Dental Equipment Market Size, Growth, Share & Trends Analysis

Dental Equipment Market by Product [Therapeutic (Dental Chairs, Dental Units, CAD/CAM, Dental Lasers, Nd:YAG Lasers, Carbon Dioxide Lasers), Diagnostic (Dental Imaging, CBCT)], End User (Dental Hospitals & Dental Clinics) - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

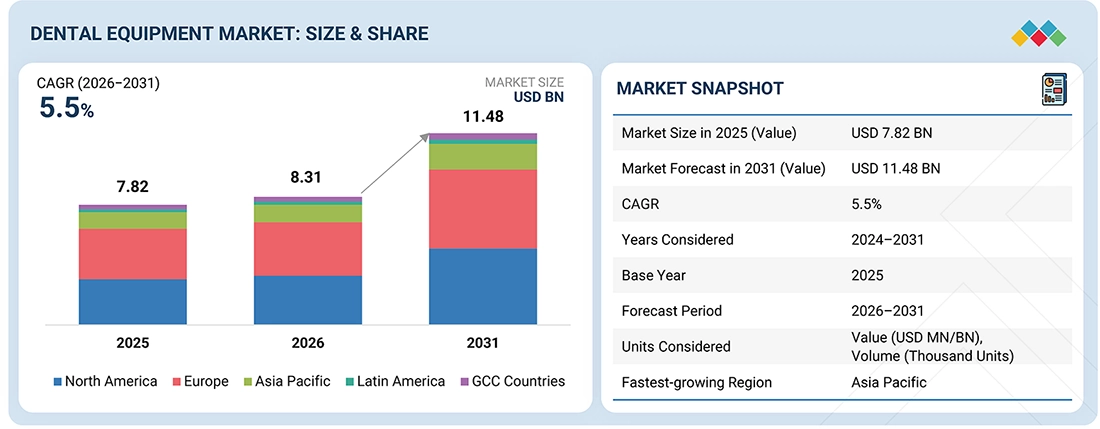

The global dental equipment market, valued at USD 7.82 billion in 2025, stood at USD 8.31 billion in 2026 and is projected to advance at a resilient CAGR of 5.5% from 2026 to 2031, culminating in a forecasted valuation of USD 11.48 billion by the end of the period. The market for dental equipment is experiencing growth due to a rise in oral health issues such as cavities, periodontal diseases, tooth loss, and malocclusions. These conditions are often linked to poor oral hygiene, unhealthy dietary habits, smoking, and a growing geriatric population in advanced countries. There is also an increasing awareness of the importance of oral health, coupled with a focus on preventive and aesthetic dentistry, which is encouraging more people to seek regular check-ups and dental treatments. Moreover, advancements in modern technology within the dental industry, including digital imaging, CAD/CAM technology, laser treatments, and 3D printing, are enhancing the accuracy and effectiveness of dental care. These innovations are making dental procedures more patient-friendly and appealing to practitioners. In addition, the growth of dental practices and hospitals, along with improved affordability and accessibility of oral health services, is contributing to the overall expansion of the dental equipment market. This trend is further supported by the rise of dental tourism and increased access to oral health services in developing countries.

KEY TAKEAWAYS

-

BY REGIONBased on region, Europe accounted for the largest share of 36.9% of the dental equipment market in 2025.

-

BY TYPEBased on product, the therapeutic dental equipment segment accounted for a larger share of 60.9% of the dental equipment market in 2025.

-

BY END USERBased on end user, the hospitals & clinics segment held the largest share of 69.9% of the dental equipment market during the forecast period

