Cryptocurrency Market Size, Share, Industry Growth, Trends & Analysis by Offering (Hardware, and Software), Process (Mining and Transaction), Type, Application (Trading, Remittance, Payment: Peer-to-Peer Payment, Ecommerce, and Retail), and Geography

Cryptocurrency Market Overview

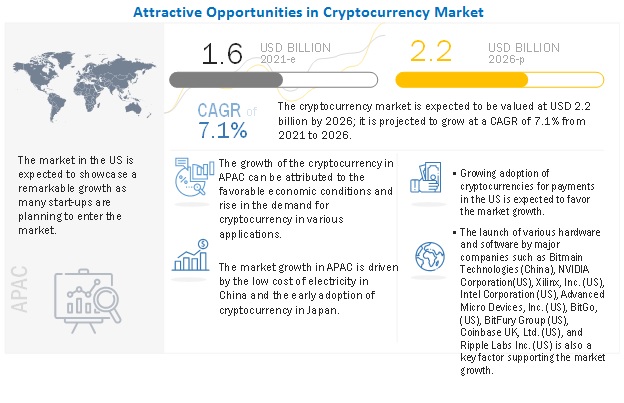

The cryptocurrency market Size, Share, Industry Growth, Trends & Analysis is projected to reach USD 2.2 billion by 2026, growing at a CAGR of 7.1% during the forecast period. Growing popularity of cryptocurrency in emerging and developed countries will create lot of opportunities for the market. Transparency or distributed ledger technology and growth in venture capital investments are the key factors driving the growth of the cryptocurrency industry.

Cryptocurrency Market Thrives with Diverse Applications: Trading, Remittance, and Peer-to-Peer Payments Drive Growth

Cryptocurrency Types: A Diverse Ecosystem

The cryptocurrency market comprises various types of digital currencies, each serving distinct purposes and use cases.

-

Bitcoin (BTC): As the first and most well-known cryptocurrency, Bitcoin is primarily used as a store of value and a medium of exchange. Its widespread recognition and acceptance make it a staple in the cryptocurrency ecosystem.

-

Ethereum (ETH): Ethereum is not just a cryptocurrency but a decentralized platform that enables smart contracts and decentralized applications (dApps). Its versatility has made it a cornerstone for various blockchain-based projects.

-

Altcoins: This category includes a wide range of cryptocurrencies like Ripple (XRP), Litecoin (LTC), and Cardano (ADA), each offering unique features. For instance, Ripple focuses on cross-border payments, while Litecoin is designed for faster transaction times.

-

Stablecoins: Cryptocurrencies like Tether (USDT) and USD Coin (USDC) are pegged to traditional fiat currencies, providing stability and making them ideal for trading and remittance.

Trading: The Backbone of Cryptocurrency Activity

Crypto exchanges remain one of the most significant applications, with platforms like Binance, Coinbase, and Kraken leading the market. The volatility and potential for high returns attract a large number of traders and investors.Innovations such as decentralized exchanges (DEXs) and automated trading bots are enhancing the trading experience, providing users with more control and efficiency. The rise of derivative products like futures and options is also adding depth to the market, catering to sophisticated traders seeking to hedge risks or speculate on price movements..

Remittance: Revolutionizing Cross-Border Transactions

Cryptocurrencies are transforming the remittance landscape by offering a faster, cheaper, and more transparent alternative to traditional money transfer services. Cryptocurrencies like Ripple (XRP) are specifically designed to facilitate cross-border remittances, reducing the time and cost associated with international transactions. Blockchain technology enables near-instantaneous transfers with minimal fees, making it especially beneficial for migrant workers sending money home to their families. This application is gaining traction in regions with limited access to traditional banking services, providing financial inclusion to the unbanked and underbanked populations.

Peer-to-Peer Payments: Empowering Users

PPeer-to-peer (P2P) payments are another significant application of cryptocurrencies, allowing users to transfer funds directly without intermediaries. Platforms like Venmo and Cash App are incorporating cryptocurrencies, enabling users to make digital payments seamlessly. Bitcoin, Litecoin, and other cryptocurrencies are popular choices for P2P transactions due to their ease of use and lower fees compared to traditional payment methods. This application is particularly appealing in economies with high inflation rates or unstable currencies, providing a reliable alternative for everyday transactions.

|

Report Metric |

Details |

|

Estimated Market Size |

USD 1.6 billion |

|

Projected Market Size |

USD 2.2 billion |

|

Growth Rate |

CAGR of 7.1% |

|

Largest Share Region |

APAC |

|

Market size available for years |

2015-2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units |

Value (USD) |

|

Segments covered |

|

|

Geographic regions covered |

|

|

Cryptocurrency Industry: Navigating the Landscape of Decentralized Digital Currencies

In recent years, the cryptocurrency industry overview shows it has grown fast, gaining significant investment and attention from both people and institutions. Decentralized digital currencies using blockchain technology to trace transactions safely and transparently include cryptocurrencies like Bitcoin, Ethereum, and others. Decentralized finance (DeFi) and non-fungible tokens are only a couple of the new use cases that are developing as the market becomes more and more diverse (NFTs). The development of DeFi platforms and NFT markets has increased the size of the bitcoin market and opened up new crypto investment opportunities. Nevertheless, the industry continues to suffer a number of difficulties, including as regulatory ambiguity, excessive volatility, and security vulnerabilities. Despite these obstacles, the bitcoin market is positioned for further expansion as new tools and uses are created and cryptocurrency adoption rates rise.

