Digital Evidence Management Market by Component (Software, Hardware, & Services), Software (Evidence Collection, Storage & Sharing, Evidence Analytics & Visualization, Evidence Security), Service, Deployment Mode, End User and Region - Global Forecast to 2028

Digital Evidence Management Market Forecast

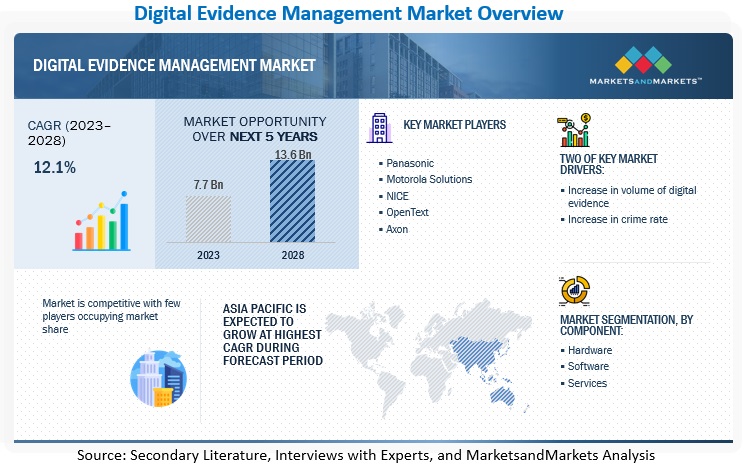

The global Digital Evidence Management Market size reached $7.7 billion in 2023 and is expected to surpass $13.6 billion by 2028 at 12.1% CAGR during forecast period. The market growth is driven by the increasing crime rate and the rising volume of digital evidence, while the use of traditional evidence collection methods poses a challenge.

Key Trends & Insights

- Growing Digital Evidence Volumes: Increasing use of cameras, mobile devices, and digital content is driving demand for efficient evidence management solutions.

- Emerging Technologies: AI, ML, deep learning, and blockchain are being integrated to improve evidence analytics, automation, and security.

- Service Segment Growth: Professional and managed services, including consulting, training, and integration, are gaining traction with law enforcement agencies.

- Evidence Analytics & Visualization: Advanced analytics tools with visualization capabilities are enhancing investigative efficiency.

- Criminal Justice Adoption: Prosecutors, public defenders, and courts increasingly rely on digital platforms for secure evidence handling.

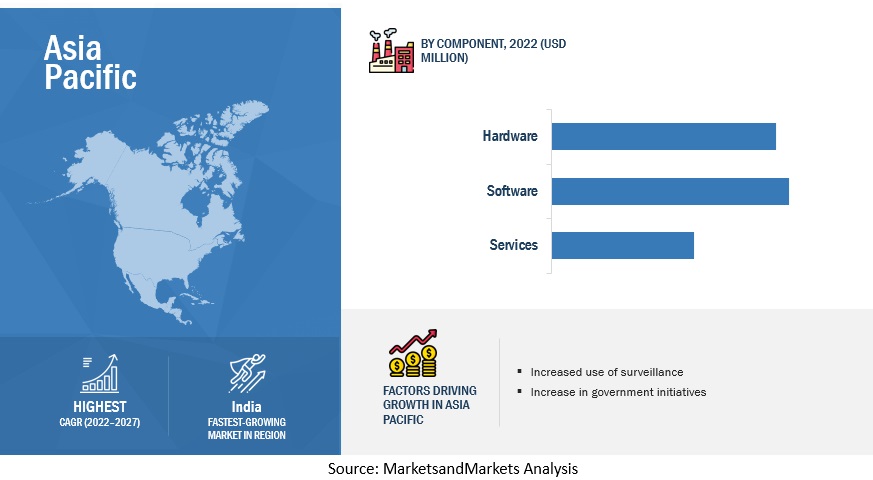

- Asia Pacific Expansion: China, India, and other APAC countries are rapidly adopting solutions due to rising surveillance infrastructure and government initiatives.

Digital Evidence Management Market Size & Forecast

- 2023 Market Size: USD 7.7 Billion

- 2028 Projected Market Size: USD 13.6 Billion

- CAGR (2023–2028): 12.1%

- Fastest Growing Region: Asia Pacific (APAC).

To know about the assumptions considered for the study, Request for Free Sample Report

Digital Evidence Management Market Dynamics

Driver: Increased in the volume of digital evidence

Due to the large volumes of digital evidence data acquired, analyzed, stored, and reported daily, significant backlogs in cases and misplacement, misuse, or redundancy of data may occur. Digital evidence management solutions are new solutions for criminal investigations and help manage and secure data efficiently. Adopting digital evidence has enabled significant improvements in citizen protection and fundamentally altered how criminal investigations are conducted. In our modern society, crimes often involve digital evidence. The pervasiveness of cameras, cell phones, laptops or tablets, and vast quantities of email, texts, photos, social media posts, and other digital content has exponentially increased the volume of digital evidence. Digital evidence management systems have become critical tools for forensic analysts, supporting the entire evidence lifecycle.

