Aircraft Oxygen System Market by System (Passenger Oxygen System, Crew Oxygen System,) Component (Oxygen Storage, Oxygen Delivery, Oxygen Mask), Mechanism (Chemical Oxygen Generator, Compressed Oxygen System), Technology and Geography - Global Forecast to 2034

The Aircraft Oxygen System Market is witnessing steady growth as aviation safety standards, fleet modernization programs, and long-range mission requirements converge to elevate onboard oxygen delivery technology. In 2025, the market is estimated at USD 4.2 billion and is projected to reach approximately USD 6.8 billion by 2034, registering a compound annual growth rate (CAGR) of about 5.3%.

Source: MarketsandMarkets Analysis, Primary Interviews, Secondary Research

Oxygen systems are a vital safety and operational component across commercial, business, and military aircraft. They ensure crew and passenger survival during cabin depressurization events and support specialized missions at high altitudes. In recent years, technological advancement in onboard oxygen generation systems (OBOGS), weight-optimized cylinders, and real-time monitoring systems has transformed aircraft oxygen supply from a static emergency feature to an integrated life-support ecosystem.

Rising production of narrow- and wide-body aircraft, the modernization of military fleets, and retrofit programs for aging civil aircraft are primary demand catalysts. Simultaneously, stringent airworthiness regulations by FAA, EASA, and ICAO Annex 6 have reinforced the adoption of advanced oxygen storage, generation, and distribution architectures.

Market Dynamics

Key Growth Drivers

- Commercial Fleet Expansion: A growing number of commercial aircraft deliveries worldwide are increasing linefit oxygen system demand.

- Military and High-Altitude Missions: Increased use of fighter, transport, and surveillance aircraft operating above 10,000 ft is driving next-generation OBOGS adoption.

- Regulatory Mandates: Mandatory inclusion of oxygen systems for both crew and passengers as per FAR 121.333 and EASA CS-25 enhances retrofit and aftermarket demand.

- Advances in Materials & Weight Optimization: Use of composite oxygen cylinders and titanium alloys reduces system mass and enhances performance.

- Cabin Safety and Passenger Experience: Airlines are adopting more reliable and ergonomic passenger oxygen systems to improve safety compliance.

Challenges

- High maintenance cost of OBOGS and mask systems.

- Complex certification and validation procedures for oxygen delivery components.

- Limited lifespan and frequent inspection requirements for stored oxygen cylinders.

Opportunities

- Increasing demand for modular and smart oxygen systems in electric and hybrid-electric aircraft.

- Development of automated oxygen flow control integrated with cabin pressure sensors.

- Growth of regional MRO capabilities for servicing oxygen systems in Asia Pacific and the Middle East.

Market Segmentation

Source: MarketsandMarkets Analysis, Primary Interviews, Secondary Research

By System Type

-

Stored Gaseous Oxygen Systems (GOX):

Use high-pressure oxygen cylinders for both cockpit and cabin. Widely used in commercial and regional aircraft. -

Chemical Oxygen Generators (COG):

Rely on sodium chlorate-based oxygen generation; common in passenger cabin emergency masks. Compact and low-maintenance, used in short-haul aircraft. -

Onboard Oxygen Generation Systems (OBOGS):

Use molecular sieve technology to separate oxygen from engine bleed air or cabin air. Increasingly adopted in fighter jets, military transports, and new-generation business jets. -

Portable Oxygen Systems (POS):

Compact units for crew use during emergencies, maintenance, or high-altitude operations.

By Component

-

Oxygen Storage Tanks & Cylinders:

High-pressure aluminum, carbon-fiber, or titanium tanks for gaseous oxygen. Key advancements include composite-wrapped designs and improved leak resistance. -

Oxygen Masks:

- Crew Masks: Quick-donning, pressure-demand masks with microphones and regulators.

- Passenger Masks: Drop-down systems triggered by cabin depressurization sensors.

-

Regulators & Valves:

Maintain consistent oxygen pressure and flow to individual users. -

Distribution Systems & Plumbing:

Pipelines, manifolds, and control valves ensuring oxygen delivery throughout the aircraft. -

Sensors, Indicators & Monitoring Units:

Smart systems enabling cockpit-level monitoring of oxygen purity, pressure, and flow rate.

