Deepfake AI Market

Deepfake AI Market by Offering (Deepfake Generation Software, Deepfake Detection & Authentication Software, Liveness Check Software, Services), Technology (Transformer Models, GANs, Autoencoders, NLP, RNNs, Diffusion Models) - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global deepfake AI market is projected to surge from USD 0.85 billion in 2025 to USD 7.27 billion by 2031, registering a remarkable CAGR of 42.8% during the forecast period. This growth is being driven by a rapid expansion in enterprise applications that require synthetic media generation, detection, and real-time liveness verification. Enterprises across finance, media, telecom, and public services are increasingly embedding deepfake detection and liveliness tools into their digital identity, onboarding, and content moderation pipelines. Meanwhile, advancements in generative AI models are enabling faster, cheaper, and more convincing deepfakes, pushing governments and companies to invest heavily in detection infrastructure.

KEY TAKEAWAYS

-

BY OFFERINGThe deepfake detection & authentication software offering is going to hold the largest market share in 2025.

-

BY TECHNOLOGYThe transformer models segment is projected to record the fastest growth rate during the forecast period, 2025–2031.

-

BY VERTICALMedia & entertainment vertical is estimated to dominate the market in 2025.

-

BY REGIONNorth America will hold the largest market share in 2025, and Asia Pacific market will reveal the highest CAGR during forecast period.

-

COMPETITIVE LANDSCAPEMajor market players have adopted organic and inorganic strategies, including partnerships and investments. For instance, Datambit (UK), Synthesia (UK), Pindrop (US), D-ID (Israel), and Reface (Ukraine) have entered into numerous collaborations and partnerships to cater to the growing demand for deepfake AI across innovative applications.

The deepfake AI market is being driven by the rise of Deepfake-as-a-Service platforms that make advanced generation tools easily accessible through the cloud, along with a growing demand for cross-platform and API-based detection solutions that fit seamlessly into social media, finance, and communication systems. Additionally, integrating liveness checks with multi-factor authentication is strengthening security layers against identity fraud. However, the market faces a major restraint in the form of ethical concerns and misuse risks, which fuel public distrust and hinder broader adoption of legitimate deepfake technologies.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from customer trends or disruptions. Hot bets are the clients of deepfake AI providers, and target applications are the clients of deepfake AI providers. Shifts, which are changing trends or disruptions, will impact the revenues of end user verticals and that of hot bets, which will further affect the revenues of deepfake AI providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Integration of deepfake pipelines in real-time content production workflows

-

•Adoption of multi-modal detection combining audiovisual and metadata signals

Level

-

§Platform de-monetization of deepfake-based channels to curb misuse

-

Interoperability issues between detection systems and diverse content platforms

Level

-

§Federated deepfake detection networks for multi-platform content policing

-

§Joint ventures between insurers and detection firms for synthetic risk products

Level

-

§Incentivizing platforms to adopt uniform deepfake moderation standards

-

§Continuous adversarial evolution making detection perpetually reactive

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Adoption of Multimodal Deepfake Detection Combining Audiovisual and Metadata Signals

A major growth driver for the Deepfake AI market is the enterprise-wide adoption of multimodal detection systems that analyze a combination of visual, auditory, and metadata signals to identify synthetic content with greater precision. As deepfakes become more realistic and accessible, conventional single-layer detection approaches are struggling to keep up in financial services, telecom, government, and media. Organizations are now integrating advanced AI models capable of detecting subtle inconsistencies in facial dynamics, lip-speech coordination, background rendering artifacts, and audio spectral signatures, while also analyzing video file metadata such as encoding parameters, timestamps, and device fingerprints.

Restrain: Fragmented Standards and Lack of Legal Precedents to Reduce Enterprise Confidence

One of the most significant restraints holding back the Deepfake AI market is the lack of consistent global standards and clear legal frameworks for the classification, detection, and admissibility of synthetic media. While the threat of deepfakes is well understood across industries, many enterprises remain hesitant to commit to large-scale deployment of detection and liveness verification tools because of unclear regulatory guidance and fragmented compliance expectations. Different countries and regions are moving at varying speeds, with the European Union introducing watermarking and provenance disclosure mandates under the AI Act, while the US still lacks a unified federal framework to govern synthetic content.

