Cell to Pack Battery Market by Form (Prismatic, Pouch, Cylindrical), Battery Type (LFP, NMC), Propulsion (BEV, PHEV), Technology (Blade, LiSER), Vehicle Type (Passenger Cars, Commercial Vehicles) and Region - Global Forecast to 2033

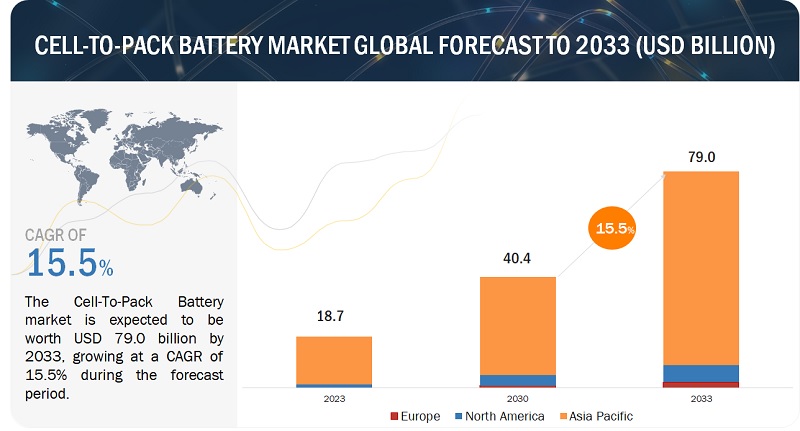

[232 Pages Report] The global cell to pack battery market size was valued at USD 18.7 billion in 2023 and is expected to reach USD 79.0 billion by 2033, at a CAGR of 15.5%, during the forecast period 2023-2033. The rise in demand for low-cost, lightweight, and high-energy-density batteries in electric vehicles has positively influenced the development of the cell to pack battery market. Also, the government initiatives for increasing the electrification of buses in public transport have created the opportunity for the growth of the cell to pack batteries due to their long-range driving capacity with fast charging feature.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Cell to Pack Battery Market Dynamics

DRIVER: Growing technological advancements in batteries

There have been substantial improvements made by several companies in EV battery technology and increased R&D efforts to make it a viable alternative to conventional vehicles. Many major battery manufacturers like CATL (China), and LG Energy Solution. (South Korea), BYD Company Ltd. (China) and C4V (US) have emphasized their research and development activities to produce advanced battery technologies to gain a competitive edge. Advantages like less material requirement and a reduction in the number of process points in the production line while manufacturing a cell to pack battery due to the elimination of modules in the battery would also benefit the manufacturers by minimizing a certain amount in their production costs. For instance, in June 2022, CATL (China) unveiled its Qilin battery, the third generation of its CTP technology. It delivers a range of 1,000 km and has an energy density of up to 255 Wh/kg. The battery is expected to be mass-produced in 2023. In March 2020, BYD Company Ltd. (China) developed the battery blade technology, which eliminated the use of modules in the battery. The name is derived from the battery-shaped cells. Such technological advancements would drive the demand for the cell to pack batteries during the forecast period.

RESTRAINT: Limiting the use of electric vehicles

EVs have gained significant popularity across prominent geographies in the past few years due to increased awareness of zero-emission vehicles and several benefits of EVs, mainly for city or short-distance travel. However, there has been some exception to the growing trend.

Some European countries are planning to ban or restrict electric vehicle sales. For instance, Switzerland is preparing to cope with possible power cuts and blackouts. As a result, the country is planning to limit or ban the usage of electric vehicles. Further, it is also facing energy crises due to the Russia-Ukraine War. The main source of power generation in the country is hydro plants and energy imports from other European countries such as France, Russia, and Germany. However, due to conflicting scenarios, the supply chain has been disrupted, and scarcity of natural gas in countries like France and Germany has reduced electricity production to the lowest level in these countries. Due to the prevailing situation, Switzerland drafted an emergency proposal in December 2022 to partially ban EVs. The longevity of the Russia-Ukraine war would further deepen the energy crisis in other European countries to follow similar steps. This would impact the demand for electric vehicles and EV batteries, impeding the growth cell to pack battery market. Similarly, the high cost of charging infrastructure, rising concern for battery recycling, and development of thermal or nuclear power sources of electricity would also question the adoption of EVs, thus contracting the growth of CTP market growth during the forecast period.

OPPORTUNITY: Advancement in differential technology

The commercial vehicle segment, which includes trucks and buses, has also been focusing on developing electric models due to rising emission regulations. Owing to stringent emission norms, many OEMs like AB Volvo (Sweden), Daimler (Germany), BYD Company Ltd. (China), Tesla (US), Tata Motors (India), and Solaris Bus & Coach sp. z o.o. (Poland) have been working toward the development of heavy-duty electric trucks and buses. With the EV battery technology improvement, OEMs are developing long-ranged electric trucks. For instance, Tesla (US) delivered its first electric semi-truck in December 2022, which was announced in 2017. The truck is powered by four independent motors with a battery range of 500 miles.

Governments are also encouraging the usage of electric buses for public transport to control carbon emissions in urban areas. Due to increased demand for high-energy-density battery vehicles, the electrification of intercity travel electric buses has risen in many countries like India, China, Germany, France, and Poland. Thus, the demand for high-energy batteries in commercial vehicles would create a growth opportunity for the development of cell to pack batteries during the forecast period.

CHALLENGE : Battery design and initial costs.

One of the significant challenges faced in manufacturing cell to pack batteries is the battery design. Every vehicle battery has different requirements from the design perspective, whether it is a passenger car, a delivery van, a special purpose car like a sports car, or a heavy commercial vehicle like a truck or bus. The production of cell to pack batteries for such different vehicle applications requires high investment and setup costs and would demand high shifting costs if there is any design change.

Another significant challenge in selling high-energy technology batteries is their initial exorbitant costs. EV battery manufacturing is capital-intensive and needs high investment. It involves many steps, including the procurement of materials, battery management system, and cell manufacturing, which requires a high level of competency and resources across the supply chain. Apart from the initial investment, the cost of electricity can be a challenge in some countries, which is constantly rising. This can hinder the demand for EV batteries, negatively affecting the cell pack battery market.

