Connected Agriculture Market by Component (Solution, Platforms, and Services), Application (Pre-Production Planning and Management, In-Production Planning and Management, and Post-Production Planning and Management), and Region - Global Forecast to 2023

[134 Pages Report] Connected agriculture is defined as the use of advanced technological solutions and services to improve, manage, and control the farming activities involved in pre-production, in-production, and post-production. Connected agriculture comprises 4 major steps, namely, data sensing, data communications, data storage, and data processing. The information generated from these steps helps various stakeholders, such as farmers, growers, livestock producers, farming cooperatives, agribusinesses, grape wine growers, seed companies, fertilizer companies, food and beverage companies, and governments, to make real-time decisions that help maximize their Return on Investment (RoI).

The Connected Agriculture Market estimated to grow from USD 1.78 billion in 2018 to USD 4.31 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 19.3% from 2018 to 2023. Major growth drivers for this market include growing need to increase per yield production and increased government initiatives to adopt new technologies

Attractive Opportunities in the Connected Agriculture Market

Source: Investor Presentations, Experts’ Interviews, and MarketsandMarkets Analysis

Device management is expected to account for the largest market size during the forecast period.

The device management solutions assist organizations to manage, track, secure, and sustain abundant devices that are used in connected agriculture deployment. The configuration management feature of the device management solution is used to configure new devices, in accordance with the need of function. The devices are based on different communication technologies, and thus, consist of different communication interfaces and operating systems. The growing requirement for access and control over connected devices is expected to drive the Connected Agriculture Market.

In-production planning and management segment is expected to gain a larger market share during the forecast period.

In-production planning and management application area involves water and irrigation management, breeding and feed management, crop scouting, production monitoring and maintenance, animal tracking and navigation, and agri finance and insurance management. Connected agriculture solution and services help in gathering real-time information about farm irrigation, animal health, feeding behavior, hygiene, location tracking, crop production, and insurance among others, to enhance the crop, farm and livestock management process, improve the productivity, and the quality of production

Rapid adoption of connected agriculture technologies is expected to make North America the largest regional market.

Presence of a large number of connected agriculture solution vendors, continuous advancements in technology, and reduction in prices of agricultural equipment are some of the growth factors for the connected agriculture market in North America. Farmers, growers, and traders in North America are moving toward digitalization through the adoption of agriculture solution, which utilizes various advanced technologies, such as IoT, AI big data, data analytics, and predictive analytics.

Market Dynamics

Drivers - Growing need to increase farm yield and reduce labor

The demand for food is growing at a rapid rate due to increase in population across the globe. World population is growing at an exponential rate and is expected to reach approximately 9.6 billion by 2050. Each year, around 85 million people are added to the total population. According to Food and Agriculture Organization (FAO), to keep up with the population growth, the food production rate must double between 2014 and 2050. The global demand for food is increasing by 2% every year; by 2050, there would be a need to produce 70% more food worldwide compared to the current production pattern. Furthermore, to add on to this issue, farmers still heavily rely on weather conditions for food production. Any unpredictable change in weather condition affects the yield and farmers have to face losses. Issues such as global warming, deforestation, and other environmental problems in many developing countries across the globe are hampering the food production and livestock farming.

Connected agriculture solutions facilitate farmers to efficiently use their limited resources, such as water, seeds, land area, and fertilizers, to meet the growing demand for food. Connected agriculture solutions help farmers automate farm equipment, increase farm yield, reduce labor, improve productivity, and enhance operational efficiency. Connected agriculture solutions help in optimizing farm operations to cope with the imbalance between food production and consumption.

Restraints - High capital investment for establishing connected agriculture infrastructure

Currently, the implementation of connected agriculture techniques and solutions on farms requires high capital investment. Most farmers across the globe are marginal farmers or small landholding farmers, who find it difficult to invest in such expensive equipment. Connected agriculture requires high initial investments, efficient farming tools, and skilled and knowledgeable farmers, thereby making them hesitant to use this technology for gathering fundamental data. The access to the latest technology is restricted mostly to big and industrialized farms, owing to high technological cost. Farmers or growers have to make huge investments in drones, Geographic Information Systems (GIS), and Global Positioning Systems (GPS) to collect input data, variable rate technology, and satellite devices, among others. GPS technology-enabled devices for navigation and mapping applications are expensive and require high initial investments. The impact of this restraint is particularly high on the market in developing countries, such as India, China, and Brazil. Currently, a majority of the developing countries are importing farming equipment from developed countries, which contributes to the high product cost. However, various countries globally have started investing in the R&D of advanced farming solutions, owing to the increasing demand for efficient agriculture solutions that help increase the productivity of farms. In the coming years, advancements in technologies are expected to reduce the price of connected agriculture solutions, which in turn, would reduce the impact of this restraining factor on the connected agriculture market.

