EV Battery Market Size, Share & Analysis

EV Battery Market by Battery Type (Li-ion, NiMH, SSB), Vehicle Type (PC, Vans/Light Truck, MHCV, Bus & OHV), Propulsion, Battery Form, Material Type, Battery Capacity, Method, Li-ion Battery Component, and Region - Global Forecast to 2035

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The EV battery market size is projected to reach USD 251.33 billion by 2035 from USD 91.93 billion in 2024 at a CAGR of 9.6%. The market is expanding rapidly, driven by the accelerating transition of global automakers and fleet operators toward vehicle electrification, supported by rising consumer demand for low-emission mobility solutions and expanding EV model portfolios across passenger and commercial segments. Government initiatives such as the European Union's proposal to mandate all new city buses to be zero-emission vehicles (ZEVs) by 2035 are creating a surge in demand for batteries and energy storage systems across public and commercial transportation sectors. As automakers scale EV production and strive to meet stricter emission targets, the need for efficient, high-capacity batteries and energy storage systems continues to drive the market, offering significant opportunities for growth in battery manufacturing and recycling.

KEY TAKEAWAYS

-

BY MATERIAL TYPEThe growing transition toward more stable battery chemistries, such as high-manganese NMC and LMFP batteries, is increasing the demand for manganese in electric vehicle batteries. At the same time, the rapid adoption of LFP batteries, favored for their safety, cost-effectiveness, and long cycle life, is driving a strong rise in phosphate demand.

-

BY BATTERY FORMAdvancements in stacking and welding technologies are making the production of prismatic cells more efficient by lowering manufacturing costs and enhancing quality consistency. Additionally, the direct integration of cylindrical cells into battery packs, eliminating the traditional module stage, is simplifying assembly processes while increasing overall pack energy density. These innovations are contributing to more cost-effective and higher-performing battery designs for electric vehicles.

-

BY PROPULSIONImprovements in LFP (lithium iron phosphate) and NMC (nickel-manganese-cobalt) battery technologies have allowed automakers to design battery electric vehicles (BEVs) that balance cost, safety, and performance across various market segments. Meanwhile, fuel cell electric vehicles (FCEVs) are expected to see growth due to their quick refueling times and long driving ranges, making them well-suited for heavy-duty vehicles and applications with high energy requirements.

-

BY VEHILE TYPEThe rising demand for EV batteries in medium and heavy trucks is mainly driven by the need to cut carbon emissions, improve fuel efficiency, and reduce operating costs. At the same time, the fast electrification of passenger cars is being pushed by strict emission regulations, government incentives, better battery technologies that offer higher energy density and longer range, and growing consumer interest in cleaner and more cost-effective mobility options.

-

BY REGIONAsia Pacific continues to lead the global EV battery market, supported by strong government policies, rapid industrial growth, and strategic investments. Lithium-ion batteries are expected to remain the dominant battery type worldwide, driven by continuous technological improvements and lower costs, especially in passenger cars, which are the main contributors to EV adoption. Meanwhile, the development of solid-state batteries is expected to transform the energy storage landscape by offering higher performance and creating new competitive advantages for manufacturers.

LFP batteries have emerged as a cost-effective alternative to nickel-manganese-cobalt (NMC) batteries, offering around 20–30% lower cost per kWh. Their widespread adoption in China is prompting many OEMs to standardize vehicle models on LFP chemistry, particularly in cost-sensitive and mass-market segments. With continuous improvements in cell and pack design, the historical energy density gap between LFP and NMC batteries is narrowing, enabling LFP to capture a growing share of mid-range EV applications. At the same time, leading players such as CATL are advancing next-generation LFP and sodium-ion technologies to further enhance performance, lower costs, and reduce dependency on scarce raw materials such as nickel and cobalt.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The EV battery market is rapidly expanding, driven by advancements in battery technologies such as lithium-ion and solid-state batteries, which are creating new opportunities for market players. These innovations enhance energy density, reduce costs, and improve charging speeds, making EVs more appealing to consumers. Additionally, emerging technologies like cell-to-pack designs and graphene batteries are set to further revolutionize the market by increasing efficiency and performance. For instance, companies like CATL invest heavily in new manufacturing plants to meet the growing demand for advanced battery solutions. As the industry continues to evolve with these breakthroughs, the potential for growth in the market remains significant, paving the way for broader adoption of electric vehicles globally.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Advancements in battery technologies

