Collaborative Robot Market Size, Share & Trends, 2025 To 2030

Collaborative Robot Market by Payload (Less than 5 kg, 5-10 kg, 11-25 kg, More than 25 kg), Component (Hardware, Software), Application (Handling, Assembling & Disassembling, Dispensing, Processing), Industry and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global collaborative robot market is projected to grow from USD 1.26 billion in 2024 to USD 3.38 billion by 2030, registering a CAGR of 18.9%. The major market drivers include higher return on investment than traditional industrial robotic systems, increased demand in e-commerce and logistics sectors, significant benefits in businesses of all sizes, and easy programming of cobots. The opportunities include an increasing focus of automation experts on pairing robotic arms with mobile platforms such as AMRS or AGVs, a growing number of subscriptions for the Robotics-as-a-Service (RaaS) model, and rising demand for automation in the healthcare industry.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is estimated to dominate the collaborative robot market with a share of 41.7% in 2025.

-

BY COMPONENTBy component, the hardware accounted for the largest market size in 2024.

-

BY PAYLOADBy payload, the Upto 5 Kg segment accounted for a share of 57.5% in terms of value in 2024.

-

BY APPLICATIONBy application, the processing segment is projected to grow at a CAGR of 20.0% during the forecast period.

-

BY INDUSTRYBy industry, automotive is expected to hold a share of 22.6% of the collaborative robot market in 2025.

-

COMPETITIVE LANDSCAPEMajor players including Universal Robots A/S, Fanuc Corporation, ABB, and KUKA AG were identified as Star players in the collaborative robot market, given their broad industry coverage and strong operational & financial strength. Franka Emika GmbH, Festo Inc., and Wyzo have distinguished themselves among startups and SMEs due to their well-developed marketing channels and extensive funding to build their product portfolios.

The collaborative robot (cobot) market is experiencing significant growth, driven by the increasing adoption of the Robotics-as-a-Service (RaaS) model. This subscription-based approach offers benefits such as reduced upfront costs, enhanced flexibility, simplified maintenance, data-driven insights, and wider accessibility to a diverse workforce. The surge in RaaS subscriptions presents exciting opportunities for market expansion, particularly benefiting small and medium-sized enterprises (SMEs) with limited budgets. Moreover, there is an increasing adoption of robots for automation in the medical sector. The ability of collaborative robots to work with healthcare professionals safely and efficiently has opened up new possibilities for enhancing patient care, improving operational efficiency, and addressing workforce challenges.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The logistics sector is undergoing a profound transformation with the advent of collaborative robots, or cobots, which significantly enhance operational efficiency by streamlining repetitive tasks such as picking, packing, and sorting. This automation not only expedites order processing but also empowers human workers to focus on more complex and value-added roles such as quality assurance and troubleshooting. Across various industries, companies and research institutions are pioneering innovative cobot solutions tailored to specific logistics functions, such as autonomous picking robots and mobile manipulation platforms. This drive for innovation fuels rapid advancements and meets the demands of specialized applications. The outcome is a substantial increase in productivity and efficiency, alongside improvements in product quality, reduced downtime, heightened worker safety, and enhanced adaptability to market demands. For instance, AI-powered cobots equipped with vision systems can conduct product inspections with greater precision than humans, while predictive maintenance strategies help prevent unexpected equipment failures, underscoring the transformative potential of IIoT and AI in industrial manufacturing.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Higher return on investment than traditional industrial robotic systems

-

Increased demand from e-commerce and logistics sectors

Level

-

Higher preference for low-payload-capacity robots in heavy-duty industrial applications

Level

-

Increasing focus of automation experts on pairing robotic arms with mobile platforms

-

Growing number of subscriptions for Robotics-as-a-Service model

Level

-

Payload and speed limitations due to inherently designed cobots

-

Difficulties in adapting to new standards and cybersecurity challenges related to connected robots

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increased demand in e-commerce and logistics sectors

Collaborative robots (cobots) can be effectively deployed alongside workers in logistics and e-commerce industries for carrying out repetitive tasks, such as packaging and shipping. Cobots offer low upfront costs, flexible implementation, and ease of programming for users.

