Coating Equipment Market by Type (Powder coating equipment, Liquid coating equipment, Specialty coating equipment), End-use Industry(Automotive & Transportation, Aerospace, Industrial, Building & Infrastructure), and Region - Global Forecast to 2026

Updated on : September 03, 2025

Coating Equipment Market

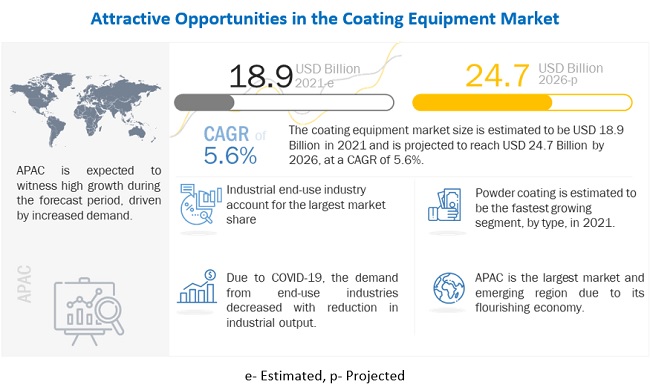

The global coating equipment market was valued at USD 18.9 billion in 2021 and is projected to reach USD 24.7 billion by 2026, growing at 5.6% cagr from 2021 to 2026. Coating equipment is defined as the equipment used for the application of coating on a substrate. Based on the type of coating, coating can be classified as liquid, powder, and specialty coating. These coatings are applied so as to protect them from rusting, degradation and corrosion which increases their effective life without any maintenance and replacement costs. Some of the important end-use industry are automotive & transportation, aerospace, industrial and building & construction. Similarly, the equipment used for applying the different type of coatings is broadly categorized as liquid coating equipment, powder coating equipment, and specialty coating equipment.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 pandemic impact on the Global Coating Equipment Market

Due to COVID-19 pandemic, the suspension of manufacturingoperation, disruption of supply chain, and declining demand for industrial goods had significant impact on the market. However, due to COVID-19 pandemic, the demand for pharmaceutical industry goods has risen, which, in turn, support for the growth of coating equipment market. At the same time, due to panic situation, people stock the hygiene products across the globe that drives the market. However, the end-use industries like footwear and foam were affected by the pandemic.

Coating Equipment Market Dynamics

Driver: Increasing demand from growing Electric Vehicle market

Electric vehicles are one of the major users of coating equipment. Coatings play an important role in the protection of the substrates of electric vehicles and its components from rust and other damages. It also plays a significant role in imparting aesthetic characteristics to electric vehicles. The increasing consumption of coatings and coated electronic devices used in electric vehicles is the major factor in driving the demand of coating equipment.

In addition to this, governments promote electric vehicles by providing subsidies on purchases, incentives for setting up charging stations and providing funds for the development of electric battery technology due to the growing climate change concerns. The policies are playing a major role in the development of electric mobility. Various governments are establishing targets for adoption of electric vehicles and charging stations. Moreover, the development of key technologies regarding electric vehicle is also enabling substantial cost reduction. This is driving the growth of the electric vehicles industry and, subsequently, fuelling the demand for coating equipment market.

Restraint: Availability of low-cost alternatives for some applications

The use of advanced coating equipment in all applications is not affordable. Cost of equipment is an important factor while considering the choice of coating materials and the process for application. For applications involving less rigid specifications and low volumes, the use of high-end coating equipment may not be an economical option. Conventional equipment such as brushes and rollers are cheaper and are preferred in some applications over other equipment. Hence, the availability of low-cost alternatives is restraining the coating equipment market in some applications.

Opportunities: Development of new technology

Continuous developments in coating processes and coating equipment are driving the coating equipment market in different applications. There is need for customized coating equipment in end-use industries such as automotive & transportation, aerospace, and other sectors. Coating equipment manufacturers are continuously conducting R&D and are developing advanced equipment to meet customers’ need.

New technological developments in coating equipment are helping achieve faster coating processes and long-lasting coatings. The development of tribo guns helped drive the powder coating equipment market. One coating manufacturer has developed a new coating that can minimize air drag and eliminate debris build-up. The development of such new technology offers opportunities for market players to expand their market in new applications.

Challenges Development of cheaper equipment for coatings

Cost is an important factor while selecting a product. The high initial cost of production and assemble cost of the equipment is further challenge the market. Providing a cheaper product with better performance is a challenging task for manufacturers. Production of quality equipment that is less expensive needs focused research & development. Understanding the customer requirement and meeting the industrial needs is the main challenge for coating equipment manufacturers. With the presence of low-cost alternatives for certain applications, the development of low-cost product would enable higher penetration in end-use industries.

