Multi-Cloud Management Market by Platform, Application (Metering & Billing, Infrastructure & Resource Management), Service Type (Cloud Automation, Migration & Integration), Deployment Model, Vertical, and Region - Global Forecast to 2022

[144 pages Report] Multi-cloud management enable enterprises to transfer their workload on multiple clouds with respective applications and data criticality. It enables management of multiple cloud services such as IaaS, PaaS, and SaaS and provides flexibility.

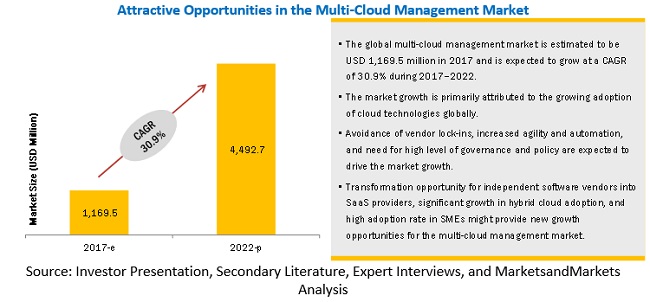

The multi-cloud management market is expected to grow from USD 1,169.5 million in 2017 to USD 4,492.7 million by 2022, at a Compound Annual Growth Rate (CAGR) of 30.9% from 2017 to 2022. Avoidance of vendor lock-ins, increased agility and automation and rising Need for high level of governance and policy are the major factors that are expected to drive the market. Additionally, with the rise of adoption of containerization and microservices for cloud native applications, there is increase adoption of multi-cloud strategy by enterprises. The objective of the report is to define, describe, and forecast the market size based on applications, service type, organization size, industry vertical, and region.

By platform, the enablement segment is expected to grow at the highest growth rate during the forecast period

Among the platform segment, the external enablement segment is expected to grow at the highest CAGR during the forecast period. The external enablement platform is expected to grow in the coming years, due to the expanding marketspace for cloud brokers across the world.

By application type, the lifecycle segment to record the highest CAGR during the forecast period

The lifecycle applications segment is expected to witness a faster growth rate in this market, as helps the enterprises in managing the lifecycle of cloud-ready products to offer state-of-the-art IaaS, PaaS, and SaaS services and reduced Time-to-Market (TTM) solutions. Additionally, it accelerates innovation through automated resource provisioning, governance, and management of available cloud services

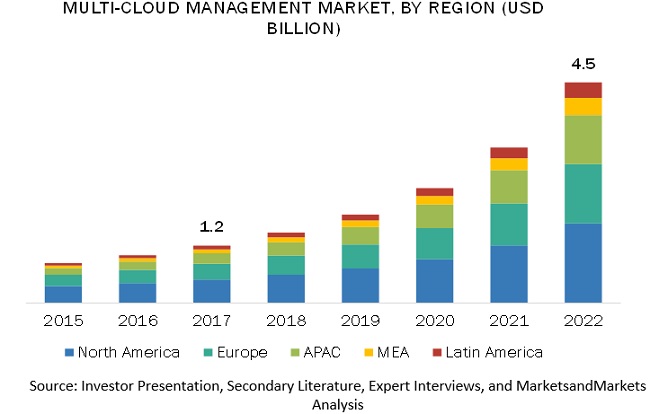

North America to account for the largest market size during the forecast period.

North America is expected to hold the largest market size in the Multi-Cloud Management market during the forecast period, followed by the European region. The cloud services market in the region is quickly shifting from isolated cloud solution, to platform that integrate onsite, public, and private IaaS. Europe is anticipated to be the second largest region in terms of market size in the market owing to robust economic infrastructure with business demand for cloud services. The APAC region for the market is driven by the growing acceptance of cloud-based solutions and emerging technologies such as IoT and edge computing.

Multi-Cloud Management Market Dynamics

Driver: Avoidance of vendor lock-ins

The fear of vendor lock-in is often cited as a major impediment to the cloud service adoption. Multi-cloud management has enabled the end-users to switch between different vendors and reduce the dependency on a single vendor. This relative independency promotes end-users to negotiate with vendors for improved pricing, Service-Level Agreements (SLAs), or both. In addition, multi-cloud management also offers flexibility in data deployment and enables end-users to move their workload to multiple clouds as per the requirement. In addition, to avail the maximum level of independence, end-users can adopt multi-cloud management platforms to manage the complex applications over multiple heterogeneous cloud platforms. Hence, multi-cloud management eliminates vendor lock-in and enables seamless migration from one vendor to another.

