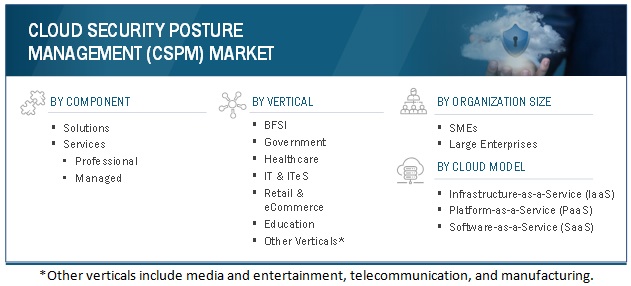

Cloud Security Posture Management Market by Component (Solutions and Services), Cloud Model (IaaS, PaaS, and SaaS), Vertical (BFSI, Healthcare, Retail & eCommerce, IT & ITeS, Government, and Education) and Region - Global Forecast to 2027

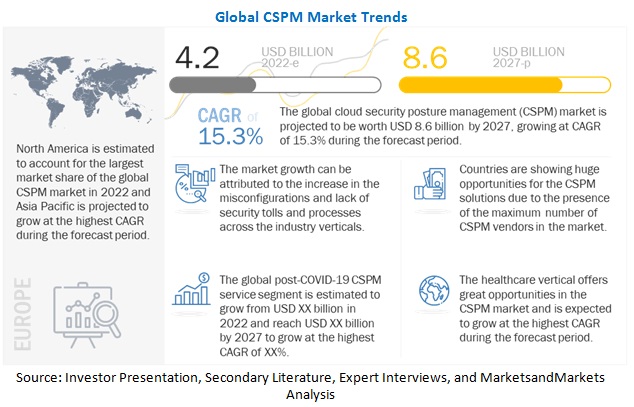

The global cloud security posture management market is expected to grow from USD 4.2 billion in 2022 to USD 8.6 billion by 2027 at a CAGR of 15.3% during the forecast period. Low visibility across the IT infrastructure and increase in configuration errors in cloud infrastructure, absence of efficient security tools and processes to handle the cloud-based environments and developing cloud security capabilities such as easy DevSecOps integration and threat intelligence are some of the factors that are driving the market growth. However, lack of skilled expertise, and lack of awareness of cloud resources, cloud security architecture, and strategy are some of the factors that are expected to hinder the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Covid-19 impact

Due to the COVID-19 pandemic in 2020, the number of users worldwide who relied on the Internet for work, education, and entertainment increased significantly. The other influential sectors, such as BFSI, retail, and government, have also seen a significant increase in user traffic on their online portals and websites. This growth is causing a substantial rise in bandwidth usage, with a sudden spike in the number of cyberattacks, such as Distributed Denial of Service (DDoS), ransomware, and others.

Market Dynamics

Driver: Low visibility across the IT infrastructure and increase in configuration errors to boost the adoption of CSPM solutions

With the growth in cloud adaption, the chances of misconfigurations have increased significantly. Cloud security and posture management help monitoring with the help of automation, which helps security personnel fix the problem as soon as notified. According to a report by CheckPoint, in 2020, the biggest threat cited by respondents is a cloud platform configuration error (68%), followed by unauthorized cloud access (58%), unsecured interfaces (52%), and account theft (50%). Recently, Capital One, an American financial institution, had a threat detection on SQL databases that was misconfigured, which left the cloud open for vulnerabilities and data breaches. Around 100 million customers’ data were compromised, including SSNs, credit scores, and addresses. Cloud security posture management can help protect against this kind of misconfiguration.

Restraint: Shortage of skilled expertise to manage and secure the CSPM solutions

When it comes to the actual usage of the CSPM solutions, the experts or the staff need to have the required technical skill and knowledge for implementing, processing, analyzing, and securing the cloud solutions. Organizations hiring security professionals lack the right skills to analyze and identify advanced security gaps while implementing and managing the operations. The 2021 Application Security Report from Fortinet and Cybersecurity Insiders found that a lack of skilled personnel tops the list of barriers for 46% of the surveyed organizations to secure cloud-based infrastructure. This is a major problem across the security industry. There’s an estimated shortage of 3.12 million professionals, according to?(ISC)2’s?2020 Cybersecurity Workforce Study. Given the specialized expertise required to manage and secure the cloud, the skills gap threatens to impact the ability of organizations to continue cloud adoption. Organizations have no choice but to turn to software and automation to address this gap.

Opportunity: Migration to cloud gives an opportunity for cloud security posture management

An increase in the agility and speeding delivery of new applications and services has given the cloud market a major boost. With technological advancements, traditional organizations are under huge competitive pressure. To become faster, agile, and competitive, most organizations transfer their legacy IT infrastructure from on-premises to the cloud. Organizations who migrate their legacy data center processes to a cloud environment can face additional costs, capability bandwidth of IT team infrastructure, and lack of vision which increases the requirement of cloud security posture management. According to a report by the DNS security firm EfficientIP, there was a sudden surge in the adoption of cloud services during the pandemic. Due to social distancing, millions of workers across the world are enabled to work from home, which has forced organizations and small enterprises to move business-critical applications to hybrid cloud environments, which creates an opportunity for the adoption of cloud security posture management.

Challenge: Organizations’ failure to adhere to the continuous changes in the compliance frameworks

During the pandemic, a prominent yet unanticipated challenge faced by the data teams when migrating to the cloud is relinquishing control. The inability to manage assets on-premises creates a void for data engineers and architects and can be a source of opportunity for various threats to get into the systems. The compliance frameworks provide high-level controls, which are mandatorily needed to be met. Many compliance frameworks (such as PCI DSS) incorporate the concept of continuous compliance as a requirement. Though many organizations have migrated to the cloud with the help of the AWS framework, that does not help them comply with the regulations. These compliance frameworks provide high-level controls, which need to be regularly met. All of these problems get compounded for cloud workloads that are changing rapidly.

