Thermal Spray Coatings Market by Materials (Ceramics and Metals & Alloys), Process (Combustion Flame and Electrical), End-Use Industry (Aerospace, Automotive, Healthcare, Agriculture, Energy & Power and Electronics) and Region - Global Forecast to 2028

Updated on : November 11, 2025

Thermal Spray Coatings Market

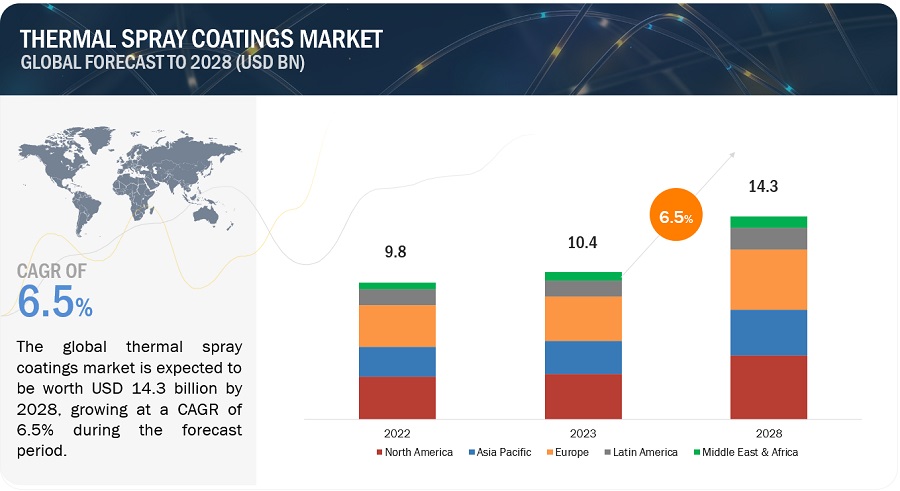

The global thermal spray coatings market was valued at USD 10.4 billion in 2023 and is projected to reach USD 14.3 billion by 2028, growing at 6.5% cagr from 2023 to 2028. The industry has observed stable growth throughout the study period and is expected to continue with the same trend during the forecast period. Thermal spray coatings are used in various industrial applications, including aerospace and defense. The aerospace industry uses Thermal spray coatings for repair and restoration. Components that have suffered wear, corrosion, or damage can be repaired by applying suitable coatings, restoring their functionality, and extending their service life.

Thermal Spray Coatings Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Thermal Spray Coatings Market

Thermal Spray Coatings Market Dynamics

Driver: Growing demand from the healthcare industry

The healthcare industry's increasing adoption of thermal spray coatings can be attributed to several driving factors that significantly enhance the performance and safety of medical devices and equipment. One primary factor is the improvement in biocompatibility achieved through these coatings, reducing the risk of adverse reactions and facilitating better integration with the human body when used in medical implants and devices. Moreover, thermal spray coatings offer extended device lifespan by increasing their durability and wear resistance, resulting in longer-lasting and more reliable products. Infection control is another crucial factor, as some thermal spray coatings exhibit antimicrobial properties, helping to minimize the risk of healthcare-associated infections. Thus, the increasing demand for the healthcare industry is expected to enhance the market for thermal spray coatings during the forecast period.

Restraint: Stringent regulations for thermal spray coatings

The thermal spray coating process produces dust filled with finely divided particles that may be explosive and cause inhalation hazards. It also produces phosgene gas when hydrocarbon vapors are exposed to ultraviolet radiation during the coating process. These hazards pose a threat to occupational safety, resulting in the imposition of regulations from different organizations. Governments also enforce strict guidelines to protect workers involved in thermal spray coating from potential hazards. These regulations may cover the use of personal protective equipment (PPE), handling of chemicals and materials, ventilation requirements, and training for workers.

Opportunity: Adoption of new measures to conserve energy & harness renewable energy sources

The growing demand for energy and power has increased fossil fuel consumption, leading to carbon dioxide emissions into the atmosphere and extreme climatic changes. Governments across the globe are setting up renewable energy plants to produce, adapt, and harness energy from renewable sources. These power plants employ various components, such as wind turbines, shafts, and fans. To protect these components from wear and corrosion, thermal spray coatings can be applied to them, which will, in turn, contribute to the growth of the thermal spray coatings industry. Thus, the use of thermal spray coatings in energy generation is expected to propel the thermal spray coatings market.

Challenge: Lack of technical skills

The thermal spray coating process is a high-precision surface coating process. Additionally, customers of this process require the finest quality output. Therefore, technicians in this process need expertise in selecting the most suitable suspension particles to achieve better-nanostructured coatings for advanced applications. The process also employs instruments and sensors to measure particle velocity to obtain high-quality results for substrate materials. Thus, the ability to deal with light alloys at controlled temperatures in heavy engineering projects is a critical skill required for technicians. Such factors can make it challenging to perform thermal spray coatings at scale and can limit its market growth.

