COVID-19 Impact on Plant-Based Meat Market by Raw Material (Soy, Wheat, Pea), Product (Burger Patties, Sausages, Strips & Nuggets, and Meatballs), Distribution Channel (Retail Outlets, Foodservice, E-commerce), and Region - Global Forecast to 2021

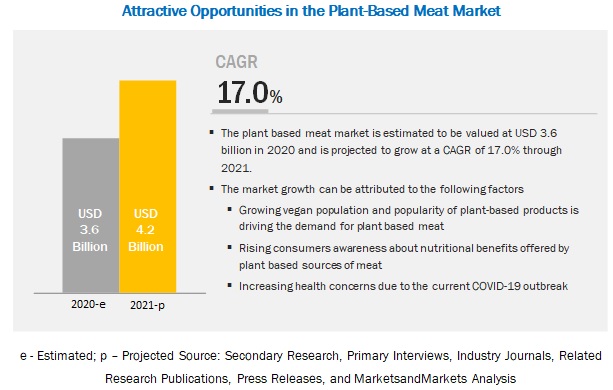

[82 Pages Report] According to MarketsandMarkets, the Covid-19 impact on plant-based meat market is projected to grow from USD 3.6 billion in 2020 to USD 4.2 billion by 2021, recording a compound annual growth rate (CAGR) of 17.0% during the forecast period. A general consumer inclination toward healthy lifestyles, now more than ever, due to the COVID-19 pandemic and government initiatives to support the plant-based meat consumption will present potential opportunities to develop plant-based solutions. The US, Australia, Argentina, Uruguay, and Brazil are some of the countries with the maximum per capita meat consumption. However, the rapidly spreading coronavirus pandemic is expected to impact the global animal meat market significantly. Many factors such as lack of availability in some of the economies, trade restrictions, controlled government measures, and fear among consumers about the consumption of animal-based meat products are expected to severely impact the traditional meat consumption and result in consumers shifting to plant-based sources of meat.

The rising number of animal-borne illnesses, as well as the prevailing coronavirus outbreak, is expected to propel the demand for clean-label products. Government initiatives and new product developments are certain factors contributing to the growth of this market. Lockdowns, closure of international borders, and trade restrictions would significantly impact the raw material supplies. Certain countries such as Russia and Kazakhstan have temporarily banned exports of raw materials such as wheat, which are used in plant-based meat production to stabilize the domestic market due to the novel coronavirus outbreak. This, however, presents opportunities for the local and regional raw material suppliers, as most of the manufacturers would now procure from these local vendors.

Plant-based meat products are a rising trend, which can serve as an alternative to animal-derived meat products. Many consumers are demanding plant-based meat, either for medical reasons or as a healthy lifestyle, and, as a result, the current generation of plant-based meat continues to expand. Additionally, continuous efforts that are being put by plant-based meat manufacturers in terms of better aroma, texture, longer shelf life, and better nutritious profile, are projected to escalate the growth of the global plant-based meat market in the coming years.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on plant-based meat market

COVID-19 is expected to affect the plant-based meat supply chain, both positively and negatively. Though the plant-based meat market is expected to be among the fastest-growing food markets due to the increased global concerns about the consumption of animal-based diets, it brings with itself some challenges simultaneously to all the stakeholders in the supply chain. The increasing health awareness and shifting preferences of consumers have led to the growing demand for plant-based diets, further supporting the growth of plant-based meat. This is projected to impact the supply chain of the plant-based meat industry positively. However, considering the current situation of COVID-19, the supply chain is likely to face short term challenges. One of the major challenges for plant-based meat is ensuring food safety compliance at every step across the supply chain. Coronavirus outbreak has led to consumers being more aware of what they consume. This would impose an increasing pressure on manufacturers to ensure they deliver safe food to the consumers. Considering the current outlook, national lockdowns and sealing of international borders have led to new transport and distribution restrictions, which could further restrict the import and export of such plant-based meat products.