Opportunities - Integration of mobile technology in farm operations

Mobile phones have empowered the agriculture industry to extend its reach across various parts of the country and globe. The mobile technology is playing a significant role in the adoption of connected agriculture techniques across the globe. According to the Farm Journal Media Survey in February 2015, more than 60% of the farmers worldwide are already using smartphones and tablet computers. The use of smartphones among farmers has been steadily rising since 2009 and is expected to grow extensively in the coming years. Smartphone has become a new agriculture tool for farmers across the globe, as it is incorporated with multiple user-friendly applications (apps) related to agriculture.

Mobile technology has empowered farmers and agriculture stakeholders with timely access to relevant information regarding crops, production, agriculture technology, production standards, and agriculture finance. Smartphones help farmers get precise information on climate data and weather changes, which enables them to plan which crops to plant, when to harvest, and so on. Smartphones can be used for aerial imaging and record keeping, which are recommended tasks by experts. Growers can load field information and then grid the information based on acres by using their mobile phones.

Mobile phones help farmers and small and medium-sized agribusinesses across remote areas with prompt access to the marketplace. Smartphones enable small-scale farmers to connect with new customers or agents who were traditionally unreachable, thereby helping them gain an advantage in the marketplace. Mobiles help farmers get information regarding the availability of commodities and their prices in the market. The agriculture-specific applications in mobiles offer agricultural information to farmers, thereby helping them effectively use the information to make better decisions.

Challenges - Lack of awareness among end users

Farmers have lack of awareness regarding the benefits of implementing connected agriculture solutions. Most of the farmers in developing countries are still following the traditional methods of farming. They are not aware of the technological developments in the agriculture sector. It is difficult for farmers to adopt advanced techniques pertaining to connected agriculture solutions. This creates a technological gap and makes it difficult for farmers to understand the concepts and benefits of connected agriculture. There is a gap between connected agriculture service providers and farmers, which is due to the vendors’ inability to extend their reach to farmers. Particularly farmers in emerging countries face this challenge as they are still struggling with challenges pertaining to basic necessities, such as electricity and water shortage. Governments across the globe and market players are taking initiatives to provide training and consultation to farmers for tackling this problem; however, many farmers still remain outside the purview of such efforts. To overcome this challenge, many developing countries are investing in educating and informing their farming populace about the benefits of connected agriculture solutions and services. Furthermore, additional support from social bodies to raise the education level among farmers about how to increase their farm yield and improve the efficiency of farm operations would help empower agriculture stakeholders.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Value (USD) and Volume (kT) |

|

Segments covered |

Component, Platforms, Services, Application, and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America and MEA |

|

Companies covered |

It includes 15 major vendors, namely IBM (US), Microsoft (US), AT&T (US), Deere & Company (US), SAP SE (Germany), Accenture (Ireland), Cisco (US), Oracle (US), Iteris (US), Trimble (US), SMAG (France), Ag Leader Technology (US), Decisive Farming (Canada), Gamaya (Switzerland), and SatSure (UK) |

This research report categorizes the connected agriculture market to forecast revenues and analyze trends in each of the following submarkets:

On the basis of component, the connected agriculture market has been segmented as follows:

- Solution

- Platforms

- Services

On the basis of platforms, the Connected Agriculture Market has been segmented as follows:

- Device Management

- Application Enablement

- Connectivity Management

On the basis of services, the connected agriculture market has been segmented as follows:

- Consulting

- Integration and Implementation

- Support and Maintenance

On the basis of application, the Connected Agriculture Market has been segmented as follows:

- Pre-Production Planning and Management

- In-Production Planning and Management

- Post-Production Planning and Management

On the basis of regions, the connected agriculture market has been segmented as follows:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- Australia and New Zealand (ANZ)

- China

- Japan

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia (KSA)

- South Africa

- Israel

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Key Market Players

Key players in Connected Agriculture Market includes IBM (US), Microsoft (US), AT&T (US), Deere & Company (US), SAP SE (Germany), Accenture (Ireland), Cisco (US), Oracle (US), Iteris (US), Trimble (US), SMAG (France), Ag Leader Technology (US), Decisive Farming (Canada), Gamaya (Switzerland), and SatSure (UK).