-

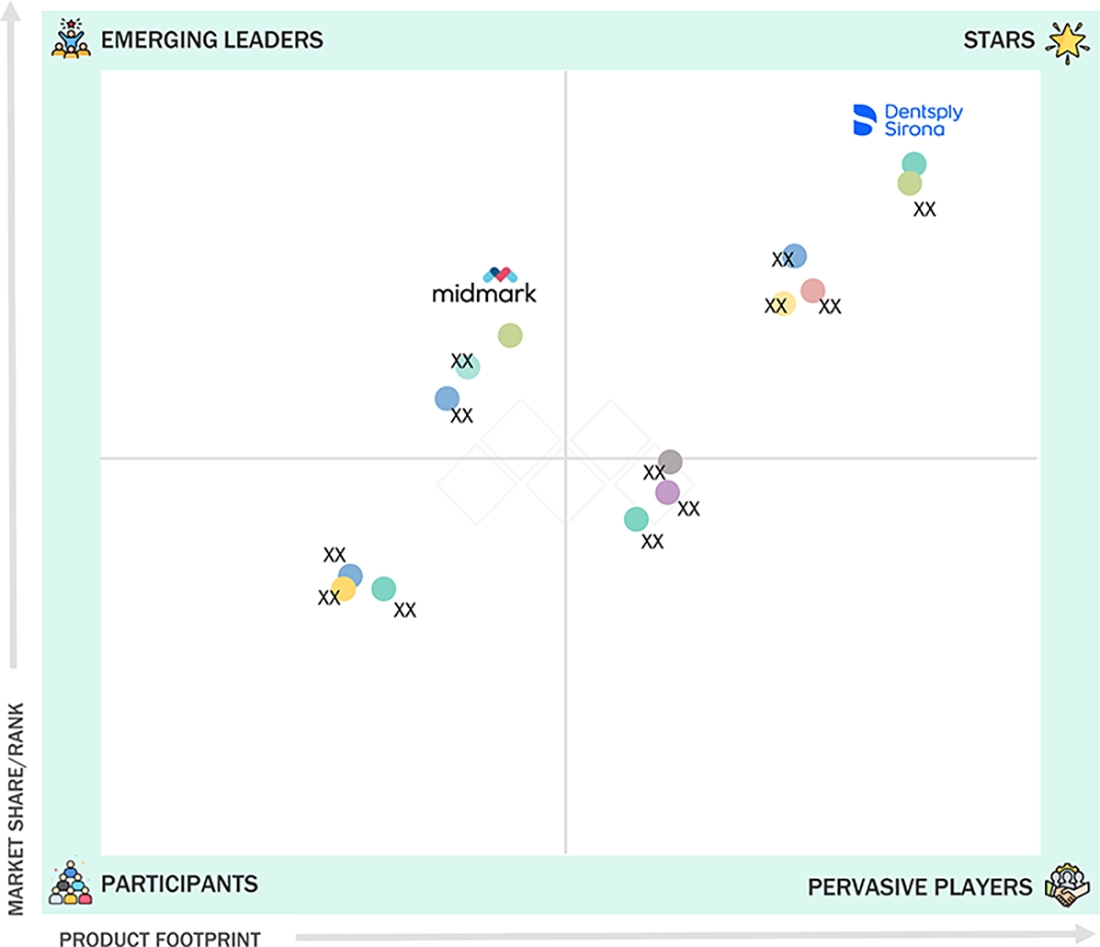

COMPETITIVE LANDSCAPEDentsply Sirona and Planmeca Oy were recognized as star players due to their established and strong product portfolios.

-

COMPETITIVE LANDSCAPECompanies such as Overjet have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The dental equipment market is expanding due to several factors, including the increasing demand for dental care, technological advancements, and better access to healthcare services. The rising prevalence of dental issues, such as cavities, periodontal diseases, tooth loss, and misalignments, is largely attributed to poor oral hygiene, unhealthy eating habits, smoking, and an aging population. As a result, there is a growing need for advanced dental care. Moreover, increased awareness about dental health and a heightened focus on preventive and cosmetic dentistry are motivating more people to visit their dentists regularly and utilize advanced dental equipment. Technological innovations, such as digital imaging, CAD/CAM technology, intraoral scanners, laser dentistry, and 3D printing, are enhancing the accuracy of diagnoses and improving the efficiency of dental procedures.