Opportunity: Enterprise Demand for Verified Synthetic Media Is Opening Monetization Avenues

While early activity in the Deepfake AI market has centered on risk management and threat detection, a parallel opportunity is accelerating around verified and responsible synthetic media creation. Enterprises in media, corporate training, education, and retail industries are beginning to adopt AI-driven tools that can generate realistic avatars, multilingual voiceovers, and interactive digital humans for high-volume content production. However, this adoption is conditional on the inclusion of safeguards such as traceability, consent frameworks, and embedded watermarking that ensure regulatory and ethical compliance. As a result, vendors that offer synthetic generation platforms with built-in governance features are emerging as preferred partners.

Challenges: Evasion Tactics and Model Degradation Are Undermining Detection Reliability

A major challenge facing the Deepfake AI market is the continuous evolution of adversarial techniques that are designed specifically to bypass detection models. As generative models become more accessible and customizable, malicious actors are experimenting with data obfuscation, voice blending, frame smoothing, and post-processing filters to reduce the effectiveness of forensic-level detection tools. In many cases, detection models that perform well on benchmark datasets fail to generalize under real-world deployment conditions where attackers have adapted to the system’s weaknesses. This problem is further amplified by the fact that deepfake creators often train their models using the very detection datasets and frameworks that vendors rely on, creating a feedback loop that erodes model efficacy over time.

DEEPFAKE AI MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

IPRoyal reduced time to verify new users while building custom-tailored KYC onboarding flow with iDenfy | With iDenfy, IPRoyal successfully onboarded more than 1,200 applicants a month. iDenfy streamlined customer verification for IPRoyal, reducing time by 70% and minimizing fraud. AI-powered biometric verification boosted conversions and customer base growth. |

|

Insight Global upskilled nurses with Synthesia AI video | 100+ videos generated in 6 months Increased speed in curriculum development Extensive training content |

|

Safe and cost-effective liveness detection with OZ Forensics for Evocabank | Evocabank attracted more than 40,000 clients from all regions of Armenia in 1 year. The rate of biometric fraud cases last year was 0.5%. No biometric attacks passed the system |

|

D-ID revolutionized media engagement for Radio Formula | Month-on-month increase in viewership was significant among the younger audience segment, which has stopped consuming news content. Realized that the overall increase in content led to higher demand for employees in supporting positions. |

|

SentinelOne and NetApp: AI-driven Real-time Malware & Ransomware Detection | Real-time detection and blocking of malware and ransomware threats Autonomous threat containment and recovery Reduced operational overhead and response time Enhanced data resilience and customer trust |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The deepfake AI ecosystem is evolving into a highly specialized and interconnected network of solution providers, strategic alliances, and technology partners. Detection tools, generation platforms, and liveness verification engines are increasingly operating within modular frameworks that allow seamless integration into enterprise workflows. Meanwhile, media authenticity collaborations are helping establish shared standards for watermarking, traceability, and content provenance. API partnerships with cloud, cybersecurity, and AI infrastructure firms are further accelerating deployment across customer-facing and back-end systems. This layered and cooperative ecosystem reflects the market’s transition from isolated tools to end-to-end digital trust platforms designed for both compliance and scalability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Deepfake AI Market, By Offering

The deepfake AI market by offering is divided into software and services, with software solutions playing a central role in addressing the risks of manipulated content. Among these, deepfake detection and authentication software is expected to grow at the highest CAGR during the forecast period. This strong growth is driven by the rising demand from enterprises, governments, and media organizations to secure digital assets, verify content authenticity, and safeguard trust in digital communications.

Deepfake AI Market, By Technology

From a technology perspective, deepfake AI solutions use methods such as GANs, natural language processing, and computer vision for generating and detecting synthetic media. Generative adversarial networks (GANs) are projected to hold the largest market share in 2025. Their dominance is linked to their wide adoption in creating realistic synthetic content, as well as their application in training advanced detection algorithms, making them critical for both deepfake creation and prevention.

