Database Security Market by Component (Solution and Services), Business function (Marketing, sales, finance, operations), Organization Size (Large Enterprises and SMEs), Deployment Mode (Cloud & On-premises), Vertical, & Region - Global Forecast to 2026

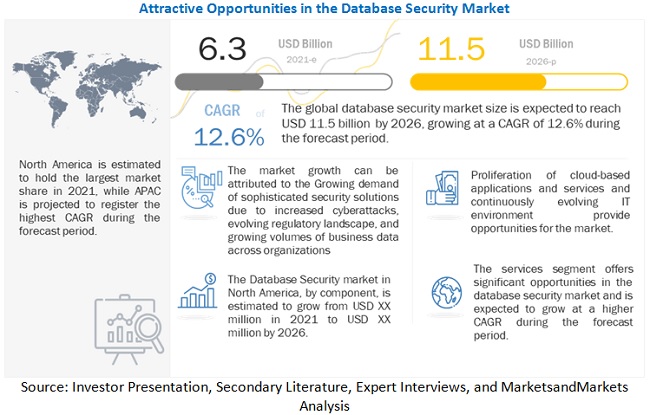

The global database security market size is projected to grow from $6.3 billion in 2021 to $11.5 billion in 2026, at a CAGR of 12.6% during the forecast period. The major factors fueling the Database Security market include Growing demand for sophisticated security solutions, Evolving regulatory landscape, Growing volumes of business data across industries. Moreover, proliferation of cloud-based applications and services, and continuously evolving IT landscape would provide lucrative opportunities for Database Security vendors.

To know about the assumptions considered for the study, Request for Free Sample Report

Covid 19 Impact

- Adopting rapid digital transformation strategies due to COVID-19 has instantly increased the amount of data stored in the clouds, followed by other issues such as performance, availability, security, and increased IT costs, necessitating Database Security solutions and services.

- COVID-19 has increased the focus of organizations on centrally managing multiple cloud resources. This is increasing the importance of database security.

- Due to advantages such as scalability and pay-as-you-go and the use of external expertise, cloud-based Database Security solutions and services witnessed an increased demand during the pandemic.

- With maximum companies still working in WFH and hybrid work models, the demand for Database Security for security assessments is further expected to increase for effective SIEM and threat intelligence across the globe.

Database Security Market Dynamics

Driver: Growing demand for sophisticated security solutions

The database security forms an integral part in the IT infrastructure security as it contains valuable and sensitive data. This data, collected around various entities such as customers and suppliers, needs to be confidential and compliant to the set regulations. For example, enterprises collect customer information such as email address, postal address, contact number, credit card details etc. during product purchase. The number of cyberattacks and their sophistication have increased dramatically in recent years. Hackers are exploiting technologies such as AI, ML, analytics, etc., to increase the sophistication of cyberattacks. Such sophisticated cyberattacks often go undetected, and even if detected, these attacks take more time for remediation. Such sophistication have increased from unauthorized access to databases to malware attacks resulting into loss or corruption of data. Database security threats vary from organizations to organizations, based on the type of information and its importance. The attacks over databases have developed with time. Some of the major threats witnessed in the recent past include SQL injection, DoS attacks, and malware attacks. According to IdentityForce in November 2020, a database for Mashable.com containing 1,852,595 records of staff, users, and subscribers’ data was leaked by hackers. According to Retarus, in 2020, with average cost of a data breach valued at USD 3.86 million, an average of USD 2.9 million was lost to cybercrime every minute. In addition, the average time to identify and contain a breach was 280 days in the same year. This increased intensity of cyber-attacks is escalating the need for comprehensive security solution to protect confidential information and data. In such cyberattack scenarios, an efficient database security architecture becomes very crucial to maintain the confidentiality of database. The organizations are continuously monitoring, auditing, reporting, assessing, classifying, and improving the database security.

Restraint: budget constraints and higher installation cost of solution

The initial investment and maintenance cost of employing database security systems are high due to the integration of high-quality hardware. SMEs, due to budgetary constraints are reluctant to adopt newer technologies and keep on working with the traditional security software. Moreover, organizations prioritize to secure only critical servers and do not give much attention toward resting data in the database. Thus, the lack of adequate budget continues to be an important concern for database security professionals to effectively carry out their IT security operations

Opportunity: Prolification of cloud based application and services

The budgetary expenditure of IT teams is always on the rise owing to the constant development in the security landscape. The need to adopt new technologies and to update the software periodically adds up to the expense of maintaining hardware solutions to have a proper security system in place. The demand for cloud-based security solutions has thus witnessed an increase in the overall deployment of software and services. Vendors such as IBM, Cisco, Broadcom, and McAfee offer their security solutions on a Software-as-a-Service (SaaS) model to the organizations. The enormous advantage of the cloud solutions over on-premises deployment in terms of cost efficiencies, flexibility, and scalability has been a major attraction for the companies to shift their preferences toward the cloud environment. Moreover, SMEs dealing with budgetary constraints are expected to deploy SaaS-based security solution significantly, and thus the market for cloud-based applications and service remain highly optimistic

Challenge: Lack of awareness about multi-layered security

Databases are majorly being targeted by various attackers due to its vulnerability and susceptibility. It needs to be protected through various security layers, including access control, data encryption, auditing, separation of environment, and others. Although database security is the most vital for every organization, many of them are unaware of the various levels of securities. They rely on the Operating System (OS)-level user administration and assumes that it is enough to secure their entire database environment. However, the databases are accessed by various people based on their requirements, which increases the possibilities of the high level of vulnerabilities and spyware. Therefore, multi-layered security is very important for organizations. According to Equifax, consumer credit reporting agency, approximately 40% of the US population is affected by cyber-attacks and their personal information including, birth dates, social security numbers, addresses, and driving license numbers being accessed by hackers. This is due to the lack of multi-layered security to the databases. Thus, lack of awareness to protect the database from internal and external threats among organizations is one of the challenges in this market.

Small and Medium enterprises segment to grow at a higher CAGR during the forecast period

The SMEs are looking for robust database security solutions to save money, time, and resources. They are said to be adopting cloud services in a rapid pace, owing to various reasons, such as flexibility, disaster recovery, automatic updates, low capital expenditure, collaboration, document control, and security. In fact, the cloud-based deployment mode has helped the SMEs in reducing the costs and providing IT services that are similar to that of the large enterprises. In addition, in the cloud deployment mode, the cloud service providers address issues in the database security solution. Such benefits are expected to have enhanced the growth of the SMEs segment.

