Consent Management Market by Component (Software and Services), Touchpoint (Mobile App and Web App), Deployment Type (Cloud and On-premises), Organization Size (SMEs and large enterprises), and Region - Global Forecast to 2025

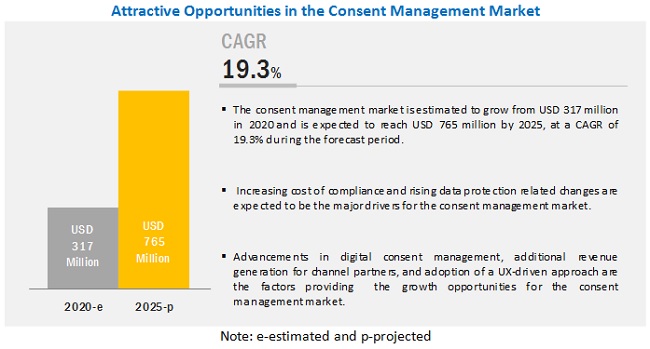

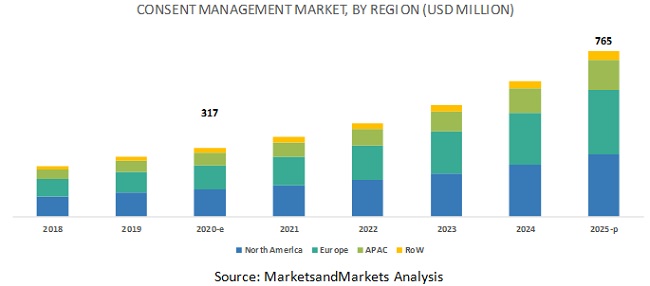

154 Pages Report] MarketsandMarkets projects the consent management market to grow from USD 317 million in 2020 to USD 765 million by 2025, at a Compound Annual Growth Rate (CAGR) of 19.3% during the forecast period. Major factors expected to drive the growth of the consent management market are growing awareness on data compliance regulations, rising cyberattacks, data breaches and the need for data security, increased demand for customers to control their consent and preferences, and implementation of Privacy by Design (PbD) to enhance data privacy.

The managed services segment to grow at a higher CAGR during the forecast period

Managed services address all the pre- and post-deployment queries and needs of customers. Managed Service Providers (MSPs) provide specialized General Data Protection Regulation (GDPR) and other regulations related services to other companies. The dearth of expertise, Information Technology (IT) resources, and budgets would encourage organizations to adopt consent management services from MSPs. MSPs have the expertise and would help organizations comply with the General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA), Health Insurance Portability and Accountability Act (HIPAA), ePrivacy Directive, and other data regulations. Cost efficiency is the major driver that fuels the demand for managed services.

The web app segment to hold a larger market size during the forecast period

Web applications completely run on the web browser. This touchpoint does not need to be downloaded and installed on the local machine of the end user. Web browsers are often used for searching different terms and to visit various websites. There are significant number of data points that can be collected by the publishers to help advertisers deliver more personalized advertisements to the user, however, many users are concerned regarding their privacy while browsing the internet and may not want to submit all the required data to the publishers to gain a more personalized experience.

Europe to hold the largest market size during forecast period

Europe is the leading region in the consent management market after enacting the GDPR and requiring data controllers to obtain consent before they can collect and use personal information. As business transformation continues to grow in Europe, organizations are looking to implement consent management platforms, to make their businesses. IAB Europe Transparency and Consent Framework (TCF) establishes a common ground of cooperation between publishers, advertisers, and consent management providers that can help smoothen the process of meeting the requirements of the GDPR.

Key Market Players

Major vendors in the Consent management market include OneTrust (OneTrust, LLC.), Quantcast, Cookiebot (Cybot A/S), iubenda (iubenda s.r.l), Trunomi (Trunomi Ltd.), TrustArc (TrustArc Inc.), Crownpeak (Crownpeak Technology, Inc.), Piwik PRO (Piwik PRO Sp. z o.o.), BigID (BigID, Inc.), CIVIC, SAP SE (SAP), Sourcepoint, HIPAAT (HIPAAT International Inc.), Didomi (DIDOMI), Osano (Osano, Inc.), Otonomo (Otonomo Technologies Ltd.) , PossibleNOW (PossibleNOW, Inc.), Verizon Media, Usercentrics (Usercentrics GmbH), Secure Privacy, and Rakuten Advertising (Rakuten, Inc.). These players have adopted various strategies, such as new product launches and product enhancements; acquisitions; and partnerships, agreements, and collaborations, to cater to the growing demand for consent management solutions across the globe as well as to strengthen their position in the market.