Market Dynamics

Drivers: Growing demand for natural/ clean-label products

Clean-label products are organic, natural, non-GMO, and minimally processed consumer-friendly products. According to the Clean Label Alliance, It is observed that nearly 75% of the consumers are willing to pay high prices for clean-label products. Increasing health awareness among consumers is driving the demand for natural and clean-label products, which, in turn, will drive the demand for clean-label plant-based meat products. Consumers are getting inclined toward clean-label products, as they are becoming more aware of the non-synthetic ingredients and their negative effects. This will drive them to adopt plant-based diets such as plant-based meat.

Clean-label is one of the most important features of packaged foods. Consumer awareness is strengthening the clean label trend, which, in turn, will prompt them to move away from traditional meat consumption and adopt plant-based diets, further supporting the growth of the plant-based meat market. Non-GMO ingredients such as soy, wheat, etc., would be more in demand by the consumers opting for plant-based meat products. Retailers are also addressing the growing demand for clean-label plant-based products by consumers by offering their private label brands. The recent outbreak of COVID-19 has led to consumers buying more ’clean label’ products, owing to their safe consumption and positive health benefits. This will promote the growth of the plant-based meat industry. Environmental concerns related to traditional meat have led to the growing demand for clean-label products, especially by vegans and vegetarians, further driving the demand for meat substitutes such as plant-based meat products.

RESTRAINTS: Lack of cold chain infrastructure & resources in developing countries

Cold chain infrastructure is one of the most important factors in storing and transporting frozen and perishable food products. Plant-based meat is one of those food products that require a lower storage temperature. Since plant-based meat is a perishable product, it is very important to maintain effective cold chain management for the safety and quality of plant-based meat products. Such products are also likely to promote the growth of pathogenic microorganisms. Therefore, they should be kept at suitable temperatures not to generate any health risk. The cold chain infrastructure should not be interrupted throughout the supply chain of plant-based meat. It is very important to monitor the storage temperature of plant-based meat. Lack of such cold chain infrastructure is still a concern for many developing countries such as India, South Africa, Mexico, and Kenya. This is a major restraining factor for the plant-based meat market in such developing countries.

In light of the recent fast-spreading pandemic COVID-19, disruptions across the supply chains have made it more difficult to maintain the cold chain infrastructure for plant-based meat products, further causing hindrance to the market growth. The coronavirus disease has led to consumers becoming more aware of the food safety related to plant-based meat products, which partly relies on the cold chain infrastructure. The use of cold technologies in the development and storage of plant-based meat products to reduce food losses is of utmost importance. Ineffective cold chain management can result in much loss of plant-based meat products. It is very important to ensure the use and funding of cold chain technology and infrastructure to minimize the food losses due to barriers in production capabilities and distribution channels, as plant-based meat products are generally frozen. The lack of ineffective management of the cold chain in developing countries due to the current pandemic situation can hurt the market growth.

OPPORTUNIT: Impact on plant-based meat manufacturing companies’ porfolios

The COVID-19 outbreak is expected to help drive the success of plant-based meat alternatives, as the aspect of wet markets and livestock losses due to other diseases such as African Swine Fever (ASF) has attracted negative consumer attention towards conventional meat processing and products. This turn of events has helped alternative meat manufacturers solidify their current market position through expanding their current line of products as well as looking to develop newer product variants to meet consumer tastes and requirements.

Given the growing consumer awareness toward the environmental impact of meat production and the unsustainable practices followed, plant-based meat manufacturers are stepping up production as well as aggressively marketing their products to showcase the benefits of sustainable sourcing and production techniques when compared to conventional meat products.

Challenges: Conventional meat products have a higher penetration

The plant-based industry is still at its nascent stage in many economies while the trend is picking up in the US. Accelerated innovations in food technology are already driving the growth of the overall plant-based industry, which is expanding in terms of product offerings to reach and serve a wide customer base. However, conventional meat markets such as cultured meat, traditional meat, and seafood markets dominate the industry. The rise in demand for animal protein has increased the demand for poultry products. The demand for processed meat has gone beyond the original projection owing to its demand in the foodservice sector. Product innovations, especially the on-the-go snacking options within the meat and seafood industry are driving the demand for meat and seafood industry posing a challenge for the plant-based meat market.