Retail and E-Commerce Vertical is Expected to Grow at the Highest Cagr During the Forecast Period

The retail and eCommerce vertical is prominently growing in the database security market. The advancements in various technologies have encouraged this vertical to adopt electronic devices and other internet-based services, along with real-time access, to provide better quality services to customers. However, the use of electronic devices has led to fear of data theft and data loss among the retailers. Further, the growing cyber-attacks and data thefts have increased the pressure on the retailers to secure their databases. Such factors have also increased the adoption rate of the database security solutions for encrypting and protecting confidential and private information of customers that is stored in the databases. Database security in the eCommerce vertical has a vital role; it helps in retrieving the data from databases and web applications, which are prone to data hacking and malicious activities. Therefore, many eCommerce businesses are allocating significant amounts of their budget toward database security. In addition, the regulatory compliances, such as Advanced Encryption Standard (AES) and PCI DSS, have helped in retaining the privacy of customer-sensitive data.

To know about the assumptions considered for the study, download the pdf brochure

North America to hold the largest market size during the forecast period

North America is exhibiting the largest number of cyber incidents across the world, and thus, has the largest number of database security vendors in the region. Database security is of the utmost importance for organizations dealing with sensitive customer data. Though the government has formulated stringent regulations around database security, the recent big data breaches have increased government intervention. Moreover, the banking and financial institutions have been considering data security as the most serious economic challenge in the region. Thus, the organizations are investing a significant amount of their capital to strengthen the security infrastructure to sustain brand image and minimize revenue loss. Specific budget allocations, support by the government and mandated data security policies are expected to further drive the growth of the database security market in the coming years. Peraton which is a US Government-focused IT firm has won a USD 2.69 billion data center and cloud contract from the US Department of Homeland Security. The US and Canada are expected to be the highest revenue-generating countries in the region with widespread demand for database security solutions to prevent cyber-attacks and commercial espionage, and to ensure security and privacy of data to facilitate business continuity. Though there is no single federal law to regulate the data privacy of customers, there are various federal and state laws to protect the data. Some of the laws pertaining to data security in the country include SOX, one of the more visible laws to regulate corporations for data protection, management, and administration; and HIPAA, a law to mandate the healthcare providers to protect an individual’s healthcare information.

Asia Pacific to grow at the highest CAGR during the forecast period

APAC is the fastest-growing region in the database security market space. Countries including India, China, Japan, Australia, and Korea are growing at a faster pace. Owing to the massive growth of data from all industries in this region, database security solutions are widely adopted. Whether it is a manufacturing or a media and entertainment industry, the enormous flow of data has shown the need for an effective database security solution. Initially, organizations used to store the data in the form of silos. These silos made it difficult to manage and maintain data security. Hence, the database security solutions and services are expected to show a high adoption rate in this region. A recent study has shown a tremendous Hadoop adoption in the APAC region. This has indicated a rise in big data volumes as well. Hence, various enterprises in this region have adopted database security solutions to secure this massive amount of data. Enterprises are trying to gain benefits from database security technologies to offer comprehensive security solutions to enterprises.

Database Security Market Players

Major vendors in the global Database Security market include Oracle (US), IBM (US), Trustwave(US), McAfee(US), Fortinet(US).

Founded in 2000 and headquartered in California, US, Fortinet is one of the prominent providers of network and content security. The company offers a wide portfolio of products, solutions, and services for data center logical security. Fortinet operates in the database security market with the help of its FortiDB platform to cater to the customer’s needs in a better manner. The company provides various services, such as support services, advanced services for enterprises and service providers, training and education, and security analysis services. Additionally, it caters to various businesses and service providers from industries, such as education, government, healthcare, BFSI, retail, and Industrial Control Systems (ICS)/Supervisory Control and Data Acquisition (SCADA). Fortinet has a prominent presence in North America, Europe, MEA, APAC, and Latin America

Database Security Market Report Scope:

|

Report Metric |

Details |

|

Market size value in 2026 |

US $11.5 billion |

|

Market size value in 2021 |

US $6.3 billion |

|

Growth Rate |

CAGR of 12.6% from 2021 to 2026 |

|

Market Size available for years |

2015-2026 |

|

Base Year Considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast Unit |

Value(USD) |

|

Segments covered |

Database Security Market: |

|

Geographies covered |

|

|

Companies Covered |

Oracle (US), IBM (US), Trustwave (US), McAfee (US), Fortinet (US), Cloudera (US), AWS (US), Microsoft (US), IRI (US), Micro Focus (US), Imperva (US), Alibaba Cloud (China), Huawei (China), Mak Logic (US), Thales Group (France), Tencent (China), Protegrity (US), Trend Micro (UK), Hashicorp (US), Datasparc (US), Scalegrid (US), Optiv Security (US), Zimcom (US), OneNeck (US), Netwrix (US). |

The research report categorizes the database security market into the following segments and subsegments:

Database Security Market, By Component

-

Software

- Database Auditing and Reporting

- Encryption and Tokenization

- Data Masking and Redaction

- Access Control Management

- Others

-

Services

- Managed Services

- Professional Services

- Consulting Services

- Support and Maintenance

- Education and Training

- Risk Assessment Services

Database Security Market, By business function

- Marketing

- Sales

- Finance

- Operations

- Others

Database Security Market, By Deployment Mode

- Cloud Based

- On Premises

Database Security Market, By Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

Database Security Market, By Vertical

- Banking, Financial Services, And Insurance

- Telecommunication and IT

- Government and Defense

- Manufacturing

- Healthcare and life sciences

- Retail and Ecommerce

- Energy and Utilities

- Media and Entertainments

- Others

Database Security Market, by Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Rest of Asia Pacific

-

Middle East and Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In March 2021, Fortinet acquired ShieldX, a cloud and network security provider to strengthen its portfolio into network securities.

- In January 2021, Fortinet had an agreement with Savex and appointed Savex as value added distributor in India to expand its customer base in India.

Frequently Asked Questions (FAQ):

How big is the Database Security Market?

What is growth rate of the Database Security Market?

What are the key trends affecting the global Database Security Market?

Who are the key players in Database Security Market?

Who will be the leading hub for Database Security Market?