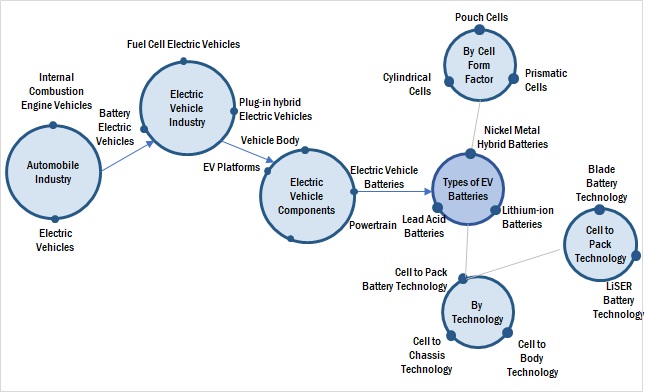

Cell to Pack Battery Market Ecosystem

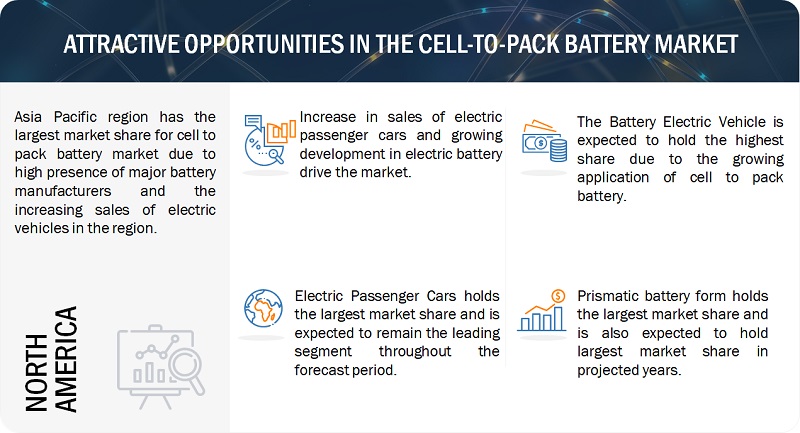

The prismatic form is estimated to hold the cell to pack battery market by battery form segment during the forecast period

Prismatic cells will lead the cell to pack battery market by battery form segment as this technology's most preferred cell form. This is mainly due to its advantages as prismatic cells are large, contribute to higher energy density, and have a compact structure than cylindrical type cells as the internal layers of the anode, cathode, and separators are folded into a cubic or flattened spiral form. A single prismatic cell may hold the same energy as 20 to 100 cylindrical cells. These benefits have prompted the higher usage of prismatic cells in cell to pack battery technology. In 2021, Tesla announced using lithium iron phosphate (LFP) batteries using prismatic cells in all standard-range vehicles globally. CATL (China) introduced the CTP3.0 battery, the Qilin battery based on a prismatic structure offering 13% higher energy density than Tesla's 4680 battery, developed with a cylindrical configuration. In February 2020, Panasonic Holdings Corporation and Toyota Motor Corporation formed a joint venture- Prime Planet Energy & Solutions, Inc. specializing in automotive prismatic batteries. Hence, the rising need for high energy density with better space utilization in cell to pack batteries would drive the demand for prismatic battery form in the future.

Blade battery is expected to be the largest in the present time for the cell to pack battery market

In March 2020, BYD Company Ltd. launched a patented technology – ‘blade battery’- based on cell to pack technology, eliminating the usage of modules. Based on the cell's shape, the battery is termed the blade battery. Leveraging this technology, BYD launched various passenger vehicles in China and received a positive response in the domestic market. In China, more than 85,000 and 5,000 units of BYD Han EV and BYD Tang were sold in 2021. With more models to be launched, the BYD Company Ltd. and Blade battery market is expected to boost in coming years.

Further, the company's vision to gain mass success triggered it to expand outside China aggressively. It launched a few models, such as e6 MPV and Atto3, available in the Indian market. e6 is the electric MPV available for the B2B segment, whereas Atto3 SUV will be available from 2023 onwards in the domestic market. Additionally, in October 2022, Maruti and Toyota announced using Blade batteries from BYD in their upcoming EV models in India by 2025. In July 2022, BYD Company Ltd. announced its entry into the Japanese market and would launch three models named Atto 3, Dolphin, and Seal in the early months of 2023. Additionally, the company also entered the European market as BYD Tang is available in Norway and some other European markets and entered in other countries of Europe, including Germany and the UK. Further, the company also offered HAN model in the US, which is equipped with blade battery technology. These technological innovations and global expansion strategies allow to reap an early mover advantage to BYD Company Ltd. in cell to pack battery market, and gaining technical stability in commercial vehicles will ensure a significant revenue boost from blade battery technology at a global level.

Asia Pacific holds the dominant position in the regional market for the cell to pack battery

Asia Pacific is projected to lead the cell to pack battery market during the forecast period, mainly due to the dominance of China. China is predicted to claim more than 90% of the market in passenger cars. The country is home to major battery suppliers such as CATL and Sunwoda Electric Co. Ltd. Additionally; major OEMs include Tesla (US) (Model 3), BYD Company Ltd. (China) (Atto3, e6 MPV, Han EV), Xpeng (China) (P7), and NIO (China) (ET7) are gaining momentum in the Chinese market. These players have developed and introduced CTP batteries in some of their EV models. The trend is expected to continue, prospering the cell to pack batteries demand in Chinese market. Other key automakers of Asia Pacific region such as Toyota Motor Corporation, Hyundai Motors, and Daihatsu Motor Co., Ltd. among others have announced to launch cell to pack battery technology in upcoming EV models from 2023-2024 onwards. Rising demand of electric mobility to achieve zero emission, significant investments by automakers, and government initiatives and incentives program will drive electric vehicle and cell to pack battery in the region.