By Technology

-

Continuous Flow Systems:

Provide constant oxygen delivery — standard in passenger systems. -

Demand Flow Systems:

Deliver oxygen only during inhalation, optimizing gas usage; preferred for crew systems. -

Pressure Demand Systems:

Designed for high-altitude and military applications, providing oxygen under pressure to maintain normal breathing levels. -

Molecular Sieve Separation (OBOGS):

Advanced generation technology enabling onboard oxygen production without external refill cycles.

By Application

-

Commercial Aviation:

Oxygen systems for cockpit, cabin, and crew stations in narrow-body, wide-body, and regional aircraft. -

Military Aviation:

Fighter and bomber aircraft with high-performance OBOGS for extended endurance and mission flexibility. -

General Aviation:

Light aircraft, turboprops, and business jets utilizing stored or portable systems for high-altitude operations. -

Helicopters & Rotorcraft:

Specialized lightweight oxygen solutions for high-altitude search and rescue (SAR) or tactical missions. -

Unmanned Aerial Vehicles (UAVs):

Emerging demand in high-altitude long-endurance (HALE) UAVs requiring oxygen-assisted payload cooling and avionics safety.

By End User

- OEM (Linefit): Installed during aircraft production for certified airframes.

- Aftermarket (Retrofit & Maintenance): Replacement of cylinders, masks, regulators, and cabin distribution lines during scheduled maintenance cycles.

By Aircraft Type

- Fixed-Wing: Commercial, business, and military aircraft.

- Rotary-Wing: Helicopters for civil and defense sectors.

- Unmanned Platforms: High-altitude and research UAVs.

Technology Landscape

Recent developments highlight a shift toward lightweight composite cylinders, digital oxygen monitoring, and modular OBOGS architectures.

- Smart Oxygen Control Units (SOCUs) now interface directly with aircraft avionics for automated flow regulation.

- Composite overwrapped pressure vessels (COPVs) are replacing metallic tanks, reducing weight by up to 40%.

- Electrochemical oxygen sensors improve reliability over mechanical gauges.

- Dual-mode OBOGS units capable of switching between onboard generation and stored supply enhance mission flexibility.

Key manufacturers such as Collins Aerospace, Zodiac Aerospace (Safran Group), Cobham Mission Systems, and Aviation Oxygen Systems Inc. are driving innovation through integrated life-support ecosystems combining oxygen, air, and pressure management functions.

Regulatory Framework

- FAA FAR 25.1443 & FAR 121.333: Define requirements for oxygen availability and mask performance.

- EASA CS-25.1443: Establishes equivalent standards for European operators.

- MIL-DTL-83133 & MIL-STD-3050: Govern oxygen purity and component specifications for military aircraft.

- ICAO Annex 6: Sets global obligations for oxygen provision for crew and passengers above 10,000 ft.

Compliance to these standards is mandatory for airworthiness certification and forms the foundation of OEM integration and aftermarket retrofit validation.

Sustainability and Safety Outlook

Sustainability efforts are focusing on recyclable cylinder materials, green manufacturing of chemical generators, and reduced oxygen leakage rates. Digital maintenance tracking also minimizes waste by predicting component life and reducing unscheduled replacements. Future systems aim to eliminate disposable chemical generators entirely through renewable air-separation technologies.

Enhanced passenger safety is achieved through real-time cabin oxygen analytics, automated emergency deployment sensors, and predictive maintenance of crew masks.

Regional Outlook

Source: MarketsandMarkets Analysis, Primary Interviews, Secondary Research

North America:

Dominates the market due to a large fleet base, continuous modernization, and strong regulatory enforcement by FAA. Major OEMs like Boeing and Collins Aerospace drive high-value integration.

Europe:

Focuses on lightweight and energy-efficient systems, led by Airbus programs and Safran Group innovations. Compliance with EASA and REACH materials regulations influences design choices.

Asia Pacific:

Fastest-growing region, driven by aircraft procurement in China, India, and Southeast Asia. Indigenous manufacturing under “Make in India” and “China Civil Aviation Equipment” initiatives strengthens regional supply chains.

Middle East & Africa:

Investments in commercial fleet expansion (Emirates, Etihad, Qatar Airways) and military programs create sustained oxygen system demand.

Latin America:

Moderate growth driven by regional carrier fleet renewals and MRO facility upgrades in Brazil and Mexico.

