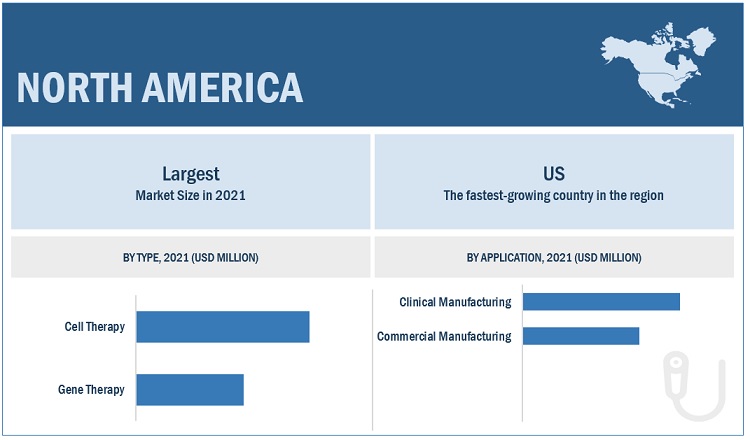

The cell therapy segment dominated the cell & gene therapy manufacturing services market in 2021.

Based on type, the global market is classified into cell therapy and gene therapy. The cell therapy segment dominated this market with the highest share. The potential applications of cell therapies in the treatment of cancers, autoimmune diseases, urinary problems, and infectious diseases and other diseases is driving the cell therapy segment growth. In addition availability of funding for new cell lines, increasing organic and inorganic growth strategies by companies to boost their cell therapy manufacturing capabitlities are some additional factors fueling the segment growth.

To know about the assumptions considered for the study, download the pdf brochure

North America was the largest regional market for cell & gene therapy manufacturing services market in 2021.

Geographically, the global market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. In 2021, North America accounted for the largest share of this market, followed by Europe and the Asia Pacific. The large share of the North American market is attributed to the rising incidence of cancer and growing research activity in cancer and stem cells.

Key players in the cell & gene therapy manufacturing services market include Lonza (Switzerland), Catalent (US), Thermo Fisher Scientific (US), Charles River Laboratories (US), WuXi AppTec (China), Merck KGaA (Germany), Takara Bio Inc. (Japan), Nikon Corporation (Japan), FUJIFILM Holdings Corporation (Japan), Oxford Biomedica plc (UK), and Cell and Gene Therapy Catapult (UK).

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) million/Billion |

|

Segments covered |

Type, Indication, Application, End User, And Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Companies covered |

Lonza (Switzerland), Catalent, Inc. (US), Thermo Fisher Scientific, Inc. (US), Charles River Laboratories (US), WuXi AppTec (China), Merck KGaA (Germany), Takara Bio Inc. (Japan), Oxford Biomedica (UK), Cell and Gene Therapy Catapult (UK), Genezen (US), FUJIFILM Holdings Corporation (Japan), Nikon Corporation (Japan), The Discovery Labs LLC (US), RoslinCT (Scotland), JRS Pharma (Germany), FinVector (Finland), ABL, Inc. (US), Resilience (US), BioCentriq (US), Porton Advanced Solutions (China), Andelyn Biosciences (US), Forge Biologics (US), Vibalogics (US), Anemocyte Srl (Italy), and ElevateBio (US) |

This report categorizes the cell & gene therapy manufacturing services market into the following segments and subsegments

By Type

-

Cell Therapy

-

Allogeneic

- Mesenchymal Stem Cells

- T-cells

- Induced Pluripotent Stem Cells

- Natural Killer Cells

- Hematopoietic Stem Cells

- Other Allogeneic Cells

-

Autologous

- T-cells

- Hematopoietic Stem Cells

- Mesenchymal Stem Cells

- Natural Killer Cells

- Other AutologousCells

-

Viral Vector

- Retroviral Vectors

- Adeno-associated Virus Vectors

- Other Viral Vectors

-

Allogeneic

-

Gene Therapy

-

Viral Vector

- Retroviral Vectors

- Adeno-associated Virus Vectors

- Other Viral Vectors

-

Non-viral Vector

- Oligonucleotides

- Other Non-viral Vectors

-

Viral Vector

By Indication

- Oncology Diseases

- Cardiovascular Diseases

- Orthopedic Diseases

- Ophthalmology Diseases

- Central Nervous System Disorders

- Infectious Diseases

- Other Indications

By Application

- Clinical Manufacturing

- Commercial Manufacturing

By End User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

-

Latin America

- Brazil

- Mexico

- Rest of Latin America (RoLA)

- Middle East and Africa

Recent Developments

- In 2021, Charles River Laboratories acquired a cell & gene therapy CDMO—Cognate BioServices—to increase its cell and gene therapy manufacturing capabilities.

