Cloud Access Security Brokers Market by Solution & Service (Control & Monitoring Cloud Services, Risk & Compliance Management, Data Security, Threat Protection, Professional Service, & Support, Training, and Maintenance Service) - Global Forecast to 2020

[139 Pages Report The cloud access security brokers market size is estimated to grow from USD 3.34 Billion in 2015 to USD 7.51 Billion by 2020, at an estimated compound annual growth rate (CAGR) of 17.6%.

The report aims at estimating the market size and future growth potential of market across different segments, such as solution, service, service model, organization size, vertical, and region. The base year considered for the study is 2014 and the forecast period is from 2015 to 2020. The increasing adoption of cloud-based applications such as Office 365, Salesforce, Google Apps, Box, and others by the end-users, SMBs, and the large enterprises is expected to play a key role in fueling the growth of the market during the forecast period.

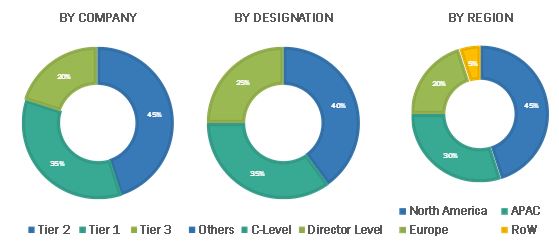

The research methodology used to estimate and forecast the cloud access security brokers market begins with capturing data from key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global market from the revenue of key players in the market. After arriving at the overall market size, the total market was split into several segments and sub-segments, which are then verified through primary research by conducting extensive interviews with key people, such as CEOs, VPs, directors, and executives. This data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The breakdown of profiles of primary is depicted in the below figure:

The key vendors providing cloud HPC services are:

- Control and Monitoring cloud services: Imperva, Bitglass, Adallom, and others.

- Risk and Compliance Management: CloudLock, Protegrity, CloudMask, and others.

- Data Security: CipherCloud, CloudLock, Netskope, Skyhigh Networks, and others.

- Threat Protection: CloudLock, Skyhigh Networks, Bitglass, Palerra, and others.

Target audience

- Software Providers

- Service Providers

- Market Research and Consulting Firms

- Head of IT and Operations in Organizations

- Investors and Venture Capitalists

- Business Intelligence Providers

Scope of the Report

The market study covers the cloud access security brokers market on the basis of solutions, services, service models, organization size, verticals, and regions.

By Solution:

- Control and Monitoring Cloud Services

- Risk and Compliance Management

- Data Security

- Encryption

- Tokenization

- Data Leakage Prevention

- Threat Protection

By Service:

- Professional Service

- Support, Training, and Maintenance

By Service Model:

- Infrastructure as a Service

- Platform as a Service

- Software as a Service

By Organization size:

- Small and Medium Businesses (SMBs)

- Large Enterprises

By Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Education

- Government

- Healthcare and Life Sciences

- Manufacturing

- Retail and Wholesale

- Telecommunication and IT

- Others

By Region:

- North America

- Europe

- Asia-Pacific (APAC)

- RoW

Available Customizations

With the given market data, MarketsandMarkets offer customization as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America market

- Further breakdown of the Europe market

- Further breakdown of the APAC market

- Further breakdown of the RoW comprising Middle East and Africa (MEA) and Latin America cloud access security brokers market

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets forecast the cloud access security brokers market size to grow from USD 3.34 Billion in 2015 to USD 7.51 Billion by 2020, at a compound annual growth rate (CAGR) of 17.6%. The major drivers of this market include control data loss, real-time monitoring capabilities, and increasing adoption of cloud-based applications.

The cloud access security brokers enable enterprises to integrate the external data loss prevention systems to prevent unauthorized access of data. In addition, the enterprises assisted in monitoring uploaded, downloaded, and shared information in real time. Enterprises are adopting the SaaS applications due to the benefits of reduced cost, faster deployment, mobility, and scalability. The SaaS offerings enable the enterprises to access and store critical business data and sensitive information on cloud.

