Connected Tires Market by Vehicle Type, Component, Rim Size (12-17 Inches, 18-22 Inches, More than 22 Inches), Sales Channel (OEM, Aftermarket), Propulsion (Electric, ICE), Offering (Hardware, Software) and Region - Global Forecast to 2028

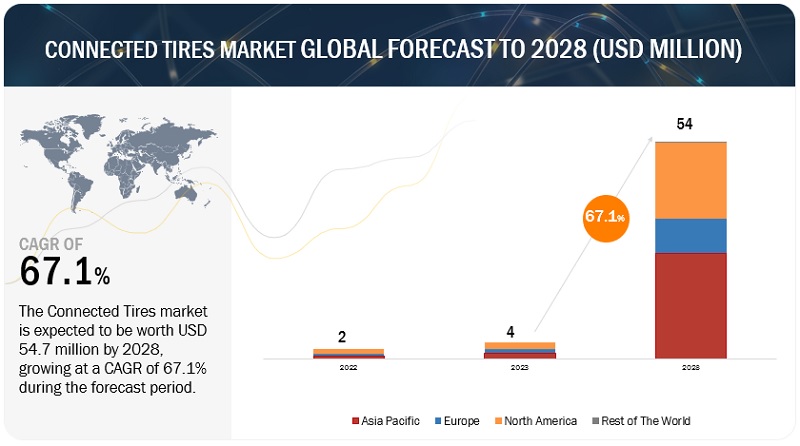

[225 Pages Report] The global Connected Tires Market is projected to grow from USD 4 million in 2023 to USD 54 million by 2028, registering a CAGR of 67.1%. New technological trends are shaping the market. One of the most notable is the emergence of 5G connectivity, which promises faster data transfer speeds and more reliable connections. This technology could enable real-time monitoring of tire data, even at high speeds, and allow for more advanced analytics and predictive maintenance. The Internet of Things (IoT) is increasingly integrated into connected tires systems, allowing seamless communication between tires and other devices, such as vehicles, smartphones, and cloud-based analytics platforms. These developments will likely drive innovations in the connected tires market and make them more valuable for consumers and businesses.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Connected Tires Market Dynamics:

Driver: Increase demand for vehicle safety

One of the primary drivers of the connected tires market is the increasing demand for vehicle safety. There is a growing awareness of the importance of tire health, performance, and safety due to the increasing number of road accidents every year. Connected tires provide real-time data on tire pressure, temperature, tread depth, and other metrics, allowing drivers and fleet operators to identify potential issues before they become dangerous. Advancements in technology play a key role in the growth of the market. With the emergence of the Internet of Things (IoT) and 5G connectivity, connected tires can communicate wirelessly with other devices, such as vehicles, smartphones, and cloud-based analytics platforms, allowing for real-time monitoring and advanced analytics. Tire manufacturers are investing in R&D to create new materials, designs, and sensors to enhance tire performance and safety.

Restraint: High cost of connected tire technology

Connected tires systems require various sensors and communication technologies, which can add significant costs to the overall vehicle price. As a result, many consumers may hesitate to invest in these systems, particularly in markets with high price sensitivity. Fleet operators may be concerned about the return on investment of connected tire systems, particularly if they operate in industries with low margins. Another significant restraint on the connected tire market is data privacy and cybersecurity concerns. As connected tire systems transmit sensitive data about vehicle performance, location, and driver behavior, legitimate concerns exist about how this data is collected, stored, and used. Consumers may hesitate to adopt connected tire systems if they are not confident that their data is being handled securely and ethically. Additionally, fleet operators may be concerned about the potential for cyberattacks that could compromise the safety of their vehicles and drivers.

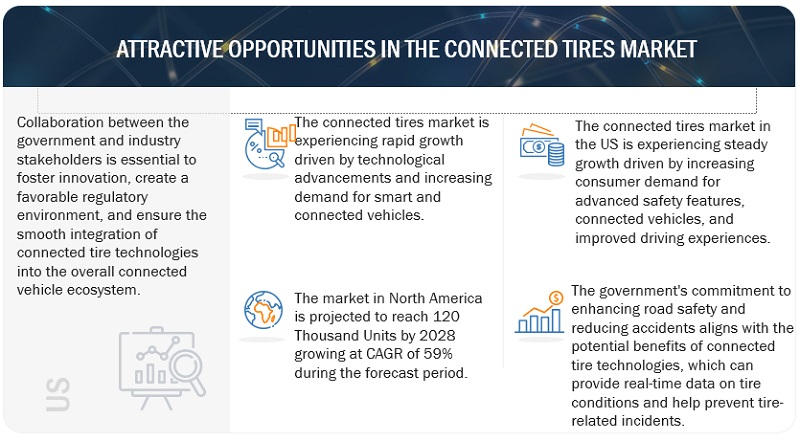

Opportunity: Increased Acceptance of Connected Mobility

The widespread acceptance of connected mobility represents a tremendous opportunity for the connected tires market. As the concept of smart vehicles gains traction, there is a growing demand for tires that can seamlessly integrate with the Internet of Things (IoT). Connected tires offer a range of benefits, including real-time monitoring of tire performance, accurate pressure and temperature readings, and predictive maintenance insights. These features not only enhance safety but also optimize fuel efficiency and extend tire lifespan. With the increasing focus on intelligent transportation systems, the market is poised for significant growth, driven by the need for advanced tire technologies in the era of connected mobility.