Pea segment is estimated to dominate the Covid-19 impact on plant-based meat market in 2021

Pea, specifically yellow pea, has emerged as a key source of protein, among other plant-based alternatives. The impact of COVID-19 on plant-based meat is becoming increasingly popular among plant-based meat manufacturers at a global level. It also serves as an alternative for consumers with soy allergy due to it being allergen-neutral. One of the leading players in the plant-based meat industry, Beyond Meat (US), is using pea as a key ingredient for alternative meat patties. Plant-based meat offers various health benefits, such as reduced cholesterol and lower blood pressure. Also, the high levels of iron, zinc, magnesium, and phosphorus in plant-based meat aid in promoting improved health and other functional benefits. Allergies are rarely associated with peas due to them being allergen-friendly. Peas are comparatively sustainable, owing to factors such as improved soil enrichment and drought tolerance. These factors, coupled with the nutritional benefits of peas, will drive the demand for plant-based meat alternatives among consumers shifting to vegan diets. The growing health-consciousness and the increasing popularity of plant-based meat as an alternative to animal-based sources amid the COVID-19 outbreak are projected to drive the demand for peas as a suitable raw material for alternative meat production.

Wide-spread availability and inclusion of healthier ingredients support plant-based strips & nuggets sales

Various companies in the plant-based meat industry are looking to expand their plant-based portfolio with the addition of meatless strips and nuggets. Morningstar Farms (US), Vegetarian Butcher (Netherlands), and VBites (UK) are some of the players in the plant-based meat industry offering strips and nuggets. Soy, wheat, chickpeas, corn, rice, and oats are the raw materials used for the production of plant-based strips and nuggets. Canadian player, Garden Protein International (Canada), is among the key companies offering plant-based chicken strips made from soy and wheat. Fast-food chain, McDonald's, launched meat-free chicken nuggets made from mashed potatoes, chickpeas, onion, carrots, and corn in Norway.

The demand for plant-based strips and nuggets is projected to grow in foodservice outlets, as consumers are becoming more aware of the adverse effects of animal meat consumption due to concerns over sourcing, quality, and the recent pandemic. Strips and nuggets are preferred appetizers among consumers, and they are likely to shift to plant-based strips and nuggets.

To know about the assumptions considered for the study, download the pdf brochure

The Europe market is growing at the faster growth rate after North America

The key countries in the European region include the UK, Germany, Italy, France, and Spain. Europe is the second-largest market for plant-based meat globally. Italy and Spain are some of the worst affected countries in the region due to the recently discovered coronavirus disease. The rising health concerns among the consumers, now more than ever due to this deadly outbreak, will increasingly incline consumers toward healthy plant-based meat products. The exponentially growing number of vegans in the region, especially in the UK, has led to increasing demand for plant-based meat alternatives.

The rising number of cases in both Italy and France and the increasing number of deaths every day due to this pandemic have caused fear in consumers. The fear of zoonotic outbreaks associated with animal originated foods will certainly lead to consumers adapting to plant-based foods. Shelf life stability of plant-based meat will further fuel the demand for such products since it is known that coronavirus is not the only animal virus that originated out of meat consumption. Consumers will shift to plant-based meat diets and clean meats as healthier and disease-free alternatives. The overall plant-based meat industry is projected to be positively influenced by the outbreak. Start-ups such as Novameat (Spain) in Europe are coming up with new plant-based products through new food technologies such as 3D printed plant-based steaks made of rice and pea proteins. Such plant-based alternatives will aid market growth post-COVID-19 in the long term.

Key Market Players

The key players in this market include Impossible Foods (US), Beyond Meat (US), Maple Leaf Foods (Canada), Garden Protein International (US), and the Meatless Farm Co. (UK). Currently, the manufacturers are aiming to reduce the price of these products to target a wider audience. With various innovations in the plant-based meat market and huge investments from new entrants, there is a brighter future for this category. Companies such as Impossible Foods (US) and Beyond Meat (US) are among the first and top players who have initiated this disruption at a commercial scale in this industry. Apart from them, many industry participants are heavily investing in R&D processes to continuously innovate and bring in the best consumer experience with plant-based frozen food

Recent Developments

- Impossible Foods is communicating with their fans/consumers on emails asking if they would be interested in buying the burgers directly from the websites. This company’s step toward the ‘direct to consumer’ model is again expected to drive the sales of its products and can reduce the short-term disruptions in the supply chain due to COVID-19.