Competitive Landscape

Leading participants include:

Source: MarketsandMarkets Analysis, Primary Interviews, Secondary Research

- Collins Aerospace (RTX): Integrated oxygen and life-support systems.

- Safran Aerosystems (Zodiac Aerospace): Full-suite OBOGS and passenger mask systems.

- Cobham Mission Systems (Eaton Corporation): Tactical OBOGS for military aircraft.

- Aviation Oxygen Systems Inc.

- Precise Flight Inc.

- Technodinamika (Russia)

- Essex Industries

- Air Liquide Aerospace

Competition focuses on certification readiness, reliability, modular retrofit kits, and sensor integration.

Market Outlook and Key Takeaways

- Base Year: 2025

- Forecast Year: 2034

- Market Size: USD 4.2 Bn → USD 6.8 Bn

- CAGR: 5.3%

The aircraft oxygen system market will remain essential for fleet safety, defense endurance, and future air mobility. Growth will be sustained by lightweight materials, onboard generation technologies, and digital diagnostics that reduce lifecycle cost and enhance operational reliability.

FAQs

1. What is the current size of the aircraft oxygen system market?

Around USD 4.2 billion in 2025, expected to reach USD 6.8 billion by 2034.

2. Which system type is gaining traction?

Onboard Oxygen Generation Systems (OBOGS) are the fastest-growing due to adoption in military and next-generation commercial aircraft.

3. What standards govern oxygen systems?

FAA FAR 25.1443, EASA CS-25, and ICAO Annex 6 define design, certification, and operational standards.

4. Which region is growing fastest?

Asia Pacific, driven by new aircraft deliveries, fleet expansion, and local manufacturing policies.

5. What is driving innovation?

Material science advancements, digital maintenance analytics, and sustainability-focused modular OBOGS architectures.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Distribution Channel Participants

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

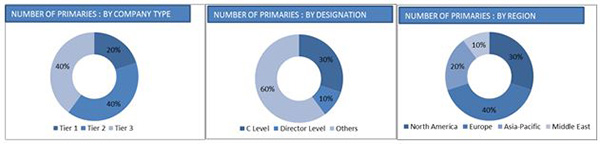

2.1.2.2 Breakdown of Primaries

2.1.3 Demand Side Factors

2.1.3.1 Replacement of Retiring Aircraft

2.1.3.2 Growth in Passenger Air Traffic

2.2 Market Size Estimation

2.2.1.1 Bottom-Up Approach

2.2.1.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunities in the Aircraft Oxygen System Market