Key Market Players

Contemporary Amperex Technology Co., Limited. (China), BYD Company Ltd. (China), LG Energy Solution. (South Korea), Tesla (US), XPENG INC. (China), C4V (US), and Sunwoda Electronic Co., Ltd. (China). These companies adopted new product launches and expansion to gain traction in the cell to pack battery market.

Recent Developments

- In Nov 2023, Volkswagen Group China has begun producing battery systems at a new factory in Hefei, China for its MEB platform EVs in the country. This marks the Volkswagen Group the first wholly-owned battery manufacturing venture in China and is the first VW Group facility to manufacturer next-generation cell-to-pack (CTP) EV batteries.

- In July 2023, The FAW-Fudi which comes under BYD (FinDreams) first battery pack which is based on BYD Blade battery technology has rolled off its production line. This expansion by FAW-BYD enhanced the localization of power battery production. These batteries will power electric vehicles of FAW Group, and EVs from joint ventures like FAW-Volkswagen, FAW-Toyota, etc.

- In November 2022, BYD Company Ltd. (China) launched the Atto 3 electric segment SUV in the Indian market, equipped with the blade battery technology battery pack. The company claimed a range of 521 km with a 60.48 kWh battery pack.

- In November 2022, BYD Company Ltd. (China) entered a partnership with LEAL Group (Mauritius), an automotive dealership, in Mauritius to promote electric vehicles with blade battery technology.

- In November 2022, LG Energy Solution. (South Korea) and Compass Minerals (US) entered into an agreement that states that LG Energy Solution. will supply 40% of Compass Minerals' annual lithium carbonate production over six years, likely to commence in 2025. The companies also expect to cooperate in good faith on a portion of phase II production of battery-grade lithium hydroxide

- In September 2022, Sunwoda Electronic Co., Ltd. has entered the cell to pack battery market by introducing a new product named SFC480 battery. The new battery type offers a fast-charging solution. As per company details, 5 minutes of charge allows for a200 kms travel range.

Frequently Asked Questions (FAQ):

What is the current size of the global cell to pack battery market?

The global differential market is estimated to be USD 18.7 billion in 2023

What would be the dominating market for the cell to pack battery market?

Asia Pacific is predicted to be the dominating and largest cell to pack battery market during the forecast period.

Which battery type is currently preferred in the cell to pack battery market?

Lithium Iron Phosphate battery types are preferred in manufacturing the cell to pack batteries. The battery material's thermal resistance and low cost promote its usage in cell to pack battery.

Many companies are operating in the cell to pack battery market space globally. Do you know who are the front leaders, and what strategies have been adopted by them?

Contemporary Amperex Technology Co., Limited. (China), BYD Company Ltd. (China), C4V (US), Sunwoda Electronic Co., Ltd. (China), and LG Energy Solution. (South Korea) are some of the early birds in the cell to pack battery manufacturing. These companies adopted new product launches and expansion strategies to gain traction in the cell to pack battery market.

How is the demand for differential varies by region?

Asia Pacific is estimated to be the largest market for the cell to pack batteries. The Asia Pacific region has recently emerged as a hub for electric vehicle sales and production. Europe and North America are also expected to grow at a decent pace during the forecast period due to the region's increased awareness for usage of decarbonized vehicles for commute.

What are the revenue shifts which would be observed in this market?

Rising sales of electric vehicles, including passenger cars and commercial vehicles like buses, would create the demand for high energy density batteries with fast charging solution to improve the vehicle's efficiency would create the demand for high energy density cell to pack battery during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increase in EV demand- Growing technological advancements in batteriesRESTRAINTS- Limiting use of electric vehiclesOPPORTUNITIES- Electrification of commercial vehiclesCHALLENGES- Battery design and initial costs- Safety concerns due to battery thermal management

-

5.3 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 IMPACT OF RECESSION ON CELL TO PACK BATTERY MARKET SCENARIO ANALYSISINTRODUCTIONREGIONAL MACRO-ECONOMIC OVERVIEWANALYSIS OF KEY ECONOMIC INDICATORSECONOMIC STAGFLATION (SLOWDOWN) VS. ECONOMIC RECESSION- Europe- Asia Pacific- AmericasECONOMIC OUTLOOK/PROJECTIONS

-

5.5 IMPACT ON ELECTRIC VEHICLE SALESANALYSIS OF ELECTRIC VEHICLE SALES- Europe- Asia Pacific- North AmericaELECTRIC VEHICLE SALES OUTLOOKIMPACT OF RECESSION ON CELL TO PACK BATTERY MARKET: SCENARIO ANALYSIS- Most likely recession scenario- High-impact recession scenario- Low-impact recession scenario

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.7 SUPPLY CHAIN ANALYSIS

-

5.8 ECOSYSTEM

-

5.9 TECHNOLOGY ANALYSISIMPROVED BATTERY DESIGN AND COMPOSITIONCELL TO CHASSIS BATTERY TECHNOLOGYSAFETY BENEFITS OF CELL-TO-PACK BATTERIES

- 5.10 AVERAGE SELLING PRICE ANALYSIS

-

5.11 CELL TO PACK BATTERY MARKET: PATENT ANALYSIS, 2019–2022

-

5.12 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America: List of regulatory bodies, government agencies, and other organizations- Europe: List of regulatory bodies, government agencies, and other organizations- Asia Pacific: List of regulatory bodies, government agencies, and other organizations- Rest of the World: List of regulatory bodies, government agencies, and other organizations

