Cerebrospinal Fluid Management Market by Product (Shunts (Ventriculoperitoneal, Ventriculoatrial, Adjustable Valve), External Drainage Systems (EVD, Lumbar Drainage)), End User (Pediatric, Adult, Geriatric) - Global Forecast to 2022

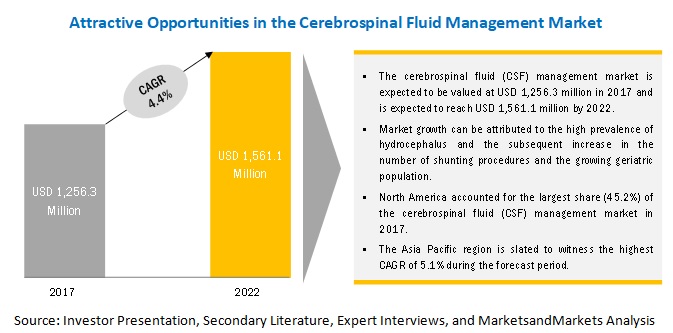

[120 Pages Report] Cerebrospinal fluid (CSF) management involves the use of devices such as shunts and external drainage systems to maintain the flow of CSF and drain excess fluid from the brain. Over the years, the disease burden of hydrocephalus has increased considerably, increasing the demand for CSF management devices as a method of treatment. The high prevalence of hydrocephalus and the subsequent increase in the number of shunting procedures and the growing geriatric population are major factors driving the market growth. The growing healthcare market in developing economies is also expected to provide growth opportunities for players in the market. On the other hand, the dearth of trained professionals and complications related to CSF shunts may challenge market growth to a certain extent.

The cerebrospinal fluid (CSF) management market is projected to reach USD 1,561.1 million by 2022 from an estimated USD 1,256.3 million in 2017, at a CAGR of 4.4%. The market is further segmented based on products, end-users, and regions.

Shunts to dominate the cerebrospinal fluid (CSF) management market in

The large market share of this product segment can be attributed to the growing number of shunting procedures performed worldwide as well as the increasing number of revisions shunt surgeries owing to shunt malfunction and infection.

Ventriculoperitoneal segment dominated the CSF shunts market in 2017

On the basis of type, the shunts market is segmented into ventriculoperitoneal (VP), ventriculoatrial (VA), ventriculopleural (VPL), and lumboperitoneal (LP) shunts. This segment is also estimated to register the highest CAGR during the forecast period. Factors propelling the growth of this segment include the advantages associated with these shunts over other shunts, such as reduced chances of revision surgery and the lower average length of hospital stay.

Adjustable valve shunts accounted for the largest share of the CSF shunts market in

On the basis of valve type, the shunts market is categorized into fixed and adjustable. The adjustable segment commanded the largest share of the shunts market in 2017 and is also estimated to register the highest CAGR during the forecast period. The major factor contributing to the growth of this market segment is the reduced intervention for the alteration of CSF flow along with their rising adoption in developed countries.

External ventricular drainage to command the largest share of external drainage systems market in 2017

On the basis of type, the external drainage systems market is categorized into external ventricular drainage (EVD) systems and lumbar drainage (LD) systems. The external ventricular drainage systems segment commanded the largest share of the external drainage systems market in 2017 and is also estimated to register the highest CAGR of during the forecast period. This can be attributed to its growing application for the treatment of acute hydrocephalus and obstructive hydrocephalus.

Pediatric end-user segment dominated the cerebrospinal fluid management market in 2017

On the basis of end-users, the market is categorized into pediatric, adult, and geriatric end users. The pediatric segment commanded the largest share of the cerebrospinal fluid (CSF) management market in 2017 and is also estimated to register the highest CAGR during the forecast period. This can be attributed to the high prevalence of congenital hydrocephalus along with the rising number of shunting procedures in the pediatric population.

APAC to account for the highest market growth during the forecast period

Asia Pacific is the third-largest market for CSF management and is slated to register the highest CAGR during the forecast period. Factors contributing to this growth include the high prevalence of congenital hydrocephalus in China, a growing geriatric population in Japan, and increasing medical tourism in India and several RoAPAC countries.

Market Dynamics

Driver: High prevalence of hydrocephalus and the subsequent increase in the number of shunting procedures

Hydrocephalus affects a large number of people worldwide. According to the Hydrocephalus Association, more than 1 million people in the US are reportedly suffering from hydrocephalus. Similarly, 700,000 older Americans are living with normal pressure hydrocephalus (NPH). According to CURE Hydrocephalus estimates, over 400,000 newborns suffer from infant hydrocephalus around the globe each year. Moreover, congenital hydrocephalus affects a huge number of infants worldwide.

