Cloud Migration Services Market by Offering (Service Type (Assessment & Planning, Managed Cloud), Deployment Mode), Application (SCM, BI & Analytics), Migration Type (Infrastructure, Data Migration), Vertical and Region - Global Forecast to 2028

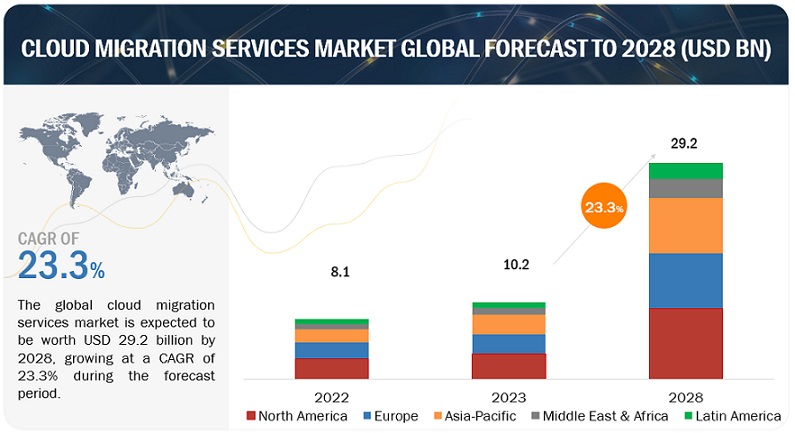

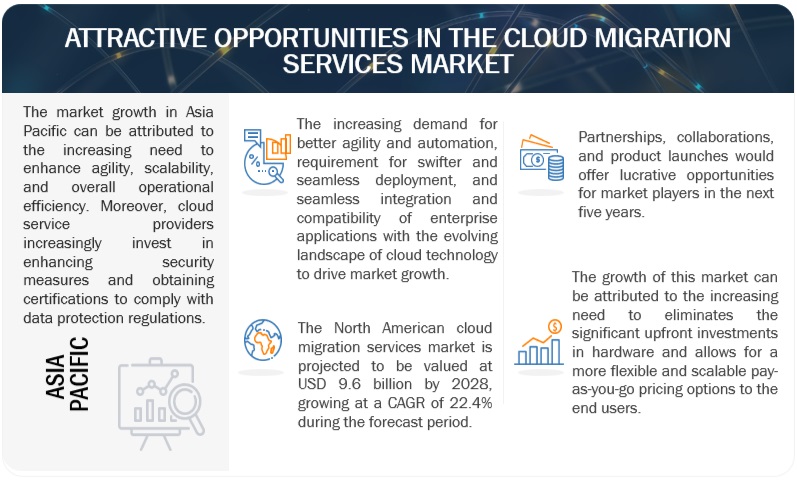

The cloud migration services market is estimated to be worth USD 10.2 billion in 2023. It is projected to reach USD 29.2 billion by 2028 at a CAGR of 23.3% during the forecast period. Due to various business drivers, the cloud migration services market is expected to grow significantly during the forecast period. The market is experiencing significant growth due to the increasing demand for better agility and automation, the requirement for swifter and seamless deployment, and seamless integration and compatibility of enterprise applications with the evolving landscape of cloud technology.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Seamless integration and compatibility of enterprise applications with the evolving landscape of cloud technology

The seamless integration and compatibility of enterprise applications with the evolving landscape of cloud technology serve as a significant driver for adopting cloud migration services. As businesses increasingly recognize the advantages of cloud solutions, ensuring that existing applications align seamlessly with cloud environments becomes imperative. This compatibility allows enterprises to leverage the full potential of the cloud, optimizing performance, scalability, and efficiency. The compatibility of enterprise applications with the advancing landscape of cloud technology plays a pivotal role in driving the demand for cloud migration services. As businesses increasingly recognize the benefits of cloud solutions, the ability to seamlessly integrate existing enterprise applications with evolving cloud technologies becomes a critical factor. This compatibility ensures that applications can operate efficiently in cloud environments, leveraging the full spectrum of advantages offered by the cloud. Furthermore, businesses often rely on a diverse range of applications, from legacy systems to modern software suites. The challenge arises when organizations seek to migrate these applications to the cloud. The process requires careful consideration of each application's architecture, dependencies, and functionalities to ensure a smooth transition. Cloud migration services specialize in addressing these challenges by offering tailored solutions that facilitate the integration of enterprise applications with cloud environments. They provide expertise in understanding the specific requirements of each application, optimizing configurations, and ensuring that the migrated applications function seamlessly in the cloud. Moreover, compatibility with rising cloud technology is instrumental in achieving key objectives of cloud migration, such as scalability, flexibility, and enhanced performance. It allows businesses to harness the advantages of cloud-native features, enabling them to adapt to changing demands and stay competitive in a dynamic market. In conclusion, the compatibility of enterprise applications with evolving cloud technology is a driving force for the cloud migration services market, emphasizing the importance of a streamlined integration process to unlock the full potential of cloud-based solutions for businesses.

