Cloud Discovery Market by Solution (Application Discovery and Infrastructure Discovery), Service (Professional Services and Managed Services), Organization Size (Large Enterprises and SMES), Vertical, and Region - Global Forecast to 2023

[127 Pages Report] The cloud discovery market was valued at USD 635.8 million in 2017 and projected to reach USD 1,564.1 million, growing at a Compound Annual Growth Rate (CAGR) of 16.4% during the forecast period. The base year considered for this study is 2017, and the forecast period is 20182023.

Cloud Discovery Market Dynamics

Drivers

- Applications running on a dynamic environment

- Growing adoption of the multi-cloud environment has increased the demand for cloud discovery solutions

- Increasing need to efficiently manage the security of the IT infrastructure

Restraints

- Strict government rules and regulations

Opportunities

- High rate of adoption of cloud discovery solutions and services among SMEs

- Lack of appropriate monitoring

Challenges

- Stiff competition

- Delivering robust yet high-performing cloud discovery solutions

Growing adoption of the multi-cloud environment has increased the demand for cloud discovery solutions

Organizations are increasingly adopting multiple cloud platforms to support their varied infrastructure and application needs. The multi-cloud environment provides flexibility to enterprises and enables them to manage various cloud services, such as Software-as-a-Service (SaaS), Infrastructure-as-a-Service (IaaS), and Platform-as-a-Service (PaaS). The rising need for different applications is driving the adoption of multi-cloud among end-users. Multi-cloud is a complex solution, where multiple clouds from different providers are used for separate tasks. With the increasing popularity of multi-cloud, IT administration needs to focus on how to keep track of all SaaS applications used by their employees in different clouds. Multi-cloud discovery solutions play a critical role in providing accurate information on Configuration Items (CI) and relationships, identifying applications that may be at risk, and ensuring monitoring of entire multi-cloud environments to implement the enterprise cloud strategy.

Objectives of the Study

- To define, describe, and forecast the cloud discovery market by components (solutions and services), organization size, verticals, and regions

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the cloud discovery market

- To forecast the market size of the market segments with respect to 5 major regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players of the cloud discovery market and comprehensively analyze their market size and core competencies in the market

- To track and analyze competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations in the global market

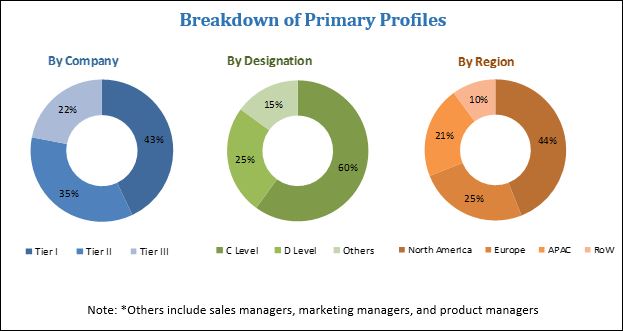

The research methodology used to estimate and forecast the cloud discovery market began with capturing the data of the revenues of the key vendors through secondary sources, such as annual reports, press releases, and associations and consortiums, such as RSA Security, the SANS Institute, SC Magazine, and Cloud Security Alliance (CSA), and databases, such as Factiva, BusinessWeek, company websites, and news articles. Vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global cloud discovery market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments. The breakdown of primary profiles has been depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The cloud discovery ecosystem comprises application discovery and infrastructure discovery providers, such as BMC Software (US), ServiceNow (US), Puppet (US), CipherCloud (US), Zscaler (US), Cisco Systems (US), McAfee (US), Qualys (US), ASG Technologies (US), and NetSkope (US). The other stakeholders of the cloud discovery market include Cloud Service Providers (CSPs), cybersecurity vendors, managed security service providers, and system integrators.

Major Market Development

- In January 2018, BMC Software forged a strategic partnership with Amazon Web Services (AWS) to help customers move enterprise workloads to the AWS cloud faster in a secure, low-risk, and cost-effective way

- In October 2017, Puppet introduced Puppet Discovery, a standalone product, for the discovery of the hybrid infrastructure to manage it with automation. This intuitive solution enables companies to know what they have in the hybrid IT infrastructure.

- In April 2018, CipherCloud announced the introduction of CASB+ platform, which enables enterprises to accelerate cloud adoption and ensure their sensitive data is always secured.

