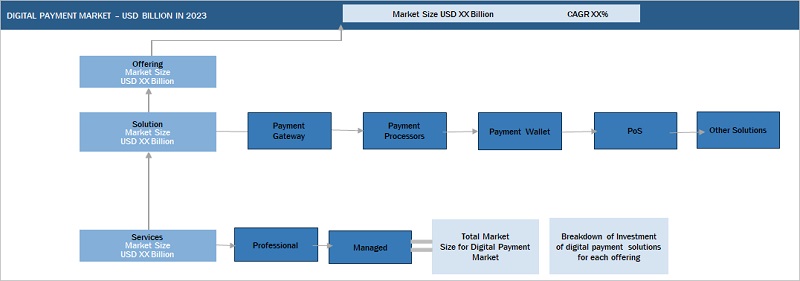

Digital Payment Market Size, Share and Trends Analysis Report by Offering (Solutions (Payment Processor, Payment Gateway, Payment Wallet, POS Solution), Services (Professional and Managed), Transaction Type (Domestic and Cross Border), Payment Mode, Vertical & Region - Global Forecast to 2028

Updated on : Nov 17, 2025

Digital Payment Market Overview

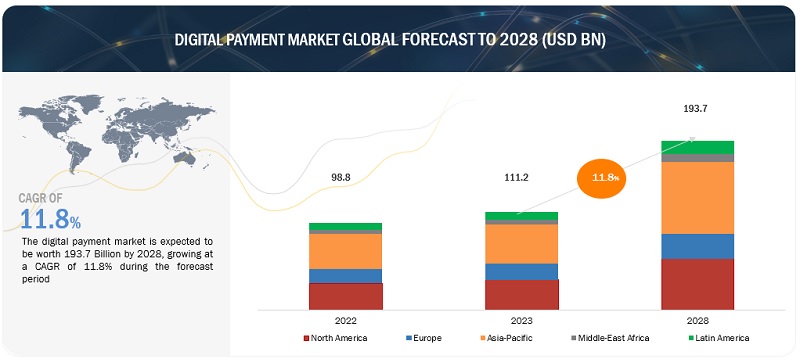

The global Digital Payment Market size was valued $111.2 billion in 2023 and is anticipated to reach over $193.7 billion by 2028, with a robust CAGR of 11.8% during forecast period.

This growth is fueled by rising smartphone adoption, fintech innovation, real-time payment platforms, and the increasing demand for secure and seamless digital transaction solutions across emerging and developed economies.. The base year for estimation is 2022, and the historical data spans from 2023 to 2028.

The rise in the adoption of contactless payments will drive the digital payments market growth. Contactless payment technologies such as Near-Field Communication (NFC), Host Card Emulation (HCE), and Radio Frequency Identification (RFID) ensure faster transactions with the touch-and-go process. Consumers across the globe can now enjoy the ease, speed, and convenience of contactless payments for small, frequent transactions using mobiles, cards, rings, and wristbands. Contactless payments also help reduce customer queues and hassles and provide better results through higher revenue for retailers.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Digital Payments Market Growth Dynamics

Driver: Rise of e-commerce and adoption of embedded payments platform

Online retail and e-commerce growth is driving increased demand for digital payment solutions. These digital payment methods offer convenience, security, and efficiency, making them essential for facilitating online shopping. They streamline checkout processes, support global transactions, enhance security, and play a vital role in mobile commerce (M-commerce). Additionally, digital payments provide valuable transaction data for businesses to personalize marketing and improve customer experiences. Overall, online retail and e-commerce are closely linked to the growing adoption of digital payment methods in the digital age.

Restraint: Lack of global standards for cross-border payments

Cross-border trade has seen consistent year-on-year growth, with organizations increasingly sourcing goods and services from around the world. Despite this opportunity, digital payment providers face challenges in capitalizing on this trend. The hurdles include the absence of global payment systems that offer user-friendly experiences, the absence of universal standards, and varying government regulations in different countries. Each country has its own unique payment regulations and data storage requirements, resulting in inefficiencies for cross-border payments. Furthermore, domestic payment infrastructures are often tailored for purposes other than facilitating cross-border transactions. The lack of a globally standardized framework for cross-border payments creates numerous challenges in international finance. It results in complex and inefficient processes, high transaction costs, inconsistent user experiences, compliance difficulties, limited financial inclusion, slow transaction processing, security risks, trade barriers, limited innovation, and a lack of transparency. Various initiatives are working toward establishing global standards to address these issues, but achieving consensus and widespread adoption remains a complex and ongoing process with the ultimate aim of making cross-border transactions more accessible, cost-effective, and secure worldwide.

Opportunity: Rapid decline in unbanked population across the globe

A large population across the globe lives in rural and remote regions. This population needs connectivity and digital literacy. Today, governments, development organizations, and private sector players recognize the importance of financial services for a large population living in rural and remote regions. The rapid decrease in unbanked individuals presents a significant opportunity for digital payment providers. With a larger customer base, increased adoption of digital payments, reduced reliance on cash, and support from financial inclusion initiatives, digital payment vendors can expand their market, foster innovation, and benefit from economic growth. This trend also enables them to gather valuable data, cross-sell additional services, and enhance security while contributing to financial inclusion efforts.

Challenges: Evolving cyber-attacks on digital payments

Digital payment solutions encompass many technology-driven tools and platforms that facilitate electronic transactions. These solutions enable individuals and businesses to transfer funds and conduct value exchanges without needing physical currency. Examples of digital payment solutions include mobile wallets, online banking, credit and debit card payments, peer-to-peer (P2P) transfers, and cryptocurrency transactions. They have gained popularity due to their convenience, speed, and accessibility and are employed for various purposes, including online shopping, bill settlement, fund transfers, and in-person purchases. In the digital era, these solutions have fundamentally transformed financial transactions, enhancing efficiency and security.