To know about the assumptions considered for the study, Request for Free Sample Report

Cryptocurrency Market Categorization

This report categorizes the Cryptocurrency market by end-user industry, applications, type, revenue, and geography.

Cryptocurrency Market By Offering:

- Hardware

- Software

By Process:

- Mining

- Transaction

By Type:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dash

- Others

Cryptocurrency Market Geographic Analysis

-

North America

- US

- Canada

- Mexico

-

Europe

- Mexico

- Germany

- France

- East Europe

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- South Korea

- Rest of APAC

- Rest of the World (RoW)

Cryptocurrency Market by Hardware

Hardware to hold largest size of Cryptocurrency market

The concept of cryptocurrency is based on decentralizing the monitoring of transactions. In the transaction monitoring process, miners (generally the users) validate the transactions made by other users. In this process, the system needs high computing power to validate the transactions.

The validation process involves the creation of hash codes to encrypt the transactions. To generate a hash code, the miner needs highly effective and efficient hardware. In other words, to get new blocks and solve them, miners need to generate as many hash codes as possible.

Miners get rewards through crypto mining. Mining rigs are available in several shapes and sizes. The cryptocurrency market for hardware has been segmented, on the basis of processor, into GPUs, central processing units (CPUs), FPGAs, and ASICs.

Cryptocurrency Market Size by Mining

Mining process to hold largest share of Cryptocurrency market

Mining is an integral process for the generation, transmission, and validation of transactions in cryptocurrencies.

It ensures stable, secure, and safe propagation of the currency from a payer to a receiver. Unlike fiat currency, where a centralized authority controls and regulates the transactions, cryptocurrencies are decentralized and work on a peer-to-peer system.

Cryptocurrency Market by APAC Region

APAC to grow at highest CAGR during the forecast period

In terms of value, APAC to grow at highest CAGR during the forecast period. This market in APAC has been studied for China, Japan, South Korea, and Rest of APAC (RoAPAC).

RoAPAC includes Singapore, Malaysia, Thailand, India, Australia, and New Zealand. China is the largest market among all APAC countries. Owing to the low cost of electricity, and presence of big crypto mining companies.

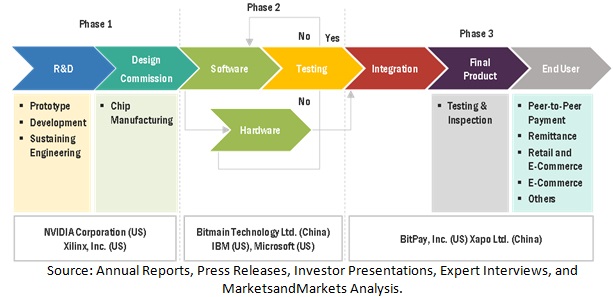

Value Chain Analysis in Cryptocurrency Industry

To know about the assumptions considered for the study, download the pdf brochure

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Cryptocurrency Market Growth Dynamics

Driver: Transparency of distributed ledger technology

Issues related to lack of transparency arise when transactions take place without the knowledge of stakeholders, especially in Asian countries where several instances of fraudulent or unwanted transactions, such as deduction of scheduled charges, are frequently observed.

This may be caused by human error, machine error, or data manipulation during the transaction process, and may result in customers losing huge amounts of money. Moreover, in most cases, financial institutions do not accept their fault. This lack of transparency in the current monetary system leads to dissatisfaction among the public.

Restraint: Uncertain regulatory status

The cryptocurrency market is not yet regulated. At present, the lack of cryptocurrency regulations and the uncertainty regarding the same are among the major factors restraining the adoption of cryptocurrencies.

While financial regulatory bodies across the world are working to find common standards for cryptocurrencies, regulatory acceptance remains one of the biggest challenges. As the distributed ledger technology is still in the nascent stage, it raises a number of questions for regulators and policymakers at national and international levels.

Opportunity: Significant growth opportunities in emerging and developed markets

Emerging economies (such as India, China, and Brazil) and developed countries (such as the US, Germany, and Japan) are expected to offer significant crypto growth opportunities for companies operating in the cryptocurrency market.

For instance, in 2020, Brazilian crypto companies have signed a code of self-regulation that aims to legitimize and boost the adoption of crypto assets in the country. The document was signed under the auspices of Abcripto, the country’s association of cryptocurrency companies.

The objective of the agreement is to establish operational practices and compliance standards that all members must adhere to. The country’s prominent cryptocurrency firms that signed the code include Foxbit, Ripio, Bitcoin Market, and Novadax.

Challenge: Concerns regarding security, privacy, and control

Cryptocurrency has the potential of transforming and revolutionizing compliance-free peer-to-peer and remittance transactions; however, end users have to overcome certain challenges related to security, privacy, and control to benefit from cryptocurrency.

As cryptocurrency transactions are recorded in the distributed public ledger known as blockchain, hackers have a large attack surface to gain access to critical and sensitive information. If this public ledger is used to store confidential contract-related information or payment data, replicating the file could potentially make it easier for hackers to access it. If a key is compromised, it can be used to access the database in a hub-and-spoke model as well as in a distributed database.