-

•Government strategies to promote the adoption of EVs

Level

-

Shortage of charging infrastructure in emerging economies

-

Emergence of alternative fuel options

Level

-

Growth of BaaS in EV battery market’s boom

-

Development of innovative solid-state batteries

Level

-

Cost disparity between electric and conventional vehicles

-

Safety concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Advancements in battery technologies

The EV battery market is set for strong growth, driven by rapid technological advancements. Lithium-ion batteries continue to dominate due to their reliability and safety, while innovations in high-nickel NMC and LFP chemistries are improving energy density, range, and cost efficiency. Developments such as BYD’s Blade Battery highlight progress in cell-to-pack designs enhancing safety and performance.

Restraint: Emergence of alternative fuels

Alternative fuels like hydrogen and ethanol could slow EV battery market growth by offering other clean transport options. Hydrogen vehicles, powered by fuel cells, emit only water and heat, and recent developments such as HORIBA India’s H2-ICE test facility and Triton EV’s hydrogen engine launch show rising investment in hydrogen technology. These advancements may divert funding and infrastructure focus from EV batteries.

Opportunity: Innovative solid-state batteries

Solid-state batteries are poised to transform the EV battery market by overcoming the key limitations of conventional lithium-ion technology. By replacing liquid electrolytes with solid ones, they offer higher energy density, faster charging, improved safety, and a longer lifespan. These advantages make them a promising solution for next-generation electric vehicles, enabling longer driving ranges, shorter charging times, and enhanced overall performance and reliability.

Challenge: Lithium shortages

The rapid increase in electric vehicle demand is putting significant pressure on global lithium supply. Since no cost-effective alternative to lithium has been identified, prices are expected to rise sharply in the coming years. This shortage presents a major challenge for the EV market. Although automakers are developing solid-state batteries that require less lithium and offer longer range, supply is still projected to fall short of demand by 2025–2026, likely increasing EV costs.

EV Battery Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supplies lithium-ion and LFP batteries for electric vehicles, energy storage systems, and electric commercial fleets globally. | Enhances vehicle range, reduces cost per kWh, and supports energy transition across automotive and grid sectors. |

|

Provides advanced pouch and cylindrical battery cells to automakers such as GM, Hyundai, and Tesla, and for stationary storage applications. | Enables high energy density, longer lifecycle, and scalable production for multiple EV and ESS platforms. |

|

Partners with Tesla and Mazda to supply high-performance cylindrical batteries for EVs and home energy storage. | Improves vehicle efficiency, accelerates charging performance, and supports global EV scaling. |

|

Manufactures Blade Batteries using LFP chemistry for passenger cars, buses, and commercial vehicles. | Increases safety through thermal stability, reduces material cost, and extends battery lifespan. |

|

Develops nickel-rich batteries for premium EVs and light commercial vehicles. | Offers higher energy output, supports fast charging, and aligns with OEM requirements for performance EVs. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The EV battery market operates through a complex and interconnected ecosystem. It begins with raw material suppliers such as Glencore, which extract and process key elements like lithium, cobalt, and nickel. These materials are then supplied to anode manufacturers such as SGL Carbon, which produce graphite anodes essential for battery cells, and to cathode material suppliers like BASF, which provide materials such as lithium cobalt oxide (LCO) and lithium iron phosphate (LFP). Battery cell and pack manufacturers, including CATL, BYD, and LG Energy Solution, use these materials to assemble high-performance batteries. Finally, automakers such as Tesla, BMW, and NIO integrate these batteries into their electric vehicles. This well-connected value chain supports continuous innovation and the steady advancement of EV battery technology.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

EV Battery Market, Battery Type

The lithium-ion segment is expected to hold the largest share of the market due to its technological maturity, reliability, and safety. Continuous advancements have improved energy density, lifespan, and charging speed, making lithium-ion batteries the preferred choice for automakers. Falling production costs are further driving EV affordability and adoption.