- In 2021, Thermo Fisher Scientific acquired Henogen S.A., Novasep's viral vector manufacturing business in Belgium, for approximately USD 859.7 million. This acquisition will increase its presence in the cell & gene therapy manufacturing therapy market.

- In 2019, Thermo Fisher Scientific acquired Brammer Bio, a company engaged in viral vector manufacturing for gene and cell therapies, for USD 1.7 billion.

Frequently Asked Questions (FAQ):

Who are the key players in the cell and gene therapy manufacturing services market?

Key players in the Cell & gene therapy manufacturing services market include Lonza (Switzerland), Catalent (US), Thermo Fisher Scientific (US), Charles River Laboratories (US), WuXi AppTec (China), Merck KGaA (Germany), Takara Bio Inc. (Japan), Nikon Corporation (Japan), FUJIFILM Holdings Corporation (Japan), Oxford Biomedica plc (UK), and Cell and Gene Therapy Catapult (UK).

Which type of segment dominates in the cell & gene therapy manufacturing services market?

In 2021, cell therapy accounted for the largest share of the cell & gene therapy manufacturing services market. This can primarily be attributed to factors such as increasing awareness about cell therapy, growing funding for new cell lines, increasing partnerships and acquisitions, and the development of advanced genomics methods for cell analysis.

Which end user segment of the global cell & gene therapy manufacturing services market is expected to witness the highest growth?

Pharmaceutical and biotechnology companies' end user segment is expected to witness the highest growth. The high growth rate in this segment can be attributed to the increasing expenditure on R&D by pharmaceutical & biotechnology companies, rising collaborations between pharmaceutical and biotechnology companies, and the growing number of cell & gene therapies in the R&D pipeline.

What is the market for cell & gene therapy manufacturing services?

The global cell & gene therapy manufacturing services market size is projected to reach USD 11.5 billion by 2027 from USD 5.1 billion in 2022, at a CAGR of 17.5% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- High incidence of cancer and other target diseases- Increasing pharmaceutical R&D spending- Increasing private and public investments in cell and gene therapy industry- Technological advancements- Increasing partnerships and agreements between pharmaceutical companies and CDMOsRESTRAINTS- High operational costs associated with cell & gene therapy manufacturingOPPORTUNITIES- Expansion of cell and gene therapy manufacturing capacities by CDMOs- Growing cell & gene therapies marketCHALLENGES- Risk of mutagenesis- Low yield outcomes- Lack of standard production systems

- 5.3 TECHNOLOGICAL ANALYSIS

- 5.4 RANGES/SCENARIOS

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 VALUE CHAIN ANALYSIS

-

5.7 ECOSYSTEM ANALYSIS OF CELL & GENE THERAPY MANUFACTURING SERVICES MARKET

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 REGULATORY ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10 KEY CONFERENCES AND EVENTS IN 2022–2023

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12 KEY BUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 CELL THERAPYALLOGENEIC- Mesenchymal stem cells- T-cells- Induced pluripotent stem cells- Natural killer cells- Hematopoietic stem cells- Other allogeneic cellsAUTOLOGOUS- T-cells- Hematopoietic stem cells- Mesenchymal stem cells- Natural killer cells- Other autologous cellsVIRAL VECTORS- Retroviral vectors- Adeno-associated virus vectors- Other viral vectors

-

6.3 GENE THERAPYVIRAL VECTORS- Retroviral vectors- Adeno-associated virus vectors- Other viral vectorsNON-VIRAL VECTORS- Oligonucleotides- Other non-viral vectors

- 7.1 INTRODUCTION

-

7.2 ONCOLOGY DISEASESRISING NUMBER OF CANCER CASES WORLDWIDE TO DRIVE DEMAND FOR CELL & GENE THERAPIES

-

7.3 CARDIOVASCULAR DISEASESGROWING INCIDENCE OF CARDIOVASCULAR DISEASES OWING TO SEDENTARY LIFESTYLES TO DRIVE MARKET

-

7.4 ORTHOPEDIC DISEASESCELL THERAPY FOR ORTHOPEDIC DISEASES ELIMINATES POST-TREATMENT COMPLICATIONS

-

7.5 OPHTHALMOLOGY DISEASESSTEM CELL THERAPIES USED FOR RESTORATION AND PRESERVATION OF VISION

-

7.6 CENTRAL NERVOUS SYSTEM DISORDERSINCREASING INCIDENCE OF SPINAL MUSCULAR ATROPHY TO SUPPORT MARKET GROWTH

-

7.7 INFECTIOUS DISEASESINCREASING PREVALENCE OF INFECTIOUS DISEASES TO DRIVE MARKET

- 7.8 OTHER INDICATIONS

- 8.1 INTRODUCTION

-

8.2 CLINICAL MANUFACTURINGRISING NUMBER OF CLINICAL TRIALS FOR CELL & GENE THERAPIES TO DRIVE MARKET

-

8.3 COMMERCIAL MANUFACTURINGINCREASING APPROVALS OF CELL & GENE THERAPY PRODUCTS FOR COMMERCIAL MANUFACTURING TO SUPPORT MARKET GROWTH