Restraint: Higher preference for low-payload-capacity robots in heavy-duty industrial applications

To operate safely in the work environment, cobots are designed to be less powerful than traditional industrial robots, making them less appropriate for heavy-duty applications. On the other hand, traditional industrial robots are heavy-duty robots with high payloads that can tackle dangerous, repetitive, and heavy applications

Opportunity: Increasing focus of automation experts on pairing robotic arms with mobile platforms

With the rise of autonomous mobile robots (AMRs) and autonomous ground vehicles (AGVs) designed for collaborative use, companies have started combining mobility technology with collaborative robots.

Challenge: Payload and speed limitations due to inherently designed cobots

The growth of collaborative robots has increased interconnectivity between them. Multiple robots working on a particular task communicate with each other for sequencing and are also connected to a centralized database to provide information on efficiency and downtime. Interconnectivity is expected to become increasingly common in a few years, raising concerns over safety and cybersecurity, which will be a critical challenge in the operation of collaborative robots.

Collaborative Robot Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Universal Robots’ cobots are deployed across automotive, electronics, and healthcare sectors for assembly, screw driving, packaging, and quality inspection tasks. The UR+ ecosystem enables easy integration with third-party end-effectors and vision systems. | Delivers fast deployment, high ROI, and improved worker safety through user-friendly programming and flexible automation across varied production scales. |

|

FANUC’s cobots support applications in electronics, metalworking, and logistics, offering simple setup, intuitive drag-and-drop programming, and compatibility with FANUC’s industrial automation suite. | Increases operational uptime, reduces training costs, and drives scalability through reliability and seamless integration with existing FANUC ecosystems. |

|

ABB’s cobots are designed for close human collaboration in material handling, assembly, and laboratory automation. Integrated with ABB’s SafeMove and RobotStudio software, they ensure precision and safety. | Enhances productivity and flexibility while maintaining safety standards, enabling hybrid work environments with efficient human-robot collaboration. |

|

Techman’s vision-integrated cobots combine AI-driven visual recognition for automated inspection, pick-and-place, and packaging applications across electronics and automotive industries. | Reduces quality defects and inspection time, enhances precision in repetitive tasks, and delivers faster adaptation to product variations. |

|

AUBO’s lightweight cobots are used in small and mid-sized enterprises for tasks like machine tending, polishing, and testing, supported by open-source control platforms for flexible integration. | Enables cost-effective automation for SMEs, increases throughput, and simplifies deployment without the need for complex programming. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the collaborative robot (cobot) market includes robot accessories providers, integrators, and end users, where accessories providers play an important role in supplying accessories such as end effectors, vision systems, and sensors.. A few of the top companies providing collaborative robots in the ecosystem are Universal Robots A/S (Denmark), FANUC Corporation (Japan), ABB (Switzerland), Techman Robot (Taiwan), KUKA AG (Germany), and Doosan Robotics Inc. (South Korea). Almost all players offer a wide range of collaborative robots with different payload capacities. These robots are widely used in automotive, electronics, metals & machining, plastics & polymers, food & beverages, furniture & equipment, healthcare, and other industries.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Collaborative Robot Market, By Payload

By payload, the up to 5 kg segment accounted for the largest share in the collaborative robot (cobot) market in 2024, and the segment is expected to continue to dominate the market during the forecast period. First-time users prefer low payload capacity cobots, which are cheaper and take up less space than robots with higher payload capacity. For instance, COBOTTA, a cobot from DENSO Corporation (Japan), has an inherently safe design owing to its low weight. The design does not require extensive use of sensors compared with higher payload cobots, thus making it more affordable. SAWYER and SAWYER Black Edition from Rethink Robotics GmbH (Germany) are single-arm cobots with a payload capacity of 4 kg and a maximum reach of 1,260 mm. These cobots are equipped with the company’s proprietary software suite, Intera. Hence, they do not require a separate software interface.