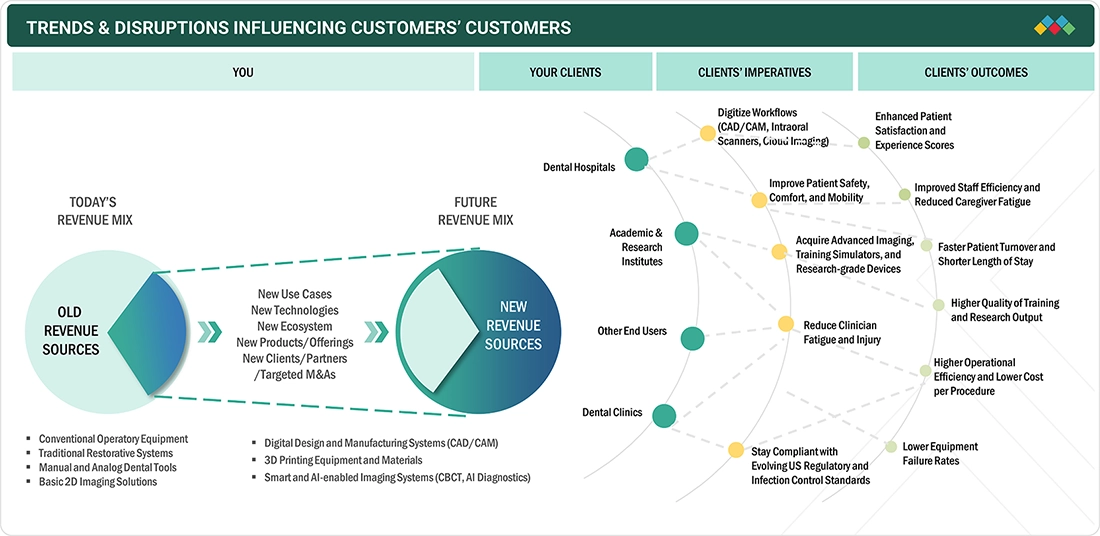

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The market is undergoing significant changes due to evolving needs and advancements in technology. Currently, the market is dominated by conventional operatory equipment, traditional restorative solutions, standard instruments, and 2D imaging solutions, which contribute about 20% of revenue. However, this revenue composition is expected to change dramatically as it shifts towards advanced solutions. In the future, technologies like CAD/CAM systems, 3D printers and materials, and AI-equipped imaging solutions such as CBCT are projected to account for approximately 80% of revenue. This shift is driven by the increasing demand from dental hospitals, clinics, universities, and institutes that aim to enhance patient safety, satisfaction, and operational efficiency. Key factors in adopting these technological advancements will include digital transformation, the procurement of advanced imaging and simulation solutions, addressing clinician fatigue, and developing solutions that meet regulatory standards. As a result, customers will experience improved patient satisfaction, enhanced staff productivity, accelerated procedures, higher-quality research, and reduced machine and instrument downtime and failure. Consequently, there is a growing focus on transitioning to value-driven, technology-enabled dentistry.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Development of technologically advanced solutions

-

Rise in oral health disorders

Level

-

High cost of dental imaging systems and lack of reimbursement for dental procedures

Level

-

Impact of DSOs on dental industry

-

Increasing number of dental laboratories investing in CAD/CAM technologies

Level

-

Dearth of trained dental practitioners

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for advanced cosmetic dental procedures

The dental equipment market is significantly influenced by the rising demand for high-end cosmetic dental treatments. This trend is fueled by increasing beauty consciousness and the importance of a good dental appearance in both personal and professional lives. Popular procedures include teeth whitening, veneers, clear aligners, dental implants, and smile design, which are gaining traction worldwide, regardless of a country's economic status. This growing demand is driving interest in the latest innovations in dental technology, such as digital imaging systems, intraoral scanners, CAD/CAM systems, laser dentistry tools, and 3D printing technologies. These advancements not only enable dentists to plan treatments with great precision but also lead to exceptional cosmetic outcomes. Additionally, social media marketing, rising disposable incomes, and the increasing popularity of minimally invasive cosmetic treatments have become significant factors promoting the adoption of advanced cosmetic dental procedures. As a result, the dental equipment market is experiencing steady and robust growth.

Restraint: High cost of dental imaging systems and lack of reimbursement for dental procedures

The high cost of dental imaging equipment and inadequate reimbursement for dental procedures significantly hinder the growth of the dental equipment market. The expense of advanced technologies, such as Cone Beam Computed Tomography (CBCT) equipment, digital radiology systems, and intraoral scanners, includes not only their initial purchase price but also ongoing maintenance and training costs. This financial burden makes it challenging for small to mid-sized dental practices to afford or even consider adopting such equipment. Additionally, the lack of reimbursement or very low reimbursements for dental services in many international markets—particularly for advanced or aesthetic procedures—complicates the ability for dentists to invest in high-cost equipment.