EV Battery Market, Material Type

The natural graphite segment is expected to grow at the fastest rate due to its vital role as the main anode material in lithium-ion batteries. Its high conductivity, long cycle life, and cost-effectiveness make it essential for EV performance. Growing efforts to localize supply chains are driving increased investment in graphite mining and processing.

EV Battery Market, Battery Form

The prismatic battery segment is expected to lead the EV market due to its high energy density, compact design, and structural flexibility, making it well-suited for modern EV architectures. Major manufacturers such as Samsung SDI, LG Energy Solution, and Panasonic favor this form to maximize energy storage and optimize space efficiency. With continuous advancements and growing adoption by automakers, prismatic batteries are set to play a key role in meeting the performance and design needs of next-generation electric vehicles.

EV Battery Market, Propulsion

The BEV segment is expected to dominate the market as consumers increasingly prefer fully electric vehicles for their zero emissions and lower maintenance costs. Advances in battery technology, including higher energy density and faster charging, are making BEVs more attractive by reducing range anxiety. Alongside strong government incentives and stricter emission regulations, these factors are driving rapid BEV adoption and boosting demand for EV batteries globally.

EV Battery Market, Vehicle Type

The passenger car segment is expected to dominate the market during the forecast period, driven by rising consumer demand, strict emission regulations, and rapid advancements in battery technology. Government incentives and major automaker investments, such as Honda’s USD 10 billion EV value chain project in Canada, are further accelerating growth.

EV Battery Market, Battery Capacity

The 50–110 kWh battery segment is expected to lead the EV market during the forecast period, driven by growing demand for mid-range electric vehicles that balance cost, performance, and range. This capacity range is ideal for mass-market EVs, offering sufficient driving range and affordability. Popular and upcoming models such as the Tesla Model 3 Long Range, BYD Dolphin, and Arcfox Alpha S feature batteries within this range.

EV Battery Market, Method

The laser bonding segment is expected to lead the market during the forecast period, driven by its precision, efficiency, and suitability for assembling various EV battery components. It supports effective thermal management by enabling the integration of cooling elements for better heat dissipation. As EV production expands, demand for laser bonding is rising due to its advantages, including enhanced performance, shorter production time, and greater manufacturing flexibility.

EV Battery Market, Lithium-ion Battery Component

The market, based on lithium-ion battery components, is segmented into positive electrode (cathode), negative electrode (anode), electrolyte, and separator. These rechargeable batteries operate through a reversible chemical reaction that enables charging and discharging. During use, electrons flow from the cathode to the anode, while the process reverses during charging. Each cell contains two electrodes immersed in an electrolyte, creating a potential difference that powers the EV motor when the vehicle is in motion.

REGION

Asia Pacific is projected to be the dominant market during the forecast period

The Asia Pacific region dominates the EV battery market, led by China’s strong manufacturing base and policy support. This leadership is driven by major players such as CATL and BYD, robust government targets for EV adoption, and rapid expansion by companies such as Mitsubishi and Panasonic to boost production capacity. Supported by strict emission regulations and continuous technological advancements, the Asia Pacific region is expected to maintain its dominance in the global market in the coming years.