Cryptocurrency Market Analysis Forecast to 2026 With COVID-19 Impact

The COVID-19 pandemic has had a huge impact on the global economy. With the virus spreading across 188 countries, a number of businesses were shut down and many people lost their jobs.

The virus mostly affected small businesses, but large corporations felt the impact as well. Apple closed all of its stores outside of China temporarily and Bloomingdale’s did the same with all of its 56 locations. Against the backdrop of the uncertainty raised by COVID-19, Bitcoin, Ethereum, and other digital currencies have garnered significant attention. Even banks have started buying crypto for the first time.

Banks in the US are creating their own blockchain-based systems, including digital currencies, to enable B2B cryptocurrency payments between their customers. Also, in October 2020, PayPal announced that its customers will be able to buy, sell, and hold Bitcoin and cryptocurrencies using their PayPal accounts, allowing customers to buy things from the 26 million sellers who accept PayPal, In 2021, PayPal is planning to allow cryptocurrency to be used as a funding source.

Recent Developments in Cryptocurrency Market Trends

- In March 2018, NVIDIA announced a series of new technologies and partnerships that expand its potential inference market to 30 million hyperscale servers worldwide, while dramatically lowering the cost of delivering deep learning-powered services .

- In February 2018, AMD launched EPYC Embedded 3000 series processor and AMD Ryzen Embedded V1000 processor that deliver high performance, exceptional integration, and on-chip security.

Frequently Asked Questions (FAQ):

How big Cryptocurrency Market?

The cryptocurrency market cap size is expected to reach USD 2.2 billion by 2026 from USD 1.6 billion in 2021 to grow at a CAGR of 7.1%.

Which are the recent industry trends that can be implemented to generate additional revenue streams?

Growing popularity cryptocurrency in emerging and developed countries will create lot of opportunities for the market.

Who are the major players operating in the Cryptocurrency detection market? Which companies are the front runners?

Bitmain (China), NVIDIA (US), Xilinx (US), Intel (US), Advanced Micro Devices (US), Ripple Labs (US), Ethereum Foundation (Switzerland), Bitfury Group (Netherlands), Coinbase (US), BitGo (US), Binance Holdings (China) Canaan Creative (China). Bitstamp (Luxemburg), Ifinex (Hong Kong), Ledger SAS (France), Xapo (Hong Kong), and Alcheminer (US). are some of the major vendors in the market.

What are the major end-use industries of Cryptocurrency market?

Retail, and banking are major end-use industries of Cryptocurrency market.

How will the increasing adoption of Cryptocurrency for mining impact the growth rate of the overall market?

The market for Mining process is estimated to grow at higher CAGR during the forecast period. Mining is an integral process for the generation, transmission, and validation of transactions in cryptocurrencies. It ensures stable, secure, and safe propagation of the currency from a payer to a receiver. Unlike fiat currency, where a centralized authority controls and regulates the transactions, cryptocurrencies are decentralized and work on a peer-to-peer system.

Why Crypto Market is falling now?

The global cryptocurrency market cap has fallen by over USD 2 trillion since last 10 months. There are several reasons to it such as regulatory challenges, for instance, in India, cryptocurrency trading is prohibited as there is no regulatory bill is place. In In January 2022, Russia’s central bank proposed banning the use and mining of cryptocurrencies on Russian territory. Cryptocurrency lending firm Celsius Network paused the withdrawal of cryptocurrencies due to extreme market conditions. The company filed for bankruptcy in June 2022. Stablecoins such as TerraUSD, crypto tokens pegged to the value of mainstream assets such as dollar are losing their pegs to the U.S. dollar. Other macroeconomic factors such as rising inflation and interest rates have further resulted in the fall in the crypto market.

How Big is the crypto market now?

If we talk in perspective of coin market cap, the global cryptocurrency market cap is close to 1 trillion. Though, global cryptocurrency market cap has fallen since last year, there have been some signs of hope as Terra Luna Classic has demonstrated good performance with 750% increase in cryptocurrency prices since June 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 INCLUSIONS & EXCLUSIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.1.1 Key industry insights

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

2.1.3.2 Primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Demand-side analysis

FIGURE 2 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1—BOTTOM-UP (DEMAND SIDE) – DEMAND FOR CRYPTOCURRENCIES

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Supply-side analysis

FIGURE 4 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)—REVENUE GENERATED FROM CRYPTOCURRENCY RELATED PRODUCTS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 1 STUDY ASSUMPTIONS

2.5 LIMITATIONS

2.5.1 METHODOLOGY-RELATED LIMITATIONS

2.5.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 7 GLOBAL INDUSTRIAL SENSORS MARKET, 2015–2026 (USD MILLION)

FIGURE 8 MARKET FOR HARDWARE CONTRIBUTED HIGHEST IN 2020

FIGURE 9 MARKET FOR MINING GENERATED MORE REVENUE IN 2020

FIGURE 10 MARKET FOR BITCOIN TO HOLD LARGEST SHARE DURING 2021–2026

FIGURE 11 MARKET FOR PAYMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 12 APAC HELD LARGEST SHARE OF MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 13 APAC TO DOMINATE MARKET DURING FORECAST PERIOD