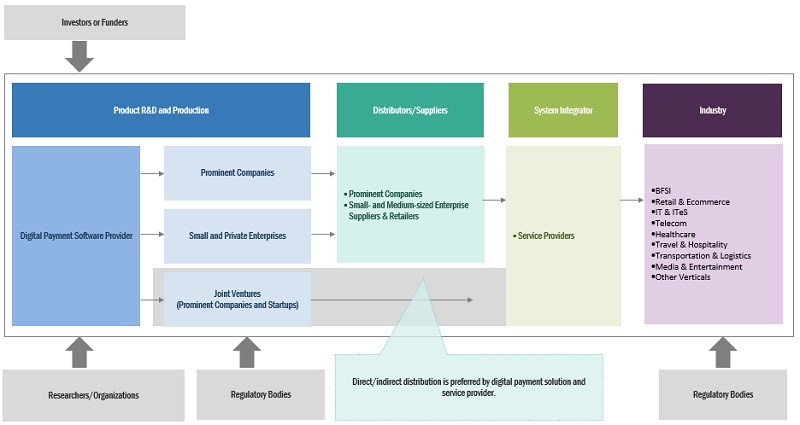

Digital Payment Market Ecosystem

Prominent companies in this market include a well-established, financially stable provider of the market. These companies have innovated their offerings and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include PayPal (US), Fiserv (US), FIS (US), Global Payments (US), Square (US), Stripe (US), VISA (US), Mastercard (US), Worldline (France), Adyen (Netherlands), and ACI Worldwide (US).

By Transaction Type, the domestic segment is expected to hold the largest market size during the forecast period.

A domestic digital payment solution is a specialized financial technology service designed for use within a specific country or region. These solutions are tailored to local needs, supporting the local currency and complying with regional financial regulations. They often integrate with local banks, aim for widespread adoption among consumers and businesses, and prioritize security and customer support. Transactions within a single country typically use the national currency, simplifying the process and eliminating the need for currency conversion. Moreover, domestic digital payments are generally faster and more efficient than cross-border transactions. Transaction fees are often lower for domestic payments as they do not involve international intermediaries or currency exchange costs.

By Vertical, the media & entertainment segment is expected to grow with the highest CAGR during the forecast period.

Media and entertainment are among the fastest-growing verticals worldwide, as several users access media portals and entertainment content over mobile devices. The growth of this vertical is fueled by the expansion of the smartphone market and the availability of high-speed and affordable data services. This vertical is undergoing a major transformation in the way in which media content is made accessible to customers. While print media and electronic media continue to be the prevailing traditional methods in the media and entertainment vertical, the availability of digital media content over mobile devices enabled by the internet is increasing rapidly.

By solution, the payment wallet segment is expected to grow with the highest CAGR during the forecast period.

The payment wallet segment is a vital and rapidly expanding component of the digital payment market. Payment wallets, typically accessed via mobile apps, allow users to store, manage, and conduct various financial transactions digitally. They support diverse transactions, offer security features, and can link to multiple payment methods. Payment wallets are often used for in-store and online purchases, bill payments, and peer-to-peer transfers. They contribute to financial inclusion, foster competition, and comply with financial regulations. While global players like Apple Pay and Google Pay dominate, regional providers also cater to specific markets. Payment wallets play a crucial role in modern digital finance.

Based on region, Asia Pacific is expected to have the highest growth rate during the forecast period.

Asia Pacific exhibits a notable propensity for technology adoption and is poised to achieve the highest growth rate in the market in the coming years. The market within the Asia Pacific region encompasses China, Japan, India, and other countries in the region. The Asia-Pacific (APAC) region is experiencing a surging demand for digital payment solutions due to several factors. Rapid economic growth, widespread smartphone adoption, a tech-savvy population, the e-commerce boom, government initiatives, international trade, urbanization, fintech innovation, and a focus on financial inclusion are all contributing to this demand. APAC's dynamic economies and the growing need for convenient and secure financial transactions are driving the adoption of digital payment methods, making the region a hotspot for digital payment innovation and expansion.

Digital Payment Companies:

The major Digital Payments companies are PayPal (US), Fiserv (US), FIS (US), Global Payments (US), Square (US), Stripe (US), VISA (US), Mastercard (US), Worldline (France), Adyen (Netherlands), ACI Worldwide (US), Temenos (Switzerland), PayU (Netherlands), Apple (US), JPMorgan Chase (US), WEX (US), FLEETCOR (US), Aurus (US), PayTrace (US), Stax by FattMerchant (US), Verifone(US), Spreedly (US), Dwolla (US), BharatPe (India), Payset (UK), PaySend (UK), MatchMove (Singapore), Ripple (US), and EBANX (Brazil). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, product enhancements, and acquisitions to expand their footprint in the Digital Payment market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

By Offering (Solutions (Payment Gateway, Payment Processors, Payment Wallet, Point of Sale, and Other Solutions), Services (professional services (Consulting, Implementation, Support & Maintenance), Managed Services), By Transaction Type (Domestic and Cross Border), Payment Mode (Cards, Digital Wallet, ACH Transfer), By Vertical (BFSI, Retail & E-commerce, Healthcare, Travel & Hospitality, IT & ITeS, Telecom, Transportation & Logistics, Media & Entertainment, Other Verticals) |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Top Digital Payments Companies |

PayPal (US), Fiserv (US), FIS (US), Global Payments (US), Square (US), Stripe (US), VISA (US), Mastercard (US), Worldline (France), Adyen (Netherlands), ACI Worldwide (US), Temenos (Switzerland), PayU (Netherlands), Apple (US), JPMorgan Chase (US), WEX (US), FLEETCOR (US), Aurus (US), PayTrace (US), Stax by FattMerchant (US), Verifone(US), Spreedly (US), Dwolla (US), BharatPe (India), Payset (UK), PaySend (UK), MatchMove (Singapore), Ripple (US), and EBANX (Brazil) |

The study categorizes the Digital Payment Market based on offering, transaction type, and vertical at the regional and global levels.