Opportunity: Growing healthcare market in developing economies

Brazil, Russia, India, China, and South Africa (BRICS) are among the fastest-growing economies in the world. The World Economic Forum estimates that these emerging economies will account for around one-third of the global healthcare expenditure by 2020. Moreover, more than half of the worlds population resides in India and China, owing to which these countries are home to a large patient pool.

Hydrocephalus affects a large number of people in developing countries. According to CURE Hydrocephalus, of the total number of children born with hydrocephalus globally, 79% are born in the developing world. It was estimated that there were over 6,000 new cases of hydrocephalus reported per year in East Africa. According to the International Federation for Spina Bifida and Hydrocephalus, over 375,000 new cases of infant hydrocephalus are reported in sub-Saharan Africa each year.

The presence of such a huge patient base in the emerging economies, along with rising healthcare expenditure, is expected to serve as an opportunity for players in the CSF management market.

Challenge: Complications related to CSF Shunts

Hydrocephalus can be treated with a shunt system; however, this treatment often includes complications. The most common shunt complications include malfunction, infection, and shunt obstruction. According to Pediatric Emergency Medicine Reports, about 40% of shunts fail within the first year and 5680% by 10 years. Additionally, between 810% of shunts eventually become infected. Shunt malfunction can lead to an acute increase in intracranial pressure (ICP), causing irreparable impairment of the brain.

Moreover, according to the Hydrocephalus Association, an estimated 50% of shunts in the pediatric population fail within two years of placement and often require repeat surgery. These shunt failures account for more than 15,000 pediatric hospital admissions per year, with an estimated mortality rate of 12% (Source: Pediatric Emergency Medicine Reports). According to Seattle Children's Hospital, each year, about 38,000 surgeries are performed to replace failed shunts in the US.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2015 2022 |

|

Base year considered |

2016 |

|

Forecast period |

2017 2022 |

|

Forecast units |

Million/Billion (USD) |

|

Segments covered |

Product, End User, and Region |

|

Geographies covered |

North America, Europe, APAC, RoW (South America, Middle East, and Africa) |

|

Companies covered |

Key market players, including |

The research report categorizes the Cerebrospinal Fluid Market to forecast the revenues and analyze the trends in each of the following sub-segments:

Cerebrospinal Fluid Market, By Product

- CSF Shunts

- External Drainage Systems

Cerebrospinal Fluid Market, By End User

- Pediatric

- Adult

- Geriatric

Cerebrospinal Fluid Market, By Geography

- North America

- Europe

- Asia Pacific (APAC)

- RoW

Key Market Players

Medtronic, Integra, DePuy Synthes, and B.Braun.

Recent Developments

- In 2018, Aesculap, a subsidiary of B. Braun entered into a joint venture with Christoph Miethke GmbH & Co. KG. to form B. Braun Miethke GmbH & Co. KG. The joint venture is expected to strengthen B. Braun's offering in the CSF management market.

- In 2017, Integra LifeSciences acquired Johnson & Johnson Codman Neurosurgery, this acquisition aimed at enhancing Integras product portfolio and position in the neurosurgery market.

- In 2017, Natus medical acquired certain neurosurgery business assets from Integra LifeSciences. The businesses acquired include the global Camino ICP monitoring product line along with its San Diego manufacturing facility, and the US rights to Integra's fixed pressure shunts and Codman's DURAFORM dural graft implant, standard EVD catheters, and CSF collection systems. This acquisition is expected to strengthen the companys offering in CSF management market.

- In 2014, B. Braun Medical opened a new subsidiary, B. Braun of Canada. This helped expand the companys presence in the North American market.

Critical questions the report answers:

- What are the upcoming trends for the Cerebrospinal Fluid Market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Cerebrospinal Fluid Management Market: Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Cerebrospinal Fluid Management Market: Research Methodology (Page No. - 15)

2.1 Research Design

2.2 Research Approach

2.2.1 Secondary Research

2.2.1.1 Secondary Sources

2.2.2 Primary Research

2.2.2.1 Primary Sources

2.3 Market Size Estimation Methodology

2.4 Market Data Validation and Triangulation

2.5 Assumptions for the Study

3 Cerebrospinal Fluid Management Market: Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 29)

4.1 Global Cerebrospinal Fluid Management Market: Market Overview

4.2 Market, By End User and Region

4.3 Geographic Snapshot: Market

4.4 Cerebrospinal Fluid Management Market, By Product

5 Market Overview (Page No. - 33)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 High Prevalence of Hydrocephalus and the Subsequent Increase in the Number of Shunting Procedures

