The digital therapeutics market research study includes four key steps to estimate the market size. Extensive secondary research was carried out to gather information about the market, its key players and its parent industry. The following step was to authenticate the research outcomes, insights and evaluations through primary research with industry experts across the value chain. A combination of bottom-up and top down approaches were executed to derive the final market sizes. Market segmentation and data triangulation techniques were conducted to estimate the market size of segments and sub-segments.

Secondary Research

Secondary research served as the primary method for identifying and gathering information for the comprehensive, technical, market-oriented, and commercial analysis of the digital therapeutics market. Various secondary sources, including directories, databases such as Bloomberg Businessweek, Factiva, and Wall Street Journal, white papers, and annual reports, were consulted to extract key information about major players, market classification, and segmentation based on industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

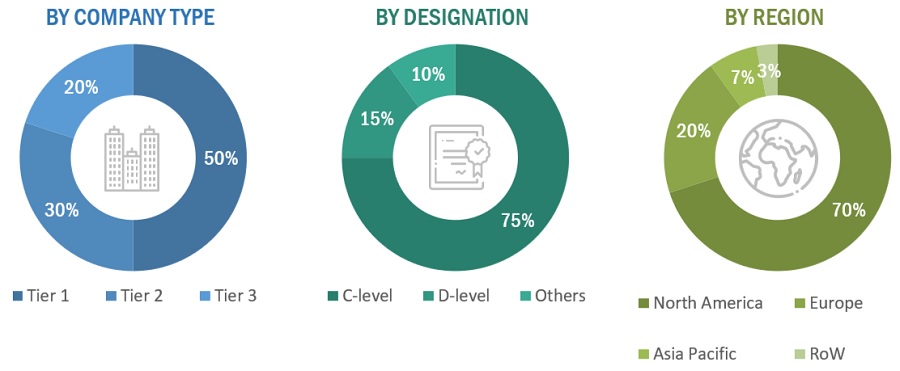

In-depth dialogues were conducted with diverse primary respondents, including subject matter experts (SMEs), key industry participants, industry consultants and C-level executives of major market players, among other experts. This was done to acquire and validate critical qualitative and quantitative information, as well as to assess the market prospects. Various primary sources from both the supply and demand sides of the market were engaged in interviews to obtain qualitative and quantitative insights. The breakdown of primary respondents is detailed below:

Note 1: C-level primaries include CEOs, CFOs, and COOs.

Note 2: Others include sales, marketing, and product and service managers.

Note 3: Tiers are defined based on a company’s total revenue, as of 2021: Tier 1 = >USD 100 million, Tier 2 = USD 100 million to USD 10 million, and Tier 3 = <USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

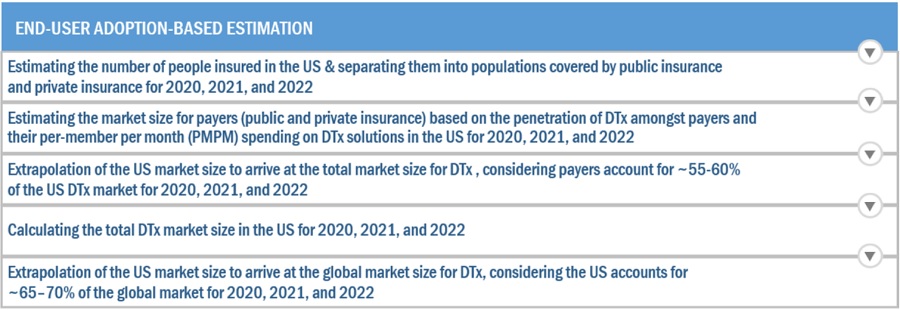

The determination of the total size of the digital therapeutics market involved the utilization of both top-down and bottom-up approaches. These methods were extensively applied to assess the sizes of various subsegments within the market. The research methodology employed for market size estimation is outlined as follows:

-

Identification of key players in the industry and markets was conducted through thorough secondary research. This involved studying annual and quarterly financial reports, regulatory filings, and data books of major market players. Additionally, insights were gathered through interviews with industry experts to obtain detailed market perspectives.

-

All percentage shares, splits, and breakdowns for the global digital therapeutics market were derived from secondary sources and subsequently verified through primary sources.

-

Key macro indicators influencing the revenue growth of market segments and subsegments were considered. These factors were examined in detail, verified through primary research, and analyzed to obtain validated quantitative and qualitative data.

-

The collected market data underwent consolidation and was complemented with detailed inputs and analysis, resulting in the comprehensive presentation found in this report.

Digital Therapeutics: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Digital Therapeutics: Top Down Approach

Data Triangulation

Following the determination of the overall market size in the estimation process, the total market was segmented into various segments and subsegments. To finalize the market engineering process and obtain precise statistics for all segments and subsegments, data triangulation and market breakdown procedures were applied whenever applicable. The triangulation of data involved a comprehensive study of various factors and trends from both the demand and supply sides of the market.

Market Definition

Digital therapeutics are health or social care interventions delivered either wholly or significantly through a smart device to induce a behavioral change in the patient. Digital therapies/programs are cost-effective and can improve patient engagement and bring about substantial changes in patient health. These solutions are evidence-based, clinically approved, and prescribed as software-as-a-drug.

Key Stakeholders

-

Digital Therapeutics Platform/Software/App/Therapy/Program Developers

-

Healthcare Institutions/Providers (Hospitals, medical Groups, Physician Practices, Community Clinics, Psychiatrists, and Outpatient Clinics)

-

Healthcare Insurance Companies/Payers

-

Healthcare IT Solution Providers

-

Venture Capitalists

-

Government Agencies

-

Market Research and Consulting Firms

Report Objectives

-

To provide detailed information regarding the major factors influencing market growth, including drivers, restraints, opportunities, and challenges.

-

To define, describe, and forecast the digital therapeutics market based on sales channel, application, and region.

-

To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall digital therapeutics market.

-

To forecast the size of market segments in four main regions: North America, Europe, Asia Pacific (APAC), Latin America (LATAM), and Middle East & Africa (MEA).

-

To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders.

-

To profile key players and analyze their market shares and core competencies.

-

To track and analyze competitive developments such as product launches, partnerships, agreements, expansions, mergers, and acquisitions in the digital therapeutics market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report.

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Michael

Mar, 2022

Which is the fastest growing market of Digital Therapeutics Market?.

David

Mar, 2022

Which are the key factors driving the growth of the Global Digital Therapeutics Market?.

William

Mar, 2022

What are the growth estimates for Digital Therapeutics Market till 2026?.