Collaborative Robot Market, By Application

By application, the handling segment accounted for the largest share in the collaborative robot (cobot) market in 2024. Handling tasks, such as picking, placing, and palletizing, are among the most mundane and repetitive tasks performed by human workers. Collaborative robots (cobots) play a vital role in shared workspaces, performing high-precision tasks such as pick-and-place, material handling, packaging, and machine tending. Known for their repeatability, flexibility, and easy programmability, cobots enhance productivity, improve safety, and reduce labor costs by automating repetitive operations while seamlessly working alongside humans.

Collaborative Robot Market, By Industry

By industry, the automotive segment contributed the largest share to the collaborative robot (cobot) market in 2024. The automotive industry is undergoing a transformative shift with the increasing integration of collaborative robots (cobots). In contrast to traditional industrial robots, cobots are designed to work seamlessly alongside humans, eliminating the need for physical barriers. Their versatility shines in various automotive applications, including precise assembly tasks, machine tending, welding, painting, and inspection.

REGION

Asia Pacific to be fastest-growing region in global collaborative robot market during forecast period

Asia Pacific is projected to grow at the highest CAGR in the collaborative robot market during the forecast period, supported by the rapid expansion of logistics networks, large-scale automation in manufacturing, and increasing adoption of AI-enabled robotics across key sectors. The region's focus on cost-effectiveness aligns with the affordability of cobots compared to traditional industrial robots, making them an attractive choice for companies seeking automation solutions. Collaborative robots are more suitable in the electrical & electronics industries because of their ability to perform the delicate work of handling electronic components, protecting fragile parts, and adding expensive fixtures.

The Asia Pacific collaborative robot market is expected to grow to USD 1.60 billion by 2030 from USD 0.59 billion in 2025, at a CAGR of 22.1% from 2025 to 2030. Collaborative robots will experience strong growth in the Asia Pacific region, driven by rapid industrial automation, especially in electronics, automotive, and manufacturing hubs. Increasing labor costs in countries such as China, South Korea, and Singapore are encouraging companies to adopt human-robot collaboration to boost productivity.

The North American collaborative robot market is projected to grow from USD 0.37 billion in 2025 to USD 0.91 billion by 2030, registering a CAGR of 19.4%. The major market drivers include higher return on investment than traditional industrial robotic systems, increased demand in e-commerce and logistics sectors, significant benefits in businesses of all sizes, and easy programming of cobots. The opportunities include an increasing focus of automation experts on pairing robotic arms with mobile platforms such as AMRS or AGVs, a growing number of subscriptions for the Robotics-as-a-Service (RaaS) model, and rising demand for automation in the healthcare industry.

The Europe collaborative robot market is projected to grow from USD 0.41 billion in 2025 to USD 0.81 billion by 2030, registering a CAGR of 14.4%. The major market drivers include a higher return on investment compared to traditional industrial robotic systems, increased demand in the e-commerce and logistics sectors, significant benefits for businesses of all sizes, and the ease of programming cobots. The opportunities include an increasing focus on pairing robotic arms with mobile platforms, such as AMRs or AGVs, a growing number of subscriptions for the Robotics-as-a-Service (RaaS) model, and a rising demand for automation in the healthcare industry.

Collaborative Robot Market: COMPANY EVALUATION MATRIX

In the collaborative robot market matrix, Universal Robots A/S (Star) leads with a strong global presence and a comprehensive cobot portfolio. Its ability to deliver scalable, AI-driven, and safety-compliant solutions across industries such as automotive, electronics, and logistics has established Universal Robots A/S as a dominant player in the market. Doosan Robotics Inc. (Emerging Leader) is rapidly expanding its footprint through strong adoption in various sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.26 Billion |

| Market Forecast in 2030 (Value) | USD 3.38 Billion |

| Growth Rate | CAGR of 18.9% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe & RoW |

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| E-commerce & Fulfillment Operator |

|

|

| Automotive OEM |

|

|

RECENT DEVELOPMENTS

- February 2025 : ABB expanded its portfolio of robotic solutions for logistics and e-commerce supply chains with the addition of two new AI-powered functional modules to its item picking family. Featuring ABB’s own AI-based vision technology, tested by leading fashion retail and logistics companies. The fashion inductor and parcel inductor offer solutions for two of the most critical logistics processes, i.e., item picking and sorter induction.