Deepfake AI Market, By Vertical

The deepfake AI market adoption is expanding across BFSI, telecommunications, retail & e-commerce, government, and other industries. The BFSI sector is expected to record the highest CAGR during the forecast period. The rapid rise is attributed to the growing need for identity verification, fraud prevention, and secure digital banking services, where deepfake-driven threats are increasingly sophisticated, pushing financial institutions to invest heavily in AI-powered authentication and detection solutions.

REGION

Asia Pacific to be fastest-growing region in global Deepfake AI Market during forecast period

The Asia Pacific deepfake AI market is emerging as a dynamic landscape, fueled by increasing awareness of synthetic media threats and the rapid integration of AI tools across industries. The region’s strong talent pool, growing startup ecosystem, and cross-border collaborations are fostering innovation in detection and prevention technologies. Moreover, cultural and linguistic diversity is driving demand for region-specific solutions tailored to local digital ecosystems.

DEEPFAKE AI MARKET: COMPANY EVALUATION MATRIX

In the deepfake AI market, Datambit is positioned as a Star, reflecting its strong solution portfolio and significant market presence, supported by its advanced capabilities in synthetic media detection and prevention. Perfios is highlighted as an Emerging Leader, demonstrating rapid growth potential through innovative applications and expanding use cases across industries. This positioning underscores Datambit’s maturity and dominance, while Perfios is steadily gaining momentum as a promising player in this evolving market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- · Datambit (UK)

- · Synthesia (UK)

- · D-ID (Israel)

- · Pindrop (US)

- · Reface (Ukraine)

- · Paravision (US)

- · Veritone (US)

- · BioID (Germany)

- · Jumio (US)

- · HyperVerge (US)

- · AWS (US)

- · Blackbird.AI (US)

- · Perfios (India)

- · ValidSoft (US)

- · Kairos AR (US)

- · iProov (UK)

- Reality Defender (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.85 BN |

| Market Forecast in 2031 (Value) | USD 7.27 BN |

| Growth Rate | 42.80% |

| Years Considered | 2020–2031 |

| Base Year | 2024 |

| Forecast Period | 2025–2031 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | • By Offering: Software Type, Software, Deployment Mode, Services • By Technology: Generative Adversarial Networks (GANs), Autoencoders, Recurrent Neural Networks (RNNs), diffusion models, Transformer Models, Natural Language Processing (NLP), Other Technologies • By Vertical: BFSI, Telecommunications, Government & Public Sector, Healthcare & life sciences, Legal, Media & Entertainment, Retail and E-Commerce, Other verticals |

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: DEEPFAKE AI MARKET REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- July 2025 : Paravision introduced its next-generation Deepfake Detection 2.0 platform, incorporating multimodal analysis to identify synthetic media with improved accuracy across diverse formats. The update integrates facial biometrics, audio pattern recognition, and contextual metadata scoring, enabling enterprises to detect real-time manipulation in high stakes use cases such as KYC, compliance screening, and public safety communications.

- May 2025 : Microsoft expanded its Azure AI Video Indexer capabilities by introducing limited-access face identification and celebrity recognition features. These updates include robust governance mechanisms that align with responsible AI principles, helping enterprises detect synthetic alterations while mitigating risks of misuse in media content workflows.

- April 2025 : Reality Defender established a specialized Government Advisory Board composed of former officials from national security, intelligence, and cybersecurity agencies. The board will guide the company’s roadmap for deploying deepfake detection solutions across sensitive public sector applications, including digital identity, disinformation monitoring, and civic integrity protection. This move positions Reality Defender as a key player in shaping national AI security frameworks against synthetic media threats.

- March 2025 : Google acquired Wiz, a leading cloud security provider, to integrate advanced threat detection across its AI infrastructure. This move strengthens Google’s deepfake defense layer by securing content authenticity pipelines and enhancing the resilience of AI-driven systems used for detection and moderation.