Specialty coating equipment accounted for the largest share in 2020

In 2020, the specialty coating equipment segment accounted for the largest share of the overall coating equipment market.

Industrial end-use industry accounted for the largest share in 2020

Coating equipment are used in the application of coatings of machines, tools, and equipment used in the Industrial end-user industry. In the power generation industry, oil & gas industry, and consumer appliances industry. Rapid industrialization and development of new manufacturing facilities are expected to increase the demand for coating equipment, globally. PVD and CVD coatings are preferred for coating metal components and moving parts.

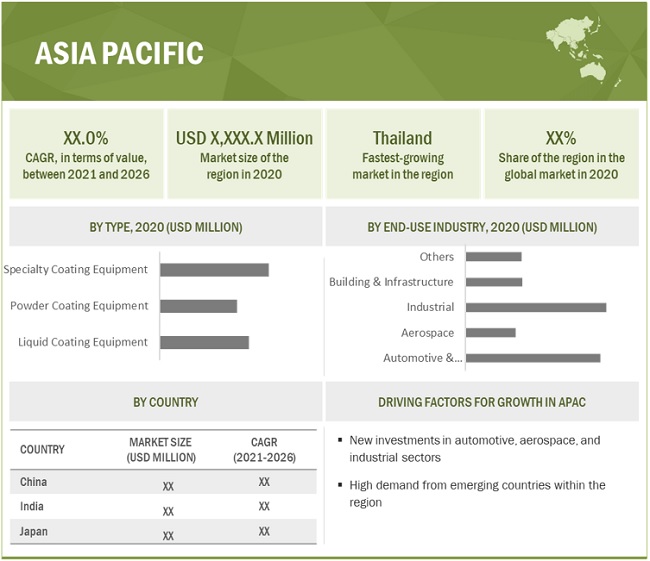

APAC is projected to account for the largest share of the Coating Equipment market during the forecast period

APAC is estimated to be the largest market for Coating Equipment and is projected to reach USD 8,474.9 Million by 2026. The market in the region is primarily driven by the rising demand for building and infrastructure, industrial and automotive industry.

To know about the assumptions considered for the study, download the pdf brochure

Coating Equipment Market Players

The coating equipment market comprises major manufacturers such as IHI Corporation (Japan), Nordson Corporation (U.S.), OC Oerlikon Management AG (Switzerland), SATA GmbH & Co. KG (Germany), Graco Inc. (U.S.), ANEST IWATA Corporation (Japan), ASAHI Sunac Corporation (Japan). Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the coating equipment market.

Coating Equipment Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 18.9 billion |

|

Revenue Forecast in 2026 |

USD 24.7 billion |

|

CAGR |

5.6% |

|

Market size available for years |

2019-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Coating Type, End-use and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and Middle East & Africa |

|

Companies covered |

IHI Corporation (Japan), Nordson Corporation (U.S.), OC Oerlikon Management AG (Switzerland), SATA GmbH & Co. KG (Germany), Graco Inc. (U.S.), ANEST IWATA Corporation (Japan). |

This research report categorizes the coating equipment market based on coating type, end-use industries, and region.

Coating Equipment Market by Coating Type

- Powder coating equipment

- Liquid coating equipment

- Specialty coating equipment

Coating Equipment Market by End-Use Industry

- Automotive & Transportation

- Aerospace

- Industrial

- Building & Infrastructure

- Others

Coating Equipment Market by Region

- North America

- Europe

- APAC

- Middle East & Africa

- South America

Recent Developments

- In 2020, Tosoh Corporation company launched the full-scale operation of its new main research building located in Shuan city, China.

- In Feb 2020, Dow Inc. The company had announced the expansion of Canada based ethylene production facility by 130 kilotons.

- In 2020, Ineos Group acquired 100% shares in its joint venture "Gemini HDPE" with Sasol Chemicals. The company produces high high-density polyethylene in LA Porte, Texas.

Frequently Asked Questions (FAQ):

What are the major drivers influencing the growth of the coating equipment market?

The major drivers influencing the growth of coating equipment are increasing demand from the automobile industry.

What are the major challenges in the coating equipment market?

The major challenges in the coating equipment market is the development of cheaper equipment for coatings.

What are the different end-use industries of coating equipment?

Coating equipment find their applications in various end-use industries such as automotive, aerospace, industrial, building and infrastructure, and others.

What is the impact of COVID-19 pandemic on the coating equipment market?

Owing to the COVID-19 pandemic, there has been an adverse impact on the coating equipment market across the globe. The demand from the end-use industries decreased due to decreased demand and supply chain disruption.

What are the industry trends in coating equipment market?