Digital Payment Market by Offering

-

Solutions

- Payment Gateway Solutions

- Payment Processor Solutions

- Payment Wallet Solutions

- Point of Sale (POS) Solutions

- Other Solutions

-

Services

-

Professional Services

- Consulting

- Implementation

- Support and Maintenance

- Managed Services

-

Professional Services

Digital Payments Industry By Transaction Type

- Domestic

- Cross Border

Digital Payment Industry By Payment Mode

- Cards

- ACH Transfer

- Digital Wallet

- Other Payment Modes

Market By Vertical

- BFSI

- Retail & E-commerce

- IT & ITeS

- Telecom

- Healthcare

- Travel & Hospitality

- Transportation & Logistics

- Media & Entertainment

- Other Verticals

Digital Payments Market By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Italy

- Spain

- France

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

-

Middle East & Africa

- UAE

- South Africa

- KSA

- Rest of MEA

Recent Developments in Digital Payments Market

- In April 2023, the new version of PayPal Payment Solution provided acceptance of PayPal payments with Apple Pay, save payment methods with PayPal Vault, and real-time account updater.

- In April 2023, Square launched Tap to Pay on Android for sellers in the UK. The new technology empowers sellers to securely accept contactless payments with a compatible Android device at no additional cost and without any need for additional hardware.

- In September 2022, the introduction of Worldpay for Platforms merged FIS' extensive merchant and banking solutions into a single platform, incorporating embedded payments technology.

- In February 2022, FIS acquired Payrix. The acquisition positioned FIS to strengthen embedded payments and finance experiences specifically tailored for small- and medium-sized businesses across diverse industries.

- In January 2022, PayPal and Salesforce extended their partnership, offering accelerated access to PayPal’s checkout solutions via the PayPal Commerce Platform to global enterprise merchants who integrate through Salesforce Payments.

Frequently Asked Questions (FAQ):

What is Digital Payments?

Digital payments is an umbrella term that encompasses a range of technologies used in different payment instruments that enable payments through digital modes. The market covers all the solutions and services that incorporate digital payment technologies.

What is the future for Digital Payments?

The global Digital Payments market size was valued $111.2 billion in 2023 and is anticipated to reach $193.7 billion by 2028, projecting a CAGR of 11.8% during the forecast period.

What are the key drivers for Digital Payments Market Growth?

The major driver of the Digital Payment market is the high proliferation of smartphones enabling m-commerce growth. The increasing penetration of smartphones is one of the major growth enablers for the digital payment market. Countries such as India, Indonesia, South Africa, and China have seen high growth in smartphone sales in the last few years. The increased number of smartphones has increased mobile commerce. The increasing number of smartphone users compels the banking and retail industry to develop their mobile applications. This has led to an increase in the demand for mobile wallets and payment gateways. Many companies and retail outlets have introduced their goods and services on online platforms. The increasing number of eCommerce websites is also fueling the growth of the digital payment market.

Which are the top Digital Payment companies included in the report?

The major Digital Payments companies include in the report are PayPal (US), Fiserv (US), FIS (US), Global Payments (US), Square (US), Stripe (US), VISA (US), Mastercard (US), Worldline (France), Adyen (Netherlands), ACI Worldwide (US), Temenos (Switzerland), PayU (Netherlands), Apple (US), JPMorgan Chase (US), WEX (US), FLEETCOR (US), Aurus (US), PayTrace (US), Stax by FattMerchant (US), Verifone(US), Spreedly (US), Dwolla (US), BharatPe (India), Payset (UK), PaySend (UK), MatchMove (Singapore), Ripple (US), and EBANX (Brazil).

What are the opportunities for new market entrants in the Digital Payment market?

The gradual adoption of open-banking APIs will create an opportunity for the digital payment market. The open banking mechanism enables third-party service providers to securely access the financial information of customers in real time through Application Programming Interfaces (APIs). With this approach, banks can provide tailor-made financial products, particularly payment solutions, to their existing customers. Open Banking API has evolved the customer base to provide a seamless payment experience. It has increased innovation in the market and created a new stream of revenue for the industry.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 MARKET OVERVIEW

-

5.2 MARKET DYNAMICSDRIVERS- Rising initiatives for promotion of digitized payments- High proliferation of smartphones enabling mCommerce growth- Rise of eCommerce and adoption of embedded payment system- High adoption of contactless payments- Increasing adoption of real-time payments and ACH transactions- Rise in changing consumer payment modesRESTRAINTS- Evolving cyber-attacks on digital paymentsOPPORTUNITIES- Provision of connectivity and digital literacy in remote areas- Increasing adoption of open-banking APIs- Rapid use of digital payments- Rise in government initiatives favoring adoption of digital payments- Rise in digital payment startup and challenger’s banks- Advancements in technology with collaboration between banks and fintech institutionsCHALLENGES- Lack of global standards for cross-border payments- Lack of digital literacy in emerging countries- Increased costs due to fragmented regional regulatory landscapeCUMULATIVE GROWTH ANALYSIS

- 5.3 REGULATORY LANDSCAPE

-

5.4 INDUSTRY TRENDSBEST PRACTICES IN DIGITAL PAYMENT MARKETVALUE CHAIN ANALYSISBRIEF HISTORY OF MARKET- 2000–2010- 2010–2020- 2020–PresentECOSYSTEM ANALYSISPATENT ANALYSIS- Methodology- Document type- Innovation and patent applications- Top applicantsCASE STUDIES- Case study 1: Tradera implemented customized platform to collect and verify individual information- Case study 2: FIS helped Zalando minimize exemptions to deliver fast and secure payment experience while reducing fraud and risk- Case study 3: Braintree was opted for as solution by Animoto to handle its recurring payments and subscriptions- Case study 4: Stripe worked with MindBody to help studios boost online revenue conversion with virtual classes- Case study 5: By integrating Square for in-person, in-app, and online payments, Brushfire created cohesive payments and reporting solutionsINDICATIVE PRICING ANALYSIS, BY PAYMENT METHOD- Average selling price of key players- Average selling price trendIMPACT OF DIGITAL PAYMENT ON ADJACENT TECHNOLOGIESTECHNOLOGY ANALYSIS- Adjacent technologiesPORTER’S FIVE FORCES ANALYSIS- Threat of new entrants- Threat of substitutes- Bargaining power of buyers- Bargaining power of suppliers- Intensity of competitive rivalryTRENDS/DISRUPTIONS IMPACTING BUYERS/CUSTOMERSKEY CONFERENCES & EVENTS, 2023-24KEY STAKEHOLDERS & BUYING CRITERIA- Key stakeholders in buying process- Buying criteriaFUTURE DIRECTION OF MARKET- Digital payment market roadmap till 2030- Short-term roadmap (2023–2025)- Mid-term roadmap (2026–2028)- Long-term roadmap (2029–2030)HS CODE