Restraints: Complexity associated with migrating legacy systems and applications to the cloud

The complexity linked to migrating legacy systems and applications to the cloud is a significant challenge within the cloud migration services market. Legacy systems, characterized by older technologies, architectures, and dependencies, pose unique hurdles when organizations aim to transition to cloud environments. Cloud migration services play a crucial role in addressing these challenges by offering specialized expertise to understand and optimize legacy architectures. This involves careful data migration, integration with modern technologies, compliance adherence, and minimizing downtime. The proficiency of cloud migration services extends to managing skill set requirements, ensuring data security, and optimizing costs, making them essential partners for organizations seeking a seamless transition from legacy systems to the advantages of cloud environments.

Opportunity: Rising adoption rate of cloud migration services across the healthcare vertical

The healthcare sector is witnessing a substantial uptake of cloud migration services, underscored by a notable surge in adoption rates. Healthcare data is highly sensitive and confidential. Much data is generated and processed daily in the healthcare vertical. However, most healthcare organizations still store their data on their premises. This data is more vulnerable to losses and creates huge security risks. For instance, a survey among healthcare providers revealed that nearly 80% are actively considering or implementing cloud migration strategies to enhance data accessibility, streamline operations, and bolster overall IT infrastructure resilience. This robust adoption indicates the industry's recognition of the strategic advantages cloud technologies offer in optimizing healthcare delivery and data management. According to the HIMSS 2022 Digital Health Trends Survey, 63% of healthcare organizations have deployed at least one application to the cloud, and 45% plan to migrate additional applications in the next two years. Cloud migration paves the way for robust telehealth platforms, expanding access to care for geographically dispersed patients and underserved communities. The need for cost control, technology innovations, increased security, and compliance requirements are expected to drive the high adoption of cloud migration services in the healthcare vertical.

Challenge: Concerns associated with Cloud interoperability

Cloud migration service providers are facing the challenge of cloud interoperability. Cloud interoperability refers to the ability to move applications from one environment to another. While migrating workloads from one cloud environment to another, or while migrating on-premises workloads to a different cloud environment, cloud migration service providers face the challenge of offering the same management tools, server images, databases, operating systems, and other variety of software on different cloud platforms and environments. Cloud providers also find it difficult to write codes that can work in multiple cloud environments and cloud frameworks.

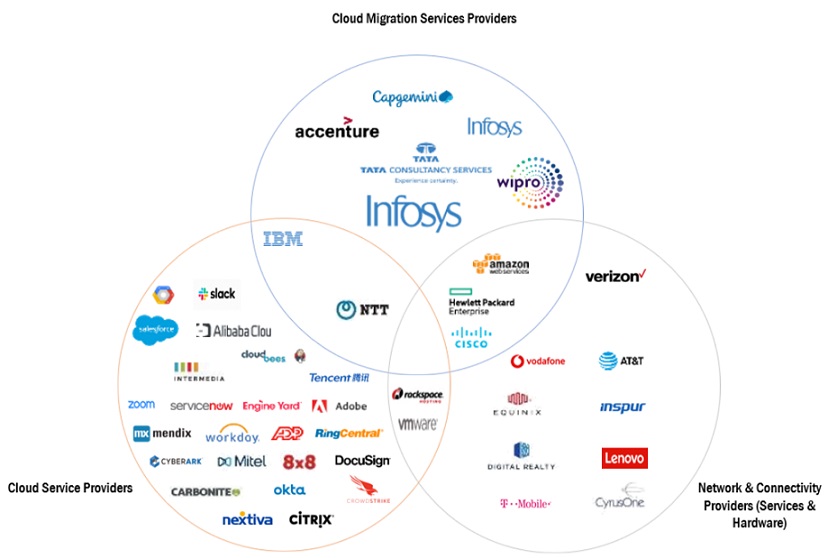

Cloud Migration Services Market Ecosystem

By service type, the data migration and management segment registered the highest CAGR during the forecast period.