In the recent past, several manufacturers have expanded their production facilities to cater to the rising demand for coating equipment and enhance their presence in the target market. Along with this, to alleviate the competitive scenario, these key players are focusing on expanding their regional presence particularly in the Asia Pacific. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS IN THE REPORT

1.3 MARKET SCOPE

FIGURE 1 COATING EQUIPMENT MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 COATING EQUIPMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH: ESTIMATING MARKET SHARE OF TOP COATING EQUIPMENT MANUFACTURERS AND ITS SHARE IN THE GLOBAL MARKET

FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.2.2 BOTTOM-UP APPROACH: ESTIMATING MARKET SIZE OF CHINA AND ITS SHARE IN THE GLOBAL MARKET

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION: COATING EQUIPMENT MARKET

2.4 RESEARCH ASSUMPTIONS

2.4.1 LIMITATIONS

2.4.2 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 6 SPECIALTY COATING EQUIPMENT ACCOUNTED FOR LARGEST SHARE OF OVERALL MARKET IN 2020

FIGURE 7 AUTOMOTIVE & TRANSPORTATION TO LEAD OVERALL COATING EQUIPMENT MARKET BETWEEN 2021 AND 2026

FIGURE 8 APAC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE OPPORTUNITIES IN THE COATING EQUIPMENT MARKET

FIGURE 9 RISING DEMAND FROM APAC REGION TO DRIVE THE MARKET

4.2 APAC: COATING EQUIPMENT MARKET, BY TYPE AND COUNTRY

FIGURE 10 CHINA ACCOUNTED FOR THE LARGEST MARKET SHARE

4.3 COATING EQUIPMENT MARKET, BY COATING TYPE

FIGURE 11 SPECIALTY COATING TO REGISTER THE HIGHEST CAGR

4.4 COATING EQUIPMENT MARKET, BY END-USE INDUSTRY

FIGURE 12 INDUSTRIAL SEGMENT TO REGISTER THE HIGHEST CAGR

4.5 COATING EQUIPMENT MARKET: MAJOR COUNTRIES

FIGURE 13 THAILAND TO BE THE FASTEST-GROWING MARKET

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

FIGURE 14 MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN COATING EQUIPMENT MARKET

5.1.1 DRIVERS

5.1.1.1 Recovery of the automotive industry and growing penetration of EVs will support the market growth

FIGURE 15 GLOBAL ELECTRIC PASSENGER CAR SALES, 2010-2020 (MILLION)

FIGURE 16 GLOBAL EV REGISTRATIONS AND MARKET SHARE, 2015-2020

5.1.1.2 Potential growth in the manufacturing industry will boost the demand for coating equipment during the forecast period

FIGURE 17 GROWTH RATES OF MANUFACTURING OUTPUT OF INDUSTRIALIZED REGION, Q1 2021

5.1.1.3 Need for replacement of existing coating systems

5.1.2 RESTRAINTS

5.1.2.1 Availability of low-cost alternatives for some applications

5.1.2.2 Economic slowdown and impact of COVID-19 on the manufacturing sector

FIGURE 18 THE DECLINING CRUDE OIL PRICES, 2014-2020

5.1.3 OPPORTUNITIES

5.1.3.1 Development of new technologies

5.1.4 CHALLENGES

5.1.4.1 Development of cheaper equipment for coatings

5.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 COATING EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

5.2.1 THREAT OF NEW ENTRANTS

5.2.2 BARGAINING POWER OF SUPPLIERS

5.2.3 THREAT OF SUBSTITUTES

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 2 COATING EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3 MACROECONOMIC INDICATORS

5.3.1 GDP GROWTH PROJECTION WORLDWIDE

TABLE 3 GDP GROWTH PROJECTION WORLDWIDE

TABLE 4 GLOBAL AUTOMOTIVE PRODUCTION (UNITS), BY COUNTRY

5.3.2 AEROSPACE INDUSTRY TRENDS

TABLE 5 DEMAND FOR NEW AIRPLANES, BY REGION, BETWEEN 2021–2040

5.4 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS OF COATING EQUIPMENT MARKET

5.4.1 DISRUPTION DUE TO COVID-19

5.5 REGULATORY LANDSCAPE

TABLE 6 REGULATORY LANDSCAPE: REGION/COUNTRY-WISE

5.6 ECOSYSTEM

FIGURE 21 COATING EQUIPMENT ECOSYSTEM

5.7 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.7.1 REVENUE SHIFTS AND REVENUE POCKETS FOR COATING EQUIPMENT MANUFACTURERS

FIGURE 22 REVENUE SHIFT FOR COATING EQUIPMENT MARKET

5.8 SCENARIO ANALYSIS OF COATING EQUIPMENT MARKET

FIGURE 23 COATING EQUIPMENT MARKET, IN TERMS OF VALUE, BY SCENARIO ANALYSIS, 2019–2026 (USD MILLION)

