Artificial Intelligence (AI) Robots Market Size, Share & Trends

Artificial Intelligence (AI) Robots Market by Component (Hardware, Software), Technology (Machine learning, Computer Vision, Context Awareness, NLP, Localization & Mapping/SLAM, Motion Planning & Control) and Robot Type - Global Forecast to 2030

OVERVIEW

-robots-market-img-overview.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global artificial intelligence robots market is projected to grow from USD 6.11 billion in 2025 to USD 33.39 billion by 2030, at a CAGR of 40.4%. increasing adoption of automation and intelligent systems across industries to enhance operational efficiency and reduce labor costs. AI-powered robots integrate perception, decision-making, and learning capabilities, enabling them to perform complex tasks with minimal human intervention. The growing demand for collaborative robots in manufacturing, healthcare, logistics, and service sectors further accelerates adoption. Additionally, advancements in machine learning, computer vision, and natural language processing are expanding robots’ functionality, making them more adaptable and safer for human interaction. This technological evolution, coupled with global labor shortages and the push for digital transformation, continues to fuel rapid market growth.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific region accounted for the largest market share of 41% in 2024.

-

BY TECHNOLOGYIn the AI robots market, machine learning technology is expected to record the highest CAGR from 2025 to 2030.

-

BY ROBOT TYPEIn the AI robots market, service robots are expected to register the highest CAGR of 40.7% from 2025 to 2030.

-

BY APPLICATIONThe personal assistance & care giving segment is expected to hold a significant share of 22% in 2030.

-

BY COMPONENTThe hardware segment is expected to hold the largest market share of 61% in 2025.

-

COMPETITIVE LANDSCAPECompanies such as Texas Instruments Incorporated and NXP Semiconductors were identified as some of Star players in the AI robots market, given their significant market share and robust footprint.

The AI robots market is projected to grow rapidly over the next decade. The rising digital transformation and adoption of Industry 4.0 strategies are driving global automation trends. This combination of technological innovation and industrial need generates strong demand for AI robots, significantly boosting market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The disruptions and emerging trends impacting customers’ businesses in the AI robots market. AI-integrated service robots can assist humans in various applications, ranging from domestic tasks, such as cleaning pools and mowing lawns, to critical jobs, such as handling drones bearing military weapons and licenses to combat enemy attacks in the military & defense sectors.

-robots-market-img-disruption.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High adoption of robots for personal use

-

Support from governments worldwide to develop modern technologies

Level

-

Reluctance to adopt new technologies

-

Absence of standardized regulations to prevent risks associated with networked and autonomous robots

Level

-

Increasing aging population worldwide boosting the demand for AI-based robots for elderly assistance

-

Increasing investments in AI robotics

Level

-

Long time to commercialize robots and high maintenance costs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: High Adoption of Robots for Personal Use

The AI robots market is being significantly driven by the increasing uptake of intelligent robots for personal and domestic applications. Enhanced functionalities in cleaning, security, entertainment, and especially caregiving are making AI robots indispensable in modern homes. Technological advances in machine learning, speech synthesis, and environment sensing have improved user experiences while ensuring higher autonomy and adaptability. Major developments, such as affordable and multifunctional personal robots, are appealing to dual-income households looking for convenience and time savings. With the rising adoption of smart home ecosystems, AI-powered robots are becoming central not just to chore automation but also to companionship, elderly care, and home monitoring. This strong consumer pull is underpinning robust market growth and prompting manufacturers to accelerate innovations tailored for residential needs.

Restraint: Reluctance to Adopt New Technologies

Despite rapid advancements, a major restraint for the AI robots market stems from user reluctance to embrace new technologies. This hesitancy is especially pronounced among older demographics and small-to-medium enterprises, which may perceive robotics as overly complex, unreliable, or difficult to integrate with existing workflows. Interoperability challenges and worries about initial costs hinder broader acceptance. In addition, data privacy concerns and apprehensions over the replacement of human jobs persist, amplifying skepticism around full-scale deployment. As a result, vendors are compelled to invest more heavily in user education, streamlined interfaces, and assurance of security, but overcoming inherent resistance to change continues to be a substantial market barrier

Opportunity: Aging Population Worldwide Boosting Demand for AI-based Robots in Elderly Assistance

A burgeoning global aging population presents a significant opportunity for AI robots, especially in the domain of elderly assistance. Countries such as Japan, China, and portions of Europe and North America are facing demographic shifts resulting in a higher ratio of seniors to working-age individuals. AI-enabled robots can deliver much-needed support through mobility aids, medication reminders, health monitoring, and social companionship, thereby fostering independent living among seniors. Robots are being rapidly integrated in care facilities and private residences, especially where healthcare worker shortages exist. Alongside rising healthcare costs and the push for in-home care solutions, smart, empathetic AI robots are positioned to become vital allies for elderly citizens, offering both practical support and emotional comfort.