Restraint: Hesitancy of legal officers over sharing digital evidence

Though digital evidence management assists law enforcement agencies in performing investigations more effectively, there are still some gaps that have raised concerns for law enforcement agencies. These gaps include tampering and manipulation of data, which can still be overcome with the help of the offering in the market, but the issue of security of data exchange is yet to be resolved completely. As per the research published by the EU on criminal justice, it was discovered that the lack of an appropriate tool for transferring digital evidence across borders could raise significant risks, which include shared information being incomplete or not updated, time being lost, and data being transmitted unsafely. Due to this, the links between cases are not identified, and jurisdictional conflicts are not detected or resolved promptly. All these factors are making the legal officer reluctant to share the evidence digitally.

Opportunity: Use of emerging technology in digital evidence management

With emerging technologies such as AI/ML, deep learning, and blockchain, digital evidence management is also experiencing new upgrades. AI and machine learning models and applications create processes that can extract, sort, filter, translate, and transcribe information from text, images, and video. Various vendors are utilizing these capabilities to offer digital evidence management solutions. For example, Microsoft enables agencies to leverage AI and machine learning to empower their investigators to be more efficient and effective.

Challenge: Use of traditional evidence collection methods

Crimes are growing more sophisticated and impacted by technology in the interconnected modern era. In criminal investigations, gathering digital evidence has become crucial for the public's protection, even as agencies struggle to deal with a never-ending data backlog. Particularly in developing countries, the present methods of physically transferring digital evidence utilizing CDs, DVDs, and USB transfers are an expensive, impracticable, and inefficient use of resources. Though it is a struggle to maintain the evidence through traditional evidence management methods, law enforcement agencies still rely on it as they are not tech-savvy or afraid of the unknown. Besides this, they are also accustomed to the existing manual system, making the transition toward the digital evidence management system more difficult.

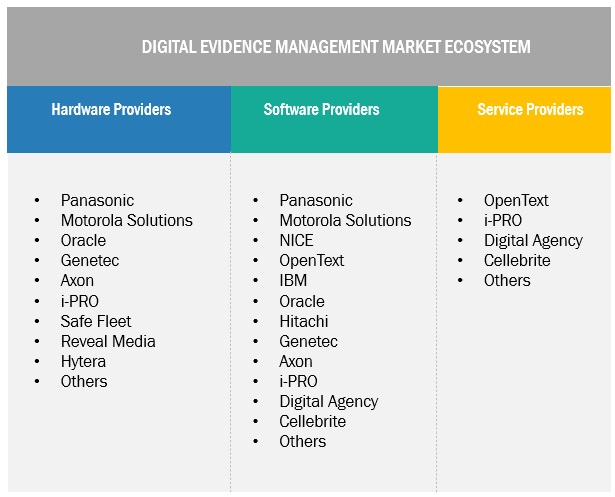

Digital Evidence Management Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By component, the services segment is expected to grow at the highest CAGR during the forecast period

Digital evidence management service providers render various services, such as digital investigation and consulting, system integration, support and maintenance, and training and education. These services enable investigators to perform a structured investigation by collaborating with the software, providing expertise to track the source of a problem, and enhancing the evidence process. Many service providers have digital evidence experts who perform the identification of data and analysis of evidence. Digital evidence management service providers also assist in enhancing investigation practices, training authorized persons, and offering customized services required by organizations. NICE, OpenText, and Cellebrite provide training services for organizations requiring employees to form internal investigation teams. In addition, these services also help in analyzing the content and reporting the evidence in court. The services market is rapidly gaining traction due to support from government entities and law enforcement agencies. Some major service providers in the digital evidence management market are Motorola Solutions, NICE, Cellebrite, MSAB, and OpenText.

By software, the evidence analytics and visualization segment is expected to grow at the highest CAGR during the forecast period

Evidence visualization presents digital evidence data in a visual form. Vendors offer visualization in many forms, such as charts, graphs, lists, and pictures. The visual representation helps officers understand the magnitude of the data. On the other hand, evidence analytics examines structured and unstructured data sets to gain insights and draw conclusions from the collected evidence. Many vendors offer integrated visual and analytics solutions for advanced results. For instance, Panasonic's Software Unified Digital Evidence (UDE) offers a unique platform to gather and store digital evidence from in-car and body-worn cameras, as well as other sources. UDE offers advanced video analytics for object recognition using deep Convolutional Neural Networks (CNN) technology that automates redaction for sharing evidence.

By end user, the criminal justice agencies segment is expected to grow at the highest CAGR during the forecast period

Prosecutors, public defenders, and courts are critical in criminal justice. Digital evidence has become ubiquitous and is critical for discovering the truth. Its use in courtrooms has increased significantly.

With growing evidence in volume and complexity, managing it traditionally using physical devices such as CDs, DVDs, and USB drives to collect and manage evidence is risky due to thefts/ loss of devices and costly in the long run term. Digital evidence management solutions are used in prosecuting cases, defending clients, and administering justice. Digital evidence management enables data management, storage, and security in a courtroom's workflow. Prosecutors, public defenders, and courts use digital evidence solutions so that documents can be tracked digitally and entered as evidence. NICE, Panasonic, Motorola Solutions, OpenText, Axon, Hitachi, VIDIZMO, and Safe Fleet are the key vendors providing digital evidence solutions to criminal justice agencies.