-

5.13 CASE STUDY ANALYSISUSE CASE 1: DEVELOPMENT OF BLADE BATTERY BY BYD COMPANY LTD.

- 5.14 WHO SUPPLIES WHOM

-

6.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONSINDUSTRY INSIGHTS

-

6.2 PRISMATIC CELLSSIMPLE DESIGN AND HIGH-ENERGY-DENSITY CAPACITY TO BOOST MARKET

-

6.3 POUCH CELLSFLEXIBLE STRUCTURAL FEATURE TO PROMOTE SEGMENT GROWTH

-

6.4 CYLINDRICAL CELLSLESS SPACE UTILIZATION TO BOOST DEMAND

-

7.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONSINDUSTRY INSIGHTS

-

7.2 LITHIUM IRON PHOSPHATE BATTERIES (LFP)LOW-COST FEATURE TO BENEFIT SEGMENT

-

7.3 NICKEL MANGANESE COBALT BATTERIES (NMC)HIGHER ENERGY DENSITY TO STRENGTHEN SEGMENTAL GROWTH

-

7.4 OTHER BATTERY TYPESNEED TO REDUCE DEPENDENCY ON LFP BATTERIES TO PROMOTE SEGMENT EXPANSION

-

8.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONSINDUSTRY INSIGHTS

-

8.2 ELECTRIC PASSENGER CARSRISING DEMAND FOR LONG-RANGE AND LIGHTWEIGHT BATTERIES TO DRIVE SEGMENT GROWTH

-

8.3 ELECTRIC BUSESGROWING TREND OF ELECTRIFICATION OF PUBLIC TRANSPORT BUSES TO DRIVE DEMAND FOR HIGH-ENERGY-DENSITY BATTERIES

-

8.4 ELECTRIC TRUCKSRISING TREND FOR ELECTRIFICATION OF TRUCKS TO CREATE OPPORTUNITIES FOR MARKET

-

9.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONSINDUSTRY INSIGHTS

-

9.2 BATTERY ELECTRIC VEHICLES (BEVS)RISING DEMAND FOR LIGHTWEIGHT, COST-EFFICIENT, AND HIGH-ENERGY-DENSITY BATTERIES TO DRIVE MARKET

-

9.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)INCREASE IN PHEV DEMAND TO SUPPORT MARKET GROWTH

-

10.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONSINDUSTRY INSIGHTS

-

10.2 BLADE BATTERYHIGHER VCTPR AND GCTPR OF BLADE BATTERIES TO SUPPORT GROWTH

-

10.3 LISER BATTERY100% NICKEL AND COBALT-FREE FEATURE TO DRIVE SEGMENTAL GROWTH

-

10.4 OTHER BATTERY TECHNOLOGIESHIGH COMPETITION IN EV BATTERY MARKET TO DRIVE DEMAND

-

11.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONSINDUSTRY INSIGHTS

-

11.2 ASIA PACIFICCHINA- Rising EV demand and increasing technological advancement for improved battery performanceJAPAN- Regional EV OEMs partnering with battery suppliers to use advanced battery solutionsINDIA- Government subsidies and incentives to drive marketSOUTH KOREA- Increasing focus on sustainable electric mobility to boost market

-

11.3 EUROPEFRANCE- Rise in e-logistics transport to drive marketGERMANY- Presence of leading companies and higher demand for BEVs to benefit marketNORWAY- Replacement of conventional vehicles with advanced EVs to drive marketSWITZERLAND- Rapid adoption of EVs to create demand for high energy density batteries to boost marketNETHERLANDS- Rising focus on enhanced battery technology in commercial vehicles to strengthen marketSPAIN- Rising domestic battery cell production to offer opportunitiesSWEDEN- Presence of OEMs to boost demand for EV batteriesUK- Increasing presence of international EV manufacturers to augment market sizeEUROPE OTHERS

-

11.4 NORTH AMERICAUS- Growing demand for electric SUVs to drive marketCANADA- Government subsidies to promote EVs to drive market

- 12.1 ADVANCEMENT IN BATTERY PACKS TO DRIVE CELL TO PACK BATTERY DEMAND

- 12.2 DEMAND FOR EFFICIENT AND LOW-COST BATTERY CHEMISTRY TO DRIVE MARKET

- 12.3 CONCLUSION

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.3 CELL TO PACK BATTERY MARKET RANKING, 2022

- 13.4 REVENUE ANALYSIS OF TOP FIVE PLAYERS

-

13.5 COMPANY EVALUATION QUADRANTTERMINOLOGYSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

- 13.6 CELL TO PACK BATTERY MARKET: COMPANY FOOTPRINT

- 13.7 COMPETITIVE BENCHMARKING

-

13.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

14.1 KEY PLAYERSCONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED.- Business overview- Recent developments- MnM viewLG ENERGY SOLUTION.- Business overview- Recent developments- MnM viewBYD COMPANY LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewC4V- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSUNWODA ELECTRONIC CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTESLA- Business overview- Recent developmentsPANASONIC HOLDINGS CORPORATION- Business overview- Recent developmentsELEVENES- Business overviewELECTRA- Business overview- Recent developmentsCAMELOT ELECTRONIC TECHNOLOGY CO., LTD.- Business overview- Products/Solutions/Services offeredSILVER POWER SYSTEMS- Business overviewBMW AG- Business overview- Recent developmentsFORD MOTOR COMPANY- Business overview- Recent developmentsSOLARIS BUS & COACH SP. Z O.O.- Business overview- Recent developmentsHENKEL AG & CO. KGAA- Business overview- Products/Solutions/Services offered- Recent developmentsAZL AACHEN GMBH- Business overviewXPENG INC.- Business overview- Products/Solutions/Services offered- Recent developmentsNIO- Business overview- Recent developmentsVDL BUS & COACH BV- Business overview- Recent developmentsHOZON NEW ENERGY AUTOMOBILE CO. LTD- Business overview- Recent developments

- 15.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

-

15.4 CUSTOMIZATION OPTIONSCELL TO PACK BATTERY MARKET, BY VEHICLE AND PROPULSION TYPEMARKET, BY PROPULSION AND COUNTRY

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

- TABLE 1 CURRENCY EXCHANGE RATES

- TABLE 2 PRE VS. POST-RECESSION SCENARIO: CELL TO PACK BATTERY MARKET, 2020–2030 (USD MILLION)

- TABLE 3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 KEY ECONOMIC INDICATORS FOR SELECT COUNTRIES, 2021–2022

- TABLE 5 EUROPE: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 6 ASIA PACIFIC: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 7 AMERICAS: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 8 GDP GROWTH PROJECTIONS FOR KEY COUNTRIES, 2024–2027 (% GROWTH)

- TABLE 9 CELL TO PACK BATTERY MARKET (MOST LIKELY RECESSION SCENARIO), BY REGION, 2020–2030 (USD MILLION)

