Data Fabric Market by Component (Solutions & Services), Type (Disk-Based & In-Memory), Application (Fraud Detection & Security Management, Preventive Maintenance Analysis), Vertical (BFSI, Healthcare & Life Sciences) and Region - Global Forecast to 2027

Data Fabric Market Latest Trends & Key Market Insights

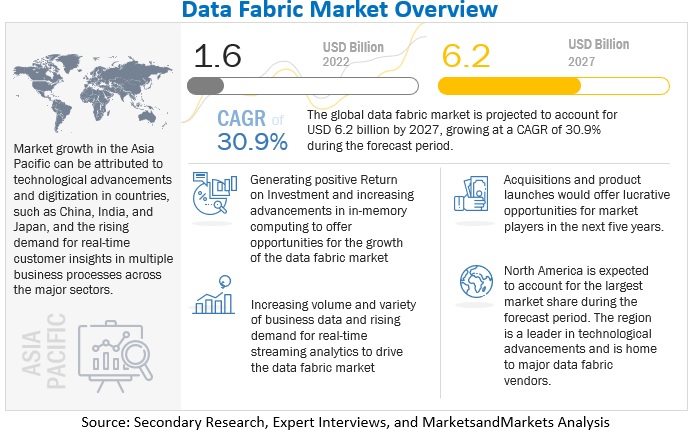

The global data fabric market size was valued at USD 1.6 billion in 2022 and is expected to expand at a CAGR of 30.9% during the forecast period, reaching revenue forecast $6.2 billion by 2027. The market growth is driven by factors like positive ROI and increasing demand for cloud-based data fabric solutions, offering scalability and potential opportunities for vendors and end users worldwide.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Fabric Market Dynamics

Driver: Increasing volume and variety of business data

Data fabric offers unique opportunities to integrate and analyze variety of data sets that if not might be ignored. The rising evolution of digital and smart technologies across varied business functions such as HR, finance, operations, supply chain to boost the market growth. Various data generated from social media and weblogs, and data from other sources such as sensor data, geo-location data, machine data are growing tremendously at a rapid pace. Most of the leading brands and organizations are implementing data fabric solutions to gain real-time insights from such rising data.. Data fabric facilitates data from a variety of sources, supports firms to store large amounts of data, and analyze those data seamlessly in some place. Data fabric offers various benefits, such as the ability to derive value from any form of data; storing all types of structured and unstructured data; and centralized access to data via a single, unified view of data across organizations.

Restraints: Issues related to integrating legacy systems

The major factor that hinders the growth of data fabric solutions across the globe is the administrative philosophy, which is built on storage and evaluating business-related data using old-fashioned techniques, such as data warehouses and data marts. Therefore, the most substantial task these days is to aware businesses about the storage and analyze of critical data in real-time across various business events to derive a sustainable impact from data fabric adoption. Hence,it is critical to incorporate such legacy data management systems combined with existing popular systems. The legacy systems do not have well-defined interfaces and theIT teams lack the requisite skills. The advantages and propositions of such data management technologies like data fabric needs awareness across the leading organizations globally.

Opportunity: Generating positive return on investment

Data fabric can generate a positive RoI for organizations in many ways. Data fabric systems, at their core, improve the efficiency of operations. They make it possible to eliminate paper forms and minimize handoff delays. Analytical systems focus on the effectiveness of business operations. They make it possible to target the best prospects, price risk more accurately, and make better use of available resources. In general, data fabric translates this effectiveness into a positive RoI in one of several ways. It offers significant throughput with lower latency than the traditional low-latency IP-based middleware. Data fabric achieves breakthrough performance with low Central Processing Unit (CPU) overhead, enabling business applications to do even more critical work faster. Ultimately, the most expensive resources can be assigned where they will make the most difference, further adding value to the solution.