Scope of Report

|

Report Metrics |

Details |

|

Market size available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Component, Software, Service, Touchpoint, Deployment Mode, Organization Size |

|

Regions covered |

Europe, North America, APAC, RoW |

|

Companies covered |

include OneTrust (OneTrust, LLC.), Quantcast, Cookiebot (Cybot A/S), iubenda (iubenda s.r.l), Trunomi (Trunomi Ltd.), TrustArc (TrustArc Inc.), Crownpeak (Crownpeak Technology, Inc.), Piwik PRO (Piwik PRO Sp. z o.o.), BigID (BigID, Inc.), CIVIC, SAP SE (SAP), Sourcepoint, HIPAAT (HIPAAT International Inc.), Didomi (DIDOMI), Osano (Osano, Inc.), Otonomo (Otonomo Technologies Ltd.) , PossibleNOW (PossibleNOW, Inc.), Verizon Media, Usercentrics (Usercentrics GmbH), Secure Privacy, and Rakuten Advertising (Rakuten, Inc.) |

This research report categorizes the market to forecast revenues and analyze trends in each of the following submarkets:

Based on component, the consent management market has the following segments:

- Component

- Software

- Services

Based on Touchpoint, the consent management market has the following segments:

- Touchpoint

- Mobile App

- Web App

Based on deployment mode, the consent management market has the following segments:

- Deployment Mode

- Cloud

- On-premises

Based on organization size, the consent management market has the following segments:

- Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

Based on region, the consent management market has the following segments:

- Europe

- United Kingdom (UK)

- Germany

- Rest of Europe

- North America

- United States (US)

- Canada

- APAC

- Australia

- India

- Rest of APAC

- RoW

- Mexico

- South Africa

- Others

Recent Developments

- In February 2020, Quantcast and Kochava partnered to deliver combined web and mobile app solution for CCPA. The objective of the partnership is to allow brands and publishers to empower consumers to make privacy decisions whether they engage with them via web or via mobile apps. Quantcast has added CCPA support to its Quantcast Choice platform for the web.

- In November 2019, TrustArc acquired Toronto-based Nymity to accelerate the development of the next-generation of technology-driven privacy solutions. The objective of the acquisition is to deliver next-generation solutions that empower privacy, security, IT, legal, and business teams to efficiently drive insights, operationalize compliance, manage risk, and demonstrate accountability.

- In June 2019, Crownpeak expanded its Universal Consent Platform (UCP) by integrating with the Adobe Cloud Platform, enabling new privacy and consent management extension for the Adobe Cloud. With Crownpeak's new extension for Adobe Launch, enterprises can build next-generation privacy experiences directly into their customer experiences, evolve in line with changes to global data regulation, and scale with ease.

- In March 2018, OneTrust launched the Universal Consent and Preference Management Platform to simplify GDPR compliance for marketers. The tool simplifies challenges, such as maintaining an accurate audit trail of valid consent, and helping organizations collect valid consent.

- In March 2018, Piwik PRO launched a new product GDPR Consent Manager. Piwik PRO Consent Manager helps automate a huge part of collecting, processing, and storing GDPR consents and data subject requests.

Critical questions answered by the report:

- What are the current technology trends driving the market?

- What are the various regulations directly impacting the adoption of consent management market software?

- Where will all these developments take the industry in the mid- to long-term?

- Which companies are top vendors in the market, and how is the competitive scenario of the market?

