Cleaning Robot Market Share by Type, Product (Floor Cleaning Robots, Lawn Cleaning Robots, Pool Cleaning Robots, Window Cleaning Robots), Operation Mode (Self-driven, Remote Controlled), Sales Channel, Application and Region - Global Forecast to 2030

The Cleaning Robot Market is projected to grow from USD 17.97 billion in 2025 to USD 41.5 billion by 2030; it is expected to grow at a CAGR of 18.2% during the forecast period. Increasing development in vacuum cleaners with self-charging capabilities and compact size will drive the cleaning robot market growth in coming years. The rapidly advancing smart home technology and the increasing penetration of AI and IoT in household appliances have allowed the development of cleaning robots, further strengthening the market growth. Cleaning robots are available in the market in various forms and designs for various purposes. Cleaning robots, such as robot vacuum cleaners, are generally used for residential as well as commercial sectors. They are also deployed in various commercial applications such as malls, offices, manufacturing plants, airports, etc.

To know about the assumptions considered for the study, Request for Free Sample Report

Cleaning Robot Market Dynamics

Drivers: Growing penetration of AI and IoT in household appliances

The development of AI and IoT has provided new avenues for robots to interact and work with humans. Also, the development and evolution of MEMS (micro-electromechanical systems) and sensors and enhancements in visualization technologies have improved the efficiency and accuracy of robots. The growth in the cleaning robot market is led by innovation and modernization in the field of robotics. Technological advancements and research activities have led to the development of cleaning robots, helping humans perform mundane tasks. In addition to this, technological advancements in manufacturing, sensors, and visualization equipment have further resulted in low-cost cleaning robots that are specialized to carry out cleaning. The development of IoT and wireless technologies has given users the power to control robots using remotes or smartphones. A user can schedule a cleaning phase without being present in the house. Such improvements and flexibility are boosting the cleaning robot market growth. The compatibility and integration of cleaning robots with smart speakers such as Amazon Echo and Google Home and virtual assistants such as Alexa, Siri, and Google Assistant, among others have further increased the automation of these devices. Furthermore, companies such as Dyson (UK), iRobot Corporation (US), and Neato Robotics, Inc. (US) are also offering Wi-Fi-connected cleaning robots in the market further integrating the cleaning robots into the smart home network.

Restraints: Higher cost of personal cleaning robots

A cleaning robot is costlier than a traditional vacuum cleaner, which makes it less affordable for residential use. People from emerging economies such as India and China still rely on professional services, labor, or traditional vacuum cleaner machines for cleaning purposes. The cost of a cleaning robot in 2024 ranged from USD 250 to USD 999 and beyond. In developing nations, there is only a limited section of individuals who can afford cleaning robots, further, the consumer awareness and penetration of this kind of technology are less because they are expensive, as compared to developed economies of the Americas and Europe, which is acting as a restraint for the growth of cleaning robot providers to commercialize their products in these economies. Further, the high-end pricing of cleaning robots can restrain the development of cleaning robots because consumers may be reluctant to spend on a relatively expensive appliance. Thus, the excessive pricing of cleaning robots is restraint in market development. However, the price of cleaning robots has been coming down year after year due to technological advancements and economies of scale. As the prices continue to fall, the affordability constraint should decrease, maybe even leading to additional market expansion in the future.

Opportunities: Proliferation of cleaning robots in industrial applications

The adoption of cleaning robots is higher in the residential sector as compared to the commercial sector owing to features such as small size and automated cleaning (without any human interference). Companies such as ADLATUS Robotics GmbH, Combijet, and Cyberdyne Inc have helped in the commercialization of cleaning robots in the commercial and industrial sectors. In the commercial and industrial sectors, cleaning is done on a large scale, and cleaning robots help in saving labor costs, which, in turn, is helping the companies involved in these sectors to cut down on operation costs. This will further add an opportunity for cleaning robot manufacturers to accelerate their scope in new applications such as the industrial sector. Such robots are now involved in steel-cleaning operations, including high-pressure washing &cleaning and hydro blasting. The robots can be used in the maritime industry for cleaning/blasting vessels, the oil & gas sector to clean storage tanks, and industrial plants to clean metal structures. New advancements would help in enhancing cleaning robots for new applications. This would help replace manual labor and save time and cost. For instance, Ecoppia, a start-up company, is engaged in providing autonomous, water-free photovoltaic (PV)-panel cleaning technology for utility-scale solar installations using its E4 cleaning robot. Similarly, IBC Robotics is engaged in providing environmentally friendly cleaning solutions to transport containers using dry ice and a robot.

Challenges: Lower penetration of obstacle avoidance technology and perceiving unstructured human environment in cleaning robots

The demand for cleaning robots has drastically increased post-pandemic. The adoption of cleaning robots in the residential sector has been one of the key drivers for the market. These robots are laced with high-end technologies and offer multiple functions. Yet, they get blocked by the simplest and basic obstacles in houses. This is due to the lower penetration of obstacle avoidance technology in cleaning robots. As the market further expands, the demand for obstacle avoidance technology may increase and manufacturers would be forced to offer this technology leading to higher prices. This is a challenge for the market, which is expected to have a low impact and is expected to be removed within the next few years.

Further, the increasing applicability of cleaning robots in various fields such as commercial, industrial, personal services, logistics, and medical has propelled the need for the efficient performance of these robots. Therefore, it becomes essential to develop advanced robotic systems that can easily interact with humans for efficient performance. The human environment has various challenging activities and obstacles that are beyond the control of robots. Perceiving the unstructured human environment is the biggest challenge for robots. Thus, creating a robot that is proactive and can foresee the needs of humans becomes the most significant challenge for the cleaning robot market. Also, the suction capacity of cleaning robots is less than traditional vacuum cleaners, which is also a challenge for the cleaning robot market. However, further advancements could remove this challenge.