Challenge: Reluctance in investment in new technologies

Adopting new technology or changes in existing ones requires considerable effort and costs for the company. Embracing new technologies such as data fabric, meta data management, data catalog across leading brands depends on numerous factors, such as the business value of the technology, compatibility with the existing infrastructure, complexity, budget limitations, administrative policies, and techniques. The total cost of ownership of the new technology covers initial set-up costs due toIT spending and infrastructure needs, training & recruiting costs, and maintenance and support costs.. Few of the other factors that affect the adoption new data management technologies includes the significance of the stakeholders and their acceptance of the change.Additionally, old-fashioned applications bring a complex interfaces, which may cause incompatibility issueswith third-party software which create inaccuracies. The integration of data generated from various channel can be a difficult task for enterprises which will degrade the overallperformance across the firms. Hence, the above mentioned factors push organizations hesitant to adopt data fabric solutions and services.

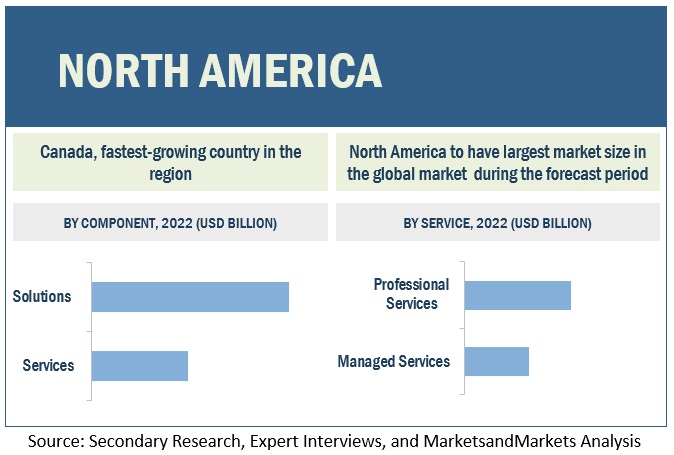

Services segment to register the higher growth rate during the forecast period

Based on services, the data fabric market is segmented into managed and professional services.. Increasing adoption of data fabric services by enterprises to help deploy a proper platform to run and support their applications rather than investing in the software leads to a higher demands for services. Managed services are completely provided by the third-party vendor and offer clients on-time conveyance.

In-memory segment to register the highest CAGR during the forecast period

Rising of huge volume and variety of data stored across data lakes to boost the demand for the growth of data fabric solution and services across the globe. Leadingorganizations are implementing data fabric solutions in order to handle and locate data among dula repositories. Hence, data fabric solutions can be offered across the firms in two ways: disk-based and in-memory.

In-memory data fabric type to grow at a rapid pace in coming years owing to the rising need to perform low-latency data access to support real-time analytics and predictive analytics to enable real-time data requirements.. In-memory data fabric falls between applications and different data sources as it delivers crucial data storage facilities across the business applications. The major benefit of an In-Memory Data Fabric type is that it offered in-memory computing components which can be used separately, while being well integrated with each other.

North America to have the largest market size during the forecast period

The major countries covered in North America are the US and Canada. The North American region, being the primary adopter of data fabric technology, is the major revenue-generating region in the global data fabric market. It is expected to grow rapidly during the forecast period due to the expanding use of data in various BI tools and the higher adoption of digital technologies in areas such as BFSI, telecom & IT, healthcare, and manufacturing. Moreover, it is a well-established economy, witnessing large-scale investments in digitalized infrastructure. The North American region has been extremely open toward adopting new and innovative technologies and is expected to provide market growth opportunities to data fabric vendors, as it is expected to witness an exponential growth of IT device-based generated data and stringent laws and policies for safeguarding the data. Investment in various technologies such as AI, IoT, and big data would boost the growth of the region in the data fabric market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Data Fabric solution and service providers have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some major players in the Data Fabric market include IBM (US), SAP (Germany), Oracle (US), Informatica (US), Talend (US), Denodo (US), HPE (US), Dell Technologies (US), NetApp (US), Teradata (US), Splunk (US), TIBCO Software (US), Software AG (Germany), Intenda (South Africa), Radiant Logic (US), Incorta (US), Idera (US), K2View (US), Cinchy (Canada), Precisely (US), Global IDs (US), Alex Solutions (Australia), Iguazio (Israel), CluedIn (Denmark), QOMPLX (US), HEXstream (US), Starburst Data (US), Gluent (US), Stardog (US), Nexla (US), and Atlan (Singapore).

