Digital Dentistry Market by Product (Intraoral Scanner, Intraoral Camera, Dental CBCT, CAD/CAM), Specialty (Orthodontic, Prosthodontic, Implantology), Application (Therapeutic, Diagnostic), End User (Hospital, Dental Clinic, Labs) & Region - Global Forecast to 2028

Market Growth Outlook Summary

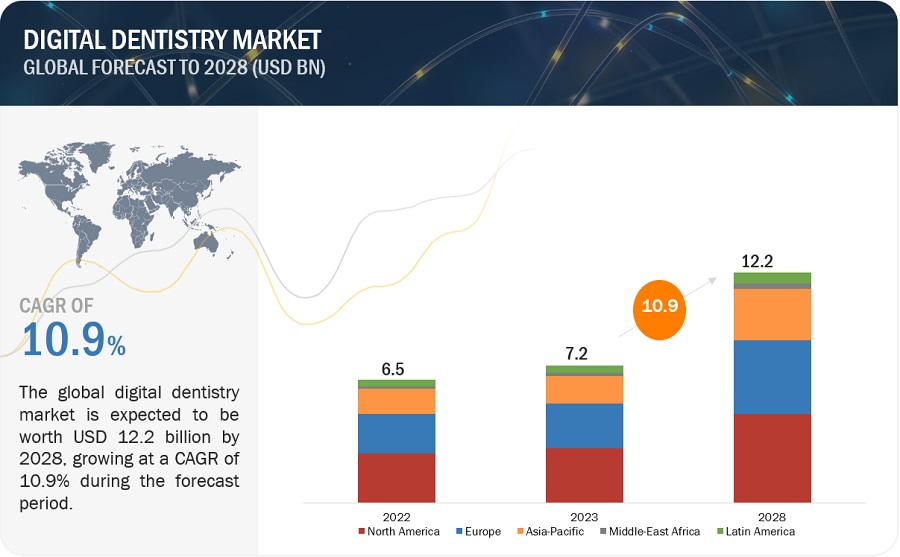

The global digital dentistry market, valued at US$6.5 billion in 2022, stood at US$7.2 billion in 2023 and is projected to advance at a resilient CAGR of 10.9% from 2023 to 2028, culminating in a forecasted valuation of US$12.2 billion by the end of the period. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Growth in this market can primarily be attributed to the high ROI from digital dentistry equipment and software, one-day dentistry that reduces patient burnout and saves dental practitioners time, increased cost-effectiveness, adoption of outsourcing activities by large dental players, increasing aesthetic treatment procedure, and increased dental visits across all the regions of the globe. However, the threat of data breach issues and leak of patient data, and reduction in the insurance available for dental procedures are the restraints to the market growth.

Attractive opportunities in digital dentistry market

To know about the assumptions considered for the study, Request for Free Sample Report

Digital Dentistry Market Dynamics

Driver: Increasing demand for same-day dentistry

The dental industry is increasingly embracing various new digital technologies, such as computer-aided design (CAD)/computer-aided manufacturing (CAM) and 3D printing, due to their high precision and better efficiency in dental restoration and digital orthodontics. These technologies are used to develop milled/3D printed crowns, dentures, bridges, and fabricated abutments used in dental restoration procedures. They can also provide personalized brackets and removable braces for orthodontic treatments. The increasing use of CAD/CAM milling and 3D printing has reduced the need to wear temporary bridges/crowns during dental restoration treatments, enabled less time-consuming treatment procedures, and reduced the number of doctor visits. Same-day dentistry takes advantage of this new digital technology to condense certain dental procedures into a single visit. Digital solutions are the drivers of this process. Not only does it decrease the total time spent on the treatment, but it also prioritizes patient comfort, and better quality of the final product in most cases.

Restraint: Lack of reimbursement for dental procedures

Most insurance providers consider dental prostheses a cosmetic product in developed regions across North America and Europe. Hence, they provide minimal or no reimbursements. Therefore, patients must bear a major portion of the cost of a dental prosthesis treatment, with little support from insurance coverage. Due to this, patients’ decision to opt for treatment largely depends on their ability to afford treatment. This is a major factor restricting the adoption of dental prosthesis surgeries in developed countries.

Developing markets across Asia Pacific and Latin America also face similar issues. Countries such as Japan, China, India, South Korea, and Mexico lack proper dental reimbursement frameworks.

Average cost of dental Surgeries

|

Dental Treatment |

Approximate cost in the US (USD) |

Approximate cost in Europe (USD) |

|

Crowns |

400 to 700 |

500 to 1,200 |

|

Bridges |

500 to 2,000 |

400 to 1,200 |

|

Veneers |

900 to 2,500 |

6,00 to 1,000 |

|

Braces (orthodontic) |

3,500 to 6,000 |

1,500 to 5,000 |

|

Fixed Dentures |

2,000 to 6,000 |

2,000 to 5,000 |

Source: Secondary Sources, Company Websites, Expert Interviews, and Markets and Markets Analysis

Opportunity: Consolidation of dental practices and rising DSO activity

DSOs (Dental Service Organizations), and other types of large dental practices, have shown rapid growth in recent years, especially in the US, the UK, Spain, and even in the developing world, including parts of Southeast Asia, such as China. Over the years, the trend has shifted toward large corporate practice set-ups instead of traditional solo practices. The increasing consolidation is attributed to the better work-life balance in large practices, the rising costs of investing in a solo dental practice, and the concentration of commercial dental insurance.