4.2 Aircraft Oxygen System Market, By System, 2013-2020

4.3 Aircraft Oxygen System Market Share in Europe

4.4 North America Accounted for the Largest Market Share Amongst All the Regions

4.5 Aircraft Oxygen System Market: By Mechanism (2015 vs 2020)

4.6 Aircraft Oxygen System Retrofit Market: Emerging and Matured Nations (2015 V/S 2020)

4.7 Life Cycle Analysis

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By System

5.2.2 By Mechanism

5.2.3 By Component

5.2.4 By Technology

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Air Travel

5.3.1.2 Replacement of Aging Aircraft

5.3.2 Restraints

5.3.2.1 Stringent Regulations for Safety

5.3.2.2 Supplier Production Capacity Limitations

5.3.3 Opportunities

5.3.3.1 Reconfiguration of Cabin Structure

5.3.4 Challenges

5.3.4.1 System Set Up Challenge

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.3.1 Key Influencers

6.4 Porter’s Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

6.5 Strategic Benchmarking

6.5.1 Technological Integration & Product Enhancement

6.5.2 Product Positioning Strategy

6.5.3 Market Retention Strategy

7 Aircraft Oxygen System Market, By System (Page No. - 52)

7.1 Introduction

7.2 Passenger Oxygen System

7.2.1 Fixed Type Passenger Oxygen System

7.2.2 Portable Passenger Oxygen System

7.3 Crew Oxygen System

7.3.1 Integrated Oxygen System

7.3.2 Protective Breathing Equipment

7.3.3 Portable Oxygen System

8 Centralised Aircraft Oxygen System, By Component (Page No. - 59)

8.1 Introduction

8.2 Centralized Oxygen System, By Component

8.2.1 Oxygen Storage System

8.2.2 Oxygen Delivery System

8.2.3 Oxygen Mask

9 Aircraft Oxygen System, By Mechanism (Page No. - 64)

9.1 Introduction

9.2 Aircraft Oxygen System Market, By Mechanism

9.2.1 Chemical Oxygen Generator

9.2.1.1 Passenger Oxygen System

9.2.1.2 Protective Breathing Equipment

9.2.1.3 Lavatory Oxygen System

9.2.2 Compressed Oxygen System

9.2.2.1 Centralized Oxygen System

9.2.2.2 Portable Oxygen System

10 Aircraft Oxygen System Market, By Technology (Page No. - 71)

10.1 Introduction

10.2 Oxygen Storage System Market

10.3 Oxygen Delivery System Market

10.4 Oxygen Mask Market

11 Aircraft Oxygen System Market, By Geography (Page No. - 74)

11.1 Introduction

11.2 North America

11.2.1 By System

11.2.1.1 Crew Oxygen System, By Type

11.2.2 By Component

11.2.3 By Mechanism

11.2.4 By Country

11.2.4.1 U.S.

11.2.4.1.1 By System

11.2.4.1.2 By Component

11.2.4.1.3 By Mechanism

11.2.4.2 Canada

11.2.4.2.1 By System

11.2.4.2.2 By Component

11.2.4.2.3 By Mechanism

11.3 Europe

11.3.1 By System

11.3.1.1 Crew Oxygen System, By Type

11.3.2 By Component

11.3.3 By Mechanism

11.3.4 By Country

11.3.4.1 France

11.3.4.1.1 By System

11.3.4.1.2 By Component

11.3.4.1.3 By Mechanism

11.3.4.2 U.K.

11.3.4.2.1 By System

11.3.4.2.2 By Component

11.3.4.2.3 By Mechanism

11.3.4.3 Germany

11.3.4.3.1 By System

11.3.4.3.2 By Component

11.3.4.3.3 By Mechanism

11.3.4.4 Italy

11.3.4.4.1 By System

11.3.4.4.2 By Component

11.3.4.4.3 By Mechanism

11.4 Asia-Pacific

11.4.1 By System

11.4.1.1 Crew Oxygen System, By Type

11.4.2 By Component

11.4.3 By Mechanism

11.4.4 By Country

11.4.4.1 China

11.4.4.1.1 By System

11.4.4.1.2 By Component

11.4.4.1.3 By Mechanism

11.4.4.2 India

11.4.4.2.1 By System

11.4.4.2.2 By Component

11.4.4.2.3 By Mechanism

11.4.4.3 Australia

11.4.4.3.1 By System

11.4.4.3.2 By Component

11.4.4.3.3 By Mechanism

11.5 the Middle East

11.5.1 By System

11.5.1.1 Crew Oxygen System, By Type

11.5.2 By Component

11.5.3 By Mechanism

11.5.4 By Country

11.5.4.1 UAE

11.5.4.1.1 By System

11.5.4.1.2 By Component

11.5.4.1.3 By Mechanism

11.5.4.2 Saudi Arabia

11.5.4.2.1 By System

11.5.4.2.2 By Component

11.5.4.2.3 By Mechanism

11.5.4.3 Qatar

11.5.4.3.1 By System

11.5.4.3.2 By Component

11.5.4.3.3 By Mechanism

11.6 Rest of the World

11.6.1 By System

11.6.1.1 Crew Oxygen System, By Type

11.6.2 By Component

11.6.3 By Mechanism

11.6.4 By Country

11.6.4.1 Brazil

11.6.4.1.1 By System

11.6.4.1.2 By Component

11.6.4.1.3 By Mechanism

11.6.4.2 South Africa

11.6.4.2.1 By System

11.6.4.2.2 By Component