Challenge: Lack of Standardization

The lack of standardization poses a significant challenge for the connected tires market. With various tire manufacturers and automotive companies developing their own proprietary technologies, interoperability and compatibility issues arise. The absence of standardized protocols and communication systems hampers the seamless integration of connected tires across different vehicles and platforms. This lack of standardization also affects data sharing and interoperability among various stakeholders, limiting the potential for collaboration and innovation. To overcome this challenge, industry players, regulatory bodies, and technology organizations need to work together to establish common standards and protocols that ensure interoperability, compatibility, and data security, fostering the widespread adoption and growth of connected tires in the market.

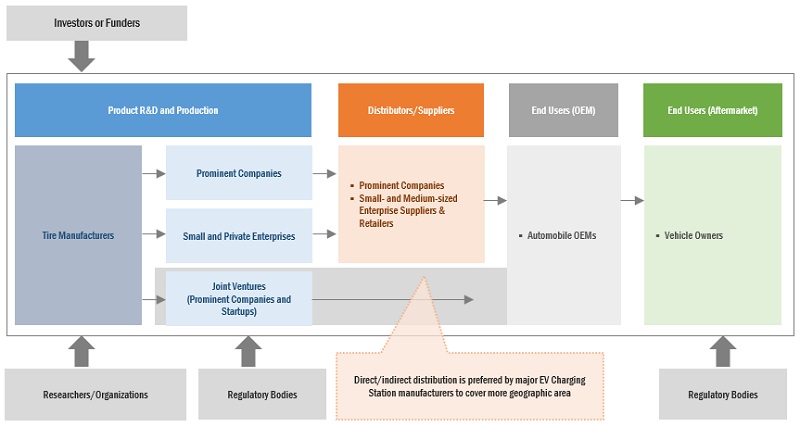

Connected Tires Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of Tires and OEMs. These companies have been operating in tires for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Bridgestone (Japan), Michelin (France), Goodyear (US), Continental AG (Germany), and Pirelli (Italy).

Based on Vehicle Type, Passenger Cars is expected to have significant market share during forecast period

Passenger cars (PCs) are designed primarily for the transportation of passengers. They are widely used for personal transportation, and their demand is expected to increase due to urbanization, rising disposable incomes, and changing lifestyles. Passenger cars are one of the key segments, accounting for a significant share of the market. The increasing adoption of advanced safety features, the growing popularity of electric vehicles, and the rise of connected car technologies drive the demand for connected tires in passenger cars. Connected tires in passenger cars offer a range of benefits, such as improved safety, enhanced fuel efficiency, and reduced emissions. For instance, connected tire sensors can provide real-time information on tire pressure and temperature, allowing drivers to take corrective action to prevent accidents and ensure optimal performance.

Connected tires can help reduce fuel consumption and emissions by optimizing tire pressure and rolling resistance. This can significantly impact the environment, as passenger cars are a major contributor to air pollution and greenhouse gas emissions. The use of advanced sensors and materials and the integration of artificial intelligence and machine learning drive innovation in the connected tires market for passenger cars. The increasing use of cloud-based platforms and mobile applications for remote monitoring and maintenance brings opportunities for market players.

Accelerometer Sensor is fast growing segment during the forecast period

Accelerometer sensors are becoming increasingly important in the connected tire market. These sensors are used to measure tire performance metrics such as tire deformation, vibration, and shock. The data generated by these sensors can be used to optimize tire design and improve vehicle safety, performance, and fuel efficiency. The system can detect and analyze data such as road roughness, potholes, and cracks, allowing drivers to adjust their driving behavior and improve vehicle safety. As the demand for connected tires with advanced sensing capabilities continues to grow, the market for accelerometers is expected to experience significant growth in the coming year.

12-17 Inches Segment to witness significant growth rate during the forecast period

The market for the 12–17 inches segment is expected to be driven by the increasing demand for advanced safety features in vehicles, including tire monitoring systems. The growth of electric vehicles is also expected to fuel demand for connected tires, as they require more precise and efficient monitoring systems. The trend of connected cars is a significant driver of growth, creating a need for real-time vehicle data analysis and monitoring. For instance, Continental's CARE system uses sensors to monitor tire pressure, temperature, and other critical parameters in real time, providing drivers with immediate alerts and recommendations for maintenance. ContiConnect is a tire monitoring system that can contribute to the optimization of tire performance. This system utilizes sensors embedded in the wheels of vehicles to monitor the pressure and temperature of every tire remotely. The data collected is analyzed and interpreted for the entire fleet, allowing for the prevention of tire-related breakdowns and increasing vehicle uptime. Real-time status updates and alerts generated by the rise in system productivity reduce maintenance requirements and save costs for fleet owners.

AI fleet management systems are expected to improve decision making by taking better routes to avoid traffic, predicting hazards more accurately, and effectively diagnosing and resolving maintenance issues. Increased efficiency provided by these systems can lead to reduced emissions and more fuel-efficient driving, enhancing the sustainability of entire fleets. Data-driven optimization can help prevent accidents by detecting slow leaks and underinflated tires, particularly in shared vehicles with multiple users who may not regularly check tire pressure.