In the UK, most of the largest DSOs (seven of the top ten) are backed by private-equity investors. Similarly, in the US, 27 out of the top 30 DSOs are backed by private equity. This helps DSOs achieve economies of scale through increased purchasing power and shared resources and invest in technology such as practice management software.

Challenge: Reluctance to switch to digital dental solutions

The adoption of new technologies in dental practices, especially for practices operating in developing countries, is challenging. Dental professionals show resistance toward the implementation of newer dental technologies. This is in part due to the lack of funds and resources to adopt and manage new technologies, coupled with a lack of knowledge about their functioning. The ability of many private clinics in developing countries to make investments is substantially lower than in developed countries.

Digital Dentistry Market Ecosystem

Prominent companies in this market include Dentsply Sirona (US), Envista Holdings Corporation (US), 3M Company (US), Ivoclar Vivadent AG (Switzerland), Planmeca OY (Finland), 3Shape (Denmark), Align Technologies (US), J Morita Corporation (Japan), 3D Systems, Inc. (US), Straumann Group (Switzerland).

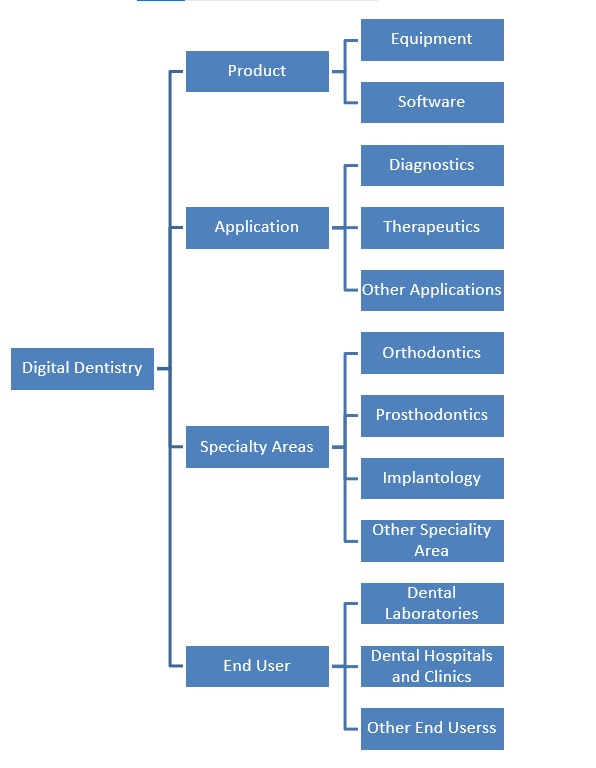

The software segment accounted for a significant CAGR in the products segment in digital dentistry industry

Based on product, the digital dentistry market is segmented into equipment and software. The software segment is expected to register the highest CAGR during the forecast period.

The software segment is further divided into dental PMS and dental clinical software. The advantages of a comprehensive cloud-based dental practice management software include reduced upfront cost, increased flexibility, and scalability, is expected to drive the market.

The diagnostic segment of the digital dentistry industry acquired the largest share followed by the therapeutics segment in the application market.

Based on application, the digital dentistry market is segmented into diagnostics, therapeutics, and other applications. . The diagnostics segment is acquired the largest share in the market followed by the therapeutic segment. The rise in geriatric population, increase in tooth caries cases, and increased annual visits in developed nations, is expected to influence the market growth. Diagnostic procedures preformed by various end users are a much higher percentage than therapeutic procedures, because many patients might not need therapeutic intervention through digital dentistry solutions, and that some patients might not opt for a dental treatment after getting a diagnostic checkup.

The orthodontics segment is expected to grow at the highest CAGR during the forecast period, in the digital dentistry industry.

Based on the specialty areas, the digital dentistry market is segmented into orthodontics, prosthodontics, implantology, and others. The orthodontics segment is expected to grow at the highest CAGR during the forecast period. Optimization of workflow and building a comprehensive dental offering with increased patient comfort and cost-effective practices. Improved time efficiency, streamlined clinical procedures, and increased adoption of chairside CAD/CAM software have influenced market growth.

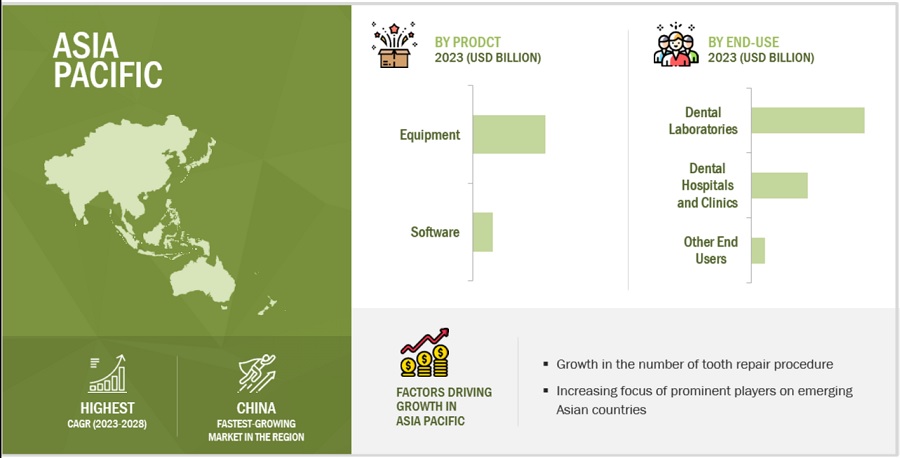

APAC is estimated to be the fastest-growing regional market for in digital dentistry industry.