IBM, one of the global providers of technology products, solutions, and services, was founded in 1911 and is headquartered in New York, US. The company operates in 5 major business segments, namely, technology services and cloud platforms, cognitive solutions, Global Business Services (GBS), systems, and global financing. It offers a diverse product portfolio in the arena of analytics, cloud, IoT, mobile, and security. The company offers Watson Decision platform to its global clientele for leveraging the benefits of connected agriculture. The solutions help customers analyze real-time data, improve the yield, and minimize risks. The company caters to a diversified clientele that is scattered across 175 countries, particularly in the Americas, APAC, and MEA. It caters its services to various industry verticals, including BFSI, insurance, manufacturing, electronics, telecommunications, media and entertainment, aerospace and defense, and life sciences.

Recent Developments

In June 2018, The Weather Company, an IBM business, partnered with one of the leading Indian agro startups, AgroStar. The partnership aims at transforming the traditional agricultural operations in rural parts and enables farmers to make informed decisions to increase productivity. As per the terms of the partnership, AgroStar would leverage the local weather forecast data and insights from The Weather Company and provide critical insights into crop disease risks and the probability of risk and disease occurrences to help farmers reduce the extent of crop damage and increase the yield.

In October 2018, Microsoft partnered with SlantRange, a leading provider of remote sensing and analytics system for agriculture. This partnership enabled SlantRange to offer new aerial measurements and data solutions for the agriculture industry.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the connected agriculture?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in Connected Agriculture Market?

- What are the opportunities for new market entrants?

Frequently Asked Questions (FAQ):

What is growth rate of connected agriculture market in the next five years?

What region holds the highest market share in the connected agriculture market?

What are the major applications in the connected agriculture market?

What are the key vendors in the connected agriculture market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

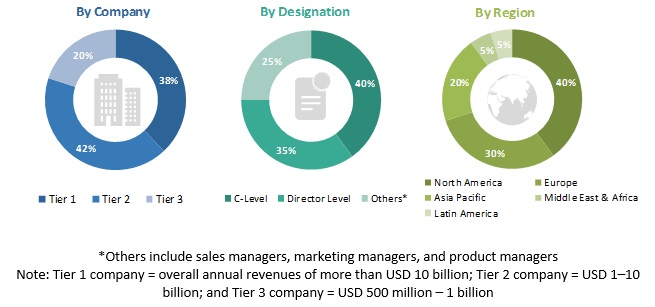

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in the Market

4.2 Market By Application and Country (2018)

4.3 Market Major Countries

5 Connected Agriculture Market Overview and Industry Trends (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Need to Increase Farm Yield and Reduce Labor

5.2.1.2 Government Initiatives for Modernizing the Agriculture Industry

5.2.2 Restraints

5.2.2.1 Poor Connectivity to Pose as the Biggest Hurdle in the Growth of the market

5.2.2.2 High Capital Investment for Establishing Connected Agriculture Infrastructure

5.2.3 Opportunities

5.2.3.1 Integration of Mobile Technology in Farm Operations

5.2.3.2 Rapid Adoption of Sensors, IoT, and Advanced Farming Techniques in Agriculture

5.2.3.3 Implementation of AI and Predictive Analytics to Enhance the Efficiency of Farm Operations

5.2.4 Challenges

5.2.4.1 Lack of Awareness Among Farmers About Connected Agriculture

5.2.4.2 Lack of Standards for Data Management in the Agriculture Industry

5.3 Industry Trends

5.3.1 Use Case 1: Fujitsu

5.3.2 Use Case 2: Amazon Web Services (AWS)

6 Connected Agriculture Market By Component (Page No. - 41)

6.1 Introduction

6.2 Solution

6.2.1 Growing Need to Increase Farm Productivity is Driving the Adoption of Connected Agriculture Solution

6.3 Platforms

6.3.1 Need to Build Efficient Connectivity and Synchronization Among Connected Farm Devices and Software is Driving the Adoption of Connected Agriculture Platforms