EV Battery Market: COMPANY EVALUATION MATRIX

In the EV battery market matrix, CATL (Star) leads with a strong global presence and a comprehensive range of EV battery solutions, driving growth through strategic partnerships and new product launches. Samsung SDI (Emerging Leader) is gaining traction with continuous advancements in solid-state and high-nickel battery technologies, strategic collaborations with major automakers, and expanding production capacity. The company demonstrates strong potential to move into the leaders’ quadrant in the near future.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 91.93 Billion |

| Revenue Forecast in 2032 | USD 251.33 Billion |

| Growth Rate | CAGR of 9.6% from 2024-2035 |

| Actual data | 2019-2035 |

| Base year | 2023 |

| Forecast period | 2023-2035 |

| Units considered | Volume (Thousand Units) and Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Europe, and North America |

WHAT IS IN IT FOR YOU: EV Battery Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global OEM (US) |

|

|

| Battery Manufacturer (China) |

|

|

| Energy Utility (Europe) |

|

|

| EV Startup (India) |

|

|

| Investment Firm (Singapore) |

|

|

| Government Agency (Middle East) |

|

|

RECENT DEVELOPMENTS

- December 2024 : Stellantis NV (Netherlands) and Contemporary Amperex Technology Co., Limited (China) announced a joint venture to invest up to USD 4.2 billion in a large-scale lithium iron phosphate (LFP) battery plant in Zaragoza, Spain. The facility, aiming for 50 GWh capacity and set to begin production by the end of 2026, will support Stellantis' strategy to produce more affordable EVs while contributing to sustainability goals in Europe.

- November 2024 : SK On, a subsidiary of SK Innovation Co., Ltd. (South Korea), signed a three-year agreement with POSCO’s (South Korea) Lithium Solution division to acquire up to 15,000 tons of lithium hydroxide.

- September 2024 : BYD Company Ltd. (China) announced that it had signed a new battery recycling agreement with Lithium Australia (Australia).

- September 2024 : Panasonic Energy Co., Ltd., a subsidiary of Panasonic Holdings Corporation (Japan), announced that it had signed an agreement with Mazda Motor Corporation (Japan) for the supply of cylindrical lithium-ion batteries for Mazda’s upcoming BEVs set to be launched in 2027.

- August 2024 : Samsung SDI (South Korea) announced the establishment of a joint venture in the US with General Motors (US). The two companies are set to invest around USD 3.5 billion, with an initial capacity of around 27 GWh, with plans to increase the capacity to 36 GWh. Production is planned to start in 2027.

Table of Contents

Methodology

The research uses extensive secondary sources, such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the EV battery market. Primary sources, such as experts from related industries, OEMs, and suppliers, have been interviewed to obtain and verify critical information and assess the growth prospects and market estimations.

Secondary Research

Secondary sources for this research study include corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; whitepapers and electric vehicles and EV Battery-related journals; certified publications; articles by recognized authors; directories; and databases. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