Data Migration and Management Services play a crucial role in the Cloud Migration Services market by addressing the complexities of transferring, organizing, and optimizing data during the transition to cloud environments. These services ensure the smooth and secure data transfer from on-premises infrastructure to the cloud. They employ methodologies and tools to minimize downtime and disruptions, facilitating a seamless migration process.

By vertical, media & entertainment register the highest CAGR during the forecast period.

Cloud migration services are increasingly gaining prominence across the Media and Entertainment vertical, transforming the way companies in this sector manage and deliver content. Cloud migration services enable media and entertainment firms to scale their content delivery infrastructure dynamically. Cloud migration services enable media companies to adapt to industry trends, such as the shift to on-demand content consumption, virtual production techniques, and the integration of augmented reality (AR) and virtual reality (VR) experiences.

By application, Business Intelligence & Analytics segment to register highest CAGR during the forecast period.

Cloud migration services enable BI and Analytics applications to leverage scalable cloud resources, ensuring optimal performance even with growing datasets. This scalability allows organizations to handle increasing data volumes efficiently. Cloud migration services facilitate the integration and centralization of diverse data sources. BI and Analytics applications can seamlessly connect to various data repositories in the cloud, enabling a comprehensive view of the organization's data for analytics purposes.

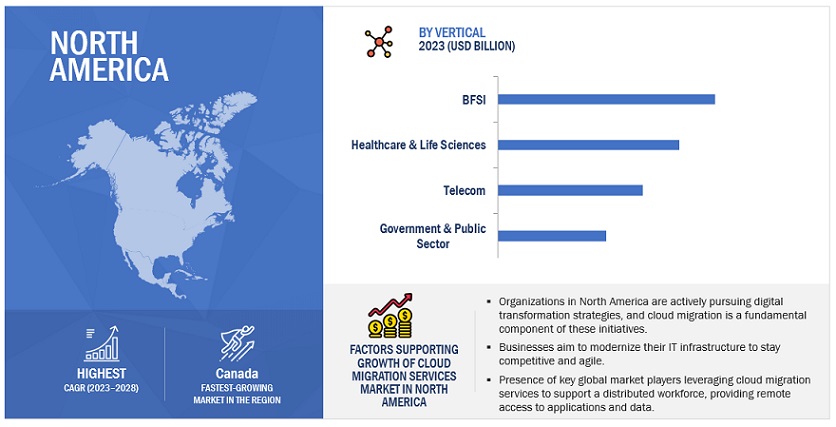

By region, North America to witness the largest market size during the forecast period.

North America is experiencing significant technological growth in the cloud migration services market. Organizations in North America are actively pursuing digital transformation strategies, and cloud migration is a fundamental component of these initiatives. Businesses aim to modernize their IT infrastructure to stay competitive and agile. Cloud service providers in North America continually enhance their security measures, offering robust solutions to address data protection and privacy concerns. Advanced security features are crucial for businesses considering cloud migration.

Key Market Players

The cloud migration services providers have implemented various organic and inorganic growth strategies, such as product upgrades, new product launches, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some major players in the cloud migration services market include IBM (US), AWS (US), Google (US), Microsoft (US), Oracle (US), SAP (Germany), VMWare (US), Cisco (US), NTT Data (Japan), Accenture (Ireland), Infosys (India), DXC (US), HPE (US), Veritis (US), RiverMeadow (US), Rackspace (US), Informatica (US), WSM (US), and so on.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD (Billion) |

|

Segments Covered |

Service Type, Deployment Mode, Migration Type Application, Vertical, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), AWS (US), Google (US), Microsoft (US), Oracle (US), SAP (Germany), VMWare (US), Cisco (US), NTT Data (Japan), Accenture (Ireland), Infosys (India), DXC (US), HPE (US), Veritis (US), RiverMeadow (US), Rackspace (US), Informatica (US), WSM (US), and so on. |

This research report categorizes the cloud migration services market based on offering, migration type, application, vertical, and region.