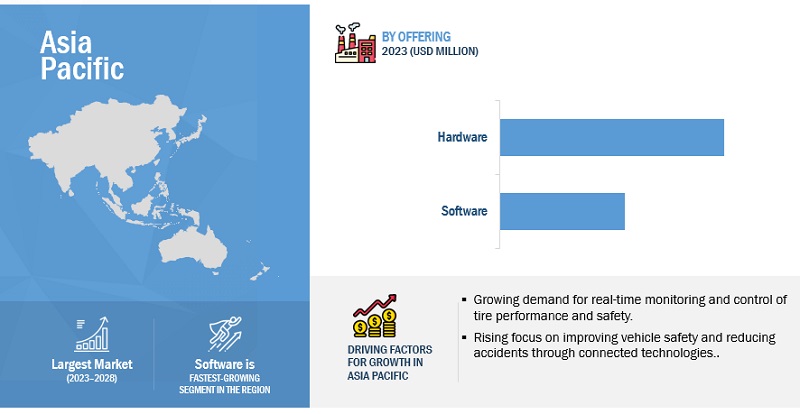

Asia Pacific to be the largest market by volume during the forecast period

Asia Pacific is estimated to account for the largest market share by 2028, followed by North America and Europe. China is the leading country in the region, with a large number of vehicle sales and a growing demand for connected tires. Countries like China, India, and Japan are expected to drive growth in this region. They are home to some of the world's leading tire manufacturers, such as Bridgestone, Michelin, and Goodyear. In addition, increasing government initiatives to promote the adoption of connected mobility solutions are also expected to contribute to the growth of this market in the region. The Asia Pacific region is witnessing a significant increase in the production of electric vehicles, which is further expected to boost the demand for connected tires with features such as tire pressure monitoring systems and real-time data analysis capabilities. As people in the region become more aware of the benefits of new technologies, including increased safety and performance, they are becoming more willing to adopt these innovations. Economic growth and rapid urbanization have also increased the number of vehicles on the road, creating a prospective market for connected tires.

Key Market Players

The connected tires market is dominated by major tire manufacturers, including Bridgestone (Japan), Michelin (France), Goodyear (US), Continental AG (Germany), and Pirelli (Italy). They develop tires and provide tire related services for different vehicle type. They have initiated partnerships to develop their Connected tires technology and provide products and services to their respective customers for the market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Volume (Thousand Units) and Value (USD Million) |

|

Segments covered |

Offering, Propulsion, Rim Size, Sales Channel, Vehicle Type, Component and Region |

|

Geographies covered |

North America, Europe, Rest of The World and Asia Pacific |

|

Companies Covered |

Bridgestone (Japan), Michelin (France), Goodyear (US), Continental AG (Germany), and Pirelli (Italy) |

This research report categorizes the Connected Tires market based on Offering, Propulsion, Rim Size, Sales Channel, Vehicle Type, Component and Region

Based on Offering:

- Hardware

- Software

Based on Propulsion:

- Electric

- ICE

Based on Rim Size:

- 12-17 Inches

- 18-22 Inches

- More Than 22 Inches

Based on Sales Channel:

- OEM

- Aftermarket

Based on Component:

- TPMS

- Accelerometer sensors

- Strain gauge sensors

- RFID chips

- Other sensors

Based on Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Based on the Region:

-

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Thailand

- Rest of ASIA Pacific

-

North America (NA)

- US

- Canada

- Mexico

-

Europe (EU)

- France

- Germany

- Spain

- UK

- Turkey

- Russia

- Italy

- Rest of Europe

-

Rest of the World (RoW)

- South Africa

- Brazil

- Other Countries

Recent Developments

- In March 2023, Continental AG showcased its digital tire management system, Conti Connect 2.0. The system enables fleet managers to monitor tire condition continuously, saving fuel and reducing CO2 emissions. This monitoring feature helps prevent early tire replacements and unscheduled downtime, resulting in better operational efficiency for fleets.

- In December 2022, Bridgestone showcased its vision for sustainable mobility at CES 2023. The company displayed a range of innovative technologies that aim to reduce carbon emissions, improve fuel efficiency and enhance safety on the road.

- In June 2022, Hyundai Motor Group and Michelin have partnered to develop next-generation tires for premium electric vehicles (EVs). The collaboration aims to address the challenges of optimizing tire performance for EVs, such as reducing rolling resistance to maximize range and improving noise and vibration characteristics. The partnership explored the use of sustainable materials for tire production. The two companies plan to conduct joint R&D and test the new tires on Hyundai Motor Group's EVs. The ultimate goal is to foster clean mobility and contribute to the transition to a low-carbon society.

- In October 2022, Pirelli invested USD 121.63 million in its plant in Silao, Mexico. The investment is part of its strategic plan to strengthen its industrial presence in the Americas and improve its competitiveness in the global tire market. The investment is used to expand and modernize the Silao plant, which produces high-performance tires for cars and light trucks. The plant is equipped with new production technologies, such as automated warehouses and robots, to increase efficiency and reduce costs. The expansion will also create new job opportunities for the local community. Pirelli's investment in the Silao plant is expected to enhance its production capacity, improve product quality, and support sustainable growth.

- In February 2022, Bridgestone Corporation has developed tire-sensing technology to detect real-time road conditions. Using advanced sensors and AI, it provides drivers with information about temperature, wetness, and slipperiness. The technology results from Bridgestone's investment of approximately USD 223 million and will be commercialized in 2024, enhancing tire safety and performance.

Frequently Asked Questions (FAQ):

Which are the major companies in the Connected Tires market? What are their major strategies to strengthen their market presence?

The Connected Tires market is dominated by major Tire manufacturers, including Bridgestone (Japan), Michelin (France), Goodyear (US), Continental AG (Germany), and Pirelli (Italy). They develop tire and provide tire related services for their customers. They have initiated partnerships with major OEMs and startups to develop connected tires technology.

Which region is expected to be the largest market during the forecast period?

Asia Pacific will be the fastest-growing market in the Connected tires market vehicles due to the huge volume of investments for connected mobility in the region.

Which are the key technology trends prevailing in the Connected tires market?

The key technologies affecting the Connected Tires market are the 5G Connectivity, IOT Integration, Artificial Intelligence and Machine Learning.