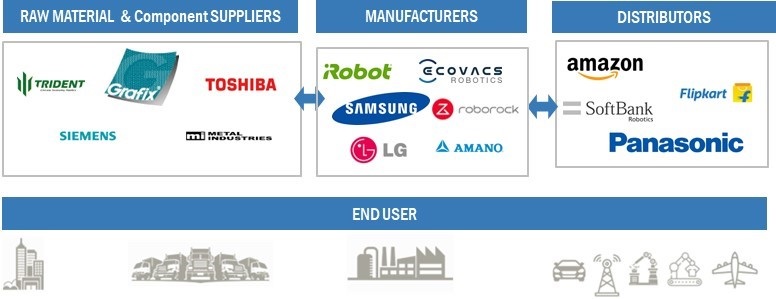

Cleaning Robot Ecosystem:

The entire supply chain AI ecosystem consists of a more complex technology chain with stakeholders and solutions. It brings in AI-based tools that are meant to support demand forecasting, inventory optimization, and logistics management, thus making a positive contribution to real-time insights and automation of each activity in the entire supply chain. This will include supply chain AI software providers, system integrators that gather, process, and analyze vast data sets to support predictions that are more accurate and workflows that are lean. Apart from that, there are technology developers, supply chain managers, and regulatory agencies that push the innovations in technology and promote seamless integration of AI solutions, thus resulting in agility, cost savings, and adaptability of the supply chain.

Personal cleaning robots to witness significant share in the cleaning robot market

The global market for personal cleaning robots is primarily being driven by expanding urban settlements and people's busier lives in urban areas. The main drivers of future demand for personal robotic vacuum cleaners are expected to be increased emphasis on hygiene, improved lifestyles in developing nations, busier daily schedules, and a lack of time for household duties. In addition, rising disposable earnings in dual-income households are strongly supporting the sales of vacuum cleaners across the world. iRobot Corporation (US), Dyson (UK), and Neato Robotics, Inc (US) are the major players in the cleaning robot market for personal use. For instance, in 2022, iRobot Corporation has refreshed its smart-vacuum cleaner portfolio in India with the new Roomba J7+. The new smart-vacuum cleaner currently sits with the existing Roomba i7 series, S9 series, i3 series, and more. Thus, rising developments by key market players are driving market growth. The increase in demand for personal cleaning robots and the growing R&D activities toward personal service robots for assistance in household applications are driving the market growth. In developed countries of North America and Europe, the market is primarily driven by a growing trend of automation and a rise in the adoption of smart devices for the smart home segment. Another key reason driving the growth of this market is the increasing consumer awareness created by the leading players.

Residential application to create lucrative growth opportunities for cleaning robots during the forecast period

The cleaning robot market for residential applications is expected to hold the largest market share during the forecast period. Floor-cleaning robots, commonly known as robotic vacuum cleaners, clean the dust from floors and different surfaces by using a suction mechanism created by a pneumatic machine installed in the unit. Cleaning robots in residential applications are utilized to perform tasks such as mopping and cleaning. In certain countries, employing domestic workers is too expensive. In such cases, cleaning robots can easily undertake the task of cleaning. A few robots are also equipped with security features such as alerting owners in case of any intruder or fire outbreak. Further, increasing product developments for residential cleaning robots are driving market growth. For instance, Ecovacs Robotics Co., Ltd, a market leader in the innovative robot vacuum cleaner category, has launched its advanced range of floor cleaning robots in India. Technological advancements are enabling these robots to become more practical and usable day by day. This is driving consumer demand and acceptance of such products. Rising consumer demand for autonomous robotic technology and the minimization of human intervention are factors driving market growth.

Cleaning robot market to witness the highest demand in Asia Pacific region

Asia Pacific is expected to witness high growth rate during forecast period. The demand for cleaning robots in Asia Pacific is driven with the strong buying power and fast adoption of new technologies in the region. Dyson (UK) first launched its flagship model, Dyson 360 Eye, in Japan, instead of the UK or the US. Apart from international players, Japanese companies such as Cyberdyne (Japan) and Panasonic (Japan) offer cleaning robots for residential and commercial purposes. In China, cleaning robots with integrated sweeping and mopping capabilities will continue to maintain rapid growth. The Chinese market also observes low levels of price sensitivity, and this is a key reason for the growth in high-end cleaning robots. Presently, China witnesses a decline in the cost of core components of robots and the maturity of the domestic market. As a result, the commercial cleaning robot market in China is preparing for the next order of magnitude increase in shipments. Yet, commercial cleaning robots are still in the early stage of development, and manufacturers are still spending a lot of money on product development and polishing, failing to form a positive cash flow.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major vendors in the AI in supply chain market include

- iRobot Corporationv (US)

- Ecovacs Robotics Co., Ltd (China)

- Samsung Electronics Co., Ltd. (South Korea)

- LG Electronics (South Korea)

- Xiaomi (China)

- Roborock (China)

- SharkNinja Operating LLC (US)

- Vorwerk & Co. KG, (Germany)

- Cecotec Innovaciones S.Lv (Spain)

- Panasonic Holdings Corporation (Japan)

- Diversey Holdings LTD (US)

- Koninklijke Philips N.V. (Netherlands)

- Amano Corporation (Japan)

- YUJIN ROBOT Co., Ltd (South Korea)

- Arcelik AS (Turkey)

Cleaning Robot Market Report Scope:

|

Report Metric |

Details |

| Estimated Market Size in 2022 | USD 18.0 Billion |

| Market size value in 2027 | USD 41.5 Billion |

| Growth rate | 18.2% |

|

Market size available for years |

2025—2030 |

|

Base year |

2030 |

|

Forecast period |

2025—2030 |

|

Segments covered |

|

|

Geographic regions covered |

|

|

Companies covered |

|

| Key Market Driver | IOT and AI in Household Appliances |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Residential Sector Segment |

| Highest CAGR Segment | Personal Cleaning Robots |

This report categorizes the Cleaning Robot market based on product, type, operation mode, sales channel, application, geography.

