Crawler Camera System Market by Component (Hardware, Software, Service), Application (Drain Inspection; Pipeline Inspection; Tank, Void, and Cavity/Conduit Inspection), Vertical (Residential, Municipal, Industrial), and Region - Global Forecast to 2025

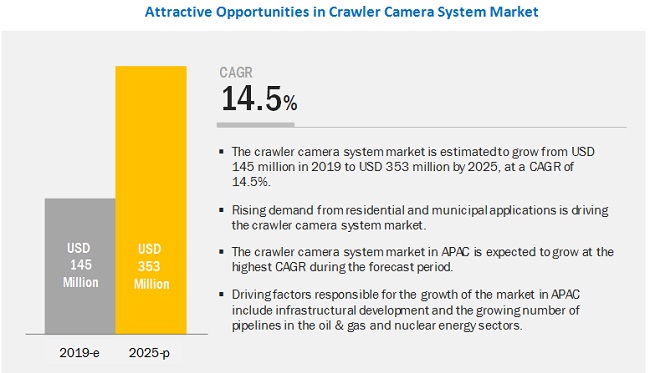

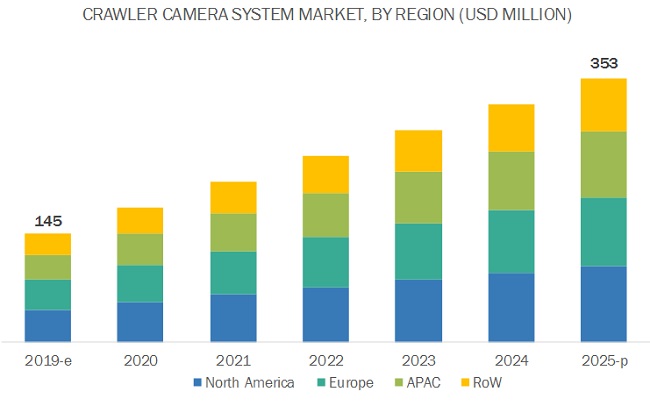

The crawler camera system market size is projected to reach USD 353 million in 2025; it is projected to grow at a CAGR of 14.5% during the forecast period.

The major drivers for the market’s growth are the rising demand from residential and municipal applications, increasing government mandates and regulations for pipeline assessment, growing demand for advanced inspection systems for underwater operations, and growing demand for sewer inspection. The introduction of magnetic crawlers will create growth opportunities for crawler camera system manufacturers.

Impact of AI on Crawler Camera System Market

Artificial Intelligence (AI) is significantly transforming the crawler camera system market by enhancing inspection accuracy, automating defect detection, and improving operational efficiency. AI-powered crawler cameras can analyze real-time video feeds to identify cracks, blockages, corrosion, and other anomalies in pipelines, sewage systems, and industrial infrastructure without human intervention. This not only reduces inspection time but also minimizes the risk of human error and improves safety. Machine learning algorithms enable these systems to learn from past inspections, refine detection capabilities, and generate predictive maintenance insights. Additionally, AI facilitates data-driven reporting and integration with asset management systems, streamlining decision-making for maintenance and repair. As infrastructure monitoring becomes increasingly critical, the integration of AI in crawler camera systems is driving demand across industries such as municipal utilities, oil & gas, construction, and environmental services.

Based on component, hardware to hold largest share of crawler camera system market

The hardware components in crawler camera systems carry out various functions such as drain inspection; pipeline inspection; and tank, void, and cavity/conduit inspection. This segment is further subsegmented into cameras, crawlers, cable drums, control units, and others. The growth of the hardware segment is driven by the increased investments in the modernization of infrastructure and the use of crawler cameras for inspection purposes in various sectors. This segment is expected to witness further modifications, innovations, and advancements, as several leading manufacturers are incorporating value-added components into their existing products. For example, Cues Inc. (US) introduced new carbide-toothed wheels in April 2018 that increases traction in both PVC and clay pipes. In February 2017, Rausch Electronics (US) launched the Pure View SD camera that can be connected to the L 135 crawler platform and record the entire pipe interior at 30 fps in a single continuous run.

Municipal vertical to be largest shareholder of crawler camera system in coming years

Crawler camera systems are used in the municipal vertical for inspection purposes due to their light weight, portability, robustness, and reliability. Increasing demand for remote-operated inspection systems is driving the growth of the crawler camera system market. Numerous municipalities are using crawler camera systems to enhance security and control the error percentage during inspections. This is projected to propel the market for the municipal vertical during the forecast period.