By region, Asia Pacific is expected to grow at the highest CAGR during the forecast period

Asia Pacific (APAC) includes large economies, such as China, Japan, India, Singapore, and Australia. Due to increasing technological innovations and the growing presence of many organizations, economies in the Asia Pacific are witnessing high growth. The countries in Asia Pacific focus on investments, and government initiatives are rising in emerging technologies to strengthen the digital evidence management market. China's Cybersecurity Law has already announced a strict security self-assessment procedure for transferring data abroad. It includes mandatory authority approval for securing the integrity of digital information that has been generated in China.

The increased volume of digital evidence is driving the digital evidence management market in the region. According to PreciseSecurity.com, China has the world's largest number of surveillance cameras. China has four times more surveillance cameras installed in its territory than the United States. Moreover, 8 of the top 10 cities with the most surveillance cameras installed are in China. This is driving the adoption of digital evidence management solutions.

Digital Evidence Management Companies

Key players in the digital evidence management market include Panasonic (Japan), Motorola Solutions (US), NICE (Israel), OpenText (Canada), Axon (US), Genetec (Canada), Cellebrite (Israel), Safe Fleet (US), VIDIZMO (US), and IBM (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

|

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

|

List of Companies in Digital Evidence Management |

Panasonic (Japan), Motorola Solutions (US), NICE (Israel), OpenText (Canada), Axon (US), Genetec (Canada), Cellebrite (Israel), Safe Fleet (US), VIDIZMO (US), IBM (US) |

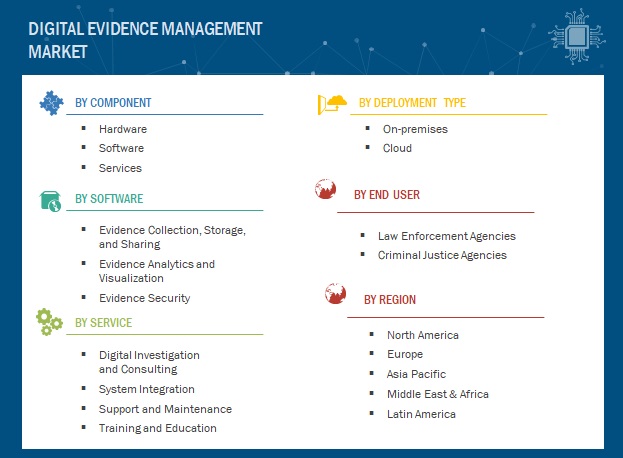

Market Segmentation

The study categorizes the digital evidence management market based on component, software, deployment mode, end user, and region.

By Component

- Hardware

- Software

- Services

By Software

- Evidence Collection, Storage, and Sharing

- Evidence Analytics and Visualization

- Evidence Security

By Services

- Digital Investigation and Consulting

- System Integration

- Support and maintenance

- Training and Education

By Deployment Mode

- On-Premise

- Cloud

By End User

- Law Enforcement Agencies

- Criminal Justice Agencies

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In January 2023, Albuquerque Police Department adopted Genetec Security Center and Genetec Clearance to enhance public safety. Albuquerque Police Department reduced the time required for sharing evidence with investigators and officers with the help of the Genetec Clearance digital evidence management system.

- In November 2022, NICE partnered with the Blue Ridge Judicial Circuit, Office of the District Attorney, to deploy NICE Justice. With this partnership, Blue Ridge Judicial Circuit, the office will digitally transform how it manages evidence.

- In December 2021, Axon launched Attorney Premier. It enables law enforcement officials and defense lawyers to efficiently manage various digital evidence types, such as body-worn video, in-car video, interview room video, CCTV video, pictures, audio, documents, etc. It enables attorneys to thoroughly evaluate evidence in less time and a secure area because it was designed from the ground up to optimize discovery.

Frequently Asked Questions (FAQ):

What is the definition of digital evidence management?

MarketsandMarkets defines digital evidence management as the digital evidence management solution commonly used by law enforcement agencies to store, manage, analyze, and share digital evidence for quicker solving of cases. Digital evidence management software enables investigators to harvest digital evidence from disparate sources, such as body-worn cameras, in-vehicle cameras, or CCTV, and bring these sources together in a simple, intuitive system.

What is the projected value of the digital evidence management market?

The digital evidence management market is projected to grow from an estimated USD 7.7 billion in 2023 to 13.6 billion USD by 2028 at a Compound Annual Growth Rate (CAGR) of 12.1% from 2023 to 2028.

Which are the key companies influencing the growth of the digital evidence management market?

Panasonic, Motorola Solutions, NICE, Axon, OpenText, IBM, Genetec, among others are recognized as key players in the digital evidence management market. They offer comprehensive solutions related to digital evidence management. These vendors adopt growth strategies to consistently achieve the desired growth and mark their presence in the market.

Which end-user segment is expected to hold a larger market share during the forecast period?

The law enforcement agencies segment is expected to hold a larger market share during the forecast period.

Which country in North America is expected to account for the largest market size during the forecast period?