The global digital dentistry market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2022, APAC is estimated to be the fastest-growing regional market for digital dentistry. The high growth in this market can majorly be attributed to the increased government initiatives to boost the adoption of digital solutions, increased outsourcing of digital equipment manufacturing, a growing number of tooth repair procedures, and the growing popularity of cosmetic procedures is expected to boost the market in this region.

To know about the assumptions considered for the study, download the pdf brochure

The digital dentistry market is dominated by a few globally established players such as Dentsply Sirona (US), Envista Holdings Corporation (US), 3M Company (US), Ivoclar Vivadent AG (Switzerland), Planmeca OY (Finland), 3Shape (Denmark), Align Technologies (US), J Morita Corporation (Japan), 3D Systems, Inc. (US), and Straumann Group (Switzerland).

Major players adopt growth strategies to expand their geographical presence and garner higher shares in the global market, such as product launches and approvals, expansions, collaborations, and acquisitions.

Scope of the Digital Dentistry Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$7.2 billion |

|

Projected Revenue by 2028 |

$12.2 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 10.9% |

|

Market Driver |

Increasing demand for same-day dentistry |

|

Market Opportunity |

Consolidation of dental practices and rising DSO activity |

The study categorizes the Digital Dentistry Market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Equipment

- Software

By Application

- Diagnostics

- Therapeutics

- Other Applications

By Specialty Areas

- Orthodontics

- Prosthodontics

- Implantology

- Other speciality areas

By End users

- Dental Laboratories

- Dental Hospitals and Clinics

- Other end users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of Digital Dentistry Industry

- In March 2023, 3Shape launched TRIOS 5 intraoral scanner, 3Shape Unite platform, TRIOS Share, patient engagement, and studio apps, to help lab professionals to ease workflow with digital integration.

- In January 2023, 3Shape (Denmark) acquired LabStar (US) to grow and manage businesses. The acquisition helps provide innovation and customer service to dental labs with many more opportunities, especially in digital dentistry.

- In February 2022, BEGO GMBH Co., KG partnered with Whip Mix so that end users of Whip Mix VeriBuild and VeriEKO 3D printers can use Bego’s 3D printing material such as VarseoSmile Crownplus and VarseoSmile Temp.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global digital dentistry market?

The global digital dentistry market boasts a total revenue value of $12.2 billion by 2028.

What is the estimated growth rate (CAGR) of the global digital dentistry market?

The global digital dentistry market has an estimated compound annual growth rate (CAGR) of 10.9% and a revenue size in the region of $7.2 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- High return on investment from digital dentistry solutions- Increasing demand for same-day dentistry- Increasing outsourcing of manufacturing to dental labs- Rising demand for advanced cosmetic dental procedures- Increasing patient pool for dental treatmentsRESTRAINTS- Data privacy and security issues- Lack of reimbursement for dental proceduresOPPORTUNITIES- Potential for growth in emerging countries- Consolidation of dental practices and rising DSO activity- Increasing popularity of CAD/CAM and 3D printing technologyCHALLENGES- Reluctance to switch to digital dental solutions- Shortage of professionals trained in usage of digital dental equipment and software

-

5.3 INDUSTRY TRENDSREDUCTION IN NUMBER OF SOLO DENTAL PRACTICES IN USINCREASING ADOPTION OF 3D PRINTINGHIGH INVESTMENT ACTIVITY IN DENTAL PRACTICES IN US AND UK

-

5.4 TECHNOLOGY ANALYSISCLOUD-BASED DENTAL SOFTWAREARTIFICIAL INTELLIGENCEAUGMENTED REALITYADVANCED 3D PRINTING MATERIALSDIGITAL SMILE DESIGN (DSD)

- 5.5 SUPPLY/VALUE CHAIN ANALYSIS

-

5.6 ECOSYSTEM ANALYSIS

-

5.7 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR DIGITAL DENTISTRYINSIGHTS ON JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.8 ADJACENT MARKETS

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 REGULATORY ANALYSISREGULATIONS IN NORTH AMERICAREGULATIONS IN EUROPEREGULATIONS IN ASIA PACIFICREGULATIONS IN MIDDLE EAST & AFRICAREGULATIONS IN LATIN AMERICAREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.12 PRICING ANALYSISAVERAGE SELLING PRICE FOR DIGITAL EQUIPMENT AND SOFTWARE IN DENTISTRYAVERAGE SELLING PRICE FOR DIGITAL DENTAL SOLUTIONS, BY TYPE- Dental 3D printers- Intraoral scanners- Digital X-rays- Dental PMSAVERAGE SELLING PRICE TRENDS

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 EQUIPMENTSCANNING/IMAGING EQUIPMENT- Dental scanners- Intraoral cameras- Digital radiology equipmentMANUFACTURING EQUIPMENT- Dental 3D printers- Dental milling equipment

-

6.3 SOFTWAREDENTAL PRACTICE MANAGEMENT SOFTWARE- Low upfront cost, flexibility, and scalability to drive marketDENTAL CLINICAL SOFTWARE- Increasing demand for CAD/CAM software and dental treatment planning software to drive growth