- Impossible Foods has undertaken aggressive expansion strategies to expand in high growth regions such as Asia Pacific, where consumers are increasingly interested in alternatives to animal-based food due to negative media hype associating COVID with animal meat.

- Beyond Meat launched Feed A Million+ in the light of the COVID-19 outbreak to provide more than a million plant-based meat burgers to help the needy during the pandemic. Beyond Meat is likely to benefit from the massive shift of consumers to alternative meats in the long term post- COVID-19.

FAQ:

Who are the major market players in the Covid-19 impact on the plant-based meat market?

The key players in this market include Impossible Foods (US), Beyond Meat (US), Maple Leaf Foods (Canada), Garden Protein International (US), and the Meatless Farm Co. (UK).

What is the impact of COVID-19 on the plant-based meat market?

The lockdown disrupted the distribution channels. The disruptions in the supply chain due to COVID-19 have led to complications in the distribution of products to end-consumers. The global plant-based meat market is dominated by the foodservice outlets. The demand shifted from foodservice outlets to retail outlets doing home deliveries and e-commerce channels. Additionally, some companies started to sell their products through their websites.

Which are the key regions that are projected to witness significant growth in the plant-based meat market?

The plant-based meat market was dominated by the North America region in 2020, which accounted for the largest share. Plant-based meat products have a longer shelf life. Consumers are stocking all essentials due to lockdowns imposed. The sustainability and good shelf life of such products will promote the growth of this market during COVID-19. Previous zoonotic outbreaks such as swine fever in Canada had resulted in the changing consumer perception toward animal-based food. The changing consumer perception due to continuous zoonotic outbreaks, such as swine fever, previously and the current COVID-19, are likely to contribute to the growing demand for plant-based meat products since it is evident that animal hosts are responsible for causing such diseases. According to the R&D activities of Mexican suppliers, it is not easy to replicate meat in a hamburger. Still, continuous R&D has resulted in texturized soy proteins to resemble meat, owing to its high protein content.

What are the major types of the plant-based meat that are projected to gain maximum market revenue and share during the forecast period?

By type, soy segment is estimated to account for the largest share in the plant-based meat market in 2021. The growing concerns associated with the consumption of animal protein sourced food and the adoption of vegan diets are expected to drive the consumption of soy as a raw material in the plant-based meat market. The WHO is advising the consumption of unsaturated fats such as soy during the COVID-19 outbreak. Since soy-based food is considered a cholesterol-free food and a good source of vitamins, fibers, and other essential nutrients, this will help drive the demand for soy for plant-based meat products. The COVID-19 outbreak has significantly affected Brazil’s soy exports to China. Soy-derived plant-based meat is gaining popularity in the US, with major manufacturers such as Beyond Meat (US) and Nestle (Switzerland) utilizing soy as an alternative to animal protein for the production of plant-based meat products.

What is the current size of the Covid-19 impact on the plant-based meat market?

The Covid-19 impact on the plant-based meat market is estimated to account for about USD 3.6 billion in 2020 and is projected to reach a value of nearly USD 4.2 billion by 2021, at a CAGR of 17.0%.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 10)