Cleaning Robot Market, by Operation Mode:

- Self-driven

- Remote Controlled

Cleaning Robot Market, by Type:

- Personal Cleaning Robots

- Professional Cleaning Robots

Cleaning Robot Market, by Product:

- Floor Cleaning Robots

- Lawn Cleaning Robots

- Pool Cleaning Robots

- Window Cleaning Robots

- Others

Cleaning Robot Market, by Sales Channel:

- Online

- Offline

Cleaning Robot Market, by Application:

- Residential

- Commercial

- Industrial

- Healthcare

- Others

Cleaning Robot Market, by Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- South Korea

- Rest of APAC

-

RoW

- Middle East

- Africa

- South America

Recent Developments

- In April 2024, Avidbots, announced the launch of Kas, a fully autonomous floor scrubber to meet the needs of the retail, transportation, health care and education industries. Avidbots previously showcased Kas and its Neo 2W robot at MODEX 2024 in Atlanta.

- In April 2024, RobotLAB, in partnership with LionsBot International, set out to broaden the availability of its leading industry cleaning robots to hospitality companies. Through the partnership, RobotLAB will include LionsBot's R3 and R12 product lines in its powerful robot line that comprises over 800 cleaning, delivery, education and hospitality robots.

- In August 2022, Amazon.com, Inc. (US) and iRobot Corporation (US) entered into a definitive merger agreement under which Amazon will acquire iRobot Corporation under its expansion strategy with a USD 1.7 billion bid. The takeover will strengthen Amazon's range of smart home devices and contribute to the retail giant's enormous storehouse of consumer information.

- In June 2022, Ecovacs Robotics Co., Ltd., (China) one of the global leaders in service robotics, is realizing its new commitment, "Robotics for all," by transforming the way floors are cleaned with the newly launched Al-enpowered DEEBOT T10 robot vacuum cleaner. The new DEEBOT combines future technology, such as AIVI 3.0 Upgraded Al-based Object Recognition and Avoidance technology, which offers tech-savvy homes' unique advantages. It also ushers in a new generation of human-robot interaction through YIKO Voice Assistant, turning the DEEBOT T10 into everybody's smart butler.

- In August 2022, Xiaomi (China) introduced the Mi Robot Vacuum-Mop 2 series in Europe, which consists of the Mop 25, Mop 2 Pro, and the Mop 2 Ultra.

Key Questions Addressed in the Report

Which are the major companies in the cleaning robot market? What are their major strategies to strengthen their market presence?

iRobot Corporation (US), Ecovacs Robotics Co., Ltd (China), Samsung Electronics Co., Ltd. (South Korea), Xiaomi (China), and Roborock (China)are the top players in the market. These companies have adopted organic as well as inorganic growth strategies such as product launch, acquisitions, and partnerships to gain competitive advantage in the market.

Which is the potential market for cleaning robot market in terms of the region?

The Asia Pacific is the region with high growth opportunities owing to rapid adoption of cleaning robots in the residential segment. China is one of the key countries for the cleaning robot market in Asia Pacific as the country is the major manufacturing hub for cleaning robots globally.

What are the opportunities for new market entrants?

Factors such as increasing adoption of cleaning robots in industrial applications and development of AI-enabled and voice-controlled smart cleaning robots are accelerating new product innovation and creating opportunities for the players in the market

Which applications are expected to drive the growth of the market in the next six years?

Rise in emphasis on hospital hygiene, followed by an improvement in patient care is expected to drive the demand for cleaning robots in coming years. Various robot manufacturers focus on manufacturing cleaning robots designed specifically for hospital facilities that can support human cleaning crews during room sanitization. Cleaning robots in the commercial sector provide hands-free operations to reduce costs and increase productivity. Consumers have started to prefer robots over domestic helpers. These robots have been commercially successful in the vacuuming market, which, in turn, has resulted in the increasing popularity of robotic vacuum cleaners.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 CLEANING ROBOT MARKET SEGMENTATION

1.4.2 GEOGRAPHIC SCOPE

FIGURE 2 CLEANING ROBOT INDUSTRY, BY REGION

1.4.3 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 3 CLEANING ROBOT INDUSTRY REVENUE IMPACT REPORT : RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

FIGURE 4 CLEANING ROBOT : RESEARCH APPROACH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach to arrive at market size using bottom-up analysis

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach to capture market size using top-down analysis

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY FOR CLEANING ROBOT MARKET INSIGHTS USING SUPPLY-SIDE ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 8 CLEANING ROBOT INDUSTRY : DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 RESEARCH ASSUMPTIONS

2.4.2 LIMITATIONS

2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 9 SELF-DRIVEN SEGMENT OF CLEANING ROBOT MARKET TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

FIGURE 10 PROFESSIONAL CLEANING ROBOTS TO REGISTER HIGHER CAGR IN MARKET FROM 2022 TO 2027

FIGURE 11 WINDOW-CLEANING ROBOT MARKET TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

FIGURE 12 ONLINE SALES CHANNEL TO REGISTER HIGHER CAGR IN MARKET DURING FORECAST PERIOD

FIGURE 13 RESIDENTIAL APPLICATION SEGMENT HELD LARGEST SIZE OF MARKET IN 2021

FIGURE 14 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CLEANING ROBOT MARKET

FIGURE 15 RISING LABOR COSTS AND INCREASING SAFETY CONCERNS TO FUEL GROWTH OF CLEANING ROBOT MARKET

4.2 CLEANING ROBOT MARKET SHARE, BY TYPE

FIGURE 16 PERSONAL CLEANING ROBOTS TO HOLD LARGER MARKET SIZE FROM 2022 TO 2027

4.3 CLEANING ROBOT MARKET SIZE, BY OPERATION MODE

FIGURE 17 SELF-DRIVEN SEGMENT TO HOLD LARGER SHARE OF MARKET IN 2027

4.4 MARKET, BY PRODUCT

FIGURE 18 FLOOR-CLEANING ROBOTS TO HOLD LARGEST MARKET SIZE IN 2027

4.5 MARKET, BY SALES CHANNEL

FIGURE 19 ONLINE SALES CHANNEL TO HOLD LARGER SHARE OF MARKET IN 2027

4.6 MARKET, BY APPLICATION

FIGURE 20 RESIDENTIAL APPLICATIONS TO HOLD LARGEST SIZE OF CLEANING ROBOT MARKET FROM 2022 TO 2027

4.7 MARKET, BY GEOGRAPHY

FIGURE 21 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 CLEANING ROBOT INDUSTRY : DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