11.6.4.2.3 By Mechanism

12 Competitive Landscape (Page No. - 112)

12.1 Overview

12.2 Market Share Analysis: By Company

12.3 Brand Analysis

12.4 Product Portfolio

12.5 Competitive Situation & Trends

12.5.1 Contracts

12.5.2 New Product Launches

12.5.3 Mergers & Acquisitions

12.5.4 Partnerships

12.5.5 New Manufacturing Units

12.5.6 Separate Entity

13 Company Profile (Page No. - 119)

13.1 Introduction

13.2 Financial Highlights of Key Market Players

13.3 B/E Aerospace, Inc.

13.3.1 Business Overview

13.3.2 Product Offerings

13.3.3 Recent Developments

13.3.4 MnM View

13.4 Zodiac Aerospace S.A.

13.4.1 Business Overview

13.4.2 Product Offerings

13.4.3 Recent Developments

13.4.4 MnM View

13.5 Cobham PLC

13.5.1 Business Overview

13.5.2 Product Offerings

13.5.3 MnM View

13.6 Air Liquide

13.6.1 Business Overview

13.6.2 Product Offerings

13.6.3 Recent Developments

13.6.4 MnM View

13.7 Technodinamika Holding, Jsc

13.7.1 Business Overview

13.7.2 Product Offerings

13.7.3 Recent Developments

13.7.4 MnM View

13.8 Aviation Oxygen System, Inc.

13.8.1 Business Overview

13.8.2 Product Offerings

13.8.3 Recent Developments

13.9 BASA Aviation Ltd.

13.9.1 Business Overview

13.9.2 Product Offerings

13.10 Aeromedix.Com Llc

13.10.1 Business Overview

13.10.2 Product Offerings

13.11 Precise Flight, Inc.

13.11.1 Business Overview

13.11.2 Product Offerings

13.11.3 Recent Developments

13.12 Ventura Aerospace, Inc.

13.12.1 Business Overview

13.12.2 Product Offerings

13.12.3 Recent Developments

14 Appendix (Page No. - 139)

14.1 Discussion Guide

14.2 Introducing RT: Real Time Market Intelligence

14.3 Available Customizations

14.4 Related Reports

List of Tables (91 Tables)

Table 1 Limitations: Aircraft Oxygen System Market

Table 2 Assumptions of the Research Study

Table 3 Aircraft Oxygen System Market Size, By System, 2013-2020 (USD Million)

Table 4 Fixed Type Passenger Oxygen System Market Size, By Region, 2013-2020 (USD Million)

Table 5 Crew Oxygen System Market Size, By Region, 2013-2020 (USD Million)

Table 6 Crew Oxygen System Market Size, By Type, 2013-2020 (USD Million)

Table 7 Integrated Oxygen System Market Size, By Region, 2013-2020 (USD Million)

Table 8 Protective Breathing Equipment Market Size, By Region, 2013-2020 (USD Million)

Table 9 Portable Oxygen System Market Size, By Region, 2013-2020 (USD Million)

Table 10 Centralized Oxygen System Market, By Component, 2013-2020 (USD Million)

Table 11 Oxygen Storage System Market Size, By Region, 2013-2020 (USD Million)

Table 12 Oxygen Delivery System Market Size, By Region, 2013-2020 (USD Million)

Table 13 Oxygen Mask Market Size, By Region, 2013-2020 (USD Million)

Table 14 Aircraft Oxygen System Market Size, By Mechanism, 2013-2020 (USD Million)

Table 15 Chemical Oxygen Generator Market Size, By Region, 2013-2020 (USD Million)

Table 16 Chemical Oxygen Generator Market Size, By Sub System, 2013-2020 (USD Million)

Table 17 Compressed Oxygen System Market Size, By Region, 2013-2020 (USD Million)

Table 18 Aircraft Oxygen System Market, By Region, 2013-2020 (USD Million)

Table 19 North America: Aircraft Oxygen System Market, By System, 2013-2020 (USD Million)

Table 20 North America: Crew Aircraft Oxygen System Market, By Type, 2013-2020 (USD Million)

Table 21 North America: Aircraft Oxygen System Market, By Mechanism, 2013-2020 (USD Million)

Table 22 North America: Aircraft Centralized Oxygen System Market, By Component, 2013-2020 (USD Million)

Table 23 North America: Market, By Country, 2013-2020 (USD Million)

Table 24 U.S.: Aircraft Oxygen System Market, By System, 2013-2020 (USD Million)

Table 25 U.S.: Aircraft Oxygen System Market, By Mechanism, 2013-2020 (USD Million)

Table 26 U.S.: Aircraft Centralized Oxygen System Market, By Component, 2013-2020 (USD Million)

Table 27 Canada: Aircraft Oxygen System Market, By System, 2013-2020 (USD Million)

Table 28 Canada: Aircraft Oxygen System Market, By Mechanism, 2013-2020 (USD Million)

Table 29 Canada: Aircraft Centralized Oxygen System Market, By Component, 2013-2020 (USD Million)

Table 30 Europe: Aircraft Oxygen System Market, By System, 2013-2020 (USD Million)