1.1 COVID-19 HEALTH ASSESSMENT

1.2 COVID-19 ECONOMIC ASSESSMENT

1.2.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

2 RESEARCH METHODOLOGY (Page No. - 16)

2.1 RESEARCH DATA

2.2 RESEARCH ASSUMPTIONS

2.3 MARKET SCENARIOS CONSIDERED

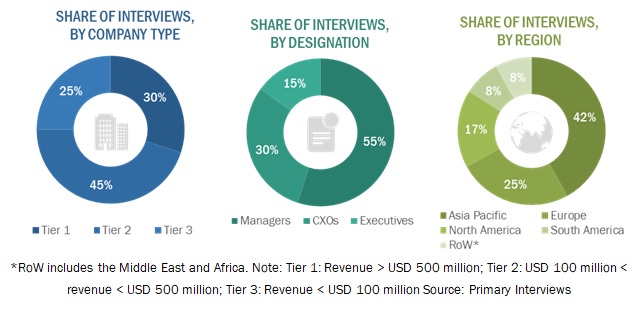

2.4 BREAKDOWN OF PRIMARY INTERVIEWS

2.5 EXCLUSION

2.6 STAKEHOLDERS

3 EXECUTIVE SUMMARY (Page No. - 20)

4 COVID-19 IMPACT ON PLANT-BASED MEAT ECOSYSTEM (Page No. - 24)

4.1 INTRODUCTION

4.2 SUPPLY CHAIN OF THE PLANT-BASED MEAT INDUSTRY

4.3 IMPACT OF COVID-19 ON THE SUPPLY CHAIN OF PLANT-BASED MEAT

4.3.1 RAW MATERIAL SUPPLIERS

4.3.2 EQUIPMENT SUPPLIERS

4.3.3 LABORATORIES

4.3.4 PLANT-BASED MEAT MANUFACTURERS

4.3.5 CERTIFICATION COMPANIES

4.3.6 DISTRIBUTORS/RETAIL CHANNELS

4.4 IMPACT OF COVID-19 ON THE CONVENTIONAL/TRADITIONAL MEAT MARKET

4.5 MACROECONOMIC INDICATORS

4.5.1 DRIVERS

4.5.1.1 Growing number of animal-borne illnesses

4.5.1.2 Growing demand for natural/clean-label products

4.5.1.3 Government support in major economies

4.5.1.4 New launches and investments in the plant-based meat industry

4.5.2 RESTRAINTS

4.5.2.1 Lack of cold chain infrastructure & resources in developing countries

4.5.2.2 Higher price of products in comparison to traditional meat

5 CUSTOMER ANALYSIS (Page No. - 33)

5.1 SHIFT TOWARD PLANT-BASED PRODUCTS

5.1.1 DEMAND FOR NATURAL/CLEAN-LABEL PRODUCTS

5.2 GROWING INCLINATION TOWARD PREMIUM/BRANDED PRODUCTS

5.3 GROWING DEMAND FOR CERTIFIED AND TESTED PRODUCTS

6 IMPACT ON RELATED MARKETS (Page No. - 36)

6.1 INTRODUCTION

6.2 POSITIVELY AFFECTED MARKETS – IMPACT AND OPPORTUNITIES

6.2.1 PB PROTEIN

6.2.2 PB DAIRY

6.3 WORST AFFECTED MARKET – IMPACT AND OPPORTUNITIES

6.3.1 CULTURED MEAT

6.3.2 CONVENTIONAL MEAT & SEAFOOD

7 GROWTH OPPORTUNITIES IN THE PLANT-BASED MEAT MARKET (Page No. - 39)

7.1 GROWTH OPPORTUNITIES IN THE PLANT-BASED MEAT MARKET

7.1.1 IMPACT ON PLANT-BASED MEAT MANUFACTURING COMPANIES’ PORTFOLIOS

7.1.2 PRODUCTION CAPACITIES

7.1.3 GEOGRAPHICAL

7.2 WINNING STRATEGIES TO GAIN MARKET SHARE

7.2.1 SHORT TERM STRATEGIES

7.2.2 MID-TERM TERM STRATEGIES

7.2.3 LONG-TERM STRATEGIES

8 IMPACT OF COVID-19 ON THE PLANT-BASED MEAT MARKET, BY RAW MATERIAL (Page No. - 43)

8.1 INTRODUCTION

8.2 SOY

8.2.1 NEW PLANT-BASED PRODUCTS INCORPORATING SOY WILL CONTRIBUTE TO THE GROWING MARKET DEMAND

8.3 WHEAT

8.3.1 WHEAT TO POSE A SUSTAINABLE ALTERNATIVE FOR THE CONSUMER POPULACE ALLERGIC TO SOY

8.4 PEA

8.4.1 INCREASING USE OF PEA FOR PLANT-BASED MEAT OWING TO ITS RICH PROTEIN CONTENT

8.5 OTHER RAW MATERIALS

9 IMPACT OF COVID-19 ON THE PLANT-BASED MEAT MARKET, BY PRODUCT (Page No. - 49)

9.1 INTRODUCTION

9.2 BURGER PATTIES

9.2.1 STRONG LIKENESS TO CONVENTIONAL MEAT PRODUCTS AND WIDESPREAD CONSUMER ACCEPTANCE DRIVE DEMAND FOR PLANT-BASED BURGER PATTIES