What is Database Security?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 53)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

FIGURE 6 DATABASE SECURITY MARKET: MARKET SEGMENTATION

1.7 YEARS CONSIDERED FOR THE STUDY

1.8 CURRENCY

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2015–2021

1.9 STAKEHOLDERS

1.10 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 62)

2.1 RESEARCH DATA

FIGURE 7 DATABASE SECURITY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key industry insights

FIGURE 8 DATA TRIANGULATION

2.2 MARKET SIZE ESTIMATION

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF DATABASE SECURITY VENDORS

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS AND SERVICES OF DATABASE SECURITY VENDORS

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3, TOP-DOWN APPROACH – DEMAND-SIDE ANALYSIS

2.3 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

FIGURE 12 LIMITATIONS OF DATABASE SECURITY MARKET REPORT

3 EXECUTIVE SUMMARY (Page No. - 71)

FIGURE 13 DATABASE SECURITY MARKET SIZE, 2016-2026

FIGURE 14 MARKET, REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 74)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE DATABASE SECURITY MARKET

FIGURE 15 PROLIFERATION OF CLOUD-BASED APPLICATIONS AND SERVICES ALONG WITH CONTINUOUSLY EVOLVING IT LANDSCAPE IS EXPECTED TO PROVIDE GROWTH OPPORTUNITIES IN THE MARKET DURING THE FORECAST PERIOD

4.2 MARKET, BY COMPONENT, 2021

FIGURE 16 SOFTWARE SEGMENT TO HAVE A LARGER MARKET SIZE DURING THE FORECAST PERIOD

4.3 MARKET, BY BUSINESS FUNCTION, 2021

FIGURE 17 OPERATIONS TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

4.4 MARKET, BY PROFESSIONAL SERVICES, 2021

FIGURE 18 CONSULTING SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.5 MARKET, BY SOFTWARE, 2021

FIGURE 19 ACCESS CONTROL MANAGEMENT SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.6 MARKET, BY VERTICAL, 2021

FIGURE 20 RETAIL AND ECOMMERCE SEGMENT TO HAVE A HIGHER MARKET SHARE DURING THE FORECAST PERIOD

4.7 DATABASE SECURITY MARKET, MARKET SHARE OF TOP THREE SOFTWARE AND REGIONS, 2021

FIGURE 21 ACCESS CONTROL MANAGEMENT AND NORTH AMERICA TO HOLD THE HIGHEST MARKET SHARES IN 2021

4.8 MARKET INVESTMENT SCENARIO

FIGURE 22 APAC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 78)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 DATABASE SECURITY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing demand for sophisticated security solutions

5.2.1.2 Evolving regulatory landscape

5.2.1.3 Growing volumes of business data across industries

5.2.2 RESTRAINTS

5.2.2.1 Budget constraints and high installation cost of solutions

5.2.2.2 Insider threats

5.2.3 OPPORTUNITIES

5.2.3.1 The proliferation of cloud-based applications and services

5.2.3.2 Continuously evolving IT landscape

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness about multi-layered security

5.2.4.2 Lack of skilled workforce

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.4 DATABASE SECURITY: USE CASES

5.4.1 USE CASE 1: GOVERNMENT

5.4.2 USE CASE 2: RETAIL

5.4.3 USE CASE 3: FINANCIAL SERVICES

5.5 RULES AND REGULATIONS

5.5.1 GENERAL DATA PROTECTION REGULATION (GDPR)

5.5.2 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.5.3 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.5.4 THE GRAMM-LEACH-BLILEY ACT

5.5.5 THE SARBANES-OXLEY ACT

5.5.6 FEDERAL INFORMATION SECURITY MANAGEMENT ACT

5.6 STANDARD FEATURES OFFERED BY DATABASE SECURITY VENDORS

5.6.1 DATA DISCOVERY AND CLASSIFICATION

5.6.2 DATA PROTECTION AND THREAT PREVENTION

5.6.3 VULNERABILITY ASSESSMENT

5.6.4 MONITORING AND ANALYTICS

5.6.5 ACCESS CONTROL AND MANAGEMENT

5.6.6 AUDIT AND COMPLIANCE

5.6.7 PERFORMANCE AND SCALABILITY

6 DATABASE SECURITY MARKET, BY COMPONENT (Page No. - 89)

6.1 INTRODUCTION

FIGURE 24 THE SERVICES SEGMENT IS EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 3 MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 4 MARKET SIZE, BY COMPONENT 2020–2026 (USD MILLION)

6.2 SOFTWARE

6.2.1 MARKET, BY SOFTWARE: DRIVERS

6.2.2 MARKET, BY SOFTWARE: COVID-19 IMPACT

FIGURE 25 ACCESS CONTROL MANAGEMENT SOFTWARE IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 5 SOFTWARE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 6 SOFTWARE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 7 SOFTWARE: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 8 SOFTWARE: DATABASE SECURITY MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

6.2.3 DATABASE AUDITING AND REPORTING

TABLE 9 DATABASE AUDITING AND REPORTING: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 10 DATABASE AUDITING AND REPORTING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.4 ENCRYPTION AND TOKENIZATION

TABLE 11 ENCRYPTION AND TOKENIZATION: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 12 ENCRYPTION AND TOKENIZATION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.5 DATA MASKING AND REDACTION

TABLE 13 DATA MASKING AND REDACTION: MARKET SIZE BY REGION, 2016–2020 (USD MILLION)

TABLE 14 DATA MASKING AND REDACTION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.6 ACCESS CONTROL MANAGEMENT

TABLE 15 ACCESS CONTROL MANAGEMENT: DATABASE SECURITY MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 16 ACCESS CONTROL MANAGEMENT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.7 OTHERS

TABLE 17 OTHERS SOFTWARE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 18 OTHERS SOFTWARE: MARKET SIZE, BY REGION 2020–2026 (USD MILLION)

6.3 SERVICES

6.3.1 MARKET, BY SOFTWARE: DRIVERS

6.3.2 MARKET, BY SOFTWARE: COVID-19 IMPACT

FIGURE 26 MANAGED SERVICES SEGMENT IS EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 19 SERVICES: DATABASE SECURITY MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 20 SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 21 SERVICES: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 22 SERVICES: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

6.3.3 MANAGED SERVICES

TABLE 23 MANAGED SERVICES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 24 MANAGED SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.4 PROFESSIONAL SERVICES

TABLE 25 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 26 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