- October 2024 : Universal Robots A/S unveils its AI Accelerator, a ready-to-use hardware and software toolkit created to further enable the development of AI-powered cobot applications. Designed for commercial and research applications, the UR AI Accelerator provides developers with an extensible platform to build applications, accelerate research, and reduce the time to market for AI products.

- June 2024 : FANUC CORPORATION announced the expansion of its production facility in Canada. The new Canadian facility is poised to become a hub for cutting-edge robotics technology, further solidifying FANUC’s position as a catalyst for advancement in the automation industry.

- May 2024 : Techman Robot Inc. unveiled the TM AI Cobot TM30S, with the ability to carry up to 35 kg and boasting a reach of 1,702 mm across six joints, the TM30S offers the best reach-to-weight ratio compared to other cobots in the 30 kg category.

- February 2024 : ABB partnered with construction technology firm Auar to develop Constructhor, a research facility in Belgium that demonstrates the future of sustainable construction. Utilizing Auar’s micro-factory technology and ABB’s robotic automation, the facility will function as a living lab for energy-neutral infrastructure and climate-neutral building materials.

Table of Contents

Methodology

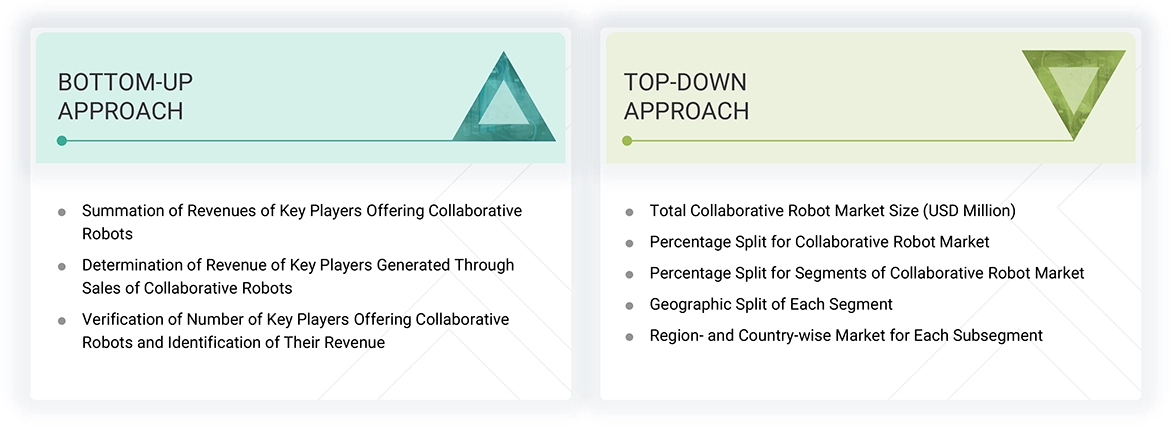

The study involved major activities in estimating the current size of the collaborative robot market. Exhaustive secondary research was done to collect information on collaborative robots. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the collaborative robot.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information relevant to this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research was mainly carried out to obtain critical information about the industry’s supply chain, value chain, the total pool of key players, and market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives. Secondary sources included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; IoT technologies journals and certified publications; articles by recognized authors; gold-and silver-standard websites; directories; and databases. Data was also collected from secondary sources, such as the International Federation of Robotics (IFR), the International Trade Centre (ITC) (Switzerland), and the Robotics Business Review (RBR).