- 7.1 INTRODUCTION

-

7.2 ORTHODONTICSINCREASING EMPHASIS ON AESTHETICS AND APPEARANCE TO DRIVE MARKET

-

7.3 PROSTHODONTICSGROWING EDENTULOUS POPULATION TO SUPPORT MARKET GROWTH

-

7.4 IMPLANTOLOGYACCURACY AND EFFICIENCY OF DIGITAL IMPLANTOLOGY WORKFLOW TO AID GROWTH

- 7.5 OTHER SPECIALTIES

- 8.1 INTRODUCTION

-

8.2 DIAGNOSTICLARGEST AND FASTEST-GROWING SEGMENT OF MARKET

-

8.3 THERAPEUTICRISING DEMAND FOR CHAIRSIDE MILLING AND 3D PRINTING EQUIPMENT TO DRIVE GROWTH

- 8.4 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 DENTAL LABORATORIESRAPID ADOPTION OF ADVANCED TECHNOLOGIES TO PROPEL GROWTH

-

9.3 DENTAL HOSPITALS & CLINICSGROWING NUMBER OF DENTAL HOSPITALS & CLINICS TO DRIVE MARKET

- 9.4 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICAN DIGITAL DENTISTRY MARKET: RECESSION IMPACTUS- Presence of prominent market players to boost growthCANADA- Rising healthcare expenditure and favorable public & private funding to support market growth

-

10.3 EUROPEEUROPEAN DIGITAL DENTISTRY MARKET: RECESSION IMPACTGERMANY- Favorable regulatory scenario to support market growthFRANCE- Rising awareness of dental diseases and increased insurance coverage to drive marketUK- Favorable coverage under NHS to support market growthITALY- Increasing dental expenditure and low cost of dental treatment to drive marketSPAIN- Presence of well-established dental healthcare infrastructure to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC DIGITAL DENTISTRY MARKET: RECESSION IMPACTJAPAN- Growing geriatric population to support market growthCHINA- Rising prevalence of dental caries to drive marketINDIA- Growing awareness of oral health to propel marketAUSTRALIA- Favorable government initiatives to support market growthSOUTH KOREA- Rise in disposable income to drive marketREST OF ASIA PACIFIC

-

10.5 LATIN AMERICALATIN AMERICAN DIGITAL DENTISTRY MARKET: RECESSION IMPACTMEXICO- Growth in dental tourism to drive marketBRAZIL- Rising investments in R&D to propel growthREST OF LATIN AMERICA

-

10.6 MIDDLE EAST & AFRICAINCREASING AWARENESS OF ORAL HYGIENE TO DRIVE MARKETMIDDLE EAST AND AFRICAN DIGITAL DENTISTRY MARKET: RECESSION IMPACT

- 11.1 OVERVIEW

- 11.2 KEY STRATEGIES ADOPTED BY PLAYERS

- 11.3 REVENUE SHARE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPETITIVE BENCHMARKINGCOMPANY FOOTPRINT ANALYSISPRODUCT FOOTPRINT OF COMPANIESREGIONAL FOOTPRINT OF COMPANIES

-

11.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSDENTSPLY SIRONA, INC.- Business overview- Products offered- Recent developments- MnM viewENVISTA HOLDINGS CORPORATION- Business overview- Products offered- Recent developments- MnM view3M- Business overview- Products offered- MnM viewIVOCLAR VIVADENT- Business overview- Products offered- Recent developments- MnM viewPLANMECA OY- Business overview- Products offered- Recent developments- MnM view3SHAPE A/S- Business overview- Products offered- Recent developmentsALIGN TECHNOLOGY, INC.- Business overview- Products offered- Recent developmentsJ. MORITA CORP.- Business overview- Products offered- Recent developments3D SYSTEMS, INC.- Business overview- Products offered- Recent developmentsSTRAUMANN GROUP- Business overview- Products offered- Recent developmentsSTRATASYS- Business overview- Products offered- Recent developmentsKULZER GMBH (SUBSIDIARY OF MITSUI CHEMICALS GROUP)- Business overview- Products offeredVATECH CO., LTD.- Business overview- Products offered- Recent developmentsCARESTREAM DENTAL LLC.- Business overview- Products offered- Recent developmentsBEGO GMBH & CO. KG- Business overview- Products offered- Recent developmentsDESKTOP METAL, INC.- Business overview- Products offered- Recent developmentsROLAND DG CORPORATION- Business overview- Products offered- Recent developmentsDWS SRL- Business overview- Products offered

-

12.2 OTHER COMPANIESMIDMARK CORPORATIONMEDIT CORP.SINOL DENTAL LIMITEDHUGE DENTALPLANET DDSGC CORPORATIONCARIMA CO., LTD. (BRAND OF ANIWAA PTE. LTD.)

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 STANDARD CURRENCY CONVERSION RATES (UNIT OF USD)

- TABLE 2 RESEARCH ASSUMPTIONS

- TABLE 3 RISK ASSESSMENT

- TABLE 4 US: PEOPLE WITH UNTREATED DENTAL CARIES, BY AGE GROUP, 2019 (PERCENTAGE OF POPULATION)

- TABLE 5 PROJECTED INCREASE IN NUMBER OF PEOPLE AGED OVER 65 YEARS, BY REGION, 2019–2050 (MILLION)

- TABLE 6 AVERAGE COST OF DENTAL SURGERIES

- TABLE 7 AVERAGE PROCEDURAL COST IN TOP TEN DENTAL TOURISM DESTINATIONS (USD)