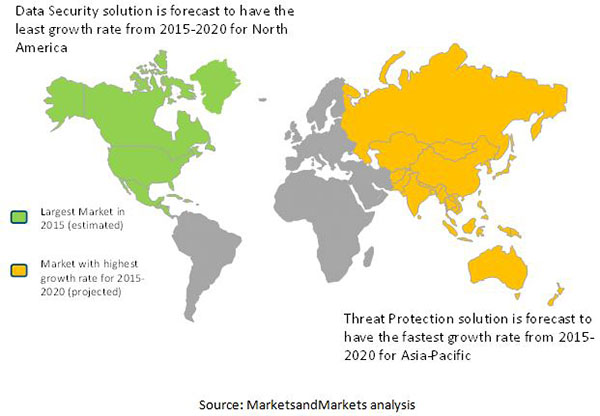

The data security solution segment is expected to have the largest market share in the cloud access security brokers market. This solution segment is contributing significantly in the market due to the growth of complex applications and increasing workloads. Currently enterprises need to follow the regulatory compliance to monitor and control their data irrespective of the location. The data security solution segment is the core segment that prevents any kind of data leakage while moving from one place to another.

SaaS service model in the cloud access security brokers market is expected to have the largest market in terms of size, during the forecast period. The major reason for the high adoption of SaaS among the service model is the increase usage of the cloud-based applications from the cloud service providers. However, the SaaS applications might contain malicious activities that may cause significant data loss. The cloud access security brokers solutions helps in minimizing the loss of data through control and regular monitoring of the cloud-based applications and cloud services.

Support, training, and maintenance service market is expected to grow at the highest rate during the forecast period. Every cloud access security broker vendor is equipped with a support team to serve customers globally. Online support, live chat, other real-time support options, and community portals are established where clients can exchange ideas with people in other organizations.

North America is expected to have the largest cloud access security brokers market share and will dominate the market from 2015 to 2020 owing to innovations through research and development and technology and increasing demand for business flexibility and agility. The market is expected to experience huge growth in Asia-Pacific (APAC) due to improved technology, cost efficiency, scalability, and improved productivity.

Major factors that are restraining the growth of the market are surviving the hype cycle and the risk of information loss market. The major vendors in the cloud access security brokers market include Imperva, Bitglass, CloudLock, CipherCloud, Skyhigh Networks, Netskope, Protegrity, Adallom, Perspescys, and CloudMask. These players adopted various strategies such as new product launches, mergers, partnerships, collaborations, agreements, and business expansions to expand their product portfolio and to increase their global footprint in the market.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumption and Limitation

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities

4.2 Market Share of the Top Four Solutions and Verticals

4.3 Lifecycle Analysis, By Region

4.4 Market Investment Scenario

5 Cloud Access Security Brokers Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Solution

5.2.2 By Service

5.2.3 By Service Model

5.2.4 By Organization Size

5.2.5 By Vertical

5.2.6 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Control Data Loss to Enable Uninterrupted Business Functions