Restraint: Application portability on various cloud environments

Cloud service brokers manage cloud resources across multiple CSPs, on a single platform. It enables organizations to govern and manage multi-cloud services more efficiently and save time and money on planning and provisioning. However, the ability to provision and de-provision public cloud services does not provide application portability, which could be defined as the ability of programs to run on different cloud environments without being installed in a way that modifies the clouds configuration information. This enables enterprises to focus on their core business activities, with all resources organized on a central platform, without worrying about different platforms and their various quirks. Cloud brokers may also face limitations while transferring workloads from one cloud ecosystem to another. Thus, workloads get locked into a single public cloud provider, once built for or ported to it. Moving workloads/applications from place to place to find the best performance and the best cost efficiencies becomes a major restraint to Cloud Services Brokerage (CSB) technologies.

Opportunity: Transformation opportunity for ISVs SaaS providers

Most of the on-premises vendors are moving toward the cloud deployment model to reduce IT costs and offer cloud-based solutions and services. Virtualization and cloud are the need of the hour to sustain in the competitive market; hence, ISVs are transforming themselves from software developers to software providers. This provides tremendous opportunity for the end-users to choose cloud services from different CSPs as per their requirement. Customization of service and flexibility is attracting more customers to adopt cloud services on a larger scale. The service providers are now trying to enter the multi-cloud management marketspace and are implementing, maintaining, and offering support for multiple cloud products, simultaneously.

Challenge: Complexities in redesigning the network for cloud

The redesigning of networks from on-premises to cloud requires high initial investment, which is difficult, especially for SMEs that have limited budgets and resources. Moreover, most of the enterprises have found the upgrade to cloud deployment complex and costly. Enterprises need to take care of a number of issues, along with the network architecture, to accommodate their cloud infrastructure setup. It is very difficult to achieve visibility, measure performance, and manage workloads across multiple cloud deployment models. Complexity is the biggest challenge in the multi-cloud environment due to its deployment structure and the strategies required for building and managing the multi-cloud environments.

Scope of the Multi-Cloud Management Market Report

|

Report Metric |

Details |

|

Market size available for years |

20152022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Platforms Type (Internal and External Enablement), Application Type (Metering and Billing, Infrastructure and Resource Management, Provisioning, Compliance Management, Lifecycle management, Identity and Policy Management & Others), Service Type (Cloud Automation, Migration And Integration, Reporting And Analytics, Data Security And Risk Management, Monitoring And Access Management, Training And Consulting, Support And Maintenance and Others), Deployment Model (Public Vs. Private Vs. Hybrid Cloud), Organization Size, Industry Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

BMC Software (US), CenturyLink (US), Accenture (Ireland), VMware (US), DoubleHorn (US), RightScale (US), CliQr (US), Cloudyn (Israel), Dell Technologies (US), Jamcracker (US), IBM (US), Citrix (US), Sixsq (Switzerland), Cloudmore (Sweden), Turbonomic (US) |

The research report categorizes the market to forecast the revenues and analyze the trends in each of the following sub-segments:

Multi-Cloud Management Market By Platform

- Internal Brokerage Enablement

- External Brokerage Enablement

Market By Application

- Metering and Billing

- Provisioning

- Compliance Management

- Infrastructure and Resource Management

- Identity and Policy Management

- Lifecycle Management

- Others (Monitoring and Notification)

Market By Service Type

- Cloud Automation

- Data Security and Risk Management

- Migration and Integration

- Reporting and Analytics

- Monitoring and Access Management

- Training and Consulting

- Support and Maintenance

- Others (Account and User Management, Backup, and Customer Service)

Multi-Cloud Management Market By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

Market By Vertical

- BFSI

- Healthcare and Life Sciences

- Telecommunications and IT-enabled Services (ITES)

- Travel and Hospitality

- Retail and Consumer Goods

- Media and Entertainment

- Government and Public Sector

- Others (Manufacturing and Education)