By component, CSPM solutions to hold the largest market size during the forecast period

The COVID-19 pandemic has played a major role in accelerating the implementation of cloud solutions and services. In the pandemic, organizations turned to the cloud to support hastily designed remote work and digital collaboration solutions. This needs to shift on-premise work operations to the cloud has caused some organizations to adopt cloud solutions more rapidly than they had planned, and without rigorous preparation, they might conduct under normal circumstances. This rapid shift to the cloud places organizations in a precarious security position. This is expected to drive the adoption of Cloud Security solutions and thereby would have a direct impact on CSPM also.

By verticals, the Healthcare segment to grow with the fastest growing CAGR during the forecast period

With an exponential rise in the generation of patient data, healthcare providers are increasingly relying on cloud data services to combat storage and security challenges. The need to comply with privacy and data security requirements, such as the Health Insurance Portability and Accountability Act (HIPAA) and Health Information Technology for Economic and Clinical Health (HITECH), requires healthcare organizations to secure information migrated to the cloud. Healthcare organizations are rapidly implementing mobile devices and digital advancements with the adoption of cloud security. Cloud computing is gaining traction due to the COVID-19 outbreak with increased storage concerns and the ongoing work from home situation. With a rising demand for cloud storage and stringent regulations, such as HIPAA, the need to deploy CSPM solutions in healthcare centers has become a mandate

By region, North America to hold the largest market size during the forecast period

To know about the assumptions considered for the study, download the pdf brochure

North America is expected to be the largest contributor in terms of the market size in the global CSPM market. The US, despite having stringent laws, offers various opportunities for CSPM providers to cater to a wide range of customers across various industries. North American organizations have taken various steps toward cloud adoption and increasingly adopting cloud data protection methods, such as data encryption, DLP, data threat protection, data integrity monitoring, and CSPM, to maintain operational functionality and business continuity and prevent misconfiguration.

Cloud Security Posture Management Companies:

The key players in the global CSPM market include Fireeye (now Trellix) (US), Cisco Systems (US), International Business Machines Corporation (US), Palo Alto Networks, Inc. (US), VMware, Inc. (US), Microsoft Corporation (US), Check Point Software Technologies (Israel), Zscaler (US), Sophos Group plc (UK), Atos SE (France), Forcepoint (US), CrowdStrike Holdings, Inc. (US), Netskope (US), Trend Micro, Inc. (Japan), Fortinet (US), Qualys, Inc. (US), Fujitsu Ltd (Japan), Radware Ltd (Israel), Oracle Corporation (US), Arctic Wolf Networks (US), Entrust Corporation (US), DivvyCloud Corporation (US), Lookout (US), Aqua Security (US), Aujas Cybersecurity Ltd (US), Fidelis Cybersecurity (US), Foreseeti (Sweden), Sysdig, Inc (US), Cynet (Israel), Snyk (US), and FireMon, LLC (US). Some emerging startups, such as Orca Security (Israel), AppOmni Inc. (US), Adaptive Shield (Israel), OpsCompass (US), C3M, LLC (US), Wiz.io (US), Caveonix (US), Ermetic (US), Obsidian Security (US), and Ascend Technologies (US), are also included in the CSPM market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Components, Cloud Models, Organization size, Verticals and Regions |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Africa (MEA), and Latin America |

|

List of Companies in Cloud Security Posture Management |

Fireeye (now Trellix) (US), Cisco Systems (US), International Business Machines Corporation (US), Palo Alto Networks, Inc. (US), VMware, Inc. (US), Microsoft Corporation (US), Check Point Software Technologies (Israel), Zscaler (US), Sophos Group plc (UK), Atos SE (France), Forcepoint (US), CrowdStrike Holdings, Inc. (US), Netskope (US), Trend Micro, Inc. (Japan), Fortinet (US), Qualys, Inc. (US), Fujitsu Ltd (Japan), Radware Ltd (Israel), Oracle Corporation (US), Arctic Wolf Networks (US), Entrust Corporation (US), DivvyCloud Corporation (US) and others. |

Market Segmentation

Recent Development

- In March 2022, VMware announced its partnership with Google Cloud. This partnership would work to help customers accelerate app modernization and cloud transformation.

- In February 2022, Check Point acquired Spectral to advance CloudGuard, with a developer-first security platform and provide the widest range of cloud application security.

- In November 2021, Sonrai Security Joins Microsoft Intelligent Security. Sonrai Dig combines Cloud Security Posture Management (CSPM), Cloud Infrastructure Entitlements Management (CIEM), and data security in one platform which is Powered by a cloud identity graph.

Frequently Asked Questions (FAQ):

What is the definition of CSPM?

Considering the sources and association’s views on CSPM, MarketsandMarkets defines CSPM as “the process of mitigating the risks while migrating to cloud. Here, compliance and security policies assessment, mitigating misconfiguration of cloud-based application deployment, reducing vulnerabilities are some of the elements associated with CSPM.

What is the projected market value of the global CSPM market?

Global CSPM market is projected to reach USD 8.6 billion by 2027 growing with 15.3% CAGR.

What are some of the regulations or mandates of CSPM?

Due to non-compliance, organizations can face various risks, such as new vulnerabilities increment in the system, incompatibility issues with the existing system, unauthorized access to the cloud security, unrecognized threat analysis and mitigation, and lack of user access control. Constantly changing guidelines and regulations add to the stress in the cloud security posture management industry. Failing to comply with stringent guidelines would attract heavy penalties and reparations. PCI DSS, IT ACT -2000, GDPR, CISA-2015, EU cybersecurity law, HIPAA, SOC 2 Compliance, and FISMA, 2002 are some of the regulations covered in the study.