FIGURE 23 MARKET DRIVERS AND THEIR IMPACT

5.2.1.1 Growing penetration of AI and IoT in household appliances

5.2.1.2 Rising labor costs and safety concerns

5.2.1.3 Increasing improvements in vacuum cleaners

5.2.1.4 Surging need for disinfecting robots in healthcare facilities

5.2.1.5 Increasing adoption of cleaning robots in commercial sector

5.2.2 RESTRAINTS

FIGURE 24 CLEANING ROBOT MARKET INSIGHTS RESTRAINTS AND THEIR IMPACT

5.2.2.1 High cost of personal cleaning robots

FIGURE 25 GDP PER CAPITA: INDIA VS. US (2014–2021)

5.2.3 OPPORTUNITIES

FIGURE 26 MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.3.1 Proliferation of cleaning robots in industrial applications

5.2.3.2 Increase in safety concerns at homes

5.2.3.3 AI-enabled and voice-controlled smart cleaning robots

5.2.4 CHALLENGES

FIGURE 27 MARKET CHALLENGES AND THEIR IMPACT

5.2.4.1 Difficulties pertaining to unstructured human environments

5.2.4.2 Low penetration of obstacle avoidance technology in cleaning robots

5.3 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET PLAYERS

5.4 VALUE CHAIN ANALYSIS

FIGURE 28 VALUE CHAIN ANALYSIS OF CLEANING ROBOT MARKET REVENUE IMPACT REPORT

TABLE 1 CLEANING ROBOT SHARE : VALUE CHAIN

5.5 CLEANING ROBOT ECOSYSTEM/MARKET MAPPING

FIGURE 29 ECOSYSTEM OF CLEANING ROBOTS

5.6 PRICING ANALYSIS

TABLE 2 AVERAGE SELLING PRICE OF CLEANING ROBOTS, BY TYPE, 2018–2021 (USD)

TABLE 3 AVERAGE SELLING PRICE OF CLEANING ROBOTS, BY TYPE, 2022–2027 (USD)

5.6.1 PROFESSIONAL CLEANING ROBOTS

TABLE 4 AVERAGE SELLING PRICE OF PROFESSIONAL CLEANING ROBOTS

5.6.2 PERSONAL CLEANING ROBOTS

TABLE 5 AVERAGE SELLING PRICE OF PERSONAL CLEANING ROBOTS

5.6.3 ASP ANALYSIS OF KEY PLAYERS

FIGURE 30 AVERAGE SELLING PRICE OF CLEANING ROBOTS, BY TYPE

TABLE 6 AVERAGE SELLING PRICE ANALYSIS OF PLAYERS, BY TYPE

5.6.4 ASP TRENDS

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 31 REVENUE SHIFT IN CLEANING ROBOT MARKET

5.7.1 ULTRAVIOLET RADIATION TECHNOLOGY FOR DISINFECTION OF SURFACES

5.7.2 INCREASING AUTONOMY OF CLEANING ROBOTS

5.8 TECHNOLOGY ANALYSIS

5.8.1 INTEGRATION OF AI INTO ROBOTS

5.8.2 RESEARCH ON STANDARD OPERATING SYSTEMS FOR ROBOTS

5.8.3 GROWTH OF ROBOT AS SERVICE BUSINESS MODEL

5.8.4 AUTONOMOUS CLEANING TECHNOLOGY

5.9 PORTER’S FIVE FORCES MODEL

TABLE 7 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.10 STAKEHOLDERS AND BUYING CRITERIA

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

5.10.2 BUYING CRITERIA

5.11 CASE STUDY

5.11.1 USE CASE 1: GLAD GROUP

5.11.2 USE CASE 2: DHL

5.11.3 USE CASE 3: HANTING HOTEL

5.11.4 USE CASE 4: HELSINKI-VANTAA AIRPORT

5.11.5 USE CASE 5: CORE FACILITY SERVICES, LLC

5.12 TRADE ANALYSIS

5.12.1 VACUUM CLEANERS

FIGURE 33 EXPORTS, BY COUNTRY, 2017–2021 (USD MILLION)

FIGURE 34 IMPORTS, BY COUNTRY, 2017–2021 (USD MILLION)

5.13 PATENT ANALYSIS

FIGURE 35 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

FIGURE 36 NUMBER OF PATENTS GRANTED PER YEAR FROM 2011 TO 2021

TABLE 9 LIST OF TOP 20 PATENT OWNERS IN LAST 10 YEARS

TABLE 10 LIST OF MAJOR PATENTS

5.14 KEY CONFERENCES AND EVENTS, 2022–2024

TABLE 11 CLEANING ROBOT MARKET INSIGHTS : DETAILED LIST OF CONFERENCES & EVENTS

5.15 REGULATORY LANDSCAPE

5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.15.2 STANDARDS AND REGULATIONS RELATED TO CLEANING ROBOTS

5.15.2.1 North America

5.15.2.1.1 US

5.15.2.2 Europe

5.15.2.3 Asia Pacific

5.15.2.3.1 Japan

5.15.2.3.2 China

6 MARKET, BY CONNECTIVITY TECHNOLOGY (Page No. - 90)

6.1 INTRODUCTION

FIGURE 37 CLEANING ROBOT SHARE, BY CONNECTIVITY TECHNOLOGY

6.2 BLUETOOTH

6.2.1 INCREASING PENETRATION OF SMARTPHONES TO CONTROL CLEANING ROBOTS

6.3 WI-FI

6.3.1 GROWING DEVELOPMENT IN WI-FI CONNECTIVITY TO DRIVE MARKET

6.4 ZIGBEE

6.4.1 RISING INTEGRATION OF IOT IN ROBOTS FOR COST-EFFICIENT PREDICTIVE MAINTENANCE

7 CLEANING ROBOT MARKET REVENUE IMPACT REPORT, BY OPERATION MODE (Page No. - 92)

7.1 INTRODUCTION

FIGURE 38 MARKET, BY OPERATION MODE

FIGURE 39 SELF-DRIVEN MARKET TO GROW AT HIGHER CAGR BETWEEN 2022 AND 2027

TABLE 16 MARKET, BY OPERATION MODE, 2018–2021 (USD MILLION)