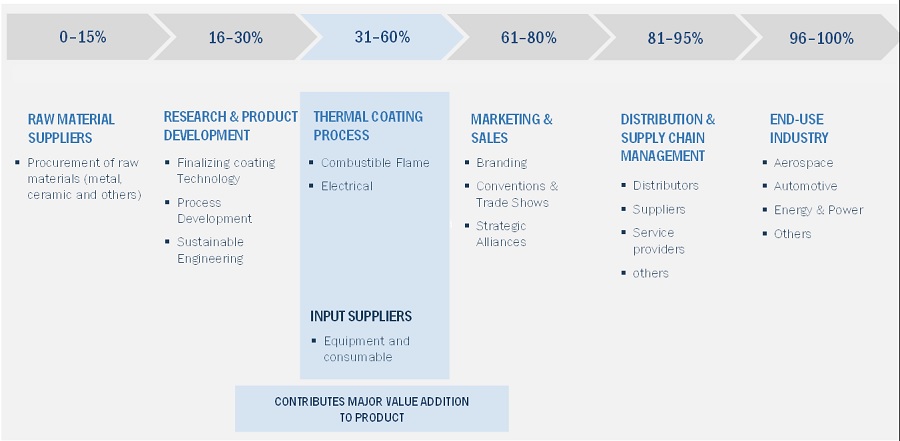

Thermal Spray Coatings Market Ecosystem

Prominent companies in this market include well-established financial service providers of thermal spray coatings. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Praxair ST Technologies, Inc. (US), H.C Starck Gmbh (Germany), Bodycote (UK), Oerlikon Metco (Switzerland), and Surface Technology (UK).

Based on the process, the combustion flame segment is projected to grow significantly during the forecast period.

The combustion flame segment accounts for the highest share based on the process. The combustion flame process is generally considered a cost-effective thermal spray technique. The equipment and materials used in this process are relatively affordable compared to other methods. Additionally, the combustion flame process can be easily scaled up for large-scale production, making it suitable for industrial applications. Such factors are expected to enhance the market for the segment during the forecast period.

Based on material, the ceramics segment accounts for the largest share of the overall market.

Based on material, the ceramics segment accounts for the highest share. Ceramic coatings are lightweight compared to traditional protective materials like metal alloys. This makes them desirable for applications where weight reduction is essential, such as aerospace and automotive industries. Components can achieve improved performance without adding significant weight by applying ceramic coatings. Thus all these factors are expected to increase the usage of thermal spray coatings in anode making, enhancing the market for thermal spray coatings.

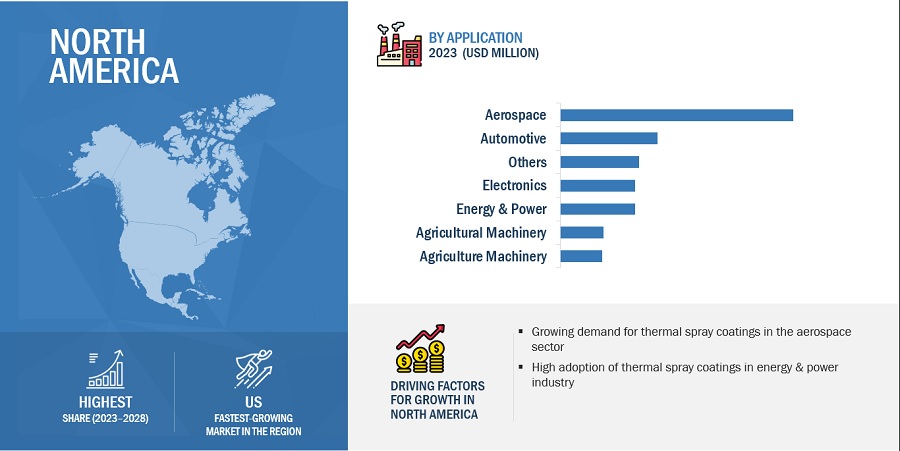

Based on end-use, the aerospace segment accounts for the largest share of the overall market.

Based on material, the ceramics segment accounts for the highest share. Aerospace exterior and interior components are susceptible to corrosion due to exposure to various elements, such as humidity, moisture, and chemicals. Thermal spray coatings with corrosion-resistant properties are applied to protect against corrosion, extend component lifespan, and minimize maintenance requirements. Thus all these factors are expected to increase the usage of thermal spray coatings in anode making, enhancing the market for thermal spray coatings.

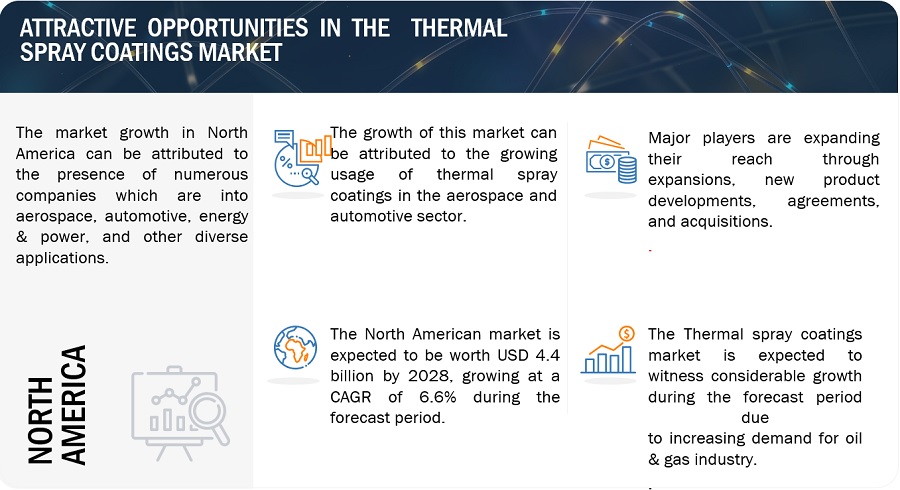

North America is expected to account for the largest share of the global market during the forecast period.

Based on the region, North America accounts for the largest share. The oil and gas industry is a significant consumer of thermal spray coatings in North America. These coatings are used for corrosion protection, erosion resistance, and insulation in various oil and gas equipment, including pipelines, valves, pumps, and offshore structures. The region’s continuous exploration and production activities drive this sector’s demand for thermal spray coatings. The US holds a significant share of the North American thermal spray coatings market. Canada is also creating a demand for thermal spray coatings in various applications, including aerospace and automotive.

