Cognitive Operations Market by Component (Solutions and Services), Application (ITOA, APM, Infrastructure Management, Network Analytics, and Security Analytics), Deployment Mode, Enterprise Size, Vertical, and Region - Global Forecast to 2023

[158 Pages Report] Cognitive operations market is projected to reach USD 21.67 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 24.4% during the forecast period (20182023). Major growth drivers of the market include the growing complexities in IT environments and an increasing focus on the adoption of cloud-based cognitive IT operations solutions across verticals.

The objective of the study is to define, describe, and forecast the global cognitive operations market by component (solutions and services), deployment mode (cloud and on-premises), application (IT operations analytics [ITOA], application performance management [APM], infrastructure management, network analytics, security analytics, and others), enteprise size (large enteprises and SMEs), vertical (BFSI, healthcare and life sciences, IT and telecom, retail and ecommerce, manufacturing, government, media and entertainment, and others), and region. Moreover, the report aims to provide detailed information about the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market.

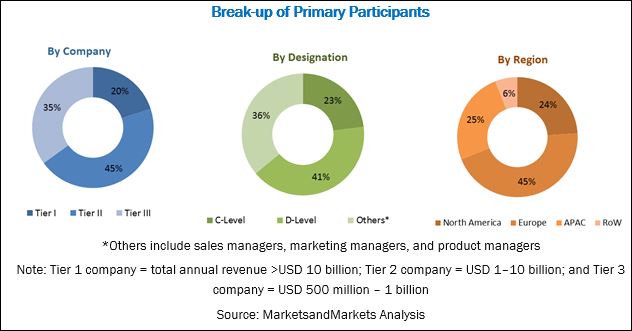

The research methodology used to estimate and forecast the global cognitive operations market size began with the capturing of data on the key vendor revenues through secondary research, annual reports, Institute of Electrical and Electronics Engineers (IEEE), Factiva, Bloomberg, and press releases. Moreover, the vendor offerings were taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size from the revenues of the key market players. Post arrival at the overall market size, the total cognitive operations market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key individuals, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

The figure below depicts the break-up of the profiles of the primary participants:

To know about the assumptions considered for the study, download the pdf brochure

Major vendors in the global cognitive operations market include IBM (US), Splunk (US), CA Technologies (US), Micro Focus (UK), VMware (US), HCL Technologies (India), AppDynamics (US), BMC Software (US), New Relic (US), Appnomic (India), CloudFabrix (US), Loom Systems (US), Dynatrace (US), Zenoss (US), Ymor (US), Devo (US), Logz.io (US), ServiceNow (US), Corvil (Ireland), Interlink Software Services (UK), Correlata (Israel), ScienceLogic (US), Sumo Logic (US), RISC Networks (US), and Bay Dynamics (US).

Target Audience for Cognitive Operations Market

- Artificial Intelligence (AI), cognitive, and analytics solutions and services providers

- Value-added Resellers (VARs)

- Managed Service Providers (MSPs)

- Cloud services providers

- System integrators

- Training and education services providers

- Information Technology (IT) directors/consultants

- Small and Medium-sized Enterprises (SMEs)

The solutions segment is expected to account for a larger market size during the forecast period. The software tools segment is expected to hold a larger market size, as cognitive operations software tools help organizations to find solutions for various tasks of IT operations, such as monitoring and managing large and complex environments with less efforts. On the contrary, the services segment is expected to grow at a faster rate during the forecast period.

The cloud deployment mode is expected to grow at a higher CAGR during the forecast period, as the cloud provides multiple benefits, such as reduced operational costs, simple deployments, and higher scalability. The on-premises deployment mode, on the other hand, is expected hold a larger market size in cognitive operations market during forecast period, as data sensitive enterprises prefer on-premises deployment of cognitive operations solutions.

The large enterprises segment is expected to account for a larger market size forecast period, whereas the Small and Medium-sized Enterprises (SMEs) segment to register a higher CAGR during the forecast period. Cognitive operations solutions enable SMEs not only to get real-time data but also to predict future outcomes.

The security analytics application is projected to be the fastest growing application in the cognitive operations market, whereas the IT operations analytics (ITOA) application to have the largest market size during the forecast period. Security analytics helps enterprises to successfully detect, investigate, and correct security threats across all the IT operation processes. ITOA helps in unlocking trends for organizations connect performance issues and infrastructure changes to incident tickets.