Who are the key companies influencing the market growth of CSPM?

VMWare, Fujitsu, Check Point, Microsoft, IBM, Palo Alto Networks, Cisco, Netskope, and Fortinet are the leaders in the CSPM market and are recognized as the star players. They offer wide solutions related to CSPM. With a wide and strong network in B2B, these companies account for a major share of the CSPM market. These vendors have been marking their presence in the market by offering customized solutions per user requirements and adopting growth strategies to consistently achieve the desired growth.

Who are the emerging start-ups/SMEs that are supporting significantly in the market growth?

Orca Security, Wiz.io, Ascend Technologies, AppOmni, Caveonix, Ermetic, OpsCompass, Obsidian Security, C3M, and Adaptive Shield are few of the emerging start-ups that are nurturing the market growth with their technical skills and expertise. These startups are technology disruptors with highly innovative product offerings compared to their competitors. They focus on developing product/service portfolios and bringing innovations to the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 42)

1.1 INTRODUCTION TO COVID–19

1.2 COVID–19 HEALTH ASSESSMENT

FIGURE 1 COVID–19: GLOBAL PROPAGATION

FIGURE 2 COVID–19 PROPAGATION: SELECT COUNTRIES

1.3 COVID–19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID–19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2017–2021

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 53)

2.1 RESEARCH DATA

FIGURE 6 CLOUD SECURITY POSTURE MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 MARKET: MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS AND SERVICES IN THE MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1: SUPPLY-SIDE ANALYSIS

FIGURE 10 MARKET—MARKET ESTIMATION APPROACH: SUPPLY-SIDE ANALYSIS (COMPANY REVENUE ESTIMATION)

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1—BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS AND SERVICES IN THE CLOUD SECURITY POSTURE MANAGEMENT MARKET

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 2—BOTTOM-UP (DEMAND SIDE): PRODUCTS/SOLUTIONS/SERVICES

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPANY EVALUATION QUADRANT METHODOLOGY

FIGURE 13 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.6 STARTUPS EVALUATION QUADRANT METHODOLOGY

FIGURE 14 STARTUP EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.7 RESEARCH ASSUMPTIONS

2.8 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 66)

FIGURE 15 CLOUD SECURITY POSTURE MANAGEMENT (CSPM) MARKET TO WITNESS SIGNIFICANT GROWTH DURING THE FORECAST PERIOD

FIGURE 16 FASTEST-GROWING SEGMENTS OF THE CLOUD SECURITY POSTURE MANAGEMENT (CSPM) MARKET

FIGURE 17 NORTH AMERICA TO ACCOUNT FOR THE HIGHEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 70)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CLOUD SECURITY POSTURE MANAGEMENT MARKET

FIGURE 18 INCREASE IN THE MISCONFIGURATIONS AND LACK OF SECURITY TOOLS & PROCESSES ACROSS THE VERTICALS TO DRIVE CSPM MARKET GROWTH

4.2 MARKET, BY COMPONENT

FIGURE 19 SOLUTIONS TO ACCOUNT FOR A LARGER MARKET SIZE DURING THE FORECAST PERIOD, 2022

4.3 CLOUD SECURITY POSTURE MANAGEMENT, BY CLOUD MODEL

FIGURE 20 IAAS TO ACCOUNT FOR A LARGER MARKET SIZE DURING THE FORECAST PERIOD

4.4 MARKET, SHARE OF TOP THREE VERTICALS AND REGIONS, 2022

FIGURE 21 BFSI VERTICAL AND NORTH AMERICAN REGION TO ACCOUNT FOR THE LARGEST MARKET SHARES IN 2022

4.5 MARKET, BY ORGANIZATION SIZE

FIGURE 22 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR A LARGER MARKET SIZE DURING THE FORECAST PERIOD

4.6 MARKET, BY VERTICAL

FIGURE 23 BFSI VERTICAL TO BE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

4.7 MARKET INVESTMENT SCENARIO

FIGURE 24 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 74)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CLOUD SECURITY POSTURE MANAGEMENT MARKET

5.2.1 DRIVERS

5.2.1.1 Low visibility across the IT infrastructure and increase in configuration errors to boost the adoption of CSPM solutions

5.2.1.2 Absence of security tools and processes to handle the cloud-based environments

5.2.1.3 Capabilities such as easy DevOps integration and threat intelligence to boost the growth of CSPM tools

5.2.2 RESTRAINTS

5.2.2.1 Shortage of skilled expertise to manage and secure the CSPM solutions

5.2.2.2 Lack of awareness of cloud resources, cloud security architecture, and strategy

5.2.3 OPPORTUNITIES

5.2.3.1 Migration to cloud gives an opportunity for cloud security posture management

5.2.3.2 Introduction of new cloud strategies in the CSPM solutions

5.2.4 CHALLENGES

5.2.4.1 Distrust and weak collaboration among enterprises and the CSPM solution providers

5.2.4.2 Organizations’ failure to adhere to the continuous changes in the compliance frameworks

5.2.5 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.2.5.1 Drivers and Opportunities