6.4 Services

6.4.1 Need to Empower Farmers to Enhance Farm Productivity Through Efficient Use of Connected Devices is Driving the Adoption of Connected Agriculture Services

7 Connected Agriculture Market By Platform (Page No. - 46)

7.1 Introduction

7.2 Device Management

7.2.1 Growing Requirement for Access and Control Over Connected Devices is Driving the Adoption of Device Management

7.3 Application Enablement

7.3.1 Growing Need to Enhance Security to Combat Increasing Cyber Threats in the IoT Ecosystem is Driving the Adoption of Application Enablement

7.4 Connectivity Management

7.4.1 Need for Proper Connectivity for Effective Implementation of Connected Agriculture Technology on Farm is Driving the Adoption of Connectivity Management

8 Connected Agriculture Market By Service (Page No. - 51)

8.1 Introduction

8.2 Consulting

8.2.1 Increasing Demand of Farmers to Improve Farm Yield With the Help of Expert Advice is Driving the Growth of Consulting Services

8.3 Integration and Implementation

8.3.1 Need to Avoid Complexities in the Deployment of Connected Agriculture Solutions to Drive the Growth of Integration and Implementation

8.4 Support and Maintenance

8.4.1 Need to Upkeep System Performance With Routine Infrastructure Maintenance is Driving the Growth of Support and Maintenance Services Segment

9 Connected Agriculture Market By Application (Page No. - 56)

9.1 Introduction

9.2 Pre-Production Planning and Management

9.2.1 Field Mapping

9.2.1.1 Accurate Positioning of Seeds and Monitoring of Soil Condition to Drive the Demand for Field Mapping Application Segment

9.2.2 Crop Planning and Yield Monitoring

9.2.2.1 Need for Maximizing Crop Production to Push Farmers to Adopt Connected Agriculture Solution for Crop Planning and Yield Monitoring Application

9.2.3 Weather Tracking and Forecasting

9.2.3.1 Need to Minimize the Environmental Effect on Crop Production to Drive the Adoption of Weather Tracking and Forecasting Application

9.2.4 Farm Labor Management

9.2.4.1 Need for Adequate Management of Labor to Reduce the Cost of Crop Production is Increasing the Deployment of Farm Labor Management Application

9.2.5 Equipment Monitoring and Maintenance

9.2.5.1 Need to Minimize Labor, Time, and Cost Involved in Farming Processes to Drive the Demand for Equipment Monitoring and Maintenance Application

9.3 In-Production Planning and Management

9.3.1 Water and Irrigation Management

9.3.1.1 Need for Enhancing Water Efficiency and Gain A Profitable Yield to Increase the Adoption of Water and Irrigation Management Application

9.3.2 Breeding and Feed Management

9.3.2.1 Need to Increase Animal Productivity and Plan Optimal Diet for Animals to Drive the Adoption of Breeding and Feed Management Application

9.3.3 Crop Scouting

9.3.3.1 Automation of Croup Scouting Process to Drive the Demand for Crop Scouting Application

9.3.4 Production Monitoring and Maintenance

9.3.4.1 Need to Maximize Crop Yield From the Farmland to Drive the Demand for Production Monitoring and Maintenance Application

9.3.5 Animal Tracking and Navigation

9.3.5.1 Need to Improve the Productivity of Animal Driving the Demand for Animal Tracking and Navigation Segment

9.3.6 Agri Finance and Insurance Management

9.3.6.1 Growing Focus on Farmers to Make A Higher Investment in Farming Practices and Lowering the Risk Associated With Damage of Crops is Driving the Demand for Agri Finance and Insurance Management Segment

9.4 Post-Production Planning and Management

9.4.1 Processing

9.4.1.1 Need to Convert Raw Product Into A Valuable Marketable Product to Drive the Processing Segment

9.4.2 Inventory Management

9.4.2.1 Need for Adequate Storage of Farming Product is Driving the Demand for Inventory Management Application Segment

9.4.3 Transportation

9.4.3.1 Need for Streamlining Time to Market is Driving the Demand for the Transportation Application Area

9.4.4 Quality Assurance and Control

9.4.4.1 Need to Improve Quality of Products and Effective Control Measures is Driving the Quality Assurance and Control Segment