- What are the drivers and challenges of the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

1.3 COVID-19 ECONOMIC ASSESSMENT

1.3.1 COVID-19 ECONOMIC IMPACTSCENARIO ASSESSMENT

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.4 MARKET FORECAST

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 32)

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

4.2 CONSENT MANAGEMENT MARKET IN EUROPE, BY COMPONENT AND COUNTRY

4.3 MARKET IN NORTH AMERICA, BY COMPONENT AND COUNTRY

4.4 CONSENT MANAGEMENT MARKET: MAJOR COUNTRIES

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 41)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing awareness of data compliance regulations

5.2.1.2 Rising cyber attacks, data breaches, and the need for data security

5.2.1.3 Increased demand for customers to control their consent and preferences

5.2.1.4 Implementation of PbD enhancing data privacy

5.2.2 OPPORTUNITIES

5.2.2.1 Advancement in digital consent management

5.2.2.2 Additional revenue generation for channel partners

5.2.2.3 Adoption of a User Experience (UX)-driven approach

5.2.3 CHALLENGES

5.2.3.1 Changing and dynamic regulatory landscape

5.2.3.2 Presence of open source consent management software vendors

5.3 INDUSTRY USE CASES

5.3.1 USE CASE 1: ANTHONY NOLAN PROTECTS DONORS MOST SENSITIVE INFORMATION WITH ONETRUST

5.3.2 USE CASE 2: EUROPEAN CLOTHING BRAND TAPS TRUSTARC FOR COMPREHENSIVE COOKIE CONSENT MANAGEMENT IN COMPLIANCE WITH EU REGULATIONS