-

6.1 INTRODUCTIONOFFERING: DIGITAL PAYMENT MARKET DRIVERS

-

6.2 SOLUTIONSPAYMENT GATEWAYS- Strong support in processing customer payment credentials and authorizing their payments to drive growthPAYMENT PROCESSORS- Increasing demand for transactions through various modes to boost growthPAYMENT WALLET- Rising demand for secure and convenient payment solutions in various verticals to encourage market expansionPOINT-OF-SALE SOLUTIONS- Elimination of need for tracking multiple payment systems to boost growthOTHER SOLUTIONS

-

6.3 SERVICESPROFESSIONAL SERVICES- Rising expertise and consulting offerings to optimize payment processes and enhance security to propel growth- Consulting- Implementation- Support & MaintenanceMANAGED SERVICES- Emergence of hosted payment solutions to contribute to market growth

-

7.1 INTRODUCTIONTRANSACTION TYPE: MARKET DRIVERS

-

7.2 DOMESTICELIMINATING NEED FOR CURRENCY CONVERSION FOR INTERNATIONAL INTERMEDIARIES TO BOLSTER GROWTH

-

7.3 CROSS BORDERFACILITATING GLOBAL TRADE FOR FUNDS EXCHANGE TO FOSTER GROWTH

-

8.1 INTRODUCTIONPAYMENT MODE: MARKET DRIVERS

-

8.2 CARDSGROWING DEMAND FOR CARDS FOR SEAMLESS ONLINE TRANSACTIONS TO DRIVE MARKET

-

8.3 DIGITAL WALLETFACILITATING CROSS-BORDER TRANSACTIONS AND CURRENCY CONVERSIONS TO SPUR GROWTH

-

8.4 AUTOMATIC CLEARING HOUSE (ACH) TRANSFERNEED TO MAKE RECURRING DEPOSITS INTO TAXABLE BROKERAGE ACCOUNTS TO FUEL DEMAND

- 8.5 OTHER PAYMENT MODES

-

9.1 INTRODUCTIONVERTICALS: DIGITAL PAYMENT MARKET DRIVERS

-

9.2 BFSIRISING ADOPTION OF DIGITALIZED TOOLS TO EASE BANKING AND OTHER FINANCIAL PROCESSES TO DRIVE GROWTHCASE STUDIES- Fino Payment Bank adopted FIS payment solution to scale its operations across India- Fundraise Up partnered with Stripe to deploy efficient payment optimization tools for better customer checkout experience- River City Bank enhanced security against rising cyber threats with help of FIS

-

9.3 RETAIL & ECOMMERCEGROWING NEED TO SUPPORT ONLINE TRANSACTIONS TO BOOST MARKETCASE STUDIES- Jilian Produce deployed Zettle terminal to ease its sales interface- Walmart Marketplace integrated PayPal's Hyperwallet for payout processing

-

9.4 HEALTHCAREADOPTION OF NEW TECHNOLOGIES TO PROVIDE IMPROVED SERVICES TO PATIENTS TO SPUR GROWTHCASE STUDIES- Doctolib leveraged Stripe Connect as part of seamless practitioner-onboarding process to reduce doctor payout frequency- Lyra Health partnered with Stripe to experience substantial growth in payment transactions

-

9.5 IT & ITESRISING TECHNOLOGICAL ADVANCEMENTS TO SUPPORT ADVANCED APIS AND SECURE PAYMENT GATEWAYS TO BOOST MARKETCASE STUDY- Atlassian selected Stripe to create single payment and billing platform for global transactions

-

9.6 TELECOMADOPTION OF DIGITAL SOLUTIONS TO MEET CHANGING DEMANDS OF CUSTOMERS TO PROPEL MARKETCASE STUDY- PayPal paired with telecom giants to expand its payment processing solutions

-

9.7 TRAVEL & HOSPITALITYMOUNTED NFC-ENABLED DEVICES IN RESTAURANTS AND HOTELS TO HELP ENABLE FAST TRANSACTIONSCASE STUDIES- Worldpay provided necessary tools to streamline payment operations and navigate business complexities- Aegean Airlines used ACI Worldwide fraud prevention solution to increase efficiency and payment management- PayPal and Expedia collaborated to improve customer’s travel experience

-

9.8 TRANSPORTATION & LOGISTICSENCOURAGING COMMUTERS TO INCORPORATE MICRO-MOBILITY SOLUTIONS INTO MULTI-MODAL JOURNEYS TO REDUCE TRAFFIC CONGESTION TO BOLSTER GROWTHCASE STUDY- Worldpay helped Steer D&G Autocare with latest technology and innovation to modernize and streamline payment processes

-

9.9 MEDIA & ENTERTAINMENTHIGH AVAILABILITY OF FEASIBLE MOBILE PAYMENT SOLUTIONS PROVIDED OVER MOBILE DEVICES TO FUEL GROWTHCASE STUDY- Radius Media adopted FIS solution for recurring and card-on-file billing

- 9.10 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: DIGITAL PAYMENT MARKET DRIVERSNORTH AMERICA: RECESSION IMPACT ANALYSISUS- Presence of huge financial institutions to encourage market expansionCANADA- Rapid adoption of digitalized platforms such as contactless eCommerce to boost growth