Challenge: Long Time to Commercialize Robots and High Maintenance Costs

One of the most significant challenges confronting the AI robots market is the extended timeline necessary for successful commercialization, compounded by ongoing high maintenance expenses. The journey from prototype to mass adoption is hampered by rigorous regulatory requirements, the necessity for extensive field validation, and continuous hardware-software integration. Moreover, the complexity of deploying robots in dynamic, real-world environments demands regular updates and specialized maintenance, increasing the total cost of ownership. High upfront investment, complexity of integration into legacy infrastructures, and the need for expert servicing personnel further elevate barriers for businesses and consumers alike. These factors slow the rate of market penetration and put pressure on suppliers to demonstrate long-term value and reliability.

Artificial Intelligence (AI) Robots Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Jetson and RTX-class GPUs for onboard perception, sensor fusion and neural-network inference; CUDA/ROS integrations for real-time vision, SLAM and motion planning; developer SDKs for multi-agent simulation and digital twins. | High throughput for neural inference and sensor processing | Mature software stack (CUDA, Isaac SDK) shortens time-to-market | Easy scaling from edge (Jetson) to data-center (RTX) for training and fleet analytics |

|

Edge vision accelerators (Movidius/Myriad), CPUs for control/coordination, OpenVINO for model optimization; Intel RealSense depth cameras used for obstacle detection and human interaction. | Low-power edge inference, wide CPU compatibility for control tasks, strong tools for model optimization, | heterogeneous compute |Depth sensors provide robust short-range perception |

|

High-performance GPUs for onboard or server-side inference and simulation; ROCm ecosystem for training and inference workloads in robotics cloud/back-end. | Cost-competitive high compute for perception and simulation |Strong parallelism for batched inference, enabling complex perception stacks and simulation-based testing |

|

Microcontrollers, motor-control analog and gate-driver ICs, power management and sensor front-ends used in motor drivers, encoders, and low-latency control loops for manipulators and mobile bases. | Deterministic, real-time control with proven motor-control IP| Highly integrated power and analog parts reduce BOM | Simplify motor-drive design, and improve energy efficiency and reliability |

|

Power MOSFETs, gate drivers, battery-management ICs, and safety MCU solutions (incl. sensor interfaces) for drive stages, BMS and functional safety; radar and sensing ICs for environment awareness. | Robust power-efficiency and reliable safety features (ASIL-capable MCUs) |high-voltage & high-current components support mobile bases and heavy manipulators | Improves system safety, thermal performance, and longevity |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis of the AI robots market reflects a highly collaborative value chain, ensuring advanced robotics solutions reach a wide array of industries and users. The ecosystem can be viewed in four main stages: component suppliers, robot manufacturers, suppliers and distributors, and end users. This streamlined four-stage ecosystem fosters innovation while enabling efficient scaling and targeted deployment across global markets.

-robots-market-img-ecosystem.webp)

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

-robots-market-img-segment.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Artificial intelligence robots market, by component

In the AI robots market, hardware components are expected to hold the largest market size, as they form the physical foundation enabling robotic functionality and intelligence. Components such as sensors, actuators, control systems, power supply units, and drive systems are essential for robot mobility, perception, and task execution. The growing adoption of advanced sensors and high-performance processors to support AI algorithms has significantly increased hardware demand.

Artificial intelligence robots market, by robot Type

In the AI robots market, service robots are expected to hold a significant share owing to their expanding adoption across healthcare, logistics, hospitality, and domestic sectors. These robots leverage AI for autonomous navigation, human interaction, and task optimization, making them ideal for functions such as patient care, delivery, cleaning, and security. The rising demand for automation in daily life, coupled with advancements in machine learning and computer vision, has boosted their capability and affordability.

Artificial intelligence robots market, by technology

In the AI robots market, machine learning (ML) is expected to hold a significant share due to its central role in enabling robots to learn, adapt, and make decisions from data without explicit programming. ML algorithms empower robots with perception, motion planning, and predictive maintenance capabilities, enhancing performance and autonomy across industrial and service applications. The integration of deep learning and reinforcement learning has further improved robots’ ability to recognize objects, interpret environments, and interact safely with humans.