- TABLE 8 EXAMPLES OF RECENT DEALS BACKED BY PRIVATE EQUITY IN US, 2020–2022

- TABLE 9 DIGITAL DENTISTRY MARKET: LIST OF MAJOR PATENTS

- TABLE 10 DIGITAL DENTISTRY MARKET: PORTER’S FIVE FORCES

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 17 DENTAL 3D PRINTERS: MAJOR BRANDS WITH APPROXIMATE PRICING IN US

- TABLE 18 AVERAGE COST OF INTRAORAL SCANNERS

- TABLE 19 AVERAGE SELLING PRICE OF TOP TWO TYPES OF DENTAL DIGITAL X-RAY SYSTEMS

- TABLE 20 PRICING FOR SOFTDENT DENTAL PMS

- TABLE 21 PRICING FOR TAB32 DENTAL PMS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR DIGITAL DENTISTRY PRODUCTS (%)

- TABLE 23 KEY BUYING CRITERIA FOR DIGITAL DENTISTRY PRODUCTS/SOLUTIONS

- TABLE 24 DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 25 DIGITAL DENTISTRY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 27 DIGITAL DENTISTRY EQUIPMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 29 DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 31 DENTAL SCANNERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 INTRAORAL SCANNERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 LAB SCANNERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 INTRAORAL CAMERAS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 36 DIGITAL RADIOLOGY EQUIPMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 EXTRAORAL RADIOLOGY EQUIPMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 INTRAORAL RADIOLOGY EQUIPMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 40 DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 DENTAL 3D PRINTERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 DENTAL MILLING EQUIPMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 44 DIGITAL DENTISTRY SOFTWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 DENTAL PRACTICE MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 DENTAL CLINICAL SOFTWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 48 DIGITAL DENTISTRY MARKET FOR ORTHODONTICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 49 DIGITAL DENTISTRY MARKET FOR PROSTHODONTICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 DIGITAL DENTISTRY MARKET FOR IMPLANTOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 DIGITAL DENTISTRY MARKET FOR OTHER SPECIALTIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 53 DIGITAL DENTISTRY MARKET FOR DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 DIGITAL DENTISTRY MARKET FOR THERAPEUTIC APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 DIGITAL DENTISTRY MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 56 DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 57 DIGITAL DENTISTRY MARKET FOR DENTAL LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 TOP DESTINATIONS FOR COST-EFFECTIVE DENTAL TREATMENT

- TABLE 59 DIGITAL DENTISTRY MARKET FOR DENTAL HOSPITALS & CLINICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 DIGITAL DENTISTRY MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 61 DIGITAL DENTISTRY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 62 DIGITAL DENTISTRY MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: DIGITAL DENTISTRY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 74 US: MACROECONOMIC INDICATORS

- TABLE 75 US: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 76 US: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 77 US: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 78 US: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 79 US: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 80 US: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 81 US: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 82 US: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 83 US: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 84 US: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 85 CANADA: MACROECONOMIC INDICATORS

- TABLE 86 CANADA: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 87 CANADA: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 88 CANADA: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 89 CANADA: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 90 CANADA: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 91 CANADA: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 92 CANADA: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 CANADA: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 94 CANADA: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 95 CANADA: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 96 EUROPE: DIGITAL DENTISTRY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 97 EUROPE: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 98 EUROPE: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 99 EUROPE: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 100 EUROPE: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 101 EUROPE: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 102 EUROPE: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 103 EUROPE: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 104 EUROPE: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 105 EUROPE: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 106 EUROPE: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 107 GERMANY: MACROECONOMIC INDICATORS

- TABLE 108 GERMANY: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 109 GERMANY: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 110 GERMANY: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 111 GERMANY: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 112 GERMANY: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 113 GERMANY: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 114 GERMANY: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 115 GERMANY: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 116 GERMANY: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 117 GERMANY: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 118 FRANCE: MACROECONOMIC INDICATORS

- TABLE 119 FRANCE: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 120 FRANCE: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 121 FRANCE: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 122 FRANCE: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 123 FRANCE: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 124 FRANCE: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 FRANCE: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 126 FRANCE: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 127 FRANCE: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 128 FRANCE: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 129 UK: MACROECONOMIC INDICATORS

- TABLE 130 UK: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 131 UK: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 132 UK: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 133 UK: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 134 UK: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 135 UK: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 136 UK: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 137 UK: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 138 UK: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 139 UK: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 140 ITALY: MACROECONOMIC INDICATORS

- TABLE 141 ITALY: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 142 ITALY: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 143 ITALY: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 144 ITALY: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 145 ITALY: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 146 ITALY: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 147 ITALY: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 148 ITALY: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 149 ITALY: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 150 ITALY: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 151 SPAIN: MACROECONOMIC INDICATORS

- TABLE 152 SPAIN: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 153 SPAIN: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 154 SPAIN: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 155 SPAIN: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 156 SPAIN: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 157 SPAIN: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 158 SPAIN: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 159 SPAIN: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 160 SPAIN: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 161 SPAIN: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 162 REST OF EUROPE: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 163 REST OF EUROPE: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 164 REST OF EUROPE: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 165 REST OF EUROPE: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 166 REST OF EUROPE: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 167 REST OF EUROPE: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 168 REST OF EUROPE: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 169 REST OF EUROPE: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 170 REST OF EUROPE: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 171 REST OF EUROPE: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: DIGITAL DENTISTRY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 173 ASIA PACIFIC: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 174 ASIA PACIFIC: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 175 ASIA PACIFIC: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 177 ASIA PACIFIC: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 178 ASIA PACIFIC: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 179 ASIA PACIFIC: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 181 ASIA PACIFIC: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 182 ASIA PACIFIC: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 183 JAPAN: MACROECONOMIC INDICATORS