North America to account for largest size of crawler camera system market in 2020

In North America, crawler camera systems are majorly used for pipeline inspection, drain and sewer inspection, and tank and cavity inspection. Pipelines are the primary mode of transportation for crude oil, petroleum products, and natural gas in both Canada and the US. In the US, approximately 70% of crude oil and petroleum products are shipped through pipelines; in Canada, approximately 97% of natural gas and petroleum products are shipped through pipelines. The focus of oil & gas companies, government bodies, and environmental agencies is on preventing oil spills, gas leaks, and other disasters because of the increase in the number of pipelines across the North American countries.

This is compelling oil & gas companies to use crawler camera systems for pipeline inspection. The US Department of Homeland Security (DHS) has set special regulations on pipelines due to their vulnerability to physical threats. The US Transportation Security Administration (TSA), along with the US Department of Energy (DOE), the Department of Transportation (DOT), and the DHS, frames policies and protection strategies for securing and monitoring pipeline infrastructure.

Inspection Camera System Market Insights and Growth Prospects

The inspection camera system market is witnessing robust growth due to its critical role in ensuring safety and efficiency across various industries, including wastewater management, oil and gas, and construction. These systems, often equipped with advanced imaging technologies and features like high-resolution cameras, remote control capabilities, and real-time data transmission, provide detailed insights into hard-to-reach areas. Their increasing adoption is driven by the need for precise inspection and maintenance, particularly in applications like pipeline monitoring, infrastructure inspection, and environmental assessments.

Key Market Players

CUES (US), Deep Trekker (Canada), Eddyfi (Canada), Mini-Cam (UK), iPEK International (Germany), ULC Robotics (US), Ratech Electronics (Canada), Envirosight (US), Rausch Electronics USA (US), Insight | Vision (US), RIEZLER (Germany), NDT Technologies (P) Limited (India), Scanprobe (UK), Subsite Electronics (US), and AM Industrial Group (UK) are a few major players in the crawler camera system market.

Crawler Camera System Market Report Scope

|

Report Metric |

Details |

| Estimated Value | USD 145 million |

| Expected Value | USD 353 million |

| Growth Rate | CAGR of 14.5% |

|

Market size available for years |

2017–2025 |

|

On Demand Data Available |

2030 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

|

|

Regions covered |

|

| Market Leaders | Deep Trekker (Canada), Eddyfi (Canada), Mini-Cam (UK), iPEK International (Germany), Ratech Electronics (Canada), RIEZLER (Germany), NDT Technologies (P) Limited (India), Scanprobe (UK), AM Industrial Group (UK), Laveer Engineering (Canada), AC-CESS (UK), Spectis Robotics (Scotland). |

| Top Companies in North America | CUES (US), ULC Robotics (US), Envirosight (US), Rausch Electronics USA (US), Insight | Vision (US), Subsite Electronics (US), Source One Environmental (S1E) (US), Subsite Electronics (US) |

|

Largest Market Vertical |

Municipal Vertical |

| Largest Growing Region | North America |

| Highest CAGR Application | Pipeline Inspection Application |

Crawler Camera System Market segmentation:

In this report, the market is segmented into the following categories:

Crawler Camera System Market, by Component:

- Hardware

- Software

- Service

Crawler Camera System Market, by Application:

- Drain Inspection

- Pipeline Inspection

- Tank, Void, and Cavity/Conduit Inspection

Crawler Camera System Market, by Vertical:

- Residential

- Municipal

- Industrial

- Commercial

Geographic Analysis

- North America

- Europe

- APAC

- RoW

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are emerging application areas that are expected to adopt crawler camera systems?

- Which vertical of the crawler camera system market is growing at the highest rate?

- Which application of crawler camera system is expected to hold the largest market share during the forecast period?

- Which regional crawler camera system market will witness highest growth during the forecast period?

Frequently Asked Questions (FAQ):

What is a crawler camera system and where does it find applications?

A crawler camera system is an advanced and full portable video inspection system used to deliver crystal clear images as well as operator friendly data reporting. The crawler camera system is used for drain inspection; pipeline inspection; and tank, void, and cavity/conduit inspection

Which are the major companies in the crawler camera system market? What are their major strategies to strengthen their market presence?