Key Target Audience of Cloud Discovery Market

- Application discovery vendors

- Infrastructure discovery vendors

- Cloud Service Providers (CSPs)

- Cyber security vendors

- Defense organizations

- Government agencies

- Independent Software Vendors (ISVs)

- Consulting firms

- System integrators

- Value-added Resellers (VARs)

- Information Technology (IT) security agencies

- Managed Security Service Providers (MSSPs)

The research study answers several questions for the stakeholders, primarily which market segments to focus in the next 2 to 5 years for prioritizing the efforts and investments.

Scope of the Report

The research report categorizes the cloud discovery market to forecast the revenues and analyzes the trends in each of the following submarkets:

By Component

- Solutions

- Application Discovery

- Infrastructure Discovery

- Services

- Professional services

- Training, education, and consulting

- Support and maintenance

- Managed services

- Professional services

By Organization Size

- Large enterprises

- Small and Medium-sized Enterprises (SMEs)

Cloud Discovery Market research report By Vertical

- BFSI

- Healthcare and Life Sciences

- Telecommunication and ITES

- Retail and Consumer Goods

- Government and Public Sector

- Media and Entertainment

- Manufacturing

- Transportation and Logistics

- Others (Travel & Hospitality and Education)

By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Critical questions which the report answers

- What are the industries which the Cloud Discovery companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the company-specific needs. The following customization options are available for the report:

Product Analysis:

Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis:

- Further breakdown of the North America Cloud Discovery market

- Further breakdown of the Europe market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the LATAM Cloud Discovery market

Company Information

Detailed analysis and profiling of additional market players (up to 5)

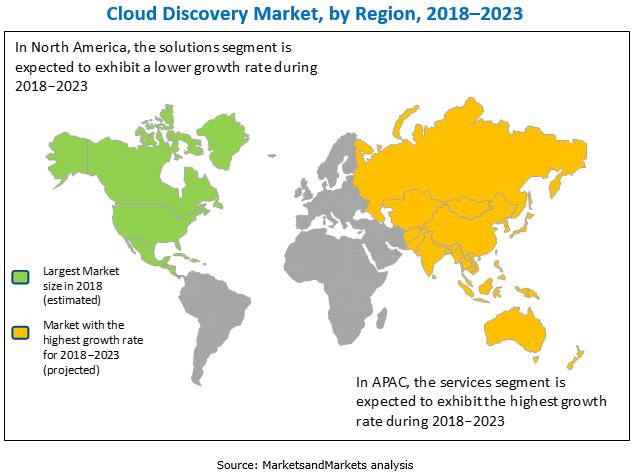

The cloud discovery market is expected to grow from USD 730.8 million in 2018 to USD 1,564.1 million by 2023, at a Compound Annual Growth Rate (CAGR) of 16.4% during the forecast period. The demand for cloud discovery solution and services is expected to be driven by several factors, such as applications running in the dynamic Information Technology (IT) environment, growing adoption of multi-cloud environment, and increasing need to efficiently manage the security of IT infrastructure.

The cloud discovery market has been segmented on the basis of components, organization size, verticals, and regions. The services segment is expected to grow at a higher CAGR during the forecast period, and the solutions segment is estimated to account for a larger market size in 2018 in the global market. The adoption of cloud discovery solutions and services among the Small and Medium-sized Enterprises (SMEs) has become a central part of the business process, due to the ease of use and flexibility offered by them.

The application discovery solution is estimated to account for the largest market size in 2018. It helps IT administrators to identify any unwanted/unverified cloud application running or residing in an enterprise network. With this solution, IT administrators can get information about the number of users accessing an application, calculate the volume of data traffic, and integrate these applications easily to enable SSO and user management. The enterprises adopting cloud discovery are increasingly inclined toward deploying application discovery solutions to run their critical business functions.

North America is estimated to account for the largest market size in 2018, whereas the Asia Pacific (APAC) region is projected to grow at the highest CAGR during the forecast period in the global market. An increasing need for efficient computing framework and complete security while operating in physical, virtual, or cloud environments are expected to drive the global cloud discovery market.

SOLUTION

The cloud discovery solution provides a comprehensive view of all the applications and IT infrastructure resources used within an enterprise. With the exponential growth of cloud-based technologies, a large number of companies have adopted cloud services on a day-to-day basis to get their jobs done, thereby creating a pool of IT resources, which becomes unmanageable for IT administrators. Therefore, with the adoption of the cloud discovery solution, IT operators can easily manage this pool of IT resources and control the data being shared internally and externally. An advanced IT infrastructure always needs better management of resources to optimize operations, which results in opportunities for cloud discovery service providers. The benefits of cloud discovery solutions are becoming more evident with the increasing number of companies adopting IT resources in various business functions. Cloud discovery solutions have been segmented on basis of application discovery and infrastructure discovery.