Secondary research was mainly used to obtain critical information about the supply chain of the industry, the value chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments from both the market and technology-oriented perspectives. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

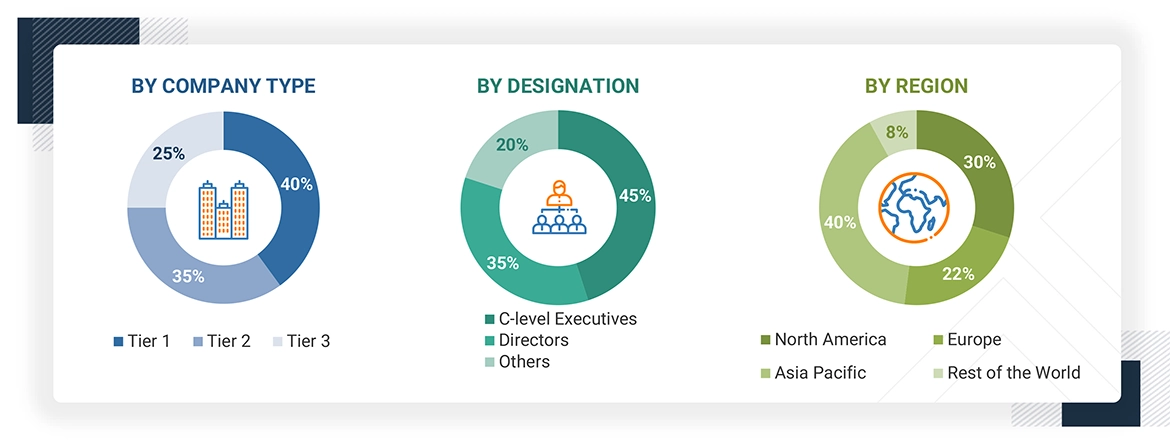

Extensive primary research was conducted after understanding and analyzing the current scenario of the collaborative robot market through secondary research. Several primary interviews were conducted with key opinion leaders from both the demand and supply sides across four major regions: North America, Europe, Asia Pacific, and the Rest of the World. Approximately 25% of the primary interviews were conducted with the demand side, while 75% were conducted with the supply side. This primary data was collected mainly through telephonic interviews, which accounted for 80% of the total primary interviews. Questionnaires and e-mails were also used to collect data.

Note: Three tiers of companies are defined based on their total revenue as of 2024; tier 1: revenue more than or equal to USD 500 million, tier 2: revenue between USD 100 million and USD 500 million, and tier 3: revenue less than or equal to USD 100 million. Other designations include sales and marketing executives and researchers, as well as members of various collaborative robot organizations

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

This report implements both top-down and bottom-up approaches to estimate and validate the size of the collaborative robot market and various other dependent submarkets. Secondary research identifies key players in this market, and their market shares in the respective regions are determined through primary and secondary research.

This report implements both top-down and bottom-up approaches to estimate and validate the size of the collaborative robot market and various other dependent submarkets. Secondary research identifies key players in this market, and their market shares in the respective regions are determined through primary and secondary research.

Top-Down Approach

- Identifying key participants in the collaborative robot market that influence the entire market

- Analyzing major manufacturers of collaborative robots involves studying their portfolios and understanding the various types of products they offer to strengthen their market presence and strategic positioning within the industry

- Analyzing trends pertaining to the use of collaborative robots for different industries

- Tracking the ongoing and upcoming developments in the market, such as investments, R&D activities, product/service launches, collaborations, and partnerships, and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand recent trends in the collaborative robot (cobot) market, thereby analyzing the breakup of the scope of work carried out by major companies

- Deriving market estimates involves analyzing the revenues generated by companies and then aggregating them to obtain the overall market estimate

- classifying the overall market into various other market segments

- Verifying and cross-checking the estimate at every level from the discussion with key opinion leaders such as CXOs, directors, and operations managers, and finally with the domain experts in MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

- Focusing initially on the top-line investments and expenditures being made in the ecosystem of the collaborative robot market, further splitting the key market areas based on payload, application, industry, and region, and listing the key developments

- Identifying all leading players in the collaborative robot market based on payload, application, and industry through secondary research and thoroughly verifying them through a brief discussion with industry experts

- Analyzing revenues, product mix, geographic presence, and key applications served by all identified players to estimate and arrive at percentage splits for all key segments

- Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Collaborative Robot Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the collaborative robot market from the estimation process explained above, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed (wherever applicable) to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The size of the collaborative robot market was validated using both top-down and bottom-up approaches..