- 9.1 INTRODUCTION

-

9.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIESGROWING NUMBER OF CELL & GENE THERAPIES IN R&D PIPELINE TO DRIVE MARKET

-

9.3 ACADEMIC & RESEARCH INSTITUTESINCREASE IN LIFE SCIENCES R&D EXPENDITURE TO SUPPORT MARKET GROWTH

- 9.4 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICARECESSION IMPACTUS- Rising prevalence of cancer and increasing clinical trials for cell and gene therapies to drive marketCANADA- Increasing investments in stem cell research to support market

-

10.3 EUROPERECESSION IMPACTGERMANY- Strong growth in biotechnology industry to drive marketUK- Rising funding and growing prevalence of chronic diseases to drive marketFRANCE- Availability of funds from government and private organizations to support marketITALY- Recent developments in cell and gene therapy to drive marketSPAIN- Rising R&D expenditure to boost marketREST OF EUROPE

-

10.4 ASIA PACIFICRECESSION IMPACTCHINA- Increasing government funding and development of novel applications to drive marketJAPAN- Robust funding coupled with growing geriatric population to propel market growthINDIA- Growing prevalence of chronic diseases and focus on grants and collaborations for research to drive marketREST OF ASIA PACIFIC

-

10.5 LATIN AMERICARECESSION IMPACTBRAZIL- Gradual increase in pharmaceutical R&D to support marketMEXICO- Favorable government policies in Mexico to support marketREST OF LATIN AMERICA

-

10.6 MIDDLE EAST & AFRICACHANGING DEMOGRAPHICS AND FAVORABLE POLICIES FOR PHARMACEUTICAL R&D TO DRIVE MARKETRECESSION IMPACT

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE SHARE ANALYSIS

-

11.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 11.7 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

-

11.8 COMPETITIVE BENCHMARKING OF TOP 25 PLAYERSCOMPANY FOOTPRINTSERVICE FOOTPRINTAPPLICATION FOOTPRINTREGIONAL FOOTPRINT

-

11.9 COMPETITIVE SCENARIO AND TRENDSCELL & GENE THERAPY MANUFACTURING SERVICES MARKET: DEALS, JANUARY 2019–DECEMBER 2022CELL & GENE THERAPY MANUFACTURING SERVICES MARKET: SERVICE LAUNCHES, JANUARY 2019–DECEMBER 2022CELL & GENE THERAPY MANUFACTURING SERVICES MARKET: OTHER DEVELOPMENTS, JANUARY 2019–DECEMBER 2022

-

12.1 KEY MARKET PLAYERSLONZA- Business overview- Services offered- Recent developments- MnM viewCATALENT, INC.- Business overview- Services offered- Recent developments- MnM viewTHERMO FISHER SCIENTIFIC, INC.- Business overview- Services offered- Recent developments- MnM viewMERCK KGAA- Business overview- Services offered- Recent developmentsCHARLES RIVER LABORATORIES- Business overview- Services offered- Recent developmentsTAKARA BIO INC.- Business overview- Services offered- Recent developmentsOXFORD BIOMEDICA PLC- Business overview- Services offered- Recent developmentsCELL AND GENE THERAPY CATAPULT- Business overview- Services offered- Recent developmentsFUJIFILM HOLDINGS CORPORATION- Business overview- Services offered- Recent developmentsWUXI APPTEC- Business overview- Services offered- Recent developmentsNIKON CORPORATION- Business overview- Services offered

-

12.2 OTHER PLAYERSTHE DISCOVERY LABSROSLINCTJRS PHARMAFINVECTORABL, INC.RESILIENCE, INC.BIOCENTRIQPORTON ADVANCED SOLUTIONSANDELYN BIOSCIENCESGENEZENVIBALOGICSANEMOCYTE SRLELEVATE BIOFORGE BIOLOGICS

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2021–2027 (% GROWTH)

- TABLE 2 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET: IMPACT ANALYSIS