Artificial intelligence robots market, by application

Based on application, personal assistance & care giving application segment is expected to hold a significant share due to the rising global aging population and increasing demand for support in daily living and healthcare monitoring. These robots provide companionship, mobility aid, and assistance with medical or household tasks, reducing caregiver burden. Growing adoption in home care, rehabilitation centers, and hospitals is driving rapid integration of humanoid and assistive AI robots in this segment.

REGION

Asia Pacific to be fastest-growing region in global AI robots market during forecast period

The Asia Pacific region is expected to hold a significant share of the AI robots market due to rapid industrial automation, strong government initiatives promoting AI adoption, and the presence of major manufacturing hubs such as China, Japan, and South Korea. The region’s expanding healthcare, logistics, and service sectors are driving demand for intelligent robots. Moreover, increasing investments in robotics research and favorable policies supporting smart factories and AI innovation are further propelling market growth in Asia Pacific.

-robots-market-img-region.webp)

Artificial Intelligence (AI) Robots Market: COMPANY EVALUATION MATRIX

In the AI robots market matrix,Texas Instruments Incorporated (Star) leads with an established product portfolio and a robust market presence. Sony Corporation (Emerging Leader) is steadily gaining traction with focused product portfolios and powerful growth strategies. While Texas Instruments Incorporated benefits from scale and a strong customer base, Sony Corporation shows solid growth potential to advance toward the leaders’ quadrant.

-robots-market-img-evaluation.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 4.56 Billion |

| Revenue Forecast in 2030 | USD 33.39 Billion |

| Growth Rate | CAGR of 40.4% from 2025-2030 |

| Actual data | 2021-2024 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million) and Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Component: Hardware & Software, By Robot Type: Industrial & Service, By Technology: Machine Learning, Computer Vision, Context Awareness, Natural Language, Localization & Mapping/SLAM Processing, Motion Planning & Control, By Application: Military & Defence, Personal Assistance and Care giving, Security and Surveillance, Public Infrastructure, Education and Entertainment, Research and Space exploration, Industrial, Agriculture, Healthcare Assistance, Warehouse & Logistics, Retail, Other Applications |

| Regional Scope | North America, Europe, Asia Pacific, and RoW |

WHAT IS IN IT FOR YOU: Artificial Intelligence (AI) Robots Market REPORT CONTENT GUIDE

-robots-market-img-content.webp)

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Component-level Assessment of Hardware and Software Architecture in AI Robots | Detailed component-level segmentation, covering drive systems, control systems, sensor modules and software stack, includes cross-mapping of component adoption by robot type (industrial, service, defense, healthcare). | Provides deep insight into component penetration and technological adoption trends across robot categories, supporting product positioning and investment prioritization. |

RECENT DEVELOPMENTS

- March 2025 : NVIDIA introduced Isaac GR00T N1, one of the world’s first open humanoid robot foundation models and simulation frameworks designed to accelerate robotic development. GR00T N1 marks the beginning of a family of fully customizable models that NVIDIA plans to pretrain and release to robotics developers globally, aiming to help industries address worldwide labor shortages exceeding 50 million workers.

- September 2025 : Texas Instruments has partnered with Apptronik to power Apollo, a commercial humanoid robot, using its advanced motor control, power management, and safety technologies. TI's microcontrollers and gate drivers enable precise, energy-efficient motion for safe human-robot interaction. The collaboration highlights TI's growing role in robotics innovation, helping develop robots that can perform complex tasks in human environments.

- June 2024 : Intel introduced the Intel Xeon 6 processors featuring efficient-cores (E-cores), designed to deliver exceptional performance and energy efficiency for high-density, scale-out data center workloads. These processors enable up to a 3:1 rack consolidation, achieving rack-level performance improvements of up to 4.2 times and performance-per-watt gains of up to 2.6 times.

- June 2025 : Advanced Micro Devices, Inc. (AMD) has acquired Enosemi, a startup specializing in silicon photonics and photonic integrated circuits, to accelerate advancements in photonics and co-packaged optics (CPO) for next-generation AI systems and high-bandwidth interconnects. This acquisition enhances AMD’s chiplet architecture strategy by enabling ultra-high-bandwidth optical interconnects between chiplets and across packages, extending beyond traditional electronic connections.

- June 2023 : Intel announced a partnership with TSMC to manufacture chips for Intel's high-performance computing and graphics products. The partnership would help Intel reduce its reliance on external foundries.