SERVICES

The services segment in the cloud discovery market has been segmented into professional services and managed services. The professional services help enterprises accelerate cloud automation, enhance efficiency, and reduce risk and cost. These service providers determine the most accurate option and optimize the cloud environment as per the clients business needs. On the other hand, Managed Service Providers (MSPs) provide enterprises with skilled resources that augment in-house functionalities and IT infrastructure, which can be managed in collaboration with a third-party MSP via cloud platforms

MANAGED SERVICES

MSPs offer remote management and monitoring of end-users IT infrastructure under a subscription model. MSPs are defined as third-party IT service providers that remotely manage customers IT infrastructure and systems. MSPs deliver technologically advanced offerings to their clients to provide the best-in-class services. MSPs provide their offerings under a Service-Level Agreement (SLA), which defines the term, type, and quality of service offered to the clients. Enterprises opt for MSPs to overcome the challenges of budget constraints and technical expertise, as they have specialized human resources, infrastructure, and industry certifications. MSPs offer cloud discovery services to help organizations offload the burden of identifying and classifying unmanaged IT resources and cloud applications used within an enterprise. These services are designed to provide technical support round-the-clock, maximize the overall performance, and achieve cost optimization.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for cloud discovery?

Data rules and regulations are in place with an intent to make data more secure. In order to follow strict industry and government data security standards, enterprises, especially SMEs, face difficulties dueto budget constraints. Hence, strict government rules and regulations could be hindering the growth of the global cloud discovery market.

Major players in the global market are AlienVault (US), ASG Technologies (US), BMC Software (US), Certero (UK), CipherCloud (US), Cisco Systems (US), Connectwise (US), iQuate (Ireland), Kmicro (US), ManageEngine (US), McAfee (US), Movere (US), Nephos Technologies (UK), NetSkope (US), Nuvalo (US), Perpetuuiti (Singapore), Puppet (US), Qualys (US), ScienceLogic (US), ServiceNow (US), vArmour (US), Virima Technologies (US), WhiteHat Security (US), Ziften (US), and Zscaler (US). These players have adopted various growth strategies, such as new product developments, mergers and acquisitions, collaborations, and partnerships, to expand their presence in the global cloud discovery market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Attractive Market Opportunities in the Cloud Discovery Market

4.2 Market By Solution (2018 vs 2023)

4.3 Market Shares of Top 3 Verticals and Regions, 2018

4.4 Market Investment Scenario

5 Market Overview and Industry Trends (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Applications Running on A Dynamic IT Environment