To know about the assumptions considered for the study, download the pdf brochure

Thermal Spray Coatings Market Players

Praxair ST Technologies, Inc. (US), H.C Starck Gmbh (Germany), Bodycote (UK), Oerlikon Metco (Switzerland), BryCoat Inc. (US), Thermal Spray Technologies Engineered Coatings Solution (US), F.W. Gartner Thermal Spraying (US), Arc Spray (Pty) Ltd. (South Africa), Metallisation Limited (UK), Plasma-Tec, Inc. (US), GTV Verschleiss-Schutz (Germany), Surface Technology (UK), and others are among the key players leading the market through their innovative offerings, enhanced production capacities, and efficient distribution channels.

Read More: Thermal Spray Coatings Companies

Thermal Spray Coatings Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 10.4 billion |

|

Revenue Forecast in 2028 |

USD 14.3 billion |

|

CAGR |

6.5% |

|

Market Size Available for Years |

2017 to 2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Process, Material, End-Use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Companies Covered |

The major market players include Praxair ST Technologies, Inc. (US), H.C Starck Gmbh (Germany), Bodycote (UK), Oerlikon Metco (Switzerland), BryCoat Inc. (US), Thermal Spray Technologies Engineered Coatings Solution (US), F.W. Gartner Thermal Spraying (US), Arc Spray (Pty) Ltd. (South Africa), Metallisation Limited (UK), Plasma-Tec, Inc. (US), GTV Verschleiss-Schutz (Germany), and others. |

This research report categorizes the thermal spray coatings market based on process, material, end-user, and region.

Based on the process, the thermal spray coatings market has been segmented as follows:

- Combustion flame

- Electrical

Based on material, the thermal spray coatings market industry has been segmented as follows:

- Ceramics

- Metal & Alloys

- Others

Based on the end-use industry, the thermal spray coatings market has been segmented as follows:

- Aerospace

- Automotive

- Healthcare

- Energy & Power

- Agriculture

- Electronics

- Others

Based on the region, the thermal spray coatings market has been segmented as follows:

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- Russia

- France

- Italy

- Belgium

- Rest of Europe (Austria, Switzerland, and Portugal)

-

Asia Pacific

- China

- Japan

- India

- Vietnam

- Rest of Asia Pacific (Thailand, Indonesia and Australia)

-

Latin America

- Mexico

- Argentina

- Brazil

- Columbia

- Rest of Latin America (Chile, Peru, and Costa Rica)

-

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Egypt

- Rest of Middle East & Africa (Iran, Qatar, and Oman)

Recent Developments

- In March 2020, Praxair ST Technology, Inc. agreed with Seimens Gas and Power that aerospace and industrial gas turbines components such as blades, vanes, casings, and discs will be coated by PST’s aluminizing, platinum aluminizing, slurry, and thermal spray processes.

- In March 2021, Oerlikon Metco announced the expansion of its manufacturing facility in Huntersville, North Carolina. This expansion intends to offer pre- and post-coating inspection and machining services.

- In October 2019, Surface Technology announced acquiring a business division of UK-based coating and engineering company Norman Hay plc to strengthen its position in the thermal spray coating market.

Frequently Asked Questions (FAQ):

What is the key driver and opportunity for the thermal spray coatings market?

Growing demand from the healthcare industry and adopting new measures to conserve energy & harness renewable energy sources is the primary driver and opportunity.

Which region is expected to hold the highest market share in the thermal spray coatings market?

The thermal spray coatings market in North America is expected to dominate the market share in 2028, showcasing strong demand from major applications such as aerospace and automotive.

What is the primary end-use industry for thermal spray coatings?

Aerospace and automotive are the major applications of thermal spray coatings.

Who are the major service providers of thermal spray coatings?

The key manufacturers operating in the market include Praxair ST Technologies, Inc. (US), H.C Starck Gmbh (Germany), Bodycote (UK), Oerlikon Metco (Switzerland), and Surface Technology (UK).

What total CAGR is expected for the thermal spray coatings market from 2023 to 2028?

The market is expected to record a CAGR of 6.5% from 2023-2028 .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand from healthcare industry- Reduced maintenance cost of thermally sprayed parts- Thermal spray substituting electroplating processes- Boom in aerospace industryRESTRAINTS- Stringent regulations for thermal spray coatingsOPPORTUNITIES- Adoption of new measures to conserve energy & harness renewable energy sourcesCHALLENGES- Lack of technical skills- Low investment in R&D activities by end-use industries

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERS- Easy availability of raw materials- Presence of large number of suppliersBARGAINING POWER OF BUYERS- Presence of large number of buyers- Large volume purchasesTHREAT OF SUBSTITUTES- Availability of substitutes- Cost of available substitutesTHREAT OF NEW ENTRANTS- Presence of established players- Requirement for specific technical skillsINTENSITY OF COMPETITIVE RIVALRY- Industry concentration- Exit barriers

- 6.1 TECHNOLOGY ANALYSIS

-

6.2 CASE STUDY ANALYSISUSE OF THERMAL SPRAY COATINGS FOR IMPROVED PERFORMANCE AND LIFESPAN IN AEROSPACE INDUSTRYUSE OF THERMAL SPRAY COATINGS FOR CORROSION PROTECTION IN OFFSHORE OIL & GAS INDUSTRYTHERMAL SPRAY COATINGS FOR WEAR PROTECTION IN MINING EQUIPMENT