The US is expected to account for the largest market size during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing availability of digital evidence- Government initiatives to support digital evidence management- Increasing crime rateRESTRAINTS- Reluctance of legal officers in sharing digital evidenceOPPORTUNITIES- Use of emerging technologies in digital evidence managementCHALLENGES- Lack of professional skills- Use of traditional evidence collection methods

-

5.3 USE CASESCASE STUDY 1: NICE HELPED NORTH WALES POLICE IN DIGITAL TRANSFORMATION DURING PANDEMICCASE STUDY 2: GENETEC COLLABORATED WITH DETECTIVES FOR EARLY CLOSURE OF CASESCASE STUDY 3: CELLEBRITE HELPED CHIAPAS CYBERCRIME UNIT SOLVE CASESCASE STUDY 4: CELLEBRITE HELPED MEXICO’S JALISCO STATE FORENSIC INVESTIGATORS MANAGE DIGITAL EVIDENCE

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.7 PRICING ANALYSISPRICING MODEL OF MOTOROLA SOLUTIONSPRICING MODEL OF PATROLEYESPRICING MODEL OF VIDIZMO

-

5.8 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCECLOUDBLOCKCHAIN

-

5.9 PATENT ANALYSIS

-

5.10 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 REVENUE SHIFT

- 6.1 INTRODUCTION

-

6.2 SOFTWARERISING INCIDENTS OF VIOLENCE AND CRIME AGAINST PROPERTYSOFTWARE: MARKET DRIVERS

-

6.3 HARDWAREHARDWARE DEVICES HELP POLICE OFFICERS TRACK AND MANAGE DIGITAL EVIDENCEHARDWARE: MARKET DRIVERSBODY-WORN CAMERASVEHICLE DASH CAMERASPUBLIC TRANSIT VIDEOS

-

6.4 SERVICESRISING NEED TO ENSURE SEAMLESS DEPLOYMENT OF DIGITAL EVIDENCE MANAGEMENT SOLUTIONSSERVICES: MARKET DRIVERSDIGITAL INVESTIGATION AND CONSULTINGSUPPORT AND MAINTENANCESYSTEM INTEGRATIONTRAINING AND EDUCATION

- 7.1 INTRODUCTION

-

7.2 EVIDENCE COLLECTION, STORAGE, AND SHARINGDIGITAL EVIDENCE MANAGEMENT SOLUTIONS STREAMLINE DATA COLLECTED IN DIFFERENT FORMATSEVIDENCE COLLECTION, STORAGE, AND SHARING: MARKET DRIVERS

-

7.3 EVIDENCE SECURITYRISING NEED TO PROTECT DIGITAL EVIDENCE FOR LEGAL AGENCIESEVIDENCE SECURITY: MARKET DRIVERS

-

7.4 EVIDENCE ANALYTICS AND VISUALIZATIONEVIDENCE ANALYTICS AND VISUALIZATION HELP GAIN INSIGHTS FROM UNSTRUCTURED DATAEVIDENCE ANALYTICS AND VISUALIZATION: MARKET DRIVERS

- 8.1 INTRODUCTION

-

8.2 ON-PREMISESINCREASING NEED TO GRANT IMMEDIATE ACCESS TO EVIDENCEON-PREMISES: MARKET DRIVERS

-

8.3 CLOUDGROWING NEED FOR FLEXIBLE AND SCALABLE DATA EVIDENCECLOUD: MARKET DRIVERS

- 9.1 INTRODUCTION

-

9.2 LAW ENFORCEMENT AGENCIESGROWING NEED TO TRANSFORM DIGITAL EVIDENCE MANAGEMENTLAW ENFORCEMENT AGENCIES: MARKET DRIVERS

-

9.3 CRIMINAL JUSTICE AGENCIESINCREASING NEED FOR CRIMINAL JUSTICE STAKEHOLDERS TO GO DIGITALCRIMINAL JUSTICE AGENCIES: MARKET DRIVERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATORY LANDSCAPEDIGITAL EVIDENCE MANAGEMENT MARKET: GOVERNMENT AGENCIES IN NORTH AMERICAUS- Rising adoption of initiatives to improve digital evidence collection and processingCANADA- Increasing government efforts to support digital evidence management

-

10.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATORY LANDSCAPEUK- Strong presence of law enforcement agenciesGERMANY- Expansion of video surveillance networks in public placesREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: DIGITAL EVIDENCE MANAGEMENT MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: REGULATORY LANDSCAPECHINA- Proliferation of digital evidence management systemsJAPAN- Rising use of dashcam video systemsINDIA- Increasing acceptance of E-evidence by judiciaryREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: REGULATORY LANDSCAPEMIDDLE EAST- Governments to boost adoption of digital evidence management solutionsAFRICA- Growing demand for use of video surveillance for road safety

-

10.6 LATIN AMERICALATIN AMERICA: DIGITAL EVIDENCE MANAGEMENT MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATORY LANDSCAPEBRAZIL- Rising use of body-worn cameras to decrease police fatality ratesMEXICO- Increasing incidents of data theftREST OF LATIN AMERICA

- 11.1 OVERVIEW

- 11.2 REVENUE ANALYSIS FOR KEY PLAYERS

- 11.3 MARKET RANKING OF KEY PLAYERS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPETITIVE BENCHMARKING FOR KEY PLAYERSCOMPANY FOOTPRINT

-

11.6 EVALUATION QUADRANT FOR KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.7 EVALUATION QUADRANT FOR STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.8 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES

- 11.9 COMPETITIVE SCENARIO

-

12.1 KEY PLAYERSPANASONIC- Business overview- Solutions offered- Recent developments- MnM viewMOTOROLA SOLUTIONS- Business overview- Solutions offered- Recent developments- MnM viewNICE- Business overview- Solutions offered- Recent developments- MnM viewOPENTEXT- Business overview- Solutions offered- Recent developments- MnM viewAXON- Business overview- Solutions offered- Recent developments- MnM viewGENETEC- Business overview- Solutions offered- Recent developmentsCELLEBRITE- Business overview- Solutions offered- Recent developmentsSAFE FLEET- Business overview- Solutions offered- Recent developmentsVIDIZMO- Business overview- Solutions offered- Recent developmentsOMNIGO SOFTWARE- Business overview- Solutions offered- Recent developmentsEXTERRO- Business overview- Solutions offered- Recent developmentsIBM- Business overview- Solutions offered- Recent developmentsORACLE- Business overview- Solutions offered- Recent developmentsHITACHI- Business overview- Solutions offeredNEC- Business overview- Solutions offeredHYTERAMSABVERITONEREVEAL MEDIAVERIPICSTORMAGIC

-

12.2 STARTUPS/SMESPATROLEYESFOTOWAREI-PRO AMERICASFILEONQPINNACLEFORAY

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 MARKETS ADJACENT TO DIGITAL EVIDENCE MANAGEMENTPUBLIC SAFETY AND SECURITY MARKETVIDEO SURVEILLANCE MARKET

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 DIGITAL EVIDENCE MANAGEMENT MARKET AND GROWTH, 2017–2022 (USD MILLION, Y-O-Y %)

- TABLE 4 MARKET AND GROWTH, 2023–2028 (USD MILLION, Y-O-Y %)

- TABLE 5 ECOSYSTEM ANALYSIS

- TABLE 6 IMPACT OF PORTER’S FIVE FORCES ON MARKET

- TABLE 7 PRICING MODEL OF MOTOROLA SOLUTIONS

- TABLE 8 PRICING MODEL OF PATROLEYES

- TABLE 9 PRICING MODEL OF VIDIZMO

- TABLE 10 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 12 MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 13 SOFTWARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 14 SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 15 HARDWARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 16 HARDWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 17 SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 18 SERVICES: DIGITAL EVIDENCE MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 DIGITAL EVIDENCE MANAGEMENT MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 20 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 21 DIGITAL INVESTIGATION AND CONSULTING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 22 DIGITAL INVESTIGATION AND CONSULTING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 SUPPORT AND MAINTENANCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 24 SUPPORT AND MAINTENANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 SYSTEM INTEGRATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 26 SYSTEM INTEGRATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 TRAINING AND EDUCATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 28 TRAINING AND EDUCATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 DIGITAL EVIDENCE MANAGEMENT MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 30 DIGITAL EVIDENCE MANAGEMENT MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 31 EVIDENCE COLLECTION, STORAGE, AND SHARING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 32 EVIDENCE COLLECTION, STORAGE, AND SHARING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 EVIDENCE SECURITY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 34 EVIDENCE SECURITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 EVIDENCE ANALYTICS AND VISUALIZATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 36 EVIDENCE ANALYTICS AND VISUALIZATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 38 MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 39 ON-PREMISES: DIGITAL EVIDENCE MANAGEMENT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 40 ON-PREMISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 CLOUD: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 42 CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 DIGITAL EVIDENCE MANAGEMENT MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 44 MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 45 LAW ENFORCEMENT AGENCIES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 46 LAW ENFORCEMENT AGENCIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 CRIMINAL JUSTICE AGENCIES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 48 CRIMINAL JUSTICE AGENCIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 50 DIGITAL EVIDENCE MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 52 NORTH AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 54 NORTH AMERICA: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 56 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 58 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 63 US: DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 64 US: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 65 US: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 66 US: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 67 US: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 68 US: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 69 US: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 70 US: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 71 US: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 72 US: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 73 CANADA: DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 74 CANADA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 75 CANADA: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 76 CANADA: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 77 CANADA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 78 CANADA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 79 CANADA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 80 CANADA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 81 CANADA: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 82 CANADA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 83 EUROPE: DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 84 EUROPE: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 85 EUROPE: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 86 EUROPE: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 87 EUROPE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 88 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 89 EUROPE: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 90 EUROPE: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 91 EUROPE: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 92 EUROPE: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 93 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 94 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 95 UK: DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 96 UK: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 97 UK: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 98 UK: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 99 UK: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 100 UK: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 101 UK: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 102 UK: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 103 UK: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 104 