Table 31 Europe: Crew Market, By Type, 2013-2020 (USD Million)

Table 32 Europe: Aircraft Oxygen System Market, By Mechanism, 2013-2020 (USD Million)

Table 33 Europe: Aircraft Centralized Oxygen System Market, By Component, 2013-2020 (USD Million)

Table 34 Europe: Aircraft Oxygen System Market, By Country, 2013-2020 (USD Million)

Table 35 France: Aircraft Oxygen System Market, By System, 2013-2020 (USD Million)

Table 36 France: Aircraft Oxygen System Market, By Mechanism, 2013-2020 (USD Million)

Table 37 France: Aircraft Centralized Oxygen System Market, By Component, 2013-2020 (USD Million)

Table 38 U.K.: Aircraft Oxygen System Market, By System, 2013-2020 (USD Million)

Table 39 U.K.: Aircraft Oxygen System Market, By Mechanism, 2013-2020 (USD Million)

Table 40 U.K.: Aircraft Centralized Oxygen System Market, By Component, 2013-2020 (USD Million)

Table 41 Germany: Aircraft Oxygen System Market, By System, 2013-2020 (USD Million)

Table 42 Germany: Aircraft Oxygen System Market, By Mechanism, 2013-2020 (USD Million)

Table 43 Germany: Aircraft Oxygen System Market, By Component, 2013-2020 (USD Million)

Table 44 Italy: Aircraft Oxygen System Market, By System, 2013-2020 (USD Million)

Table 45 Italy: Aircraft Oxygen System Market, By Mechanism, 2013-2020 (USD Million)

Table 46 Italy: Aircraft Centralized Oxygen System Market, By Component, 2013-2020 (USD Million)

Table 47 Asia-Pacific: Market, By System, 2013-2020 (USD Million)

Table 48 Asia-Pacific : Aircraft Crew Oxygen System Market, By Type, 2013-2020 (USD Million)

Table 49 Asia-Pacific: Aircraft Oxygen System Market, By Mechanism, 2013-2020 (USD Million)

Table 50 Asia-Pacific: Aircraft Oxygen System Market, By Component, 2013-2020 (USD Million)

Table 51 Asia-Pacific: Aircraft Oxygen System Market, By Country, 2013-2020 (USD Million)

Table 52 China: Market, By System, 2013-2020 (USD Million)

Table 53 China: Market, By Mechanism, 2013-2020 (USD Million)

Table 54 China: Aircraft Centralized Oxygen System Market, By Component, 2013-2020 (USD Million)

Table 55 India: Market, By Usage System, 2013-2020 (USD Million)

Table 56 India: Market, By Mechanism, 2013-2020 (USD Million)

Table 57 India: Aircraft Centralized Oxygen System Market, By Component, 2013-2020 (USD Million)

Table 58 Australia: Market, By Usage System, 2013-2020 (USD Million)

Table 59 Australia: Market, By Mechanism, 2013-2020 (USD Million)

Table 60 Australia: Aircraft Centralized Oxygen System Market, By Component, 2013-2020 (USD Million)

Table 61 Middle East: Market Size, By System, 2013-2020 (USD Million)

Table 62 Middle East: Aircraft Crew Oxygen System Market Size, By Type, 2013-2020 (USD Million)

Table 63 Middle East : Aircraft Crew Oxygen System Market Size, By Mechanism, 2013-2020 (USD Million)

Table 64 Middle East: Aircraft Centralized Oxygen System Market Size, By Component, 2013-2020 (USD Million)

Table 65 Middle East: Aircraft Centralized Oxygen System Market Size, By Country, 2013-2020 (USD Million)

Table 66 UAE: Market Size, By System, 2013-2020 (USD Million)

Table 67 UAE: Market Size, By Mechanism, 2013-2020 (USD Million)

Table 68 UAE: Market Size, By Component, 2013-2020 (USD Million)

Table 69 Saudi Arabia: Market Size, By System, 2013-2020 (USD Million)

Table 70 Saudi Arabia: Market Size, By Mechanism, 2013-2020 (USD Million)

Table 71 Saudi Arabia : Market Size, By Component, 2013-2020 (USD Million)

Table 72 Qatar: Market Size, By System, 2013-2020 (USD Million)

Table 73 Qatar: Market Size, By Mechanism, 2013-2020 (USD Million)