What is the total CAGR expected to be recorded for the Connected Tire market during 2023-2028?

The CAGR is expected to record a CAGR of 67.1% from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERSRESTRAINTSOPPORTUNITIESCHALLENGES

-

5.3 CONNECTED TIRES MARKET ECOSYSTEMTIRE MANUFACTURERSTECHNOLOGY PROVIDERSIOT PLATFORM PROVIDERSAUTOMOTIVE OEMSCONNECTIVITY PROVIDERS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 PRICING ANALYSIS

-

5.6 PATENT ANALYSISLEGAL STATUS OF PATENTS

-

5.7 CASE STUDIESCASE STUDY 1: SMART TIRES IOT PRODUCT DEVELOPMENTCASE STUDY 2: BUILDING BETTER TIRES WITH AICASE STUDY 3: TIREMATICS CLOUD SYSTEMCASE STUDY 4: CONTINENTAL AND HEWLETT PACKARD ENTERPRISE (HPE)CASE STUDY 5: PIRELLI AND ERICSSON

-

5.8 TECHNOLOGY ANALYSIS5G CONNECTIVITYIOT INTEGRATIONARTIFICIAL INTELLIGENCE AND MACHINE LEARNINGAUGMENTED REALITY

-

5.9 TRADE ANALYSISIMPORT DATAEXPORT DATA

-

5.10 REGULATORY FRAMEWORKNORTH AMERICAEUROPEASIA PACIFICREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS, BY REGION

- 5.11 TRENDS AND DISRUPTIONS

- 5.12 SOLUTION COMPARISON BY LEADING PLAYERS

-

5.13 MACROECONOMIC INDICATORSGDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAPASSENGER CARSCOMMERCIAL VEHICLESKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIAROI ANALYSIS

- 5.15 KEY CONFERENCES AND EVENTS IN 2023 AND 2024

-

5.16 CONNECTED TIRES MARKET SCENARIO (2023–2028)MOST LIKELY SCENARIOOPTIMISTIC SCENARIOPESSIMISTIC SCENARIO

- 6.1 INTRODUCTION

-

6.2 12–17 INCHESINCORPORATION OF NEW TECHNOLOGIES FOR BETTER PRODUCTIVITY

-

6.3 18–22 INCHESENABLES BETTER PERFORMANCE AND HANDLING AT HIGHER SPEEDS FOR SUVS, SPORTS CARS, AND OTHERS

-

6.4 MORE THAN 22 INCHESINCREASED USAGE IN COMMERCIAL AND HEAVY-DUTY VEHICLES

- 6.5 KEY PRIMARY INSIGHTS

- 7.1 INTRODUCTION

-

7.2 ELECTRICSUSTAINABLE AND ECO-FRIENDLY SOLUTION

-

7.3 ICEDEVELOPMENT OF NEW CONNECTED TIRE TECHNOLOGIES TO ENHANCE FUEL EFFICIENCY

- 7.4 KEY PRIMARY INSIGHTS

- 8.1 INTRODUCTION

- 8.2 OEM

- 8.3 AFTERMARKET

- 9.1 INTRODUCTION

-

9.2 PASSENGER CARSINTEGRATION OF AI AND ML FOR BETTER RESULTS

-

9.3 COMMERCIAL VEHICLESNEED FOR ENHANCED SAFETY AND EFFICIENCY

- 9.4 KEY INDUSTRY INSIGHTS

- 10.1 INTRODUCTION

-

10.2 SOFTWAREINVESTMENTS IN CLOUD-BASED PLATFORMS FOR REAL-TIME DATA ANALYSIS AND TIRE MONITORING

-

10.3 HARDWARER&D INVESTMENTS IN NEXT-GENERATION CONNECTED TIRES

- 10.4 KEY PRIMARY INSIGHTS

- 11.1 INTRODUCTION

-

11.2 ACCELEROMETER SENSORSMEASURES TIRE PERFORMANCE METRICS

-

11.3 STRAIN GAUGE SENSORSMORE RELIABLE AND COST-EFFECTIVE

-

11.4 RFID CHIPSALLOWS QUICK AND EASY IDENTIFICATION AND TRACKING OF TIRES

-

11.5 TPMSMANDATED BY GOVERNMENTS WORLDWIDE TO IMPROVE ROAD SAFETY

- 11.6 OTHER SENSORS

- 11.7 KEY PRIMARY INSIGHTS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICACANADA- Increased demand for technologies to optimize performance and efficiency of electric vehiclesUS- Strong government support and presence of leading providersMEXICO- Implementation of several initiatives by government to promote connected technologies

-

12.3 ASIA PACIFICCHINA- Government initiatives to promote technological advancementsINDIA- Increased investment by government in connected mobility marketJAPAN- High R&D investmentsSOUTH KOREA- Partnerships to develop next-generation tires for premium electric vehiclesTHAILAND- Low awareness among consumers of connected tiresREST OF ASIA PACIFIC

-

12.4 EUROPEFRANCE- Investment by manufacturers to develop new and innovative connected tire technologiesGERMANY- Ideal market for adoption of connected tiresRUSSIA- Automotive demand set to recoverITALY- Need for efficient and safe transportationUK- Higher growth in fleet management sectorTURKEY- Market to grow at slow rateSPAIN- Presence of major automotive manufacturersREST OF EUROPE

-

12.5 REST OF THE WORLDBRAZILSOUTH AFRICAOTHER COUNTRIES

- 13.1 OVERVIEW

- 13.2 MARKET RANKING ANALYSIS FOR CONNECTED TIRES MARKET

- 13.3 REVENUE ANALYSIS OF TOP LISTED PLAYERS

-

13.4 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSEXPANSIONSOTHERS

-

13.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.6 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 13.7 COMPETITIVE BENCHMARKING