- February 2025 : Truepic announced a strategic partnership to deploy its content authenticity infrastructure across regulated enterprise workflows. The initiative focuses on embedding verifiable metadata and tamper-evident layers into digital images used in sectors such as insurance, compliance auditing, and product recalls. By extending its Vision platform through API integrations, Truepic is enabling enterprise-grade protection against image-based deepfake manipulation, while aligning with emerging traceability mandates.

Table of Contents

Methodology

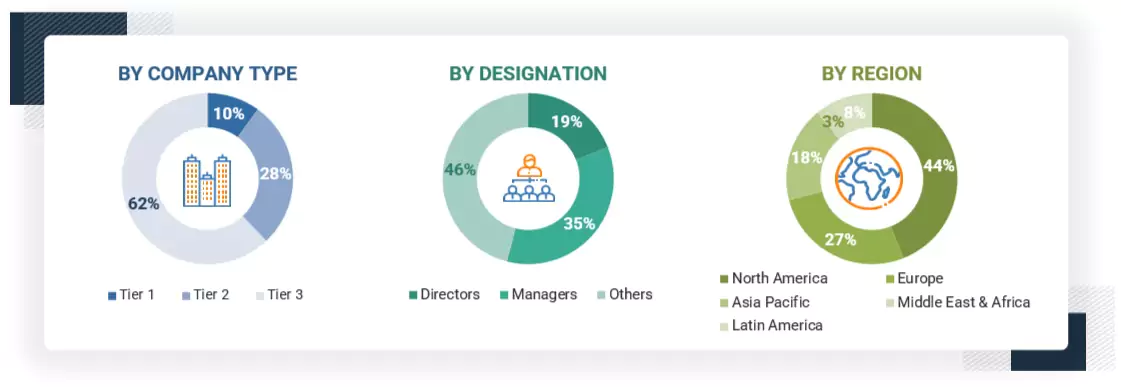

The research methodology for the global deepfake AI market report involved the use of extensive secondary sources and directories, as well as various reputed open-source databases, to identify and collect useful information for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including deepfake AI software providers, deepfake AI service providers, iPaaS providers, data virtualization tool vendors, and enterprise end users; high-level executives of multiple companies offering deepfake AI solutions; and industry consultants to obtain and verify critical qualitative and quantitative information and assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; white papers, certified publications such as Elsevier Journal of Information Security and Applications, ACM Transactions on Multimedia Computing, Communications, and Applications, Springer Artificial Intelligence Review, Nature Machine Intelligence, Pattern Recognition Letters (Elsevier), Neural Networks (Elsevier), Computer Vision and Image Understanding (Elsevier), Journal of Visual Communication and Image Representation (Elsevier), Multimedia Tools and Applications (Springer); and articles from recognized associations and government publishing sources including but not limited to National Institute of Standards and Technology (NIST), European Commission Joint Research Centre (JRC), US Department of Homeland Security (DHS), Federal Trade Commission (FTC), OECD Directorate for Science, Technology and Innovation, MITRE Corporation, Interpol Innovation Centre, United Nations Interregional Crime and Justice Research Institute (UNICRI), World Economic Forum (WEF), UK Department for Science, Innovation and Technology (DSIT), and the Cybersecurity and Infrastructure Security Agency (CISA).

The secondary research was used to obtain key information about the industry’s value chain, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

In the primary research process, a diverse range of stakeholders from both the supply and demand sides of the deepfake AI ecosystem were interviewed to gather qualitative and quantitative insights specific to this market. From the supply side, key industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology & innovation directors, as well as technical leads from vendors offering deepfake AI software & services, were consulted. Additionally, system integrators, service providers, and IT service firms that implement and support deepfake AI were included in the study. On the demand side, input from IT decision-makers, infrastructure managers, and business heads of prominent enterprise end users was collected to understand the user perspectives and adoption challenges within targeted industries.

The primary research ensured that all crucial parameters affecting the deepfake AI market—from technological advancements and evolving use cases (election campaign management, AML & fraud detection, government communications, IP protection etc.) to regulatory and compliance needs (EU Digital Services Act, EU AI Act, US DEEPFAKES Accountability Act, California AB 730 and AB 602, China’s Deep Synthesis Provisions, etc.) were considered. Each factor was thoroughly analyzed, verified through primary research, and evaluated to obtain precise quantitative and qualitative data for this market.