-

10.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: RECESSION IMPACT ANALYSISUK- Increased use of cards and popularity of contactless payments to propel growthGERMANY- Increasing smartphone and internet penetration in fintech sector to fuel growthFRANCE- Strong government initiatives to promote instant payment methods to drive growthSPAIN- Shift toward adoption and acceptance of electronic payments to boost growthREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: DIGITAL PAYMENT MARKET DRIVERSASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Robust government initiatives to launch digital currency and enable cross-border business payments to drive marketINDIA- Robust efforts to support Digital India initiative for strong internet connectivity to drive marketJAPAN- High usage of credit cards for transactions to boost marketAUSTRALIA & NEW ZEALAND (ANZ)- Rising popularity of eCommerce to propel growthREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: DIGITAL PAYMENT MARKET DRIVERSMIDDLE EAST- UAE- Saudi Arabia- Bahrain- Kuwait- Rest of Middle EastAFRICA- Government’s rapid payments program to enable new entrants to access core payment systems

-

10.6 LATIN AMERICALATIN AMERICA: MARKET DRIVERSLATIN AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Improved economic conditions, rapid urbanization, and expansion of eCommerce industry to drive market in BrazilMEXICO- Launch of social benefit programs to increase digital transactions to contribute to market growthREST OF LATIN AMERICA

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

- 11.4 HISTORICAL REVENUE ANALYSIS

- 11.5 COMPETITIVE BENCHMARKING

-

11.6 PRODUCT BENCHMARKING FOR PROMINENT DIGITAL PAYMENT SOLUTION PROVIDERSVISASTRIPEMASTERCARDPAYPAL

- 11.7 COMPANY PRODUCT FOOTPRINT ANALYSIS

- 11.8 MARKET RANKING OF KEY PLAYERS, 2023

-

11.9 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.10 SME/STARTUP EVALUATION MATRIX: METHODOLOGY AND DEFINITIONSPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.11 VALUATION AND FINANCIAL METRICS OF KEY DIGITAL PAYMENT VENDORS

-

11.12 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

12.1 MAJOR PLAYERSPAYPAL- Business overview- Products offered- Recent developments- MnM viewFISERV- Business overview- Products offered- Recent developments- MnM viewFIS- Business overview- Products offered- Recent developments- MnM viewBLOCK- Business overview- Products offered- Recent developmentsGLOBAL PAYMENTS- Business overview- Products offered- Recent developmentsSTRIPE- Business overview- Products offered- Recent developmentsVISA- Business overview- Products offered- Recent developments- MnM viewMASTERCARD- Business overview- Products offered- Recent developments- MnM viewWORLDLINE- Business overview- Products offered- Recent developmentsADYEN- Business overview- Products offered- Recent developmentsACI WORLDWIDE- Business overview- Products offered- Recent developmentsTEMENOS- Business overview- Products offered- Recent developmentsPAYU- Business overview- Products offered- Recent developmentsAPPLE- Business overview- Products offered- Recent developmentsFLEECTORJPMORGAN CHASEWEXVERIFONERIPPLE

-

12.2 OTHER PLAYERSPAYTRACESTAXSPREEDLYDWOLLABHARATPEPAYSETMATCHMOVEPAYSENDEBANXAURUS

-

13.1 PAYMENT PROCESSING SOLUTIONS MARKETMARKET DEFINITIONMARKET OVERVIEWPAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD

-

13.2 B2B DIGITAL PAYMENT MARKETMARKET DEFINITIONMARKET OVERVIEWB2B MARKET, BY OFFERINGSOLUTIONSSERVICES

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 PRIMARY INTERVIEWS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 GLOBAL INITIATIVES TO PROMOTE DIGITAL PAYMENTS

- TABLE 5 CUMULATIVE GROWTH ANALYSIS

- TABLE 6 DIGITAL PAYMENT MARKET: ECOSYSTEM ANALYSIS

- TABLE 7 PATENTS FILED, 2020–2023

- TABLE 8 PRICING ANALYSIS

- TABLE 9 TECHNOLOGY ENABLERS IN DIGITAL PAYMENTS

- TABLE 10 PORTER’S FIVE FORCES MODEL

- TABLE 11 DETAILED LIST OF KEY CONFERENCES & EVENTS, 2023-24

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 14 HS CODES, BY PAYMENT METHOD (IMPORT)

- TABLE 15 HS CODES, BY PAYMENT METHOD (EXPORT)

- TABLE 16 MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 17 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 18 MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 19 MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 20 PAYMENT GATEWAYS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 21 PAYMENT GATEWAYS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 PAYMENT PROCESSORS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 23 PAYMENT PROCESSORS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 PAYMENT WALLET: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 25 PAYMENT WALLET: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 POINT-OF-SALE SOLUTIONS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 POINT-OF-SALE SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 OTHER SOLUTIONS: DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 29 OTHER SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 31 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 32 MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 33 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 34 CONSULTING: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 35 CONSULTING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 IMPLEMENTATION: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 37 IMPLEMENTATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 41 MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 42 DOMESTIC: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 DOMESTIC: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 CROSS BORDER: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 45 CROSS BORDER: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 MARKET, BY PAYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 47 MARKET, PAYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 48 CARDS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 CARDS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 DIGITAL WALLET: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 DIGITAL WALLET: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 ACH TRANSFER: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 ACH TRANSFER: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 OTHER PAYMENT MODES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 55 OTHER PAYMENT MODES: DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 57 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 58 BFSI: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 59 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 RETAIL & ECOMMERCE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 RETAIL & ECOMMERCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 HEALTHCARE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 63 HEALTHCARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 IT & ITES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 65 IT & ITES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 TELECOM: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 67 TELECOM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 69 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 71 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 73 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 OTHER VERTICALS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 75 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 77 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: MARKET, BY PAYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY PAYMENT MODE 2023–2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 94 US: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 95 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 96 US: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 97 US: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 98 US: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 99 US: DIGITAL PAYMENT MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 100 US: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 101 US: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 102 US: MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 103 US: MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 104 US: MARKET, BY PAYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 105 US: MARKET, BY PAYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 106 US: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 107 US: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 108 CANADA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 109 CANADA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 110 CANADA: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 111 CANADA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 112 CANADA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 113 CANADA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 114 CANADA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 115 CANADA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 116 CANADA: MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 117 CANADA: MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 118 CANADA: MARKET, BY PAYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 119 CANADA: MARKET, BY PAYMENT MODE 2023–2028 (USD MILLION)