5.3.3 USE CASE 3: CANDID PARTNERED WITH PIWIK PRO TO ESTABLISH THE GDPR COMPLIANCE SYSTEM

5.4 IMPACT OF EMERGING TECHNOLOGIES

5.4.1 ARTIFICIAL INTELLIGENCE/MACHINE LEARNING

5.4.2 BIG DATA AND ANALYTICS

5.4.3 BLOCKCHAIN

5.5 IMPACT OF COVID-19 ON CONSENT AND PRIVACY MANAGEMENT

6 CONSENT MANAGEMENT MARKET, BY COMPONENT (Page No. - 52)

6.1 INTRODUCTION

6.2 SOFTWARE

6.2.1 SOFTWARE: MARKET DRIVERS

6.3 SERVICES

6.3.1 PROFESSIONAL SERVICES

6.3.1.1 Consulting

6.3.1.1.1 Consulting: market drivers

6.3.1.2 Implementation

6.3.1.2.1 Implementation: market drivers

6.3.1.3 Support and maintenance

6.3.1.3.1 Support and maintenance: market drivers

6.3.2 MANAGED SERVICES

6.3.2.1 Managed services: market drivers

7 CONSENT MANAGEMENT MARKET, BY TOUCHPOINT (Page No. - 62)

7.1 INTRODUCTION

7.2 MOBILE APP

7.2.1 MOBILE APP: MARKET DRIVERS

7.3 WEB APP

7.3.1 WEB APP: MARKET DRIVERS

8 CONSENT MANAGEMENT MARKET, BY DEPLOYMENT TYPE (Page No. - 66)

8.1 INTRODUCTION

8.2 CLOUD

8.2.1 CLOUD: MARKET DRIVERS

8.3 ON-PREMISES

8.3.1 ON-PREMISES: MARKET DRIVERS

9 CONSENT MANAGEMENT MARKET, BY ORGANIZATION SIZE (Page No. - 70)

9.1 INTRODUCTION

9.2 LARGE ENTERPRISES

9.2.1 LARGE ENTERPRISES: MARKET DRIVERS

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES

9.3.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

10 CONSENT MANAGEMENT MARKET, BY REGION (Page No. - 75)

10.1 INTRODUCTION

10.2 EUROPE

10.2.1 EUROPE: MARKET REGULATORY IMPLICATIONS

10.2.2 UNITED KINGDOM

10.2.2.1 United Kingdom: market drivers

10.2.3 GERMANY

10.2.3.1 Germany: market drivers

10.2.4 REST OF EUROPE

10.3 NORTH AMERICA

10.3.1 NORTH AMERICA: MARKET REGULATORY IMPLICATIONS

10.3.2 UNITED STATES

10.3.2.1 United States: Market drivers

10.3.3 CANADA

10.3.3.1 Canada: Market drivers

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET REGULATORY IMPLICATIONS

10.4.2 AUSTRALIA

10.4.2.1 Australia: Market drivers

10.4.3 INDIA

10.4.3.1 India: Market drivers

10.4.4 REST OF ASIA PACIFIC

10.5 REST OF THE WORLD

10.5.1 REST OF THE WORLD: CONSENT MANAGEMENT MARKET REGULATORY IMPLICATIONS

10.5.2 MEXICO

10.5.2.1 Mexico: Market drivers

10.5.3 SOUTH AFRICA

10.5.3.1 South Africa: Market drivers

10.5.4 OTHERS

11 COMPETITIVE LANDSCAPE (Page No. - 113)

11.1 OVERVIEW

11.2 COMPETITIVE SITUATION AND TRENDS

11.2.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

11.2.2 PARTNERSHIPS

11.2.3 ACQUISITIONS

11.3 MARKET RANKING OF KEY PLAYERS

12 COMPANY PROFILES (Page No. - 119)

12.1 INTRODUCTION

12.2 ONETRUST

(Business Overview, Solutions Offered, Recent Developments, and SWOT Analysis)*

12.3 QUANTCAST

12.4 PIWIK PRO

12.5 TRUSTARC

12.6 COOKIEBOT

12.7 IUBENDA

12.8 TRUNOMI

12.9 CROWNPEAK

12.10 BIGID

12.11 CIVIC

12.12 SAP

12.13 SOURCEPOINT

12.14 HIPAAT INTERNATIONAL

12.15 DIDOMI

12.16 OSANO

12.17 OTONOMO

12.18 POSSIBLENOW

12.19 VERIZON MEDIA

12.20 USERCENTRICS

12.21 SECURE PRIVACY

12.22 RAKUTEN MARKETING

*Details on Business Overview, Solutions Offered, Recent Developments, and SWOT Analysis might not be captured in case of unlisted companies.

12.23 RIGHT TO WIN

13 APPENDIX (Page No. - 148)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

LIST OF TABLES (102 Tables)

TABLE 1 FACTOR ANALYSIS

TABLE 2 CONSENT MANAGEMENT MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 3 SOFTWARE: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 4 SERVICES: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 5 SERVICES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 6 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 7 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 8 CONSULTING MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 9 IMPLEMENTATION MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 10 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 11 MANAGED SERVICES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 12 CONSENT MANAGEMENT MARKET SIZE, BY TOUCHPOINT, 20182025 (USD MILLION)

TABLE 13 MOBILE APP: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 14 WEB APP: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 15 CONSENT MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 16 CLOUD: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 17 ON-PREMISES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 18 CONSENT MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 19 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 20 LARGE ENTERPRISES: MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 21 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 22 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 23 CONSENT MANAGEMENT MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 24 EUROPE: CONSENT MANAGEMENT MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 25 EUROPE: MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 26 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 20182025 (USD MILLION)

TABLE 27 EUROPE: MARKET SIZE, BY TOUCHPOINT, 20182025 (USD MILLION)

TABLE 28 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 29 EUROPE: LARGE ENTERPRISES MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 30 EUROPE: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 31 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 32 EUROPE: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 33 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 34 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 35 UNITED KINGDOM: MARKET SIZE, BY PROFESSIONAL SERVICE, 20182025 (USD MILLION)

TABLE 36 UNITED KINGDOM: MARKET SIZE, BY TOUCHPOINT, 20182025 (USD MILLION)

TABLE 37 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 38 UNITED KINGDOM: LARGE ENTERPRISES MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 39 UNITED KINGDOM: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 40 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 41 GERMANY: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 42 GERMANY: MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 43 GERMANY: MARKET SIZE, BY PROFESSIONAL SERVICE, 20182025 (USD MILLION)

TABLE 44 GERMANY: MARKET SIZE, BY TOUCHPOINT, 20182025 (USD MILLION)

TABLE 45 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 46 GERMANY: LARGE ENTERPRISES MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 47 GERMANY: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 48 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 49 NORTH AMERICA: CONSENT MANAGEMENT MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 20182025 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY TOUCHPOINT, 20182025 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 54 NORTH AMERICA: LARGE ENTERPRISES MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 55 NORTH AMERICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 58 UNITED STATES: CONSENT MANAGEMENT MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 59 UNITED STATES: MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 60 UNITED STATES: MARKET SIZE, BY PROFESSIONAL SERVICE, 20182025 (USD MILLION)