4.2 MARKET FOR PAYMENT, BY TYPE

FIGURE 14 PEER-TO PEER PAYMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.3 MARKET FOR MINING, BY TYPE

FIGURE 15 MARKET FOR POOL MINING WILL HAVE HIGHEST MARKET SHARE IN 2026

4.4 CRYPTOCURRENCY MARKET IN NORTH AMERICA, BY APPLICATION AND COUNTRY

FIGURE 16 TRADING AND US SEGMENTS TO HOLD LARGEST SHARE OF MARKET IN NORTH AMERICA IN 2021

4.5 MARKET, BY GEOGRAPHY

FIGURE 17 MARKET IN SOUTH AMERICA TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Transparency of distributed ledger technology

5.2.1.2 High inflow of remittances to developing countries

FIGURE 19 GLOBAL REMITTANCE FLOWS, 2014–2019

FIGURE 20 TOP REMITTANCE RECEIVERS, 2019

5.2.1.3 High charges of cross-border remittances

FIGURE 21 COSTS OF REMITTANCES, 2017 VS. 2018

5.2.1.4 Growth in venture capital investments

TABLE 2 FUNDING IN MARKET, 2014–2018 (USD MILLION)

FIGURE 22 MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Uncertain regulatory status

5.2.2.2 Lack of awareness and technical understanding regarding cryptocurrencies

FIGURE 23 MARKET RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Significant growth opportunities in emerging and developed markets

5.2.3.2 Growing acceptance of cryptocurrency across various industries

FIGURE 24 MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Concerns regarding security, privacy, and control

5.2.4.2 Technical challenges pertaining to scalability

5.2.4.3 Lack of legislation

FIGURE 25 MARKET CHALLENGES AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS OF MARKET

FIGURE 26 VALUE CHAIN ANALYSIS OF CRYPTOCURRENCY, 2018

6 INDUSTRY TRENDS (Page No. - 59)

6.1 CASE STUDY

6.1.1 RANSOMWARE CASE STUDY

6.1.1.1 Technology behind ransomware

6.1.1.2 Encryption

6.1.1.3 Advent of cryptocurrencies

6.1.1.4 Impact of ransomware attack

6.1.1.5 Decline of ransomware

6.2 TECHNOLOGY TRENDS

6.2.1 RISE IN CRYPTOCURRENCY MINING MALWARE

6.2.2 INITIAL COIN OFFERING (ICO)

6.2.3 CRYPTOGRAPHY IN CRYPTOCURRENCY

6.3 CRYPTOCURRENCY PRICES (IN USD)

TABLE 3 CRYPTOCURRENCY PRICE TREND, 2014–2021 (USD)

6.3.1 HARDFORK IN CRYPTOCURRENCIES

TABLE 4 CRYPTOCURRENCY FORK, 2017–2018

6.4 REGULATIONS PERTAINING TO CRYPTOCURRENCY

TABLE 5 CRYPTOCURRENCY STATUS, BY COUNTRY, 2019

6.5 PATENT ANALYSIS

TABLE 6 IMPORTANT INNOVATIONS AND PATENTS REGISTRATION

6.6 PORTER’S FIVE FORCES MODEL

TABLE 7 CRYPTOCURRENCY MARKET: PORTER’S FIVE FORCES ANALYSIS

6.7 CRYPTOCURRENCY TRADING VOLUME

TABLE 8 CRYPTOCURRENCY TRADING VOLUME, 2018–2021 (USD BILLION)

6.8 CRYPTOCURRENCY ECOSYSTEM/MARKET MAPPING

FIGURE 27 ECOSYSTEM OF CRYPTOCURRENCIES

6.8.1 IMPACT OF COVID-19

7 CRYPTOCURRENCY MARKET, BY OFFERING (Page No. - 70)

7.1 INTRODUCTION

FIGURE 28 SOFTWARE TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 9 MARKET, BY OFFERING, 2015–2020 (USD MILLION)

TABLE 10 MARKET, BY OFFERING, 2021–2026 (USD MILLION)

7.2 HARDWARE

TABLE 11 MARKET FOR HARDWARE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 12 MARKET FOR HARDWARE, BY PROCESS, 2021–2026 (USD MILLION)

TABLE 13 MARKET FOR HARDWARE, BY REGION, 2015–2020 (USD MILLION)

TABLE 14 MARKET FOR HARDWARE, BY REGION, 2021–2026 (USD MILLION)

TABLE 15 MARKET FOR HARDWARE IN APAC, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 16 MARKET FOR HARDWARE IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 17 MARKET FOR HARDWARE IN NORTH AMERICA, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 18 MARKET FOR HARDWARE IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 19 MARKET FOR HARDWARE IN EUROPE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 20 MARKET FOR HARDWARE IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 21 MARKET FOR HARDWARE IN ROW, BY REGION, 2015–2020 (USD MILLION)

TABLE 22 MARKET FOR HARDWARE IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 23 MARKET FOR HARDWARE, BY PROCESSOR, 2015–2020 (USD MILLION)

TABLE 24 MARKET FOR HARDWARE, BY PROCESSOR, 2021–2026 (USD MILLION)

7.2.1 ASIC

7.2.1.1 Application-specific integrated circuit (ASIC) helps solve problems by building gates to emulate logic

TABLE 25 ASIC MARKET, BY VOLUME AND ASP, 2015–2020

TABLE 26 ASIC MARKET, BY VOLUME AND ASP, 2021–2026

TABLE 27 CRYPTOCURRENCY ASIC HARDWARE

7.2.2 GPU

7.2.2.1 GPU is specialized electronic circuit designed to rapidly manipulate and alter memory to accelerate creation of images in framebuffer intended for output on display device