- 6.3 VALUE CHAIN ANALYSIS

-

6.4 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.5 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSKEY BUYING CRITERIA, BY END-USE INDUSTRY

-

6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

- 6.7 KEY CONFERENCES AND EVENTS, 2023

-

6.8 PATENT ANALYSISMETHODOLOGYPATENT PUBLICATION TRENDSINSIGHTJURISDICTION ANALYSISTOP COMPANIES/APPLICANTSMAJOR PATENTS

-

6.9 ECOSYSTEM/MARKET MAP OF THERMAL SPRAY COATINGS

- 7.1 INTRODUCTION

-

7.2 COMBUSTION FLAMETYPES- Wire flame spraying- Powder flame spraying- Detonation gun spraying- Ceramic rod spraying- High Velocity Oxy Fuel (HVOF) process

-

7.3 ELECTRICALTYPES- Vacuum Plasma Spraying (VPS)- Atmospheric Plasma Spraying (APS)- Electric arc wire spraying- Plasma spraying- Arc spraying- Cold gas dynamic spray process- Radio Frequency (RF) plasma- Two-wire electric arc spraying

- 8.1 INTRODUCTION

-

8.2 CERAMICSALUMINAZIRCONIAYTTRIA

-

8.3 METALS & ALLOYSNICKELMOLYBDENUMALUMINUMCOBALTZINC

-

8.4 OTHERSRESINSPOLYMERSCARBIDESCOMPOSITES

- 9.1 INTRODUCTION

-

9.2 AEROSPACEFLAME TUBESTURBINE BLADESLANDING GEAR

-

9.3 AUTOMOTIVESUSPENSION PARTSPISTON RINGSTURBOCHARGERSENGINE PARTSCHASSISCYLINDER LINERSEXHAUST PIPES

-

9.4 HEALTHCAREORTHOPEDICSMEDICAL INSTRUMENTSOVER-THE-COUNTER MEDICINES

-

9.5 ENERGY & POWERBOILERSSHAFTSHYDRO TURBINESPOWER GENERATORSCOMPRESSOR BLADES

-

9.6 ELECTRONICSELECTRONIC ENCLOSURESINSTRUMENT NUTSMAGNETIC TAPESDIELECTRIC COATINGSSHIELDING

-

9.7 AGRICULTURAL MACHINERYHARVESTER BLADESBALERSCOMPRESSORSTHRESHING COMPONENTSAGRICULTURAL PUMPS & WASTEWATER TREATMENT EQUIPMENT

-

9.8 OTHERSFOOD PROCESSINGDEFENSEPRINTING

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICRECESSION IMPACTCHINA- Massive industrial growth to drive marketJAPAN- Increasing urbanization, capital investments, and technological advancements to drive marketINDIA- Increasing foreign investments to drive marketSOUTH KOREA- Technological advancements in electronics to drive marketVIETNAM- Availability of raw materials to drive marketREST OF ASIA PACIFIC

-

10.3 EUROPERECESSION IMPACTGERMANY- Growth of end-use industries to drive marketUK- Increased production of automobiles and government investments to fuel marketRUSSIA- Growth of automotive industry to drive marketITALY- Increased investments in healthcare and automotive industries to fuel marketFRANCE- Growth of aerospace industry to drive consumptionBELGIUM- Growth of automotive & healthcare industries to drive marketREST OF EUROPE

-

10.4 NORTH AMERICARECESSION IMPACTUS- US to lead North American thermal spray coatings marketCANADA- Increase in investments to drive growth

-

10.5 LATIN AMERICARECESSION IMPACTMEXICO- Increased investments in automotive industry to support growthBRAZIL- Growth of automotive industry to drive marketCOLOMBIA- Growing automotive and construction industries to drive marketARGENTINA- End-use industries to witness growthREST OF LATIN AMERICA

-

10.6 MIDDLE EAST & AFRICARECESSION IMPACTSAUDI ARABIA- Growth of automotive industry to drive marketSOUTH AFRICA- Investments in manufacturing sector to drive marketUAE- Rise in healthcare expenditure and growth of aviation sector to drive marketEGYPT- Increased focus on harnessing renewable energy and growth of healthcare industry to drive marketREST OF MIDDLE EAST & AFRICA

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY MARKET PLAYERS

-

11.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2022MARKET SHARE OF KEY PLAYERSREVENUE ANALYSIS OF TOP PLAYERS

- 11.4 COMPANY FOOTPRINT

-

11.5 COMPANY EVALUATION QUADRANT (TIER 1), 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 START-UPS/SMES EVALUATION QUADRANT, 2022PROGRESSIVE COMPANIESDYNAMIC COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKS

- 11.7 COMPETITIVE BENCHMARKING

- 11.8 COMPETITIVE SCENARIO

-

12.1 PRAXAIR S.T. TECHNOLOGY, INC.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS- Deals- OthersMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

12.2 OERLIKON METCOBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS- Deals- OthersMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

12.3 BODYCOTEBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS- Deals- Other developmentsMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

12.4 SURFACE TECHNOLOGYBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS- DealsMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

12.5 H.C. STARCK GMBHBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDOTHER DEVELOPMENTSMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