- TABLE 3 FDA-APPROVED CAR T-CELL THERAPIES

- TABLE 4 TECHNOLOGIES OFFERED BY CELL & GENE THERAPY MANUFACTURING SERVICE PROVIDERS

- TABLE 5 PARTNERSHIPS BETWEEN PHARMACEUTICAL COMPANIES AND CDMOS

- TABLE 6 MANUFACTURING CAPACITY EXPANSIONS BY CDMOS

- TABLE 7 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET ECOSYSTEM

- TABLE 8 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 15 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 16 CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 17 CELL THERAPY MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 18 NORTH AMERICA: CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 19 EUROPE: CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 20 ASIA PACIFIC: CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 21 LATIN AMERICA: CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 22 ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 23 ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 24 NORTH AMERICA: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 25 EUROPE: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 26 ASIA PACIFIC: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 27 LATIN AMERICA: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 28 ALLOGENEIC MESENCHYMAL STEM CELL MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 29 NORTH AMERICA: ALLOGENEIC MESENCHYMAL STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 30 EUROPE: ALLOGENEIC MESENCHYMAL STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 31 ASIA PACIFIC: ALLOGENEIC MESENCHYMAL STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 32 LATIN AMERICA: ALLOGENEIC MESENCHYMAL STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 33 ALLOGENEIC T-CELL MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 34 NORTH AMERICA: ALLOGENEIC T-CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 35 EUROPE: ALLOGENEIC T-CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 36 ASIA PACIFIC: ALLOGENEIC T-CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 37 LATIN AMERICA: ALLOGENEIC T-CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 38 ALLOGENEIC INDUCED PLURIPOTENT STEM CELL MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 39 NORTH AMERICA: ALLOGENEIC INDUCED PLURIPOTENT STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 40 EUROPE: ALLOGENEIC INDUCED PLURIPOTENT STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 41 ASIA PACIFIC: ALLOGENEIC INDUCED PLURIPOTENT STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 42 LATIN AMERICA: ALLOGENEIC INDUCED PLURIPOTENT STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 43 ALLOGENEIC NATURAL KILLER CELL MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 44 NORTH AMERICA: ALLOGENEIC NATURAL KILLER CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 45 EUROPE: ALLOGENEIC NATURAL KILLER CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 46 ASIA PACIFIC: ALLOGENEIC NATURAL KILLER CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 47 LATIN AMERICA: ALLOGENEIC NATURAL KILLER CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 48 ALLOGENEIC HEMATOPOIETIC STEM CELL MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 49 NORTH AMERICA: ALLOGENEIC HEMATOPOIETIC STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 50 EUROPE: ALLOGENEIC HEMATOPOIETIC STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 51 ASIA PACIFIC: ALLOGENEIC HEMATOPOIETIC STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 52 LATIN AMERICA: ALLOGENEIC HEMATOPOIETIC STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 53 OTHER ALLOGENEIC CELL MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 54 NORTH AMERICA: OTHER ALLOGENEIC CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 55 EUROPE: OTHER ALLOGENEIC CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 56 ASIA PACIFIC: OTHER ALLOGENEIC CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 57 LATIN AMERICA: OTHER ALLOGENEIC CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 58 AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 59 AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 60 NORTH AMERICA: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 61 EUROPE: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 62 ASIA PACIFIC: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 63 LATIN AMERICA: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 64 AUTOLOGOUS T-CELL MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 65 NORTH AMERICA: AUTOLOGOUS T-CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 66 EUROPE: AUTOLOGOUS T-CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 67 ASIA PACIFIC: AUTOLOGOUS T-CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 68 LATIN AMERICA: AUTOLOGOUS T-CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 69 AUTOLOGOUS HEMATOPOIETIC STEM CELL MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 70 NORTH AMERICA: AUTOLOGOUS HEMATOPOIETIC STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 71 EUROPE: AUTOLOGOUS HEMATOPOIETIC STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 72 ASIA PACIFIC: AUTOLOGOUS HEMATOPOIETIC STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 73 LATIN AMERICA: AUTOLOGOUS HEMATOPOIETIC STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 74 AUTOLOGOUS MESENCHYMAL STEM CELL MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 75 NORTH AMERICA: AUTOLOGOUS MESENCHYMAL STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 76 EUROPE: AUTOLOGOUS MESENCHYMAL STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 77 ASIA PACIFIC: AUTOLOGOUS MESENCHYMAL STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 78 LATIN AMERICA: AUTOLOGOUS MESENCHYMAL STEM CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 79 AUTOLOGOUS NATURAL KILLER CELL MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 80 NORTH AMERICA: AUTOLOGOUS NATURAL KILLER CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 81 EUROPE: AUTOLOGOUS NATURAL KILLER CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 82 ASIA PACIFIC: AUTOLOGOUS NATURAL KILLER CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 83 LATIN AMERICA: AUTOLOGOUS NATURAL KILLER CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 84 OTHER AUTOLOGOUS CELL MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 85 NORTH AMERICA: OTHER AUTOLOGOUS CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 86 EUROPE: OTHER AUTOLOGOUS CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 87 ASIA PACIFIC: OTHER AUTOLOGOUS CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 88 LATIN AMERICA: OTHER AUTOLOGOUS CELL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 89 VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 90 VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 91 NORTH AMERICA: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 92 EUROPE: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 93 ASIA PACIFIC: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 94 LATIN AMERICA: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 95 RETROVIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 96 NORTH AMERICA: RETROVIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 97 EUROPE: RETROVIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 98 ASIA PACIFIC: RETROVIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 99 LATIN AMERICA: RETROVIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 100 ADENO-ASSOCIATED VIRUS VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 101 NORTH AMERICA: ADENO-ASSOCIATED VIRUS VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 102 EUROPE: ADENO-ASSOCIATED VIRUS VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 103 ASIA PACIFIC: ADENO-ASSOCIATED VIRUS VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 104 LATIN AMERICA: ADENO-ASSOCIATED VIRUS VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 105 OTHER VIRUS VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 