Among the verticals, the Banking, Financial Services, and Insurance (BFSI) vertical is expected to hold the largest market size in the cognitive operations market. The IT and telecom vertical is expected to grow at the highest CAGR during the forecast period. The IT and telecom vertical uses cognitive operations solutions to get critical insights from the huge volumes of data generated from user networks. With the help of cognitive operations capabilities, the banking sector can analyze large volumes of data to enhance customer experience.

The report on the global cognitive operations market covers 4 major regions: North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW). North America is expected to be the largest revenue generating region, due to the growing demand for cognitive operations solutions to optimize the IT operations processes. APAC, on the other hand, is expected to be the fastest growing region in the market during the forecast period.

Constantly changing IT operations environment, complex integration of cognitive operations capabilities with the existing systems, and lack of skills and expertise are major challenges for the market.

Major vendors in the global cognitive operations market include IBM (US), Splunk (US), CA Technologies (US), Micro Focus (UK), VMware (US), HCL Technologies (India), AppDynamics (US), BMC Software (US), New Relic (US), Appnomic (India), CloudFabrix (US), Loom Systems (US), Dynatrace (US), Zenoss (US), Ymor (US), Devo (US), Logz.io (US), ServiceNow (US), Corvil (Ireland), Interlink Software Services (UK), Correlata (Israel), ScienceLogic (US), Sumo Logic (US), RISC Networks (US), and Bay Dynamics (US).

Drivers : Cognitive Operations Market

Growing need to monitor the complex IT environment

In IT operations are becoming crucial across all industries, and with the advancement in technology and digitalization, IT operations are becoming more complex. The effective management of the same has become crucial to achieve competitive advantage. Therefore, business is primarily focusing on enhancing system performance and availability. This can be achieved by analyzing performance and activity of server, infrastructure as well as IT applications. By analyzing log and metrics data generated from IT systems, IT operational teams can analyze the performance and health of the IT systems. Here, cognitive operations solutions can play important role to help IT teams find issues as well as quickly solve incidents to understand root causes that are impacting the business.

Increasing focus toward adoption of cloud-based cognitive IT operations solutions

Organizations are shifting their core business applications to the cloud to leverage the benefits offered by the cloud. The cloud deployment option provides various benefits, such as scalability, reduced cost, and ease of deployment. Furthermore, organizations are migrating toward cloud, due to growing data storage requirements. In addition to that, cloud-based solutions can help organizations easily implement predictive analytics capabilities into various business applications. These benefits are expected to create the demand for cloud-based cognitive operations solutions. Moreover, with the growing complexity to manage the hybrid environment, along with the physical and virtual environment, IT operations teams are shifting their focus from their traditional monitoring suites to the cloud.

Restraints

Lack of skills and expertise

Most of the organizations face issues related to lack of expertise and analytical talent while developing, deploying, and managing AI-powered systems into IT operations. Organizations primarily face concerns related to lack of skilled employees and analytical talent. Machine learning algorithms are becoming crucial to analyze IT operations data. Building machine learning models is a complex thing and requires skills, expertise, and proper training. Moreover, integration of cognitive solutions into the existing system requires a large volume of data processing as well as skilled employees and expertise. There is limited skillset in the machine learning and artificial intelligence space, which may act as a challenge while implementing cognitive solutions in the IT environment. Therefore, lack of skills and expertise in cognitive technologies, including machine learning and artificial intelligence, can act as a restraining factor for organizations operating in the cognitive operations market space.

Opportunities

Growing need to deliver an enhanced customer experience

With the advent of the digital world, organizations are primarily focusing on delivering enhanced customer experiences. A poor customer experience may lead organizations to lose significant opportunities in the market. In addition to that, as the adoption of digital technologies is growing across various industries, IT operations and Devops managers are looking at cognitive solutions that can help them deliver a superior customer experience. Cognitive solutions can help IT operations and DevOps teams achieve this objective by providing a systematic way to detect problems and manage digital experiences across various channels.