The major companies in crawler camera system market include Cues Inc. (Acquired By Spx Corporation) (US), Deep Trekker (Canada), Eddyfi (Canada), Mini-Cam (A Halma Group Company) (UK), IPEK International (An Idex Group Company) (Germany). Cues Inc. (SPX Corporation) (US) is the dominant player in the global crawler camera system market. It is a leading manufacturer of crawler cameras and transporters. The major strategies adopted by these players are product launches and expansion strategy.

What are the drivers and opportunities for the crawler camera system market?

Major drivers for the market’s growth are rising demand from residential and municipal applications, increasing government mandates and regulations for pipeline assessment, growing demand for advanced inspection systems for underwater operations and growing demand for sewer inspection system. Further, introduction of magnetic crawlers will create growth opportunities for crawler camera system manufacturers.

What are the challenges faced by the companiesin the crawler camera system market?

Time involved in data analytics in crawler camera system pose a major challenge to this market.

Which vertical is expected to drive the growth of the market in the next 5 years?

Crawler camera system is largely used in the municipal vertical for inspection purposes due to their light weight, portability, robustness, and reliability. Increasing demand for remote-operated inspection systems is driving the growth of the crawler camera system market. Numerous municipalities are using crawler camera systems to enhance security and control the error percentage during inspections. This is projected to propel the crawler camera system market for the municipal vertical in coming years.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Study Objectives

1.2 Definition and Scope

1.2.1 Inclusions and Exclusions

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.1.3 Secondary and Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach Used to Arrive at Market Share By Bottom-Up Analysis (Demand Side)

2.2.1.2 Approach for Capturing Company-Specific Information in Crawler Camera System Value Chain

2.2.2 Top-Down Approach

2.2.2.1 Approach Used to Arrive at Market Size By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 32)

4.1 Attractive Growth Opportunities in Market

4.2 Market, By Application

4.3 Market in APAC, By Application and Country

4.4 Market in North America, By Vertical

4.5 Market, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics: Crawler Camera System Market

5.2.1 Drivers

5.2.1.1 Rising Demand From Municipal and Residential Applications

5.2.1.2 Increasing Government Mandates and Regulations for Pipeline Assessment

5.2.1.3 Growing Demand for Advanced Inspection Systems for Underwater Operations

5.2.1.4 Growing Demand for Sewer Inspection Systems

5.2.2 Restraints

5.2.2.1 Fast Battery Drainage of Crawler Camera Systems

5.2.3 Opportunities

5.2.3.1 Introduction of Magnetic Crawlers

5.2.3.2 Big Data Analytics Would Increase the Scope of Pipeline Monitoring Systems

5.2.3.3 Increasing Demand for Pipeline Monitoring Solutions Due to Enhanced Pipeline Infrastructure

5.2.4 Challenges

5.2.4.1 More Time Required for Data Analytics

6 Crawler Camera System Market, By Component (Page No. - 40)

6.1 Introduction

6.2 Hardware

6.2.1 Cameras

6.2.1.1 Market for Cameras to Grow at Highest CAGR in APAC

6.2.2 Crawlers

6.2.2.1 North America is Expected to Lead Crawlers Market During Forecast Period

6.2.3 Cable Drums

6.2.3.1 Cable Drums are Responsible for the Movement of Crawler Camera Systems

6.2.4 Control Units

6.2.4.1 Control Units are Responsible for Safety of Crawler Camera Systems

6.2.5 Others

6.2.5.1 Use of Other Components in Crawler Camera Systems Varies According to Application Requirements

6.3 Software

6.3.1 Software are Responsible for Data Gathering and Report Generation in Crawler Camera Systems

6.4 Services

6.4.1 APAC Crawler Camera System Services Market to Grow at Highest CAGR During Forecast Period

7 Market, By Application (Page No. - 47)

7.1 Introduction

7.2 Drain Inspection

7.2.1 North America to Lead Market for Drain Inspection During Forecast Period

7.3 Pipeline Inspection

7.3.1 Market for Pipeline Inspection in APAC to Grow at Highest CAGR During Forecast Period

7.4 Tank, Void, and Cavity/Conduit Inspection

7.4.1 Market for Tank, Void, and Cavity/Conduit Inspection to Grow at Highest CAGR in US During Forecast Period

8 Market, By Vertical (Page No. - 55)

8.1 Introduction

8.2 Residential

8.2.1 Residential Segment to Grow Owing to Increasing Use of Crawler Camera Systems in Water Management Sector Across the World