5.3.1.2 Real-Time Monitoring Capabilities

5.3.1.3 Increasing Adoption of Cloud-Based Applications

5.3.2 Restraints

5.3.2.1 Risk of Information Loss

5.3.2.2 Surviving the Hype Cycle

5.3.3 Opportunities

5.3.3.1 Adoption of Pay-As-You-Go Model

5.3.3.2 High Adoption Rate in SMBS

5.3.4 Challenges

5.3.4.1 Lack of Awareness and Security Concerns

5.4 Technological Overview

5.4.1 Single Sign-On (SSO)

5.4.2 Security Information and Event Management (SIEM)

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Ecosystem

6.4 Strategic Benchmarking

7 Cloud Access Security Brokers Market Analysis, By Solution (Page No. - 47)

7.1 Introduction

7.2 Control and Monitoring Cloud Services

7.3 Risk and Compliance Management

7.4 Data Security

7.4.1 Data Leakage Prevention

7.4.2 Cloud Data Encryption

7.4.3 Tokenization

7.5 Threat Protection

8 Market Analysis, By Service (Page No. - 54)

8.1 Introduction

8.2 Professional Service

8.3 Support, Training and Maintenance

9 Cloud Access Security Brokers Market Analysis, By Service Model (Page No. - 58)

9.1 Introduction

9.2 Infrastructure as A Service

9.3 Platform as A Service

9.4 Software as A Service

10 Market Analysis, By Organization Size (Page No. - 63)

10.1 Introduction

10.2 SMBS

10.3 Large Enterprises

11 Cloud Access Security Brokers Market Analysis, By Vertical (Page No. - 67)

11.1 Introduction

11.2 Banking, Financial Services and Insurance (BFSI)

11.3 Education

11.4 Government

11.5 Healthcare and Life Sciences

11.6 Manufacturing

11.7 Retail and Wholesale

11.8 Telecommunication and It

11.9 Others

12 Geographic Analysis (Page No. - 83)

12.1 Introduction

12.2 North America

12.3 Europe

12.4 Asia-Pacific (Apac)

12.5 Rest of World

13 Competitive Landscape (Page No. - 99)

13.1 Overview

13.2 Competitive Situation and Trends

13.3 New Product Launches

13.4 Mergers and Acquisitions

13.5 Partnerships/Collaborations/Agreements

13.6 Business Expansions

13.7 Venture Funding

14 Company Profiles (Page No. - 107)

14.1 Imperva, Inc.

14.1.1 Business Overview

14.1.2 Products Offered

14.1.3 Recent Developments

14.1.4 MnM View

14.1.4.1 Key Strategies

14.1.4.2 SWOT Analysis

14.2 Bitglass

14.2.1 Business Overview

14.2.2 Products Offered

14.2.3 Recent Developments

14.2.4 MnM View

14.2.4.1 Key Strategies

14.3 Cloudlock

14.3.1 Business Overview

14.3.2 Products Offered

14.3.3 Recent Developments

14.3.4 MnM View

14.3.4.1 Key Strategies

14.4 Ciphercloud

14.4.1 Business Overview

14.4.2 Products and Services Offered

14.4.3 Recent Developments

14.4.4 MnM View

14.4.4.1 Key Strategies

14.5 Skyhigh Networks

14.5.1 Business Overview

14.5.2 Products Offered

14.5.3 Recent Developments

14.5.4 MnM View

14.5.4.1 Key Strategies

14.6 Netskope

14.6.1 Business Overview

14.6.2 Products Offered

14.6.3 Recent Developments

14.7 Protegrity

14.7.1 Business Overview

14.7.2 Product and Services Offered

14.7.3 Recent Developments

14.8 Adallom

14.8.1 Business Overview

14.8.2 Products Offered

14.8.3 Recent Developments

14.9 Perspecsys

14.9.1 Business Overview

14.9.2 Product Offered

14.9.3 Recent Developments

14.10 Cloudmask

14.10.1 Business Overview

14.10.2 Products Offered

14.10.3 Recent Developments

14.11 Other Key Innovators

14.11.1 Elastica

14.11.2 Palerra

14.11.3 Vaultive

14.11.4 Firelayers

14.11.5 Palo Alto Networks

15 Appendix (Page No. - 133)

15.1 Excerpts From Industry Experts

15.2 Discussion Guide

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customization

15.5 Related Reports

List of Tables (67 Tables)

Table 1 Cloud Access Security Brokers Market Size and Growth Rate, 20132020 (USD Billion, Y-O-Y %)

Table 2 Market Size, By Solution, 2013-2020 (USD Million)

Table 3 Control and Monitoring Cloud Services: Market Size, By Vertical, 2013-2020 (USD Million)

Table 4 Risk and Compliance Management: Market Size, By Vertical, 2013-2020 (USD Million)

Table 5 Data Security: Market Size, By Vertical, 2013-2020 (USD Million)

Table 6 Threat Protection: Market Size, By Region, 2013-2020 (USD Million)

Table 7 Market Size, By Service, 2013-2020 (USD Million)