TABLE 17 MARKET, BY OPERATION MODE, 2022–2027 (USD MILLION)

TABLE 18 MARKET, BY OPERATION MODE, 2018–2021 (THOUSAND UNITS)

TABLE 19 MARKET, BY OPERATION MODE, 2022–2027 (THOUSAND UNITS)

7.2 SELF-DRIVEN

7.2.1 INTEGRATION OF ADVANCED SENSORS AND MAPPING TECHNOLOGY IN SELF-DRIVEN CLEANING ROBOTS TO ACCELERATE MARKET GROWTH

TABLE 20 SELF-DRIVEN CLEANING ROBOT MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 21 SELF-DRIVEN MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.3 REMOTE CONTROLLED

7.3.1 GROWING DEVELOPMENTS BY MAJOR PLAYERS TO BOOST OPPORTUNITIES FOR REMOTE-CONTROLLED MARKET

TABLE 22 REMOTE-CONTROLLED CLEANING ROBOT MARKET ANALYSIS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 23 REMOTE-CONTROLLED MARKET, BY TYPE, 2022–2027 (USD MILLION)

8 MARKET, BY TYPE (Page No. - 97)

8.1 INTRODUCTION

FIGURE 40 CLEANING ROBOT MARKET, BY TYPE

FIGURE 41 MARKET FOR PROFESSIONAL CLEANING ROBOTS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 24 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 25 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 26 MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 27 MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

8.2 PERSONAL CLEANING ROBOTS

8.2.1 PERSONAL CLEANING ROBOTS TO ACCOUNT FOR LARGER MARKET SHARE

TABLE 28 PERSONAL MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 29 PERSONAL MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

8.3 PROFESSIONAL CLEANING ROBOTS

8.3.1 INCREASING DEMAND FROM COMMERCIAL SECTOR TO DRIVE ADOPTION

TABLE 30 PROFESSIONAL MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 31 PROFESSIONAL MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

9 CLEANING ROBOT MARKET, BY PRODUCT (Page No. - 103)

9.1 INTRODUCTION

FIGURE 42 CLEANING ROBOT GROWTH, BY PRODUCT

FIGURE 43 FLOOR-CLEANING ROBOTS TO HOLD LARGEST SIZE OF CLEANING ROBOT MARKET BETWEEN 2022 AND 2027

TABLE 32 MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 33 MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 34 MARKET, BY PRODUCT, 2018–2021 (THOUSAND UNITS)

TABLE 35 MARKET, BY PRODUCT, 2022–2027 (THOUSAND UNITS)

9.2 FLOOR-CLEANING ROBOTS

9.2.1 FLOOR-CLEANING ROBOTS TO HOLD LARGEST SHARE OF CLEANING ROBOT MARKET INSIGHTS

TABLE 36 FLOOR-MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 37 FLOOR-MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 38 FLOOR-MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 39 FLOOR-CLEANING ROBOT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.3 LAWN-CLEANING ROBOTS

9.3.1 MARKET TO BE DRIVEN BY RISING ADOPTION OF LAWN-CLEANING ROBOTS IN RESIDENTIAL SECTOR

TABLE 40 LAWN-MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 41 LAWN-MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 42 LAWN-MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 43 LAWN-CLEANING ROBOT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.4 POOL-CLEANING ROBOTS

9.4.1 RISING HUMAN SAFETY CONCERNS RELATED TO CLEANING POOLS TO BOOST MARKET GROWTH

TABLE 44 POOL-MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 45 POOL-MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 46 POOL-MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 47 POOL-CLEANING ROBOT MARKET INSIGHTS, BY APPLICATION, 2022–2027 (USD MILLION)

9.5 WINDOW-CLEANING ROBOTS

9.5.1 INCREASING DEMAND FOR CLEANING ROBOTS IN COMMERCIAL APPLICATIONS TO DRIVE MARKET

TABLE 48 WINDOW-MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 49 WINDOW-MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 50 WINDOW-MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 51 WINDOW-CLEANING ROBOT MARKET REVENUE IMPACT REPORT, BY APPLICATION, 2022–2027 (USD MILLION)

9.6 OTHERS

TABLE 52 OTHERS: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 53 OTHERS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 54 OTHERS: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 55 OTHERS: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10 MARKET, BY SALES CHANNEL (Page No. - 115)

10.1 INTRODUCTION

FIGURE 44 CLEANING ROBOT MARKET SHARE, BY SALES CHANNEL

FIGURE 45 MARKET FOR ONLINE SALES CHANNEL TO GROW AT HIGHER CAGR BETWEEN 2022 AND 2027

TABLE 56 MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

TABLE 57 MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

TABLE 58 MARKET, BY SALES CHANNEL, 2018–2021 (THOUSAND UNITS)

TABLE 59 MARKET, BY SALES CHANNEL, 2022–2027 (THOUSAND UNITS)

10.2 ONLINE

10.2.1 SUBSTANTIAL GROWTH OF E-COMMERCE INDUSTRY TO PROPEL DEMAND

TABLE 60 ONLINE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 61 ONLINE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3 OFFLINE

10.3.1 INCREASING FOCUS ON ADOPTING NEW METHODS OF OFFLINE SALES TO DRIVE MARKET GROWTH

TABLE 62 OFFLINE: CLEANING ROBOT MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 63 OFFLINE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11 CLEANING ROBOT MARKET, BY APPLICATION (Page No. - 120)

11.1 INTRODUCTION

FIGURE 46 MARKET, BY APPLICATION

FIGURE 47 MARKET FOR RESIDENTIAL APPLICATIONS TO HOLD MAJORITY SHARE BETWEEN 2022 AND 2027

TABLE 64 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 65 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 66 MARKET, BY APPLICATION, 2018–2021 (THOUSAND UNITS)