- TABLE 10 MARKET (HIGH-IMPACT RECESSION SCENARIO), BY REGION, 2020–2030 (USD MILLION)

- TABLE 11 MARKET (LOW-IMPACT RECESSION SCENARIO), BY REGION, 2020–2030 (USD MILLION)

- TABLE 12 ROLE OF COMPANIES IN MARKET ECOSYSTEM

- TABLE 13 CELL TO PACK BATTERY (USD/UNIT)

- TABLE 14 AVERAGE SELLING PRICE, BY BATTERY FORM

- TABLE 15 PATENT ANALYSIS 2019–2022

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 CELL TO PACK BATTERY MARKET, BY BATTERY FORM, 2022–2033 (‘000 UNITS)

- TABLE 21 MARKET, BY BATTERY FORM, 2022–2033 (USD MILLION)

- TABLE 22 PRISMATIC MARKET, BY REGION, 2022–2033 (‘000 UNITS)

- TABLE 23 PRISMATIC MARKET, BY REGION, 2022–2033 (USD MILLION)

- TABLE 24 POUCH MARKET, BY REGION, 2022–2033 (‘000 UNITS)

- TABLE 25 POUCH MARKET, BY REGION, 2022–2033 (USD MILLION)

- TABLE 26 CYLINDRICAL MARKET, BY REGION, 2022–2033 (‘000 UNITS)

- TABLE 27 CYLINDRICAL MARKET, BY REGION, 2022–2033 (USD MILLION)

- TABLE 28 CELL TO PACK BATTERY MARKET, BY BATTERY TYPE, 2022–2033 (‘000 UNITS)

- TABLE 29 MARKET, BY BATTERY TYPE, 2022–2033 (USD MILLION)

- TABLE 30 LFP: MARKET, BY REGION, 2022–2033 (‘000 UNITS)

- TABLE 31 LFP: MARKET, BY REGION, 2022–2033 (USD MILLION)

- TABLE 32 NMC: MARKET, BY REGION, 2022–2033 (‘000 UNITS)

- TABLE 33 NMC: MARKET, BY REGION, 2022–2033 (USD MILLION)

- TABLE 34 OTHER BATTERY TYPES: CELL TO PACK BATTERY MARKET, BY REGION, 2022–2033 (‘000 UNITS)

- TABLE 35 OTHER BATTERY TYPES: MARKET, BY REGION, 2022–2033 (USD MILLION)

- TABLE 36 MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2033 (‘000 UNITS)

- TABLE 37 CELL TO PACK BATTERY MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2033 (USD MILLION)

- TABLE 38 ELECTRIC PASSENGER CARS: CELL TO PACK BATTERY MARKET, BY REGION, 2022–2033 (‘000 UNITS)

- TABLE 39 ELECTRIC PASSENGER CARS: MARKET, BY REGION, 2022–2033 (USD MILLION)

- TABLE 40 ELECTRIC BUSES: MARKET, BY REGION, 2022–2033 (‘000 UNITS)

- TABLE 41 ELECTRIC BUSES: MARKET, BY REGION, 2022–2033 (USD MILLION)

- TABLE 42 ELECTRIC TRUCKS: MARKET, BY REGION, 2022–2033 (‘000 UNITS)

- TABLE 43 ELECTRIC TRUCKS: MARKET, BY REGION, 2022–2033 (USD MILLION)

- TABLE 44 CELL TO PACK BATTERY MARKET, BY PROPULSION, 2022–2033 (‘000 UNITS)

- TABLE 45 MARKET, BY PROPULSION, 2022–2033 (USD MILLION)

- TABLE 46 BATTERY ELECTRIC VEHICLE: MARKET, BY REGION, 2022–2033 (‘000 UNITS)

- TABLE 47 BATTERY ELECTRIC VEHICLE: MARKET, BY REGION, 2022–2033 (USD MILLION)

- TABLE 48 PLUG-IN HYBRID ELECTRIC VEHICLE: MARKET, BY REGION, 2022–2033 (USD MILLION)

- TABLE 49 MARKET, BY BATTERY TECHNOLOGY, 2022–2033 (‘000 UNITS)

- TABLE 50 BLADE BATTERY: MARKET, BY REGION, 2022–2033 (‘000 UNITS)

- TABLE 51 LISER BATTERY: MARKET, BY REGION, 2022–2033 (’000 UNITS)

- TABLE 52 OTHER BATTERY TECHNOLOGIES: MARKET, BY REGION, 2022–2033 (‘000 UNITS)

- TABLE 53 CELL TO PACK BATTERY MARKET, BY REGION, 2022–2033 (‘000 UNITS)

- TABLE 54 MARKET, BY REGION, 2022–2033 (USD MILLION)

- TABLE 55 ASIA PACIFIC: CELL TO PACK BATTERY MARKET, BY COUNTRY, 2022–2033 (‘000 UNITS)

- TABLE 56 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2033 (USD MILLION)

- TABLE 57 CHINA: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (‘000 UNITS)

- TABLE 58 CHINA: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (USD MILLION)

- TABLE 59 JAPAN: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (‘000 UNITS)

- TABLE 60 JAPAN: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (USD MILLION)

- TABLE 61 INDIA: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (‘000 UNITS)

- TABLE 62 INDIA: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (USD MILLION)

- TABLE 63 SOUTH KOREA: CELL TO PACK BATTERY MARKET, BY ELECTRIC VEHICLE, 2022–2033 (‘000 UNITS)

- TABLE 64 SOUTH KOREA: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (USD MILLION)

- TABLE 65 EUROPE: MARKET, BY COUNTRY, 2022–2033 (‘000 UNITS)

- TABLE 66 EUROPE: MARKET, BY COUNTRY, 2022–2033 (USD MILLION)

- TABLE 67 FRANCE: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (‘000 UNITS)

- TABLE 68 FRANCE: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (USD MILLION)

- TABLE 69 GERMANY: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (‘000 UNITS)

- TABLE 70 GERMANY: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (USD MILLION)