8.3 Municipal

8.3.1 Municipal Vertical to Witness Highest Growth in APAC Due to Ongoing Infrastructural Developments in the Pipeline Industry in This Region

8.4 Industrial

8.4.1 North America to Dominate Market for Industrial Vertical During Forecast Period

8.5 Commercial

8.5.1 Market for Commercial Vertical to Witness Highest Growth in APAC

9 Geographic Analysis (Page No. - 65)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Market in North America Will Be Dominated By US During Forecast Period

9.2.2 Canada

9.2.2.1 Growing Awareness About Use of Crawler Cameras for Pipeline Inspection is Expected to Drive Market in Canada

9.2.3 Mexico

9.2.3.1 Increase in Pipeline Projects in Mexico Will Drive Market During Forecast Period

9.3 Europe

9.3.1 UK

9.3.1.1 Increasing Production of Oil & Gas Will Drive Market in UK

9.3.2 Germany

9.3.2.1 German Market for Crawler Camera System Will Witness High Growth Owing to Increasing Concerns Over Safety of Pipelines and Energy Infrastructure

9.3.3 France

9.3.3.1 Growing Demand for Sewer Inspection Will Boost Market in France

9.3.4 Spain

9.3.4.1 Rising Demand From Municipal and Residential Verticals for Inspection of Pipes Will Boost Market in Spain

9.3.5 Rest of Europe

9.4 APAC

9.4.1 China

9.4.1.1 China to Hold Largest Share of Market in APAC

9.4.2 Japan

9.4.2.1 Market in Japan to Grow at Highest CAGR Among APAC Countries During Forecast Period

9.4.3 South Korea

9.4.3.1 Requirement of Crawler Camera for Pipeline and Sewer Line Inspection Will Help the Market to Grow in South Korea

9.4.4 Australia

9.4.4.1 Increasing Investment Opportunities and Government Policies in Energy Sector Will Drive Australian Market

9.4.5 Rest of APAC

9.5 RoW

9.5.1 Middle East

9.5.1.1 Rising Environmental Concerns and Increasing Export Activities Will Boost Market in Middle East

9.5.2 Africa

9.5.2.1 Growing Number of Pipeline Projects in Africa Will Drive African Market

9.5.3 South America

9.5.3.1 Growing Number of Pipelines in South America Will Boost Market in the Region

10 Competitive Landscape (Page No. - 94)

10.1 Overview

10.2 Ranking Analysis of Key Players in Crawler Camera System Market

10.3 Competitive Situations and Trends

10.3.1 Product Developments

10.3.2 Contracts

10.3.3 Partnerships

10.3.4 Acquisitions

10.4 Competitive Leadership Mapping, 2019

10.4.1 Visionary Leaders

10.4.2 Dynamic Differentiators

10.4.3 Innovators

10.4.4 Emerging Companies

11 Company Profiles (Page No. - 100)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Key Players

11.1.1 Cues Inc. (Acquired By Spx Corporation)

11.1.2 Deep Trekker

11.1.3 Eddyfi

11.1.4 Mini-Cam (A Halma Group Company)

11.1.5 IPEK International (An Idex Group Company)

11.1.6 ULC Robotics

11.1.7 Ratech Electronics

11.1.8 Envirosight

11.1.9 Rausch Electronics USA

11.1.10 Insight | Vision

11.2 Right to Win

11.3 Other Players

11.3.1 Riezler Inspection Systems

11.3.2 NDT Technologies (P) Limited

11.3.3 Scanprobe

11.3.4 Subsite Electronics (The Charles Machine Works Company)

11.3.5 Am Industrial Group

11.4 Key Innovators

11.4.1 Source One Environmental (Fernco Company)

11.4.2 Crawler Pipeline Services

11.4.3 Laveer Engineering

11.4.4 Ac-Cess

11.4.5 Spectis Robotics

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 125)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (105 Tables)

Table 1 Crawler Camera System Market, By Component, 2017–2025 (USD Million)

Table 2 Crawler Camera System Hardware Market, 2017–2025 (USD Million)

Table 3 Crawler Camera System Hardware Market, By Region, 2017–2025 (USD Million)