TABLE 67 BY APPLICATION, 2022–2027 (THOUSAND UNITS)

11.2 RESIDENTIAL

11.2.1 RESIDENTIAL APPLICATIONS TO HOLD LARGEST MARKET SHARE IN 2027

TABLE 68 RESIDENTIAL: CLEANING ROBOT MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 69 RESIDENTIAL: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 70 RESIDENTIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 RESIDENTIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 COMMERCIAL

11.3.1 INCREASING CONCERNS REGARDING HYGIENE MAINTENANCE TO DRIVE DEMAND

TABLE 72 COMMERCIAL: CLEANING ROBOT MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 73 COMMERCIAL: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 74 COMMERCIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 COMMERCIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 INDUSTRIAL

11.4.1 GROWING INDUSTRIAL AUTOMATION MARKET TO DRIVE MARKET DURING FORECAST PERIOD

TABLE 76 INDUSTRIAL: CLEANING ROBOT MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 77 INDUSTRIAL: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 78 INDUSTRIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 79 INDUSTRIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5 HEALTHCARE

11.5.1 SURGING ADOPTION OF CLEANING ROBOTS IN HOSPITALS TO BOOST MARKET

TABLE 80 HEALTHCARE: CLEANING ROBOT MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 81 HEALTHCARE: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 82 HEALTHCARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 83 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.6 OTHERS

TABLE 84 OTHER APPLICATIONS: CLEANING ROBOT MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 85 OTHER APPLICATIONS: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 86 OTHER APPLICATIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 87 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

12 GEOGRAPHIC ANALYSIS (Page No. - 133)

12.1 INTRODUCTION

FIGURE 48 CLEANING ROBOT MARKET REVENUE IMPACT REPORT IN CHINA TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

FIGURE 49 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

TABLE 88 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 89 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 90 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 91 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

12.2 NORTH AMERICA

FIGURE 50 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 51 CLEANING ROBOT INDUSTRY IN CANADA TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

TABLE 92 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.1 US

12.2.1.1 Proliferation of cleaning robots in residential sector to offer market opportunities

TABLE 96 US: CLEANING ROBOT SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 97 US: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.2.2 CANADA

12.2.2.1 Market in Canada to grow at highest CAGR during forecast period

TABLE 98 CANADA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 99 CANADA: CLEANING ROBOT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.2.3 MEXICO

12.2.3.1 Growing awareness of advanced cleaning technology to add advantage for market players

TABLE 100 MEXICO: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 101 MEXICO: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3 EUROPE

FIGURE 52 EUROPE: MARKET SNAPSHOT

FIGURE 53 CLEANING ROBOT MARKET IN UK TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

TABLE 102 EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 105 EUROPE: CLEANING ROBOT GROWTH, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.1 UK

12.3.1.1 High disposable income among population to drive market growth

TABLE 106 UK: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 107 UK: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.2 GERMANY

12.3.2.1 Increasing adoption of cleaning robots in healthcare facilities to boost market

TABLE 108 GERMANY: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 109 GERMANY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.3 FRANCE

12.3.3.1 Surging demand from residential sector to drive market growth

TABLE 110 FRANCE: CLEANING ROBOT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 111 FRANCE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.4 REST OF EUROPE

TABLE 112 REST OF EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 113 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

FIGURE 54 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 55 CHINA TO LEAD MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

TABLE 114 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Proliferation of cleaning robots for professional services to drive growth

TABLE 118 CHINA: CLEANING ROBOT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 119 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4.2 JAPAN

12.4.2.1 Growing adoption of cleaning robots in commercial sector expected to drive market

TABLE 120 JAPAN: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 121 JAPAN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4.3 INDIA

12.4.3.1 Emergence of international players in India to drive growth

TABLE 122 INDIA: CLEANING ROBOT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 123 INDIA: CLEANING ROBOT INDUSTRY, BY APPLICATION, 2022–2027 (USD MILLION)

12.4.4 SOUTH KOREA

12.4.4.1 Increasing use of robot vacuum cleaners for household usage to drive market

TABLE 124 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 125 SOUTH KOREA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4.5 REST OF APAC

TABLE 126 REST OF APAC: CLEANING ROBOT GROWTH, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 127 REST OF APAC: CLEANING ROBOT SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

12.5 ROW

FIGURE 56 ROW: MARKET SNAPSHOT

FIGURE 57 CLEANING ROBOT MARKET IN SOUTH AMERICA TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

TABLE 128 ROW: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 129 ROW: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 130 ROW: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 131 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.5.1 MIDDLE EAST

12.5.1.1 Increasing disposable income of population to drive market

TABLE 132 MIDDLE EAST: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 133 MIDDLE EAST: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.5.2 AFRICA

12.5.2.1 Lucrative opportunities for cleaning robots in commercial sector to drive market

TABLE 134 AFRICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 135 AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.5.3 SOUTH AMERICA

12.5.3.1 Presence of several domestic and international players to boost market growth

TABLE 136 SOUTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 137 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 164)

13.1 INTRODUCTION

13.2 MARKET EVALUATION FRAMEWORK

TABLE 138 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN CLEANING ROBOT MARKET REVENUE IMPACT REPORT

13.2.1 PRODUCT PORTFOLIO

13.2.2 REGIONAL FOCUS

13.2.3 MANUFACTURING FOOTPRINT

13.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

13.3 REVENUE ANALYSIS OF TOP PLAYERS IN MARKET

FIGURE 58 5-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN MARKET

13.4 MARKET SHARE ANALYSIS, 2021

TABLE 139 CLEANING ROBOT MARKET INSIGHTS : DEGREE OF COMPETITION

13.5 COMPANY EVALUATION QUADRANT

13.5.1 STARS

13.5.2 PERVASIVE PLAYERS

13.5.3 EMERGING LEADERS

13.5.4 PARTICIPANTS

FIGURE 59 MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

13.6 STARTUP/SME EVALUATION QUADRANT

13.6.1 PROGRESSIVE COMPANIES

13.6.2 RESPONSIVE COMPANIES

13.6.3 DYNAMIC COMPANIES

13.6.4 STARTING BLOCKS

FIGURE 60 GLOBAL CLEANING ROBOT MARKET : STARTUP/SME EVALUATION QUADRANT, 2021

13.7 CLEANING ROBOT MARKET: COMPANY FOOTPRINT

TABLE 140 COMPANY FOOTPRINT

TABLE 141 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 142 APPLICATION FOOTPRINT OF COMPANIES

TABLE 143 REGIONAL FOOTPRINT OF COMPANIES

13.8 COMPETITIVE BENCHMARKING

TABLE 144 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 145 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