-

14.1 KEY PLAYERSGOODYEAR- Business overview- Recent developments- MnM viewMICHELIN- Business overview- Recent developments- MnM viewPIRELLI- Business overview- Recent developments- MnM viewBRIDGESTONE- Business overview- Recent developments- MnM viewCONTINENTAL AG- Business overview- Recent developments- MnM viewNOKIAN TYRES- Business overview- Recent developmentsYOKOHAMA RUBBER CO.- Business overviewSUMITOMO RUBBER INDUSTRIES LTD.- Business overview- Recent developmentsTOYO TIRES- Business overview- Recent developmentsJK TYRE- Business overview- Recent developmentsMRF- Business overviewHANKOOK TIRES- Business overview- Recent developments

-

14.2 OTHER PLAYERSKUMHOBF GOODRICHMAXXISFALKENGENERAL TIREUNIROYALCOOPER TIRE & RUBBER COMPANYFIRESTONE TIRE AND RUBBER COMPANYNITTO TIRESMART TIRE COMPANYSAILUN TIRES

- 15.1 ASIA PACIFIC TO OFFER MOST LUCRATIVE OPPORTUNITIES IN CONNECTED TIRES MARKET

- 15.2 TECHNOLOGICAL ADVANCEMENTS TO BE CRUCIAL FOR MARKET GROWTH

- 15.3 SOFTWARE SOLUTIONS TO BE INTEGRAL PART OF CONNECTED TIRES AND ADVANCED IOT-ENABLED APPLICATIONS

- 15.4 CONCLUSION

- 16.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS

- TABLE 1 CONNECTED TIRES MARKET DEFINITION, BY SALES CHANNEL

- TABLE 2 CONNECTED TIRES MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 3 CONNECTED TIRES MARKET DEFINITION, BY RIM SIZE

- TABLE 4 CONNECTED TIRES MARKET DEFINITION, BY COMPONENT

- TABLE 5 CONNECTED TIRES MARKET DEFINITION BY PROPULSION TYPE

- TABLE 6 CONNECTED TIRES MARKET DEFINITION, BY OFFERING

- TABLE 7 INCLUSIONS AND EXCLUSIONS

- TABLE 8 CURRENCY EXCHANGE RATES

- TABLE 9 CONNECTED TIRES MARKET: IMPACT OF MARKET DYNAMICS

- TABLE 10 CONNECTED TIRES MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 11 CONNECTED TIRES COST SUMMARY

- TABLE 12 CONNECTED TIRES COST, BY VEHICLE TYPE

- TABLE 13 IMPORTANT PATENT REGISTRATIONS RELATED TO CONNECTED TIRES MARKET

- TABLE 14 US: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 15 MEXICO: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 16 CHINA: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 17 JAPAN: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 18 INDIA: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 19 GERMANY: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 20 FRANCE: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 21 SPAIN: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 22 US: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 23 CHINA: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 24 JAPAN: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 25 INDIA: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 26 GERMANY: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 27 FRANCE: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 28 SPAIN: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 29 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 31 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 32 GDP TRENDS AND FORECAST BY MAJOR ECONOMIES, 2019–2026 (USD BILLION)

- TABLE 33 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP APPLICATIONS (%)

- TABLE 34 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- TABLE 35 ASSUMPTIONS: YEAR 1

- TABLE 36 POTENTIAL BENEFITS: YEAR 1

- TABLE 37 ROI CALCULATION: YEAR 1

- TABLE 38 CONNECTED TIRES MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 39 MOST LIKELY SCENARIO, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 OPTIMISTIC SCENARIO, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 PESSIMISTIC SCENARIO, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 CONNECTED TIRES MARKET, BY RIM SIZE, 2019–2022 (THOUSAND UNITS)

- TABLE 43 CONNECTED TIRES MARKET BY RIM SIZE, 2023–2028 (THOUSAND UNITS)

- TABLE 44 12–17 INCHES: CONNECTED TIRES MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 45 12–17 INCHES: CONNECTED TIRES MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 46 18–22 INCHES: CONNECTED TIRES MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 47 18–22 INCHES: CONNECTED TIRES MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 48 MORE THAN 22 INCHES: CONNECTED TIRES MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 49 MORE THAN 22 INCHES: CONNECTED TIRES MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 50 CONNECTED TIRES MARKET, BY PROPULSION TYPE, 2019–2022 (THOUSAND UNITS)

- TABLE 51 CONNECTED TIRES MARKET, BY PROPULSION TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 52 ELECTRIC: CONNECTED TIRES MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 53 ELECTRIC: CONNECTED TIRES MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 54 ICE: CONNECTED TIRES MARKET BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 55 ICE: CONNECTED TIRES MARKET BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 56 CONNECTED TIRES MARKET, BY VEHICLE TYPE, 2019–2022 (THOUSAND UNITS)

- TABLE 57 CONNECTED TIRES MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 58 PASSENGER CARS: CONNECTED TIRES MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 59 PASSENGER CARS: CONNECTED TIRES MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 60 COMMERCIAL VEHICLES: CONNECTED TIRES MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 61 COMMERCIAL VEHICLES: CONNECTED TIRES MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 62 CONNECTED TIRES MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 63 CONNECTED TIRES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 64 SOFTWARE BY COMPANY NAMES