UK: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 105 GERMANY: DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 106 GERMANY: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 107 GERMANY: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 108 GERMANY: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 109 GERMANY: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 110 GERMANY: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 111 GERMANY: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 112 GERMANY: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 113 GERMANY: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 114 GERMANY: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 115 REST OF EUROPE: DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 116 REST OF EUROPE: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 117 REST OF EUROPE: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 118 REST OF EUROPE: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 119 REST OF EUROPE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 120 REST OF EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 121 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 122 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 123 REST OF EUROPE: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 124 REST OF EUROPE: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 125 ASIA PACIFIC: DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 126 ASIA PACIFIC: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 128 ASIA PACIFIC: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 129 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 130 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 132 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 136 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 137 CHINA: DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 138 CHINA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 139 CHINA: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 140 CHINA: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 141 CHINA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 142 CHINA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 143 CHINA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 144 CHINA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 145 CHINA: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 146 CHINA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 147 JAPAN: DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 148 JAPAN: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 149 JAPAN: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 150 JAPAN: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 151 JAPAN: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 152 JAPAN: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 153 JAPAN: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 154 JAPAN: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 155 JAPAN: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 156 JAPAN: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 157 INDIA: DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 158 INDIA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 159 INDIA: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 160 INDIA: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 161 INDIA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 162 INDIA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 163 INDIA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 164 INDIA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 165 INDIA: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 166 INDIA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 189 MIDDLE EAST: DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 190 MIDDLE EAST: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 191 MIDDLE EAST: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 192 MIDDLE EAST: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 193 MIDDLE EAST: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 194 MIDDLE EAST: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 195 MIDDLE EAST: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 196 MIDDLE EAST: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 197 MIDDLE EAST: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 198 MIDDLE EAST: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 199 AFRICA: DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 200 AFRICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 201 AFRICA: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 202 AFRICA: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 203 AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 204 AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 205 AFRICA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 206 AFRICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 207 AFRICA: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 208 AFRICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 209 LATIN AMERICA: DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 210 LATIN AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 211 LATIN AMERICA: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 212 LATIN AMERICA: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 213 LATIN AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 214 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 215 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 216 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 217 LATIN AMERICA: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 218 LATIN AMERICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 219 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 220 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 221 BRAZIL: DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 222 BRAZIL: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 223 BRAZIL: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 224 BRAZIL: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 225 BRAZIL: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 226 BRAZIL: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 227 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 228 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 229 BRAZIL: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 230 BRAZIL: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 231 MEXICO: DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 232 MEXICO: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 233 MEXICO: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 234 MEXICO: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 235 MEXICO: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 236 MEXICO: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 237 MEXICO: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 238 MEXICO: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 239 MEXICO: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 240 MEXICO: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 241 REST OF LATIN AMERICA: DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 242 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 243 REST OF LATIN AMERICA: MARKET, BY SOFTWARE, 2017–2022 (USD MILLION)