- TABLE 120 CANADA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 121 CANADA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 122 EUROPE: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 123 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 124 EUROPE: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 125 EUROPE: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 126 EUROPE: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 127 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 128 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 129 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 130 EUROPE: MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 131 EUROPE: MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 132 EUROPE: MARKET, BY PAYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 133 EUROPE: MARKET, BY PAYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 134 EUROPE: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 135 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 136 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 137 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 138 UK: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 139 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 140 UK: DIGITAL PAYMENT MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 141 UK: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 142 UK: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 143 UK: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 144 UK: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 145 UK: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 146 UK: MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 147 UK: MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 148 UK: MARKET, BY PAYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 149 UK: MARKET, BY PAYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 150 UK: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 151 UK: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 152 GERMANY: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 153 GERMANY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 154 GERMANY: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 155 GERMANY: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 156 GERMANY: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 157 GERMANY: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 158 GERMANY: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 159 GERMANY: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 160 GERMANY: MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 161 GERMANY: MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 162 GERMANY: MARKET, BY PAYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 163 GERMANY: MARKET, BY PAYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 164 GERMANY: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 165 GERMANY: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 166 ASIA PACIFIC: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 167 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 168 ASIA PACIFIC: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 169 ASIA PACIFIC: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 170 ASIA PACIFIC: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 171 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 173 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 174 ASIA PACIFIC: MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 175 ASIA PACIFIC: MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: MARKET, BY PAYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 177 ASIA PACIFIC: MARKET, BY PAYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 178 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 179 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 181 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 182 CHINA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 183 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 184 CHINA: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 185 CHINA: DIGITAL PAYMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 186 CHINA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 187 CHINA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 188 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 189 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 190 CHINA: MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 191 CHINA: MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 192 CHINA: MARKET, BY PAYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 193 CHINA: MARKET, BY PAYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 194 CHINA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 195 CHINA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 196 INDIA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 197 INDIA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 198 INDIA: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 199 INDIA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 200 INDIA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 201 INDIA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 202 INDIA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 203 INDIA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 204 INDIA: MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 205 INDIA: MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 206 INDIA: MARKET, BY PAYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 207 INDIA: MARKET, BY PAYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 208 INDIA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 209 INDIA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: DIGITAL PAYMENT MARKET, BY PAYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: MARKET, BY PAYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 226 MIDDLE EAST: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 227 MIDDLE EAST: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 228 MIDDLE EAST: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 229 MIDDLE EAST: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 230 MIDDLE EAST: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 231 MIDDLE EAST: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 232 MIDDLE EAST: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 233 MIDDLE EAST: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 234 MIDDLE EAST: MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 235 MIDDLE EAST: MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 236 MIDDLE EAST: MARKET, BY PAYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 237 MIDDLE EAST: MARKET, BY PAYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 238 MIDDLE EAST: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 239 MIDDLE EAST: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 240 MIDDLE EAST: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 241 MIDDLE EAST: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 242 UAE: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 243 UAE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 244 UAE: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 245 UAE: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 246 UAE: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 247 UAE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 248 UAE: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 249 UAE: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 250 UAE: MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 251 UAE: MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 252 UAE: MARKET, BY PAYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 253 UAE: MARKET, BY PAYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 254 UAE: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 255 UAE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 256 KSA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 257 KSA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 258 KSA: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 259 KSA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 260 KSA: DIGITAL PAYMENT MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 261 KSA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 262 KSA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 263 KSA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 264 KSA: MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 265 KSA: MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 266 KSA: MARKET, BY PAYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 267 KSA: MARKET, BY PAYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 268 KSA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 269 KSA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 270 LATIN AMERICA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 271 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 272 LATIN AMERICA: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 273 LATIN AMERICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 274 LATIN AMERICA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 275 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 276 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 277 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 278 LATIN AMERICA: MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 279 LATIN AMERICA: MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 280 LATIN AMERICA: MARKET, BY PAYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 281 LATIN AMERICA: MARKET, BY PAYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 282 LATIN AMERICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 283 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 284 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 285 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 286 BRAZIL: DIGITAL PAYMENT MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 287 BRAZIL: DIGITAL PAYMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 288 BRAZIL: DIGITAL PAYMENT MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 289 BRAZIL: DIGITAL PAYMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 290 BRAZIL: DIGITAL PAYMENT MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 291 BRAZIL: DIGITAL PAYMENT MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 292 BRAZIL: DIGITAL PAYMENT MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 293 BRAZIL: DIGITAL PAYMENT MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 294 BRAZIL: DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 295 BRAZIL: DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 296 BRAZIL: MARKET, BY PAYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 297 BRAZIL: MARKET, BY PAYMENT MODE 2023–2028 (USD MILLION)

- TABLE 298 BRAZIL: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 299 BRAZIL: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 300 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 301 MARKET: DEGREE OF COMPETITION

- TABLE 302 PRODUCT FOOTPRINT WEIGHTAGE

- TABLE 303 MARKET: COMPETITIVE BENCHMARKING OF PLAYERS, BY OFFERING, VERTICAL, AND REGION

- TABLE 304 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 305 COMPARATIVE ANALYSIS OF DIGITAL PAYMENT SOLUTION PROVIDERS