5.2.5.2 Restraints and Challenges

5.2.5.3 Cumulative Growth Analysis

5.3 USE CASES

5.3.1 USE CASE 1: ZSCALER HELPED GLOBAL MINING COMPANY AUTOMATE RISK MITIGATION

5.3.2 USE CASE 2: PALO ALTO NETWORKS HELPED EXPERIAN TO GAIN A UNIFIED VIEW OF GLOBAL SECURITY

5.3.3 USE CASE 3: SYSDIG HELPED BEEKEEPER TO SECURE COMMUNICATIONS, DATA, AND APPLICATIONS ACROSS CLOUD ENVIRONMENTS

5.4 TARIFF AND REGULATORY LANDSCAPE

5.4.1 INTRODUCTION

5.4.2 PERSONAL INFORMATION PROTECTION AND ELECTRONIC DOCUMENTS ACT

5.4.3 GENERAL DATA PROTECTION REGULATION COMPLIANCE

5.4.4 THE INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 27001

5.4.5 SYSTEM AND ORGANIZATION CONTROLS 2 (SOC 2) TYPE II COMPLIANCE

5.4.6 CLOUD SECURITY ALLIANCE SECURITY TRUST ASSURANCE AND RISK

5.4.7 REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

TABLE 3 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

5.5 VALUE CHAIN

FIGURE 26 CLOUD SECURITY POSTURE MANAGEMENT MARKET: VALUE CHAIN

5.5.1 CSPM SOLUTION PROVIDERS

5.5.2 CSPM SERVICE PROVIDERS

5.5.3 SYSTEM INTEGRATORS

5.5.4 RETAIL/DISTRIBUTION

5.5.5 END USERS

5.6 CLOUD SECURITY POSTURE MANAGEMENT FRAMEWORK

FIGURE 27 FRAMEWORK: MARKET

5.7 ECOSYSTEM

FIGURE 28 ECOSYSTEM: MARKET

5.7.1 ECOSYSTEM

TABLE 4 MARKET ECOSYSTEM

5.8 PRICING ANALYSIS

TABLE 5 MONTHLY PRICING STRUCTURE OF A FEW CLOUD SECURITY POSTURE MANAGEMENT VENDORS

5.8.1 AVERAGE SELLING PRICE (ASP) TREND

TABLE 6 CLOUD SECURITY POSTURE MANAGEMENT MARKET: ASP TREND

5.9 TECHNOLOGY ANALYSIS

FIGURE 29 CLOUD SECURITY POSTURE MANAGEMENT TECHNOLOGY ANALYSIS

FIGURE 30 CLOUD SECURITY POSTURE MANAGEMENT: ADJACENT TECHNOLOGIES

5.9.1 CLOUD SECURITY POSTURE MANAGEMENT AND MACHINE LEARNING

5.9.2 CLOUD SECURITY POSTURE MANAGEMENT AND DATA ANALYTICS

5.9.3 CLOUD SECURITY POSTURE MANAGEMENT & ARTIFICIAL INTELLIGENCE

5.10 PATENT ANALYSIS

FIGURE 31 PATENT ANALYSIS: MARKET

FIGURE 32 DOCUMENT COUNTS RELATED TO THE CLOUD SECURITY, 1990–2020

FIGURE 33 TOP APPLICANTS FOR CLOUD SECURITY-RELATED PATENTS

FIGURE 34 CLOUD SECURITY-RELATED DOCUMENT SHARE, BY COUNTRY

5.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 PORTER’S FIVE FORCES ANALYSIS: CSPM MARKET

FIGURE 35 CLOUD SECURITY POSTURE MANAGEMENT: PORTER’S FIVE FORCES ANALYSIS

5.11.1 THREAT FROM NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 36 CSPM MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

TABLE 8 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

5.14 KEY CONFERENCES & EVENTS

TABLE 9 MARKET: LIST OF CONFERENCES & EVENTS IN 2022–2023

6 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY COMPONENT (Page No. - 100)

6.1 INTRODUCTION

FIGURE 38 SOLUTIONS TO BE A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 10 MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 11 MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

6.2.1 SOLUTIONS: MARKET DRIVERS

6.2.2 SOLUTION: COVID-19 IMPACT

TABLE 12 CLOUD SECURITY POSTURE MANAGEMENT SOLUTIONS MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 13 CLOUD SECURITY POSTURE MANAGEMENT SOLUTIONS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

6.3.1 SERVICES: MARKET DRIVERS

6.3.2 SERVICES: COVID-19 IMPACT

TABLE 14 CLOUD SECURITY POSTURE MANAGEMENT SERVICES MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 15 CLOUD SECURITY POSTURE MANAGEMENT SERVICES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3.3 PROFESSIONAL SERVICES

6.3.4 MANAGED SERVICES

7 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY CLOUD MODEL (Page No. - 106)

7.1 INTRODUCTION

FIGURE 39 CLOUD-SHARED RESPONSIBILITY MODEL

FIGURE 40 INFRASTRUCTURE-AS-A-SERVICE TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 16 MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 17 MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

7.2 INFRASTRUCTURE-AS-A-SERVICE (IAAS)

7.2.1 IAAS: MARKET DRIVERS

7.2.2 IAAS: COVID-19 IMPACT

TABLE 18 IAAS SECURITY POSTURE MANAGEMENT MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 19 IAAS SECURITY POSTURE MANAGEMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.3 PLATFORM-AS-A-SERVICE (PAAS)

7.3.1 PAAS: MARKET DRIVERS

7.3.2 PAAS: COVID-19 IMPACT

TABLE 20 PAAS SECURITY POSTURE MANAGEMENT MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 21 PAAS SECURITY POSTURE MANAGEMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.4 SOFTWARE-AS-A-SERVICE (SAAS)

7.4.1 SAAS: MARKET DRIVERS

7.4.2 SAAS: COVID-19 IMPACT

TABLE 22 SAAS SECURITY POSTURE MANAGEMENT MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 23 SAAS SECURITY POSTURE MANAGEMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY ORGANIZATION SIZE (Page No. - 114)

8.1 INTRODUCTION

FIGURE 41 SMES TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 24 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 25 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 SMALL & MEDIUM ENTERPRISES