Market Definition

According to the International Federation of Robotics (IFR), robots intended for collaborative use need to adhere to the International Organization for Standards (ISO) standard 10218-1. This standard establishes essential criteria and recommendations to guarantee the safe design, effective protective measures, and comprehensive usage guidelines for industrial robots. By adhering to these standards, a secure and efficient environment can be ensured for both operators and machinery.

Collaborative robots (also known as cobots) are designed to work alongside humans with precision, strength, and speed to achieve greater efficiency in production. Using robots to assist humans can help significantly reduce the workload of human workers and relieve them of monotonous, repetitive tasks. As an emerging automation technology, cobots complement the existing industrial robotics market. The total cost of ownership of factory automation solutions, especially for small and medium-sized enterprises (SMEs), can be significantly reduced by adopting cobots. Cobot operations are primarily governed by the ISO 15066:2016 standard that further specifies various safety requirements. Other standards governing the safe operations of cobots include ISO 10218-1:2011, RIA/ANSI R15.06-2012, ISO 12100:2010, and ISO 13849-1:2008.

Key Stakeholders

- Original equipment manufacturers (OEMs)

- OEM technology solution providers

- Research institutes

- Market research and consulting firms

- Forums, alliances, and associations

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

- End users who want to know more about technology and the latest technological developments in industry

Report Objectives

- To describe and forecast the collaborative robot market by payload, component, application, and industry, in terms of value and volume

- To describe and forecast the market for four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World, in terms of value and volume

- To provide detailed information regarding factors, including drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To provide a detailed overview of the cobot value chain

- To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, ASP analysis, Porter’s five forces analysis, 2025 US tariff and AI/Gen AI impact analyses, and regulations pertaining to the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments

- To benchmark players operating in the market using the proprietary Competitive Leadership Mapping framework, which analyzes market players using multiple parameters within the broad categories of business and product strategy

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as collaborations, agreements, partnerships, product developments, and research and development (R&D) in the market

- To evaluate the impact of macroeconomic factors on the regional market

Available Customizations

With the market data given, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Collaborative Robot Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Collaborative Robot Market

Mani

Aug, 2019

I teach a course titled "Technology, Innovation and Future of Work". It is a graduate level course in our Business School (elective course of Operations Management Area). Robots and Cobots in manufacturing is a module of the course. Your report will be useful in explaining the significance of cobots/robots in manufacturing. So, can you help me with a sample and few more insights on this?.

Jennifer

Aug, 2018

I'm writing an article on cobots in Pharma labs (R&D and QC). Would you like to comment on data/trends/uses? Deadline Dec. 24. .

Daniel

Jul, 2019

hey guys, I'm working on an Augmented reality startup and we had the idea to enable robot collaboration with Augmented Reality glasses. Unfortunately we're bootstrapping (out of University) and cannot afford to buy a report in this price range. However it would be great to find a few more information about this arising industry..

Clive

Mar, 2019

I'm a New-York-based journalist working with a new science and technology magazine being launched this spring. I'm writing a piece about the rise of cobots, and would love to talk to one of your analysts about the report "Collaborative Robot Market worth $12,303 million by 2025", and quote them in this piece. Would someone be free to talk with me? If so, let me know a good time and we'll do it!.

Henrik

Nov, 2017

We are a robot drive manufacturing company and our specific interest lies in collaborative robot market for above 10 kg and their respective applications interlinked with regional analysis..

User

Nov, 2021

I wonder why there is completely missing Mitsubishi electric (one of the top robot producers). .

Jared

Jan, 2019

My thesis for my EMBA is based on the cobot market. Would be great to be able to use some of the research in this report..

Timo

Oct, 2017

Dear Sir or Madam, I am a student at an University and writing my dissertation about collaborative robots. Therefore, I would like to ask you if it is possible to send me any information regarding the price forecast for collaborative robots? If so, it would be great and I would be very grateful since I am not able to buy your report due to my financial situation. However, I am really interested in Cobots..

SOOHYUN

Sep, 2019

I'm evaluating collaborative robot market for our company's new business area. So, I want to know the each region's market size and upcoming applications in detail..