Table 4 Cameras Market, By Region, 2017–2025 (USD Thousand)

Table 5 Crawlers Market, By Region, 2017–2025 (USD Thousand)

Table 6 Cable Drums Market, By Region, 2017–2025 (USD Thousand)

Table 7 Control Units Market, By Region, 2017–2025 (USD Thousand)

Table 8 Other Hardware Components Market, By Region, 2017–2025 (USD Thousand)

Table 9 Crawler Camera System Software Market, By Region, 2017–2025 (USD Million)

Table 10 Crawler Camera System Services Market, By Region, 2017–2025 (USD Million)

Table 11 Crawler Camera System Market, By Application, 2017–2025 (USD Million)

Table 12 Market for Drain Inspection, By Region, 2017–2025 (USD Million)

Table 13 Market for Drain Inspection in North America, By Country, 2017–2025 (USD Thousand)

Table 14 Market for Drain Inspection in Europe, By Country, 2017–2025 (USD Thousand)

Table 15 Market for Drain Inspection in APAC, By Country, 2017–2025 (USD Thousand)

Table 16 Market for Drain Inspection in RoW, By Region, 2017–2025 (USD Thousand)

Table 17 Market for Pipeline Inspection, By Region, 2017–2025 (USD Million)

Table 18 Market for Pipeline Inspection in North America, By Country, 2017–2025 (USD Thousand)

Table 19 Market for Pipeline Inspection in Europe, By Country, 2017–2025 (USD Thousand)

Table 20 Market for Pipeline Inspection in APAC, By Country, 2017–2025 (USD Thousand)

Table 21 Market for Pipeline Inspection, By Region, 2017–2025 (USD Thousand)

Table 22 Market for Tank, Void, and Cavity/Conduit Inspection, By Region, 2017–2025 (USD Million)

Table 23 Market for Tank, Void, and Cavity/Conduit Inspection in North America, By Country, 2017–2025 (USD Thousand)

Table 24 Market for Tank, Void, and Cavity/Conduit Inspection in Europe, By Country, 2017–2025 (USD Thousand)

Table 25 Market for Tank, Void, and Cavity/Conduit Inspection in APAC, By Country, 2017–2025 (USD Thousand)

Table 26 Market for Tank, Void, and Cavity/Conduit Inspection in RoW, By Region, 2017–2025 (USD Thousand)

Table 27 Market, By Vertical, 2017–2025 (USD Million)

Table 28 Crawler Camera System Market for Residential Vertical, By Region, 2017–2025 (USD Thousand)

Table 29 Market for Residential Vertical in North America, By Country, 2017–2025 (USD Thousand)

Table 30 Market for Residential Vertical in Europe, By Country, 2017–2025 (USD Thousand)

Table 31 Market for Residential Vertical in APAC, By Country, 2017–2025 (USD Thousand)

Table 32 Market for Residential Vertical in RoW, By Region, 2017–2025 (USD Thousand)

Table 33 Market for Municipal Vertical, By Region, 2017–2025 (USD Thousand)

Table 34 Market for Municipal Vertical in North America, By Country, 2017–2025 (USD Thousand)

Table 35 Market for Municipal Vertical in Europe, By Country, 2017–2025 (USD Thousand)

Table 36 Market for Municipal Vertical in APAC, By Country, 2017–2025 (USD Thousand)

Table 37 Market for Municipal Vertical in RoW, By Region, 2017–2025 (USD Thousand)

Table 38 Market for Industrial Vertical, By Region, 2017–2025 (USD Thousand)

Table 39 Market for Industrial Vertical in North America, By Country, 2017–2025 (USD Thousand)

Table 40 Market for Industrial Vertical in Europe, By Country, 2017–2025 (USD Thousand)

Table 41 Market for Industrial Vertical in APAC, By Country, 2017–2025 (USD Thousand)

Table 42 Market for Industrial Vertical in RoW, By Region, 2017–2025 (USD Thousand)

Table 43 Market for Commercial Vertical, By Region, 2017–2025 (USD Thousand)

Table 44 Market for Commercial Vertical in North America, By Country, 2017–2025 (USD Thousand)

Table 45 Market for Commercial Vertical in Europe, By Country, 2017–2025 (USD Thousand)

Table 46 Market for Commercial Vertical in APAC, By Country, 2017–2025 (USD Thousand)