Opportunity: Increasing number of dental laboratories investing in CAD/CAM technologies

CAD/CAM technologies are increasingly being adopted in dental labs for creating prosthetics and restorations, presenting a significant opportunity for entry into the dental equipment market. Dental labs are shifting towards digital processes to improve precision and speed, ensuring accurate fabrication of crowns, bridges, dentures, and dental implants. These technologies, combined with milling machines, 3D printing instruments, and enhanced dental materials, enable dental laboratories to produce superior personalized restorations on a large scale while reducing the need for manpower and minimizing errors compared to traditional methods. Additionally, the growing collaboration between dental practices and dental labs, along with the rising demand for same-day dental care and the transition toward digital dental practices, is accelerating the adoption of CAD/CAM technologies. This trend is driving greater investments in the dental equipment market.

Challenge: Dearth of trained dental practitioners

The shortage of trained dental professionals is a significant barrier to the growth of the dental equipment market. Advanced dental equipment, such as digital imaging solutions, CAD/CAM technology, laser dentistry, and robotic and AI-enabled solutions, requires skilled professionals to operate effectively. Unfortunately, there is a notable lack of trained dental professionals, especially in emerging regions, which limits the use of these advanced solutions and forces many to rely on traditional practices. Furthermore, the high costs and time required to train and certify dental professionals also contribute to the restricted adoption of advanced technologies.

DENTAL EQUIPMENT MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Dentsply Sirona's Primeprint is a high-precision dental 3D printing system for in-office and laboratory use. It enables rapid production of dental restorations, including surgical guides, crowns, bridges, and splints, through an automated, fully integrated digital workflow. Primeprint can be seamlessly integrated with intraoral scanners and CAD/CAM software, enabling efficient chairside and lab-based fabrication. | Primeprint improves workflow efficiency by reducing turnaround times and minimizing reliance on external laboratories. Its high accuracy ensures consistent restoration quality, while automation reduces manual errors and labor costs. The system supports same-day dentistry, enhances patient satisfaction, and enables dental practices to expand their digital services. |

|

CBCT systems are part of Planmeca's 3D imaging solutions, used for advanced diagnostics and treatment planning in implantology, orthodontics, endodontics, and maxillofacial surgery. Such systems provide a three-dimensional visualization of dental and craniofacial structures in great detail, supporting very precise clinical decision-making. | Planmeca’s 3D imaging improves diagnostic accuracy and treatment predictability while enhancing patient safety through optimized radiation dosing. High-quality imaging enables precise planning of complex procedures, reduces procedural risks, and improves clinical outcomes, making it a critical tool for modern dental practices. |

|

The Align Technology intraoral scanner captures highly accurate digital impressions for orthodontic, restorative, and cosmetic dental procedures. These eliminate the use of conventional impression materials and integrate directly into digital treatment planning and aligner manufacturing workflows. | Intraoral scanners enhance patient comfort by eliminating messy impressions and reducing chair time. They improve impression accuracy, enable faster case submission, and support seamless digital workflows. This leads to improved treatment efficiency, better clinical outcomes, and higher patient satisfaction. |

|

Envista's dental curing lights are used to polymerize light-cured dental materials, such as composites, adhesives, and sealants, in restorative dentistry. These devices are widely used in routine restorative and cosmetic procedures in dental clinics. | Envista's curing lights provide a steady, powerful light output, ensuring the material is thoroughly cured and the restoration lasts. Their comfortable design makes the clinician's work easier, whereas fast curing times reduce procedure time, thereby enhancing practice efficiency and patient throughput. |

|

Carestream Dental's dental chairs support a variety of dental procedures, ensuring stable patient positioning while providing clinicians with ergonomic access. These chairs are utilized in general dentistry, orthodontics, and surgical applications within dental clinics and hospitals. | Carestream dental chairs are designed to ensure that patients are comfortable and safe during procedures. At the same time, these chairs enhance clinician ergonomics and workflow efficiency. Features such as advanced positioning and integrated delivery systems help operators avoid fatigue, facilitate smooth procedures, and create a clinical environment that is both productive and patient-friendly. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