- TABLE 65 SOFTWARE CONNECTED TIRES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 SOFTWARE CONNECTED TIRES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 HARDWARE CONNECTED TIRES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 68 HARDWARE CONNECTED TIRES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 CONNECTED TIRES MARKET, BY COMPONENT, 2019–2022 (THOUSAND UNITS)

- TABLE 70 CONNECTED TIRES MARKET, BY COMPONENT, 2023–2028 (THOUSAND UNITS)

- TABLE 71 ACCELEROMETER SENSORS: CONNECTED TIRES MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 72 ACCELEROMETER SENSORS: CONNECTED TIRES MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 73 STRAIN GAUGE SENSORS: CONNECTED TIRES MARKET BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 74 STRAIN GAUGE SENSORS: CONNECTED TIRES MARKET BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 75 RFID CHIPS: CONNECTED TIRES MARKET BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 76 RFID CHIPS: CONNECTED TIRES MARKET BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 77 TPMS: CONNECTED TIRES MARKET BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 78 TPMS: CONNECTED TIRES MARKET BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 79 CONNECTED TIRES MARKET, BY REGION, 2019–2022(USD MILLION)

- TABLE 80 CONNECTED TIRES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: CONNECTED TIRES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: CONNECTED TIRES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 83 CANADA: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 84 US: CONNECTED TIRES MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 85 US: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 86 MEXICO: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 87 ASIA PACIFIC: CONNECTED TIRES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 88 ASIA PACIFIC: CONNECTED TIRES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 89 CHINA: CONNECTED TIRES MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 90 CHINA: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 91 INDIA: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 92 JAPAN: CONNECTED TIRES MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 93 JAPAN: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 94 SOUTH KOREA: CONNECTED TIRES MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 95 SOUTH KOREA: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 96 THAILAND: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028(USD MILLION)

- TABLE 97 REST OF ASIA PACIFIC: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: CONNECTED TIRES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 99 EUROPE: CONNECTED TIRES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 100 FRANCE: CONNECTED TIRES MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 101 FRANCE: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 102 GERMANY: CONNECTED TIRES MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 103 GERMANY: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 104 RUSSIA: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 105 ITALY: CONNECTED TIRES MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 106 ITALY: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 107 UK: CONNECTED TIRES MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 108 UK: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 109 TURKEY: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 110 SPAIN: CONNECTED TIRES MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 111 SPAIN: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 112 REST OF EUROPE: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 113 REST OF THE WORLD: CONNECTED TIRES MARKET, BY COUNTRY, 2023–2028(USD MILLION)

- TABLE 114 BRAZIL: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028(USD MILLION)

- TABLE 115 SOUTH AFRICA: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 116 OTHER COUNTRIES: CONNECTED TIRES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 117 CONNECTED TIRES MARKET: PRODUCT LAUNCHES, FEBRUARY 2021– MARCH 2023

- TABLE 118 CONNECTED TIRES MARKET: DEALS, JUNE 2020–MARCH 2023

- TABLE 119 CONNECTED TIRES MARKET: EXPANSIONS, OCTOBER 2022

- TABLE 120 CONNECTED TIRES MARKET: OTHERS, FEBRUARY 2022–DECEMBER 2022

- TABLE 121 CONNECTED TIRES MARKET: COMPANY FOOTPRINT, 2022

- TABLE 122 CONNECTED TIRES MARKET: VEHICLE TYPE FOOTPRINT, 2022

- TABLE 123 CONNECTED TIRES MARKET: REGIONAL FOOTPRINT, 2022

- TABLE 124 CONNECTED TIRES MARKET: DETAILED LIST OF KEY STARTUPS

- TABLE 125 CONNECTED TIRES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS]

- TABLE 126 GOODYEAR: BUSINESS OVERVIEW

- TABLE 127 GOODYEAR: PRODUCTS OFFERED

- TABLE 128 GOODYEAR: PRODUCT LAUNCHES

- TABLE 129 MICHELIN: BUSINESS OVERVIEW

- TABLE 130 MICHELIN: PRODUCTS OFFERED

- TABLE 131 MICHELIN: PRODUCT LAUNCHES

- TABLE 132 MICHELIN: DEALS

- TABLE 133 PIRELLI: BUSINESS OVERVIEW

- TABLE 134 PIRELLI: PRODUCTS OFFERED

- TABLE 135 PIRELLI: PRODUCT LAUNCHES

- TABLE 136 PIRELLI: DEALS

- TABLE 137 PIRELLI: OTHERS

- TABLE 138 BRIDGESTONE: BUSINESS OVERVIEW

- TABLE 139 BRIDGESTONE: PRODUCTS OFFERED

- TABLE 140 BRIDGESTONE: PRODUCT LAUNCHES

- TABLE 141 BRIDGESTONE: DEALS

- TABLE 142 BRIDGESTONE: OTHERS

- TABLE 143 CONTINENTAL AG: BUSINESS OVERVIEW

- TABLE 144 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 145 CONTINENTAL AG: PRODUCT LAUNCHES