Multi-Cloud Management Market By Region

- North America

- United States

- Canada

- Europe

- United Kingdom

- Germany

- France

- Rest of Europe

- Asia Pacific (APAC)

- China

- Japan

- Australia and New Zealand

- Rest of APAC

- Middle East and Africa (MEA)

- Middle East

- Africa

- Rest of Middle East

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Key Market Players

BMC Software (US), CenturyLink (US), Accenture (Ireland), VMware (US), DoubleHorn (US), RightScale (acquired by Flexera) (US), CliQr (acquired by Cisco) (US), Cloudyn (acquired by Microsoft) (Israel), Dell Technologies (US), Jamcracker (US), IBM (US), Citrix (US), Sixsq (Switzerland), Cloudmore (Sweden), Turbonomic (US)

BMC Software is a private company that was founded in 1980 and is headquartered in Texas, US. The company offers IT management solutions for mainframe, mobile, and cloud. The companys robust products and solutions offerings include service management, workload automation, IT operations, cloud management, IT automation, and mainframe. BMC Software has presence in more than 30 countries and has an employee base of more than 6,000. The company offers innovative software solutions to its customers that include mid-sized as well as large enterprises. The company has more than 500 partners and over 10,000 customers in more than 120 countries. The company has its presence in the US, Europe, MEA, Latin America, and APAC.

BMC Software offers robust multi-cloud management solutions including Innovation Suite, SecOps Response Service, TrueSight, Remedy OnDemand, cloud lifecycle management, BMC Digital Workplace, Control-M, and Discovery for multi-cloud. The company has healthy partnerships with leading market players, such as TIBCO Software, Software AG, Saama Technologies, and 21st Century Software. It serves several industry verticals, including public sector, manufacturing, telecom, retail, financial services, and healthcare.

Recent Developments

- In September 2017, BMC Software launched a BMC discovery solution with enhanced multi-cloud capabilities to provide greater visibility into multi-cloud environments. The new capabilities include scale discovery and dependency mapping of assets for both, on-premises and cloud.

- In July 2017, BMC Software launched a cloud-based service known as BMC Digital Workplace. It focuses on providing increased integration and digitalized workplace for IT and various other departments.

- In June 2017, BMC Software introduced DevOps capabilities with the launch of Control-M Workbench, which is a no cost, self-service, and standalone development environment. It offers the benefit of speedy and improved application delivery to organizations. Moreover, it supports digital business automation to simplify the management of hybrid multi-cloud environments.

- In May 2017, BMC Software launched SecOps response service to reduce security risks and attack possibilities across multi-cloud as well as on-premises environments

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the Multi-Cloud Management market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 13)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 MULTI-CLOUD MANAGEMENT MARKET: MARKET SEGMENTATION

FIGURE 2 MARKET: REGIONAL SCOPE

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 20142016

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 17)

2.1 RESEARCH DATA

FIGURE 3 MULTI-CLOUD MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key industry insights

FIGURE 4 DATA TRIANGULATION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 RESEARCH ASSUMPTIONS

FIGURE 7 MARKET: ASSUMPTIONS

2.4 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 25)

FIGURE 8 MULTI-CLOUD MANAGEMENT MARKET IS EXPECTED TO RECORD HIGH GROWTH DURING THE FORECAST PERIOD

FIGURE 9 NORTH AMERICA IS ESTIMATED TO HOLD THE LARGEST MARKET SHARE IN 2017

FIGURE 10 TOP 3 SEGMENTS WITH THE LARGEST MARKET SHARES IN THE MARKET

4 PREMIUM INSIGHTS (Page No. - 29)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE MULTI-CLOUD MANAGEMENT MARKET

FIGURE 11 INCREASED AGILITY AND AUTOMATION IS EXPECTED TO CONTRIBUTE TO THE GROWTH OF THE MARKET

4.2 MARKET: MARKET SHARE OF DEPLOYMENT MODELS, 20172022

FIGURE 12 PUBLIC CLOUD IS ESTIMATED TO HAVE THE LARGEST MARKET SIZE IN 2017

4.3 MARKET INVESTMENT SCENARIO

FIGURE 13 ASIA PACIFIC IS EXPECTED TO EMERGE AS THE BEST MARKET FOR INVESTMENT IN THE NEXT 5 YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 31)