Table 47 Market for Commercial Vertical in RoW, By Region, 2017–2025 (USD Thousand)

Table 48 Crawler Camera System Market, By Region, 2017–2025 (USD Million)

Table 49 Crawler Camera System Market in North America, By Country, 2017–2025 (USD Million)

Table 50 Market in North America, By Component, 2017–2025 (USD Million)

Table 51 Market in North America, By Hardware Component, 2017–2025 (USD Thousand)

Table 52 Market in North America, By Application, 2017–2025 (USD Million)

Table 53 Market in North America, By Vertical, 2017–2025 (USD Million)

Table 54 Market in US, By Application, 2017–2025 (USD Thousand)

Table 55 Market in US, By Vertical, 2017–2025 (USD Thousand)

Table 56 Market in Canada, By Application, 2017–2025 (USD Thousand)

Table 57 Market in Canada, By Vertical, 2017–2025 (USD Thousand)

Table 58 Market in Mexico, By Application, 2017–2025 (USD Thousand)

Table 59 Market in Mexico, By Vertical, 2017–2025 (USD Thousand)

Table 60 Market in Europe, By Country, 2017–2025 (USD Thousand)

Table 61 Market in Europe, By Component, 2017–2025 (USD Million)

Table 62 Market in Europe, By Hardware Component, 2017–2025 (USD Thousand)

Table 63 Market in Europe, By Application, 2017–2025 (USD Million)

Table 64 Market in Europe, By Vertical, 2017–2025 (USD Million)

Table 65 Market in UK, By Application, 2017–2025 (USD Thousand)

Table 66 Market in UK, By Vertical, 2017–2025 (USD Thousand)

Table 67 Market in Germany, By Application, 2017–2025 (USD Thousand)

Table 68 Market in Germany, By Vertical, 2017–2025 (USD Thousand)

Table 69 Market in France, By Application, 2017–2025 (USD Thousand)

Table 70 Market in France, By Vertical, 2017–2025 (USD Thousand)

Table 71 Market in Spain, By Application, 2017–2025 (USD Thousand)

Table 72 Market in Spain, By Vertical, 2017–2025 (USD Thousand)

Table 73 Market in Rest of Europe, By Application, 2017–2025 (USD Thousand)

Table 74 Market in Rest of Europe, By Vertical, 2017–2025 (USD Thousand)

Table 75 Market in APAC, By Country, 2017–2025 (USD Thousand)

Table 76 Market in APAC, By Component, 2017–2025 (USD Thousand)

Table 77 Market in APAC, By Hardware Component, 2017–2025 (USD Thousand)

Table 78 Market in APAC, By Application, 2017–2025 (USD Million)

Table 79 Market in APAC, By Vertical, 2017–2025 (USD Million)

Table 80 Market in China, By Application, 2017–2025 (USD Thousand)

Table 81 Market in China, By Vertical, 2017–2025 (USD Thousand)

Table 82 Market in Japan, By Application, 2017–2025 (USD Thousand)

Table 83 Market in Japan, By Vertical, 2017–2025 (USD Thousand)

Table 84 Market in South Korea, By Application, 2017–2025 (USD Thousand)

Table 85 Market in South Korea, By Vertical, 2017–2025 (USD Thousand)

Table 86 Market in Australia, By Application, 2017–2025 (USD Thousand)

Table 87 Market in Australia, By Vertical, 2017–2025 (USD Thousand)

Table 88 Market in Rest of APAC, By Application, 2017–2025 (USD Thousand)

Table 89 Market in Rest of APAC, By Vertical, 2017–2025 (USD Thousand)

Table 90 Market in RoW, By Region, 2017–2025 (USD Thousand)

Table 91 Market in RoW, By Component, 2017–2025 (USD Thousand)

Table 92 Market in RoW, By Hardware Component, 2017–2025 (USD Thousand)

Table 93 Market in RoW, By Application, 2017–2025 (USD Thousand)

Table 94 Market in RoW, By Vertical, 2017–2025 (USD Million)

Table 95 Market in Middle East, By Application, 2017–2025 (USD Thousand)

Table 96 Market in Middle East, By Vertical, 2017–2025 (USD Thousand)

Table 97 Market in Africa, By Application, 2017–2025 (USD Thousand)

Table 98 Market in Africa, By Vertical, 2017–2025 (USD Thousand)