5.1.1.2 Growing Geriatric Population

5.1.2 Opportunities

5.1.2.1 Growing Healthcare Market in Developing Economies

5.1.3 Challenges

5.1.3.1 Dearth of Trained Professionals

5.1.3.2 Complications Related to CSF Shunts

6 Cerebrospinal Fluid Management Market, By Product (Page No. - 38)

6.1 Introduction

6.2 Shunts

6.2.1 Shunts Market, By Type

6.2.1.1 Ventriculoperitoneal (VP) Shunts

6.2.1.2 Ventriculoatrial (VA) Shunts

6.2.1.3 Lumboperitoneal (LP) Shunts

6.2.1.4 Ventriculopleural (VPL) Shunts

6.2.2 Shunts Market, By Valve Type

6.2.2.1 Fixed Valve Shunts

6.2.2.2 Adjustable Valve Shunts

6.3 External Drainage Systems

6.3.1 External Ventricular Drainage (EVD) Systems

6.3.2 Lumbar Drainage (LD) Systems

7 Cerebrospinal Fluid Management Market, By End User (Page No. - 48)

7.1 Introduction

7.2 Pediatric End Users

7.3 Adult End Users

7.4 Geriatric End Users

8 Cerebrospinal Fluid Management Market, By Region (Page No. - 53)

8.1 Introduction

8.2 North America

8.2.1 Us

8.2.2 Canada

8.3 Europe

8.3.1 EU5

8.3.2 RoE

8.4 Asia Pacific

8.4.1 Japan

8.4.2 China

8.4.3 India

8.4.4 Rest of Asia Pacific

8.5 Rest of the World

9 Market Share Analysis (Page No. - 90)

9.1 Introduction

9.1.1 Medtronic

9.1.2 Depuy Synthes

9.1.3 B.Braun

9.1.4 Integra

9.1.5 Other Players

10 Company Profiles (Page No. - 92)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

10.1 Medtronic

10.2 Integra Lifesciences Holdings Corporation

10.3 B. Braun Melsungen

10.4 Spiegelberg GmbH & Co. Kg

10.5 SOPHYSA (A Subsidiary of TKB Group)

10.6 Natus Medical Incorporated

10.7 Dispomedica GmbH

10.8 Deltasurgical

10.9 Argi Grup

10.10 Moller Medical GmbH

10.11 G.SURGIWEAR LTD

10.12 Wellong Instruments Co., Ltd

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 112)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Introducing RT: Real-Time Market Intelligence

11.3.1 Features and Benefits of RT :

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (92 Tables)

Table 1 Prevalence of Congenital Hydrocephalus, 2012

Table 2 Population Aged 60 and Above, By Region, 2017

Table 3 Neurosurgery Workforce in Major Countries, 2016

Table 4 CSF Management Market, By Product, 20152022 (USD Million)

Table 5 CSF Management Shunts Market, By Region, 20152022 (USD Million)

Table 6 Differences Between the Types of CHF Shunts Available in the Market

Table 7 CSF Management Shunts Market, By Type, 20152022 (USD Million)

Table 8 Ventriculoperitoneal Shunts Market, By Region, 20152022 (USD Million)

Table 9 Ventriculoatrial Shunts Market, By Region, 20152022 (USD Million)

Table 10 Lumboperitoneal Shunts Market, By Region, 20152022 (USD Million)

Table 11 Ventriculopleural Shunts Market, By Region, 20152022 (USD Million)

Table 12 CSF Management Shunts Market, By Valve Type, 20152022 (USD Million)

Table 13 Fixed Valve Shunts Market, By Region, 20152022 (USD Million)

Table 14 Adjustable Valve Shunts Market, By Region, 20152022 (USD Million)

Table 15 Differences Between External Ventricular Drainage and Lumbar Drainage Systems

Table 16 CSF Management External Drainage Systems Market, By Type, 20152022 (USD Million)

Table 17 CSF Management External Drainage Systems Market, By Region, 20152022 (USD Million)

Table 18 External Ventricular Drainage Systems Market, By Region, 20152022 (USD Million)

Table 19 Lumbar Drainage Systems Market, By Region, 20152022 (USD Million)

Table 20 CSF Management Market, By End User, 20152022 (USD Million)

Table 21 Pediatric CSF Management Market, By Region, 20152022 (USD Million)