106 NORTH AMERICA: OTHER VIRUS VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 107 EUROPE: OTHER VIRUS VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 108 ASIA PACIFIC: OTHER VIRUS VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 109 LATIN AMERICA: OTHER VIRUS VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 110 GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 111 GENE THERAPY MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 112 NORTH AMERICA: GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 113 EUROPE: GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 114 ASIA PACIFIC: GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 115 LATIN AMERICA: GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 116 VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 117 VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 118 NORTH AMERICA: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 119 EUROPE: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 120 ASIA PACIFIC: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 121 LATIN AMERICA: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 122 RETROVIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 123 NORTH AMERICA: RETROVIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 124 EUROPE: RETROVIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 125 ASIA PACIFIC: RETROVIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 126 LATIN AMERICA: RETROVIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 127 ADENO-ASSOCIATED VIRUS VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 128 NORTH AMERICA: ADENO-ASSOCIATED VIRUS VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 129 EUROPE: ADENO-ASSOCIATED VIRUS VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 130 ASIA PACIFIC: ADENO-ASSOCIATED VIRUS VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 131 LATIN AMERICA: ADENO-ASSOCIATED VIRUS VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 132 OTHER VIRUS VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 133 NORTH AMERICA: OTHER VIRUS VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 134 EUROPE: OTHER VIRUS VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 135 ASIA PACIFIC: OTHER VIRUS VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 136 LATIN AMERICA: OTHER VIRUS VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 137 NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 138 NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 139 NORTH AMERICA: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 140 EUROPE: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 141 ASIA PACIFIC: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 142 LATIN AMERICA: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 143 OLIGONUCLEOTIDE MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 144 NORTH AMERICA: OLIGONUCLEOTIDE MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 145 EUROPE: OLIGONUCLEOTIDE MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 146 ASIA PACIFIC: OLIGONUCLEOTIDE MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 147 LATIN AMERICA: OLIGONUCLEOTIDE MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 148 OTHER NON-VIRAL VECTOR MANUFACTURING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 149 NORTH AMERICA: OTHER NON-VIRAL VECTOR MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 150 EUROPE: OTHER NON-VIRAL VECTOR MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 151 ASIA PACIFIC: OTHER NON-VIRAL VECTOR MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 152 LATIN AMERICA: OTHER NON-VIRAL VECTOR MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 153 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 154 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR ONCOLOGY DISEASES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 155 NORTH AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR ONCOLOGY DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 156 EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR ONCOLOGY DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 157 ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR ONCOLOGY DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 158 LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR ONCOLOGY DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 159 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR CARDIOVASCULAR DISEASES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 160 NORTH AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 161 EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 162 ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 163 LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 164 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR ORTHOPEDIC DISEASES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 165 NORTH AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR ORTHOPEDIC DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 166 EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR ORTHOPEDIC DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 167 ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR ORTHOPEDIC DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 168 LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR ORTHOPEDIC DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 169 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR OPHTHALMOLOGY DISEASES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 170 NORTH AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR OPHTHALMOLOGY DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 171 EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR OPHTHALMOLOGY DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 172 ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR OPHTHALMOLOGY DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 173 LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR OPHTHALMOLOGY DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 174 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR CENTRAL NERVOUS SYSTEM DISORDERS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 175 NORTH AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR CENTRAL NERVOUS SYSTEM DISORDERS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 176 EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR CENTRAL NERVOUS SYSTEM DISORDERS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 177 ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR CENTRAL NERVOUS SYSTEM DISORDERS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 178 LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR CENTRAL NERVOUS SYSTEM DISORDERS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 179 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR INFECTIOUS DISEASES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 180 NORTH AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 181 EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 182 ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 183 LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 184 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR OTHER INDICATIONS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 185 NORTH AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR OTHER INDICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 186 EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR OTHER INDICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 187 ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR OTHER INDICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 188 LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR OTHER INDICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 189 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 190 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR CLINICAL MANUFACTURING, BY REGION, 2020–2027 (USD MILLION)