Table 8 Professional Service: Market Size, By Vertical, 2013-2020 (USD Million)

Table 9 Support, Training and Maintenance: Market Size, By Vertical, 2013-2020 (USD Million)

Table 10 Cloud Access Security Brokers Market Size, By Service Model, 2013-2020 (USD Million)

Table 11 IAAS: Market Size, By Region, 2013-2020 (USD Million)

Table 12 PAAS: Market Size, By Region, 2013-2020 (USD Million)

Table 13 SAAS: Market Size, By Region, 2013-2020 (USD Million)

Table 14 Market Size, By Organization Size, 2013-2020 (USD Million)

Table 15 Small and Medium Business: Market Size, By Region, 2013-2020 (USD Million)

Table 16 Large Enterprise: Market Size, By Region, 2013-2020 (USD Million)

Table 17 Cloud Access Security Brokers Market Size, By Vertical, 2013-2020 (USD Million)

Table 18 BFSI: Market Size, By Solution, 2013-2020 (USD Million)

Table 19 BFSI: Market Size, By Service, 2013-2020 (USD Million)

Table 20 BFSI: Market Size, By Region, 2013-2020 (USD Million)

Table 21 Education: Market Size, By Solution, 2013-2020 (USD Million)

Table 22 Education: Market Size, By Service, 2013-2020 (USD Million)

Table 23 Education: Market Size, By Region, 2013-2020 (USD Million)

Table 24 Government: Market Size, By Solution, 2013-2020 (USD Million)

Table 25 Government: Market Size, By Service, 2013-2020 (USD Million)

Table 26 Government: Market Size, By Region, 2013-2020 (USD Million)

Table 27 Healthcare and Life Sciences: Cloud Access Security Brokers Market Size, By Solution, 2013-2020 (USD Million)

Table 28 Healthcare and Life Sciences: Market Size, By Service, 2013-2020 (USD Million)

Table 29 Healthcare and Life Sciences: Market Size, By Region, 2013-2020 (USD Million)

Table 30 Manufacturing: Market Size, By Solution, 2013-2020 (USD Million)

Table 31 Manufacturing: Market Size, By Service, 2013-2020 (USD Million)

Table 32 Manufacturing: Market Size, By Region, 2013-2020 (USD Million)

Table 33 Retail and Wholesale: Market Size, By Solution, 2013-2020 (USD Million)

Table 34 Retail and Wholesale: Market Size, By Service, 2013-2020 (USD Million)

Table 35 Retail and Wholesale: Market Size, By Region, 2013-2020 (USD Million)

Table 36 Telecommunication and IT: Cloud Access Security Brokers Market Size, By Solution, 2013-2020 (USD Million)

Table 37 Telecommunication and IT: Market Size, By Service, 2013-2020 (USD Million)

Table 38 Telecommunication and IT: Market Size, By Region, 2013-2020 (USD Million)

Table 39 Others: Market Size, By Solution, 2013-2020 (USD Million)

Table 40 Others: Market Size, By Service, 2013-2020 (USD Million)

Table 41 Others: Market Size, By Region, 2013-2020 (USD Million)

Table 42 Cloud Access Security Brokers Market Size, By Region, 20152020 (USD Million)

Table 43 North America: Market Size, By Vertical, 20132020 (USD Million)

Table 44 North America: Market Size, By Solution, 20132020 (USD Million)

Table 45 North America: Market Size, By Service, 20132020 (USD Million)

Table 46 North America: Market Size, By Organization Size, 20132020 (USD Million)

Table 47 North America: Market Size, By Service Model, 20132020 (USD Million)

Table 48 Europe: Market Size, By Vertical, 20132020 (USD Million)

Table 49 Europe: Market Size, By Solution, 20132020 (USD Million)

Table 50 Europe: Market Size, By Service, 20132020 (USD Million)

Table 51 Europe: Market Size, By Organization Size, 20132020 (USD Million)

Table 52 Europe: Market Size, By Service Model, 20132020 (USD Million)

Table 53 Asia-Pacific: Market Size, By Vertical, 20132020 (USD Million)