8.2.1 SMALL & MEDIUM ENTERPRISES: MARKET DRIVERS

8.2.2 SMALL & MEDIUM ENTERPRISES: COVID-19 IMPACT

TABLE 26 MARKET IN SMALL & MEDIUM ENTERPRISES, BY REGION, 2016–2021 (USD MILLION)

TABLE 27 MARKET IN SMALL & MEDIUM ENTERPRISES, BY REGION, 2022–2027 (USD MILLION)

8.3 LARGE ENTERPRISES

8.3.1 LARGE ENTERPRISES: MARKET DRIVERS

8.3.2 LARGE ENTERPRISES: COVID-19 IMPACT

TABLE 28 MARKET IN LARGE ENTERPRISES, BY REGION, 2016–2021 (USD MILLION)

TABLE 29 MARKET IN LARGE ENTERPRISES, BY REGION, 2022–2027 (USD MILLION)

9 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY VERTICAL (Page No. - 120)

9.1 INTRODUCTION

FIGURE 42 BANKING, FINANCIAL, AND INSURANCE SERVICES SEGMENT TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 30 MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 31 MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 BANKING, FINANCIAL, AND INSURANCE SERVICES (BFSI)

9.2.1 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET DRIVERS

9.2.2 BANKING, FINANCIAL SERVICES, AND INSURANCE: COVID-19 IMPACT

TABLE 32 MARKET IN BANKING, FINANCIAL, AND INSURANCE SERVICES, BY REGION, 2016–2021 (USD MILLION)

TABLE 33 MARKET IN BANKING, FINANCIAL, AND INSURANCE SERVICES, BY REGION, 2022–2027 (USD MILLION)

9.3 HEALTHCARE

9.3.1 HEALTHCARE: MARKET DRIVERS

9.3.2 HEALTHCARE: COVID-19 IMPACT

TABLE 34 MARKET IN HEALTHCARE, BY REGION, 2016–2021 (USD MILLION)

TABLE 35 MARKET IN HEALTHCARE, BY REGION, 2022–2027 (USD MILLION)

9.4 RETAIL & ECOMMERCE

9.4.1 RETAIL & ECOMMERCE: MARKET DRIVERS

9.4.2 RETAIL & ECOMMERCE: COVID-19 IMPACT

TABLE 36 MARKET IN RETAIL & ECOMMERCE, BY REGION, 2016–2021 (USD MILLION)

TABLE 37 MARKET IN RETAIL & ECOMMERCE, BY REGION, 2022–2027 (USD MILLION)

9.5 EDUCATION

9.5.1 EDUCATION: MARKET DRIVERS

9.5.2 EDUCATION: COVID-19 IMPACT

TABLE 38 MARKET IN EDUCATION, BY REGION, 2016–2021 (USD MILLION)

TABLE 39 MARKET IN EDUCATION, BY REGION, 2022–2027 (USD MILLION)

9.6 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES (IT & ITES)

9.6.1 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES: MARKET DRIVERS

9.6.2 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES: COVID-19 IMPACT

TABLE 40 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 41 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY ENABLED SERVICES: CLOUD SECURITY POSTURE MANAGEMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.7 GOVERNMENT

9.7.1 GOVERNMENT: MARKET DRIVERS

9.7.2 GOVERNMENT: COVID-19 IMPACT

TABLE 42 MARKET IN GOVERNMENT, BY REGION, 2016–2021 (USD MILLION)

TABLE 43 MARKET IN GOVERNMENT, BY REGION, 2022–2027 (USD MILLION)

9.8 OTHER VERTICALS

TABLE 44 MARKET IN OTHER VERTICALS, BY REGION, 2016–2021 (USD MILLION)

TABLE 45 MARKET IN OTHER VERTICALS, BY REGION, 2022–2027 (USD MILLION)

10 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY REGION (Page No. - 133)

10.1 INTRODUCTION

FIGURE 43 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 46 MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 47 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICAN MARKET: COVID-19 DRIVERS

10.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 44 NORTH AMERICA: MARKET SNAPSHOT

TABLE 48 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.4 UNITED STATES

TABLE 58 UNITED STATES: CLOUD SECURITY POSTURE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 59 UNITED STATES: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 60 UNITED STATES: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 61 UNITED STATES: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 62 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 63 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 64 UNITED STATES: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 65 UNITED STATES: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.2.5 CANADA

TABLE 66 CANADA: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 67 CANADA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 68 CANADA: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 69 CANADA: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 70 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 71 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 72 CANADA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 73 CANADA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: CLOUD SECURITY POSTURE MANAGEMENT MARKET DRIVERS

10.3.2 EUROPE: MARKET: COVID-19 DRIVERS

10.3.3 EUROPE: REGULATORY LANDSCAPE

TABLE 74 EUROPE: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 75 EUROPE: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 76 EUROPE: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 79 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 80 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.4 UNITED KINGDOM

TABLE 84 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 85 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 86 UNITED KINGDOM: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 87 UNITED KINGDOM: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 88 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 89 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 90 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 91 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.5 GERMANY

TABLE 92 GERMANY: CLOUD SECURITY POSTURE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 93 GERMANY: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 94 GERMANY: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 95 GERMANY: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 96 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 97 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 98 GERMANY: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 99 GERMANY: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.6 FRANCE

TABLE 100 FRANCE: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 101 FRANCE: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 102 FRANCE: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 103 FRANCE: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 104 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 105 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 106 FRANCE: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 107 FRANCE: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.7 REST OF EUROPE

TABLE 108 REST OF EUROPE: CLOUD SECURITY POSTURE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 109 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 110 REST OF EUROPE: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 111 REST OF EUROPE: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 112 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 113 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 114 REST OF EUROPE: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 115 REST OF EUROPE: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: CLOUD SECURITY POSTURE MANAGEMENT MARKET DRIVERS