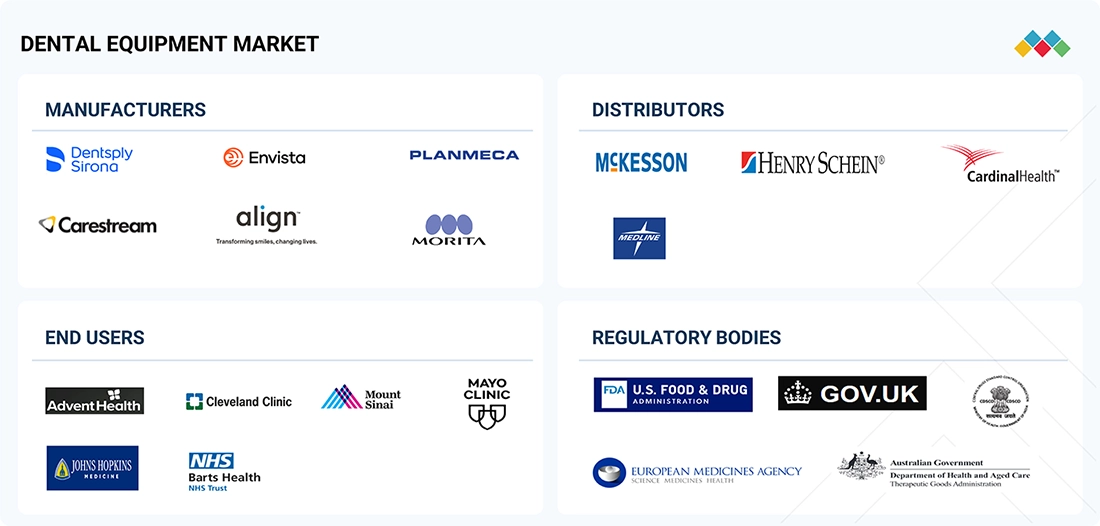

MARKET ECOSYSTEM

The dental equipment market ecosystem consists of an integrated network of manufacturers, distributors, end users, and government health regulation authorities that contribute to the market's growth. Key manufacturers such as Dentsply Sirona, Envista, Planmeca, Carestream Dental, Align, and MORITA focus on developing innovative diagnostic, therapeutic, and digital dental technologies and devices to meet global market demands. These manufacturers distribute their dental technologies and devices through effective distribution networks like Henry Schein, McKesson, Medline, and Cardinal Health. These networks ensure that products reach end users, which include dental hospitals, clinics, and major healthcare organizations such as the Mayo Clinic, Cleveland Clinic, Johns Hopkins Medicine, and the UK's National Health Service (NHS). This distribution ultimately enhances the efficiency and quality of healthcare services provided to these end-user groups. Additionally, government health regulation authorities, including the FDA, EMA, and country-specific regulatory agencies, play a crucial role in ensuring the quality and safety of devices and technologies in the global market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