12.6 FLAME SPRAY TECHNOLOGIES B.V.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

12.7 THERMAL SPRAY TECHNOLOGIES ENGINEERED COATING SOLUTIONSBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

12.8 A&A COATINGSBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

12.9 GENERAL MAGNAPLATE CORPORATIONBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

12.10 PLASMA-TEC, INC.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

12.11 ASB INDUSTRIES INC.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS- Deals

-

12.12 POLYMET CORPORATIONBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

12.13 PROGRESSIVE SURFACEBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

12.14 BRYCOAT INC.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

12.15 METALLISATION LIMITEDBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

12.16 EXLINE INC.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

12.17 ARC-SPRAY (PTY) LTD.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

12.18 F.W. GARTNER THERMAL SPRAYINGBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

12.19 FLAME SPRAY SPABUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS- Deals

-

12.20 TOCALO CO., LTD.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

12.21 TREIBACHER INDUSTRIE AGBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

12.22 GTC VERSCHLEISS-SCHUTZBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

12.23 SAINT-GOBAINBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

12.24 C & M TECHNOLOGIES GMBHBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 THERMAL SPRAY COATINGS MARKET, BY PROCESS: INCLUSIONS & EXCLUSIONS

- TABLE 2 THERMAL SPRAY COATING MARKET, BY MATERIAL: INCLUSIONS & EXCLUSIONS

- TABLE 3 THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY: INCLUSIONS & EXCLUSIONS

- TABLE 4 THERMAL SPRAY COATING MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

- TABLE 5 THERMAL SPRAY COATINGS MARKET SNAPSHOT

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 7 KEY BUYING CRITERIA, BY TOP THREE END-USE INDUSTRIES

- TABLE 8 THERMAL SPRAY COATINGS MARKET: KEY CONFERENCES AND EVENTS

- TABLE 9 THERMAL SPRAY COATING MARKET: ECOSYSTEM

- TABLE 10 THERMAL SPRAY COATING MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 11 THERMAL SPRAY COATING MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 12 COMBUSTION FLAME THERMAL SPRAY COATINGS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 13 COMBUSTION FLAME THERMAL SPRAY COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 14 ELECTRICAL THERMAL SPRAY COATING MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 15 ELECTRICAL THERMAL SPRAY COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 16 THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 17 THERMAL SPRAY COATING MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 18 CERAMIC THERMAL SPRAY COATINGS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 19 CERAMIC THERMAL SPRAY COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 METAL & ALLOY THERMAL SPRAY COATINGS MARKET, BY REGION, 2017–2022(USD MILLION) (PRE-COVID)

- TABLE 21 METAL & ALLOY THERMAL SPRAY COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 OTHER MATERIALS THERMAL SPRAY COATINGS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 23 OTHER MATERIALS THERMAL SPRAY COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 25 THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 26 THERMAL SPRAY COATING MARKET IN AEROSPACE, BY REGION, 2017–2022 (USD MILLION)

- TABLE 27 THERMAL SPRAY COATING MARKET IN AEROSPACE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 THERMAL SPRAY COATING MARKET IN AUTOMOTIVE, BY REGION, 2017–2022 (USD MILLION)

- TABLE 29 THERMAL SPRAY COATING MARKET IN AUTOMOTIVE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 THERMAL SPRAY COATING MARKET IN HEALTHCARE, BY REGION, 2017–2022 (USD MILLION)

- TABLE 31 THERMAL SPRAY COATING MARKET IN HEALTHCARE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 THERMAL SPRAY COATING MARKET IN ENERGY & POWER, BY REGION, 2017–2022 (USD MILLION)

- TABLE 33 THERMAL SPRAY COATING MARKET IN ENERGY & POWER, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 THERMAL SPRAY COATING MARKET IN ELECTRONICS, BY REGION, 2017–2022 (USD MILLION)

- TABLE 35 THERMAL SPRAY COATING MARKET IN ELECTRONICS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 THERMAL SPRAY COATING MARKET IN AGRICULTURAL MACHINERY, BY REGION, 2017–2022 (USD MILLION)

- TABLE 37 THERMAL SPRAY COATING MARKET IN AGRICULTURAL MACHINERY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 THERMAL SPRAY COATING MARKET IN OTHER INDUSTRIES, BY REGION, 2017–2022 (USD MILLION)

- TABLE 39 THERMAL SPRAY COATING MARKET IN OTHER INDUSTRIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 THERMAL SPRAY COATING MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 41 THERMAL SPRAY COATINGS MARKET, BY REGION 2023–2028 (USD MILLION)

- TABLE 42 ASIA PACIFIC: THERMAL SPRAY COATINGS MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 43 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 44 ASIA PACIFIC: THERMAL SPRAY COATING MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 45 ASIA PACIFIC: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 46 ASIA PACIFIC: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 47 ASIA PACIFIC: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 48 ASIA PACIFIC: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 49 ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 50 CHINA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 51 CHINA: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 52 CHINA: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 53 CHINA: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 54 CHINA: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 55 CHINA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 56 JAPAN: THERMAL SPRAY COATING MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 57 JAPAN: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 58 JAPAN: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 59 JAPAN: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 60 JAPAN: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 61 JAPAN: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 62 INDIA: THERMAL SPRAY COATING MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 63 INDIA: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 64 INDIA: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 65 INDIA: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 66 INDIA: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 67 INDIA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 68 SOUTH KOREA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 69 SOUTH KOREA: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 70 SOUTH KOREA: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 71 SOUTH KOREA: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 72 SOUTH KOREA: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 73 SOUTH KOREA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 74 VIETNAM: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 75 VIETNAM: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 76 VIETNAM: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 77 VIETNAM: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 78 VIETNAM: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 79 VIETNAM: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 80 REST OF ASIA PACIFIC: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 81 REST OF ASIA PACIFIC: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 82 REST OF ASIA PACIFIC: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 83 REST OF ASIA PACIFIC: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 84 REST OF ASIA PACIFIC: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 85 REST OF ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: THERMAL SPRAY COATINGS MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 87 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: THERMAL SPRAY COATING MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 89 EUROPE: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022(USD MILLION)