5.9 PRICING ANALYSIS

5.9.1 FACTORS AFFECTING THE PRICES OF COATING EQUIPMENT

TABLE 7 AVERAGE PRICES OF DIFFERENT COATING EQUIPMENT IN DIFFERENT REGIONS (USD)

5.10 CASE STUDY ANALYSIS

5.10.1 THERMAL SPRAYING OF A F100 AUGMENTER

5.11 FORECASTING FACTORS AND IMPACT OF COVID-19 PANDEMIC

5.11.1 COVID-19 ECONOMIC ASSESSMENT

5.11.2 MAJOR ECONOMIC EFFECTS OF COVID-19

FIGURE 24 EFFECTS ON GDP OF COUNTRIES

5.11.3 DISRUPTION IN THE AUTOMOTIVE INDUSTRY

5.11.3.1 Most affected regions/countries

5.11.3.1.1 China

5.11.3.1.2 Europe

FIGURE 25 SLOW RECOVERY IN DEMAND FOR COATING EQUIPMENT MARKET

5.12 TRADE ANALYSIS

TABLE 8 INTENSITY OF TRADE, BY KEY COUNTRY

5.13 PATENT ANALYSIS

5.13.1 INTRODUCTION

5.13.2 METHODOLOGY

5.13.3 DOCUMENT TYPE

FIGURE 26 NUMBER OF PATENTS PUBLISHED FROM 2010 TO 2020

FIGURE 27 NUMBER OF PATENTS PUBLISHED YEAR-WISE (2010-2020)

5.13.4 INSIGHTS

5.13.5 JURISDICTION ANALYSIS

FIGURE 28 PATENT ANALYSIS, BY TOP JURISDICTION

5.13.6 TOP COMPANIES/APPLICANTS

FIGURE 29 TOP 10 COMPANIES/APPLICANTS WITH THE HIGHEST NUMBER OF PATENTS

5.13.6.1 List of patents by Fujimi Incorporated

TABLE 9 LIST OF PATENTS BY FUJIMI INCORPORATED

5.13.6.2 List of patents by Beijing Boyang Dingrong PV Tech Co Ltd

5.13.6.3 List of patents by Daimler AG

5.13.6.4 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

6 COATING EQUIPMENT MARKET, BY COATING TYPE (Page No. - 77)

6.1 INTRODUCTION

FIGURE 30 SPECIALTY COATING EQUIPMENT ACCOUNTED FOR LARGEST SHARE OF OVERALL COATING EQUIPMENT MARKET IN 2020

TABLE 10 COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 11 COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

6.2 LIQUID COATING EQUIPMENT

6.2.1 AVAILABILITY OF ALTERNATIVES SUCH AS BRUSHES AND ROLLERS ARE EXPECTED TO HAMPER THE GROWTH OF THE MARKET

TABLE 12 LIQUID COATING EQUIPMENT MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 13 LIQUID COATING EQUIPMENT MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3 POWDER COATING EQUIPMENT

6.3.1 BETTER COATING EFFICIENCY AND ADVANTAGE OF RECLAMATION TO BOOST DEMAND FOR POWDER COATING EQUIPMENT

TABLE 14 POWDER COATING EQUIPMENT MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 15 POWDER COATING EQUIPMENT MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.4 SPECIALTY COATING EQUIPMENT

6.4.1 MIDDLE EAST & AFRICA IS FASTEST-GROWING MARKET FOR SPECIALTY COATING EQUIPMENT

TABLE 16 SPECIALTY COATING EQUIPMENT MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 17 SPECIALTY COATING EQUIPMENT MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7 COATING EQUIPMENT MARKET, BY END-USE INDUSTRY (Page No. - 86)

7.1 INTRODUCTION

FIGURE 31 AUTOMOTIVE SEGMENT ACCOUNTED FOR LARGEST SHARE OF OVERALL COATING EQUIPMENT MARKET, 2020 (USD MILLION)

TABLE 18 COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 19 COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

7.2 AUTOMOTIVE & TRANSPORTATION

7.2.1 EMERGING TRENDS AND NEW INVESTMENTS TO DRIVE DEMAND FOR COATING EQUIPMENT IN AUTOMOTIVE & TRANSPORTATION

7.2.1.1 Growth in EV production to drive the demand

TABLE 20 EQUIPMENT COATING MARKET SIZE IN AUTOMOTIVE, BY REGION, 2016–2018 (USD MILLION)

TABLE 21 EQUIPMENT COATING MARKET SIZE IN AUTOMOTIVE, BY REGION, 2019–2026 (USD MILLION)