10.4.2 ASIA PACIFIC MARKET: COVID-19 DRIVERS

10.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 45 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 116 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2016–2021 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

10.4.4 CHINA

TABLE 126 CHINA: CLOUD SECURITY POSTURE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 127 CHINA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 128 CHINA: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 129 CHINA: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 130 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 131 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 132 CHINA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 133 CHINA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.5 JAPAN

TABLE 134 JAPAN: CLOUD SECURITY POSTURE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 135 JAPAN: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 136 JAPAN: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 137 JAPAN: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 138 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 139 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 140 JAPAN: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 141 JAPAN: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.6 INDIA

TABLE 142 INDIA: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 143 INDIA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 144 INDIA: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 145 INDIA: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 146 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 147 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 148 INDIA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 149 INDIA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.7 AUSTRALIA & NEW ZEALAND

TABLE 150 AUSTRALIA & NEW ZEALAND: CLOUD SECURITY POSTURE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 151 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 152 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 153 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 154 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 155 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 156 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 157 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.8 REST OF ASIA PACIFIC

TABLE 158 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 159 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 160 REST OF ASIA PACIFIC: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 161 REST OF ASIA PACIFIC: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 162 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 163 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 164 REST OF ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 165 REST OF ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA: CLOUD SECURITY POSTURE MANAGEMENT MARKET DRIVERS

10.5.2 MIDDLE EAST & AFRICA: MARKET: COVID-19 DRIVERS

10.5.3 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

TABLE 166 MIDDLE EAST & AFRICA: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 167 MIDDLE EAST & AFRICA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 168 MIDDLE EAST & AFRICA: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 169 MIDDLE EAST & AFRICA: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.4 UNITED ARAB EMIRATES

TABLE 176 UNITED ARAB EMIRATES: CLOUD SECURITY POSTURE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 177 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 178 UNITED ARAB EMIRATES: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 179 UNITED ARAB EMIRATES: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 180 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 181 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 182 UNITED ARAB EMIRATES: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 183 UNITED ARAB EMIRATES: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.5.5 SOUTH AFRICA

TABLE 184 SOUTH AFRICA: CLOUD SECURITY POSTURE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 185 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 186 SOUTH AFRICA: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 187 SOUTH AFRICA: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 188 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 189 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 190 SOUTH AFRICA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 191 SOUTH AFRICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.5.6 REST OF THE MIDDLE EAST & AFRICA

TABLE 192 REST OF THE MIDDLE EAST & AFRICA: CLOUD SECURITY POSTURE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 193 REST OF THE MIDDLE EAST & AFRICA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 194 REST OF THE MIDDLE EAST & AFRICA: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 195 REST OF THE MIDDLE EAST & AFRICA: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 196 REST OF THE MIDDLE EAST & AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 197 REST OF THE MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 198 REST OF THE MIDDLE EAST & AFRICA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 199 REST OF THE MIDDLE EAST & AFRICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: CLOUD SECURITY POSTURE MANAGEMENT MARKET DRIVERS

10.6.2 LATIN AMERICAN MARKET: COVID-19 DRIVERS

10.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 200 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 206 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 207 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.4 BRAZIL

TABLE 210 BRAZIL: CLOUD SECURITY POSTURE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 211 BRAZIL: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 212 BRAZIL: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 213 BRAZIL: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 214 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 215 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 216 BRAZIL: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 217 BRAZIL: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.6.5 MEXICO

TABLE 218 MEXICO: CLOUD SECURITY POSTURE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 219 MEXICO: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 220 MEXICO: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 221 MEXICO: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 222 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 223 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 224 MEXICO: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 225 MEXICO: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.6.6 REST OF LATIN AMERICA

TABLE 226 REST OF LATIN AMERICA: CLOUD SECURITY POSTURE MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 227 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 228 REST OF LATIN AMERICA: MARKET SIZE, BY CLOUD MODEL, 2016–2021 (USD MILLION)

TABLE 229 REST OF LATIN AMERICA: MARKET SIZE, BY CLOUD MODEL, 2022–2027 (USD MILLION)

TABLE 230 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 231 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 232 REST OF LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 233 REST OF LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 207)

11.1 OVERVIEW

11.2 KEY PLAYERS STRATEGIES

FIGURE 46 MARKET EVALUATION FRAMEWORK: 2019, 2020, AND 2021 PROJECTED TO WITNESS CSPM MARKET DEVELOPMENTS AND CONSOLIDATION

11.3 REVENUE ANALYSIS

FIGURE 47 FIVE-YEAR REVENUE ANALYSIS OF KEY CSPM VENDORS, 2016–2021 (USD MILLION)

11.4 MARKET SHARE ANALYSIS

FIGURE 48 CSPM MARKET (GLOBAL), MARKET SHARE, 2021

TABLE 234 DEGREE OF COMPETITION

11.5 RANKING OF KEY PLAYERS IN THE CSPM MARKET

FIGURE 49 KEY PLAYERS RANKING, 2021

11.6 COMPANY EVALUATION QUADRANT

11.6.1 OVERVIEW

11.6.2 PRODUCT FOOTPRINT

FIGURE 50 PRODUCT FOOTPRINT OF KEY COMPANIES

11.6.3 COMPANY EVALUATION QUADRANT

TABLE 235 EVALUATION CRITERIA

11.6.4 STARS

11.6.5 EMERGING LEADERS

11.6.6 PERVASIVE PLAYERS

11.6.7 PARTICIPANTS

FIGURE 51 CSPM MARKET, COMPANY EVALUATION QUADRANT, 2021

11.7 STARTUP EVALUATION QUADRANT

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 52 CSPM MARKET, STARTUP EVALUATION QUADRANT, 2021