- TABLE 191 NORTH AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR CLINICAL MANUFACTURING, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 192 EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR CLINICAL MANUFACTURING, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 193 ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR CLINICAL MANUFACTURING, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 194 LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR CLINICAL MANUFACTURING, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 195 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR COMMERCIAL MANUFACTURING, BY REGION, 2020–2027 (USD MILLION)

- TABLE 196 NORTH AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR COMMERCIAL MANUFACTURING, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 197 EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR COMMERCIAL MANUFACTURING, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 198 ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR COMMERCIAL MANUFACTURING, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 199 LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR COMMERCIAL MANUFACTURING, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 200 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 201 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 202 NORTH AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 203 EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 204 ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 205 LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 206 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 207 NORTH AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 208 EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 209 ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 210 LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 211 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR OTHER END USERS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 212 NORTH AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 213 EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 214 ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 215 LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 216 CELL & GENE THERAPY MANUFACTURING THERAPY SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 217 NORTH AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 218 NORTH AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 219 NORTH AMERICA: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 220 NORTH AMERICA: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 221 NORTH AMERICA: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 222 NORTH AMERICA: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 223 NORTH AMERICA: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 224 NORTH AMERICA: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 225 NORTH AMERICA: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 226 NORTH AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 227 NORTH AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 228 NORTH AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 229 US: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 230 US: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 231 US: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 232 US: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 233 US: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 234 US: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 235 US: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 236 US: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 237 US: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 238 US: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 239 US: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 240 CANADA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 241 CANADA: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 242 CANADA: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 243 CANADA: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 244 CANADA: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 245 CANADA: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 246 CANADA: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 247 CANADA: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 248 CANADA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 249 CANADA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 250 CANADA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 251 EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 252 EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 253 EUROPE: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 254 EUROPE: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 255 EUROPE: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 256 EUROPE: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 257 EUROPE: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 258 EUROPE: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 259 EUROPE: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 260 EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 261 EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 262 EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 263 GERMANY: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 264 GERMANY: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 265 GERMANY: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 266 GERMANY: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 267 GERMANY: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 268 GERMANY: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 269 GERMANY: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 270 GERMANY: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 271 GERMANY: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 272 GERMANY: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 273 GERMANY: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 274 UK: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 275 UK: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 276 UK: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 277 UK: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 278 UK: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 279 UK: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 280 UK: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 281 UK: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 282 UK: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 283 UK: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 284 UK: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 285 FRANCE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 286 FRANCE: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 287 FRANCE: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 288 FRANCE: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 289 FRANCE: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 290 FRANCE: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 291 FRANCE: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 292 FRANCE: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 293 FRANCE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 294 FRANCE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 295 FRANCE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 296 ITALY: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 297 ITALY: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 298 ITALY: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 299 ITALY: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 300 ITALY: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 301 ITALY: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 302 ITALY: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 303 ITALY: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 304 ITALY: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 305 ITALY: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 306 ITALY: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 307 SPAIN: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 308 SPAIN: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 309 SPAIN: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 310 SPAIN: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 311 SPAIN: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 312 SPAIN: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 313 SPAIN: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 314 SPAIN: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 315 SPAIN: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 316 SPAIN: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 317 SPAIN: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 318 REST OF EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 319 REST OF EUROPE: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 320 REST OF EUROPE: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 321 REST OF EUROPE: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 322 REST OF EUROPE: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 323 REST OF EUROPE: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 324 REST OF EUROPE: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 325 REST OF EUROPE: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 326 REST OF EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 327 REST OF EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 328 REST OF EUROPE: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 329 ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 330 ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 331 ASIA PACIFIC: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 332 ASIA PACIFIC: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 333 ASIA PACIFIC: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 334 ASIA PACIFIC: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 335 ASIA PACIFIC: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 336 ASIA PACIFIC: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 337 ASIA PACIFIC: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 338 ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 339 ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 340 ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 341 CHINA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 342 CHINA: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 343 CHINA: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 344 CHINA: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 345 CHINA: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 346 CHINA: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 347 CHINA: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 348 CHINA: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 349 CHINA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 350 CHINA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 351 CHINA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 352 JAPAN: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 353 JAPAN: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 354 JAPAN: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 355 JAPAN: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 356 JAPAN: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 357 JAPAN: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 358 JAPAN: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 359 JAPAN: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 360 JAPAN: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 361 JAPAN: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 362 JAPAN: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 363 INDIA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 364 INDIA: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 365 INDIA: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 366 INDIA: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 367 INDIA: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 368 INDIA: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 369 INDIA: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 370 INDIA: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 371 INDIA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 372 INDIA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 373 INDIA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 374 REST OF ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 375 REST OF ASIA PACIFIC: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 376 REST OF ASIA PACIFIC: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 377 REST OF ASIA PACIFIC: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 378 REST OF ASIA PACIFIC: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 379 REST OF ASIA PACIFIC: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 380 REST OF ASIA PACIFIC: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 381 REST OF ASIA PACIFIC: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 382 REST OF ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 383 REST OF ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 384 REST OF ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 385 LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 386 LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 387 LATIN AMERICA: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 388 LATIN AMERICA: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 389 LATIN AMERICA: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 390 LATIN AMERICA: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 391 LATIN AMERICA: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 392 LATIN AMERICA: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 393 LATIN AMERICA: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 394 LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 395 LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 396 LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 397 BRAZIL: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 398 BRAZIL: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 399 BRAZIL: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 400 BRAZIL: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 401 BRAZIL: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 402 BRAZIL: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 403 BRAZIL: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 404 BRAZIL: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 405 BRAZIL: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 406 BRAZIL: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 407 BRAZIL: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 408 MEXICO: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 409 MEXICO: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 410 MEXICO: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 411 MEXICO: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 412 MEXICO: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 413 MEXICO: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 414 MEXICO: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 415 MEXICO: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 416 MEXICO: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 417 MEXICO: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 418 MEXICO: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 419 REST OF LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 420 REST OF LATIN AMERICA: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 421 REST OF LATIN AMERICA: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 422 REST OF LATIN AMERICA: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 423 REST OF LATIN AMERICA: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 424 REST OF LATIN AMERICA: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 425 REST OF LATIN AMERICA: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 426 REST OF LATIN AMERICA: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 427 REST OF LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 428 REST OF LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 429 REST OF LATIN AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 430 MIDDLE EAST & AFRICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 431 MIDDLE EAST & AFRICA: CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 432 MIDDLE EAST & AFRICA: ALLOGENEIC CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 433 MIDDLE EAST & AFRICA: AUTOLOGOUS CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 434 MIDDLE EAST & AFRICA: VIRAL VECTOR CELL THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 435 MIDDLE EAST & AFRICA: GENE THERAPY MANUFACTURING SERVICES MARKET, BY VECTOR, 2020–2027 (USD MILLION)