- TABLE 91 EUROPE: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 93 EUROPE: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 94 GERMANY: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 95 GERMANY: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 96 GERMANY: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 97 GERMANY: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 98 GERMANY: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 99 GERMANY: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 100 UK: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 101 UK: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 102 UK: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 103 UK: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 104 UK: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 105 UK: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 106 RUSSIA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 107 RUSSIA: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 108 RUSSIA: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 109 RUSSIA: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 110 RUSSIA: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 111 RUSSIA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 112 ITALY: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 113 ITALY: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 114 ITALY: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 115 ITALY: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 116 ITALY: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 117 ITALY: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 118 FRANCE: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 119 FRANCE: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 120 FRANCE: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 121 FRANCE: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 122 FRANCE: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 123 FRANCE: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 124 BELGIUM: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 125 BELGIUM: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 126 BELGIUM: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 127 BELGIUM: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 128 BELGIUM: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 129 BELGIUM: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 130 REST OF EUROPE: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 131 REST OF EUROPE: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 132 REST OF EUROPE: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 133 REST OF EUROPE: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 134 REST OF EUROPE: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 135 REST OF EUROPE: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: THERMAL SPRAY COATINGS MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 137 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 138 NORTH AMERICA: THERMAL SPRAY COATING MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 139 NORTH AMERICA: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 141 NORTH AMERICA: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 143 NORTH AMERICA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 144 US: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 145 US: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 146 US: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 147 US: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 148 US: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 149 US: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 150 CANADA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 151 CANADA: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 152 CANADA: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 153 CANADA: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 154 CANADA: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 155 CANADA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 156 LATIN AMERICA: THERMAL SPRAY COATINGS MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 157 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 158 LATIN AMERICA: THERMAL SPRAY COATING MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 159 LATIN AMERICA: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 160 LATIN AMERICA: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 161 LATIN AMERICA: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 162 LATIN AMERICA: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 163 LATIN AMERICA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 164 MEXICO: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 165 MEXICO: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 166 MEXICO: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 167 MEXICO: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 168 MEXICO: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 169 MEXICO: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 170 BRAZIL: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 171 BRAZIL: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 172 BRAZIL: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 173 BRAZIL: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 174 BRAZIL: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 175 BRAZIL: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 176 COLOMBIA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 177 COLOMBIA: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 178 COLOMBIA: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 179 COLOMBIA: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 180 COLOMBIA: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 181 COLOMBIA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 182 ARGENTINA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 183 ARGENTINA: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 184 ARGENTINA: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 185 ARGENTINA: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 186 ARGENTINA: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 187 ARGENTINA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 188 REST OF LATIN AMERICA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 189 REST OF LATIN AMERICA: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 190 REST OF LATIN AMERICA: THERMAL SPRAY COATING MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 191 REST OF LATIN AMERICA: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 192 REST OF LATIN AMERICA: THERMAL SPRAY COATING MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 193 REST OF LATIN AMERICA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: THERMAL SPRAY COATING MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 202 SAUDI ARABIA: THERMAL SPRAY COATING MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 203 SAUDI ARABIA: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 204 SAUDI ARABIA: MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 205 SAUDI ARABIA: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 206 SAUDI ARABIA: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 207 SAUDI ARABIA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 208 SOUTH AFRICA: THERMAL SPRAY COATING MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 209 SOUTH AFRICA: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 210 SOUTH AFRICA: MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 211 SOUTH AFRICA: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 212 SOUTH AFRICA: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 213 SOUTH AFRICA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 214 UAE: THERMAL SPRAY COATING MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 215 UAE: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 216 UAE: MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 217 UAE: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 218 UAE: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 219 UAE: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 220 EGYPT: THERMAL SPRAY COATING MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 221 EGYPT: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 222 EGYPT: MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 223 EGYPT: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 224 EGYPT: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 225 EGYPT: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 226 REST OF MIDDLE EAST & AFRICA: THERMAL SPRAY COATING MARKET, BY PROCESS, 2017–2022 (USD MILLION)

- TABLE 227 REST OF MIDDLE EAST & AFRICA: MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 228 REST OF MIDDLE EAST & AFRICA: MARKET, BY MATERIAL, 2017–2022 (USD MILLION)

- TABLE 229 REST OF MIDDLE EAST & AFRICA: MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 230 REST OF MIDDLE EAST & AFRICA: MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 231 REST OF MIDDLE EAST & AFRICA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 232 STRATEGIES ADOPTED BY KEY THERMAL SPRAY COATINGS SERVICE PROVIDERS

- TABLE 233 THERMAL SPRAY COATINGS MARKET: DEGREE OF COMPETITION

- TABLE 234 THERMAL SPRAY COATING MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 235 THERMAL SPRAY COATING MARKET: PROCESS FOOTPRINT

- TABLE 236 THERMAL SPRAY COATING MARKET: MATERIAL FOOTPRINT

- TABLE 237 THERMAL SPRAY COATING MARKET: REGION FOOTPRINT

- TABLE 238 THERMAL SPRAY COATING MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 239 THERMAL SPRAY COATING MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 240 THERMAL SPRAY COATING MARKET: PRODUCT LAUNCHES, 2018–2022