11.7.5 COMPETITIVE BENCHMARKING FOR STARTUPS

TABLE 236 CSPM MARKET: LIST OF STARTUPS/SMES

TABLE 237 CSPM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

11.8 COMPETITIVE SCENARIO AND TRENDS

TABLE 238 PRODUCT LAUNCHES, 2020–2021

TABLE 239 DEALS, 2020–2021

12 COMPANY PROFILES (Page No. - 222)

12.1 INTRODUCTION

12.2 LARGE PLAYERS

(Business overview, Solutions and services offered, Recent developments, COVID-19-related developments, MNM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats)*

12.2.1 IBM

TABLE 240 IBM: BUSINESS OVERVIEW

FIGURE 53 IBM: COMPANY SNAPSHOT

TABLE 241 IBM: SOLUTIONS OFFERED

TABLE 242 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 243 IBM: DEALS

12.2.2 VMWARE

TABLE 244 VMWARE: BUSINESS OVERVIEW

FIGURE 54 VMWARE: COMPANY SNAPSHOT

TABLE 245 VMWARE: SOLUTIONS OFFERED

TABLE 246 VMWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 247 VMWARE: DEALS

12.2.3 MICROSOFT

TABLE 248 MICROSOFT: BUSINESS OVERVIEW

FIGURE 55 MICROSOFT: COMPANY SNAPSHOT

TABLE 249 MICROSOFT: SOLUTIONS OFFERED

TABLE 250 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 251 MICROSOFT: DEALS

12.2.4 CHECK POINT

TABLE 252 CHECK POINT: BUSINESS OVERVIEW

FIGURE 56 CHECK POINT: COMPANY SNAPSHOT

TABLE 253 CHECK POINT: SOLUTIONS OFFERED

TABLE 254 CHECK POINT: PRODUCT LAUNCHES

TABLE 255 CHECK POINT: DEALS

12.2.5 ZSCALER

TABLE 256 ZSCALER: BUSINESS OVERVIEW

FIGURE 57 ZSCALER: COMPANY SNAPSHOT

TABLE 257 ZSCALER: SOLUTIONS OFFERED

TABLE 258 ZSCALER: PRODUCT LAUNCHES

TABLE 259 ZSCALER: DEALS

12.2.6 SOPHOS

TABLE 260 SOPHOS: BUSINESS OVERVIEW

TABLE 261 SOPHOS: SOLUTIONS OFFERED

TABLE 262 SOPHOS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 263 SOPHOS: DEALS