By Offering:

-

Service Type

-

Assessment and Planning Services

- Readiness Assessment

- Dependency Mapping

- Migration Roadmap

-

Migration and Deployment Services

- Lift-and-Shift Migration

- DevOps Integration

-

Integration and Customization Services

- Application Integration

- Customization and Configuration

- System Interoperability

-

Data Data Migration and Management

- Data Mapping and Cleansing

- Large-Scale Data Migration

- Data Lifecycle Management

-

Security and Compliance Services

- Security Assessment and Remediation

- Compliance Adherence

- Identity and Access Management (IAM)

-

Training and Support Services

- User Training and Adoption

- Ongoing Support

- Knowledge Transfer

-

Managed Cloud Services

- Cloud Infrastructure Management

- Security Management

- Performance Optimization

- Other Service Type

-

Assessment and Planning Services

-

Deployment Mode

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Migration Type:

- Infrastructure Migration

- Platform Migration

- Data Migration

- Application Migration

- Other Migration Types

By Application:

- Supply Chain Management (SCM)

- Project Management

- Content Management

- Data Warehouse Management

- Business Intelligence (BI) & Analytics

- Other Applications

By Vertical:

- BFSI

- Healthcare & Life Sciences

- Telecom

- Retail & Consumer Goods

- Government & Public Sector

- Media & Entertainment

- Automoitive & Transportation

- Manufacturing

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia and New Zealand (ANZ)

- South Korea

- ASEAN Countries

- Rest of Asia Pacific

-

Middle East & Africa

- GCC

- South Africa

- Egypt

- Turkey

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In November 2023, Infosys entered into a three-year strategic collaboration agreement with AWS to accelerate cloud transformation for financial institutions across Europe, the middle east, and Africa (EMEA). this collaboration, under Infosys cobalt, combines AWS's cloud-native innovation with info sys's domain knowledge, delivering specialized cloud migration and modernization services. the aim is to provide transformative cloud solutions, leveraging generative AI and data analytics, industry-specific use cases, and shared toolsets for accelerated adoption and compliance.

- In September 2023, Oracle and Microsoft announced Oracle Database at Azure, which gives customers direct access to Oracle database services running on Oracle Cloud Infrastructure (OCI) and deployed in Microsoft Azure datacenters.

- In September 2023, Red Hat, and Oracle announced the expansion of their alliance to offer customers a greater choice in deploying applications on Oracle Cloud Infrastructure (OCI). As part of the expanded collaboration, Red Hat OpenShift, the industry’s leading hybrid cloud application platform powered by Kubernetes for architecting, building, and deploying cloud-native applications, will be supported and certified to run on OCI.

- In August 2023, Cisco and Nutanix partnership streamlined cloud migration with a pre-integrated solution, leveraging SaaS-managed infrastructure through Cisco's Intersight. This collaboration supports flexible deployment options, ensuring compatibility with diverse server environments and cloud choices. Nutanix Cloud Platform capabilities provide a consistent operating model, simplified application management, and scalability for migrated workloads. The partnership's benefits include faster migration, reduced costs, improved management, enhanced security, and increased scalability and agility.

Frequently Asked Questions (FAQ):

What is Cloud migration services?

Cloud migration services in the market refer to a comprehensive set of solutions and strategies to facilitate the seamless transition of an organization's digital assets, applications, data, and IT processes from on-premises infrastructure to cloud computing environments. These services encompass thorough planning, assessment, and execution phases, addressing workload optimization, data security, scalability, and cost efficiency. Cloud migration services aim to minimize downtime, enhance operational efficiency, and leverage the benefits of cloud technologies, ensuring that businesses can adapt and thrive in the dynamic landscape of cloud computing.

What is the total CAGR expected to be recorded for the Cloud migration services market during the forecast period?

The market is expected to record a CAGR of 23.3% during the forecast period.

What are the key drivers supporting the growth of the cloud migration services market?

Some factors driving the growth of the cloud migration services market are increasing demand for better agility and automation, requirement for swifter and seamless deployment, and seamless integration and compatibility of enterprise applications with the evolving landscape of cloud technology.

Which are the key migration types prevailing in the Cloud migration services market?

The key migration types include Infrastructure Migration, Platform Migration, Data Migration, Application Migration, and others.

Who are the key vendors in the Cloud migration services market?