- TABLE 244 REST OF LATIN AMERICA: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 245 REST OF LATIN AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 246 REST OF LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 247 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 248 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 249 REST OF LATIN AMERICA: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 250 REST OF LATIN AMERICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 251 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 252 COMPANY FOOTPRINT, BY COMPONENT

- TABLE 253 COMPANY FOOTPRINT, BY END USER

- TABLE 254 COMPANY FOOTPRINT, BY REGION

- TABLE 255 LIST OF STARTUPS/SMES

- TABLE 256 COMPANY FOOTPRINT FOR STARTUPS/SMES, BY REGION

- TABLE 257 MARKET: PRODUCT LAUNCHES, 2020—2022

- TABLE 258 DIGITAL EVIDENCE MANAGEMENT MARKET: DEALS, 2019—2023

- TABLE 259 PANASONIC: COMPANY OVERVIEW

- TABLE 260 PANASONIC: SOLUTIONS OFFERED

- TABLE 261 PANASONIC: PRODUCT LAUNCHES

- TABLE 262 PANASONIC: DEALS

- TABLE 263 MOTOROLA SOLUTIONS: COMPANY OVERVIEW

- TABLE 264 MOTOROLA SOLUTIONS: SOLUTIONS OFFERED

- TABLE 265 MOTOROLA SOLUTIONS: SERVICE LAUNCHES

- TABLE 266 MOTOROLA SOLUTIONS: DEALS

- TABLE 267 NICE: COMPANY OVERVIEW

- TABLE 268 NICE: SOLUTIONS OFFERED

- TABLE 269 NICE: SOLUTION LAUNCHES

- TABLE 270 NICE: DEALS

- TABLE 271 OPENTEXT: BUSINESS OVERVIEW

- TABLE 272 OPENTEXT: SOLUTIONS OFFERED

- TABLE 273 OPENTEXT: PRODUCT LAUNCHES

- TABLE 274 OPENTEXT: DEALS

- TABLE 275 AXON: BUSINESS OVERVIEW

- TABLE 276 AXON: SOLUTIONS OFFERED

- TABLE 277 AXON: PRODUCT LAUNCHES

- TABLE 278 AXON: DEALS

- TABLE 279 GENETEC: COMPANY OVERVIEW

- TABLE 280 GENETEC: SOLUTIONS OFFERED

- TABLE 281 GENETEC: DEALS

- TABLE 282 CELLEBRITE: COMPANY OVERVIEW

- TABLE 283 CELLEBRITE: SOLUTIONS OFFERED

- TABLE 284 CELLEBRITE: PRODUCT LAUNCHES

- TABLE 285 CELLEBRITE: DEALS

- TABLE 286 SAFE FLEET: COMPANY OVERVIEW

- TABLE 287 SAFE FLEET: SOLUTIONS OFFERED

- TABLE 288 SAFE FLEET: DEALS

- TABLE 289 VIDIZMO: COMPANY OVERVIEW

- TABLE 290 VIDIZMO: SOLUTIONS OFFERED

- TABLE 291 VIDIZMO: PRODUCT LAUNCHES

- TABLE 292 VIDIZMO: DEALS

- TABLE 293 OMNIGO SOFTWARE: COMPANY OVERVIEW

- TABLE 294 OMNIGO SOFTWARE: SOLUTIONS OFFERED

- TABLE 295 OMNIGO SOFTWARE: PRODUCT LAUNCHES

- TABLE 296 OMNIGO SOFTWARE: DEALS

- TABLE 297 EXTERRO: COMPANY OVERVIEW

- TABLE 298 EXTERRO: SOLUTIONS OFFERED

- TABLE 299 EXTERRO: PRODUCT LAUNCHES

- TABLE 300 EXTERRO: DEALS

- TABLE 301 IBM: COMPANY OVERVIEW

- TABLE 302 IBM: SOLUTIONS OFFERED

- TABLE 303 IBM: PRODUCT LAUNCHES

- TABLE 304 ORACLE: COMPANY OVERVIEW

- TABLE 305 ORACLE: SOLUTIONS OFFERED

- TABLE 306 ORACLE: PRODUCT LAUNCHES

- TABLE 307 HITACHI: COMPANY OVERVIEW

- TABLE 308 HITACHI: SOLUTIONS OFFERED

- TABLE 309 NEC: COMPANY OVERVIEW

- TABLE 310 NEC: SOLUTIONS OFFERED

- TABLE 311 ADJACENT MARKETS AND FORECASTS

- TABLE 312 PUBLIC SAFETY AND SECURITY MARKET, BY SOLUTION, 2015–2020 (USD MILLION)

- TABLE 313 PUBLIC SAFETY AND SECURITY MARKET, BY SOLUTION, 2021–2027 (USD MILLION)

- TABLE 314 PUBLIC SAFETY AND SECURITY MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

- TABLE 315 PUBLIC SAFETY AND SECURITY MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

- TABLE 316 VIDEO SURVEILLANCE MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 317 VIDEO SURVEILLANCE MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 318 HARDWARE: VIDEO SURVEILLANCE MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 319 HARDWARE: VIDEO SURVEILLANCE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 320 CAMERAS: VIDEO SURVEILLANCE MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

- TABLE 321 CAMERAS: VIDEO SURVEILLANCE MARKET, BY FORM FACTOR, 2022–2027 (USD MILLION)

- FIGURE 1 DIGITAL EVIDENCE MANAGEMENT MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET: RESEARCH FLOW

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH (SUPPLY SIDE): REVENUE OF SOFTWARE/HARDWARE/SERVICES OF DIGITAL EVIDENCE MANAGEMENT VENDORS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET AND Y-O-Y GROWTH RATE (2021–2028)

- FIGURE 6 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 7 SEGMENTS WITH SIGNIFICANT GROWTH RATES IN MARKET

- FIGURE 8 INCREASING VOLUME OF DIGITAL EVIDENCE TO DRIVE GROWTH IN MARKET

- FIGURE 9 SOFTWARE SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 10 EVIDENCE COLLECTION, STORAGE, AND SHARING SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 11 CLOUD SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2023

- FIGURE 12 LAW ENFORCEMENT AGENCIES SEGMENT TO LEAD MARKET IN 2023

- FIGURE 13 EUROPE TO EMERGE AS MOST LUCRATIVE MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 14 DIGITAL EVIDENCE MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 INCIDENTS OF VIOLENCE AND CRIME AGAINST PROPERTY, 2008–2022

- FIGURE 16 VALUE CHAIN ANALYSIS

- FIGURE 17 ECOSYSTEM ANALYSIS

- FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 19 PATENT ANALYSIS

- FIGURE 20 YC/YCC SHIFT FOR MARKET

- FIGURE 21 SERVICES SEGMENT TO GROW AT HIGHEST CAGR BY 2028

- FIGURE 22 TRAINING AND EDUCATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 23 EVIDENCE ANALYTICS AND VISUALIZATION SEGMENT TO GROW AT HIGHEST CAGR BY 2028

- FIGURE 24 CLOUD SEGMENT TO GROW AT HIGHER CAGR BY 2028

- FIGURE 25 CRIMINAL JUSTICE AGENCIES SEGMENT TO GROW AT HIGHER CAGR BY 2028

- FIGURE 26 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE BY 2028

- FIGURE 27 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 28 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 29 REVENUE ANALYSIS FOR KEY PLAYERS, 2017–2021 (USD MILLION)