- TABLE 184 JAPAN: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 185 JAPAN: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 186 JAPAN: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 187 JAPAN: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 188 JAPAN: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 189 JAPAN: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 190 JAPAN: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 191 JAPAN: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 192 JAPAN: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 193 JAPAN: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 194 CHINA: MACROECONOMIC INDICATORS

- TABLE 195 CHINA: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 196 CHINA: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 197 CHINA: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 198 CHINA: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 199 CHINA: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 200 CHINA: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 201 CHINA: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 202 CHINA: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 203 CHINA: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 204 CHINA: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 205 INDIA: MACROECONOMIC INDICATORS

- TABLE 206 INDIA: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 207 INDIA: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 208 INDIA: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 209 INDIA: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 210 INDIA: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 211 INDIA: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 212 INDIA: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 213 INDIA: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 214 INDIA: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 215 INDIA: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 216 AUSTRALIA: MACROECONOMIC INDICATORS

- TABLE 217 AUSTRALIA: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 218 AUSTRALIA: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 219 AUSTRALIA: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 220 AUSTRALIA: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 221 AUSTRALIA: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 222 AUSTRALIA: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 223 AUSTRALIA: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 224 AUSTRALIA: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 225 AUSTRALIA: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 226 AUSTRALIA: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 227 SOUTH KOREA: MACROECONOMIC INDICATORS

- TABLE 228 SOUTH KOREA: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 229 SOUTH KOREA: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 230 SOUTH KOREA: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 231 SOUTH KOREA: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 232 SOUTH KOREA: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 233 SOUTH KOREA: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 234 SOUTH KOREA: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 235 SOUTH KOREA: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 236 SOUTH KOREA: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 237 SOUTH KOREA: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 238 REST OF ASIA PACIFIC: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 239 REST OF ASIA PACIFIC: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 240 REST OF ASIA PACIFIC: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 241 REST OF ASIA PACIFIC: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 242 REST OF ASIA PACIFIC: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 243 REST OF ASIA PACIFIC: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 244 REST OF ASIA PACIFIC: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 245 REST OF ASIA PACIFIC: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 246 REST OF ASIA PACIFIC: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 247 REST OF ASIA PACIFIC: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 248 LATIN AMERICA: DIGITAL DENTISTRY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 249 LATIN AMERICA: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 250 LATIN AMERICA: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 251 LATIN AMERICA: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 252 LATIN AMERICA: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 253 LATIN AMERICA: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 254 LATIN AMERICA: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 255 LATIN AMERICA: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 256 LATIN AMERICA: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 257 LATIN AMERICA: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 258 LATIN AMERICA: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 259 MEXICO: MACROECONOMIC INDICATORS

- TABLE 260 MEXICO: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 261 MEXICO: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 262 MEXICO: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 263 MEXICO: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 264 MEXICO: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 265 MEXICO: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 266 MEXICO: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 267 MEXICO: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 268 MEXICO: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 269 MEXICO: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 270 BRAZIL: MACROECONOMIC INDICATORS

- TABLE 271 BRAZIL: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 272 BRAZIL: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 273 BRAZIL: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 274 BRAZIL: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 275 BRAZIL: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 276 BRAZIL: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 277 BRAZIL: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 278 BRAZIL: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 279 BRAZIL: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 280 BRAZIL: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 281 REST OF LATIN AMERICA: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 282 REST OF LATIN AMERICA: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 283 REST OF LATIN AMERICA: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 284 REST OF LATIN AMERICA: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 285 REST OF LATIN AMERICA: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 286 REST OF LATIN AMERICA: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 287 REST OF LATIN AMERICA: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 288 REST OF LATIN AMERICA: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 289 REST OF LATIN AMERICA: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 290 REST OF LATIN AMERICA: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 291 MIDDLE EAST AND AFRICA: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 292 MIDDLE EAST AND AFRICA: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 293 MIDDLE EAST AND AFRICA: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 294 MIDDLE EAST AND AFRICA: DENTAL SCANNERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 295 MIDDLE EAST AND AFRICA: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 296 MIDDLE EAST AND AFRICA: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 297 MIDDLE EAST AND AFRICA: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 298 MIDDLE EAST AND AFRICA: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021–2028 (USD MILLION)

- TABLE 299 MIDDLE EAST AND AFRICA: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 300 MIDDLE EAST AND AFRICA: DIGITAL DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 301 PRODUCT LAUNCHES (JANUARY 2020–JULY 2023)

- TABLE 302 DEALS (JANUARY 2020–JULY 2023)

- TABLE 303 OTHER DEVELOPMENTS (JANUARY 2020–JULY 2023)