Scope of the Report

|

Report Metrics |

Details |

| Market size value in 2022 | USD 1.6 billion |

| Revenue forecast in 2027 | USD 6.2 billion |

| Growth rate | CAGR of 30.9% from 2022 to 2027 |

| Market size available for years | 2018–2027 |

| Base year considered | 2021 |

| Forecast period | 2022–2027 |

| Forecast units | USD (Million/Billion) |

| Segments covered | Component, Type, Organization Size, Deployment Mode, Application, Vertical and Region |

| Geographies covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

| Companies covered | IBM (US), SAP (Germany), Oracle (US), Informatica (US), Talend (US), Denodo (US), HPE (US), Dell Technologies (US), NetApp (US), Teradata (US), Splunk (US), TIBCO Software (US), Software AG (Germany), Intenda (South Africa), Radiant Logic (US), Incorta (US), Idera (US), K2View (US), Cinchy (Canada), Precisely (US), Global IDs (US), Alex Solutions (Australia), Iguazio (Israel), CluedIn (Denmark), QOMPLX (US), HEXstream (US), Starburst Data (US), Gluent (US), Stardog (US), Nexla (US), and Atlan (Singapore) |

This research report categorizes the Data Fabric market based on component, type, organization size, deployment mode, applications, verticals and region.

By Component:

- Solutions

- Services

By Type:

- Disk-based

- In-memory

By Organization Size:

- Large Enterprises

- SMEs

By Deployment Mode:

- On-premises

- Cloud

By Applications:

- Fraud Detection & Security Management

- Government, Risk & Compliance Management

- Customer Intelligence

- Sales & Marketing Management

- Business Process Management

- Preventative Maintenance Analysis

- Other Applications

By Verticals:

- BFSI

- Government, Defense & Public Agencies

- Manufacturing

- Healthcare & Life Sciences

- Energy & Mining

- Telecom

- Media & Entertainment

- Retail & eCommerce

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- India

- Japan

- China

- Australia

- Rest of Asia Pacific

-

Middle East and Africa

- United Arab Emirates

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

-

Latin Amercia

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In October 2022, Informatica, an enterprise cloud data management leader, announced its inclusion as an initial partner of the Microsoft Intelligent Data Platform Partner Ecosystem. Microsoft announced the launch of this ecosystem during its Microsoft Ignite 2022. This initiative represented an investment both companies are making toward helping enterprises truly operationalize AI with trusted and governed data.

- In July 2022, IBM announced its acquisition of Databand.ai, a leading provider of data observability software that helps organizations fix issues with the data, including errors, pipeline failures, and poor quality before it impacts the bottom line.

- In June 2022, Informatica announced that the Informatica Enterprise Data Integrator would be offered natively on Snowflake Marketplace as an Accelerated Program partner for the Snowflake Native Application Framework, which would, until then, be in private preview. Snowflake customers would be able to use enterprise data source integrations for apps such as Google, Microsoft, Oracle, Salesforce, and SAP offered through the IDMC platform directly from the existing Snowflake accounts using this new application.

- In June 2022, HPE introduced HPE GreenLake for Data Fabric, a fully managed service that combined the industry’s first hybrid analytics-ready data fabric with HPE GreenLake hardware, software, and services. This service would keep IT in control with a single view to manage and monitor distributed data. HPE GreenLake for Data Fabric was powered by HPE Ezmeral Data Fabric, which would unify files, objects, NoSQL databases, and real-time and batch streams across distributed locations. Unifying and preparing data for processing increases data integrity because errors and duplicate files are removed.

- In October 2021, NetApp announced new additions and enhanced capabilities across its hybrid cloud portfolio to help organizations modernize their IT infrastructures and accelerate digital transformation. Delivering new secure ways to consume and operate data services on-premises and in the cloud, NetApp hybrid cloud solutions would make it simpler for enterprise customers to put the data to work wherever and whenever needed.