Table of Contents

Methodology

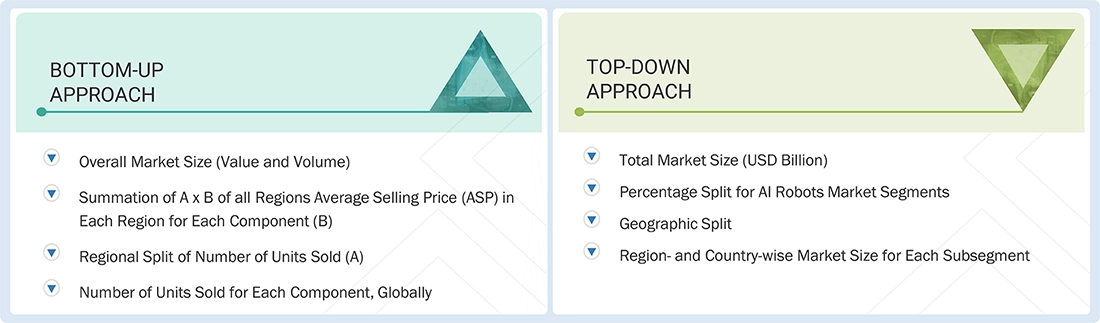

The study involved major activities in estimating the current size of the AI robots market. Exhaustive secondary research was done to collect information on AI-powered robots. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, including top-down and bottom-up methods, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to determine the size of the segments and subsegments within the AI robots market.

Secondary Research

Various secondary sources were used to identify and collect information relevant to this study. These include corporate filings such as annual reports, press releases, investor presentations, and financial statements; trade, business, and professional associations; white papers, journals, and articles from recognized authors; certified publications related to AI robots; directories; and databases.

Secondary research was conducted to gather key information about the industry's supply chain, the market's monetary chain, the total pool of key players, market segmentation based on industry trends, geographic markets, and key developments from a market-oriented perspective. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Primary Research

During the primary research process, various primary sources, including both supply and demand sides, were interviewed to gather qualitative and quantitative information for this report. Primary sources from the supply side included experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, SMEs, consultants, and related key executives from the major companies and organizations operating in the AI robots market.

After the complete market engineering process (which includes market statistics calculations, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical market numbers.

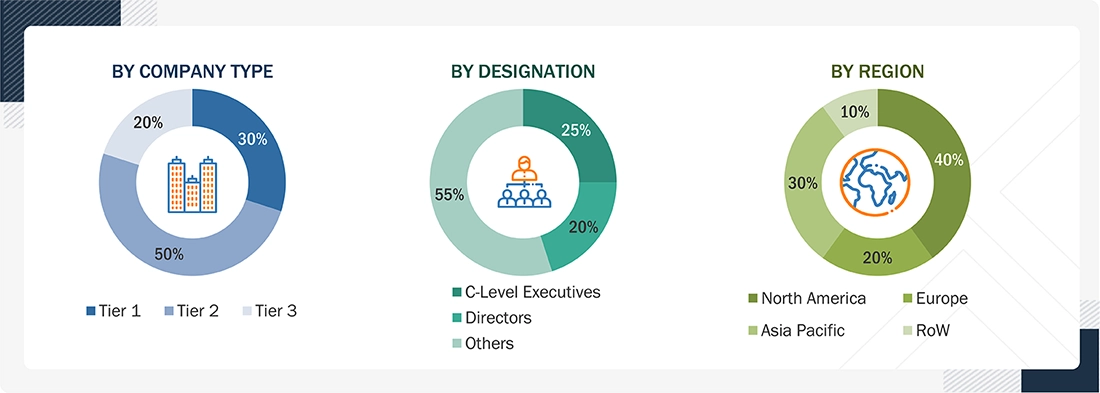

Several primary interviews were conducted with experts from both the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 35% of the primary interviews were conducted with demand-side respondents, while 65% were conducted with supply-side respondents. This primary data has been collected through questionnaires, emails, and telephonic interviews.

Notes: Other designations include sales & marketing executives, and researchers

Note: The three tiers of companies are based on their total revenue as of 2024: Tier 1, equal to or greater than USD 1,000 million; Tier 2, between USD 500 million and USD 1,000 million; and Tier 3, less than or equal to USD 500 million. Other designations include managers and academicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A bottom-up approach was employed to determine the overall size of the AI robots market, based on the revenues of key players and their corresponding market shares.

Approach to arrive at market size using bottom-up analysis (supply side)

- Shipments of various robot types (industrial AI robots, service AI robots) were identified through primary and secondary research.

- The number of semiconductor components integrated into each robot type was mapped across, drive systems, sensors, control systems, energy supply systems and software.

- Robot shipments were multiplied by the average number of components per robot to calculate component shipment volumes.