Increasing need to analyze growing IT operations data

Nowadays, data across IT departments is growing at a rapid pace. Furthermore, digital transformation is also contributing to the generation of large volumes of data, including events data, log data, performance data, and configuration data. IT operations managers can use this data to enhance their operational efficiency and streamline business operations. IT analytics solutions coupled with cognitive capabilities can play a crucial role in solving various problems. For instance, analytics solutions can find data patterns, and cognitive capabilities such as machine learning can be applied on data patterns to generate insights. Therefore, machine learning algorithms can be useful to assess data and respond to this data in the IT operations environment, which would further help save time and money by automating and managing issues that occur in the IT operations environment.

Challenges

Constantly changing IT operations environment

IT operations management requires IT managers to keep a track of capacity, performance, and availability of the IT infrastructure. Small changes in the systems can majorly affect the performance of IT systems and the overall performance. Moreover, unexpected changes may disrupt the functioning of applications, which needs to be resolved quickly to prevent losses. Additionally, with the growth in adoption containers, virtualized technologies, and cloud, the IT operations environment is changing drastically. Apart from that, after shifting their legacy on-premises environment to the cloud, organizations are relying on on-premises data centers, public cloud resources, and private cloud deployments. This constantly changing IT operations environment may become a challenge for successfully implementing cognitive operations solutions.

Integration of cognitive operations capabilities with the existing systems

One of the challenges in the cognitive operations market is the integration of the cognitive technology with the existing IT infrastructure. The proper integration of cognitive solutions with the existing IT infrastructure is crucial to generate the desired output. Improper integration of cognitive capabilities into the IT infrastructure may damage the working mechanism of the IT systems. With the increasing complexity of the IT environment, the proper implementation of cognitive solutions into the IT infrastructure becomes crucial to realize the benefits offered by cognitive solutions in the IT operations environment. As systematic integration becomes crucial to avoid any further losses and system breakdowns, the proper integration of cognitive capabilities may act as a challenge in the global market.

Competitive Landscape

New Product Launches/Product Upgradations

|

Date |

Company Name |

Description |

|

July 2018 |

VMware (US) |

The company released an enhanced version of the vRealize Suite Lifecycle Manager. The new features include support for vRealize Network Insight, content management enhancements, and product upgrade pre-checker. |

|

June 2018 |

BMC Software (US) |

BMC Software launched a new offering, MC Helix Cognitive Service Management (CSM), with the aim to integrate cognitive capabilities, such as AI and machine learning, into the traditional IT Service Management (ITSM) solutions. |

Source: Press Releases

Partnerships and Collaborations

|

Date |

Company Name |

Description |

|

May 2018 |

IBM (US) and Nlyte Software (US) |

IBM partnered with Nlyte Software to offer the first cognitive Data Center Infrastructure Management (DCIM) solution, named Nlyte Machine Learning. By leveraging the cognitive capabilities, such as machine learning from IBM Watson IoT, the solution has been designed with an aim to address issues in data centers. |

|

October 2017 |

BMC Software (US) and IBM (US) |

BMC Software partnered with IBM, according to which, BMC integrated the AI capabilities of IBM Watson into BMC's ITSM solutions specifically designed for digital enterprises. BMC Software, by combining Watson's capabilities into its cognitive service management portfolio, has been able to focus on providing solutions to help enterprises transform their IT management capabilities. |

Source: Press Releases

Mergers and Acquisitions

|

Date |

Company Name |

Description |

|

June 2018 |

Splunk (US) and VictorOps (US) |

Splunk acquired VictorOps for delivering information on machine data for preventing, resolving, and monitoring issues that degrade customer engagement. |

|

May 2018 |

ServiceNow (US) Parlo (US) |

ServiceNow acquired the Silicon Valley-based company, Parlo, which specializes in natural language understanding and AI workforce solutions. Following this acquisition, ServiceNow aims at enhancing its investments in AI with the intent to leverage the benefit of the technology for its platforms, products, and solutions. |

Source: Press Releases

Scope of the Report

The research report segments the cognitive operations into the following segments and subsegments:

By component

- Solutions

- Software Tools

- Platform

- Services

- Deployment and integration

- Support and maintenance

- Training and consulting

By deployment mode

- Cloud

- On-premises

Cognitive Operations Market By application

- IT Operations Analytics

- Application Performance Management

- Infrastructure Management

- Network Analytics

- Security analytics

- Others (Log and Event Management, Predictive Maintenance, Anomaly Detection, App Experience Analytics, and Root Cause Analytics)

By enterprise size

- Large Enterprises

- SMEs

By vertical

- BFSI

- Healthcare and Life Sciences

- BFSI

- IT and telecom

- Retail and eCommerce

- Manufacturing

- Government

- Media and Entertainment

- Others (Energy and Utilities, Transportation and Logistics, and Education)

By region

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Available Customization

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the APAC cognitive operations market.