TABLE 61 UNITED STATES: MARKET SIZE, BY TOUCHPOINT, 20182025 (USD MILLION)

TABLE 62 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 63 UNITED STATES: LARGE ENTERPRISES MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 64 UNITED STATES: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 65 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 66 CANADA: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 67 CANADA: MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 68 CANADA: MARKET SIZE, BY PROFESSIONAL SERVICE, 20182025 (USD MILLION)

TABLE 69 CANADA: MARKET SIZE, BY TOUCHPOINT, 20182025 (USD MILLION)

TABLE 70 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 71 CANADA: LARGE ENTERPRISES MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 72 CANADA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 73 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 74 ASIA PACIFIC: CONSENT MANAGEMENT MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 75 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 76 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 20182025 (USD MILLION)

TABLE 77 ASIA PACIFIC: MARKET SIZE, BY TOUCHPOINT, 20182025 (USD MILLION)

TABLE 78 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 79 ASIA PACIFIC: LARGE ENTERPRISES MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 80 ASIA PACIFIC: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 81 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 82 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 83 AUSTRALIA: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 84 AUSTRALIA: MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 85 AUSTRALIA: MARKET SIZE, BY PROFESSIONAL SERVICE, 20182025 (USD MILLION)

TABLE 86 AUSTRALIA: MARKET SIZE, BY TOUCHPOINT, 20182025 (USD MILLION)

TABLE 87 AUSTRALIA: MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 88 AUSTRALIA: LARGE ENTERPRISES MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 89 AUSTRALIA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 90 AUSTRALIA: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 91 REST OF THE WORLD: CONSENT MANAGEMENT MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 92 REST OF THE WORLD: MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 93 REST OF THE WORLD: MARKET SIZE, BY PROFESSIONAL SERVICE, 20182025 (USD MILLION)

TABLE 94 REST OF THE WORLD: MARKET SIZE, BY TOUCHPOINT, 20182025 (USD MILLION)

TABLE 95 REST OF THE WORLD: MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 96 REST OF THE WORLD: LARGE ENTERPRISES MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 97 REST OF THE WORLD: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY DEPLOYMENT TYPE, 20182025 (USD MILLION)

TABLE 98 REST OF THE WORLD: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 99 REST OF THE WORLD: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 100 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, MARCH 2018- APRIL 2020

TABLE 101 PARTNERSHIPS, JUNE 2018- FEBRUARY 2020

TABLE 102 ACQUISITIONS, OCTOBER 2018- NOVEMBER 2019

LIST OF FIGURES (40 Figures)

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

FIGURE 3 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

FIGURE 6 CONSENT MANAGEMENT MARKET: RESEARCH DESIGN

FIGURE 7 DATA TRIANGULATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF CONSENT MANAGEMENT VENDORS OFFERING SOFTWARE AND SERVICES

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - TOP-DOWN (DEMAND SIDE): SHARE OF THE MARKET THROUGH OVERALL PRIVACY SPENDING ON COMPLIANCE

FIGURE 10 CONSENT MANAGEMENT MARKET SIZE, 20182025, USD MILLION

FIGURE 11 SOFTWARE SEGMENT TO HOLD A HIGHER MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 12 PROFESSIONAL SERVICES SEGMENT TO HOLD A HIGHER MARKET SHARE IN 2020

FIGURE 13 IMPLEMENTATION SEGMENT TO HOLD THE HIGHEST MARKET SHARE IN 2020

FIGURE 14 WEB APP SEGMENT TO LEAD THE CONSENT MANAGEMENT MARKET IN 2020

FIGURE 15 CLOUD SEGMENT TO ACCOUNT FOR A HIGHER MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 16 LARGE ENTERPRISES SEGMENT TO LEAD THE MARKET IN 2020

FIGURE 17 CONSENT MANAGEMENT MARKET: REGIONAL SNAPSHOT WITH KEY COUNTRIES

FIGURE 18 NORTH AMERICA TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2025