7.3 AEROSPACE

7.3.1 TECHNOLOGICAL INNOVATIONS AND INCREASING PENETRATION OF COATINGS TO DRIVE THE DEMAND IN THIS SEGMENT

TABLE 22 EQUIPMENT COATING MARKET SIZE IN AEROSPACE, BY REGION, 2016–2018 (USD MILLION)

TABLE 23 EQUIPMENT COATING MARKET SIZE IN AEROSPACE, BY REGION, 2019–2026 (USD MILLION)

7.4 INDUSTRIAL

7.4.1 INCREASING INVESTMENT AND ESTABLISHMENT OF NEW MANUFACTURING FACILITIES TO DRIVE THE MARKET

FIGURE 32 TOTAL INDUSTRY PRODUCTION OUTPUT INDEX OF OECD COUNTRIES, Q2-2019 – Q1-2021 (2015 = 100 INDEX)

TABLE 24 EQUIPMENT COATING MARKET SIZE IN INDUSTRIAL, BY REGION, 2016–2018 (USD MILLION)

TABLE 25 EQUIPMENT COATING MARKET SIZE IN INDUSTRIAL, BY REGION, 2019–2026 (USD MILLION)

7.5 BUILDING & INFRASTRUCTURE

7.5.1 GROWING CONSTRUCTION INDUSTRY TO BOOST THE DEMAND FOR COATING EQUIPMENT

TABLE 26 EQUIPMENT COATING MARKET SIZE IN BUILDING & INFRASTRUCTURE, BY REGION, 2016–2018 (USD MILLION)

TABLE 27 EQUIPMENT COATING MARKET SIZE IN BUILDING & INFRASTRUCTURE, BY REGION, 2019–2026 (USD MILLION)

7.6 OTHERS

TABLE 28 EQUIPMENT COATING MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2016–2018 (USD MILLION)

TABLE 29 EQUIPMENT COATING MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2019–2026 (USD MILLION)

8 COATING EQUIPMENT MARKET, BY REGION (Page No. - 96)

8.1 INTRODUCTION

FIGURE 33 REGIONAL SNAPSHOT: RAPIDLY GROWING ECONOMIES EMERGING AS NEW HOTSPOTS

TABLE 30 COATING EQUIPMENT MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 34 NORTH AMERICA: COATING EQUIPMENT MARKET SNAPSHOT

TABLE 31 NORTH AMERICA: COATING EQUIPMENT MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 32 NORTH AMERICA: COATING EQUIPMENT MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 33 NORTH AMERICA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 34 NORTH AMERICA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 35 NORTH AMERICA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 36 NORTH AMERICA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.2.1 US

8.2.1.1 Steady growth in automotive and aerospace industries expected to drive US market

TABLE 37 US: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 38 US: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 39 US: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 40 US: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Rising investment in end-use industries likely to drive market in Canada

TABLE 41 CANADA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 42 CANADA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 43 CANADA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 44 CANADA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.2.3 MEXICO

8.2.3.1 Mexican aerospace industry is a major growth driver for coating equipment market

TABLE 45 MEXICO: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 46 MEXICO: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 47 MEXICO: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 48 MEXICO: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.3 APAC

FIGURE 35 APAC: COATING EQUIPMENT MARKET SNAPSHOT

TABLE 49 APAC: COATING EQUIPMENT MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 50 APAC: COATING EQUIPMENT MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 51 APAC: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 52 APAC: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 53 APAC: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 54 APAC: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.3.1 CHINA

8.3.1.1 Growing investments in automotive and aerospace industries boosting market in China

TABLE 55 CHINA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 56 CHINA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 57 CHINA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 58 CHINA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.3.2 INDIA

8.3.2.1 New automotive and aircraft manufacturing facilities expected to drive demand for coating equipment in India

TABLE 59 INDIA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 60 INDIA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 61 INDIA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 62 INDIA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.3.3 JAPAN

8.3.3.1 Establishment of new automotive manufacturing facilities likely to lead to market growth

TABLE 63 JAPAN: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 64 JAPAN: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 65 JAPAN: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 66 JAPAN: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.3.4 SOUTH KOREA

8.3.4.1 Steady growth of end-use industries driving coating equipment market in South Korea

TABLE 67 SOUTH KOREA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 68 SOUTH KOREA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 69 SOUTH KOREA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 70 SOUTH KOREA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.3.5 INDONESIA

8.3.5.1 Strong growth of automotive, aerospace, and industrial segments expected to boost market for coating equipment

TABLE 71 INDONESIA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 72 INDONESIA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 73 INDONESIA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 74 INDONESIA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.3.6 THAILAND