13.9 COMPETITIVE SITUATION AND TRENDS

13.9.1 PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 146 CLEANING ROBOT MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2018– MAY 2022

13.9.2 DEALS

TABLE 147 MARKET: DEALS, JANUARY 2018–MAY 2022

13.9.3 OTHERS

TABLE 148 MARKET: OTHERS, JANUARY 2018–MAY 2022

14 COMPANY PROFILES (Page No. - 181)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1 KEY PLAYERS

14.1.1 IROBOT CORPORATION

TABLE 149 IROBOT CORPORATION: BUSINESS OVERVIEW

FIGURE 61 IROBOT CORPORATION: COMPANY SNAPSHOT

14.1.2 ECOVACS ROBOTICS CO., LTD.

TABLE 150 ECOVACS ROBOTICS CO., LTD.: BUSINESS OVERVIEW

FIGURE 62 ECOVACS ROBOTICS CO., LTD.: COMPANY SNAPSHOT

TABLE 151 ECOVACS ROBOTICS CO., LTD.: DEALS

14.1.3 SAMSUNG ELECTRONICS CO., LTD.

TABLE 152 SAMSUNG ELECTRONICS CO., LTD.: BUSINESS OVERVIEW

FIGURE 63 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

14.1.4 XIAOMI

TABLE 153 XIAOMI: BUSINESS OVERVIEW

FIGURE 64 XIAOMI: COMPANY SNAPSHOT

14.1.5 ROBOROCK

TABLE 154 ROBOROCK: BUSINESS OVERVIEW

FIGURE 65 ROBOROCK: COMPANY SNAPSHOT

14.1.6 LG ELECTRONICS

TABLE 155 LG ELECTRONICS: BUSINESS OVERVIEW

FIGURE 66 LG ELECTRONICS: COMPANY SNAPSHOT

TABLE 156 LG ELECTRONICS: OTHERS

14.1.7 SHARKNINJA OPERATING LLC

TABLE 157 SHARKNINJA OPERATING LLC: BUSINESS OVERVIEW

14.1.8 CECOTEC INNOVACIONES S.L.

TABLE 158 CECOTEC INNOVACIONES S.L.: BUSINESS OVERVIEW

14.1.9 PANASONIC HOLDINGS CORPORATION

TABLE 159 PANASONIC HOLDINGS CORPORATION: BUSINESS OVERVIEW

FIGURE 67 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

14.1.10 DIVERSEY HOLDINGS LTD

TABLE 160 DIVERSEY HOLDINGS LTD: BUSINESS OVERVIEW

14.1.11 VORWERK & CO. KG

TABLE 161 VORWERK & CO. KG: BUSINESS OVERVIEW

FIGURE 68 VORWERK & CO. KG: COMPANY SNAPSHOT

14.1.12 KONINKLIJKE PHILIPS N.V.

TABLE 162 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

FIGURE 69 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT

14.2 OTHER PLAYERS

14.2.1 KEY PLAYERS IN CHINA

14.2.1.1 Shenzhen Proscenic Technology Co., Ltd.

14.2.1.2 HangZhou TaRen Robotics Technology CO. LTD

14.2.1.3 Shenzhen Reeman Intelligent Equipment Co., Ltd.

14.2.1.4 Yluspp Electronics (Shenzhen) Co., Ltd.

14.2.1.5 Jashen (Suzhou) Technology Ltd.

14.2.1.6 Gaussian Robotics

14.2.1.7 ILIFE

14.2.2 KEY PLAYERS IN JAPAN

14.2.2.1 Cyberdyne Inc.

14.2.2.2 Yotsuyanagi Co., Ltd.

14.2.2.3 Miraikikai, Inc.

14.2.2.4 Amano Corporation

14.2.2.5 SoftBank Robotics

14.2.3 KEY PLAYERS IN SOUTH KOREA

14.2.3.1 Everybot

14.2.3.2 Hyundai Robotics

14.2.3.3 Hanool Robotics Corp.

14.2.3.4 Dasarobot Ltd.

14.2.3.5 Life Innovation Ltd.

14.2.3.6 Yujin Robot

14.2.4 OTHER PLAYERS

14.2.4.1 Freudenberg Home and Cleaning Solutions GmbH (Vileda)

14.2.4.2 Arcelik AS

14.2.4.3 Alfred Kärcher SE & Co. KG

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 ADJACENT & RELATED MARKETS (Page No. - 238)

15.1 INTRODUCTION

15.2 LIMITATIONS

15.3 HOUSEHOLD ROBOTS MARKET INSIGHTS

15.4 HOUSEHOLD ROBOTS MARKET, BY OFFERING

FIGURE 70 HOUSEHOLD ROBOTS MARKET, BY OFFERING

FIGURE 71 PRODUCTS TO LEAD HOUSEHOLD ROBOTS MARKET DURING FORECAST PERIOD

TABLE 163 HOUSEHOLD ROBOTS MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 164 HOUSEHOLD ROBOTS MARKET, BY OFFERING, 2022–2027 (USD MILLION)

15.5 PRODUCTS

15.5.1 PRODUCT SEGMENT TO DOMINATE HOUSEHOLD ROBOTS MARKET DURING FORECAST PERIOD

15.6 SERVICES

15.6.1 SERVICES SEGMENT TO MAINTAIN LOWER SHARE OF HOUSEHOLD ROBOTS MARKET DURING FORECAST PERIOD

16 APPENDIX (Page No. - 241)

16.1 INSIGHTS FROM INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 CUSTOMIZATION OPTIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