- In September 2020, Talend announced an update for Talend Data Fabric. The new update included new capabilities within Talend Trust Score. Talend Trust Score instantly would assess the reliability of an organization’s data and intelligently diagnoses and resolves data integrity issues.

Frequently Asked Questions (FAQ):

What is the market forecast for Data Fabric?

What was the value of the global Data Fabric Market in 2022?

What is the Data Fabric Market growth?

Who are the key players in Data Fabric Market?

What are the key drivers supporting the Data Fabric Market growth?

Which is the key Opportunities for the Data Fabric Market growth?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

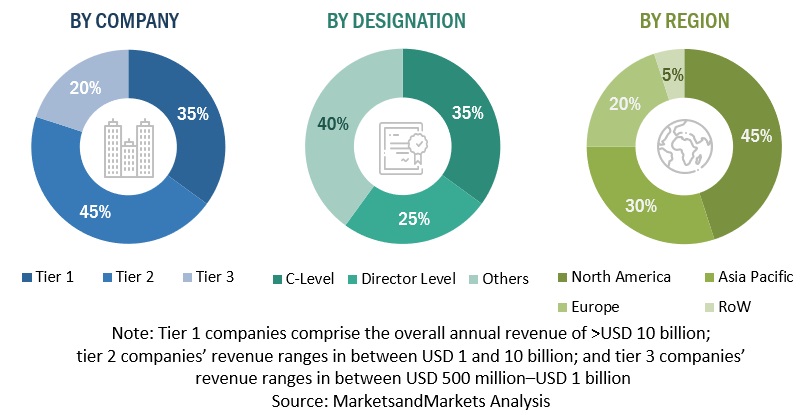

The research study for the data fabric market involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred data fabric providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

The market size of companies offering data fabric services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to, for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors websites. Additionally, data fabric spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, applications, types, organization sizes, verticals, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and data fabric expertise; related key executives from data fabric solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployment modes, types, verticals and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using data fabric solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of data fabric solutions and services, which would impact the overall data fabric market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For market estimation, key data fabric and service vendors, such as IBM (US), SAP (Germany), Oracle (US), Informatica (US), Talend (US), Denodo (US), HPE (US), Dell Technologies (US), NetApp (US), Teradata (US), Splunk (US), TIBCO Software (US), Software AG (Germany), Intenda (South Africa), Radiant Logic (US), Incorta (US), Idera (US), K2View (US), Cinchy (Canada), Precisely (US), Global IDs (US), Alex Solutions (Australia), Iguazio (Israel), CluedIn (Denmark), QOMPLX (US), HEXstream (US), Starburst Data (US), Gluent (US), Stardog (US), Nexla (US), and Atlan (Singapore) were identified. These vendors contribute nearly 45%–55% to the global data fabric market.

The market is competitive due to the presence of numerous vendors. After confirming these companies through primary interviews with industry experts, their total revenue through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases was estimated. The revenue pertaining to Business Units (BUs) that offer data fabric solutions was identified through similar sources. Then, through primaries, the data of revenue generated from specific data fabric solutions was collected. The collective revenue of key companies that offer data fabric solutions comprises 40%–50% of the market, which was again confirmed through primary interviews with industry experts.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For converting various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency, the USD, remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on data fabric based on some of the key use cases. These factors for the data fabric industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, start-up ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the data fabric market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major data fabric providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall data fabric market size and segments’ size were determined and confirmed using the study.

Report Objectives

- To define, describe, and predict the data fabric market in terms of component (solutions and services), deployment mode, type, application, organization size, vertical, and region.

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the market

- To analyze the impact of the recession across all the regions in the data fabric market.

Available customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American data fabric market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Middle East & Africa market

- Further breakup of the Latin America market

Company information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Data Fabric Market

I am interested in knowing a Data Fabric Product that would have demand in the Southeast Asia market.