6.3.4.1 Consulting services

TABLE 27 CONSULTING SERVICES: DATABASE SECURITY MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 28 CONSULTING SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.4.2 Support and maintenance

TABLE 29 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 30 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.4.3 Education and training

TABLE 31 EDUCATION AND TRAINING: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 32 EDUCATION AND TRAINING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.4.4 Risk assessment services

TABLE 33 RISK ASSESSMENT SERVICES: MARKET SIZE BY REGION, 2016–2020 (USD MILLION)

TABLE 34 RISK ASSESSMENT SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7 DATABASE SECURITY MARKET, BY BUSINESS FUNCTION (Page No. - 107)

7.1 INTRODUCTION

FIGURE 27 OPERATIONS BUSINESS FUNCTION IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 35 MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 36 MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

7.2 MARKETING

TABLE 37 MARKETING: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 38 MARKETING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.3 SALES

TABLE 39 SALES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 40 SALES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.4 FINANCE

TABLE 41 FINANCE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 42 FINANCE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.5 OPERATIONS

TABLE 43 OPERATIONS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 44 OPERATIONS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.6 OTHERS

TABLE 45 OTHERS BUSINESS FUNCTIONS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 46 OTHERS BUSINESS FUNCTIONS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8 DATABASE SECURITY MARKET, BY DEPLOYMENT MODE (Page No. - 115)

8.1 INTRODUCTION

FIGURE 28 CLOUD DEPLOYMENT MODE IS EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 47 MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 48 MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

8.2 ON-PREMISES

8.2.1 MARKET FOR ON-PREMISES: DRIVERS

8.2.2 MARKET FOR ON-PREMISES: COVID-19 IMPACT

TABLE 49 ON-PREMISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 50 ON-PREMISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.3 CLOUD

8.3.1 MARKET FOR CLOUD: DRIVERS

8.3.2 MARKET FOR CLOUD: COVID-19 IMPACT

TABLE 51 CLOUD: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 52 CLOUD: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9 DATABASE SECURITY MARKET, BY ORGANIZATION SIZE (Page No. - 120)

9.1 INTRODUCTION

FIGURE 29 SMALL AND MEDIUM-SIZED ENTERPRISES ARE EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 53 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 54 MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

9.2 SMALL AND MEDIUM-SIZED ENTERPRISES

9.2.1 MARKET FOR SMALL AND MEDIUM-SIZED ENTERPRISES: DRIVERS

9.2.2 MARKET FOR SMALL AND MEDIUM-SIZED ENTERPRISES: COVID-19 IMPACT

TABLE 55 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 56 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.3 LARGE ENTERPRISES

9.3.1 MARKET FOR LARGE ENTERPRISES: DRIVERS

9.3.2 MARKET FOR LARGE ENTERPRISES: COVID-19 IMPACT

TABLE 57 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 58 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10 DATABASE SECURITY MARKET, BY VERTICAL (Page No. - 125)

10.1 INTRODUCTION

FIGURE 30 RETAIL AND ECOMMERCE VERTICAL IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 59 MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 60 MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

10.2.1 MARKET FOR BANKING, FINANCIAL SERVICES, AND INSURANCE: DRIVERS

10.2.2 MARKET FOR BAKING, FINANCIAL SERVICES, AND INSURANCE: COVID-19 IMPACT

TABLE 61 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 62 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.3 TELECOMMUNICATIONS AND IT

10.3.1 MARKET FOR TELECOMMUNICATIONS AND IT: DRIVERS

10.3.2 MARKET FOR TELECOMMUNICATIONS AND IT: COVID-19 IMPACT

TABLE 63 TELECOMMUNICATIONS AND IT: DATABASE SECURITY MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 64 TELECOMMUNICATIONS AND IT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.4 GOVERNMENT AND DEFENSE

10.4.1 MARKET FOR GOVERNMENT AND DEFENSE: DRIVERS

10.4.2 MARKET FOR GOVERNMENT AND DEFENSE: COVID-19 IMPACT

TABLE 65 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 66 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.5 MANUFACTURING

10.5.1 MARKET FOR MANUFACTURING: DRIVERS

10.5.2 MARKET FOR MANUFACTURING: COVID-19 IMPACT

TABLE 67 MANUFACTURING: DATABASE SECURITY MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 68 MANUFACTURING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.6 HEALTHCARE AND LIFE SCIENCES

10.6.1 MARKET FOR HEALTHCARE AND LIFE SCIENCES: DRIVERS

10.6.2 MARKET FOR HEALTHCARE AND LIFE SCIENCES: COVID-19 IMPACT

TABLE 69 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 70 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.7 RETAIL AND ECOMMERCE

10.7.1 MARKET FOR RETAIL AND ECOMMERCE: DRIVERS

10.7.2 MARKET FOR RETAIL AND ECOMMERCE: COVID-19 IMPACT

TABLE 71 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 72 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.8 ENERGY AND UTILITIES

10.8.1 DATABASE SECURITY MARKET FOR ENERGY AND UTILITIES: DRIVERS

10.8.2 MARKET FOR ENERGY AND UTILITIES: COVID-19 IMPACT

TABLE 73 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 74 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.9 MEDIA AND ENTERTAINMENT

10.9.1 MARKET FOR MEDIA AND ENTERTAINMENT: DRIVERS

10.9.2 MARKET FOR MEDIA AND ENTERTAINMENT: COVID-19 IMPACT

TABLE 75 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 76 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.10 OTHERS

TABLE 77 OTHERS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 78 OTHERS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11 DATABASE SECURITY MARKET, BY REGION (Page No. - 141)

11.1 INTRODUCTION

FIGURE 31 ASIA PACIFIC IS EXPECTED TO HAVE THE HIGHEST CAGR IN THE MARKET DURING THE FORECAST PERIOD

TABLE 79 MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 80 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 MARKET IN NORTH AMERICA: DRIVERS

11.2.2 MARKET IN NORTH AMERICA: COVID-19 IMPACT

FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

11.2.3 MARKET ESTIMATES AND FORECASTS, BY COMPONENT

TABLE 81 NORTH AMERICA: DATABASE SECURITY MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