Once the initial phase of market engineering was completed, including detailed calculations for market statistics, segment-specific growth forecasts, and data triangulation, an additional round of primary research was undertaken. This step was crucial for refining and validating critical data points, such as deepfake AI offerings (software & services), industry adoption trends, the competitive landscape, and key market dynamics like demand drivers (adoption of multi-modal detection combining audiovisual and metadata signals, cloud-based deepfake generation APIs democratizing access for small studios, integration of deepfake pipelines in real-time content production workflows, collaboration between social platforms and detection vendors for automated moderation), challenges (incentivizing platforms to adopt uniform deepfake moderation standards, continuous adversarial evolution making detection perpetually reactive), and opportunities (federated deepfake detection networks for multi-platform content policing, joint ventures between insurers and detection firms for synthetic risk products, IP clearinghouses for automated licensing and royalty management of digital likeness).

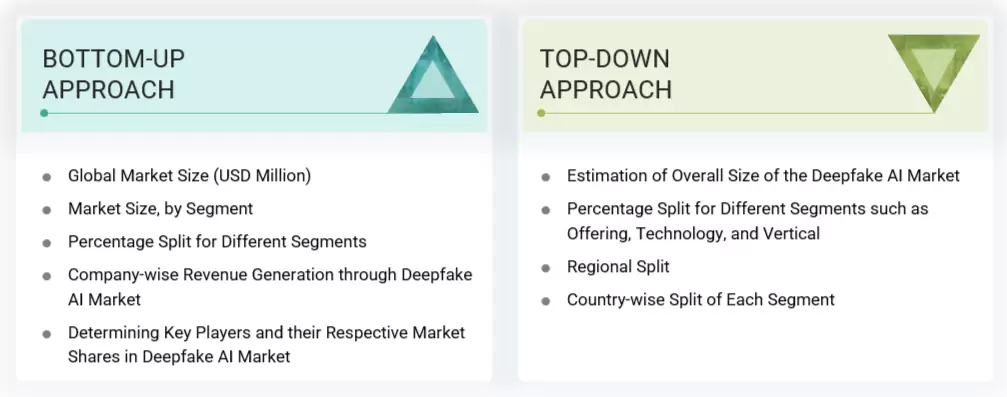

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to record the critical information/insights throughout the report.

Note: Three tiers of companies are defined based on their total revenue as of 2024; tier 1 = revenue more

than USD 500 million, tier 2 = revenue between USD 500 million and 100 million, tier 3 = revenue less than USD 100 million

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To estimate and forecast the deepfake AI market and its dependent submarkets, both top-down and bottom-up approaches were employed. This multi-layered analysis was further reinforced through data triangulation, incorporating both primary and secondary research inputs. The market figures were also validated against the existing MarketsandMarkets repository for accuracy. The following research methodology has been used to estimate the market size:

Deepfake AI Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Deepfake AI refers to the application of artificial intelligence techniques to the creation, identification, and validation of synthetic media that closely imitates human appearance, voice, or behavior across audio, video, and image formats. It encompasses three core capabilities:

- First, deepfake AI involves the use of generative models such as GANs, diffusion models, and autoencoders to produce highly realistic fake content, including face swaps, voice clones, and text-to-video avatars.

- Second, it includes detection technologies that analyze media for signs of manipulation, using forensic, biometric, and multimodal algorithms to assess authenticity and flag inauthentic or altered content.

- Third, deepfake AI supports liveness detection and identity verification. Models are trained to confirm whether a real human is present during a biometric interaction and to detect spoofing attempts involving synthetic or replayed media.

Collectively, these technologies serve a range of applications in media integrity, digital identity, fraud prevention, and content moderation, and are increasingly relevant across both enterprise and regulatory contexts.