- FIGURE 30 MARKET RANKING OF KEY PLAYERS

- FIGURE 31 MARKET SHARE ANALYSIS, 2022

- FIGURE 32 EVALUATION QUADRANT FOR KEY PLAYERS, 2023

- FIGURE 33 EVALUATION QUADRANT FOR STARTUPS/SMES, 2023

- FIGURE 34 PANASONIC: COMPANY SNAPSHOT

- FIGURE 35 MOTOROLA SOLUTIONS: COMPANY SNAPSHOT

- FIGURE 36 NICE: COMPANY SNAPSHOT

- FIGURE 37 OPENTEXT: COMPANY SNAPSHOT

- FIGURE 38 AXON: COMPANY SNAPSHOT

- FIGURE 39 CELLEBRITE: COMPANY SNAPSHOT

- FIGURE 40 IBM: COMPANY SNAPSHOT

- FIGURE 41 ORACLE: COMPANY SNAPSHOT

- FIGURE 42 HITACHI: COMPANY SNAPSHOT

- FIGURE 43 NEC: COMPANY SNAPSHOT

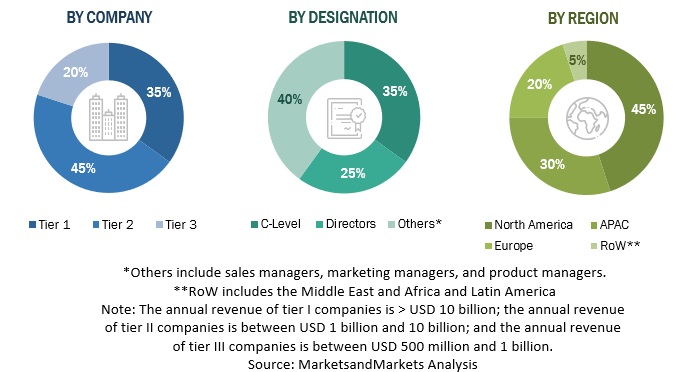

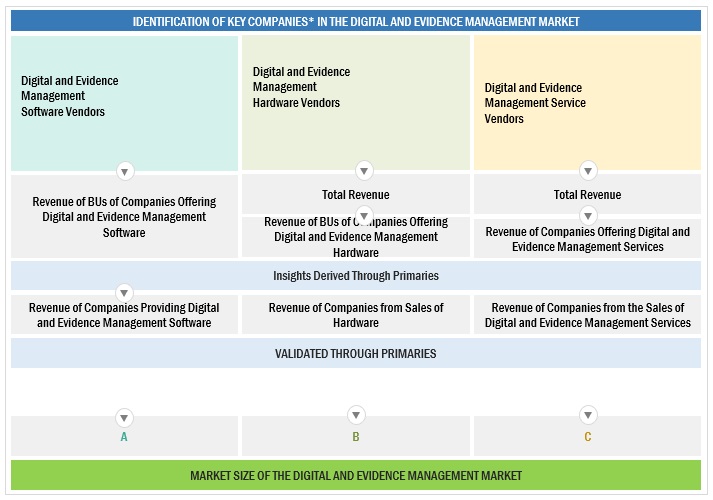

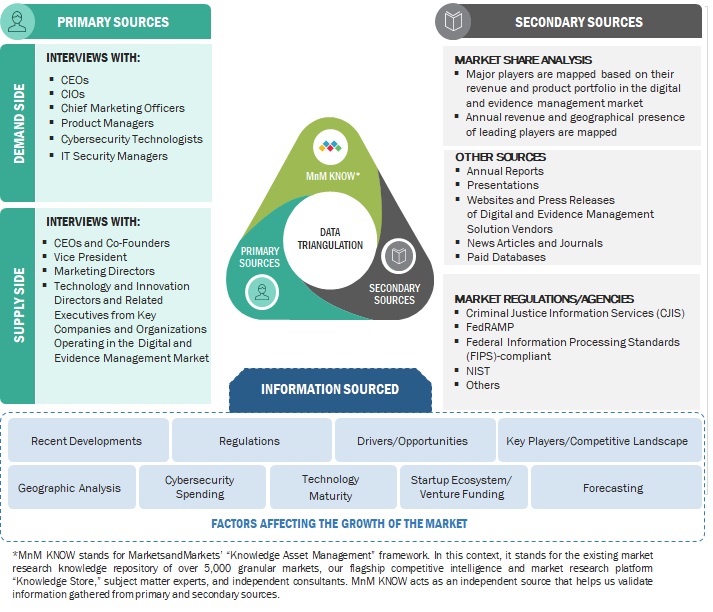

This study involved multiple steps in estimating the current size of the digital evidence management market. Exhaustive secondary research was carried out to collect information on the digital evidence management industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. The top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, investor presentations of companies; white papers, journals, certified publications; and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report in the primary research process. The primary sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the digital evidence management market. Extensive primary research was conducted during the research to gather information and verify and validate the critical numbers arrived at. The primary research was also conducted to identify the segmentation types; industry trends; the competitive landscape of the digital evidence management market players; and the key market dynamics, such as drivers, restraints, opportunities, challenges, and key strategies.

Breakup of primary interviews:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and sub-segments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report. This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The digital evidence management solution is commonly used by law enforcement agencies to store, manage, analyze, and share digital evidence for quicker solving of cases. Digital evidence management software enables investigators to harvest digital evidence from disparate sources, such as body-worn cameras, in-vehicle cameras, or CCTV and bring these sources together in a simple, intuitive system.

- Key Stakeholders

- Information technology professionals

- Government agencies

- Investors and venture capitalists

- Small and medium-sized enterprises (SMEs) and large enterprises

- Professional service providers

- Digital evidence management vendors

- Independent software vendors

- Consultants/Consultancies/Advisory firms

- System integrators

- Third-Party providers

- Value-added Resellers (VARs)

- Project managers

- Business analysts

Report Objectives

- To describe and forecast the global digital evidence management market by component (hardware, software, and services), deployment mode, end user, and region based on individual growth trends and contributions toward the overall market

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the digital evidence management market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the digital evidence management market

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To analyze subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the digital evidence management market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as product enhancements and product launches; acquisitions; and partnerships and collaborations, in the digital evidence management market globally

Customization Options

MarketsandMarkets offers the following customization for this market report:

- Additional country-level analysis of the digital evidence management market

- Profiling of additional market players (up to 5)

Product Analysis

Product matrix, which provides a detailed comparison of the product portfolio of each company in the Digital Evidence Management Market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Evidence Management Market

Understand the total market size of DEMS, and a breakdown of its key segments by product/service and/or end customer.

Gather insights into the market size of the digital evidence market for children advocacy centers.