8.3.6.1 Strong growth of end-use industries expected to drive demand for coating equipment in Thailand

TABLE 75 THAILAND: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 76 THAILAND: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 77 THAILAND: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 78 THAILAND: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.3.7 VIETNAM

8.3.7.1 Growing urbanization driving demand for coating equipment from building & infrastructure industry

TABLE 79 VIETNAM: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 80 VIETNAM: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 81 VIETNAM: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 82 VIETNAM: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.3.8 REST OF APAC

TABLE 83 REST OF APAC: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 84 REST OF APAC: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 85 REST OF APAC: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 86 REST OF APAC: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.4 EUROPE

TABLE 87 EUROPE: COATING EQUIPMENT MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 88 EUROPE: COATING EQUIPMENT MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 89 EUROPE: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 90 EUROPE: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 91 EUROPE: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 92 EUROPE: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.4.1 GERMANY

8.4.1.1 Growing EV penetration and growth of manufacturing industries expected to drive demand for coating equipment

TABLE 93 GERMANY: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 94 GERMANY: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 95 GERMANY: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 96 GERMANY: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.4.2 FRANCE

8.4.2.1 Aerospace MRO services, new investments in automatic machinery & equipment, and emergence of lightweight & energy-efficient vehicles likely to drive coating equipment demand

TABLE 97 FRANCE: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 98 FRANCE: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 99 FRANCE: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 100 FRANCE: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.4.3 NETHERLANDS

8.4.3.1 Changing trends in automotive industry expected to fuel demand for coating equipment in Netherlands

TABLE 101 NETHERLANDS: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 102 NETHERLANDS: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 103 NETHERLANDS: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 104 NETHERLANDS: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.4.4 RUSSIA

8.4.4.1 Recovery of automotive industry likely to drive market in Russia

TABLE 105 RUSSIA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 106 RUSSIA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 107 RUSSIA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 108 RUSSIA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.4.5 UK

8.4.5.1 Increasing investments in aerospace industry expected to drive UK market

TABLE 109 UK: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 110 UK: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 111 UK: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 112 UK: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.4.6 TURKEY

8.4.6.1 Automotive industry a major driver for Turkish coating equipment market

TABLE 113 TURKEY: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 114 TURKEY: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 115 TURKEY: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 116 TURKEY: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026, (USD MILLION)

8.4.7 REST OF EUROPE

TABLE 117 REST OF EUROPE: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 118 REST OF EUROPE: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 119 REST OF EUROPE: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 120 REST OF EUROPE: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.5 MIDDLE EAST & AFRICA

TABLE 121 MIDDLE EAST & AFRICA: COATING EQUIPMENT MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 122 MIDDLE EAST & AFRICA: COATING EQUIPMENT MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 123 MIDDLE EAST & AFRICA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 124 MIDDLE EAST & AFRICA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 125 MIDDLE EAST & AFRICA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 126 MIDDLE EAST & AFRICA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.5.1 SAUDI ARABIA

8.5.1.1 Investments in end-use industries expected to increase the demand for coating equipment in the country

TABLE 127 SAUDI ARABIA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 128 SAUDI ARABIA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 129 SAUDI ARABIA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 130 SAUDI ARABIA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.5.2 UAE

8.5.2.1 Growth in the automotive and aerospace industries expected to drive the coating equipment market

TABLE 131 UAE: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 132 UAE: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 133 UAE: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 134 UAE: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.5.3 REST OF THE MIDDLE EAST & AFRICA

TABLE 135 REST OF THE MIDDLE EAST & AFRICA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 136 REST OF THE MIDDLE EAST & AFRICA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 137 REST OF THE MIDDLE EAST & AFRICA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 138 REST OF THE MIDDLE EAST & AFRICA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.6 SOUTH AMERICA

TABLE 139 SOUTH AMERICA: COATING EQUIPMENT MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 140 SOUTH AMERICA: COATING EQUIPMENT MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 141 SOUTH AMERICA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 142 SOUTH AMERICA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 143 SOUTH AMERICA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 144 SOUTH AMERICA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.6.1 BRAZIL

8.6.1.1 The country’s economic recovery and investments in the automotive industry are expected to propel the market

TABLE 145 BRAZIL: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 146 BRAZIL: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 147 BRAZIL: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 148 BRAZIL: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.6.2 ARGENTINA

8.6.2.1 Strategic alliances in the aerospace industry are expected to contribute to the growth of the coating equipment market in the country

TABLE 149 ARGENTINA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 150 ARGENTINA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 151 ARGENTINA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 152 ARGENTINA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.6.3 REST OF SOUTH AMERICA

TABLE 153 REST OF SOUTH AMERICA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2016–2018 (USD MILLION)

TABLE 154 REST OF SOUTH AMERICA: COATING EQUIPMENT MARKET SIZE, BY COATING TYPE, 2019–2026 (USD MILLION)