Table 99 Market in South America, By Application, 2017–2025 (USD Thousand)

Table 100 Market in South America, By Vertical, 2017–2025 (USD Thousand)

Table 101 Crawler Camera System Market: Ranking of Key Companies

Table 102 Product Developments, 2016–2019

Table 103 Contracts, 2017–2019

Table 104 Partnerships, 2018–2019

Table 105 Acquisitions, 2016–2019

List of Figures (33 Figures)

Figure 1 Market Segmentation

Figure 2 Crawler Camera Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Services to Capture Largest Market Share During Forecast Period

Figure 7 Cameras to Dominate Crawler Camera System Hardware Market During Forecast Period

Figure 8 Municipal Vertical to Hold Largest Market Share in 2020

Figure 9 North America Accounted for Largest Share of Market in 2019

Figure 10 Increasing Demand From Municipal and Residential Applications Drives Market

Figure 11 Pipeline Inspection to Dominate Market During Forecast Period

Figure 12 Pipeline Inspection to Account for Largest Share of Market in APAC By 2025

Figure 13 Residential Segment to Witness Highest CAGR in North American Market From 2020 to 2025

Figure 14 APAC Market to Witness Highest CAGR During Forecast Period

Figure 15 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Impact Analysis: Drivers

Figure 17 Crawler Camera System Market, By Component

Figure 18 Services to Hold Largest Share of Market in 2020

Figure 19 Market, By Application

Figure 20 Pipeline Inspection to Hold Largest Share of Market in 2020

Figure 21 Market, By Vertical

Figure 22 Municipal Segment to Hold Largest Share of Market in 2020

Figure 23 Market, By Region

Figure 24 Geographic Snapshot: Crawler Camera System Market

Figure 25 Crawler Camera System Market in North America

Figure 26 Snapshot: Market in North America

Figure 27 Market in Europe

Figure 28 Snapshot: Market in Europe

Figure 29 Market in APAC

Figure 30 Snapshot: Market in APAC

Figure 31 Market in RoW

Figure 32 New Product Launches Was the Key Growth Strategy From 2016 to 2019

Figure 33 Market (Global) Competitive Leadership Mapping, 2019

The study involved 4 major activities in estimating the current size of the crawler camera system market. Exhaustive secondary research was done to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to in this research study include corporate filings (such as company websites, investor presentations, and financial statements); trade, business, and professional associations; white papers, crawler camera system-related journals, IEST publications; directories; and databases. The secondary data has been collected and analyzed to arrive at the overall market size estimations, which has been further validated by primary research.

Primary Research

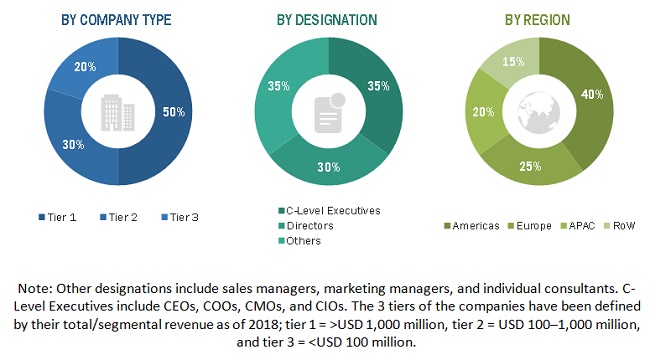

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information relevant to this report. Extensive primary research has been conducted after understanding and analyzing the market through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 regions: the Americas, Europe, APAC, and RoW. RoW comprises the Middle East, Africa, and South America. Approximately 25% of the primary interviews have been conducted with the demand side and 75% with the supply side. This primary data has been collected mainly through telephonic interviews, which accounted for 80% of the total primary interviews. Besides, questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were implemented to estimate and validate the total size of the crawler camera system market. These methods were also used extensively to estimate the size of the markets based on various subsegments. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides across different end-use applications.

Study Objectives

- To describe and forecast the market, in terms of value, by component, application, and vertical

- To describe and forecast the market size by regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To describe the components and functions of crawler camera systems

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market

- To strategically profile key players in the market and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments such as contracts, product launches/developments, expansions, and research and development (R&D) activities carried out by players in the crawler camera system market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company's specific needs. The following customization options are available for this report:

Regional Analysis

- Country-wise breakdown for America, Europe, APAC, and RoW

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Crawler Camera System Market