5.1 INTRODUCTION

5.2 REGULATORY IMPLICATIONS

5.2.1 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD (PCI-DSS)

5.2.2 FEDERAL INFORMATION SECURITY MANAGEMENT ACT (FISMA)

5.2.3 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION/INTERNATIONAL ELECTROTECHNICAL COMMISSION 27018 (ISO/IEC 27018)

5.3 INNOVATION SPOTLIGHT

5.4 MULTI-CLOUD MANAGEMENT MARKET ECOSYSTEM: A BUSINESS MODEL FRAMEWORK

FIGURE 14 MULTI-CLOUD MANAGEMENT PLATFORM ECOSYSTEM

5.5 MARKET DYNAMICS

FIGURE 15 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Avoidance of vendor lock-ins

5.5.1.2 Increased agility and automation

5.5.1.3 Need for high level of governance and policy

5.5.2 RESTRAINTS

5.5.2.1 Application portability on various cloud environments

5.5.2.2 Compliance with stringent regulations

5.5.3 OPPORTUNITIES

5.5.3.1 Transformation opportunity for ISVs into SaaS providers

5.5.3.2 Significant growth in hybrid cloud adoption

5.5.3.3 High adoption rate in SMEs

5.5.4 CHALLENGES

5.5.4.1 Complexities in redesigning the network for cloud

5.5.4.2 Lack of expertise and management overheads

6 MULTI-CLOUD MANAGEMENT MARKET ANALYSIS, BY PLATFORM (Page No. - 38)

6.1 INTRODUCTION

TABLE 2 MARKET SIZE, BY PLATFORM, 20152022 (USD MILLION)

FIGURE 16 INTERNAL ENABLEMENT PLATFORM IS EXPECTED TO HAVE A LARGER MARKET SIZE DURING THE FORECAST PERIOD

6.2 INTERNAL ENABLEMENT

TABLE 3 INTERNAL ENABLEMENT: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

6.3 EXTERNAL ENABLEMENT

TABLE 4 EXTERNAL ENABLEMENT: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

7 MULTI-CLOUD MANAGEMENT MARKET ANALYSIS, BY APPLICATION (Page No. - 42)

7.1 INTRODUCTION

TABLE 5 MARKET SIZE, BY APPLICATION, 20152022 (USD MILLION)

FIGURE 17 METERING AND BILLING APPLICATION IS EXPECTED TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

7.2 METERING AND BILLING

TABLE 6 METERING AND BILLING: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

7.3 INFRASTRUCTURE AND RESOURCE MANAGEMENT

TABLE 7 INFRASTRUCTURE AND RESOURCE MANAGEMENT: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

7.4 PROVISIONING

TABLE 8 PROVISIONING: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

7.5 COMPLIANCE MANAGEMENT

TABLE 9 COMPLIANCE MANAGEMENT: MULTI-CLOUD MANAGEMENT MARKET SIZE, BY REGION, 20152022 (USD MILLION)

7.6 LIFECYCLE MANAGEMENT

TABLE 10 LIFECYCLE MANAGEMENT: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

7.7 IDENTITY AND POLICY MANAGEMENT

TABLE 11 IDENTITY AND POLICY MANAGEMENT: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

7.8 OTHERS

TABLE 12 OTHERS: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

8 MULTI-CLOUD MANAGEMENT MARKET ANALYSIS, BY SERVICE TYPE (Page No. - 49)

8.1 INTRODUCTION

TABLE 13 MARKET SIZE, BY SERVICE TYPE, 20152022 (USD MILLION)

FIGURE 18 CLOUD AUTOMATION SERVICE TYPE IS ESTIMATED TO HAVE THE LARGEST MARKET SIZE IN 2017

8.2 CLOUD AUTOMATION

TABLE 14 CLOUD AUTOMATION: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

8.3 MIGRATION AND INTEGRATION

TABLE 15 MIGRATION AND INTEGRATION: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

8.4 REPORTING AND ANALYTICS

TABLE 16 REPORTING AND ANALYTICS: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

8.5 DATA SECURITY AND RISK MANAGEMENT

TABLE 17 DATA SECURITY AND RISK MANAGEMENT: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