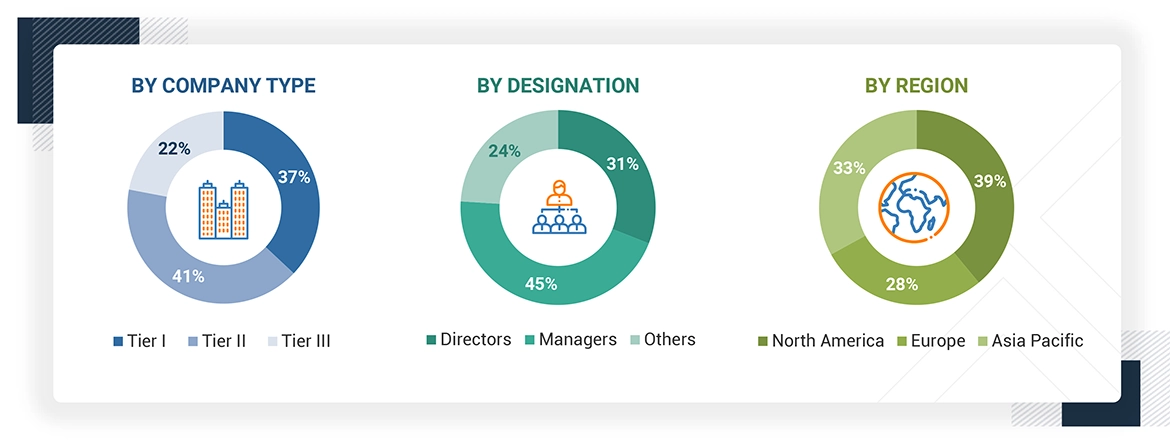

Primary Research

After understanding the EV battery market scenario through secondary research, extensive primary research has been conducted. Primary interviews have been conducted with market experts from both demand and supply sides across North America, Europe, and Asia Pacific. Approximately 43% of interviews have been conducted from the demand side, while 57% of primary interviews have been conducted from the supply side. The primary data has been collected through questionnaires, emails, and telephone interviews.

In the canvassing of primaries, various departments within organizations, such as sales and operations, have been covered to provide a holistic viewpoint in this report. Primary sources from the supply side include various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders have also been interviewed.

Note: Others include sales, managers, and product managers.

Company tiers are based on the value chain; the company's revenue is not considered.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the web content management market. The first approach involves estimating the market size by companies’ revenue generated through the sale of WCM products.

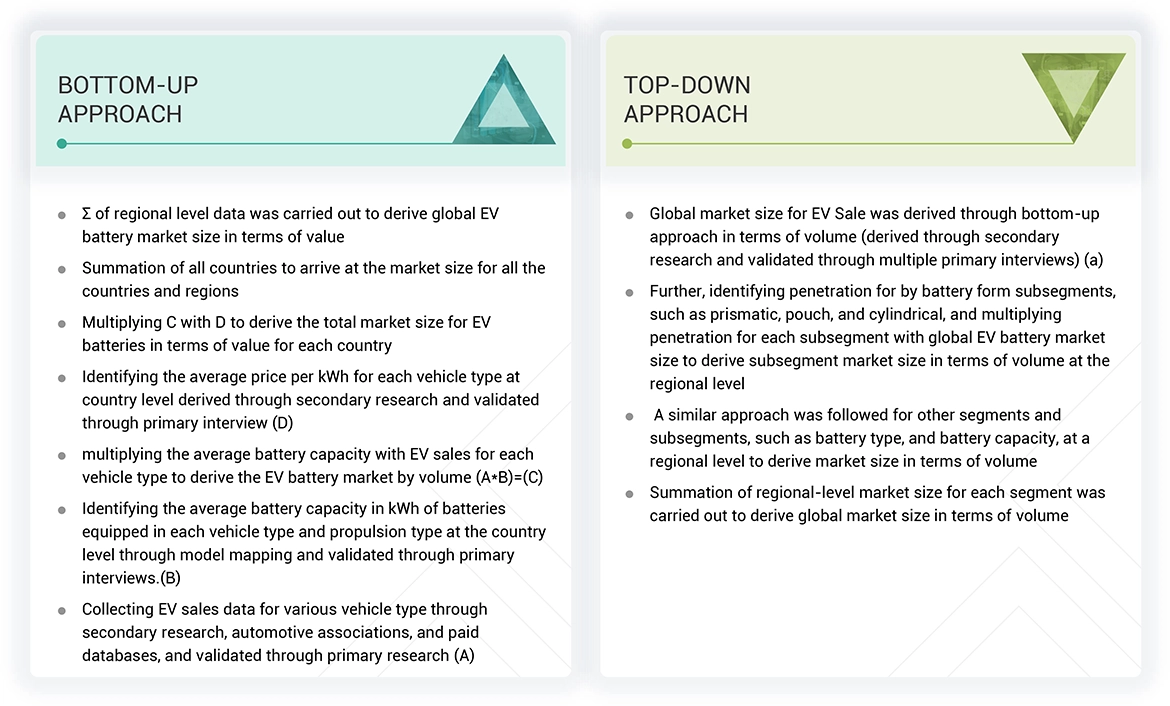

Market Size Estimation Methodology- Top-down approach

Both top-down and bottom-up approaches were used to estimate and validate the total size of the EV battery market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

EV Battery Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size of the global market through the methodology mentioned above, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact market value data for the key segments and sub-segments, wherever applicable. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand and supply-side participants.