- TABLE 241 THERMAL SPRAY COATING MARKET: DEALS, 2018–2022

- TABLE 242 THERMAL SPRAY COATINGS MARKET: OTHERS, 2018–2022

- TABLE 243 PRAXAIR SURFACE TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 244 OERLIKON METCO: COMPANY OVERVIEW

- TABLE 245 BODYCOTE: COMPANY OVERVIEW

- TABLE 246 SURFACE TECHNOLOGY: COMPANY OVERVIEW

- TABLE 247 H.C. STARCK GMBH: COMPANY OVERVIEW

- TABLE 248 FLAME SPRAY TECHNOLOGIES B.V.: COMPANY OVERVIEW

- TABLE 249 THERMAL SPRAY TECHNOLOGIES ENGINEERED COATING SOLUTION: COMPANY OVERVIEW

- TABLE 250 A&A COATINGS: COMPANY OVERVIEW

- TABLE 251 GENERAL MAGNAPLATE CORPORATION: COMPANY OVERVIEW

- TABLE 252 PLASMA-TEC, INC.: COMPANY OVERVIEW

- TABLE 253 ASB INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 254 POLYMET CORPORATION: COMPANY OVERVIEW

- TABLE 255 PROGRESSIVE SURFACE: COMPANY OVERVIEW

- TABLE 256 BRYCOAT INC.: COMPANY OVERVIEW

- TABLE 257 METALLISATION LIMITED: COMPANY OVERVIEW

- TABLE 258 EXLINE, INC.: COMPANY OVERVIEW

- TABLE 259 ARC-SPRAY (PTY) LTD.: COMPANY OVERVIEW

- TABLE 260 F.W. GARTNER THERMAL SPRAYING: COMPANY OVERVIEW

- TABLE 261 FLAME SPRAY SPA: COMPANY OVERVIEW

- TABLE 262 TOCALO CO., LTD.: COMPANY OVERVIEW

- TABLE 263 TREIBACHER INDUSTRIE AG: COMPANY OVERVIEW

- TABLE 264 GTC VERSCHLEISS-SCHUTZ: COMPANY OVERVIEW

- TABLE 265 SAINT-GOBAIN: COMPANY OVERVIEW

- TABLE 266 C & M TECHNOLOGIES GMBH: COMPANY OVERVIEW

- FIGURE 1 THERMAL SPRAY COATINGS MARKET SEGMENTATION

- FIGURE 2 THERMAL SPRAY COATINGS MARKET: RESEARCH DESIGN

- FIGURE 3 BASE NUMBER CALCULATION APPROACH 1

- FIGURE 4 BASE NUMBER CALCULATION APPROACH 2

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 7 THERMAL SPRAY COATINGS MARKET: DATA TRIANGULATION

- FIGURE 8 CERAMICS TO BE MOST WIDELY CONSUMED MATERIAL IN THERMAL SPRAY COATINGS MARKET BETWEEN 2023 AND 2028

- FIGURE 9 AEROSPACE TO BE LARGEST END-USE INDUSTRY OF THERMAL SPRAY COATINGS

- FIGURE 10 ASIA PACIFIC THERMAL SPRAY COATINGS MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 COMBUSTION FLAME SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF THERMAL SPRAY COATINGS MARKET IN 2022

- FIGURE 13 US ACCOUNTED FOR LARGER SHARE OF THERMAL SPRAY COATINGS MARKET IN NORTH AMERICA

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THERMAL SPRAY COATINGS MARKET

- FIGURE 15 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 16 VALUE CHAIN ANALYSIS OF THERMAL SPRAY COATINGS MARKET

- FIGURE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 18 KEY BUYING CRITERIA

- FIGURE 19 REVENUE SHIFT & NEW REVENUE POCKETS FOR THERMAL SPRAY COATING MANUFACTURERS

- FIGURE 20 NUMBER OF PATENTS, YEAR-WISE (2014–2022)

- FIGURE 21 CHINA ACCOUNTED FOR HIGHEST PATENT COUNT

- FIGURE 22 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 23 ECOSYSTEM/MARKET MAP OF THERMAL SPRAY COATINGS

- FIGURE 24 COMBUSTION FLAME SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 25 CERAMICS MATERIAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 26 ENERGY & POWER INDUSTRY TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 27 ASIA PACIFIC: THERMAL SPRAY COATINGS MARKET SNAPSHOT

- FIGURE 28 EUROPE: THERMAL SPRAY COATINGS MARKET SNAPSHOT

- FIGURE 29 NORTH AMERICA: THERMAL SPRAY COATINGS MARKET SNAPSHOT

- FIGURE 30 RANKING OF TOP FIVE PLAYERS IN THERMAL SPRAY COATINGS MARKET, 2022

- FIGURE 31 PRAXAIR S.T. TECHNOLOGIES, INC. LED THERMAL SPRAY COATINGS MARKET IN 2022

- FIGURE 32 TOP PLAYERS – REVENUE ANALYSIS (2018–2022)