Raul

Oct, 2017

I'm a course designer at an university for the subject 'industrial automation'. I am thinking of including some content on collaborative robots in our curriculum and hence would like to understand the role of collaborative robots in industrial automation. Few use cases also might be helpful..

Ana

Mar, 2019

Hi, I would request for a free sample report as I need to validate the collaborative robot market data for one of my clients. If found satisfactory, the client will buy it for sure..

Stefan

Sep, 2019

We are looking for report focusing on Mexican collaborative robot market (overall and by industry) and after-market services of collaborative robots. Could you please quickly provide estimated fees and timeline for delivery?.

Prakash

May, 2019

We are looking to get into the business of collaborative robots as our clients face a big challenge to configure Industrial Robots. Does this cover the aspect of better RoI owing to adoption of collaborative robots compared to industrial robots?.

Dan

Jan, 2019

I have been approached by a company that wants to hire me to sell Collaborative Robots. I am investigating the market before I make a decision..

Suresh

Apr, 2019

Investigating the availability and capability of Collaborative Robots for applications in Body Shops in Automotive Assembly Plants, especially for assisting manual installations and assembly processes..

Hendrik

Oct, 2019

We are trying to identify the ideal collaborative robot for a material handling task for one of our clients. Can this report address our concern?.

Nasi

May, 2019

I am working on a project in industrial automation focusing on collaborative robots. My immediate task is a market sizing exercise. Hence would need insights on annual shipment and selling prices for various companies..

Rakesh

Dec, 2020

I would like to know more about COVID 19 impact on Cobots Industry..

Rakesh

Dec, 2020

I would like to know more about COVID 19 impact on Cobots Industry..

Lennart

Sep, 2019

I'm looking to refer this study for understanding the growth opportunities specifically in machine tending and processing applications. The insights obtained will have a direct impact on our upcoming R&D investments for product development..

João

Aug, 2019

I intend to use the report for academic purpose, namely for the theoretical introduction of my master thesis. Can I get some insight about the collaborative robot market? I would cite your report as a part of references..

Ulrikke

Aug, 2019

As I´m preparing a report about collaborative robots market developments, I would like to use some of the figures in your report. Can you help me with this?.

Zoltan

Jul, 2019

Dear MarketsandMarkets, I am writing my PhD thesis about the collaborative robots, I would like to use your research result in the introduction chapter (main players, forecast in the future). Of course keeping the correct citation and reference rules. Please share your research with me..

Jagdish

Jul, 2017

Does the report cover information on, how you categorize revenues for different application types? Additionally, testing doesn’t seem to be that large last year. I will purchase the report if you can provide some insights specifically around this application – waiting for your reply and if you think the question can be answered I will purchase soon. High priority, urgent purchase requirement, I can specifically visit your premises post confirmation as I am currently working on a project in Pune..

Joe

Jun, 2019

We are a venture capital firm and are trying to understand the state of the art in AI for cobot vision, task definition, error handling etc. Further, insights on the new entrants with AI integrated vision products offered in the market would help us in making investment decisions..

Annette

Jun, 2019

I have recently joined a renowned robotics institute, and I am trying to get a perspective and an estimate of market sizes of various end use industries such as automotive, electronics, and food. Can you share a document with me for the same?.

Atin

May, 2022

Since, covid has impacted the market for cobots, in what innovative ways can the companies bounce back?.

kim

Mar, 2019

I would like to check the collaborative robot market status and growth etc. as my company is preparing new 5G smart factory product..

Frederik

Feb, 2018

I'm currently writing my thesis for bachelor in business and economics, where I'm analyzing the impact of the future technological advancements on the collaborative robot market and how is it going to affect the SMEs (small medium enterprises) worldwide. Therefore this forecast would be very valuable to me..

Xinye

Jan, 2017

I'd like to get an idea on how have you incorporated impact of future technology trends for forecasting collaborative robots market..

Season

Jan, 2022

Interested in partnering with other industrial and collaborative robot manufacturers. Can you help us with few crucial details?.