TABLE 155 REST OF SOUTH AMERICA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2016–2018 (USD MILLION)

TABLE 156 REST OF SOUTH AMERICA: COATING EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 152)

9.1 INTRODUCTION

TABLE 157 EXPANSION OF FACILITIES IS A KEY STRATEGY ADOPTED BY PLAYERS BETWEEN 2018 AND 2021

9.2 MARKET SHARE ANALYSIS

FIGURE 36 MARKET SHARE OF KEY PLAYERS, 2020

TABLE 158 COATING EQUIPMENT MARKET: SHARE OF KEY PLAYERS

TABLE 159 STRATEGIC POSITIONING OF KEY PLAYERS

9.3 COMPANY EVALUATION MATRIX DEFINITION AND TECHNOLOGY

9.3.1 STAR

9.3.2 PERVASIVE

9.3.3 EMERGING LEADER

9.3.4 PARTICIPANT

FIGURE 37 COATING EQUIPMENT MARKET: COMPANY EVALUATION MATRIX, 2020

9.4 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

9.4.1 RESPONSIVE COMPANIES

9.4.2 DYNAMIC COMPANIES

9.4.3 STARTING BLOCKS

FIGURE 38 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2020

9.5 REVENUE ANALYSIS OF TOP PLAYERS

TABLE 160 REVENUE ANALYSIS OF KEY PLAYERS

9.6 COMPANY PRODUCT FOOTPRINT

TABLE 161 COMPANY FOOTPRINT, BY TYPE

TABLE 162 COMPANY FOOTPRINT, BY END-USE INDUSTRY

TABLE 163 COMPANY FOOTPRINT, BY REGION

9.7 KEY MARKET DEVELOPMENTS

9.7.1 DEALS

9.7.2 NEW PRODUCT LAUNCHES

9.7.3 OTHERS

10 COMPANY PROFILES (Page No. - 166)

10.1 MAJOR COMPANIES

(Business Overview, Product/Solution/Service Offered, Recent Developments, Winning Imperatives, and MnM View)*