8.6 MONITORING AND ACCESS MANAGEMENT

TABLE 18 MONITORING AND ACCESS MANAGEMENT: MULTI-CLOUD MANAGEMENT MARKET SIZE, BY REGION, 20152022 (USD MILLION)

8.7 TRAINING AND CONSULTING

TABLE 19 TRAINING AND CONSULTING: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

8.8 SUPPORT AND MAINTENANCE

TABLE 20 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

8.9 OTHERS

TABLE 21 OTHERS: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

9 MULTI-CLOUD MANAGEMENT MARKET ANALYSIS, BY DEPLOYMENT MODEL (Page No. - 57)

9.1 INTRODUCTION

TABLE 22 MARKET SIZE, BY DEPLOYMENT MODEL, 20152022 (USD MILLION)

FIGURE 19 PUBLIC CLOUD DEPLOYMENT MODEL IS EXPECTED TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

9.2 PUBLIC CLOUD

TABLE 23 PUBLIC CLOUD: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

9.3 PRIVATE CLOUD

TABLE 24 PRIVATE CLOUD: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

9.4 HYBRID CLOUD

TABLE 25 HYBRID CLOUD: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

10 MULTI-CLOUD MANAGEMENT MARKET ANALYSIS, BY VERTICAL (Page No. - 61)

10.1 INTRODUCTION

TABLE 26 MARKET SIZE, BY VERTICAL, 20152022 (USD MILLION)

FIGURE 20 TELECOMMUNICATIONS AND ITES VERTICAL IS EXPECTED TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

10.2 TELECOMMUNICATIONS AND ITES

TABLE 27 TELECOMMUNICATIONS AND ITES: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

10.3 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 28 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

10.4 HEALTHCARE AND LIFE SCIENCES

TABLE 29 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

10.5 GOVERNMENT AND PUBLIC SECTOR

TABLE 30 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

10.6 RETAIL AND CONSUMER GOODS

TABLE 31 RETAIL AND CONSUMER GOODS: MULTI-CLOUD MANAGEMENT MARKET SIZE, BY REGION, 20152022 (USD MILLION)

10.7 TRAVEL AND HOSPITALITY

TABLE 32 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

10.8 MEDIA AND ENTERTAINMENT

TABLE 33 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

10.9 OTHERS

TABLE 34 OTHERS: MARKET SIZE, BY REGION, 20152022 (USD MILLION)

11 GEOGRAPHIC ANALYSIS (Page No. - 69)

11.1 INTRODUCTION

TABLE 35 MARKET SIZE, BY REGION, 20152022 (USD MILLION)

FIGURE 21 NORTH AMERICA IS EXPECTED TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

11.2 NORTH AMERICA

FIGURE 22 NORTH AMERICA: MARKET SNAPSHOT

11.2.1 UNITED STATES

11.2.2 CANADA

TABLE 36 NORTH AMERICA: MULTI-CLOUD MANAGEMENT MARKET SIZE, BY COUNTRY, 20152022 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET SIZE, BY PLATFORM, 20152022 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 20152022 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET SIZE, BY SERVICE TYPE, 20152022 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 20152022 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 20152022 (USD MILLION)

11.3 EUROPE

11.3.1 UNITED KINGDOM

11.3.2 GERMANY

11.3.3 FRANCE

11.3.4 REST OF EUROPE

TABLE 42 EUROPE: MULTI-CLOUD MANAGEMENT MARKET SIZE, BY COUNTRY, 20152022 (USD MILLION)

TABLE 43 EUROPE: MARKET SIZE, BY PLATFORM, 20152022 (USD MILLION)

TABLE 44 EUROPE: MARKET SIZE, BY APPLICATION, 20152022 (USD MILLION)

TABLE 45 EUROPE: MARKET SIZE, BY SERVICE TYPE, 20152022 (USD MILLION)

TABLE 46 EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 20152022 (USD MILLION)

TABLE 47 EUROPE: MARKET SIZE, BY VERTICAL, 20152022 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 23 ASIA PACIFIC: MARKET SNAPSHOT