11.2.4 MARKET ESTIMATES AND FORECASTS, BY SOFTWARE

TABLE 83 NORTH AMERICA: MARKET SIZE, BY SOFTWARE, 2016–2020 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

11.2.5 MARKET ESTIMATES AND FORECASTS, BY SERVICE

TABLE 85 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

11.2.6 MARKET ESTIMATES AND FORECASTS, BY BUSINESS FUNCTION

TABLE 89 NORTH AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 90 NORTH AMERICA: DATABASE SECURITY MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

11.2.7 MARKET ESTIMATES AND FORECASTS, BY DEPLOYMENT TYPE

TABLE 91 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

11.2.8 MARKET ESTIMATES AND FORECASTS, BY ORGANIZATION SIZE

TABLE 93 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

11.2.9 MARKET ESTIMATES AND FORECASTS BY VERTICAL

TABLE 95 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.2.10 MARKET ESTIMATES AND FORECASTS, BY COUNTRY

TABLE 97 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

11.2.10.1 United States

TABLE 99 UNITED STATES: DATABASE SECURITY MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 100 UNITED STATES: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 101 UNITED STATES: MARKET SIZE, BY SOFTWARE, 2016–2020 (USD MILLION)

TABLE 102 UNITED STATES: MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

TABLE 103 UNITED STATES: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 104 UNITED STATES: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 105 UNITED STATES: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 106 UNITED STATES: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 107 UNITED STATES: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 108 UNITED STATES: MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

TABLE 109 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 110 UNITED STATES: DATABASE SECURITY MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 111 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 112 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 113 UNITED STATES: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 114 UNITED STATES: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.2.10.2 Canada

TABLE 115 CANADA: DATABASE SECURITY MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 116 CANADA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 117 CANADA: MARKET SIZE, BY SOFTWARE, 2016–2020 (USD MILLION)

TABLE 118 CANADA: MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

TABLE 119 CANADA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 120 CANADA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 121 CANADA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 122 CANADA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 123 CANADA: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 124 CANADA: MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

TABLE 125 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 126 CANADA: DATABASE SECURITY MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 127 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 128 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 129 CANADA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 130 CANADA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.3 EUROPE

11.3.1 DATABASE SECURITY MARKET IN EUROPE: DRIVERS

11.3.2 MARKET IN EUROPE: COVID-19 IMPACT

11.3.3 MARKET ESTIMATES AND FORECASTS, BY COMPONENT

TABLE 131 EUROPE: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 132 EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

11.3.4 MARKET ESTIMATES AND FORECASTS, BY SOFTWARE

TABLE 133 EUROPE: MARKET SIZE, BY SOFTWARE, 2016–2020 (USD MILLION)

TABLE 134 EUROPE: MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

11.3.5 MARKET ESTIMATES AND FORECASTS, BY SERVICE

TABLE 135 EUROPE: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 136 EUROPE: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 137 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 138 EUROPE: DATABASE SECURITY MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

11.3.6 MARKET ESTIMATES AND FORECASTS, BY BUSINESS FUNCTION

TABLE 139 EUROPE: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 140 EUROPE: MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

11.3.7 MARKET ESTIMATES AND FORECASTS, BY DEPLOYMENT TYPE

TABLE 141 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 142 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

11.3.8 MARKET ESTIMATES AND FORECASTS, BY ORGANIZATION SIZE

TABLE 143 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 144 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

11.3.9 MARKET ESTIMATES AND FORECASTS BY VERTICAL

TABLE 145 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 146 EUROPE: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.3.10 MARKET ESTIMATES AND FORECASTS, BY COUNTRY

TABLE 147 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 148 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

11.3.10.1 United Kingdom

TABLE 149 UNITED KINGDOM: DATABASE SECURITY MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 150 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 151 UNITED KINGDOM: MARKET SIZE, BY SOFTWARE, 2016–2020 (USD MILLION)

TABLE 152 UNITED KINGDOM: MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

TABLE 153 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 154 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 155 UNITED KINGDOM: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 156 UNITED KINGDOM: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 157 UNITED KINGDOM: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 158 UNITED KINGDOM: DATABASE SECURITY MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

TABLE 159 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 160 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 161 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 162 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 163 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 164 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.3.10.2 Germany

TABLE 165 GERMANY: DATABASE SECURITY MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 166 GERMANY: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 167 GERMANY: MARKET SIZE, BY SOFTWARE, 2016–2020 (USD MILLION)

TABLE 168 GERMANY: MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

TABLE 169 GERMANY: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 170 GERMANY: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 171 GERMANY: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 172 GERMANY: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 173 GERMANY: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 174 GERMANY: DATABASE SECURITY MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

TABLE 175 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 176 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 177 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 178 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 179 GERMANY: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 180 GERMANY: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.3.10.3 Rest of Europe

TABLE 181 REST OF EUROPE: DATABASE SECURITY MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 182 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 183 REST OF EUROPE: MARKET SIZE, BY SOFTWARE, 2016–2020 (USD MILLION)

TABLE 184 REST OF EUROPE: MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

TABLE 185 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 186 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 187 REST OF EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 188 REST OF EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 189 REST OF EUROPE: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 190 REST OF EUROPE: DATABASE SECURITY MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

TABLE 191 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 192 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 193 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 194 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 195 REST OF EUROPE: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 196 REST OF EUROPE: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 DATABASE SECURITY MARKET IN ASIA PACIFIC: DRIVERS

11.4.2 MARKET IN EUROPE: COVID-19 IMPACT

FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

11.4.3 MARKET ESTIMATES AND FORECASTS, BY COMPONENT

TABLE 197 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 198 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

11.4.4 MARKET ESTIMATES AND FORECASTS, BY SOFTWARE

TABLE 199 ASIA PACIFIC: MARKET SIZE, BY SOFTWARE, 2016–2020 (USD MILLION)

TABLE 200 ASIA PACIFIC: MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

11.4.5 MARKET ESTIMATES AND FORECASTS, BY SERVICE

TABLE 201 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 202 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 203 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 204 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

11.4.6 MARKET ESTIMATES AND FORECASTS, BY BUSINESS FUNCTION

TABLE 205 ASIA PACIFIC: DATABASE SECURITY MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 206 ASIA PACIFIC: MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

11.4.7 MARKET ESTIMATES AND FORECASTS, BY DEPLOYMENT TYPE

TABLE 207 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 208 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

11.4.8 MARKET ESTIMATES AND FORECASTS, BY ORGANIZATION SIZE

TABLE 209 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 210 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