- TABLE 71 NORWAY: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2033 (‘000 UNITS)

- TABLE 72 NORWAY: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (USD MILLION)

- TABLE 73 SWITZERLAND: CELL TO PACK BATTERY MARKET, BY ELECTRIC VEHICLE, 2022–2033 (‘000 UNITS)

- TABLE 74 SWITZERLAND: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (USD MILLION)

- TABLE 75 NETHERLANDS: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (‘000 UNITS)

- TABLE 76 NETHERLANDS: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (USD MILLION)

- TABLE 77 SPAIN: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (‘000 UNITS)

- TABLE 78 SPAIN: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (USD MILLION)

- TABLE 79 SWEDEN: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (‘000 UNITS)

- TABLE 80 SWEDEN: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (USD MILLION)

- TABLE 81 UK: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2033 (‘000 UNITS)

- TABLE 82 UK: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2033 (USD MILLION)

- TABLE 83 EUROPE OTHERS: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (‘000 UNITS)

- TABLE 84 EUROPE OTHERS: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (USD MILLION)

- TABLE 85 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2033 (‘000 UNITS)

- TABLE 86 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2033 (USD MILLION)

- TABLE 87 US: CELL TO PACK BATTERY MARKET, BY ELECTRIC VEHICLE, 2022–2033 (‘000 UNITS)

- TABLE 88 US: MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2033 (USD MILLION)

- TABLE 89 CANADA: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (‘000 UNITS)

- TABLE 90 CANADA: MARKET, BY ELECTRIC VEHICLE, 2022–2033 (USD MILLION)

- TABLE 91 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MARKET OEMS

- TABLE 92 MARKET: COMPANY FOOTPRINT ANALYSIS, 2022

- TABLE 93 MARKET: COMPANY PRODUCT CATEGORY FOOTPRINT, 2022

- TABLE 94 MARKET: COMPANY REGION FOOTPRINT, 2022

- TABLE 95 CELL TO PACK BATTERY MARKET: KEY SMES

- TABLE 96 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [SMES]

- TABLE 97 MARKET: PRODUCT LAUNCHES, 2019–2022

- TABLE 98 MARKET: DEALS, 2020–2022

- TABLE 99 MARKET: OTHERS, 2020–2022

- TABLE 100 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED.: BUSINESS OVERVIEW

- TABLE 101 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED.: PRODUCT LAUNCHES

- TABLE 102 CONTEMPORARY AMPEREX TECHNOLOGY LIMITED.: DEALS

- TABLE 103 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED.: OTHERS

- TABLE 104 LG ENERGY SOLUTION.: BUSINESS OVERVIEW

- TABLE 105 LG ENERGY SOLUTION.: PRODUCT LAUNCHES

- TABLE 106 LG ENERGY SOLUTION.: DEALS

- TABLE 107 BYD COMPANY LTD.: BUSINESS OVERVIEW

- TABLE 108 BYD COMPANY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 109 BYD COMPANY LTD.: PRODUCT LAUNCHES

- TABLE 110 BYD COMPANY LTD.: DEALS

- TABLE 111 BYD COMPANY LTD: OTHERS

- TABLE 112 C4V: BUSINESS OVERVIEW

- TABLE 113 C4V: PRODUCT LAUNCHES

- TABLE 114 C4V: DEALS

- TABLE 115 SUNWODA ELECTRONIC CO., LTD.: BUSINESS OVERVIEW

- TABLE 116 SUNWODA ELECTRONIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 117 SUNWODA ELECTRONIC CO., LTD.: PRODUCT LAUNCHES

- TABLE 118 SUNWODA ELECTRONIC CO., LTD.: DEALS

- TABLE 119 SUNWODA ELECTRONIC CO., LTD.: OTHERS

- TABLE 120 TESLA: BUSINESS OVERVIEW

- TABLE 121 TESLA: DEALS

- TABLE 122 PANASONIC HOLDINGS CORPORATION: BUSINESS OVERVIEW

- TABLE 123 PANASONIC HOLDINGS CORPORATION: DEALS

- TABLE 124 PANASONIC HOLDINGS CORPORATION: OTHERS

- TABLE 125 ELEVENES: BUSINESS OVERVIEW

- TABLE 126 ELECTRA: BUSINESS OVERVIEW

- TABLE 127 ELECTRA: DEALS

- TABLE 128 CAMELOT ELECTRONIC TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

- TABLE 129 CAMELOT ELECTRONIC TECHNOLOGY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 SILVER POWER SYSTEMS: BUSINESS OVERVIEW

- TABLE 131 BMW AG: BUSINESS OVERVIEW

- TABLE 132 BMW AG: DEALS

- TABLE 133 FORD MOTOR COMPANY: BUSINESS OVERVIEW

- TABLE 134 FORD MOTOR COMPANY: DEALS

- TABLE 135 SOLARIS BUS & COACH SP. Z O.O.: BUSINESS OVERVIEW

- TABLE 136 SOLARIS BUS & COACH SP. Z O.O.: DEALS

- TABLE 137 HENKEL AG & CO. KGAA: BUSINESS OVERVIEW

- TABLE 138 HENKEL AG & CO. KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 HENKEL AG & CO. KGAA.: DEALS

- TABLE 140 HENKEL AG & CO. KGAA: OTHERS

- TABLE 141 AZL AACHEN GMBH: BUSINESS OVERVIEW

- TABLE 142 XPENG INC.: BUSINESS OVERVIEW

- TABLE 143 XPENG INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 XPENG INC.: PRODUCT LAUNCHES

- TABLE 145 XPENG INC.: OTHERS

- TABLE 146 NIO: BUSINESS OVERVIEW

- TABLE 147 NIO INC.: PRODUCT LAUNCHES

- TABLE 148 VDL BUS & COACH BV: BUSINESS OVERVIEW

- TABLE 149 VDL BUS & COACH BV: DEALS

- TABLE 150 HOZON NEW ENERGY AUTOMOBILE CO. LTD: BUSINESS OVERVIEW

- TABLE 151 HOZON NEW ENERGY AUTOMOBILE CO. LTD: DEALS

- FIGURE 1 MARKET SEGMENTATION: CELL TO PACK BATTERY MARKET

- FIGURE 2 MARKET: REGIONAL SCOPE

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 RESEARCH METHODOLOGY MODEL

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY STAKEHOLDER, DESIGNATION, AND REGION