Some major players in the cloud migration services market include IBM (US), AWS (US), Google (US), Microsoft (US), Oracle (US), SAP (Germany), VMWare (US), Cisco (US), NTT Data (Japan), Accenture (Ireland), Infosys (India), DXC (US), HPE (US), Veritis (US), RiverMeadow (US), Rackspace (US), Informatica (US), WSM (US), and so on. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

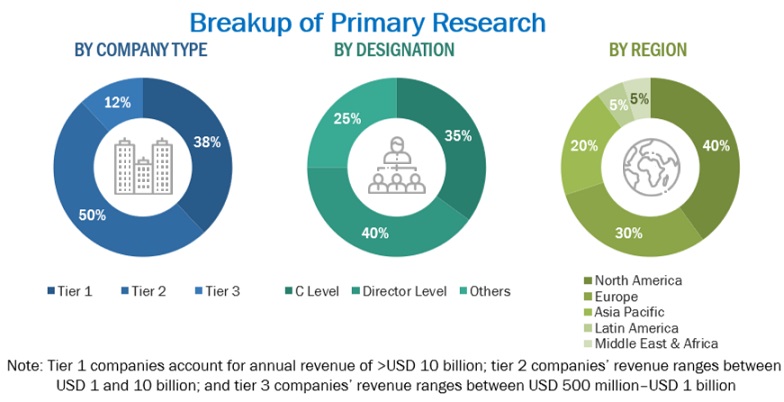

The cloud migration services market research study involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred cloud migration services providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, cloud migration services spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on service type, market classification, and segmentation according to offerings of major players, industry trends related to service type, deployment modes, migration type, application, vertical, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and cloud migration services expertise; related key executives from cloud migration services vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to migration types, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using cloud migration services solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of cloud migration services, which would impact the overall cloud migration services market.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

IBM |

Senior Partner, Global Hybrid Cloud Migration Offering |

|

AWS |

Cloud Migration Consultant |

|

Accenture |

Cloud Migration Consultant |

|

NTT Data |

Director- Data & Analytics |

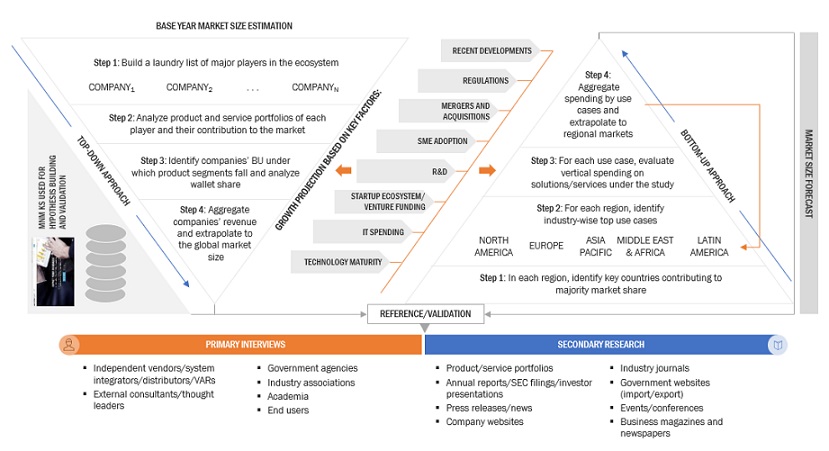

Market Size Estimation

In the bottom-up approach, the adoption rate of cloud migration services among different verticals in key countries concerning their regions contributing the most to the market share was identified. For cross-validation, the adoption of cloud migration services among industries and different use cases concerning their regions was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the cloud migration services market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major cloud migration services providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall cloud migration services market size and segments’ size were determined and confirmed using the study.

Global Cloud migration services Market Size: Bottom-Up and Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the cloud migration services market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major cloud migration services providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall cloud migration services market size and segments’ size were determined and confirmed using the study.

Market Definition

A cloud migration services refer to the collection of processes that help enterprises in migrating data, applications, servers, databases, and various workloads from on-premises to the Infrastructure as a Service (IaaS) cloud model, or from one cloud environment to another. Cloud migration is critical for achieving improved operational performance and efficiency, which requires careful planning, analysis, and execution to maintain the compatibility of the cloud environment with the organizational requirements.

STAKEHOLDERS

- Cloud migration services vendors

- Cloud migration vendors

- Managed service providers

- Support and maintenance service providers

- System Integrators (SIs)/migration service providers

- Value-Added Resellers (VARs) and distributors

- Distributors and Value-added Resellers (VARs)

- System Integrators (SIs)

- Independent Software Vendors (ISV)

- Third-party providers

- Technology providers

Report Objectives

- To define, describe, and predict the cloud migration services market by offering (service type, and deployment mode), migration type, application, vertical and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the cloud migration services market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the cloud migration services market

- To analyze the impact of recession across all the regions across the cloud migration services market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the North American cloud migration services market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Middle Eastern & African market

- Further breakup of the Latin America cloud migration services market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Cloud Migration Services Market