11.4.1 CHINA

11.4.2 JAPAN

11.4.3 AUSTRALIA AND NEW ZEALAND

11.4.4 REST OF ASIA PACIFIC

TABLE 48 ASIA PACIFIC: MULTI-CLOUD MANAGEMENT MARKET SIZE, BY COUNTRY, 20152022 (USD MILLION)

TABLE 49 ASIA PACIFIC: MARKET SIZE, BY PLATFORM, 20152022 (USD MILLION)

TABLE 50 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20152022 (USD MILLION)

TABLE 51 ASIA PACIFIC: MARKET SIZE, BY SERVICE TYPE, 20152022 (USD MILLION)

TABLE 52 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 20152022 (USD MILLION)

TABLE 53 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 20152022 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST

11.5.2 AFRICA

11.5.3 REST OF MIDDLE EAST

TABLE 54 MIDDLE EAST AND AFRICA: MULTI-CLOUD MANAGEMENT MARKET SIZE, BY SUB-REGION, 20152022 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PLATFORM, 20152022 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 20152022 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE TYPE, 20152022 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 20152022 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 20152022 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 BRAZIL

11.6.2 MEXICO

11.6.3 REST OF LATIN AMERICA

TABLE 60 LATIN AMERICA: MULTI-CLOUD MANAGEMENT MARKET SIZE, BY COUNTRY, 20152022 (USD MILLION)

TABLE 61 LATIN AMERICA: MARKET SIZE, BY PLATFORM, 20152022 (USD MILLION)

TABLE 62 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 20152022 (USD MILLION)

TABLE 63 LATIN AMERICA: MARKET SIZE, BY SERVICE TYPE, 20152022 (USD MILLION)

TABLE 64 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 20152022 (USD MILLION)

TABLE 65 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 20152022 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 92)

12.1 MICROQUADRANT OVERVIEW

12.2 COMPETITIVE LEADERSHIP MAPPING

12.2.1 VISIONARY LEADERS

12.2.2 INNOVATORS

12.2.3 DYNAMIC DIFFERENTIATORS

12.2.4 EMERGING COMPANIES

FIGURE 24 MULTI-CLOUD MANAGEMENT MARKET (GLOBAL), COMPETITIVE LEADERSHIP MAPPING, 2017

TABLE 66 MARKET RANKING FOR THE MARKET, 2017

12.3 COMPETITIVE BENCHMARKING

12.3.1 STRENGTH OF PRODUCT PORTFOLIO ADOPTED BY MAJOR PLAYERS IN THE MARKET (25 PLAYERS)

12.3.2 BUSINESS STRATEGY EXCELLENCE ADOPTED BY MAJOR PLAYERS IN THE MARKET (25 PLAYERS)

13 COMPANY PROFILES (Page No. - 96)

13.1 BMC SOFTWARE

(Business Overview, Products offered & Services strategies, Key Insights, Recent Developments, MnM View)*

13.2 CENTURYLINK

FIGURE 25 CENTURYLINK: COMPANY SNAPSHOT

13.3 ACCENTURE

FIGURE 26 ACCENTURE: COMPANY SNAPSHOT

13.4 VMWARE

FIGURE 27 VMWARE: COMPANY SNAPSHOT

13.5 DOUBLEHORN

13.6 RIGHTSCALE

13.7 CLIQR

FIGURE 28 CLIQR: COMPANY SNAPSHOT

13.8 CLOUDYN

FIGURE 29 CLOUDYN: COMPANY SNAPSHOT

13.9 JAMCRACKER

13.10 DELL TECHNOLOGIES

FIGURE 30 DELL TECHNOLOGIES: COMPANY SNAPSHOT

13.11 IBM

FIGURE 31 IBM: COMPANY SNAPSHOT

13.12 CITRIX

FIGURE 32 CITRIX: COMPANY SNAPSHOT

13.13 UNITYONECLOUD

*Details on Business Overview, Products offered & Services strategies, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

13.14 OTHER KEY VENDORS

13.14.1 SIXSQ

13.14.2 CLOUDMORE

13.14.3 TURBONOMIC

14 APPENDIX (Page No. - 134)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.3 INTRODUCING RT: REAL-TIME MARKET INTELLIGENCE

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

Growth opportunities and latent adjacency in Multi-Cloud Management Market