- Further breakdown of the North American market

- Further breakdown of the European market

- Further breakdown of the RoW market

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunities in the Cognitive Operations Market

4.2 Market By Vertical

4.3 Market Analysis, By Region

5 Market Overview and Industry Trends (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Need to Monitor the Complex IT Environment

5.2.1.2 Increasing Focus Toward Adoption of Cloud-Based Cognitive IT Operations Solutions

5.2.2 Restraints

5.2.2.1 Lack of Skills and Expertise

5.2.3 Opportunities

5.2.3.1 Growing Need to Deliver an Enhanced Customer Experience

5.2.3.2 Increasing Need to Analyze Growing IT Operations Data

5.2.4 Challenges

5.2.4.1 Constantly Changing IT Operations Environment

5.2.4.2 Integration of Cognitive Operations Capabilities With the Existing Systems

5.3 Cognitive Operations Market: Use Cases

5.3.1 Use Case 1: AI-Powered Monitoring Solutions to Enhance the Customer Experience (IT Services)

5.3.2 Use Case 2: AI-Powered Software for Enterprise Security (Digital Marketing and Media)

5.3.3 Use Case 3: AI-Powered Capacity Optimization Solution to Improve the Efficiency and Reduce the Cost of IT Resources (Italian Bank)

5.3.4 Use Case 4: AI-Powered Platform to Simplify Infrastructure Management and Improve Transparency (IT Service)

5.3.5 Use Case 5: AI-Powered Platform to Improve Customer Experience (Banking and Finance)

5.4 Regulatory Implications

5.4.1 Introduction

5.4.2 Sarbanes-Oxley Act 2002

5.4.3 General Data Protection Regulation

5.4.4 Basel

6 Cognitive Operations Market, By Component (Page No. - 44)

6.1 Introduction

6.2 Solutions

6.2.1 Software Tools

6.2.2 Platforms

6.3 Services

6.3.1 Deployment and Integration

6.3.2 Training and Consulting

6.3.3 Support and Maintenance

7 Market By Application (Page No. - 53)

7.1 Introduction

7.2 IT Operations Analytics

7.3 Application Performance Management

7.4 Infrastructure Management

7.5 Network Analytics

7.6 Security Analytics

7.7 Others

8 Cognitive Operations Market, By Deployment Mode (Page No. - 60)

8.1 Introduction

8.2 Cloud

8.3 On-Premises

9 Market By Enterprise Size (Page No. - 64)

9.1 Introduction

9.2 Large Enterprises

9.3 Small and Medium-Sized Enterprises

10 Cognitive Operations Market, By Vertical (Page No. - 68)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.3 Healthcare and Life Sciences

10.4 IT and Telecom

10.5 Retail and Ecommerce

10.6 Manufacturing

10.7 Government

10.8 Media and Entertainment

10.9 Others

11 Cognitive Operations Market, By Region (Page No. - 76)

11.1 Introduction

11.2 North America

11.2.1 United States

11.2.2 Canada

11.3 Europe

11.3.1 United Kingdom

11.3.2 Germany

11.3.3 France

11.3.4 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 Rest of Asia Pacific

11.5 Rest of World (RoW)

11.5.1 Israel

11.5.2 United Arab Emirates

11.5.3 Mexico

11.5.4 Rest of RoW

12 Competitive Landscape (Page No. - 98)

12.1 Overview

12.2 Top Players in the Cognitive Operations Market

12.3 Competitive Scenario

12.3.1 New Product Launches/Product Upgradations

12.3.2 Partnerships and Collaborations

12.3.3 Mergers and Acquisitions

13 Company Profiles (Page No. - 104)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

13.1 Introduction

13.2 IBM

13.3 CA Technologies

13.4 Micro Focus

13.5 VMware

13.6 Splunk

13.7 BMC Software

13.8 HCL Technologies

13.9 New Relic

13.10 Servicenow

13.11 Cloudfabrix

13.12 Loom Systems

13.13 Dynatrace

13.14 Devo

13.15 Logz.Io

13.16 Corvil

13.17 Interlink Software Services

13.18 Correlata

13.19 Science Logic

13.20 Sumo Logic

13.21 Risc Networks

13.22 Bay Dynamics

13.23 Appnomic

13.24 Appdynamics

13.25 Zenoss

13.26 Ymor

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 150)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Related Reports