Stakeholders

- Deepfake AI detection software developers

- Deepfake AI generation software developers

- Liveness check providers

- Business analysts

- Cloud service providers

- Consulting service providers

- Enterprise end users

- Distributors and Value-added Resellers (VARs)

- Government agencies

- Independent Software Vendors (ISVs)

- Managed service providers

- Market research and consulting firms

- Support & maintenance service providers

- System Integrators (SIs)/Migration service providers

- Technology providers

- Academia & research institutions

- Investors & venture capital firms

Report Objectives

- To define, describe, and forecast the deepfake AI market, by offering (software and services), technology, and vertical

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the deepfake AI market

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments, such as partnerships, product launches, mergers, and acquisitions, in the deepfake AI market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakup of the North American market for deepfake AI

- Further breakup of the European market for deepfake AI

- Further breakup of the Asia Pacific market for deepfake AI

- Further breakup of the Middle East & African market for deepfake AI

- Further breakup of the Latin American market for deepfake AI

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is deepfake AI?

Deepfake AI refers to the use of artificial intelligence techniques to create, detect, or verify synthetic media that mimics real individuals in voice, image, or video form. The market comprises three major segments: deepfake generation (used for avatars, AI videos, and entertainment), deepfake detection (for identifying manipulated or synthetic media), and liveness verification (which confirms whether a video or voice is captured from a live source). Deepfake AI is increasingly relevant in digital identity, content authenticity, fraud prevention, and synthetic media governance across sectors like BFSI, telecom, media, and government.

What is the total CAGR expected to be recorded for the deepfake AI market during 2025 – 2031?

The deepfake AI market is expected to record a CAGR of 42.8% from 2025 to 2031.

How is the generative AI market shaping the deepfake AI industry?

Generative AI is fundamentally transforming the deepfake AI market by enabling highly realistic and customizable synthetic media creation at scale. Advances in models like GANs, diffusion architectures, and transformer-based generators have accelerated the production of synthetic faces, voices, and full-motion avatars. This progress is fueling demand for stronger detection, watermarking, and authenticity tools across sectors such as media, finance, and identity verification. As generation becomes more accessible, enterprises are prioritizing governance frameworks to mitigate deepfake misuse and ensure regulatory compliance.

Which are the key drivers supporting the growth of the deepfake AI market?

Some factors driving the growth of the deepfake AI market include the adoption of multi-modal detection combining audiovisual and metadata signals; cloud-based deepfake generation APIs democratizing access for small studios; integration of deepfake pipelines in real-time content production workflows; and Collaboration between social platforms and deepfake detection vendors for automated moderation.

Which are the top three verticals prevailing in the deepfake AI market?

The top three verticals in the deepfake AI market are BFSI, media & entertainment, and government & defense, each facing high exposure to synthetic media threats and clear ROI from adopting detection, verification, and governed generation tools. BFSI leverages deepfake AI for fraud prevention, voice impersonation detection, and secure eKYC. Media & entertainment uses it for hyper-realistic content generation, AI dubbing, and global localization. Government & defense deploys these solutions for election security, intelligence operations, and digital forensics, making them the most mature and strategically invested sectors.

Who are the key vendors in the deepfake AI market?

Major vendors offering deepfake AI solutions and services across the globe include Datambit (UK), Microsoft (US), AWS (US), Google (US), Intel (US), Veritone (US), Cogito Tech (US), Primeau Forensics (US), iProov (UK), Kairos (US), ValidSoft (US), MyHeritage (Israel), HyperVerge (US), BioID (Germany), DuckDuckGoose AI (Netherlands), Pindrop (US), Truepic (US), Synthesia (UK), BLACKBIRD.AI (US), Deepware (Turkey), iDenfy (US), Q-Integrity (Switzerland), D-ID (Israel), Resemble AI (US), Sensity AI (Netherlands), Reality Defender (US), Attestiv (US), WeVerify (Germany), DeepMedia.AI (US), Kroop AI (India), Respeecher (Ukraine), DeepSwap (US), Reface (Ukraine), Facia.ai (UK), Oz Forensics (UAE), Perfios (US), Illuminarty (US), Deepfake Detector (UK), buster (France), AutheticID (US), Jumio (US), and Paravision (US).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Deepfake AI Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Deepfake AI Market