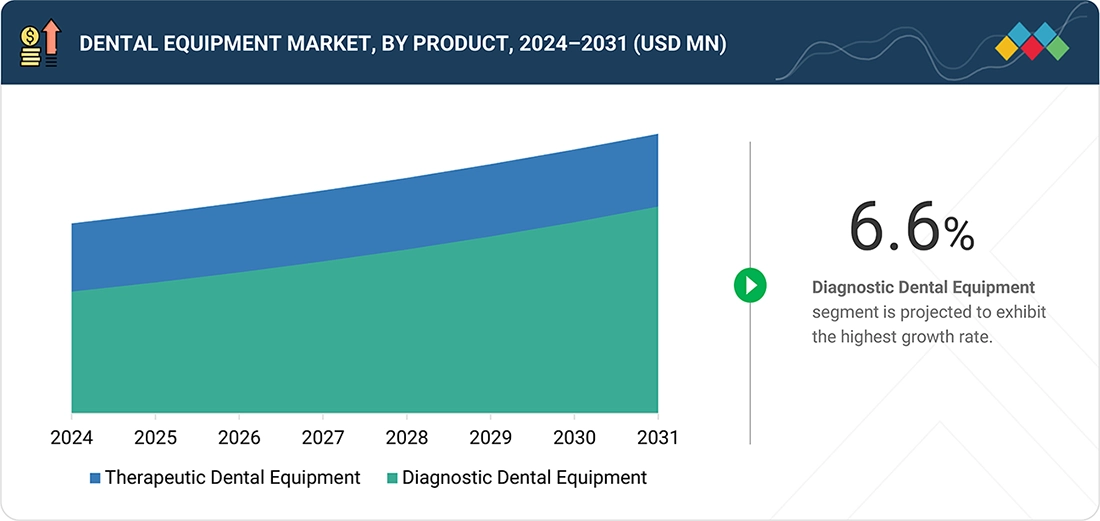

Dental Equipment Market, By Type

Therapeutic dental equipment accounts for the majority of the dental equipment market, as the demand for treatment-based procedures is increasing in both developed and emerging regions. The rise in oral health issues, including dental caries, periodontal diseases, tooth loss, and malocclusion, has led to a greater need for restorative, endodontic, orthodontic, and surgical treatments. This, in turn, has fueled the demand for dental handpieces, lasers, electrosurgical units, and implant systems. Compared to diagnostic devices, therapeutic equipment is directly used during dental procedures, making it essential that this equipment is highly durable; otherwise, its parts often need to be replaced or maintained. As a result, the repurchase of these items can be anticipated, contributing to a recurring market. Furthermore, the preference for non-invasive and high-tech treatment methods, the growth of dental clinics and hospitals, and patients' desires for aesthetically pleasing corrective dentistry all contribute to the continued dominance of therapeutic dental equipment in the market.

Dental Equipment Market, By End User

In the dental equipment market, hospitals & clinics hold the largest share of end users due to the high volume of dental procedures performed and their established infrastructure. These facilities are key referrers for a variety of treatments, including preventive, restorative, surgical, orthodontic, and cosmetic procedures, all of which require advanced dental equipment. Hospitals & clinics are open to adopting new technologies such as digital imaging, CAD/CAM technology, dental chairs, and therapeutic devices. This openness is aimed at enhancing diagnostic precision, treatment efficiency, and patient outcomes. Factors contributing to their dominant market share include the presence of trained dental staff, availability of funding, favorable reimbursement policies in developed regions, and patient preference for facilities equipped with the latest technology.

REGION

Asia Pacific to be fastest-growing region in global dental equipment market during forecast period

The Asia Pacific market is expected to experience the highest growth rate in the dental equipment sector. This growth can be attributed to several factors related to the region's demographics, economy, and healthcare industry. The area has a large population that faces an increasing prevalence of dental diseases due to dietary habits, tobacco use, and poor oral health practices in various countries. Moreover, there is a growing awareness among the population about the importance of oral health, alongside a rising middle-class population and increased affluence in the region. These trends are leading to higher spending on dental care and advanced treatments. Additionally, the expansion of dental facilities and advancements in the healthcare sector further contribute to the growth of the dental equipment market. Governments in countries that attract significant dental tourism, such as India, Thailand, and South Korea, also play a crucial role in the market's potential by offering affordable treatment options.

DENTAL EQUIPMENT MARKET: COMPANY EVALUATION MATRIX

In the dental equipment market, Dentsply Sirona (US) and Planmeca Oy (Finland) are recognized as leaders, often referred to as "Stars," due to their extensive global presence, strong brand recognition, and comprehensive portfolios of dental equipment. Meanwhile, 3Shape A/S (Denmark), identified as an "Emerging Leader," is quickly gaining traction with its versatile products that include medical gas and equipment for various therapeutic and diagnostic applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 7.82 Billion |

| Market Forecast in 2031 (Value) | USD 11.48 Billion |

| Growth Rate | CAGR of 5.5% from 2026–2031 |

| Years Considered | 2024–2031 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Related Segment & Geographic Reports |

US Dental Equipment Market Europe Dental Equipment Market MEA Dental Equipment Market North America Dental Equipment Market APAC Dental Equipment Market |