- TABLE 146 CONTINENTAL AG: DEALS

- TABLE 147 NOKIAN TYRES: BUSINESS OVERVIEW

- TABLE 148 NOKIAN TYRES: PRODUCTS OFFERED

- TABLE 149 NOKIAN TYRES: PRODUCT LAUNCHES

- TABLE 150 YOKOHAMA RUBBER CO.: BUSINESS OVERVIEW

- TABLE 151 YOKOHAMA RUBBER CO.: PRODUCTS OFFERED

- TABLE 152 YOKOHAMA RUBBER CO.: DEALS

- TABLE 153 SUMITOMO RUBBER INDUSTRIES LTD.: BUSINESS OVERVIEW

- TABLE 154 SUMITOMO RUBBER INDUSTRIES LTD.: PRODUCTS OFFERED

- TABLE 155 SUMITOMO RUBBER INDUSTRIES LTD.: PRODUCT LAUNCHES

- TABLE 156 TOYO TIRES: BUSINESS OVERVIEW

- TABLE 157 TOYO TIRES: PRODUCTS OFFERED

- TABLE 158 TOYO TIRES: DEALS

- TABLE 159 JK TYRE: BUSINESS OVERVIEW

- TABLE 160 JK TYRE: PRODUCTS OFFERED

- TABLE 161 JK TYRE: PRODUCT LAUNCHES

- TABLE 162 MRF: BUSINESS OVERVIEW

- TABLE 163 MRF: PRODUCTS OFFERED

- TABLE 164 HANKOOK TIRES: BUSINESS OVERVIEW

- TABLE 165 HANKOOK TIRES: PRODUCTS OFFERED

- TABLE 166 HANKOOK TIRES: DEALS

- TABLE 167 KUMHO TIRE: BUSINESS OVERVIEW

- TABLE 168 BF GOODRICH: BUSINESS OVERVIEW

- TABLE 169 MAXXIS: BUSINESS OVERVIEW

- TABLE 170 FALKEN: BUSINESS OVERVIEW

- TABLE 171 GENERAL TIRE: BUSINESS OVERVIEW

- TABLE 172 UNIROYAL: BUSINESS OVERVIEW

- TABLE 173 COOPER TIRE & RUBBER COMPANY: BUSINESS OVERVIEW

- TABLE 174 FIRESTONE TIRE AND RUBBER COMPANY: BUSINESS OVERVIEW

- TABLE 175 NITTO TIRE: BUSINESS OVERVIEW

- TABLE 176 SMART TIRE COMPANY: BUSINESS OVERVIEW

- TABLE 177 SAILUN TIRES: BUSINESS OVERVIEW

- FIGURE 1 MARKETS COVERED

- FIGURE 2 CONNECTED TIRES MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 KEY INDUSTRY INSIGHTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 7 CONNECTED TIRES MARKET: BOTTOM-UP APPROACH

- FIGURE 8 TOP-DOWN APPROACH: CONNECTED TIRES MARKET

- FIGURE 9 CONNECTED TIRES: MARKET ESTIMATION NOTES

- FIGURE 10 CONNECTED TIRES MARKET: RESEARCH DESIGN AND METHODOLOGY – DEMAND SIDE

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- FIGURE 12 FACTOR ANALYSIS: CONNECTED TIRES MARKET

- FIGURE 13 CONNECTED TIRES MARKET: MARKET OVERVIEW

- FIGURE 14 CONNECTED TIRES MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- FIGURE 15 HARDWARE SEGMENT ESTIMATED TO LEAD CONNECTED TIRES MARKET IN 2023

- FIGURE 16 KEY PLAYERS IN CONNECTED TIRES MARKET

- FIGURE 17 PASSENGER CARS SEGMENT TO HAVE HIGHEST MARKET SHARE IN CONNECTED TIRES MARKET IN 2023

- FIGURE 18 INCREASING DEMAND FOR SMART AND CONNECTED VEHICLES TO BOOST MARKET

- FIGURE 19 ELECTRIC SEGMENT EXPECTED TO HAVE FASTEST CAGR DURING FORECAST PERIOD

- FIGURE 20 PASSENGER CARS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 21 12–17 INCHES RIM SIZE TO HAVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 22 SOFTWARE SEGMENT TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 23 TPMS AND RFID CHIPS TO REGISTER FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 24 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 25 CONNECTED TIRES MARKET: MARKET DYNAMICS

- FIGURE 26 DRIVING FACTORS OF CONNECTED TIRES MARKET

- FIGURE 27 RESTRAINING FACTORS OF CONNECTED TIRES MARKET

- FIGURE 28 OPPORTUNITIES IN CONNECTED TIRES MARKET

- FIGURE 29 CHALLENGING FACTORS OF CONNECTED TIRES MARKET

- FIGURE 30 CONNECTED TIRES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 31 SUPPLY CHAIN ANALYSIS OF CONNECTED TIRES MARKET

- FIGURE 32 NUMBER OF PUBLISHED PATENTS (2012–2022)

- FIGURE 33 LEGAL STATUS OF PATENTS FILED FOR CONNECTED TIRES

- FIGURE 34 MICROSOFT TIRE MONITORING SYSTEM

- FIGURE 35 AUTOMATED TIRE INFORMATION GATHERING SYSTEM FOR BUSES AND TRUCKS

- FIGURE 36 FALKEN TIRES AUGMENTED REALITY

- FIGURE 37 CONNECTED TIRES MARKET: TRENDS AND DISRUPTIONS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP APPLICATIONS

- FIGURE 39 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- FIGURE 40 CONNECTED TIRES MARKET – FUTURE TRENDS AND SCENARIOS, 2023–2028 (USD MILLION)

- FIGURE 41 MORE THAN 22 INCHES SEGMENT TO DOMINATE RIM SIZE MARKET DURING FORECAST PERIOD

- FIGURE 42 ELECTRIC SEGMENT TO BE DOMINANT DURING FORECAST PERIOD (2023–2028)

- FIGURE 43 CONNECTED TIRES MARKET, BY VEHICLE TYPE, 2023−2028

- FIGURE 44 SOFTWARE PROJECTED TO REGISTER HIGHER RATE DURING FORECAST PERIOD

- FIGURE 45 TPMS AND RFID CHIPS PROJECTED TO HAVE HIGH GROWTH RATE DURING FORECAST PERIOD (2023–2028)