12.2.7 ATOS

TABLE 264 ATOS: BUSINESS OVERVIEW

FIGURE 58 ATOS: COMPANY SNAPSHOT

TABLE 265 ATOS: SOLUTIONS OFFERED

TABLE 266 ATOS: SERVICES OFFERED

TABLE 267 ATOS: PRODUCT LAUNCHES

TABLE 268 ATOS: DEALS

12.2.8 PALO ALTO NETWORKS

TABLE 269 PALO ALTO NETWORKS: BUSINESS OVERVIEW

FIGURE 59 PALO ALTO NETWORKS: COMPANY SNAPSHOT

TABLE 270 PALO ALTO NETWORKS: SOLUTIONS OFFERED

TABLE 271 PALO ALTO NETWORKS: PRODUCT LAUNCHES

TABLE 272 PALO ALTO NETWORKS: DEALS

12.2.9 FORCEPOINT

TABLE 273 FORCEPOINT: BUSINESS OVERVIEW

TABLE 274 FORCEPOINT: SOLUTIONS OFFERED

TABLE 275 FORCEPOINT: PRODUCT LAUNCHES

TABLE 276 FORCEPOINT: DEALS

12.2.10 CROWDSTRIKE

TABLE 277 CROWDSTRIKE: BUSINESS OVERVIEW

FIGURE 60 CROWDSTRIKE: COMPANY SNAPSHOT

TABLE 278 CROWDSTRIKE: SOLUTIONS OFFERED

TABLE 279 CROWDSTRIKE: SERVICES OFFERED

TABLE 280 CROWDSTRIKE: PRODUCT LAUNCHES

TABLE 281 CROWDSTRIKE: DEALS

12.2.11 NETSKOPE

TABLE 282 NETSKOPE: BUSINESS OVERVIEW

TABLE 283 NETSKOPE: SOLUTIONS OFFERED

TABLE 284 NETSKOPE: PRODUCT LAUNCHES

TABLE 285 NETSKOPE: DEALS

12.2.12 TRENDMICRO

TABLE 286 TRENDMICRO: BUSINESS OVERVIEW

FIGURE 61 TRENDMICRO: COMPANY SNAPSHOT

TABLE 287 TRENDMICRO: SOLUTIONS OFFERED

TABLE 288 TRENDMICRO: PRODUCT LAUNCHES

TABLE 289 TRENDMICRO: DEALS

12.2.13 CISCO

TABLE 290 CISCO: BUSINESS OVERVIEW

FIGURE 62 CISCO: COMPANY SNAPSHOT

TABLE 291 CISCO: SOLUTIONS OFFERED

TABLE 292 CISCO: PRODUCT LAUNCHES

TABLE 293 CISCO: DEALS

12.2.14 FORTINET

TABLE 294 FORTINET: BUSINESS OVERVIEW

FIGURE 63 FORTINET: COMPANY SNAPSHOT

TABLE 295 FORTINET: SOLUTIONS OFFERED

TABLE 296 FORTINET: PRODUCT LAUNCHES

TABLE 297 FORTINET: DEALS

12.2.15 QUALYS

12.2.16 FUJITSU

12.2.17 RADWARE

12.2.18 ORACLE

12.2.19 ARCTIC WOLF

12.2.20 ENTRUST

12.3 SMES

12.3.1 DIVVYCLOUD

12.3.2 LOOKOUT

12.3.3 AQUA SECURITY

12.3.4 AUJAS

12.3.5 FIDELIS CYBERSECURITY

12.3.6 FORESEETI

12.3.7 SYSDIG

12.3.8 CYNET

12.3.9 SNYK (FUGUE)

12.3.10 FIREMON

12.4 STARTUPS

12.4.1 ORCA SECURITY

12.4.2 APPOMNI

12.4.3 ADAPTIVE SHIELD

12.4.4 OPSCOMPASS

12.4.5 C3M, LLC

12.4.6 WIZ.IO

12.4.7 CAVEONIX

12.4.8 ERMETIC

12.4.9 OBSIDIAN SECURITY

12.4.10 ASCEND TECHNOLOGIES

*Details on Business overview, Solutions and services offered, Recent developments, COVID-19-related developments, MNM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 279)

13.1 ADJACENT MARKETS

TABLE 298 ADJACENT MARKETS AND FORECASTS

13.1.1 LIMITATIONS

13.1.2 CLOUD SECURITY MARKET

13.1.2.1 Inclusions and exclusions

TABLE 299 CLOUD SECURITY MARKET SIZE AND GROWTH, 2015–2020 (USD MILLION, Y-O-Y)

TABLE 300 POST-COVID-19: CLOUD SECURITY MARKET SIZE AND GROWTH, 2020–2026 (USD MILLION, Y-O-Y)

TABLE 301 CLOUD SECURITY MARKET SIZE, BY SECURITY TYPE, 2015–2020 (USD MILLION)

TABLE 302 CLOUD SECURITY MARKET SIZE, BY SECURITY TYPE, 2020–2026 (USD MILLION)

TABLE 303 CLOUD SECURITY MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 304 CLOUD SECURITY MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 305 CLOUD SECURITY MARKET SIZE, BY SERVICE MODEL, 2015–2020 (USD MILLION)

TABLE 306 CLOUD SECURITY MARKET SIZE, BY SERVICE MODEL, 2020–2026 (USD MILLION)

TABLE 307 CLOUD SECURITY MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 308 CLOUD SECURITY MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 309 CLOUD SECURITY MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 310 CLOUD SECURITY MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 311 CLOUD SECURITY SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 312 CLOUD SECURITY MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

13.1.3 CLOUD INFRASTRUCTURE SERVICES MARKET

TABLE 313 IAAS MARKET SIZE, BY SERVICE TYPE, 2017–2024 (USD BILLION)

TABLE 314 IAAS MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2024 (USD BILLION)

TABLE 315 IAAS MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD BILLION)

TABLE 316 IAAS MARKET SIZE, BY VERTICAL, 2017–2024 (USD BILLION)

TABLE 317 IAAS MARKET SIZE, BY REGION, 2017–2024 (USD BILLION)

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

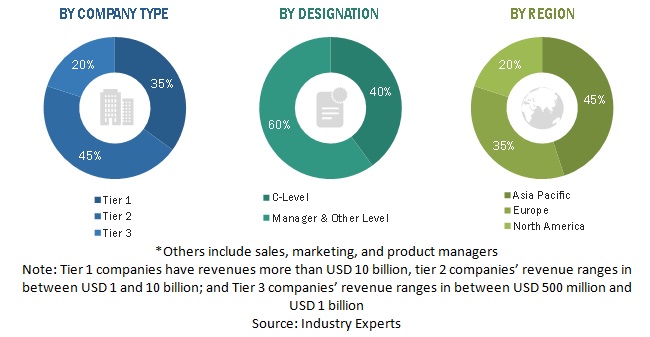

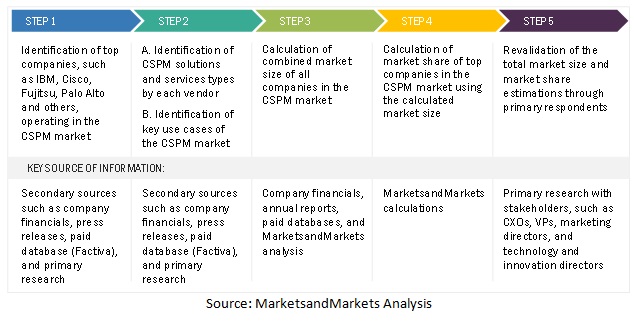

The study involved major activities in estimating the current market size for the CSPM market. Exhaustive secondary research was done to collect information on the CSPM industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches like top-down, bottom up were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the CSPM market.

Secondary Research

Various secondary sources were referred to in the secondary research process to identify and collect information regarding the study. The secondary sources included annual reports, press releases, investor presentations of CSPM solutions and service vendors, forums, certified publications, and whitepapers. The secondary research was mainly used to obtain key information about the industry's supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report in the primary research process. The primary sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the CSPM market.

In the market engineering process, top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. The complete market engineering process was extensive qualitative and quantitative analysis to list key information/insights throughout the report.

After the complete market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research was also conducted to identify the segmentation types; industry trends; the competitive landscape of CSPM market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To know about the assumptions considered for the study, download the pdf brochure

Top-down and bottom-up approaches were used to estimate and validate the size of the global CSPM market and the size of various other dependent subsegments. The research methodology used to estimate the market size included the following details:

- The key players in the market were identified through secondary research, and their revenue contributions in respective regions were determined through primary and secondary research.

- This entire procedure included studying the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market and have been covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the global Cloud Security Posture Management (CSPM) market by component, organization size, cloud model, vertical, and region

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape details of major players

- To profile the key players of the CSPM market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions (M&A), new product developments, and partnerships and collaborations, in the market

- To track and analyze the impact of COVID-19 on the cloud security posture management market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle East & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cloud Security Posture Management Market