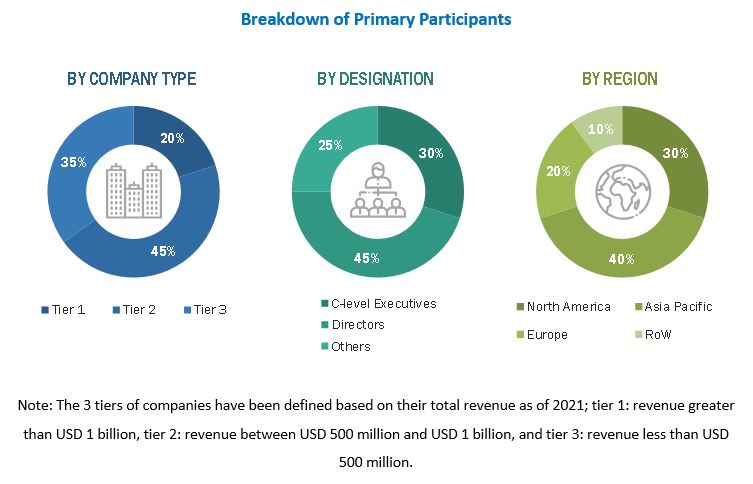

The research process for this study included the systematic gathering, recording, and analysis of data about customers and companies operating in the cleaning robot market. This research study involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting information useful for this extensive technical, market-oriented, and commercial study of the market. In-depth interviews were conducted with various primary respondents including experts from core and related industries and manufacturers to obtain and verify critical qualitative and quantitative information, as well as assess growth prospects. Key players in the market have been identified through secondary research and their market rankings have been determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

During the secondary research process, various secondary sources were referred to for identifying and collecting information pertinent to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases. Secondary research was mainly carried out to obtain key information about the supply chain of the cleaning robot market, the value chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments from both, market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both, the supply and demand sides were interviewed to obtain qualitative and quantitative information relevant to this report. The primary sources are mainly experts from core and related industries and suppliers, manufacturers, distributors, service providers, system integrators, technology developers, IP vendors, standards and organizations related to all segments of this industry’s value chain. In-depth interviews with various primary respondents have been conducted with key industry participants, subject matter experts (SMEs), C-level executives of key players, and consultants to obtain and verify the critical qualitative and quantitative information arrived at as well as assess prospects.

After the complete market engineering (including calculations for the market statistics, market breakdown, data triangulation, market size estimations, and market forecasting), extensive primary research was conducted to verify and validate the critical numbers obtained.

To know about the assumptions considered for the study, download the pdf brochure

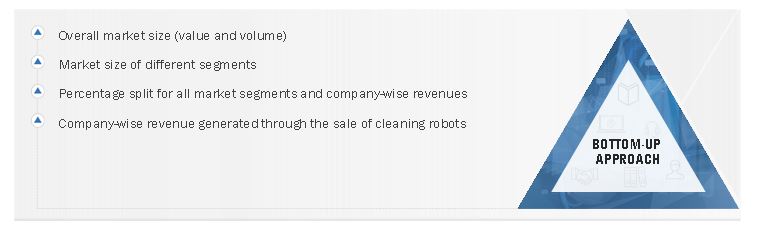

Market Size Estimation

In the complete market engineering process, both, top-down and bottom-up approaches have been used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses have been carried out on the complete market engineering process to list the key information/insights pertaining to the cleaning robot market.

The key players in the market have been identified through secondary research, and their rankings in the respective regions have been determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for both, quantitative and qualitative key insights. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Cleaning Robot Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the cleaning robot market from the market size estimation process explained above, the total market has been split into several segments and subsegments. The data triangulation procedure has been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both, the demand and supply sides. Along with this, the market size has been validated using the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the cleaning robot market, in terms of value and volume, segmented by connectivity technology, operation mode, type, product, sales channel, and application

- To forecast the market size, in terms of value, for North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the market growth

- To identify the major market trends and factors driving or restricting the growth of the cleaning robot market

- To provide a comprehensive overview of the value chain of the cleaning robot ecosystem

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2, and provide a detailed competitive landscape of the market

- To analyze the major strategies such as collaborations, acquisitions, product launches, and expansions adopted by the key players to enhance their position in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cleaning Robot Market

Hi Sir/Madam, There is a huge market on toilet cleaning robots. I would like to know if there is such products available in the market.

I am interested in obtaining the information related to this markets shares for floor robots in the US.

We already purchased this market study from you in 2016. So, is there new revamp study will publish from your end, please let us know about it.

I am a graduate student researching robotic vacuums for a class project and want to know more about the robotic vacuum report. Appreciate any assistance!

I am an industrial design student, and am conducting a research project about autonomous floor cleaning robots. I have heard that this website has very useful information, so I would much like to discuss with the concern analyst of the report.

We are a end use industry includes commercial and residential business, could you please suggest us with which cleaning robot manufacturers we have to establish our long term partnership?

We are a leading HVAC services provider in the Indian market. We are often asked by clients if we can take up duct cleaning services too. We would like to understand if this is something we must outsource to another agency or if this is worth for us to do it ourselves.

Can you help me to find out the market share captured by residential and commercial application? Also please share the split of each and which are the other application considered for this study? Furthermore, do you provide any market size or growth projections by industry verticals (e.g. retail, transportation, etc.)?

I am currently researching a product development methodology, which I want to apply to a simulated use case. This will include vacuum robots as an example. We want to know more about the overview of the market, it would help me to increase the quality of my thesis as well.

Is report involves the market sizing for Canada and Mexico country along with hardware and application?

I am trying to develop a window cleaner robot for high rise building. I need the information for the market research.

We are interested to know the market data on the growth and investment opportunities for this market. Moreover, which are the top players involved in this market, their organic and inorganic growth strategies.