11.4.9 MARKET ESTIMATES AND FORECASTS BY VERTICAL

TABLE 211 ASIA PACIFIC: MARKET SIZE, BY VERTICAL 2016–2020 (USD MILLION)

TABLE 212 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.4.10 MARKET ESTIMATES AND FORECASTS, BY COUNTRY

TABLE 213 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 214 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

11.4.10.1 China

TABLE 215 CHINA: DATABASE SECURITY MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 216 CHINA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 217 CHINA: MARKET SIZE, BY SOFTWARE, 2016–2020 (USD MILLION)

TABLE 218 CHINA: MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

TABLE 219 CHINA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 220 CHINA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 221 CHINA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 222 CHINA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 223 CHINA: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 224 CHINA: MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

TABLE 225 CHINA: DATABASE SECURITY MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 226 CHINA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 227 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 228 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 229 CHINA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 230 CHINA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.4.10.2 Japan

TABLE 231 JAPAN: DATABASE SECURITY MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 232 JAPAN: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 233 JAPAN: MARKET SIZE, BY SOFTWARE, 2016–2020 (USD MILLION)

TABLE 234 JAPAN: MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

TABLE 235 JAPAN: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 236 JAPAN: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 237 JAPAN: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 238 JAPAN: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 239 JAPAN: DATABASE SECURITY MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 240 JAPAN: MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

TABLE 241 JAPAN: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 242 JAPAN: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 243 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 244 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 245 JAPAN: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 246 JAPAN: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.4.10.3 Rest of Asia Pacific

TABLE 247 REST OF ASIA PACIFIC: DATABASE SECURITY MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 248 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 249 REST OF ASIA PACIFIC: MARKET SIZE, BY SOFTWARE, 2016–2020 (USD MILLION)

TABLE 250 REST OF ASIA PACIFIC: MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

TABLE 251 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 252 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 253 REST OF ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 254 REST OF ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 255 REST OF ASIA PACIFIC: DATABASE SECURITY MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 256 REST OF ASIA PACIFIC: MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

TABLE 257 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 258 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 259 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 260 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 261 REST OF ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 262 REST OF ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 DATABASE SECURITY MARKET IN MIDDLE EAST AND AFRICA: DRIVERS

11.5.2 MARKET IN MIDDLE EAST AND AFRICA: COVID-19 IMPACT

11.5.3 MARKET ESTIMATES AND FORECASTS, BY COMPONENT

TABLE 263 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 264 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

11.5.4 MARKET ESTIMATES AND FORECASTS, BY SOFTWARE

TABLE 265 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOFTWARE, 2016–2020 (USD MILLION)

TABLE 266 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

11.5.5 MARKET ESTIMATES AND FORECASTS, BY SERVICE

TABLE 267 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 268 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 269 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 270 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

11.5.6 MARKET ESTIMATES AND FORECASTS, BY BUSINESS FUNCTION

TABLE 271 MIDDLE EAST AND AFRICA: DATABASE SECURITY MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 272 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

11.5.7 MARKET ESTIMATES AND FORECASTS, BY DEPLOYMENT TYPE

TABLE 273 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 274 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

11.5.8 MARKET ESTIMATES AND FORECASTS, BY ORGANIZATION SIZE

TABLE 275 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 276 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

11.5.9 MARKET ESTIMATES AND FORECASTS BY VERTICAL

TABLE 277 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 278 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.5.10 MARKET ESTIMATES AND FORECASTS, BY COUNTRY

TABLE 279 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 280 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

11.5.10.1 Middle East

TABLE 281 MIDDLE EAST: DATABASE SECURITY MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 282 MIDDLE EAST: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 283 MIDDLE EAST: MARKET SIZE, BY SOFTWARE, 2016–2020 (USD MILLION)

TABLE 284 MIDDLE EAST: MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

TABLE 285 MIDDLE EAST: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 286 MIDDLE EAST: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 287 MIDDLE EAST: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 288 MIDDLE EAST: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 289 MIDDLE EAST: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 290 MIDDLE EAST: MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

TABLE 291 MIDDLE EAST: DATABASE SECURITY MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 292 MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 293 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 294 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 295 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 296 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.5.10.2 Africa

TABLE 297 AFRICA: DATABASE SECURITY MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 298 AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 299 AFRICA: MARKET SIZE, BY SOFTWARE, 2016–2020 (USD MILLION)

TABLE 300 AFRICA: MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

TABLE 301 AFRICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 302 AFRICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 303 AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 304 AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 305 AFRICA: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 306 AFRICA: MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

TABLE 307 AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 308 AFRICA: DATABASE SECURITY MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 309 AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 310 AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 311 AFRICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 312 AFRICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 MARKET IN LATIN AMERICA: DRIVERS

11.6.2 MARKET IN LATIN AMERICA: COVID-19 IMPACT

11.6.3 MARKET ESTIMATES AND FORECASTS, BY COMPONENT

TABLE 313 LATIN AMERICA: DATABASE SECURITY MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 314 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

11.6.4 MARKET ESTIMATES AND FORECASTS, BY SOFTWARE

TABLE 315 LATIN AMERICA: MARKET SIZE, BY SOFTWARE, 2016–2020 (USD MILLION)

TABLE 316 LATIN AMERICA: MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

11.6.5 MARKET ESTIMATES AND FORECASTS, BY SERVICE

TABLE 317 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 318 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 319 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 320 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

11.6.6 MARKET ESTIMATES AND FORECASTS, BY BUSINESS FUNCTION

TABLE 321 LATIN AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 322 LATIN AMERICA: DATABASE SECURITY MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

11.6.7 MARKET ESTIMATES AND FORECASTS, BY DEPLOYMENT TYPE

TABLE 323 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 324 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

11.6.8 MARKET ESTIMATES AND FORECASTS, BY ORGANIZATION SIZE

TABLE 325 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 326 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

11.6.9 MARKET ESTIMATES AND FORECASTS BY VERTICAL

TABLE 327 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 328 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.6.10 MARKET ESTIMATES AND FORECASTS, BY COUNTRY

TABLE 329 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 330 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

11.6.10.1 Brazil

TABLE 331 BRAZIL: DATABASE SECURITY MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 332 BRAZIL: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 333 BRAZIL: MARKET SIZE, BY SOFTWARE, 2016–2020 (USD MILLION)