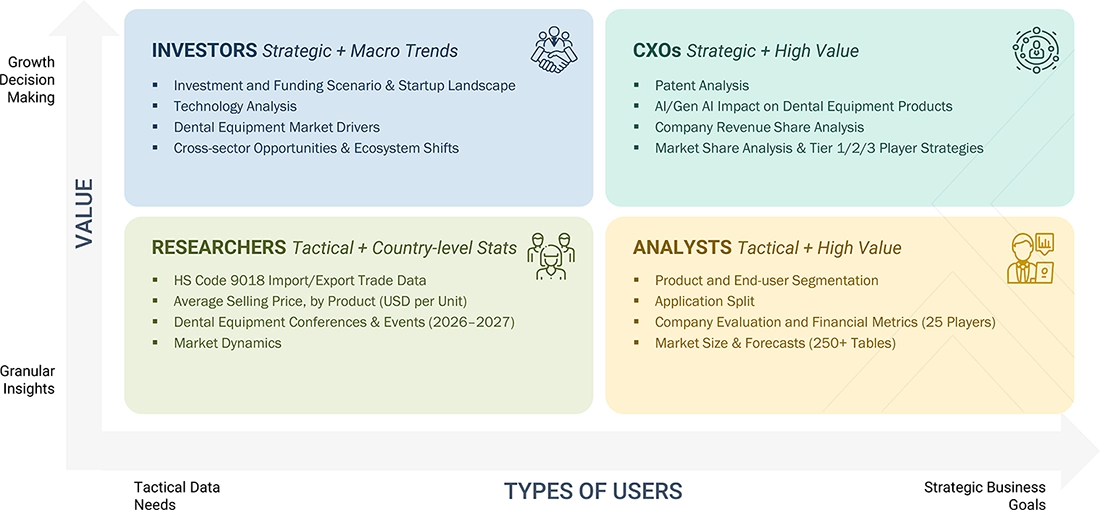

WHAT IS IN IT FOR YOU: DENTAL EQUIPMENT MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Volume Analysis | Market assessment, by volume (units), for dental equipment used in dental ecosystems |

|

| Product Analysis | Further breakdown of other applications in the market | Insights on other applications involved in the market |

| Company Information |

|

Insights on market share analysis, by country |

| Geographic Analysis |

|

Country-level demand mapping for new product launches and localization strategy planning |

RECENT DEVELOPMENTS

- October 2024 : Align Technology introduced the Invisalign Palatal Expander System in the US as part of the company's continued expansion of its comprehensive portfolio of orthodontic products. The system will provide a less invasive, digitally guided option for palatal expansion in a way that improves precision in treatment, increases comfort and clinical outcomes for patients, and supports Align's integrated digital orthodontic workflow.

- February 2024 : Carestream Dental launched the CS 8200 3D Access system, a compact and versatile imaging solution that supports imaging in the areas of panorama, CBCT, and object imaging, with the ability to provide high-quality images at a significantly lower dose of radiation, thus being more diagnostic, as well as safer and more friendly in a dental environment.

Table of Contents

Methodology

This study involved four major activities in estimating the current global Dental Equipment market size. First, extensive secondary research was conducted to gather information on the market, including related and parent markets. The next step was to validate these findings, assumptions, and sizing estimates with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the global Dental Equipment market. It was also used to obtain important information on key players, market classification, segmentation aligned with industry trends to the bottom-most level, and key developments from market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources on the supply side include industry experts such as CEOs, vice presidents, marketing & sales directors, technology & innovation directors, and other key executives from leading companies and organizations operating in the global Dental Equipment market. The primary sources on the demand side included industry experts, purchasing & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players, and gather insights into key industry trends and market dynamics.

A breakdown of the primary respondents for the global Dental Equipment market is provided below:

Note 1: C-level executives include CEOs, CFOs, COOs, and VPs.

Note 2: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

Source: MarketsandMarkets Analysis

Market Size Estimation

For the global market value, annual revenues were calculated using revenue mapping for major product manufacturers and OEMs active in the global dental equipment market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/subsegments was done for the major players. Also, the global dental equipment market was split into various segments and subsegments based on the:

- List of major players operating in the products market at the regional and/or country level

- Product mapping of various dental equipment manufacturers at the regional and/or country level

- Mapping of annual revenues generated by listed major players from dental equipment (or the nearest reported business unit/product category)

- Revenue mapping of major players covered

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global dental equipment market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Dental Equipment Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall size of the global dental equipment market using the above-mentioned methodology, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, as applicable, to complete the overall market engineering process and obtain exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macroindicators and regional trends from both demand- and supply-side participants.