10 Connected Agriculture Market By Region (Page No. - 66)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.1.1 Automation of Farming Processes for Increasing Production to Drive the US Connected Agriculture Market

10.2.2 Canada

10.2.2.1 Deployment of Connected Agriculture Solution to Track Animals to Fuel the Market Growth in Canada

10.3 Europe

10.3.1 Germany

10.3.1.1 Developed Communication Infrastructure to Propel the Market Growth in Germany

10.3.2 United Kingdom

10.3.2.1 Digital Farming Practice to Drive the Adoption of Connected Agriculture Solution and Services in the United Kingdom

10.3.3 France

10.3.3.1 Increasing Focus on Environment Protection to Encourage Deployment of Connected Agriculture Solution in France

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 Australia and New Zealand

10.4.1.1 Initiatives By Agriculture Committees and Organizations to Drive the Adoption of Digital Agriculture Technologies

10.4.2 China

10.4.2.1 Growing Need Among Agriculture Stakeholders to Adopt Smart Techniques to Fuel the Market Growth in China

10.4.3 Japan

10.4.3.1 Rapid Development of Connected Agricultural Equipment to Drive the Market in Japan

10.4.4 Rest of Asia Pacific

10.5 Middle East and Africa

10.5.1 Kingdom of Saudi Arabia

10.5.1.1 Increasing Investments in Aquaculture to Drive the Connected Agriculture Market in the Kingdom of Saudi Arabia

10.5.2 South Africa

10.5.2.1 Government Initiatives to Boost the Market Growth in South Africa

10.5.3 Israel

10.5.3.1 Shortage of Labor to Boost the Adoption of Connected Agriculture Solution and Services in Israel

10.5.4 Rest of Middle East and Africa

10.6 Latin America

10.6.1 Brazil

10.6.1.1 Increasing Awareness About Advanced Agriculture Techniques to Drive the Adoption of Connected Agriculture Solution and Services in Brazil

10.6.2 Mexico

10.6.2.1 Digital Revolution in the Agriculture Vertical to Boost the Market Growth in Mexico

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 86)

11.1 Overview

11.2 Competitive Scenario

11.2.1 Product/Solution Launches and Enhancements

11.2.2 Business Expansions

11.2.3 Acquisitions

11.2.4 Partnerships, Agreements, and Collaborations

11.3 Competitive Leadership Mapping

11.3.1 Visionary Leaders

11.3.2 Dynamic Differentiators

11.3.3 Innovators

11.3.4 Emerging Companies

12 Company Profiles

12.1 Introduction

12.2 IBM

12.2.1 Business Overview

12.2.2 Platforms And Services Offered

12.2.3 Recent Developments

12.2.4 Swot Analysis

12.2.5 MnM View

12.3 Microsoft

12.3.1 Business Overview

12.3.2 Products And Services Offered

12.3.3 Recent Development

12.3.4 Swot Analysis

12.3.5 MnM View

12.4 AT &T

12.4.1 Business Overview

12.4.2 Solutions And Services Offered

12.4.3 Recent Developments

12.4.4 Swot Analysis

12.4.5 MnM View

12.5 Deere & Company

12.5.1 Business Overview

12.5.2 Solutions Offered

12.5.3 Recent Developments

12.5.4 Swot Analysis

12.5.5 MnM View

12.6 SAP

12.6.1 Business Overview

12.6.2 Solutions And Services Offered

12.6.3 Recent Developments

12.6.4 Swot Analysis

12.6.5 MnM View

12.7 Accenture

12.7.1 Business Overview

12.7.2 Solutions And Services Offered

12.7.3 MnM View

12.8 Cisco

12.8.1 Business Overview

12.8.2 Products And Services Offered

12.8.3 Recent Development

12.8.4 MnM View

12.9 Oracle

12.9.1 Business Overview

12.9.2 Products Offered

12.9.3 Recent Developments

12.9.4 MnM View

12.10 Iteris

12.10.1 Business Overview

12.10.2 Solutions, Products, And Services Offered

12.10.3 Recent Developments

12.11 Trimble

12.11.1 Business Overview

12.11.2 Solutions Offered

12.11.3 Recent Developments

12.11.4 MnM View

12.12 Smag

12.12.1 Business Overview

12.12.2 Software And Services Offered

12.12.3 Recent Developments

12.12.4 MnM View

12.13 Ag Leader Technology

12.14 Decisive Farming

12.15 Gamaya

12.16 Satsure

13 Appendix

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List Of Tables (49 Tables)