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

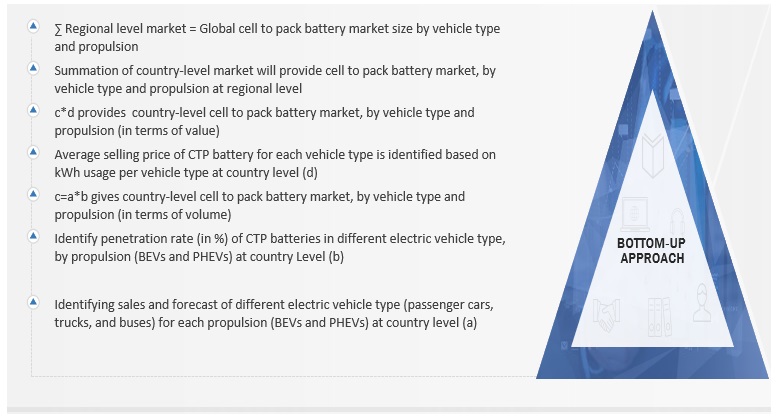

- FIGURE 7 MARKET, BY VEHICLE TYPE: BOTTOM-UP APPROACH

- FIGURE 8 MARKET, BY BATTERY TYPE: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 PRE VS. POST-RECESSION SCENARIO: MARKET SIZE, 2020–2030 (USD MILLION)

- FIGURE 11 CELL TO PACK BATTERY MARKET, BY REGION, 2023 VS. 2033 (USD MILLION)

- FIGURE 12 RISING DEMAND FOR HIGH ENERGY DENSITY BATTERIES TO DRIVE MARKET GROWTH

- FIGURE 13 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 PRISMATIC FORM SEGMENT PREDICTED TO DOMINATE MARKET IN 2023

- FIGURE 15 LITHIUM IRON PHOSPHATE SEGMENT TO HOLD LARGEST SHARE FOR MARKET

- FIGURE 16 BEVS SEGMENT PROJECTED TO SECURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 BLADE BATTERY TECHNOLOGY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 PASSENGER CARS SEGMENT TO SECURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 CELL TO PACK BATTERY: MARKET DYNAMICS

- FIGURE 20 EV BATTERY MARKET, BY MATERIAL TYPE, 2022 VS 2027

- FIGURE 21 ELECTRIC BUSES MARKET, BY REGION, 2020-2023

- FIGURE 22 ELECTRIC TRUCKS MARKET, BY REGION, 2020-2023

- FIGURE 23 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 EUROPE: ELECTRIC PASSENGER CARS, BEV, AND PHEV SALES, BY COUNTRY, 2021–2022

- FIGURE 25 ASIA PACIFIC: PASSENGER CARS, BEV AND PHEV SALES, BY COUNTRY, 2021–2022

- FIGURE 26 NORTH AMERICA: PASSENGER CARS, BEVS, AND PHEVS SALES, BY COUNTRY, 2021–2022

- FIGURE 27 PASSENGER CARS, BEVS, AND PHEVS VEHICLE SALES FORECAST, 2022 VS. 2030 (UNITS)

- FIGURE 28 SCENARIO ANALYSIS: CELL TO PACK BATTERY MARKET SCENARIO, 2020–2030 (USD MILLION)

- FIGURE 29 REVENUE SHIFT DRIVING MARKET GROWTH

- FIGURE 30 SUPPLY CHAIN ANALYSIS: MARKET (1/2)

- FIGURE 31 SUPPLY CHAIN ANALYSIS: MARKET (2/2)

- FIGURE 32 MARKET: ECOSYSTEM

- FIGURE 33 MARKET: ECOSYSTEM ANALYSIS

- FIGURE 34 MARKET, BY BATTERY FORM, 2023 VS. 2030

- FIGURE 35 MARKET, BY BATTERY TYPE, 2023 VS. 2033 (USD MILLION)

- FIGURE 36 MARKET, BY ELECTRIC VEHICLE TYPE, 2023 VS. 2033 (USD MILLION)

- FIGURE 37 CELL TO PACK BATTERY MARKET, BY PROPULSION, 2023 VS. 2033 (USD MILLION)

- FIGURE 38 MARKET, BY TECHNOLOGY, 2023 VS. 2033 (THOUSAND UNITS)

- FIGURE 39 ARKET, BY REGION, 2023 VS. 2033 (USD MILLION)

- FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 41 EUROPE: MARKET SNAPSHOT

- FIGURE 42 NORTH AMERICA: MARKET, BY REGION, 2023 VS. 2033 (USD MILLION)

- FIGURE 43 MARKET RANKING, 2022

- FIGURE 44 MARKET, REVENUE ANALYSIS

- FIGURE 45 CELL TO PACK BATTERY MARKET COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 46 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED.: COMPANY SNAPSHOT

- FIGURE 47 LG ENERGY SOLUTION.: COMPANY SNAPSHOT

- FIGURE 48 BYD COMPANY LTD.: COMPANY SNAPSHOT

- FIGURE 49 SUNWODA ELECTRONIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 50 TESLA: COMPANY SNAPSHOT

- FIGURE 51 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 BMW AG: COMPANY SNAPSHOT

- FIGURE 53 FORD MOTOR COMPANY: COMPANY SNAPSHOT

- FIGURE 54 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 55 XPENG INC.: COMPANY SNAPSHOT