9.3 SAUSAGES

9.3.1 CONCERNS OVER SOURCING AND DISEASE OUTBREAKS AMONG LIVESTOCK AID GROWTH PROSPECTS FOR PLANT-BASED SAUSAGES

9.4 STRIPS AND NUGGETS

9.4.1 WIDESPREAD AVAILABILITY AND HEALTHIER INGREDIENTS SUPPORT PLANT-BASED STRIPS AND NUGGET SALES

9.5 MEATBALLS

9.5.1 DEVELOPMENT OF PLANT-BASED MEAT SOURCES AND AVAILABILITY IN RETAIL AND FOODSERVICE BOLSTER DEMAND FOR PLANT-BASED MEATBALLS

9.6 OTHER PRODUCTS

10 IMPACT OF COVID-19 ON PLANT-BASED MEAT MARKET, BY DISTRIBUTION CHANNEL (Page No. - 55)

10.1 INTRODUCTION

10.2 RETAIL OUTLETS

10.2.1 EASY AVAILABILITY AND ESTABLISHED SUPPLY CHAIN NETWORKS SUPPORT RETAIL OUTLETS GROWTH DURING COVID-19 OUTBREAK

10.3 FOODSERVICE

10.3.1 EASY DELIVERY ACCESS AND WIDESPREAD AVAILABILITY THROUGH THIRD-PARTY SERVICE PROVIDERS DRIVE FOODSERVICE GROWTH

10.4 E-COMMERCE

10.4.1 GROWING ADOPTION IN OMNICHANNEL AND INTERNET PENETRATION SUPPLEMENTS E-COMMERCE GROWTH

11 COVID-19 IMPACT ON PLANT-BASED MEAT, BY REGION (Page No. - 58)

11.1 INTRODUCTION

11.2 NORTH AMERICA

11.3 EUROPE

11.4 ASIA PACIFIC

11.5 REST OF THE WORLD

12 COVID-19 FOCUSED PROFILE OF KEY VENDORS (Page No. - 70)

(Company overview, Products offered, MNM view)*

12.1 IMPOSSIBLE FOODS INC.

12.2 BEYOND MEAT

12.3 MAPLE LEAF FOODS INC.

12.4 THE MEATLESS FARM CO.

12.5 GARDEN PROTEIN INTERNATIONAL (PINNACLE FOODS)

*Details on Company overview, Products offered, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 77)

13.1 KEY INSIGHTS BY INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AUTHOR DETAILS

LIST OF TABLES (31 Tables)

TABLE 1 IMPACT ANALYSIS OF COVID-19 ON VARIOUS STAKEHOLDERS IN THE PLANT-BASED MEAT SUPPLY CHAIN

TABLE 2 TABLE: LIST OF PLANT-BASED MEAT MANUFACTURERS

TABLE 3 IMPACT OF COVID-19 ON THE PLANT-BASED MEAT MARKET, BY RAW MATERIAL, 2018–2021 (USD MILLION) (OPTIMISTIC SCENARIO)

TABLE 4 IMPACT OF COVID-19 ON THE PLANT-BASED MEAT MARKET, BY RAW MATERIAL, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

TABLE 5 IMPACT OF COVID-19 ON THE PLANT-BASED MEAT MARKET, BY RAW MATERIAL, 2018–2021 (USD MILLION) (PESSIMISTIC SCENARIO)

TABLE 6 SOY: IMPACT OF COVID-19 ON THE PLANT-BASED MEAT MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 7 WHEAT: IMPACT OF COVID-19 ON THE PLANT-BASED MEAT MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 8 PEA: IMPACT OF COVID-19 ON THE PLANT-BASED MEAT MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 9 OTHER RAW MATERIALS: IMPACT OF COVID-19 ON THE PLANT-BASED MEAT MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 10 IMPACT OF COVID-19 ON THE PLANT-BASED MEAT MARKET, BY PRODUCT, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

TABLE 11 BURGER PATTIES: IMPACT OF COVID-19 ON THE PLANT-BASED MEAT MARKET, BY REGION, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

TABLE 12 SAUSAGES: IMPACT OF COVID-19 ON THE PLANT-BASED MEAT MARKET, BY REGION, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