TABLE 334 BRAZIL: MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

TABLE 335 BRAZIL: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 336 BRAZIL: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 337 BRAZIL: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 338 BRAZIL: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 339 BRAZIL: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 340 BRAZIL: DATABASE SECURITY MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

TABLE 341 BRAZIL: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 342 BRAZIL: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 343 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 344 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 345 BRAZIL: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 346 BRAZIL: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.6.10.2 Rest of Latin America

TABLE 347 REST OF LATIN AMERICA: DATABASE SECURITY MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 348 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 349 REST OF LATIN AMERICA: MARKET SIZE, BY SOFTWARE, 2016–2020 (USD MILLION)

TABLE 350 REST OF LATIN AMERICA: MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

TABLE 351 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 352 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 353 REST OF LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 354 REST OF LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 355 REST OF LATIN AMERICA: DATABASE SECURITY MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 356 REST OF LATIN AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

TABLE 357 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 358 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 359 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 360 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 361 REST OF LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 362 REST OF LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 245)

12.1 INTRODUCTION

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 34 DATABASE SECURITY: MARKET EVALUATION FRAMEWORK

12.3 COMPANY EVALUATION QUADRANT

12.3.1 COMPANY EVALUATION QUADRANT: DEFINITION AND METHODOLOGY

TABLE 363 EVALUATION CRITERIA

12.3.2 STAR

12.3.3 PERVASIVE

12.3.4 EMERGING LEADERS

12.3.5 PARTICIPANTS

FIGURE 35 DATABASE SECURITY MARKET: COMPANY EVALUATION QUADRANT, 2020

13 COMPANY PROFILE (Page No. - 248)

13.1 KEY PLAYERS

(Business overview, Products/Solutions and services offered, Response to COVID-19, MnM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats)*

13.1.1 ORACLE

TABLE 364 ORACLE: BUSINESS OVERVIEW

FIGURE 36 ORACLE: COMPANY SNAPSHOT

TABLE 365 ORACLE: PRODUCTS/SOLUTIONS OFFERED

TABLE 366 ORACLE: DEALS

13.1.2 IBM

TABLE 367 IBM: BUSINESS OVERVIEW

FIGURE 37 IBM: COMPANY SNAPSHOT

TABLE 368 IBM: PRODUCTS OFFERED

TABLE 369 IBM: SERVICES OFFERED

TABLE 370 IBM: DEALS

13.1.3 TRUSTWAVE

TABLE 371 TRUSTWAVE: BUSINESS OVERVIEW

TABLE 372 TRUSTWAVE: PRODUCTS/SOLUTIONS OFFERED

TABLE 373 TRUSTWAVE: DEALS

13.1.4 MCAFEE

TABLE 374 MCAFEE: BUSINESS OVERVIEW

FIGURE 38 MCAFEE: COMPANY SNAPSHOT

TABLE 375 MCAFEE: SERVICES OFFERED

TABLE 376 MCAFEE: DEALS

13.1.5 FORTINET

TABLE 377 FORTINET: BUSINESS OVERVIEW

FIGURE 39 FORTINET: COMPANY SNAPSHOT

TABLE 378 FORTINET: PRODUCTS OFFERED

TABLE 379 FORTINET: DEALS

13.1.6 CLOUDERA

TABLE 380 CLOUDERA: BUSINESS OVERVIEW

FIGURE 40 CLOUDERA: COMPANY SNAPSHOT

TABLE 381 CLOUDERA: PRODUCTS OFFERED

TABLE 382 CLOUDERA: SERVICES OFFERED

TABLE 383 CLOUDERA: DEALS

13.1.7 AMAZON WEB SERVICES (AWS)

TABLE 384 AMAZON WEB SERVICES: BUSINESS OVERVIEW

TABLE 385 AMAZON WEB SERVICES: SERVICES OFFERED

TABLE 386 AMAZON WEB SERVICES: SERVICES OFFERED

TABLE 387 AMAZON WEB SERVICES: DEALS

13.1.8 MICROSOFT

TABLE 388 MICROSOFT: BUSINESS OVERVIEW

FIGURE 41 MICROSOFT: COMPANY SNAPSHOT

TABLE 389 MICROSOFT: SERVICES OFFERED

TABLE 390 MICROSOFT: DEALS

13.1.9 IRI

TABLE 391 IRI: BUSINESS OVERVIEW

TABLE 392 IRI: PRODUCTS OFFERED

TABLE 393 IRI: DEALS

13.1.10 MICRO FOCUS

TABLE 394 MICRO FOCUS: BUSINESS OVERVIEW

FIGURE 42 MICRO FOCUS: COMPANY SNAPSHOT

TABLE 395 MICRO FOCUS: SERVICES OFFERED

TABLE 396 MICRO FOCUS: DEALS

13.1.11 IMPERVA

TABLE 397 IMPERVA: BUSINESS OVERVIEW

TABLE 398 IMPERVA: PRODUCTS OFFERED

TABLE 399 IMPERVA: DEALS

13.1.12 ALIBABA CLOUD

TABLE 400 ALIBABA CLOUD: BUSINESS OVERVIEW

TABLE 401 ALIBABA CLOUD: PRODUCTS OFFERED

TABLE 402 ALIBABA CLOUD: SERVICES OFFERED

TABLE 403 ALIBABA CLOUD: DEALS

13.1.13 HUAWEI

TABLE 404 HUAWEI: BUSINESS OVERVIEW

FIGURE 43 HUAWEI: COMPANY SNAPSHOT

TABLE 405 HUAWEI: PRODUCTS/SOLUTIONS OFFERED

TABLE 406 HUAWEI: DEALS

13.1.14 MARKLOGIC

TABLE 407 MARKLOGIC: BUSINESS OVERVIEW

TABLE 408 MARKLOGIC: PRODUCTS/SOLUTIONS OFFERED

TABLE 409 MARKLOGIC: DEALS

13.1.15 THALES GROUP

TABLE 410 THALES GROUP: BUSINESS OVERVIEW

FIGURE 44 THALES GROUP: COMPANY SNAPSHOT

TABLE 411 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 412 THALES GROUP: DEALS