Table 54 Asia-Pacific: Market Size, By Solution, 20132020 (USD Million)

Table 55 Asia-Pacific: Market Size, By Service, 20132020 (USD Million)

Table 56 Asia-Pacific: Market Size, By Organization Size, 20132020 (USD Million)

Table 57 Asia Pacific: Market Size, By Service Model, 20132020 (USD Million)

Table 58 Rest of World: Cloud Access Security Brokers Market Size, By Vertical, 20132020 (USD Million)

Table 59 Rest of World: Market Size, By Solution, 20132020 (USD Million)

Table 60 Rest of World: Market Size, By Service, 20132020 (USD Million)

Table 61 Rest of World: Market Size, By Organization Size, 20132020 (USD Million)

Table 62 Rest of World: Market Size, By Service Model, 20132020 (USD Million)

Table 63 New Product Launches, 2014-2015

Table 64 Mergers and Acquisitions, 2014-2015

Table 65 Partnerships/Collaborations/New Synergies, 2014-2015

Table 66 Business Expansions, 2014-2015

Table 67 Venture Funding, 2013-2015

List of Figures (47 Figures)

Figure 1 Cloud Access Security Brokers Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown and Data Triangulation

Figure 6 Assumptions of the Research Study

Figure 7 Market Size, 2015 - 2020 (USD Billion)

Figure 8 Market, By Solution (2015 vs. 2020)

Figure 9 Market, By Service Model (2015-2020)

Figure 10 North America is Expected to Hold the Largest Market Share of the Market in 2015

Figure 11 Lucrative Growth Prospects in the Cloud Access Security Brokers Market Due to the Increasing Adoption of Cloud-Based Applications

Figure 12 Market Share of Solutions and Verticals

Figure 13 Lifecycle Analysis, By Region (2015): Asia-Pacific is Expected to Enter the Growth Phase in the Coming Years

Figure 14 Market Investment Scenario: Cloud Access Security Broker

Figure 15 Market Segmentation: By Solution

Figure 16 Market Segmentation: Service

Figure 17 Market Segmentation: By Service Model

Figure 18 Market Segmentation: By Organization Size

Figure 19 Market Segmentation: By Vertical

Figure 20 Market Segmentation: By Region

Figure 21 Market Dynamics

Figure 22 Market Value Chain Analysis

Figure 23 Market Ecosystem

Figure 24 Strategic Benchmarking: Cloud Access Security Brokers Market

Figure 25 Data Security Estimated to Have the Largest Market Size During the Forecast Period

Figure 26 Support, Training and Maintenance is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 27 SAAS is Estimated to Have the Largest Market Size During the Forecast Period

Figure 28 Large Enterprises Segment is Estimated to Have the Largest Market Size During the Forecast Period

Figure 29 Retail and Wholesale Vertical is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 30 North America is Estimated to Have the Largest Market Size During the Forecast Period

Figure 31 Asia-Pacific: an Attractive Destination for the Cloud Access Security Brokers Market, 2015-2020

Figure 32 North America Snapshot

Figure 33 Asia-Pacific Market Snapshot

Figure 34 Companies Adopted New Product Launches as the Key Growth Strategy From 2014 to 2015

Figure 35 Product Portfolio Comparison of the Top Five Companies

Figure 36 Battle for Market Share: New Product Launch and Development is the Key Strategy

Figure 37 Imperva,Inc.: Company Snapshot

Figure 38 Imperva,Inc.: SWOT Analysis

Figure 39 Bitglass: Company Snapshot

Figure 40 Cloudlock: Company Snapshot

Figure 41 Ciphercloud: Company Snapshot

Figure 42 Skyhigh Networks: Company Snapshot

Figure 43 Netskope: Company Snapshot

Figure 44 Protegrity: Company Snapshot

Figure 45 Adallom: Company Snapshot

Figure 46 Perspecsys :Company Snapshot

Figure 47 Cloudmask: Company Snapshot

Growth opportunities and latent adjacency in Cloud Access Security Brokers Market