TABLE 13 STRIPS & NUGGETS: IMPACT OF COVID-19 ON THE PLANT-BASED MEAT MARKET, BY REGION, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

TABLE 14 MEATBALLS: IMPACT OF COVID-19 ON THE PLANT-BASED MEAT MARKET, BY REGION, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

TABLE 15 OTHER PRODUCTS: IMPACT OF COVID-19 ON THE PLANT-BASED MEAT MARKET, BY REGION, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

TABLE 16 IMPACT OF COVID-19 ON PLANT-BASED MEAT MARKET, BY DISTRIBUTION CHANNEL, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

TABLE 17 COVID-19 IMPACT ON THE PLANT-BASED MEAT MARKET SIZE, BY REGION, 2018–2021, (OPTIMISTIC) (USD MILLION)

TABLE 18 COVID-19 IMPACT ON THE PLANT-BASED MEAT MARKET SIZE, BY REGION, 2018–2021, (REALISTIC) (USD MILLION)

TABLE 19 COVID-19 IMPACT ON THE PLANT-BASED MEAT MARKET SIZE, BY REGION, 2018–2021, (PESSIMISTIC) (USD MILLION)

TABLE 20 NORTH AMERICA: COVID-19 IMPACT ON THE PLANT-BASED MEAT MARKET SIZE, BY SCENARIO, 2018–2021, (USD MILLION)

TABLE 21 NORTH AMERICA: COVID-19 IMPACT ON THE PLANT-BASED MEAT MARKET SIZE, BY RAW MATERIAL, 2018–2021, (REALISTIC) (USD MILLION)

TABLE 22 NORTH AMERICA: COVID-19 IMPACT ON THE PLANT-BASED MEAT MARKET SIZE, BY PRODUCT, 2018–2021, (REALISTIC) (USD MILLION)

TABLE 23 EUROPE: COVID-19 IMPACT ON THE PLANT-BASED MEAT MARKET SIZE, BY SCENARIO, 2018–2021, (USD MILLION)

TABLE 24 EUROPE: COVID-19 IMPACT ON PLANT-BASED MEAT MARKET SIZE, BY RAW MATERIAL, 2018–2021, (REALISTIC) (USD MILLION)

TABLE 25 EUROPE: COVID-19 IMPACT ON PLANT-BASED MEAT MARKET SIZE, BY PRODUCT, 2018–2021, (REALISTIC) (USD MILLION)

TABLE 26 ASIA PACIFIC: COVID-19 IMPACT ON THE PLANT-BASED MEAT MARKET SIZE, BY SCENARIO, 2018–2021, (USD MILLION)

TABLE 27 ASIA PACIFIC: COVID-19 IMPACT ON PLANT-BASED MEAT MARKET SIZE, BY RAW MATERIAL, 2020–2021, (REALISTIC) (USD MILLION)

TABLE 28 ASIA PACIFIC: COVID-19 IMPACT ON PLANT-BASED MEAT MARKET SIZE, BY PRODUCT, 2020–2021, (REALISTIC) (USD MILLION)

TABLE 29 REST OF THE WORLD: COVID-19 IMPACT ON THE PLANT-BASED MEAT MARKET SIZE, BY SCENARIO, 2018–2021, (USD MILLION)

TABLE 30 REST OF THE WORLD: COVID-19 IMPACT ON PLANT-BASED MEAT MARKET SIZE, BY RAW MATERIAL, 2018–2021, (REALISTIC) (USD MILLION)

TABLE 31 REST OF THE WORLD: COVID-19 IMPACT ON PLANT-BASED MEAT MARKET SIZE, BY PRODUCT, 2018–2021, (REALISTIC) (USD MILLION)

LIST OF FIGURES (22 Figures)

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

FIGURE 3 COUNTRIES BEGIN WITH SIMILAR TRAJECTORIES BUT CURVES DEVIATE BASED ON MEASURES TAKEN

FIGURE 4 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

FIGURE 5 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 6 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

FIGURE 7 IMPACT OF COVID-19 ON THE PLANT-BASED MEAT MARKET: RESEARCH DESIGN

FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS: BY VALUE CHAIN, DESIGNATION, AND REGION