- FIGURE 56 NIO.: COMPANY SNAPSHOT

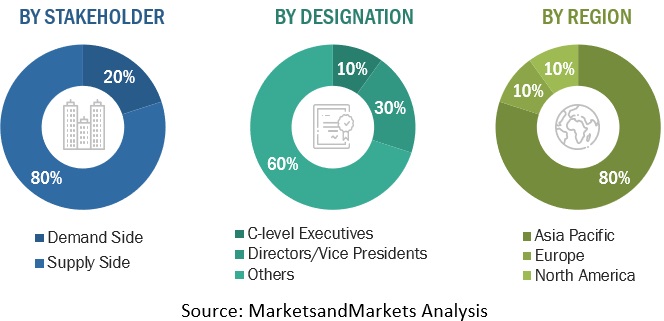

The study involved four major activities in estimating the current size of the cell to pack battery market. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company websites, press releases, industry association publications, Intralogistics magazine articles, directories, technical handbooks, world economic outlook, trade websites, and technical articles were used to identify and collect information useful for an extensive commercial study of the cell to pack battery market.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the battery pack market. The primary sources from the supply side included various industry experts, such as CXOs; vice presidents; directors from business development, marketing, and product development/innovation teams; and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews were conducted to gather insights such as cell to pack battery market forecast, current technology trends, and upcoming technologies in the market. Data triangulation of all these points was carried out with the information gathered from secondary research. Stakeholders from the supply side were interviewed to understand their views on the points mentioned above.

Primary interviews were conducted with market experts from the supply side (cell to pack battery manufacturers) across the major regions, namely, Asia Pacific, Europe, and North America. Primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report. After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches were used to estimate and validate the size of the global cell to pack battery market. In these approaches, the electric vehicle sales statistics for each vehicle type (electric passenger cars, heavy trucks and buses) at country level were considered.

Cell to pack battery market: Bottom-Up Approach

In the bottom-up approach, the sale and forecast of electric vehicle type which included the electric passenger cars, electric buses and electric trucks on the basis of the propulsion type like BEV and PHEV was determined. Further the penetration of cell to pack battery in different vehicle type by the propulsion (BEV and PHEV) at each country level was identified. The multiplication of the penetration rate and the sales of electric vehicles by propulsion gave the country level market in terms of volume by vehicle type and by propulsion type. The average selling price of cell to pack battery for each vehicle type based on the kWh usage depending on the vehicle type was identified on the country level. Further, multiplying the country level market for vehicle type and propulsion on country level with the average selling prices for each vehicle type determined on country level determined the country level market by vehicle type and propulsion in terms of value. The summation of the country-level market for each vehicle type and propulsion, by volume and value, would give the regional level market, by vehicle type and propulsion. The summation of the regional markets provides the global market, by vehicle type and propulsion.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analysed to obtain the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in the report.

Report Objectives

-

To define, describe, and forecast the cell to pack battery market in terms of value (USD million) and volume (units) based on the following segments:

- By battery form (prismatic, pouch, and cylindrical)

- By battery type (lithium iron phosphate (LFP), nickel manganese cobalt oxide (NMC), and other battery types)

- By electric vehicle type [electric passenger cars and electric commercial vehicles (buses and trucks)]

- By Propulsion (BEV and PHEV)

- By technology (blade battery technology, LiSER battery technology, and other battery technology)

- By region (Asia Pacific, Europe, and North America)

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the market share of leading players in the market and evaluate the competitive evaluation quadrant.

- To assess the key player strategies and company revenue

- To evaluate the market with Porter’s Five Forces analysis, supply chain analysis, market ecosystem, case studies, ASP analysis, patent analysis, trends/disruptions impacting buyers, technology trends, recession impact, and regulatory analysis

- To analyze recent developments, including supply contracts, new product launches, expansions, and other activities, undertaken by key industry participants in the market

- To determine realistic, pessimistic, and optimistic scenarios related to the cell to pack battery market.

- To give a brief understanding of the market in the recommendations chapter

Scope of the Report

|

Report Attribute |

Details |

|

Base year for estimation |

2022 |

|

Forecast period |

2023 - 2033 |

|

Market Growth and Revenue forecast |

$ 79.0 Bn by 2033 at a CAGR of 15.5% |

|

Top Players |

Contemporary Amperex Technology Co., Limited. (China), BYD Company Ltd. (China), LG Energy Solution. (South Korea), Tesla (US), XPENG INC. (China) |

|

Fastest Growing Market |

Europe |

|

Largest Market |

Asia Pacific |

|

Segments covered |

|

|

By Battery Form |

Prismatic, Pouch and Cylindrical |

|

By Battery Type |

Lithium Iron Phosphate, Nickel Cobalt Manganese and Other Battery Type |

|

By Electric Vehicle Type |

Electric Passenger Cars and Electric Commercial Vehicles (Buses and Trucks) |

|

By Propulsion |

BEV and PHEV |

|

By Battery Technology |

Blade Battery Technology, LiSER Battery Technology and Other Battery Technology |

|

By Region |

Asia Pacific – China, India, Japan, and South Korea. |

|

Additional Customization to be offered |

|

This research report categorizes the cell to pack battery market based on Battery Form, Battery Type, Electric Vehicle, Propulsion, Battery Technology and Region

By Battery Form

- Prismatic

- Pouch

- Cylindrical

By Battery Type

- Lithium Iron Phosphate (LFP)

- Nickel Manganese Cobalt (NMC)

- Other Battery Type

By Electric Vehicle Type

- Electric Passenger Cars

- Electric Trucks

- Electric Buses

By Propulsion

- BEV

- PHEV

By Battery Technology

- Blade Battery Technology

- LiSER Battery Technology

- Other Battery Technology

By Region

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

Europe

- France

- Germany

- Spain

- UK

- Sweden

- Norway

- Switzerland

- Netherlands

- Europe Others

-

North America

- US

- Canada

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

The following customization options are available for the report:

Cell to Pack Battery, By Vehicle and Propulsion type

- Passenger vehicles

- Commercial vehicle

Note: The electric vehicle type market will be provided by provided by propulsion (BEV and PHEV) for the considered regions

Cell to Pack Battery market, by Propulsion and Country

- BEV

- PHEV

Note: The market will be provided at countries considered under each region for the study

Note:

Asia Pacific (China, Japan, South Korea, India), Europe (France, Germany, Spain, UK, Switzerland, Netherlands, Norway, Sweden) and Americas (US, Canada)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cell to Pack Battery Market