5.2.1.2 Growing Adoption of the Multi-Cloud Environment has Increased the Demand for Cloud Discovery Solutions

5.2.1.3 Increasing Need to Efficiently Manage the Security of the IT Infrastructure

5.2.2 Restraints

5.2.2.1 Strict Government Rules and Regulations

5.2.3 Opportunities

5.2.3.1 High Rate of Adoption of Cloud Discovery Solutions and Services Among SMEs

5.2.3.2 Lack of Appropriate Monitoring

5.2.4 Challenges

5.2.4.1 Stiff Competition

5.2.4.2 Delivering Robust Yet High-Performing Cloud Discovery Solutions

5.3 Regulatory Framework

5.3.1 International Organization for Standardization 27001

5.3.2 National Institute of Standards and Technology (NIST) Cybersecurity Framework

5.3.3 Cloud Security Alliance Cloud Controls Matrix

5.3.4 Federal Information Security Management Act

5.3.5 Cloud Security Alliance Security, Trust, and Assurance Registry

6 Cloud Discovery Market, By Component (Page No. - 34)

6.1 Introduction

6.2 Solutions

6.2.1 Application Discovery

6.2.2 Infrastructure Discovery

6.3 Services

6.3.1 Professional Services

6.3.1.1 Training, Education, and Consulting

6.3.1.2 Support and Maintenance

6.3.2 Managed Services

7 Market By Organization Size (Page No. - 43)

7.1 Introduction

7.2 Large Enterprises

7.3 Small and Medium-Sized Enterprises

8 Cloud Discovery Market, By Vertical (Page No. - 46)

8.1 Introduction

8.2 Banking, Financial Services, and Insurance

8.3 Healthcare and Life Sciences

8.4 Telecommunications and ITes

8.5 Retail and Consumer Goods

8.6 Government and Public Sector

8.7 Media and Entertainment

8.8 Manufacturing

8.9 Transportation and Logistics

8.10 Others

9 Cloud Discovery Market, By Region (Page No. - 55)

9.1 Introduction

9.2 North America

9.2.1 United States

9.2.2 Canada

9.3 Europe

9.3.1 United Kingdom

9.3.2 Germany

9.3.3 France

9.3.4 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 Japan

9.4.3 Singapore

9.4.4 Australia and New Zealand

9.4.5 Rest of Asia Pacific

9.5 Middle East and Africa

9.5.1 Middle East

9.5.2 Africa

9.6 Latin America

9.6.1 Brazil

9.6.2 Mexico

9.6.3 Rest of Latin America

10 Competitive Landscape (Page No. - 76)

10.1 Overview

10.2 Competitive Scenario

10.2.1 New Product Launches/Product Upgradations

10.2.2 Partnerships, Agreements, and Collaborations

10.2.3 Mergers and Acquisitions

10.2.4 Business Expansions

11 Company Profiles (Page No. - 81)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Introduction

11.2 BMC Software

11.3 Servicenow

11.4 Puppet

11.5 Mcafee

11.6 Cisco Systems

11.7 Qualys

11.8 Ciphercloud

11.9 Zscaler

11.10 Netskope

11.11 ASG Technologies

11.12 Alienvault

11.13 Certero

11.14 Connectwise

11.15 Iquate

11.16 Kmicro

11.17 Movere

11.18 Nephos Technologies

11.19 Nuvalo

11.20 Perpetuuiti

11.21 Varmour

11.22 Virima Technologies

11.23 Whitehat Security

11.24 Ziften

11.25 Manageengine

11.26 Sciencelogic

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 119)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (65 Tables)

Table 1 Cloud Discovery Market Size, By Component, 20162023 (USD Million)

Table 2 Solutions: Market Size By Region, 20162023 (USD Million)

Table 3 Market Size By Type, 20162023 (USD Million)

Table 4 Application Discovery: Market Size By Region, 20162023 (USD Million)

Table 5 Infrastructure Discovery: Market Size By Region, 20162023 (USD Million)

Table 6 Market Size By Service, 20162023 (USD Million)

Table 7 Services: Market Size By Region, 20162023 (USD Million)

Table 8 Professional Services Market Size, By Region, 20162023 (USD Million)

Table 9 Professional Services Market Size, By Type, 20162023 (USD Million)

Table 10 Training, Education, and Consulting Market Size, By Region, 20162023 (USD Million)

Table 11 Support and Maintenance Market Size, By Region, 20162023 (USD Million)

Table 12 Managed Services Market Size, By Region, 20162023 (USD Million)

Table 13 Cloud Discovery Market Size, By Organization Size, 20162023 (USD Million)

Table 14 Large Enterprises: Market Size By Region, 20162023 (USD Million)

Table 15 Small and Medium-Sized Enterprises: Market Size By Region, 20162023 (USD Million)

Table 16 Cloud Discovery Market Size, By Vertical, 20162023 (USD Million)

Table 17 Banking, Financial Services, and Insurance: Market Size By Region, 20162023 (USD Million)

Table 18 Healthcare and Life Sciences: Market Size By Region, 20162023 (USD Million)

Table 19 Telecommunications and ITes: Market Size By Region, 20162023 (USD Million)

Table 20 Retail and Consumer Goods: Market Size By Region, 20162023 (USD Million)

Table 21 Government and Public Sector: Market Size By Region, 20162023 (USD Million)

Table 22 Media and Entertainment: Market Size By Region, 20162023 (USD Million)

Table 23 Manufacturing: Market Size By Region, 20162023 (USD Million)

Table 24 Transportation and Logistics: Market Size By Region, 20162023 (USD Million)

Table 25 Others: Market Size By Region, 20162023 (USD Million)

Table 26 Cloud Discovery Market Size, By Region, 20162023 (USD Million)

Table 27 North America: Market Size By Component, 20162023 (USD Million)

Table 28 North America: Market Size By Solution, 20162023 (USD Million)

Table 29 North America: Market Size By Service, 20162023 (USD Million)

Table 30 North America: Market Size By Professional Service, 20162023 (USD Million)