Table 22 Adult CSF Management Market, By Region, 20152022 (USD Million)

Table 23 Geriatric CSF Management Market, By Region, 20152022 (USD Million)

Table 24 CSF Management Market, By Region, 20152022 (USD Million)

Table 25 North America: Market, By Country, 20152022 (USD Million)

Table 26 North America: Cerebrospinal Fluid Management Market, By Product, 20152022 (USD Million)

Table 27 North America: Cerebrospinal Fluid Management Shunts Market, By Type, 20152022 (USD Million)

Table 28 North America: Cerebrospinal Fluid Management Shunts Market, By Valve Type, 20152022 (USD Million)

Table 29 North America: Cerebrospinal Fluid Management External Drainage Systems Market, By Type, 20152022 (USD Million)

Table 30 North America: Market, By End User, 20152022 (USD Million)

Table 31 Hydrocephalus Research Projects in the Us, 20142018

Table 32 US: Cerebrospinal Fluid Management Market, By Product, 20152022 (USD Million)

Table 33 US: Cerebrospinal Fluid Management Shunts Market, By Type, 20152022 (USD Million)

Table 34 US: Cerebrospinal Fluid Management Shunts Market, By Valve Type, 20152022 (USD Million)

Table 35 US: Cerebrospinal Fluid Management External Drainage Systems Market, By Type, 20152022 (USD Million)

Table 36 US: Market, By End User, 20152022 (USD Million)

Table 37 Hydrocephalus Canada: Funds Raised and Program Spending, 2016

Table 38 Canada: Cerebrospinal Fluid Management Market, By Product, 20152022 (USD Million)

Table 39 Canada: Cerebrospinal Fluid Management Shunts Market, By Type, 20152022 (USD Million)

Table 40 Canada: Cerebrospinal Fluid Management Shunts Market, By Valve Type, 20152022 (USD Million)

Table 41 Canada: Cerebrospinal Fluid Management External Drainage Systems Market, By Type, 20152022 (USD Million)

Table 42 Canada: Market, By End User, 20152022 (USD Million)

Table 43 Europe: Market, By Region, 20152022 (USD Million)

Table 44 Europe: Cerebrospinal Fluid Management Market, By Product, 20152022 (USD Million)

Table 45 Europe: Cerebrospinal Fluid Management Shunts Market, By Type, 20152022 (USD Million)

Table 46 Europe: Cerebrospinal Fluid Management Shunts Market, By Valve Type, 20152022 (USD Million)

Table 47 Europe: Cerebrospinal Fluid Management External Drainage Systems Market, By Type, 20152022 (USD Million)

Table 48 Europe: Market, By End User, 20152022 (USD Million)

Table 49 Shunting Procedures in the UK, 20102014

Table 50 EU5: Market, By Product, 20152022 (USD Million)

Table 51 EU5: Cerebrospinal Fluid Management Shunts Market, By Type, 20152022 (USD Million)

Table 52 EU5: Cerebrospinal Fluid Management Shunts Market, By Valve Type, 20152022 (USD Million)

Table 53 EU5: Cerebrospinal Fluid Management External Drainage Systems Market, By Type, 20152022 (USD Million)

Table 54 EU5: Cerebrospinal Fluid Management Market, By End User, 20152022 (USD Million)

Table 55 Geriatric Population in RoE Countries (As A Percentage of the Total Population)

Table 56 RoE: CSF Management Market, By Product, 20152022 (USD Million)

Table 57 RoE: CSF Management Shunts Market, By Type, 20152022 (USD Million)

Table 58 RoE: CSF Management Shunts Market, By Valve Type, 20152022 (USD Million)

Table 59 RoE: CSF Management External Drainage Systems Market, By Type, 20152022 (USD Million)

Table 60 RoE: CSF Management Market, By End User, 20152022 (USD Million)

Table 61 Asia Pacific: CSF Management Market, By Country, 20152022 (USD Million)

Table 62 Asia Pacific: CSF Management Market, By Product, 20152022 (USD Million)

Table 63 Asia Pacific: CSF Management Shunts Market, By Type, 20152022 (USD Million)

Table 64 Asia Pacific: CSF Management Shunts Market, By Valve Type, 20152022 (USD Million)

Table 65 Asia Pacific: CSF Management External Drainage Systems Market, By Type, 20152022 (USD Million)

Table 66 Asia Pacific: Cerebrospinal Fluid Management Market, By End User, 20152022 (USD Million)

Table 67 Japan: Market, By Product, 20152022 (USD Million)