- TABLE 436 MIDDLE EAST & AFRICA: VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 437 MIDDLE EAST & AFRICA: NON-VIRAL VECTOR GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 438 MIDDLE EAST & AFRICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 439 MIDDLE EAST & AFRICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 440 MIDDLE EAST & AFRICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 441 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET: DEGREE OF COMPETITION

- TABLE 442 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 443 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 444 COMPANY FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 445 SERVICE FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 446 APPLICATION FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 447 REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 448 LONZA: BUSINESS OVERVIEW

- TABLE 449 CATALENT, INC.: BUSINESS OVERVIEW

- TABLE 450 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

- TABLE 451 MERCK KGAA: BUSINESS OVERVIEW

- TABLE 452 CHARLES RIVER LABORATORIES: BUSINESS OVERVIEW

- TABLE 453 TAKARA BIO INC.: BUSINESS OVERVIEW

- TABLE 454 OXFORD BIOMEDICA PLC: BUSINESS OVERVIEW

- TABLE 455 CELL AND GENE THERAPY CATAPULT: BUSINESS OVERVIEW

- TABLE 456 FUJIFILM HOLDINGS CORPORATION: BUSINESS OVERVIEW

- TABLE 457 WUXI APPTEC: BUSINESS OVERVIEW

- TABLE 458 NIKON CORPORATION: BUSINESS OVERVIEW

- FIGURE 1 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET: BREAKDOWN OF PRIMARIES

- FIGURE 4 AVERAGE MARKET SIZE ESTIMATION (2021)

- FIGURE 5 MARKET SIZE ESTIMATION — BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF CELL & GENE THERAPY MANUFACTURING SERVICES IN MARKET

- FIGURE 6 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2021)

- FIGURE 7 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET: CAGR PROJECTIONS

- FIGURE 8 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- FIGURE 11 MARKET VALIDATION FROM PRIMARY EXPERTS

- FIGURE 12 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY INDICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 14 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 15 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 16 GEOGRAPHICAL SNAPSHOT OF CELL & GENE THERAPY MANUFACTURING SERVICES MARKET

- FIGURE 17 HIGH INCIDENCE OF CANCER AND OTHER TARGET DISEASES TO DRIVE MARKET

- FIGURE 18 CELL THERAPY SEGMENT ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN MARKET IN 2022