- FIGURE 33 THERMAL SPRAY COATINGS MARKET: COMPANY OVERALL FOOTPRINT

- FIGURE 34 COMPANY EVALUATION QUADRANT (TIER 1), 2022

- FIGURE 35 START-UPS/SMES EVALUATION QUADRANT, 2022

- FIGURE 36 PRAXAIR S.T. TECHNOLOGY, INC.: COMPANY SNAPSHOT

- FIGURE 37 OERLIKON METCO: COMPANY SNAPSHOT

- FIGURE 38 BODYCOTE: COMPANY SNAPSHOT

- FIGURE 39 TOCALO CO., LTD.: COMPANY SNAPSHOT

- FIGURE 40 SAINT-GOBAIN: COMPANY SNAPSHOT

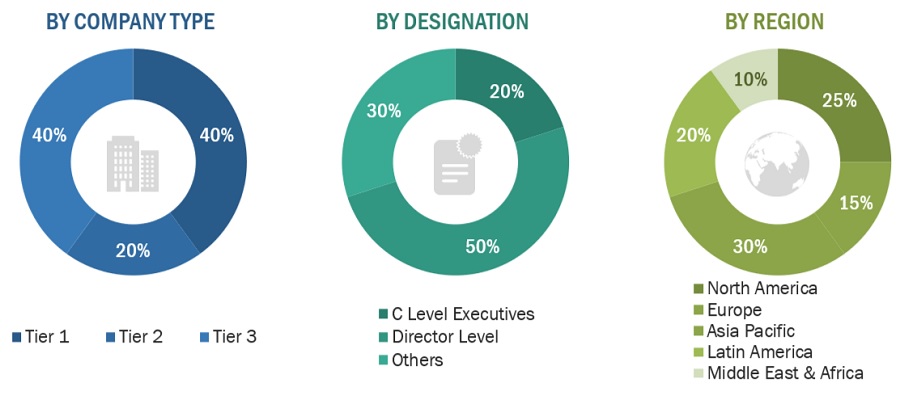

The study involved four major activities in estimating the current thermal spray coatings market size—exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and measures with industry experts across the value chain of thermal spray coatings through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on the revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; notifications by regulatory bodies; trade directories; and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

The thermal spray coatings market comprises several stakeholders in the supply chain, such as service providers, equipment manufacturers, traders, associations, and regulatory organizations. The demand side of this market is characterized by the development of aerospace, automotive, healthcare, energy & power, electronics, and other end-use industries. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

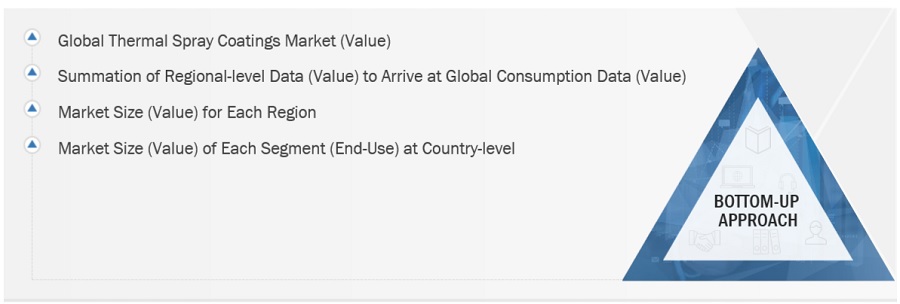

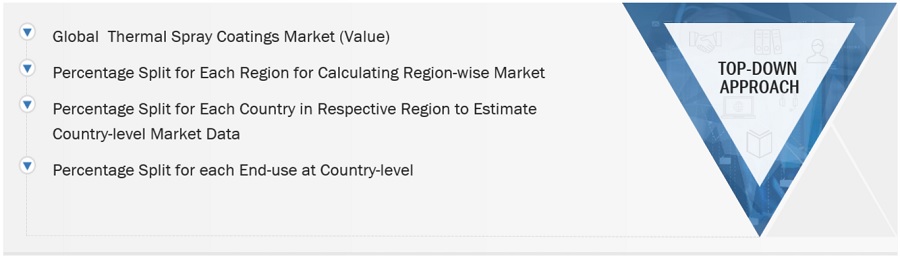

The top-down and bottom-up approaches were used to estimate and validate the total size of the thermal spray coatings market. These methods were also used extensively to determine the market size of various segments. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the thermal spray coatings market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Thermal Spray Coatings Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Thermal Spray Coatings Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

The thermal spray coatings market is a rapidly growing market that involves the application of a coating to a solid surface by the impact of molten or semi-molten particles. The market is driven by the increasing demand for corrosion protection, wear resistance, and heat resistance in various industries. The primary technologies used in thermal spray coatings are flame spray, plasma spray, HVOF, and cold spray. The significant applications of thermal spray coatings are aerospace, automotive, oil & gas, and medical.

Key Stakeholder

- Thermal spray coatings service providers

- Distributors and Suppliers of thermal spray coatings goods.

- Manufacturers of automobiles, medical equipment, and agricultural equipment.

- Associations and Industrial Bodies such as the Occupational Safety and Health Administration (OSHA), European Chemicals Agency (ECHA), National Institute for Occupational Safety and Health (NIOSH), United States Environmental Protection Agency (EPA), International Organization for Standardization (ISO) and Others

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives:

- To define, describe, and forecast the size of the global thermal spray coatings market in terms of value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the thermal spray coatings market

- To analyze and forecast the size of various segments (process, material, and end-user) of the thermal spray coatings market based on five major regions—North America, Europe, Asia Pacific, Latin America, Middle East & Africa—along with key countries in each of these regions

- To analyze recent developments and competitive strategies, such as expansions, new product developments, partnerships, and acquisitions, to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the thermal spray coatings market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Growth opportunities and latent adjacency in Thermal Spray Coatings Market

Thermal Spray Market

Interested in market size and forecast of Thermal Spray Coating Market

Need customized market information on Tungsten carbide, chromium carbide, and molybdenum based thermal spray powders.

Interested in Thermal spray coating market report

Need market intelligence on Thermal Spray in various applications, especially in the services segment.

Customized information on thermal spray market for Tungsten Carbides, chromium carbides, and Molybdenum based powders.

Specific information on wear resistant coatings using thermal spray technology. Looking to acquire companies

Looking for specific information on metal spraying market and dynamics

Non- conventional & economical solution in industrial pipe line.