- Component shipment volumes were multiplied with the average selling price (ASP) of each component category to derive global number.

- The process was repeated for all robot categories, including industrial (traditional, collaborative), service (human assist, mobile, social).

- The global AI robots market size for robots was derived by summing revenues across all robot types and component segments.

- CAGR was estimated based on robotics penetration rate, industry adoption trends, and demand-supply dynamics for AI robots.

- All estimates were validated through discussions with key stakeholders (AI robot vendors, robotics OEMs, and domain experts) and cross-checked with company reports, press releases, and industry databases.

Top-down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research. The bottom-up approach has also been implemented for the data extracted from the secondary research to validate the market size of various segments.

The approximate market share of each company has been estimated to verify revenue shares used earlier in the bottom-up approach. With the help of the data triangulation procedure and the validation of data through primary interviews, the overall market size and each individual market size have been determined and confirmed in this study.

The data triangulation procedure used in this study is explained in the next section.

Approach to arrive at market size using top-down analysis (demand side)

- Focusing on the top-line investment and spending being made across various industry ecosystems.

- Building and developing the information related to revenue generated through key components used in robotic systems.

- Carrying out multiple on-field discussions with key opinion leaders (KOLs) across each major company involved in the development of AI robots.

- Estimating the application split using secondary sources, based on factors such as the robot type and the component mix (drive systems, sensors, control systems, energy supply systems).

- Estimating the regional split using secondary sources, based on various factors such as the number of players in a specific country and region, robot adoption maturity, and types of products demanded.

- Estimating the geographic split with the help of secondary sources based on various factors, such as the number of players in a specific country/region and systems used in various applications, such as personal assistance & care giving, warehousing & logistics, healthcare assistance, industrial and military & defense.

Artificial Intelligence (AI) Robots Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size through the process explained earlier, the total market was divided into several segments. The market breakdown and data triangulation procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

Artificially intelligent robots refer to service and industrial robots that are integrated with AI technology. These robots can learn a few repetitive tasks without any human intervention and can even communicate with humans or, in some cases, with other peer robots. Hardware such as AI processors and network devices, along with AI platforms, are the key differentiating components of an AI robot from a traditional robot. Hence, this AI robots market report comprises a study of the differentiating components, along with various types of robots.

Key Stakeholders

- AI robot providers

- AI robot manufacturers

- End users for AI robots

- Research organizations and consulting companies

- Associations, organizations, forums, and alliances related to AI robots

- Government bodies such as regulatory authorities and policymakers

- Venture capitalists, private equity firms, and startup companies

Report Objectives

- To define, describe, segment, and forecast the AI robots market size, by component, robot type, technology, and application, in terms of value

- To estimate the global AI robots market, by component, in terms of volume

- To forecast the market size of four key regions, namely, North America, Europe, Asia Pacific, and the RoW, in terms of value

- To present detailed information regarding market dynamics such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, ASP analysis, Porter's five forces analysis, and regulations pertaining to the market

- To offer a comprehensive overview of the value chain of the AI robots market ecosystem

- To critically assess micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

- To assess the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments in the market, such as collaborations, partnerships, product developments, and R&D

- To evaluate the macroeconomic outlook for each region and the US tariff impact on the AI robots market

Note: Micromarkets are defined as the further segments and subsegments of the AI robots market included in the report.

Available Customizations:

With the market data given, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Artificial Intelligence (AI) Robots Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Artificial Intelligence (AI) Robots Market

Tim

Jan, 2019

We founded a startup which helps corporates to learn about new technologies. We are interested in market data and insights due to two facts: - To know what's new - To get a better understanding of market size etc. What is the scope of the artificial intelligence that you have considered in your research?.

ANDO

Jun, 2019

I am graduate student and trying to analyze the field of AI & robotics, and I want to know the statistical data in this field. Could you tell me your research methodology so that I can understand the directions and also the scope of your research. .

CHOI

Dec, 2018

Our company want to buy this report. But our budget is only US $2,600. Is it possible that discount price? What all future trends other than AI have you included in your scope? .

Prachi

Mar, 2019

Looking on a good report on recent market trends of AI and Robotics and what is the future for the same. How have you segmented AI and Robotics based on applications, regions, technologies, etc.?.

Matteo

Jun, 2019

Forward Pass is a start-up which provides custom Machine-Learning-based software and robotics solutions, including data-set creation and cleansing, ML model design, on premise and Cloud deployment, and mechatronic solutions development. We are in the process of outlining our business plan and executive summary, for which a thorough market research is necessary..