Table 1 United States Dollar Exchange Rate, 2015–2017

Table 2 Factor Analysis

Table 3 Connected Agriculture Market Size, By Component, 2016–2023 (Usd Million)

Table 4 Solution: Market Size, By Region, 2016–2023 (Usd Million)

Table 5 Platforms: Market Size, By Region, 2016–2023 (Usd Million)

Table 6 Services: Market Size, By Region, 2016–2023 (Usd Million)

Table 7 Connected Agriculture Market Size, By Platform, 2016–2023 (Usd Million)

Table 8 Device Management: Market Size, By Region, 2016–2023 (Usd Million)

Table 9 Application Enablement: Market Size, By Type, 2016–2023 (Usd Million)

Table 10 Connectivity Management: Market Size, By Type, 2016–2023 (Usd Million)

Table 11 Connected Agriculture Market Size, By Service, 2016–2023 (Usd Million)

Table 12 Consulting: Connected Agriculture Market Size, By Region, 2016–2023 (Usd Million)

Table 13 Integration And Implementation: Market Size, By Region, 2016–2023 (Usd Million)

Table 14 Support And Maintenance: Market Size, By Region, 2016–2023 (Usd Million)

Table 15 Connected Agriculture Market Size, By Application, 2016–2023 (Usd Million)

Table 16 Pre-Production Planning And Management: Market Size, By Region, 2016–2023 (Usd Million)

Table 17 In-Production Planning And Management: Market Size, By Region, 2016–2023 (Usd Million)

Table 18 Post-Production Planning And Management: Market Size, By Region, 2016–2023 (Usd Million)

Table 19 Connected Agriculture Market Size, By Region, 2016–2023 (Usd Million)

Table 20 North America: Market Size, By Component, 2016–2023 (Usd Million)

Table 21 North America: Market Size, By Platform, 2016–2023 (Usd Million)

Table 22 North America: Connected Agriculture Market Size, By Service, 2016–2023 (Usd Million)

Table 23 North America: Market Size, By Application, 2016–2023 (Usd Million)

Table 24 North America: Market Size, By Country, 2016–2023 (Usd Million)

Table 25 Europe: Connected Agriculture Market Size, By Component, 2016–2023 (Usd Million)

Table 26 Europe: Market Size, By Platform, 2016–2023 (Usd Million)

Table 27 Europe: Market Size, By Service, 2016–2023 (Usd Million)

Table 28 Europe: Connected Agriculture Market Size, By Application, 2016–2023 (Usd Million)

Table 29 Europe: Market Size, By Country, 2016–2023 (Usd Million)

Table 30 Asia Pacific: Connected Agriculture Market Size, By Component, 2016–2023 (Usd Million)

Table 31 Asia Pacific: Market Size, By Platform, 2016–2023 (Usd Million)

Table 32 Asia Pacific: Connected Agriculture Market Size, By Service, 2016–2023 (Usd Million)

Table 33 Asia Pacific: Market Size, By Application, 2016–2023 (Usd Million)

Table 34 Asia Pacific: Market Size, By Country, 2016–2023 (Usd Million)

Table 35 Middle East And Africa: Connected Agriculture Market Size, By Component, 2016–2023 (Usd Million)

Table 36 Middle East And Africa: Market Size, By Platform, 2016–2023 (Usd Million)

Table 37 Middle East And Africa: Connected Agriculture Market Size, By Service, 2016–2023 (Usd Million)

Table 38 Middle East And Africa: Market Size, By Application, 2016–2023 (Usd Million)

Table 39 Middle East And Africa: Market Size, By Country, 2016–2023 (Usd Million)

Table 40 Latin America: Connected Agriculture Market Size, By Component, 2016–2023 (Usd Million)