- TABLE 306 COMPANY PRODUCT FOOTPRINT

- TABLE 307 PRODUCT LAUNCHES, 2019–2023

- TABLE 308 DEALS, 2019–2023

- TABLE 309 PAYPAL: BUSINESS OVERVIEW

- TABLE 310 PAYPAL: PRODUCTS OFFERED

- TABLE 311 PAYPAL: PRODUCT LAUNCHES

- TABLE 312 PAYPAL: DEALS

- TABLE 313 PAYPAL: OTHERS

- TABLE 314 FISERV: BUSINESS OVERVIEW

- TABLE 315 FISERV: PRODUCTS OFFERED

- TABLE 316 FISERV: PRODUCT LAUNCHES

- TABLE 317 FISERV: DEALS

- TABLE 318 FISERV: OTHERS

- TABLE 319 FIS: BUSINESS OVERVIEW

- TABLE 320 FIS: PRODUCTS OFFERED

- TABLE 321 FIS: PRODUCT LAUNCHES

- TABLE 322 FIS: DEALS

- TABLE 323 FIS: OTHERS

- TABLE 324 BLOCK: BUSINESS OVERVIEW

- TABLE 325 BLOCK: PRODUCTS OFFERED

- TABLE 326 BLOCK: PRODUCT LAUNCHES

- TABLE 327 SQUARE: DEALS

- TABLE 328 SQUARE: OTHERS

- TABLE 329 GLOBAL PAYMENTS: BUSINESS OVERVIEW

- TABLE 330 GLOBAL PAYMENTS: PRODUCTS OFFERED

- TABLE 331 GLOBAL PAYMENTS: DEALS

- TABLE 332 STRIPE: BUSINESS OVERVIEW

- TABLE 333 STRIPE: PRODUCTS OFFERED

- TABLE 334 STRIPE: PRODUCT LAUNCHES

- TABLE 335 STRIPE: DEALS

- TABLE 336 STRIPE: OTHERS

- TABLE 337 VISA: BUSINESS OVERVIEW

- TABLE 338 VISA: PRODUCTS OFFERED

- TABLE 339 VISA: PRODUCT LAUNCHES

- TABLE 340 VISA: DEALS

- TABLE 341 VISA: OTHERS

- TABLE 342 MASTERCARD: BUSINESS OVERVIEW

- TABLE 343 MASTERCARD: PRODUCTS OFFERED

- TABLE 344 MASTERCARD: PRODUCT LAUNCHES

- TABLE 345 MASTERCARD: DEALS

- TABLE 346 WORLDLINE: BUSINESS OVERVIEW

- TABLE 347 WORLDLINE: PRODUCTS OFFERED

- TABLE 348 WORLDLINE: PRODUCT LAUNCHES

- TABLE 349 WORLDLINE: DEALS

- TABLE 350 WORLDLINE: OTHERS

- TABLE 351 ADYEN: BUSINESS OVERVIEW

- TABLE 352 ADYEN: PRODUCTS OFFERED

- TABLE 353 ADYEN: PRODUCT LAUNCHES

- TABLE 354 ADYEN: DEALS

- TABLE 355 ADYEN: OTHERS

- TABLE 356 ACI WORLDWIDE: BUSINESS OVERVIEW

- TABLE 357 ACI WORLDWIDE: PRODUCTS OFFERED

- TABLE 358 ACI WORLDWIDE: PRODUCT LAUNCHES

- TABLE 359 ACI WORLDWIDE: DEALS

- TABLE 360 TEMENOS: BUSINESS OVERVIEW

- TABLE 361 TEMENOS: PRODUCTS OFFERED

- TABLE 362 TEMENOS: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 363 TEMENOS: DEALS

- TABLE 364 PAYU: BUSINESS OVERVIEW

- TABLE 365 PAYU: PRODUCTS OFFERED

- TABLE 366 PAYU: PRODUCT LAUNCHES

- TABLE 367 PAYU: DEALS

- TABLE 368 PAYU: OTHERS

- TABLE 369 APPLE: BUSINESS OVERVIEW

- TABLE 370 APPLE: PRODUCTS OFFERED

- TABLE 371 APPLE: DEALS

- TABLE 372 PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 373 PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 374 PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 375 PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 376 PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 377 PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 378 B2B MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 379 B2B MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 380 SOLUTIONS: B2B MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 381 SOLUTIONS: B2B MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 382 SERVICES: B2B MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 383 SERVICES: B2B MARKET, BY REGION, 2023–2028 (USD MILLION)

- FIGURE 1 DIGITAL PAYMENT MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 APPROACH 1 (SUPPLY-SIDE): REVENUE OF OFFERINGS IN DIGITAL PAYMENT MARKET

- FIGURE 4 APPROACH 2 (DEMAND-SIDE): DIGITAL PAYMENT MARKET

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 DIGITAL PAYMENT MARKET, 2023–2028 (USD MILLION)

- FIGURE 9 DIGITAL PAYMENT MARKET, BY OFFERING, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 DIGITAL PAYMENT MARKET, BY SOLUTION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 DIGITAL PAYMENT MARKET, BY PAYMENT MODE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 DIGITAL PAYMENT MARKET, BY VERTICAL, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 DIGITAL PAYMENT MARKET, BY REGION, 2023

- FIGURE 15 INCREASING USE OF ONLINE PLATFORM TO DRIVE MARKET GROWTH

- FIGURE 16 OFFERING SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE IN 2023

- FIGURE 17 APAC: SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2023

- FIGURE 18 EUROPE: SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2023

- FIGURE 19 ASIA PACIFIC TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 DIGITAL PAYMENT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 BRIEF HISTORY OF DIGITAL PAYMENT

- FIGURE 23 DIGITAL PAYMENT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 TOTAL NUMBER OF PATENTS GRANTED, 2020–2023

- FIGURE 25 TOP TEN PATENT APPLICANTS, 2020–2023

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING BUYERS/CUSTOMERS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 29 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 30 PAYMENT WALLET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 MANAGED SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 32 CONSULTING SERVICES TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 33 CROSS BORDER SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 34 DIGITAL WALLET SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 MEDIA & ENTERTAINMENT VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 39 REVENUE ANALYSIS OF LEADING PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 40 MARKET RANKING OF KEY PLAYERS, 2023

- FIGURE 41 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 42 COMPANY EVALUATION MATRIX, 2023

- FIGURE 43 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 44 SME/STARTUP EVALUATION MATRIX, 2023