10.1.1 IHI CORPORATION

TABLE 164 IHI CORPORATION: BUSINESS OVERVIEW

FIGURE 39 IHI CORPORATION: COMPANY SNAPSHOT

TABLE 165 IHI CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERED

TABLE 166 IHI CORPORATION: DEALS

TABLE 167 IHI CORPORATION: EXPANSIONS

FIGURE 40 IHI CORPORATION’S CAPABILITY IN COATING EQUIPMENT MARKET

10.1.2 NORDSON CORPORATION

TABLE 168 NORDSON CORPORATION: BUSINESS OVERVIEW

FIGURE 41 NORDSON CORPORATION: COMPANY SNAPSHOT

TABLE 169 NORDSON CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERED

TABLE 170 NORDSON CORPORATION: NEW PRODUCT LAUNCHES

FIGURE 42 NORDSON CORPORATION’S CAPABILITY IN COATING EQUIPMENT MARKET

10.1.3 OC OERLIKON MANAGEMENT AG

TABLE 171 OC OERLIKON MANAGEMENT AG: BUSINESS OVERVIEW

FIGURE 43 OC OERLIKON MANAGEMENT AG: COMPANY SNAPSHOT

TABLE 172 OC OERLIKON MANAGEMENT AG: PRODUCT/SOLUTION/SERVICE OFFERED

TABLE 173 OC OERLIKON MANAGEMENT AG: DEALS

FIGURE 44 OC OERLIKON MANAGEMENT AG CAPABILITY IN COATING EQUIPMENT MARKET

10.1.4 GRACO INC.

TABLE 174 GRACO INC.: BUSINESS OVERVIEW

FIGURE 45 GRACO INC.: COMPANY SNAPSHOT

TABLE 175 GRACO INC.: PRODUCT/SOLUTION/SERVICE OFFERED

TABLE 176 GRACO INC.: NEW PRODUCT LAUNCHES

TABLE 177 GRACO INC.: DEALS

FIGURE 46 GRACO INC. CAPABILITY IN COATING EQUIPMENT MARKET

10.1.5 ANEST IWATA CORPORATION

TABLE 178 ANEST IWATA CORPORATION: BUSINESS OVERVIEW

FIGURE 47 ANEST IWATA CORPORATION: COMPANY SNAPSHOT

TABLE 179 ANEST IWATA CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERED

FIGURE 48 ANEST IWATA CORPORATION CAPABILITY IN COATING EQUIPMENT MARKET

10.1.6 SATA GMBH & CO. KG

TABLE 180 SATA GMBH & CO. KG: BUSINESS OVERVIEW

TABLE 181 SATA GMBH & CO. KG: PRODUCT/SOLUTION/SERVICE OFFERED

TABLE 182 SATA GMBH & CO. KG: NEW PRODUCT LAUNCH

10.1.7 ASAHI SUNAC CORPORATION

TABLE 183 ASAHI SUNAC CORPORATION: BUSINESS OVERVIEW

TABLE 184 ASAHI SUNAC CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERED

10.1.8 WIWA WILHELM WAGNER GMBH & CO. KG

TABLE 185 WIWA WILHELM WAGNER GMBH & CO. KG: BUSINESS OVERVIEW

TABLE 186 WIWA WILHELM WAGNER GMBH & CO. KG: PRODUCT/SOLUTION/SERVICE OFFERED

10.1.9 J. WAGNER GMBH

TABLE 187 J. WAGNER GMBH: BUSINESS OVERVIEW

TABLE 188 J. WAGNER GMBH: PRODUCT/SOLUTION/SERVICE OFFERED

TABLE 189 J. WAGNER GMBH: NEW PRODUCT LAUNCHES

10.1.10 TRITECH INDUSTRIES, INC.

TABLE 190 TRITECH INDUSTRIES, INC.: BUSINESS OVERVIEW

TABLE 191 TRITECH INDUSTRIES, INC.: PRODUCT/SOLUTION/SERVICE OFFERED

10.1.11 LARIUS

TABLE 192 LARIUS: BUSINESS OVERVIEW

TABLE 193 LARIUS: PRODUCT/SOLUTION/SERVICE OFFERED

10.1.12 TITAN TOOL

TABLE 194 TITAN TOOL: BUSINESS OVERVIEW

TABLE 195 TITAN TOOL: PRODUCT/SOLUTION/SERVICE OFFERED

10.1.13 NINGBO DINO-POWER MACHINERY

TABLE 196 NINGBO DINO-POWER MACHINERY: BUSINESS OVERVIEW

TABLE 197 NINGBO DINO-POWER MACHINERY: PRODUCT/SOLUTION/SERVICE OFFERED

10.1.14 W.I.T. S.R.L.

TABLE 198 W.I.T. S.R.L.: BUSINESS OVERVIEW

TABLE 199 W.I.T. S.R.L.: PRODUCT/SOLUTION/SERVICE OFFERED

(Business Overview, Product/Solution/Service Offered, Recent Developments, Winning Imperatives, and MnM View might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 208)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

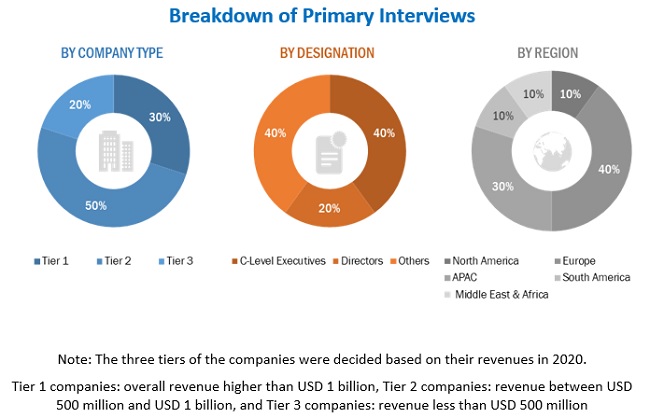

The study involved four major activities for estimating the current size of the global coating equipment market. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The COVID-19 pandemic impact on the demand regarding end-use industries, application areas, and countries was comprehended. The next step was to validate these findings, assumptions and sizes with the industry experts across the supply chain of the coating equipment market through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the coating equipment market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect this study's coating equipment market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

The market size of coating equipment has been estimated based on secondary data available through paid and unpaid sources, and by analyzing the product portfolios of key companies. This data has been further validated through various primary sources

Primary Research

Various primary sources from both the supply and demand sides of the coating equipment market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the coating equipment market industry. The primary sources from the demand side included key executives from end-use industries. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global coating equipment market size. These approaches were also used extensively to estimate the size of various segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- In terms of value, the industry's supply chain and market size were determined through primary and secondary research processes.

- Impact of COVID-19 pandemic was ascertained

- All percentage split and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments of the coating equipment market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the coating equipment market in terms of value based on coating type, end use industries, and region

- To project the size of the market and its segments with respect to the five main regions, namely, North America, Europe, Asia Pacific Middle East and Africa and South America.

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, COVID-19 pandemic impact, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the coating equipment market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the coating equipment market report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further breakdown of the Rest of the APAC, coating equipment market into more nations not covered in the study

- Further breakdown of Rest of Europe, Coating Equipment market into more nations not covered in the study

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Coating Equipment Market