7.2.3 FPGA

7.2.3.1 FPGA is an integrated circuit that can be configured by customer or designer even after it is manufactured

TABLE 28 FPGA MARKET, BY VOLUME AND ASP, 2015–2020

TABLE 29 FPGA MARKET, BY VOLUME AND ASP, 2021–2026

7.2.4 WALLET

7.2.4.1 Cryptocurrency wallets allow users to send and receive cryptocurrency

7.3 SOFTWARE

TABLE 30 MARKET FOR SOFTWARE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 31 MARKET FOR SOFTWARE, BY PROCESS, 2021–2026 (USD MILLION)

TABLE 32 MARKET FOR SOFTWARE, BY REGION, 2015–2020 (USD MILLION)

TABLE 33 MARKET FOR SOFTWARE, BY REGION, 2021–2026 (USD MILLION)

TABLE 34 MARKET FOR SOFTWARE IN APAC, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 35 MARKET FOR SOFTWARE IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 36 MARKET FOR SOFTWARE IN NORTH AMERICA, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 37 MARKET FOR SOFTWARE IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 38 MARKET FOR SOFTWARE IN EUROPE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 39 MARKET FOR SOFTWARE IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 40 MARKET FOR SOFTWARE IN ROW, BY REGION, 2015–2020 (USD MILLION)

TABLE 41 MARKET FOR SOFTWARE IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 42 MARKET, BY SOFTWARE, 2015–2020 (USD MILLION)

TABLE 43 MARKET, BY SOFTWARE, 2021–2026 (USD MILLION)

7.3.1 MINING PLATFORM

7.3.1.1 Mining is an integral process in generation, transmission, and validation of cryptocurrency transactions

7.3.2 COIN WALLET

7.3.2.1 Coin wallet is a software program that is used to securely store, send, and receive cryptocurrencies through management of private and public cryptographic keys

7.3.3 EXCHANGE

7.3.3.1 Coin exchanges play an important role in promoting cryptocurrency by enabling conversion of cryptocurrency coins to fiat currency and vice versa

8 CRYPTOCURRENCY MARKET, BY PROCESS (Page No. - 90)

8.1 INTRODUCTION

FIGURE 29 TRANSACTION TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 44 CRYPTOCURRENCY MARKET, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 45 MARKET, BY PROCESS, 2021–2026 (USD MILLION)

8.2 MINING

TABLE 46 MARKET FOR MINING, BY OFFERING, 2015–2020 (USD MILLION)

TABLE 47 MARKET FOR MINING, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 48 MARKET FOR MINING, BY REGION, 2015–2020 (USD MILLION)

TABLE 49 MARKET FOR MINING, BY REGION, 2021–2026 (USD MILLION)

TABLE 50 MARKET FOR MINING IN APAC, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 51 MARKET FOR MINING IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 52 MARKET FOR MINING IN NORTH AMERICA, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 53 MARKET FOR MINING IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 54 MARKET FOR MINING IN EUROPE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 55 MARKET FOR MINING IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 56 MARKET FOR MINING IN ROW, BY REGION, 2015–2020 (USD MILLION)

TABLE 57 MARKET FOR MINING IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 58 MARKET FOR MINING, BY TYPE, 2015–2020 (USD MILLION)

TABLE 59 MARKET FOR MINING, BY TYPE, 2021–2026 (USD MILLION)

8.2.1 SOLO MINING

8.2.1.1 Solo mining relies mainly on chance and probability of winning a block within a given period of time

8.2.2 POOL MINING

8.2.2.1 In pool mining, group of miners create ways to even out rewards

8.2.3 CLOUD MINING

8.2.3.1 In cloud mining, large group of interconnected computers, known as network servers, is used by miners

8.3 TRANSACTION

TABLE 60 CRYPTOCURRENCY MARKET FOR TRANSACTION, BY OFFERING, 2015–2020 (USD MILLION)

TABLE 61 MARKET FOR TRANSACTION, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 62 MARKET FOR TRANSACTION, BY REGION, 2015–2020 (USD MILLION)

TABLE 63 MARKET FOR TRANSACTION, BY REGION, 2021–2026 (USD MILLION)

TABLE 64 MARKET FOR TRANSACTION IN APAC, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 65 MARKET FOR TRANSACTION IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 66 MARKET FOR TRANSACTION IN NORTH AMERICA, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 67 MARKET FOR TRANSACTION IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 68 MARKET FOR TRANSACTION IN EUROPE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 69 MARKET FOR TRANSACTION IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 70 MARKET FOR TRANSACTION IN ROW, BY REGION, 2015–2020 (USD MILLION)

TABLE 71 MARKET FOR TRANSACTION IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 72 MARKET FOR TRANSACTION, BY TYPE, 2015–2020 (USD MILLION)

TABLE 73 MARKET FOR TRANSACTION, BY TYPE, 2021–2026 (USD MILLION)