Table 74 Qatar : Market Size, By Component, 2013-2020 (USD Million)

Table 75 RoW: Aircraft System Market, By System, 2013-2020 (USD Million)

Table 76 RoW: Aircraft Crew Oxygen System Market, By Type, 2013-2020 (USD Million)

Table 77 RoW : Aircraft Crew Oxygen System Market, By Mechanism, 2013-2020 (USD Million)

Table 78 RoW: Aircraft Centralized Oxygen System Market, By Component, 2013-2020 (USD Million)

Table 79 RoW: Aircraft Centralized Oxygen System Market, By Country, 2013-2020 (USD Million)

Table 80 Brazil: Market, By System, 2013-2020 (USD Million)

Table 81 Brazil: Market, By Mechanism, 2013-2020 (USD Million)

Table 82 Brazil: Market, By Component, 2013-2020 (USD Million)

Table 83 South Africa: Market, By System, 2013-2020 (USD Million)

Table 84 South Africa: Market, By Mechanism, 2013-2020 (USD Million)

Table 85 South Africa: Market, By Component, 2013-2020 (USD Million)

Table 86 Contracts, 2013–2015

Table 87 New Product Launches, 2014

Table 88 Mergers & Acquisitions, 2014

Table 89 Partnerships, 2014

Table 90 New Manufacturing Units, 2015

Table 91 Separate Entity, 2014

List of Figures (61 Figures)

Figure 1 Markets Covered: Aircraft Oxygen System Market

Figure 2 Aircraft Oxygen System Market: Geographic Scope

Figure 3 Study Years: Aircraft Oxygen System Market

Figure 4 Research Design

Figure 5 Key Data From Secondary Sources

Figure 6 Key Data From Primary Sources

Figure 7 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 8 Worldwide Air Passenger Growth in 2014

Figure 9 Worldwide Passenger Traffic By Air, 2010-2014

Figure 10 Market Size Estimation Methodology: Bottom-Up Approach

Figure 11 Market Size Estimation Methodology: Top-Down Approach

Figure 12 Market Breakdown & Data Triangulation

Figure 13 Passenger Oxygen System to Grow at the Highest CAGR During the Forecast Period

Figure 14 Chemical Oxygen Generator and Compressed Oxygen System From 2013 to 2020

Figure 15 Asia-Pacific Region Expected to Grow at the Highest CAGR in the Aircraft Oxygen System Market

Figure 16 Lavatory Oxygen System Expected to Grow at the Highest CAGR During the Forecast Period

Figure 17 Contracts and Mergers & Acquisitions Will Be the Key Growth Strategies

Figure 18 Attractive Market Opportunities in the Aircraft Oxygen System Market, 2015-2020

Figure 19 Passenger Oxygen System Dominates the Growth in the Aircraft Oxygen System Market

Figure 20 France Accounted for the Largest Share in 2015

Figure 21 North America Accounted for the Largest Share of the Aircraft Oxygen System Market in 2015

Figure 22 Chemical Oxygen Generator to Dominate the Aircraft Oxygen System Market Globally

Figure 23 Matured Nations to Dominate the Market Share During the Forecast Period

Figure 24 Asia-Pacific Expected to Be the Fastest-Growing Market

Figure 25 Aircraft Oxygen System : Market Segmentation

Figure 26 Global Rise in Passenger Traffic is the Major Driver for the Aircraft Oxygen System Market

Figure 27 Aircraft Oxygen System Market: Value-Chain Analysis

Figure 28 Aircraft Oxygen System Market: Supply Chain Analysis

Figure 29 Porter’s Five Forces Analysis

Figure 30 Installing Light Weight Equipment is A Growing Trend in the Aircraft Oxygen System Market

Figure 31 Product Positioning Strategy Adopted By Key Market Players

Figure 32 Market Retention Strategy Adopted By Key Market Players

Figure 33 Aircraft Oxygen System Market, By System, 2015 V/S 2020 (USD Million)

Figure 34 Fixed Type Passenger Oxygen System Market, By Region, 2015 V/S 2020 (USD Million)

Figure 35 Crew Oxygen System Market, By Region, 2015 V/S 2020 (USD Million)

Figure 36 Crew Oxygen System Market, By Type, 2015 V/S 2020 (USD Million)

Figure 37 Centralized Oxygen System Market, By Component, 2015 vs 2020 (USD Million)