- TABLE 304 DENTSPLY SIRONA, INC.: BUSINESS OVERVIEW

- TABLE 305 ENVISTA HOLDINGS CORPORATION: BUSINESS OVERVIEW

- TABLE 306 3M COMPANY: BUSINESS OVERVIEW

- TABLE 307 IVOCLAR VIVADENT: BUSINESS OVERVIEW

- TABLE 308 PLANMECA OY: BUSINESS OVERVIEW

- TABLE 309 3SHAPE A/S: BUSINESS OVERVIEW

- TABLE 310 ALIGN TECHNOLOGY, INC.: BUSINESS OVERVIEW

- TABLE 311 J. MORITA CORP.: BUSINESS OVERVIEW

- TABLE 312 3D SYSTEMS, INC.: BUSINESS OVERVIEW

- TABLE 313 STRAUMANN GROUP: BUSINESS OVERVIEW

- TABLE 314 STRATASYS: BUSINESS OVERVIEW

- TABLE 315 KULZER GMBH: BUSINESS OVERVIEW

- TABLE 316 VATECH CO., LTD.: BUSINESS OVERVIEW

- TABLE 317 CARESTREAM DENTAL LLC.: BUSINESS OVERVIEW

- TABLE 318 BEGO GMBH & CO. KG: BUSINESS OVERVIEW

- TABLE 319 DESKTOP METAL, INC.: BUSINESS OVERVIEW

- TABLE 320 ROLAND DG CORPORATION: BUSINESS OVERVIEW

- TABLE 321 DWS SRL: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 PRIMARY SOURCES

- FIGURE 3 PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 6 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 7 REVENUE SHARE ANALYSIS ILLUSTRATION: DENTSPLY SIRONA INC.

- FIGURE 8 SUPPLY-SIDE ANALYSIS: DENTAL DIGITAL X-RAY MARKET (2022)

- FIGURE 9 SUPPLY-SIDE ANALYSIS: INTRAORAL SCANNERS MARKET (2022)

- FIGURE 10 SUPPLY-SIDE ANALYSIS: LAB SCANNERS MARKET (2022)

- FIGURE 11 SUPPLY-SIDE ANALYSIS: DENTAL 3D PRINTING MARKET (2022)

- FIGURE 12 SUPPLY-SIDE ANALYSIS: DENTAL MILLING EQUIPMENT MARKET (2022)

- FIGURE 13 SUPPLY-SIDE ANALYSIS: DENTAL PMS MARKET (2022)

- FIGURE 14 DEMAND-SIDE ESTIMATION FOR INTRAORAL SCANNERS MARKET

- FIGURE 15 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2023–2028)

- FIGURE 16 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 17 TOP-DOWN APPROACH

- FIGURE 18 MARKET DATA TRIANGULATION METHODOLOGY

- FIGURE 19 DIGITAL DENTISTRY MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 20 DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2023 VS. 2028 (USD MILLION)

- FIGURE 21 DIGITAL DENTISTRY MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 22 DIGITAL DENTISTRY MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 23 GEOGRAPHICAL SNAPSHOT OF DIGITAL DENTISTRY MARKET

- FIGURE 24 RISING CASES OF DENTAL CARIES AND OTHER DENTAL DISORDERS TO DRIVE ADOPTION OF DIGITAL DENTISTRY

- FIGURE 25 DIGITAL DENTISTRY EQUIPMENT HELD LARGEST MARKET SHARE IN 2022

- FIGURE 26 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 27 NORTH AMERICA WILL CONTINUE TO DOMINATE DIGITAL DENTISTRY MARKET IN 2028

- FIGURE 28 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 29 DIGITAL DENTISTRY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 30 EXAMPLE OF DENTAL TREATMENT WORKFLOW WITH DIGITAL SOLUTIONS

- FIGURE 31 PREVALENCE OF DENTAL CARIES IN 6–19-YEAR AGE GROUP, BY COUNTRY, 2019 (PERCENTAGE OF POPULATION)

- FIGURE 32 DIGITAL DENTISTRY MARKET: STAKEHOLDERS IN VALUE/SUPPLY CHAIN

- FIGURE 33 DIGITAL DENTISTRY MARKET: ECOSYSTEM ANALYSIS

- FIGURE 34 PATENT PUBLICATION TRENDS (2013–2023)

- FIGURE 35 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR DIGITAL DENTISTRY PATENTS, 2013–2023

- FIGURE 36 TOP 10 APPLICANT COUNTRIES/REGIONS FOR DIGITAL DENTISTRY PATENTS, 2013–2023

- FIGURE 37 DIGITAL DENTISTRY MARKET: ADJACENT MARKETS

- FIGURE 38 AVERAGE SELLING PRICE OF DIGITAL DENTAL SOLUTIONS, BY TYPE, 2022

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR DIGITAL DENTISTRY PRODUCTS

- FIGURE 40 KEY BUYING CRITERIA FOR DIGITAL DENTISTRY PRODUCTS/SOLUTIONS

- FIGURE 41 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 42 NORTH AMERICA: DIGITAL DENTISTRY MARKET SNAPSHOT

- FIGURE 43 US: RISE IN DENTAL EXPENDITURE, 2010–2030

- FIGURE 44 ASIA PACIFIC: DIGITAL DENTISTRY MARKET SNAPSHOT

- FIGURE 45 DENTAL MILLING EQUIPMENT REVENUE SHARE ANALYSIS, BY KEY PLAYER, 2018–2022 (USD MILLION)

- FIGURE 46 DENTAL LAB SCANNERS REVENUE SHARE ANALYSIS, BY KEY PLAYER, 2018–2022 (USD MILLION)

- FIGURE 47 DENTAL 3D PRINTERS REVENUE SHARE ANALYSIS, BY KEY PLAYER, 2018–2022 (USD MILLION)

- FIGURE 48 DENTAL INTRAORAL SCANNERS REVENUE SHARE ANALYSIS, BY KEY PLAYER, 2018–2022 (USD MILLION)

- FIGURE 49 DENTAL PMS REVENUE SHARE ANALYSIS, BY KEY PLAYER, 2018–2022 (USD MILLION)

- FIGURE 50 DENTAL RADIOLOGY REVENUE SHARE ANALYSIS, BY KEY PLAYER, 2018–2022 (USD MILLION)