8.3.1 EXCHANGE

8.3.1.1 Crypto exchanges facilitate crypto trading and set rate of currencies for transactions

8.3.2 WALLET

8.3.2.1 Desktop wallets are installed on desktop computers and provide users with complete control over wallet

9 CRYPTOCURRENCY MARKET, BY TYPE (Page No. - 104)

9.1 INTRODUCTION

TABLE 74 MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 75 MARKET, BY TYPE, 2017–2021 (USD MILLION)

9.2 BITCOIN

9.2.1 BITCOIN MINING PROCESS HAS CHANGED FROM SOFTWARE- TO HARDWARE-ORIENTED

9.3 ETHEREUM (ETH)

9.3.1 ETHEREUM BLOCKCHAIN FOCUSES ON RUNNING PROGRAMMING CODE OF ANY DECENTRALIZED APPLICATION, ENABLING IT TO BE BUILT AND RUN WITHOUT ANY DOWNTIME, FRAUD, CONTROL, OR INTERFERENCE FROM A THIRD PARTY

9.4 BITCOIN CASH

9.4.1 BITCOIN CASH, CONTINUATION OF BITCOIN PROJECT, WAS FORMED BY SPLIT OF BITCOIN PROJECT AND ITS COMMUNITY INTO TWO

9.5 RIPPLE (XRP)

9.5.1 XRP USES A GLOBAL CONSENSUS LEDGER MODEL FOR TRANSACTIONS

9.6 DASHCOIN

9.6.1 DASHCOIN IS AN OPEN-SOURCE, PEER-TO-PEER CRYPTOCURRENCY THAT OFFERS SAME FEATURES AS BITCOIN

9.7 LITECOIN (LTC)

9.7.1 LTC IS AN OPEN SOURCE, GLOBAL PAYMENT NETWORK THAT IS FULLY DECENTRALIZED

9.8 OTHERS

10 CRYPTOCURRENCY MARKET, BY END-USER INDUSTRY (Page No. - 109)

10.1 BANKING

10.1.1 CENTRAL BANKS ACROSS ASIA AND EUROPE ARE PLANNING TO LAUNCH DIGITAL CURRENCIES FOR FUTURE PAYMENT SYSTEMS AND CROSS-BORDER TRANSACTIONS

10.2 REAL ESTATE

10.2.1 CURRENT PROCEDURES FOR SEARCHING AND LEASING PROPERTIES IN COMMERCIAL REAL ESTATE (CRE) INDUSTRY CAN BE SIGNIFICANTLY IMPROVED BY CRYPTOCURRENCY AND BLOCKCHAIN TECHNOLOGIES

10.3 RETAIL & ECOMMERCE

10.3.1 CRYPTOCURRENCY USE IN RETAIL AND ECOMMERCE INDUSTRIES IS LIMITED TO MOST TECHNOLOGICALLY ADVANCED BUYERS

10.3.2 OVERSTOCK

10.3.3 NEWEGG

10.3.4 CRYPTOPET

10.3.5 BEESBROS

10.3.6 BITGILD

11 GEOGRAPHIC ANALYSIS (Page No. - 111)

11.1 INTRODUCTION

FIGURE 30 MARKET IN ROW TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 31 APAC TO HOLD LARGEST SHARE OF CRYPTOCURRENCY MARKET DURING FORECAST PERIOD

TABLE 76 MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 77 MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 32 NORTH AMERICA: SNAPSHOT OF CRYPTOCURRENCY MARKET

TABLE 78 MARKET IN NORTH AMERICA, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 79 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 80 MARKET IN NORTH AMERICA, BY OFFERING, 2015–2020 (USD MILLION)

TABLE 81 MARKET IN NORTH AMERICA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 82 MARKET IN NORTH AMERICA, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 83 MARKET IN NORTH AMERICA, BY PROCESS, 2021–2026 (USD MILLION)

TABLE 84 MARKET IN NORTH AMERICA, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 85 MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

11.2.1 US

11.2.1.1 Concentration of large and small-scale companies providing cryptocurrency-based products and solutions favor growth of market in US

TABLE 86 MARKET IN US, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 87 MARKET IN US, BY PROCESS, 2021–2026 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Cryptocurrency dealers in Canada need to register themselves as money service businesses (MSBs) with Financial Transactions and Reports Analysis Centre of Canada (FINTRAC)

TABLE 88 MARKET IN CANADA, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 89 MARKET IN CANADA, BY PROCESS, 2021–2026 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Mexico is emerging as a major contributor to cryptocurrency market in North America

TABLE 90 CRYPTOCURRENCY MARKET IN MEXICO, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 91 CRYPTOCURRENCY MARKET IN MEXICO, BY PROCESS, 2021–2026 (USD MILLION)

11.3 EUROPE

FIGURE 33 EUROPE: SNAPSHOT OF CRYPTOCURRENCY MARKET

TABLE 92 MARKET IN EUROPE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 93 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 94 MARKET IN EUROPE, BY OFFERING, 2015–2020 (USD MILLION)

TABLE 95 MARKET IN EUROPE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 96 MARKET IN EUROPE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 97 MARKET IN EUROPE, BY PROCESS, 2021–2026 (USD MILLION)

TABLE 98 MARKET IN EUROPE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 99 MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Suitable temperature makes mining profitable in Germany

TABLE 100 MARKET IN GERMANY, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 101 MARKET IN GERMANY, BY PROCESS, 2021–2026 (USD MILLION)