FIGURE 9 PLANT-BASED MEAT MARKET, BY RAW MATERIAL, 2020 VS. 2021 (USD MILLION)- REALISTIC SCENARIO

FIGURE 10 PLANT-BASED MEAT MARKET SIZE, BY PRODUCT, 2020 VS. 2021 (USD MILLION)- REALISTIC SCENARIO

FIGURE 11 PLANT-BASED MEAT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020 VS. 2021 (USD MILLION)- REALISTIC SCENARIO

FIGURE 12 PLANT-BASED MEAT MARKET SHARE, BY REGION

FIGURE 13 PLANT-BASED MEAT ECOSYSTEM

FIGURE 14 SUPPLY CHAIN – PLANT-BASED MEAT INDUSTRY

FIGURE 15 IMPACT OF COVID-19 ON THE PLANT-BASED MEAT MARKET SIZE, BY RAW MATERIAL, 2020 VS. 2021 (USD MILLION) (OPTIMISTIC SCENARIO)

FIGURE 16 IMPACT OF COVID-19 ON THE PLANT-BASED MEAT MARKET SIZE, BY PRODUCT, 2020 VS. 2021 (USD MILLION)

FIGURE 17 IMPACT OF COVID-19 ON PLANT-BASED MEAT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020 VS. 2021 (USD MILLION)

FIGURE 18 SALES OF FRESH MEAT ALTERNATIVES IN THE UNITED STATES, (GROWTH %) (03/20-04/20)

FIGURE 19 SALES OF FULLY COOKED MEAT ALTERNATIVES IN THE UNITED STATES, (GROWTH %) (03/20-04/20)

FIGURE 20 NORTH AMERICA MARKET SNAPSHOT FOR COVID-19 IMPACT ON PLANT-BASED MEAT

FIGURE 21 EUROPE MARKET SNAPSHOT FOR COVID-19 IMPACT ON PLANT-BASED MEAT

FIGURE 22 ASIA PACIFIC MARKET SNAPSHOT FOR COVID-19 IMPACT ON PLANT-BASED MEAT

The study involved four major steps in estimating the size of the plant-based meat market. Exhaustive secondary research was done to collect information on the market, as well as the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to, to identify and collect information for this study. These secondary sources included reports from the Food and Agriculture Organization (FAO), the United States Department of Agriculture (USDA), GFI (Good Food Institute), and PBFA (Plant-Based Foods Association). The secondary sources also included annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and databases.

Secondary research was mainly conducted to obtain key information about the industry’s supply chain, COVID-19 impact across the stakeholders of the supply chain, total pool of key players, market classification & segmentation according to the industry trends to the bottom-most level and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The overall plant-based meat market comprises several stakeholders in the supply chain, which include global and regional plant-based meat manufacturers, suppliers, and retailers. Primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, regional plant-based meat products dealers, and manufacturers. The primary sources from the supply side include raw material suppliers, manufacturers of plant-based meat products, research institutions involved in R&D, and key opinion leaders in the plant-based meat market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the plant-based meat market due to the COVID-19 impact. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through extensive secondary research.

- The COVID-19 impact on market size of plant-based meat, in terms of value and volume, was determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed to estimate the global plant-based meat market due to COVID impact and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- Determining and projecting the size of the plant-based meat market, with respect to raw material, product type, distribution channels, and regional markets, over a period, ranging from 2018 to 2021.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the COVID-19 impact on plant-based meat supply chain and its impact on various stakeholders such as raw material suppliers, manufacturers, R&D laboratories, and retailers across the supply chain.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- Identifying and profiling the key players in the plant-based meat market and impact of COVID on the key vendors.

-

Providing a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions due to COVID.

- Analyzing the value chain and products offered across key regions and their impact on the growth of the prominent market players

- Providing insights on key product innovations and investments in the plant-based meat market.

Geographical Analysis

- Further breakdown of the Rest of Europe plant-based meat market, by key country

- Further breakdown of the Rest of Asia Pacific plant-based meat market, by key country

Company Information

- Analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in COVID-19 Impact on Plant-Based Meat Market

Does this report provide latest market trends and technologies, market forecast in Value (USD) and Volume (KT)?