14.5 Author Details

List of Tables (70 Tables)

Table 1 United States Dollar Exchange Rate, 20152017

Table 2 Global Cognitive Operations Market Size and Growth Rate, 20162023 (USD Million, Y-O-Y %)

Table 3 Market Size By Component, 20162023 (USD Million)

Table 4 Market Size By Solution, 20162023 (USD Million)

Table 5 Solutions: Market Size By Region, 20162023 (USD Million)

Table 6 Software Tools: Market Size, By Region, 20162023 (USD Million)

Table 7 Platforms: Market Size By Region, 20162023 (USD Million)

Table 8 Cognitive Operations Market Size, By Service, 20162023 (USD Million)

Table 9 Services: Market Size By Region, 20162023 (USD Million)

Table 10 Deployment and Integration Market Size, By Region, 20162023 (USD Million)

Table 11 Training and Consulting Market Size, By Region, 20162023 (USD Million)

Table 12 Support and Maintenance Market Size, By Region, 20162023 (USD Million)

Table 13 Cognitive Operations Market Size, By Application, 20162023 (USD Million)

Table 14 IT Operations Analytics: Market Size By Region, 20162023 (USD Million)

Table 15 Application Performance Management: Market Size By Region, 20162023 (USD Million)

Table 16 Infrastructure Management: Market Size By Region, 20162023 (USD Million)

Table 17 Network Analytics: Market Size By Region, 20162023 (USD Million)

Table 18 Security Analytics: Market Size By Region, 20162023 (USD Million)

Table 19 Others: Market Size By Region, 20162023 (USD Million)

Table 20 Cognitive Operations Market Size, By Deployment Mode, 20162023 (USD Million)

Table 21 Cloud: Market Size By Region, 20162023 (USD Million)

Table 22 On-Premises: Market Size By Region, 20162023 (USD Million)

Table 23 Cognitive Operations Market Size, By Enterprise Size, 20162023 (USD Million)

Table 24 Large Enterprises: Market Size By Region, 20162023 (USD Million)

Table 25 Small and Medium-Sized Enterprises: Market Size By Region, 20162023 (USD Million)

Table 26 Cognitive Operations Market Size, By Vertical, 20162023 (USD Million)

Table 27 Banking, Financial Services, and Insurance: Market Size By Region, 20162023 (USD Million)

Table 28 Healthcare and Life Sciences: Market Size By Region, 20162023 (USD Million)

Table 29 IT and Telecom: Market Size By Region, 20162023 (USD Million)

Table 30 Retail and Ecommerce: Market Size By Region, 20162023 (USD Million)

Table 31 Manufacturing: Market Size By Region, 20162023 (USD Million)

Table 32 Government: Market Size By Region, 20162023 (USD Million)

Table 33 Media and Entertainment: Market Size By Region, 20162023 (USD Million)

Table 34 Others: Market Size By Region, 20162023 (USD Million)

Table 35 Cognitive Operations Market Size, By Region, 20162023 (USD Million)

Table 36 North America: Market Size By Country, 20162023 (USD Million)

Table 37 North America: Market Size By Component, 20162023 (USD Million)

Table 38 North America: Market Size By Solution, 20162023 (USD Million)

Table 39 North America: Market Size By Service, 20162023 (USD Million)

Table 40 North America: Market Size By Deployment Mode, 20162023 (USD Million)

Table 41 North America: Market Size By Enterprise Size, 20162023 (USD Million)

Table 42 North America: Market Size By Application, 20162023 (USD Million)

Table 43 North America: Market Size By Vertical, 20162023 (USD Million)

Table 44 Europe: Cognitive Operations Market Size, By Country, 20162023 (USD Million)

Table 45 Europe: Market Size By Component, 20162023 (USD Million)