Table 68 Japan: CSF Management Shunts Market, By Type, 20152022 (USD Million)

Table 69 Japan: CSF Management Shunts Market, By Valve Type, 20152022 (USD Million)

Table 70 Japan: CSF Management External Drainage Systems Market, By Type, 20152022 (USD Million)

Table 71 Japan: Cerebrospinal Fluid Management Market, By End User, 20152022 (USD Million)

Table 72 China: Market, By Product, 20152022 (USD Million)

Table 73 China: CSF Management Shunts Market, By Type, 20152022 (USD Million)

Table 74 China: CSF Management Shunts Market, By Valve Type, 20152022 (USD Million)

Table 75 China: CSF Management External Drainage Systems Market, By Type, 20152022 (USD Million)

Table 76 China: Cerebrospinal Fluid Management Market, By End User, 20152022 (USD Million)

Table 77 India: Market, By Product, 20152022 (USD Million)

Table 78 India: CSF Management Shunts Market, By Type, 20152022 (USD Million)

Table 79 India: CSF Management Shunts Market, By Valve Type, 20152022 (USD Million)

Table 80 India: CSF Management External Drainage Systems Market, By Type, 20152022 (USD Million)

Table 81 India: Market, By End User, 20152022 (USD Million)

Table 82 RoAPAC: Cerebrospinal Fluid Management Market, By Product, 20152022 (USD Million)

Table 83 RoAPAC: CSF Management Shunts Market, By Type, 20152022 (USD Million)

Table 84 RoAPAC: CSF Management Shunts Market, By Valve Type, 20152022 (USD Million)

Table 85 RoAPAC: CSF Management External Drainage Systems Market, By Type, 20152022 (USD Million)

Table 86 RoAPAC: Cerebrospinal Fluid Management Market, By End User, 20152022 (USD Million)

Table 87 Middle East & Latin America: Population Aged 65 Years & Above (% of the Total Population)

Table 88 RoW: Market, By Product, 20152022 (USD Million)

Table 89 RoW: CSF Management Shunts Market, By Type, 20152022 (USD Million)

Table 90 RoW: CSF Management Shunts Market, By Valve Type, 20152022 (USD Million)

Table 91 RoW: CSF Management External Drainage Systems Market, By Type, 20152022 (USD Million)

Table 92 RoW: Cerebrospinal Fluid Management Market, By End User, 20152022 (USD Million)

List of Figures (31 Figures)

Figure 1 Research Design: CSF Management Market

Figure 2 CSF Management Market: Research Methodology Steps

Figure 3 Sampling Frame: Primary Research

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Key Industry Insights

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation Methodology

Figure 9 Shunts to Dominate the Cerebrospinal Fluid Management Market in 2017

Figure 10 Ventriculoperitoneal Segment Dominated the CSF Shunts Market in 2017

Figure 11 Adjustable Valve Shunts Accounted for the Largest Share of the CSF Shunts Market in 2017

Figure 12 External Ventricular Drainage to Command the Largest Share of External Drainage Systems Market in 2017

Figure 13 Pediatric End-User Segment Dominated the Cerebrospinal Fluid Management Market in 2017

Figure 14 Asia Pacific to Witness the Highest Market Growth During the Forecast Period

Figure 15 Increasing Prevalence of Hydrocephalus and Growing Geriatric Population are Driving Market Growth

Figure 16 Pediatric End-User Segment Dominated the Cerebrospinal Fluid Management Market in 2017

Figure 17 Asia Pacific to Witness the Highest Growth During the Forecast Period

Figure 18 Shunts Commanded the Largest Market Share in 2017

Figure 19 Market: Drivers, Opportunities, and Challenges

Figure 20 Shunts Dominated the Cerebrospinal Fluid Management Market in 2017

Figure 21 Pediatric End Users to Dominate the Cerebrospinal Fluid Management Market in 2017

Figure 22 North America to Command the Largest Share of the Market in 2017

Figure 23 North America: Market Snapshot

Figure 24 Europe: Market Snapshot

Figure 25 Asia Pacific: Cerebrospinal Fluid Management Market Snapshot

Figure 26 RoW: CSF Management Market Snapshot

Figure 27 Value-Based Market Shares of Key Players, 2016

Figure 28 Medtronic: Company Snapshot (2016)

Figure 29 Integra Lifesciences Holdings Corporation: Company Snapshot (2017)

Figure 30 B. Braun Melsungen: Company Snapshot (2017)

Figure 31 Natus Medical Incorporated: Company Snapshot (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cerebrospinal Fluid Management Market