Table 31 North America: Market Size By Organization Size, 20162023 (USD Million)

Table 32 North America: Market Size By Vertical, 20162023 (USD Million)

Table 33 North America: Market Size By Country, 20162023 (USD Million)

Table 34 Europe: Cloud Discovery Market Size, By Component, 20162023 (USD Million)

Table 35 Europe: Market Size By Solution, 20162023 (USD Million)

Table 36 Europe: Market Size By Service, 20162023 (USD Million)

Table 37 Europe: Market Size By Professional Service, 20162023 (USD Million)

Table 38 Europe: Market Size By Organization Size, 20162023 (USD Million)

Table 39 Europe: Market Size By Vertical, 20162023 (USD Million)

Table 40 Europe: Market Size By Country, 20162023 (USD Million)

Table 41 Asia Pacific: Cloud Discovery Market Size, By Component, 20162023 (USD Million)

Table 42 Asia Pacific: Market Size By Solution, 20162023 (USD Million)

Table 43 Asia Pacific: Market Size By Service, 20162023 (USD Million)

Table 44 Asia Pacific: Market Size By Professional Service, 20162023 (USD Million)

Table 45 Asia Pacific: Market Size By Organization Size, 20162023 (USD Million)

Table 46 Asia Pacific: Market Size By Vertical, 20162023 (USD Million)

Table 47 Asia Pacific: Market Size By Country, 20162023 (USD Million)

Table 48 Middle East and Africa: Cloud Discovery Market Size, By Component, 20162023 (USD Million)

Table 49 Middle East and Africa: Market Size By Solution, 20162023 (USD Million)

Table 50 Middle East and Africa: Market Size By Service, 20162023 (USD Million)

Table 51 Middle East and Africa: Market Size By Professional Service, 20162023 (USD Million)

Table 52 Middle East and Africa: Market Size By Organization Size, 20162023 (USD Million)

Table 53 Middle East and Africa: Market Size By Vertical, 20162023 (USD Million)

Table 54 Middle East and Africa: Market Size By Sub-Region, 20162023 (USD Million)

Table 55 Latin America: Cloud Discovery Market Size, By Component, 20162023 (USD Million)

Table 56 Latin America: Market Size By Solution, 20162023 (USD Million)

Table 57 Latin America: Market Size By Service, 20162023 (USD Million)

Table 58 Latin America: Market Size By Professional Service, 20162023 (USD Million)

Table 59 Latin America: Market Size By Organization Size, 20162023 (USD Million)

Table 60 Latin America: Market Size By Vertical, 20162023 (USD Million)

Table 61 Latin America: Market Size By Country, 20162023 (USD Million)

Table 62 New Product Launches/Product Upgradations, 20172018

Table 63 Partnerships, Agreements, and Collaborations, 20162018

Table 64 Mergers and Acquisitions, 2018

Table 65 Business Expansions, 20172018

List of Figures (30 Figures)

Figure 1 Cloud Discovery Market Segmentation

Figure 2 Regional Scope

Figure 3 Market Research Design

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Cloud Discovery Market: Assumptions

Figure 9 Market Size and Growth, 20162023 (USD Million, Y-O-Y %)

Figure 10 Top 3 Segments With the Largest Market Shares in the Market

Figure 11 Market Regional Snapshot

Figure 12 Applications Running on Dynamic IT Environments are Expected to Contribute to the Growth of the Cloud Discovery Market

Figure 13 Application Discovery Solution is Estimated to Have the Larger Market Size in 2018

Figure 14 Banking, Financial Services, and Insurance Vertical, and North America Region are Expected to Have the Largest Market Shares in 2018

Figure 15 Asia Pacific is Expected to Emerge as the Best Market for Investment in the Next 5 Years

Figure 16 Cloud Discovery Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Solution Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 18 Application Discovery Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 19 Professional Services Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 20 Large Enterprises Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 21 Banking, Financial Services, and Insurance Vertical is Expected to Have the Largest Market Size During the Forecast Period

Figure 22 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 23 North America: Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Key Developments By the Leading Players in the Cloud Discovery Market During 20162018

Figure 26 Geographic Revenue Mix of the Top Market Players

Figure 27 Servicenow: Company Snapshot

Figure 28 Cisco Systems: Company Snapshot

Figure 29 Qualys: Company Snapshot

Figure 30 Zscaler: Company Snapshot

Growth opportunities and latent adjacency in Cloud Discovery Market