Figure 38 Aircraft Oxygen System Market, By Mechanism, 2015 V/S 2020 (USD Million)

Figure 39 Chemical Oxygen Generator Market, By Region, 2015 V/S 2020 (USD Million)

Figure 40 Chemical Oxygen Generator Market, By Sub System, 2015 V/S 2020 (USD Million)

Figure 41 Compressed Oxygen System Market, By Region, 2015 V/S 2020 (USD Million)

Figure 42 Aircraft Oxygen System Market, By Technology

Figure 43 Aircraft Oxygen System Market: Geographic Snapshot (2015-2020)

Figure 44 North American Aircraft Oxygen System Market Snapshot: U.S. Commanded the Largest Market Share in 2015

Figure 45 Europe Aircraft Oxygen System Market Snapshot, 2015-2020 (USD Million)

Figure 46 Asia-Pacific Aircraft Oxygen System Market Snapshot

Figure 47 Middle East Aircraft Oxygen System Market Snapshot

Figure 48 Companies Adopted Contracts as the Key Growth Strategy During the Period (2013-2015)

Figure 49 Market Share Analysis, 2014

Figure 50 Brand Analysis : Aircraft Oxygen System Market

Figure 51 Product Portfolio : Key Market Player

Figure 52 Battle for Market Share: Gaining New Contract is the Key Strategy

Figure 53 Geographical Revenue Snapshot: Key Players

Figure 54 B/E Aerospace, Inc.: Company Snapshot

Figure 55 B/E Aerospace, Inc.: SWOT Analysis

Figure 56 Zodiac Aerospace S.A.: Company Snapshot

Figure 57 Zodiac Aerospace S.A.: SWOT Analysis

Figure 58 Cobham PLC.: Company Snapshot

Figure 59 Cobham PLC: SWOT Analysis

Figure 60 Air Liquide: Company Snapshot

Figure 61 Air Liquide: SWOT Analysis

An aircraft oxygen system provides oxygen supply to passengers and crew of an aircraft when it is in operation. These systems are used when the cabin air pressure reduces due to the aircraft operating above 12,000 ft., or in emergency situations. Some of the major players in the aircraft manufacturing business, requiring AOS, have partnerships with leading players for replacement.

The market size estimations for the various segments and subsegments of this market were arrived at through extensive secondary research, corroboration with primaries, and further market triangulation with the help of statistical techniques using econometric tools. This research study involved the usage of both primary and secondary sources. Secondary sources include directories and databases, such as Hoovers, Bloomberg Businessweek, and Factiva to identify and collect relevant information on the AOS market. Major players of the AOS market were identified across regions and their offerings, distribution channel, and regional presence was understood through in-depth discussions. Also, average revenue generated by these companies segmented by region was used to arrive at the overall market size.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the AOS market comprises various component suppliers of for oxygen systems. The various AOS component manufacturers and suppliers, such as B/E Aerospace, Inc. (U.S.) and Cobham Plc (U.K.) that sell various components to AOS manufacturers are an important part of the AOS ecosystem. These companies also manufacture AOS in-house. This study answers several questions for the stakeholders; primarily which segments to focus over the next five years for prioritizing efforts and investments.

Target Audience

- Aircraft Oxygen system Manufacturers

- Aviation Regulatory Authorities

- Sub-component Manufacturers

- Technology Support Providers

Scope of the Report

Aircraft Oxygen Systems Market, By System

- Passenger Oxygen System

- Crew Oxygen System

Aircraft Oxygen Systems Market, By Component

-

Oxygen Storage System

- Oxygen Delivery System

- Oxygen Mask

Aircraft Oxygen Systems Market, By Mechanism

- Chemical Oxygen Generator

- Compressed Oxygen System

Aircraft Oxygen Systems Market, By Technology

Aircraft Oxygen Systems Market, By Region

- North America

- Europe

- Asia-Pacific

- The Middle East

- Rest of the World

Paid Customization

With the given market data, MarketsandMarkets offers customizations in accordance to company-specific needs. The following customization options are available for the report:

- Market Analysis

Aircraft Oxygen Systems Market, By Fit

- Line Fit

- Retrofit

Aircraft Oxygen Systems Market, By Aircraft Type

- Narrow Body

- Wide Body

- Very Large Aircraft

- Regional Transport Aircraft

Growth opportunities and latent adjacency in Aircraft Oxygen System Market