- FIGURE 19 CELL THERAPY SEGMENT WILL CONTINUE TO DOMINATE MARKET IN 2027

- FIGURE 20 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 21 ASIA PACIFIC COUNTRIES TO REGISTER HIGHEST GROWTH IN CELL & GENE THERAPY MANUFACTURING SERVICES MARKET FROM 2022 TO 2027

- FIGURE 22 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 INCREASE IN GLOBAL PHARMACEUTICAL R&D SPENDING, 2012–2026

- FIGURE 24 SPECTRUM OF SCENARIOS BASED ON IMPACT OF UNCERTAINTIES ON GROWTH OF CELL & GENE THERAPY MANUFACTURING SERVICES MARKET

- FIGURE 25 REVENUE SHIFT AND NEW POCKETS FOR CELL & GENE THERAPY MANUFACTURING SERVICE PROVIDERS

- FIGURE 26 VALUE CHAIN ANALYSIS OF CELL & GENE THERAPY MANUFACTURING SERVICES MARKET: HARVESTING AND CRYOPRESERVATION PHASES ADD MAXIMUM VALUE

- FIGURE 27 ECOSYSTEM ANALYSIS OF CELL & GENE THERAPY MANUFACTURING SERVICES MARKET

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR CELL & GENE THERAPY MANUFACTURING SERVICES

- FIGURE 29 BUYING CRITERIA OF END USERS FOR CELL & GENE THERAPY MANUFACTURING SERVICES

- FIGURE 30 NORTH AMERICA: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET SNAPSHOT

- FIGURE 31 ASIA PACIFIC: CELL & GENE THERAPY MANUFACTURING SERVICES MARKET SNAPSHOT

- FIGURE 32 KEY PLAYER STRATEGIES IN CELL & GENE THERAPY MANUFACTURING SERVICES MARKET, 2019–2022

- FIGURE 33 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET SHARE ANALYSIS, BY KEY PLAYER, 2021

- FIGURE 34 REVENUE SHARE ANALYSIS OF KEY MARKET PLAYERS

- FIGURE 35 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET: COMPANY EVALUATION QUADRANT, 2021

- FIGURE 36 CELL & GENE THERAPY MANUFACTURING SERVICES MARKET: COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES, 2021

- FIGURE 37 LONZA: COMPANY SNAPSHOT (2021)

- FIGURE 38 CATALENT, INC.: COMPANY SNAPSHOT (2021)

- FIGURE 39 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2021)

- FIGURE 40 MERCK KGAA: COMPANY SNAPSHOT (2021)

- FIGURE 41 CHARLES RIVER LABORATORIES: COMPANY SNAPSHOT (2021)

- FIGURE 42 TAKARA BIO INC.: COMPANY SNAPSHOT (2021)

- FIGURE 43 OXFORD BIOMEDICA PLC: COMPANY SNAPSHOT (2021)

- FIGURE 44 CELL AND GENE THERAPY CATAPULT: COMPANY SNAPSHOT (2021)

- FIGURE 45 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 46 WUXI APPTEC: COMPANY SNAPSHOT (2021)

- FIGURE 47 NIKON CORPORATION: COMPANY SNAPSHOT (2021)

This study involved four major activities in estimating the current size of the cell & gene therapy manufacturing services market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the cell & gene therapy manufacturing services market. The secondary sources used for this study include Some of the key secondary sources referred to for this study include the American Society of Gene & Cell Therapy (ASGCT), Centers for Disease Control and Prevention (CDC), GLOBOCAN, World Health Organization (WHO), US Food and Drug Administration (FDA), National Institutes of Health (NIH), European Union (EU), National Stem Cell Foundation, International Society for Cell & Gene Therapy (ISCT), EuroStemCell, European Society of Gene and Cell Therapy, Japan Human Cell Society, Indian Pharmaceutical Association (IPA), Pharmaceutical Research and Manufacturers of America (PhRMA), and European Federation of Pharmaceutical Industries and Associations (EFPIA). These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

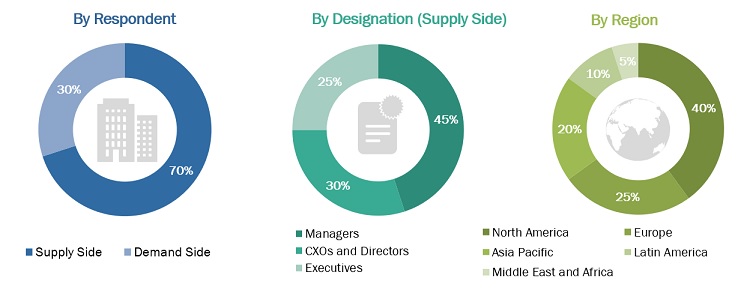

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cell & gene therapy manufacturing services market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the cell & gene therapy manufacturing services business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global cell & gene therapy manufacturing services market based on the type, indication, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, opportunities, and trends)