Table 46 Europe: Market Size By Solution, 20162023 (USD Million)

Table 47 Europe: Market Size By Service, 20162023 (USD Million)

Table 48 Europe: Market Size By Deployment Mode, 20162023 (USD Million)

Table 49 Europe: Market Size By Enterprise Size, 20162023 (USD Million)

Table 50 Europe: Market Size By Application, 20162023 (USD Million)

Table 51 Europe: Market Size By Vertical, 20162023 (USD Million)

Table 52 Asia Pacific: Cognitive Operations Market Size, By Country, 20162023 (USD Million)

Table 53 Asia Pacific: Market Size By Component, 20162023 (USD Million)

Table 54 Asia Pacific: Market Size By Solution, 20162023 (USD Million)

Table 55 Asia Pacific: Market Size By Service, 20162023 (USD Million)

Table 56 Asia Pacific: Market Size By Deployment Mode, 20162023 (USD Million)

Table 57 Asia Pacific: Market Size By Enterprise Size, 20162023 (USD Million)

Table 58 Asia Pacific: Market Size By Application, 20162023 (USD Million)

Table 59 Asia Pacific: Market Size By Vertical, 20162023 (USD Million)

Table 60 Rest of World: Cognitive Operations Market Size, By Country, 20162023 (USD Million)

Table 61 Rest of World: Market Size By Component, 20162023 (USD Million)

Table 62 Rest of World: Market Size By Solution, 20162023 (USD Million)

Table 63 Rest of World: Market Size By Service, 20162023 (USD Million)

Table 64 Rest of World: Market Size By Deployment Mode, 20162023 (USD Million)

Table 65 Rest of World: Market Size By Enterprise Size, 20162023 (USD Million)

Table 66 Rest of World: Market Size By Application, 20162023 (USD Million)

Table 67 Rest of World: Market Size By Vertical, 20162023 (USD Million)

Table 68 New Product Launches/Product Upgradations, 20162018

Table 69 Partnerships and Collaborations, 20162017

Table 70 Mergers and Acquisitions, 20152018

List of Figures (43 Figures)

Figure 1 Global Cognitive Operations Market Segmentation

Figure 2 Global Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Cognitive Operations Market Snapshot, By Component, 2018 vs 2023

Figure 8 Market Snapshot By Solution

Figure 9 Market Snapshot By Service

Figure 10 Market Snapshot By Application, 2018 vs 2023

Figure 11 Market Snapshot By Enterprise Size

Figure 12 Market Snapshot By Deployment Mode

Figure 13 Market Snapshot By Vertical, 20182023

Figure 14 Market Snapshot Regional Snapshot

Figure 15 The Growing Need to Monitor Complex IT Environments is Expected to Drive the Overall Growth of the Cognitive Operations Market During the Forecast Period

Figure 16 IT and Telecom Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 17 Asia Pacific is Expected to Exhibit the Highest Growth Potential During the Forecast Period

Figure 18 Asia Pacific is Expected to Rise as the Best Opportunity Market for Investments in the Next 5 Years

Figure 19 Cognitive Operations: Drivers, Restraints, Opportunities, and Challenges

Figure 20 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 21 Platforms Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 22 Support and Maintenance Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Security Analytics Segment is Expected to Register the Highest CAGR During the Forecast Period

Figure 24 Cloud Deployment Mode is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 25 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 26 IT and Telecom Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 27 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 28 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 29 North America: Market Snapshot

Figure 30 Asia Pacific: Market Snapshot

Figure 31 Key Developments By the Major Players in the Cognitive Operations Market, 20152018

Figure 32 IBM: Company Snapshot

Figure 33 IBM: SWOT Analysis

Figure 34 CA Technologies: Company Snapshot

Figure 35 CA Technologies: SWOT Analysis

Figure 36 Micro Focus: Company Snapshot

Figure 37 Micro Focus: SWOT Analysis

Figure 38 VMware: Company Snapshot

Figure 39 VMware: SWOT Analysis

Figure 40 Splunk: Company Snapshot

Figure 41 Splunk: SWOT Analysis

Figure 42 HCL Technologies: Company Snapshot

Figure 43 New Relic: Company Snapshot

Growth opportunities and latent adjacency in Cognitive Operations Market