FIGURE 19 ADVANCEMENT IN DIGITAL CONSENT MANAGEMENT TO PROVIDE GROWTH OPPORTUNITIES IN THE MARKET DURING THE FORECAST PERIOD

FIGURE 20 SOFTWARE SEGMENT AND UNITED KINGDOM TO LEAD THE CONSENT MANAGEMENT MARKET IN 2020

FIGURE 21 SOFTWARE SEGMENT AND UNITED STATES TO LEAD THE CONSENT MANAGEMENT MARKET IN 2020

FIGURE 22 UNITED STATES, UNITED KINGDOM, AND AUSTRALIA TO GROW AT HIGH GROWTH RATES DURING THE FORECAST PERIOD

FIGURE 23 DRIVERS, OPPORTUNITIES, AND CHALLENGES: CONSENT MANAGEMENT MARKET

FIGURE 24 SOFTWARE SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 25 PROFESSIONAL SERVICES SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 26 IMPLEMENTATION SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 27 MOBILE APP SEGMENT TO GROW AT A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

FIGURE 28 CLOUD SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 29 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 30 NORTH AMERICA TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 31 EUROPE: MARKET SNAPSHOT

FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 33 COMPANIES ADOPTED NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS AS KEY GROWTH STRATEGIES BETWEEN JANUARY 2018 AND JANUARY 2020

FIGURE 34 MARKET EVALUATION FRAMEWORK

FIGURE 35 MARKET RANKING OF KEY PLAYERS IN THE CONSENT MANAGEMENT MARKET, 2020

FIGURE 36 ONETRUST: SWOT ANALYSIS

FIGURE 37 QUANTCAST: SWOT ANALYSIS

FIGURE 38 PIWIK PRO: SWOT ANALYSIS

FIGURE 39 TRUSTARC: SWOT ANALYSIS

FIGURE 40 COOKIEBOT: SWOT ANALYSIS

The study involved four major activities to estimate the current market size for the consent management market. An exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the market.

Secondary Research

In the secondary research process, various secondary sources, such as D &B Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies, whitepapers, and articles by recognized authors, gold standard, and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

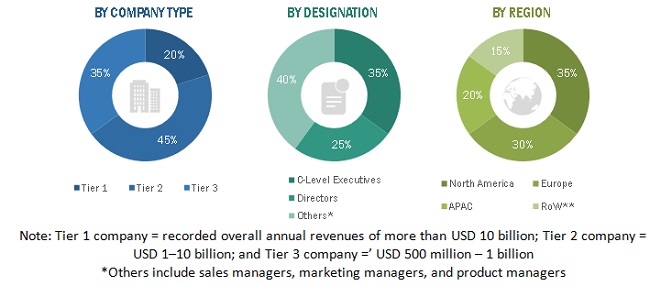

The consent management market comprises several stakeholders, such as consent management operators, consent management service providers, venture capitalists, government organizations, regulatory authorities, policy makers and financial organizations, consulting firms, research organizations, academic institutions, resellers and distributors, and training providers. The demand side of the market consists of all the firms operating in several industry verticals. The supply side includes consent management providers, offering consent management solutions. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakup of the primary respondents:

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global consent management market and various other dependent submarkets in the overall market. An exhaustive list of all the players offering solutions and services in the market was prepared while using the top-down approach. The market share for all the players in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each player was evaluated based on its component (software and services). The aggregate of all companies revenues was extrapolated to reach the overall market size.

Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and marketing executives.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Report Objectives

- To determine and forecast the global consent management market by component (software and services), service (professional services and managed services), touchpoint (mobile app and web app), deployment mode (cloud and on-premises), organization size (large enterprises and small and medium-sized enterprises), and region from 2020 to 2025, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to four main regions: Europe, North America, Asia Pacific (APAC), and Rest of the World (RoW).

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall consent management market

- To profile key market players; generate a comparative analysis based on their business overviews, service offerings, regional presence, business strategies, and key financials; and provide companies with in-house statistical tools required to understand the competitive landscape

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

- To provide detailed information about major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the consent management market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the India consent management market, by component

- Further breakdown of the Mexico market, by component

- Further breakdown of the South Africa market, by component

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Consent Management Market