- FIGURE 46 CONNECTED TIRES MARKET, BY REGION (2023–2028)

- FIGURE 47 NORTH AMERICA: CONNECTED TIRES MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: CONNECTED TIRES MARKET SNAPSHOT

- FIGURE 49 CONNECTED TIRES IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- FIGURE 50 REST OF THE WORLD: CONNECTED TIRES MARKET SNAPSHOT

- FIGURE 51 MARKET RANKING ANALYSIS, 2022

- FIGURE 52 REVENUE ANALYSIS, 2017–2021

- FIGURE 53 CONNECTED TIRES MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 54 CONNECTED TIRES MARKET: STRATUP/SME EVALUATION MATRIX, 2022

- FIGURE 55 GOODYEAR: COMPANY SNAPSHOT

- FIGURE 56 GOODYEAR REMOTE TIRE MONITORING

- FIGURE 57 MICHELIN: COMPANY SNAPSHOT

- FIGURE 58 MICHELIN CONNECTED TECHNOLOGIES

- FIGURE 59 PIRELLI: COMPANY SNAPSHOT

- FIGURE 60 PIRELLI MOBILITY OF FUTURE

- FIGURE 61 BRIDGESTONE: COMPANY SNAPSHOT

- FIGURE 62 BRIDGESTONE ACQUIRES TOMTOM TELEMATICS

- FIGURE 63 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 64 CONTINENTAL AG DIGITAL TIRE MONITORING

- FIGURE 65 NOKIAN TYRES: COMPANY SNAPSHOT

- FIGURE 66 YOKOHAMA RUBBER CO.: COMPANY SNAPSHOT

- FIGURE 67 SUMITOMO RUBBER INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 68 TOYO TIRES: COMPANY SNAPSHOT

- FIGURE 69 JK TYRE: COMPANY SNAPSHOT

- FIGURE 70 MRF: COMPANY SNAPSHOT

- FIGURE 71 HANKOOK TIRES: COMPANY SNAPSHOT

The study involved 4 major activities in estimating the current size of the connected tires market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used in estimating the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering connected tires and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the connected tires market, which primary respondents validated.

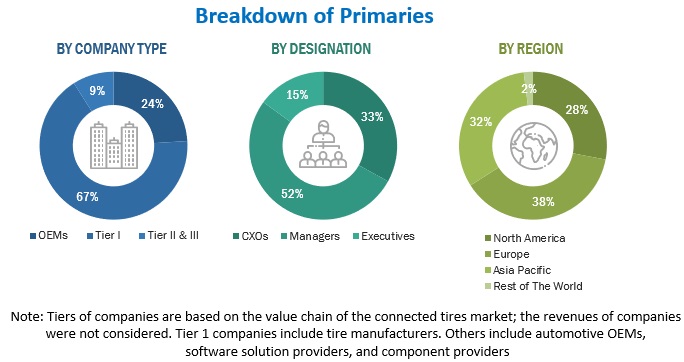

Primary Research

Extensive primary research was conducted after obtaining information regarding the Connected Tires market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from connected tires manufacturers; Automotive OEMs, component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped understand the various technology, application, vertical, and region trends. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using Connected tires were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of Connected Tires and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

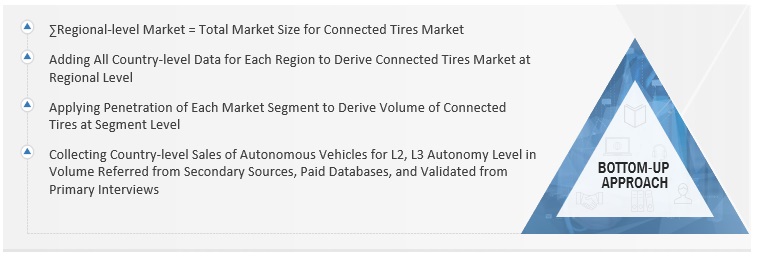

Market Size Estimation

The bottom-up approach was used to estimate and validate the total size of the connected tires market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s future supply chain and market size, in terms of volume, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Connected Tires Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

According to the European Tire and Rim Technical Organization (ETRTO), a connected tire has additional features beyond its primary function of supporting and moving the vehicle, such as sensors that monitor and communicate tire performance. The sensors on a connected tire can monitor a range of metrics, including tire pressure, temperature, and tread depth. The data collected by the sensors is sent for analysis to a vehicle's onboard computer or a connected device, such as a smartphone.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To segment and forecast the connected tires market size in terms of volume (thousand units) and value (USD million)

- To define, describe, and forecast the connected tires market based on component, rim size, vehicle type, sales channel, offering, propulsion type, and region

- To segment the market and forecast its size, by volume and value, based on region (Asia Pacific, Europe, North America, and Rest of the World)

- To segment and forecast the market based on vehicle type (passenger cars, commercial vehicles)

- To segment and forecast the market based on rim size (12-17 Inches, 18-22 Inches, more than 22 Inches)

- To provide qualitative insights based on sales channels (OEM, aftermarket)

- To segment and forecast the market based on sensing components (TPMS, accelerometer sensors, strain gauge sensors, RFID chips, and qualitative insights on other sensors)

- To segment and forecast the market based on propulsion (ICE, electric)

- To segment and forecast the market based on offering (hardware, software)

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the market with respect to individual growth trends, prospects, and contribution to the total market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Further breakdown of region into countries which are not taken in this report.

- Further breakdown of propulsion segment can be done for hybrid vehicles.

Company Information

- Profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Connected Tires Market