11.3.2 FRANCE

11.3.2.1 French Government termed cryptocurrency as an instrument for money laundering and other illegal activities

TABLE 102 MARKET IN FRANCE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 103 MARKET IN FRANCE, BY PROCESS, 2021–2026 (USD MILLION)

11.3.3 UK

11.3.3.1 Exchanges in UK have to be registered with Financial Conduct Authority (FCA)

TABLE 104 MARKET IN UK, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 105 MARKET IN UK, BY PROCESS, 2021–2026 (USD MILLION)

11.3.4 EAST EUROPE

11.3.4.1 Malta to emerge as potential growth ground for cryptocurrency market in East Europe

TABLE 106 CRYPTOCURRENCY MARKET IN EAST EUROPE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 107 MARKET IN EAST EUROPE, BY PROCESS, 2021–2026 (USD MILLION)

11.3.5 REST OF EUROPE

TABLE 108 MARKET IN REST OF EUROPE, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 109 MARKET IN REST OF EUROPE, BY PROCESS, 2021–2026 (USD MILLION)

11.4 APAC

FIGURE 34 APAC: SNAPSHOT OF CRYPTOCURRENCY MARKET

TABLE 110 MARKET IN APAC, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 111 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 112 MARKET IN APAC, BY OFFERING, 2015–2020 (USD MILLION)

TABLE 113 MARKET IN APAC, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 114 MARKET IN APAC, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 115 MARKET IN APAC, BY PROCESS, 2021–2026 (USD MILLION)

TABLE 116 MARKET IN APAC, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 117 MARKET IN APAC, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Cryptocurrency cannot be traded as currency in China

TABLE 118 MARKET IN CHINA, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 119 MARKET IN CHINA, BY PROCESS, 2021–2026 (USD MILLION)

11.4.2 JAPAN

11.4.2.1 People can buy or sell cryptocurrency as a commodity in Japan, and cryptocurrency exchange businesses are regulated

TABLE 120 MARKET IN JAPAN, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 121 MARKET IN JAPAN, BY PROCESS, 2021–2026 (USD MILLION)

11.4.3 SOUTH KOREA

11.4.3.1 Cryptocurrency dealers must have contracts with banks concerning cryptocurrency trades In South Korea

TABLE 122 MARKET IN SOUTH KOREA, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 123 MARKET IN SOUTH KOREA, BY PROCESS, 2021–2026 (USD MILLION)

11.4.4 REST OF APAC

TABLE 124 MARKET IN REST OF APAC, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 125 MARKET IN REST OF APAC, BY PROCESS, 2021–2026 (USD MILLION)

11.5 ROW

TABLE 126 MARKET IN ROW, BY REGION, 2015–2020 (USD MILLION)

TABLE 127 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 128 MARKET IN ROW, BY OFFERING, 2015–2020 (USD MILLION)

TABLE 129 MARKET IN ROW, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 130 MARKET IN ROW, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 131 MARKET IN ROW, BY PROCESS, 2021–2026 (USD MILLION)

TABLE 132 MARKET IN ROW, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 133 MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.1 SOUTH AMERICA

11.5.1.1 Cryptocurrencies are not specifically regulated in South America; however, they are increasingly being used in Argentina

TABLE 134 CRYPTOCURRENCY MARKET IN SOUTH AMERICA, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 135 CRYPTOCURRENCY MARKET IN SOUTH AMERICA, BY PROCESS, 2021–2026 (USD MILLION)

11.5.2 MIDDLE EAST AND AFRICA

11.5.2.1 High remittance inflow drives growth of cryptocurrency market in MEA

TABLE 136 MARKET IN MEA, BY PROCESS, 2015–2020 (USD MILLION)

TABLE 137 MARKET IN MEA, BY PROCESS, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 142)

12.1 OVERVIEW

FIGURE 35 COMPANIES ADOPTED PRODUCT LAUNCHES AS KEY GROWTH STRATEGY FROM 2017 TO 2020

12.2 MARKET SHARE ANALYSIS: MARKET

TABLE 138 MARKET SHARE OF KEY PLAYERS IN MARKET, 2020

12.3 REVENUE ANALYSIS OF TOP 5 PLAYERS IN MARKET

FIGURE 36 REVENUE ANALYSIS OF TOP FIVE PLAYERS IN MARKET (2016–2020)