- FIGURE 45 VALUATION AND FINANCIAL METRICS OF KEY DIGITAL PAYMENT VENDORS

- FIGURE 46 PAYPAL: COMPANY SNAPSHOT

- FIGURE 47 FISERV: COMPANY SNAPSHOT

- FIGURE 48 FIS: COMPANY SNAPSHOT

- FIGURE 49 BLOCK: COMPANY SNAPSHOT

- FIGURE 50 GLOBAL PAYMENTS: COMPANY SNAPSHOT

- FIGURE 51 VISA: COMPANY SNAPSHOT

- FIGURE 52 MASTERCARD: COMPANY SNAPSHOT

- FIGURE 53 WORLDLINE: COMPANY SNAPSHOT

- FIGURE 54 ADYEN COMPANY SNAPSHOT

- FIGURE 55 ACI WORLDWIDE: COMPANY SNAPSHOT

- FIGURE 56 TEMENOS: COMPANY SNAPSHOT

- FIGURE 57 APPLE: COMPANY SNAPSHOT

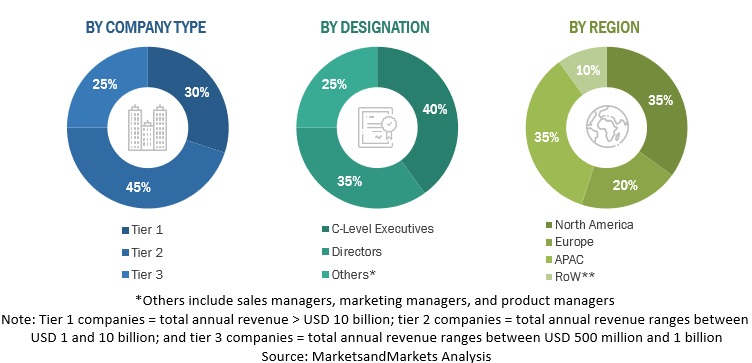

The study involved four major activities in estimating the current market size of the digital payment market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the digital payment market.

The market size of companies offering digital payments solutions and services was arrived at based on the secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolio of major companies and rating them based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The other secondary sources, such as the National Automated Clearing House Association (NACHA), Electronic Transactions Association (ETA), European Mobile Payment Systems Association (EMPSA), European Card Payment Association (ECPA), and The Smart Payment Association (SPA) were used to collect secondary data. The market trends and initiatives in various countries were extracted from government associations, such as the Electronic Money Association (EMA), APSCA, Singapore FinTech Association, The Payments Council of India (PCI), The Australian Payments Clearing Association (APCA), and Payments Association of South Africa (PASA).

Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Technology Officers (CTOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from digital payment solution and service vendors, system integrators, professional and managed service providers, industry associations, and consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology, application, deployment, and region trends. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use digital payment solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of digital payment solutions, which is expected to affect the overall digital payment market growth.

Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

PayPal |

Senior Manager |

|

Fiserv |

Senior Analyst |

|

Global Payments |

Sales Executive |

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the digital payments market and various other dependent submarkets in the overall market.

The bottom-up procedure was employed to arrive at the overall size of the digital payments market from the revenues of key players (companies) and their market shares. The calculation was done based on estimations and by verifying key companies’ revenue through extensive primary interviews. Calculations based on the revenues of the key companies identified in the market led to the overall market size. The overall market size was used in the top-down procedure to estimate the size of other individual segments (component, deployment mode, organization size, vertical, and region) via the percentage splits of the market segments from secondary and primary research. The bottom-up procedure was also implemented for the data extracted from the secondary research to validate the market segment revenues obtained. Market shares were then estimated for each company to verify the revenue shares used earlier in the bottom-up procedure. With the data triangulation procedure and validation of data through primary interviews, the exact values of the overall parent market size and its segments’ market size were determined and confirmed using this study.

Digital Payment Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

In the top-down approach, the estimation of the digital payment market was prepared from the global Fintech market. The global FinTech market has seven key areas: banking, insurance, loans, personal finance, digital payments, venture capital, and wealth management, and the share of digital payments was estimated through secondary sources, in-house research databases, and primary interviews. The digital payment area was studied and analyzed for its regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. These market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

Digital Payments Market Size: Top-Down Approach

Data Triangulation

With data triangulation and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of the other individual markets via percentage splits of the market segmentation.

Market Definition

Digital payment is an umbrella term encompassing various technologies used in different payment instruments that enable payments through digital modes. The digital payment market covers all the solutions and services incorporating digital payment technologies. Digital payments, also referred to as electronic payments, can be defined as transactions that are initiated without the use of physical cards or paper currencies and are conducted over the internet and mobile channels.

Key Stakeholders

- Payment solution and service providers

- Smart card vendors

- Financial institutions

- Merchants and merchant acquirers

- Mobile network operators

- Credit/Debit card providers

- Contactless payment solution providers

- Cloud payment solution providers

- PoS device manufacturers

- Payment security service providers

- Professional and managed service providers

- System integrators

- Technology consultants

Report Objectives

- To determine and forecast the global digital payments market by offering, transaction type, vertical, and region from 2023 to 2028 and analyze various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market’s segments with respect to five main regions: North America, Europe, Latin America, Asia Pacific (APAC), and Middle East and Africa (MEA)

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall digital payment market

- To provide detailed information regarding major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the digital payments market

- To profile key market players and provide a comparative analysis based on their business overviews, service offerings, regional presence, business strategies, and key financials.

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific requirements. The following customization options are available for the report:

Product Analysis

- The product matrix provides detailed product information and comparisons

Geographic Analysis

- Further breakup of the European digital payment market

- Further breakup of the APAC market

- Further breakup of the MEA market

- Further breakup of the Latin American digital payments market

Company Information

- Detailed analysis and profiles of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Payment Market

This report will give you a 360 analysis of Digital Payment Market landscape with deep-dive data market sizing, growth projections up to 2026, adoptions rates for platform, services and various application segments across various buyer segments. The report will also cover intel on top vendor developments, Regional analysis for North America, Europe, APAC, Latin America and MEA along with country level data and how this market will shape in the coming years of COVID-19 pandemic as opposed to previous years. Digital Payment Market Report is market focused study on the subject for industry stakeholders recently published and has been well received by many of the industry players aiming to determine the potential revenue opportunities and partnerships in Digital Payment Market space. The study will enable you to gauge the market potential within each of the product areas; and thereby make an informed decision to strategize partnerships, collaboration and marketing efforts to maximize potential revenues.