Market Definition

According to the Batteries Directive 2006/66/EC, batteries are defined as any source of electrical energy generated by direct conversion of chemical energy and consisting of one or more primary battery cells (non-rechargeable) or one or more secondary battery cells (rechargeable). An EV battery is a rechargeable battery used to power BEVs), PHEVs, and HEVs. An EV battery usually comprises numerous small, individual cells arranged in series or parallel to achieve the desired voltage and capacity.

Stakeholders

- Automotive OEMs

- Battery-related Service Providers

- End Users

- EV Battery Casing Manufacturers

- EV Component Manufacturers

- EV Battery Manufacturing Organizations

- EV Battery Cell Manufacturing Organizations

- EV Battery Pack Manufacturing Organizations

- EV Battery Raw Material Miners and Suppliers

- EV Battery Raw Material Refinery Companies

- EV Infrastructure Component Manufacturers

- EV Infrastructure Developers

- Government Bodies (who directly and indirectly provide incentives, aid, and orders to EV manufacturers)

- Manufacturers of Electric Vehicles (EVs)

- Regulatory Bodies

- Traders and Distributors of Electric Vehicles

- Traders, Distributors, and Suppliers of EV Battery Components

Report Objectives

- To analyze and forecast the EV battery market in terms of volume (thousand units) and value (USD million) from 2024 to 2035

-

To segment the market by Battery Capacity, Battery Form, Battery Type, Lithium-ion Battery Component, Material Type, Method, Propulsion, Vehicle Type, and Region

- To segment and forecast the market by Battery Capacity (<50 kWh, 51-110 kWh, 111-200 kWh, 201-300 kWh, and >301 kWh)

- To segment and forecast the market by Battery Form (Prismatic, Pouch, and Cylindrical)

- To segment and forecast the market by Battery Type (Lithium-ion, Nickel-metal Hydride, Solid-state, and Sodium-ion)

- To segment and forecast the market by Lithium-ion Battery Component (Negative electrode, Positive electrode, Electrolyte, and Separator)

- To segment and forecast the market by Material Type (Cobalt, Lithium, Natural Graphite, Manganese, Iron, Phosphate, and Nickel)

- To segment and forecast the market by Method (Wire Bonding, Laser Bonding, and Ultrasonic Metal Welding)

- To segment and forecast the market by Propulsion (Battery Electric Vehicles, Plug-In Hybrid Electric Vehicles, Fuel Cell Electric Vehicles, and Hybrid Electric Vehicles)

- To segment and forecast the market by Vehicle Type (Passenger Cars, Vans/Light Trucks, Medium & Heavy Trucks, Buses, and Off-highway Vehicles)

- To forecast the market by Region (North America, Europe, and Asia Pacific)

- To identify and analyze key drivers, challenges, restraints, and opportunities influencing the market growth

- To strategically analyze the market for individual growth trends, prospects, and contributions to the total market

-

To study the following with respect to the market

- Pricing Analysis

- Investment and Funding Scenario

- Value Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- HS Code

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Key Stakeholders and Buying Criteria

- Key Conferences and Events

- To strategically profile the key players and comprehensively analyze their market share and core competencies

- To analyze the impact of AI on the market

- To track and analyze competitive developments such as deals, product launches/developments, expansions, and other activities undertaken by the key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company's specific needs.

- Additional Company Profiles (Up to 5)

- Global EV battery market, By Propulsion Type, at Country Level

- Global EV battery market, By Propulsion Type at Vehicle Type Level

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the EV Battery Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in EV Battery Market

John

Jun, 2022

Which factors are majorly influencing the global growth of EV Battery Market?.

Evan

Jul, 2022

We need details on the passenger cars segment for this market in Asia & Africa.