12.4 COMPANY EVALUATION MATRIX

12.4.1 STARS

12.4.2 EMERGING LEADERS

12.4.3 PERVASIVE

12.4.4 PARTICIPANTS

FIGURE 37 MARKET: COMPANY EVALUATION MATRIX, 2020

12.5 STARTUP/SME EVALUATION MATRIX, 2020

12.5.1 PROGRESSIVE COMPANIES

12.5.2 RESPONSIVE COMPANIES

12.5.3 DYNAMIC COMPANIES

12.5.4 STARTING BLOCKS

FIGURE 38 MARKET: STARTUP/SME EVALUATION MATRIX, 2020

13 COMPANY PROFILES (Page No. - 148)

13.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View)*

13.1.1 BITMAIN TECHNOLOGIES LTD

13.1.2 NVIDIA

FIGURE 39 NVIDIA: COMPANY SNAPSHOT

13.1.3 ADVANCED MICRO DEVICES, INC.

FIGURE 40 ADVANCED MICRO DEVICES: COMPANY SNAPSHOT

13.1.4 XILINX

FIGURE 41 XILINX: COMPANY SNAPSHOT

13.1.5 BITFURY GROUP LIMITED

13.1.6 INTEL

FIGURE 42 INTEL: COMPANY SNAPSHOT

13.1.7 RIPPLE

13.1.8 ETHEREUM FOUNDATION

13.1.9 COINBASE

13.1.10 BITGO

13.1.11 BINANCE

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13.2 OTHER COMPANIES

13.2.1 CANAAN CREATIVE CO., LTD

13.2.2 ZHEJIANG EBANG COMMUNICATION CO., LTD

13.2.3 BITSTAMP LTD

13.2.4 IFINEX INC

13.2.5 LEDGER SAS

13.2.6 XAPO

13.2.7 ADVANCED MINING TECHNOLOGIES INC.

13.2.8 ALCHEMINER, LTD.

13.2.9 UPBIT

13.2.10 SHARK MINING

13.2.11 ETHEREUMMINER.EU

13.2.12 PANDAMINER

14 APPENDIX (Page No. - 180)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

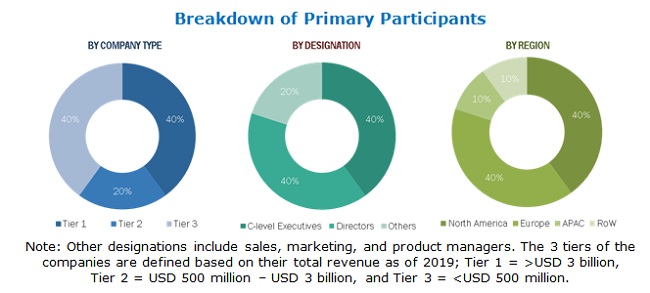

The study involved 4 major activities in estimating the current size of the Cryptocurrency market. Exhaustive secondary research has been done to collect information about the market, the peer markets, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information pertinent to this study. Secondary sources include annual reports; press releases; investor presentations; white papers; journals and certified publications; and articles from recognized authors, directories, and databases. Secondary research has been conducted to obtain important information about the industry’s supply chain, value chain, total pool of key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the Cryptocurrency market scenario through secondary research. Several primary interviews have been conducted with market experts from both demand (commercial application providers) and supply (equipment manufacturers and distributors) sides across four major regions: North America, Europe, APAC, and RoW. Approximately 20% and 80% of primary interviews have been conducted with parties from demand and supply sides, respectively. The primary data has been collected through questionnaires, emails, and telephonic interviews.

Market Size Estimation

- In the complete engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to estimate and validate the size of the Cryptocurrency market and other dependent submarkets.

- The key players in the market have been determined through primary and secondary research. This entire research methodology involves the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) into the Cryptocurrency market.

Market Size Estimation Methodology: Bottom-up Approach

Data Triangulation

All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Report Objectives

- To describe and forecast the Cryptocurrency market, in terms of value, by type, process, and application

- To describe and forecast the market, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding major factors influencing growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall market

- To provide detailed overview of value chain analysis in the Cryptocurrency market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the Cryptocurrency market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as product developments, expansions, mergers and research & development in the Cryptocurrency market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cryptocurrency Market

What is this report all about

I need current and future market analysis of different cryptocurrencies.

I want to understand the cryptocurrency market and looking for market size of cryptocurrency trading in real estate.

Hello,want to Underst and the trend of cryptocurrency market

I am making the report on awareness of crypto in India for that I want this infoprmation

Information to support my Senior Honor Thesis Project on growth rate and implementation of Defi

I need to know what is the annual FIAT volume procesed by exchanges in LATAM

Changing share of Metaverse, crypto, and digital assets (FinTech trends) in market size of Finance (Banking, Insurance, Real Estate) sector in the USA.

Hi, I am writing my dissertation with regards to cryptocurrencies thus this analysis would add huge value to my research!

I am in the position of the venture and would like to learn about the background and fast-changing environment in the Crypto world. Thank you for the great content and hard work will appreciate it if you may share the Crypto market research report. Thank you again. Have a good one! Share Shawn

I am interested in cryptocurrencies and markets

I want to understand the cryptocurrency ecosystem and who are the key players in this market.

I want to understand cryptocurrency software market. Please share what has been covered in the report wrt cryptocurrency software.

I want to understand impact of roll out of new currencies such as eos, tezos, wanchain, cardano on cryptocurrency market.

I want to understand the scope of cryptocurrency market.

I want to understand the research methodology of cryptocurrency market and method used for company analysis.

I am interested in cryptocurrency market in Peru. Does the report cover cryptocurrency market for Peru?

I am interested in cryptocurrency market for trading, remittance, and payment. Please share if in depth analysis is available for trading, remittance, and payment.

I am interested in cryptocurrency market report and I am looking for information on payments/transactions for cryptocurrencies vs fiat currencies.

I am interested in current use cases of cryptocurrency . Please share the scope of cryptocurrency market report.

Companies providing transactions and mining processes and their USPs, along with other details. Can you support us with this info?

I want to understand cryptocurrency market and risks associated with various cryptocurrencies.

We want to understand the use cases of cryptocurrency for applications apart from trading.

I am interested in cryptocurrency market. Please share the scope of cryptocurrency market.