Table 41 Latin America: Market Size, By Platform, 2016–2023 (Usd Million)

Table 42 Latin America: Connected Agriculture Market Size, By Service, 2016–2023 (Usd Million)

Table 43 Latin America: Market Size, By Application, 2016–2023 (Usd Million)

Table 44 Latin America: Connected Agriculture Market Size, By Country, 2016–2023 (Usd Million)

Table 45 Product/Solution Launches And Enhancements, 2016–2018

Table 46 Business Expansions, 2017–2018

Table 47 Acquisitions, 2018

Table 48 Partnerships, Agreements, And Collaborations, 2018

Table 49 Evaluation Criteria

List Of Figures (36 Figures)

Figure 1 Connected Agriculture Market: Research Design

Figure 2 Top Down And Bottom Up Approch

Figure 3 Pre-Production Planning And Management Segment And Device Management To Hold The Highest Market Shares In The Connected Agriculture Market In 2018

Figure 4 North America To Account For The Highest Share Of The Connected Agriculture Market In 2018

Figure 5 Growing Need And Focus To Improve Farm Operations By Adopting Modern Farming Technologies To Drive The Growth Of The Connected Agriculture Market

Figure 6 Pre-Production Planning And Management Segment And United States To Account For The Highest Shares In The North American Connected Agriculture Market In 2018

Figure 7 Australia And New Zealand To Grow At The Highest Rate During The Forecast Period

Figure 8 Drivers, Restraints, Opportunities, And Challenges: Connected Agriculture Market

Figure 9 World Food Consumption In Kcal/Person/Day By 2030

Figure 10 Global Agtech Investment In Usd Billion (2012–2016)

Figure 11 Services Segment To Grow At The Highest Cagr During The Forecast Period

Figure 12 Connectivity Management Segment To Grow At The Highest Cagr During The Forecast Period

Figure 13 Consulting Services Segment To Grow At The Highest Cagr During The Forecast Period

Figure 14 In-Production Planning And Management Segment To Grow At A Higher Cagr During The Forecast Period

Figure 15 Asia Pacific To Witness Significant Growth During The Forecast Period

Figure 16 North America: Market Snapshot

Figure 17 Asia Pacific: Market Snapshot

Figure 18 Key Developments In The Market, 2016–2018

Figure 19 Market Evaluation Framework

Figure 20 Connected Agriculture Market (Global), Competitive Leadership Mapping, 2018

Figure 21 Geographic Revenue Mix Of The Top Market Players

Figure 22 IBM: Company Snapshot

Figure 23 Swot Analysis: IBM

Figure 24 Microsoft: Company Snapshot

Figure 25 Swot Analysis: Microsoft

Figure 26 At&T: Company Snapshot

Figure 27 Swot Analysis: At&T

Figure 28 Deere & Company: Company Snapshot

Figure 29 Swot Analysis: Deere & Company

Figure 30 SAP: Company Snapshot

Figure 31 Swot Analysis: SAP

Figure 32 Accenture: Company Snapshot

Figure 33 Cisco: Company Snapshot

Figure 34 Oracle: Company Snapshot

Figure 35 Iteris: Company Snapshot

Figure 36 Trimble: Company Snapshot

The study involved 4 major activities in estimating the current market size for the connected agriculture market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments of the connected agriculture market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva have been referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, certified publications and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The connected agriculture market comprises several stakeholders, such as connected agriculture vendors, system integrators, consulting service providers, resellers and distributors, research organizations, government agencies, enterprise users, technology providers, venture capitalists, private equity firms, and startup companies. The demand-side of the connected agriculture market consists of farmers, growers, cooperatives, agribusiness, seed companies, fertilizer companies, and food and beverage companies. The supply-side includes connected agriculture providers, offering connected agriculture solutions and services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the connected agriculture market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Report Objectives

- To define, describe, and forecast the connected agriculture market by component (solution, platforms, and services), application, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the market

- To forecast the market size of 5 main regional segments, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their core competencies in each microsegment

- To analyze the competitive developments, such as agreements, partnerships, alliances, and acquisitions, in the connected agriculture market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the European connected agriculture market into countries

- Further breakup of the APAC market into countries

- Further breakup of the MEA market into countries

- Further breakup of the Latin American market into countries

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Connected Agriculture Market