Market Definition

Dental equipment encompasses the tools and instruments used to diagnose and treat a range of dental diseases and disorders. These supplies are utilized by dentists, dental hygienists, and dental laboratories. The category includes a variety of dental equipment, such as diagnostic tools and therapeutic instruments.

Key Stakeholders

- Manufacturers and distributors of medical devices

- Dental equipment manufacturers

- Contract manufacturers of dental equipment

- Distributors of dental equipment

- Research and consulting firms

- Raw material suppliers of dental equipment

- Dental hospitals and clinics

- Dental laboratories and associations

- Dental practitioners

- Dental laboratory technicians

- Healthcare institutions

- Diagnostic laboratories

- Academic institutions

- Research institutions

- Government associations

- Venture capitalists and investors

Report Objectives

- To define, describe, and forecast the global Dental Equipment market based on type, end user, and region

- To provide detailed information about the major factors influencing the global Dental Equipment market growth (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall global Dental Equipment market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players n the global Dental Equipment market

- To profile the key players and comprehensively analyze their market shares and core competencies in the global Dental Equipment market

- To track and analyze competitive developments such as partnerships, expansions, acquisitions, collaborations, product launches, agreements, and other developments in the global Dental Equipment market

- To benchmark players within the global Dental Equipment market using the Company Evaluation Quadrant framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and service offerings

Available customizations:

Based on the given market data, MarketsandMarkets offers customizations tailored to your company’s specific needs. The following customization options are available for the report:

GEOGRAPHIC ANALYSIS

- Further breakdown of the Rest of Europe Dental Equipment market into Russia, Switzerland, Denmark, Austria, and others

- Further breakdown of the Rest of Asia Pacific Dental Equipment market into South Korea, Taiwan, and others

- Further breakdown of the Rest of Latin America Dental Equipment market into Argentina, Colombia, Chile, Ecuador, and others

- Further breakdown of the Southeast Asia Dental Equipment market into Malaysia, Singapore, New Zealand, and others

COMPETITIVE LANDSCAPE ASSESSMENT

- Market share analysis, by region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa), which provides market shares of the top 3–5 key players in the global Dental Equipment market

- Company Evaluation Matrix for established players in the US.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Dental Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Dental Equipment Market

MnM Analyst

Sep, 2023

Hi Ivan,

The growth of the European dental manufacturing market is attributed to a number of factors, including:

1. Increasing geriatric population: The aging population in Europe is leading to an increase in the prevalence of dental diseases, such as cavities, gum disease, and tooth loss. This is driving the demand for dental implants, crowns, bridges, and other restorative devices.

2. Growing awareness about oral health: There is a growing awareness about the importance of oral health among the general population in Europe. This is leading to an increase in the demand for preventive dental care, such as dental cleanings and checkups.

3. Advances in dental technology: There have been significant advances in dental technology in recent years. This has led to the development of new dental products and services, such as 3D printing, laser dentistry, and digital imaging. These new technologies are making it possible to provide more accurate and efficient dental care.

4. Increased disposable income: The rising disposable income of consumers in Europe is making it possible for them to afford more expensive dental care. This is driving the demand for high-end dental products and services.

The European dental manufacturing market is highly competitive. Some of the major players in the market include:

1. 3M

2. Dentsply Sirona

3. Straumann

4. Danaher

5. Henry Schein

6. Zimmer Biomet

7. Planmeca

8. Ivoclar Vivadent

9. GC Corporation

10. Biolase Inc.

These companies are investing heavily in research and development to develop new products and services that meet the needs of consumers. They are also expanding their geographic presence to tap into new markets.

The European dental manufacturing market is expected to continue to grow in the coming years. The growth of the market will be driven by the factors mentioned above, as well as by the increasing demand for dental care in emerging markets, such as China and India..

Ivan

Sep, 2023

WHAT IS EUROPE OF GLOBAL DENTAL MANUFACTURING MARKET.