- FIGURE 51 DENTAL MILLING EQUIPMENT MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- FIGURE 52 DENTAL LAB SCANNERS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- FIGURE 53 DENTAL 3D PRINTERS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- FIGURE 54 DENTAL INTRAORAL SCANNERS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- FIGURE 55 DENTAL PMS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- FIGURE 56 DENTAL RADIOLOGY MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- FIGURE 57 DIGITAL DENTISTRY MARKET: COMPANY EVALUATION MATRIX (2022)

- FIGURE 58 DENTSPLY SIRONA, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 59 ENVISTA HOLDINGS CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 60 3M: COMPANY SNAPSHOT (2022)

- FIGURE 61 ALIGN TECHNOLOGY, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 62 3D SYSTEMS, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 63 STRAUMANN GROUP: COMPANY SNAPSHOT (2022)

- FIGURE 64 STRATASYS: COMPANY SNAPSHOT (2022)

- FIGURE 65 MITSUI CHEMICALS GROUP: COMPANY SNAPSHOT (2021)

- FIGURE 66 VATECH CO., LTD.: COMPANY SNAPSHOT (2022)

- FIGURE 67 DESKTOP METAL, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 68 ROLAND DG CORPORATION: COMPANY SNAPSHOT (2022)

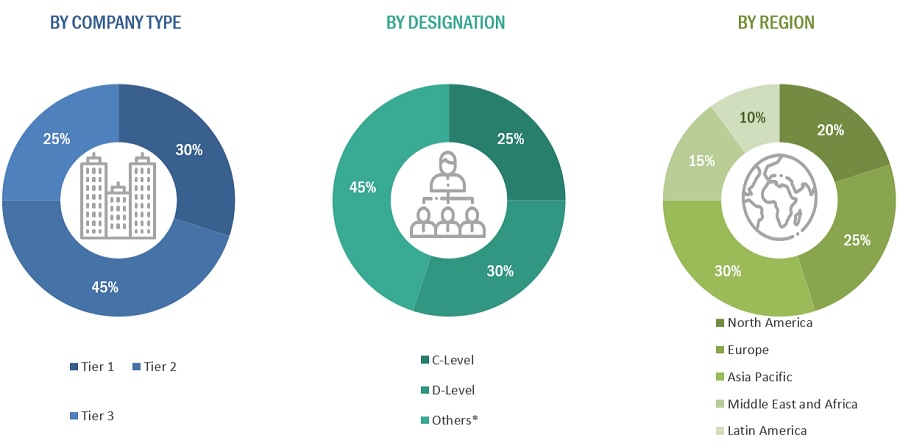

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the digital dentistry market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Extensive primary research was conducted after obtaining information regarding the digital dentistry Market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives, system integrators; component providers; distributors; and key opinion leaders/consultants.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. The primary sources from the supply side and demand side are detailed below.

A breakdown of the primary respondents is provided below:

Breakdown Of Primary Interviews: Supply-Side Participants, By Company Type, Designation, And Region

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

Breakdown Of Primary Interviews: By Company Type, Designation, And Region

Note: Others include sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the digital dentistry market was arrived at after data triangulation from two different approaches, as mentioned below. After each approach, the weighted average of all approaches was taken based on the level of assumptions used in each approach, to bottom up the two approaches to obtain the digital dentistry market.

Global Digital Dentistry Market : Bottom Up Approach (Demand Side Approach)

To know about the assumptions considered for the study, Request for Free Sample Report

Global Digital Dentistry Market Size: Top Down Approach

Data Triangulation

After arriving at the market size, the total market was divided into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were employed, wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in this report’s market engineering process.

Market Definition

Digital dentistry includes dental technology that involves the use of computer-based components such as hardware devices and software solutions. These technologies complement each other for treatment planning, design, and delivery of the final product or treatment.

Key Stakeholders

- Healthcare IT vendors

- Dental software vendors

- Dental Equipment Manufacturers

- Contract Manufacturers of Dental Equipment

- Distributors of Dental Equipment

- Research and Consulting Firms

- Raw Material Suppliers

- Dental Hospitals and Clinics

- Dental Service Organizations

- Dental Laboratories and Associations

- Dental Practitioners

- Dental Laboratory Technicians

- Healthcare Institutions

- Diagnostic Laboratories

- Academic Institutions

- Research Institutions

- Government Associations

- Market Research and Consulting Firms

- Venture Capitalists and Investors

Objectives of the Study

- To define, describe, segment, and forecast the digital dentistry market by product, specialty area, application, end user, and region.

- To strategically analyze the industry trends, technology trends, pricing analysis, regulatory scenario, supply/value chain, ecosystem/market map, Porter’s Five Forces, trade & patent analysis, key stakeholders & buying criteria, and conferences & events

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the market size based on region in North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa

- To strategically profile key players in the digital dentistry market and comprehensively analyze their core competencies2

- To track and analyze competitive developments such as acquisitions, product launches, approvals, expansions, and partnerships

- To analyze the impact of the recession on the digital dentistry market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the RoE Digital Dentistry Market into Austria, Finland, and others

- Further breakdown of the RoLATAM Digital Dentistry Market into Argentina, Colombia, Chile, and others

Competitive Landscape Assessment

- Market share analysis for the North America and Europe region, which provides market shares of the top 3–5 key players in the Digital Dentistry Market

Growth opportunities and latent adjacency in Digital Dentistry Market