13.1.16 TENCENT

TABLE 413 TENCENT: BUSINESS OVERVIEW

TABLE 414 TENCENT: PRODUCTS OFFERED

TABLE 415 TENCENT: DEALS

13.2 OTHER PLAYERS

13.2.1 PROTEGRITY

13.2.2 TREND MICRO

13.2.3 HASHICORP

13.2.4 DATASPARC

13.2.5 SCALEGRID

13.2.6 OPTIV SECURITY

13.2.7 ZIMCOM

13.2.8 ONENECK

13.2.9 PENTA SECURITY

13.2.10 NETWRIX

*Details on Business overview, Products/Solutions and services offered, Response to COVID-19, MnM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT MARKETS (Page No. - 287)

14.1 INTRODUCTION TO ADJACENT MARKETS

TABLE 416 ADJACENT MARKETS AND FORECASTS

14.2 LIMITATIONS

14.3 DATABASE SECURITY MARKET ECOSYSTEM AND ADJACENT MARKETS

14.4 MANAGED SECURITY SERVICES MARKET

14.4.1 ADJACENT MARKET: MANAGED SECURITY SERVICES MARKET, BY SECURITY TYPE

TABLE 417 MANAGED SECURITY SERVICES MARKET SIZE, BY SECURITY TYPE, 2016–2020 (USD MILLION)

TABLE 418 MANAGED SECURITY SERVICES MARKET SIZE, BY SECURITY TYPE, 2021–2026 (USD MILLION)

14.4.2 ADJACENT MARKET: MANAGED SECURITY SERVICES MARKET, BY VERTICAL

TABLE 419 BANKING, FINANCIAL SERVICES, AND INSURANCE: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 420 BANKING, FINANCIAL SERVICES. AND INSURANCE: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 421 GOVERNMENT: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 422 GOVERNMENT: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 423 RETAIL: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 424 RETAIL: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 425 HEALTHCARE: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 426 HEALTHCARE: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 427 INFORMATION TECHNOLOGY AND ENTERPRISES: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 428 INFORMATION TECHNOLOGY AND ENTERPRISES: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 429 TELECOMMUNICATIONS: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 430 TELECOMMUNICATIONS: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 431 ENERGY AND UTILITIES: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 432 ENERGY AND UTILITIES: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 433 MANUFACTURING: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 434 MANUFACTURING: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 435 OTHER VERTICALS: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 436 OTHER VERTICALS: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

14.4.3 ADJACENT MARKET: MANAGED SECURITY SERVICES MARKET, BY REGION

TABLE 437 MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 438 MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

14.5 CYBERSECURITY MARKET

14.5.1 ADJACENT MARKET: CYBERSECURITY MARKET, BY OFFERING

TABLE 439 CYBERSECURITY MARKET SIZE, BY OFFERING, 2015–2020 (USD MILLION)

TABLE 440 CYBERSECURITY MARKET SIZE, BY OFFERING, 2020–2026 (USD MILLION)

14.5.2 ADJACENT MARKET: CYBERSECURITY MARKET, BY SECURITY TYPE

TABLE 441 CYBERSECURITY MARKET SIZE, BY SECURITY TYPE, 2015–2020 (USD MILLION)

TABLE 442 CYBERSECURITY MARKET SIZE, BY SECURITY TYPE, 2020–2026 (USD MILLION)

14.5.3 ADJACENT MARKET: CYBERSECURITY MARKET, BY VERTICAL

TABLE 443 CYBERSECURITY MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 444 CYBERSECURITY MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

14.5.4 ADJACENT MARKET: CYBERSECURITY MARKET, BY VERTICAL

TABLE 445 CYBERSECURITY MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 446 CYBERSECURITY MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

15 APPENDIX (Page No. - 299)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

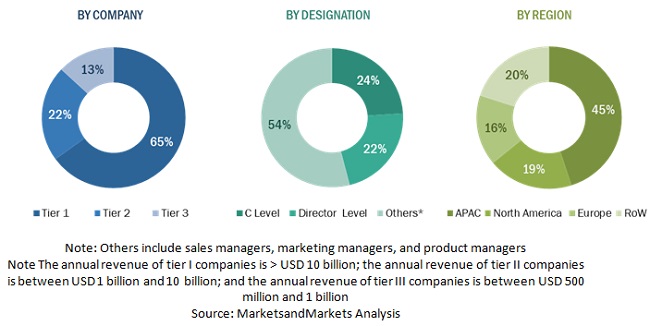

The study involved major activities in estimating the current market size for the Database Security market. An exhaustive secondary research was done to collect information on the Database Security industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches like Top-down, bottom-up were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the Database Security market.

Secondary Research

The market share and revenue of the companies offering Database Security software and services for various verticals were identified the secondary data available through paid and unpaid sources and by analyzing the product portfolio of major companies in the ecosystem and rating them on the basis of their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers on Database Security by companies such as bitpipe, odbms, and Google; journals such as Security in Database Systems, Database Security – Threats and Prevention, The Overview of Database Security Threats Solutions; research papers such as Database Security and Encryption, Database Security: An Overview and Analysis of Current Trend; and certified publications and articles from recognized authors, directories, and databases. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspective—all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), chief information security officers (CISOs), chief technology officers (CTOs), chief operating officers (COOs), vice presidents (VPs), managing directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the Database Security market.

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this market size estimation approach, we identified the key companies providing database security software and services, including Oracle, IBM, Microsoft, Cloudera, etc. These companies contribute to more than 50% of the global database security market. After confirming the market share of these companies with industry experts through primary interviews, we estimated their total revenue through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases. The revenues of the business units (BUs) of these companies that offer database security solutions were identified through similar sources. We then estimated the revenue generated through the sale of specific database security solutions via primary research. The collective revenue of vendors offering database security software comprised 45– 50% of the market, which was again confirmed through primary interviews with industry experts. With the assumption that the rest of the market is contributed to by smaller players that are a part of the unorganized market, the market size of organized players (60–70%) and unorganized players (30–40%) collectively was assumed to be the size of the database security market for the financial year (FY) 2021.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe, segment, and forecast the global database security market based on components, business functions, deployment modes, organization sizes, verticals, and regions

- To forecast the market size of the 5 main regional segments, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze market subsegments with respect to the individual growth trends, future prospects, and contributions to the total market

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze market opportunities for stakeholders and provide details of a competitive landscape for the major players

- To comprehensively analyze the core competencies* of the key players

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the North America Database Security market into countries

- Further breakup of the Europe market into countries

- Further breakup of the APAC market into countries

- Further breakup of the Middle East and Africa market into countries

- Further breakup of the Latin America market into countries

Company information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Database Security Market