Digital Transformation Market by Offering (Solutions & Services), Technology (Cloud Computing, Big Data & Analytics, Blockchain, Cybersecurity, AI), Business Function (Accounting & Finance, IT, HR), Vertical,& Region - Global Forecast to 2030

Digital Transformation Market Size, Trends & Growth Report - 2030

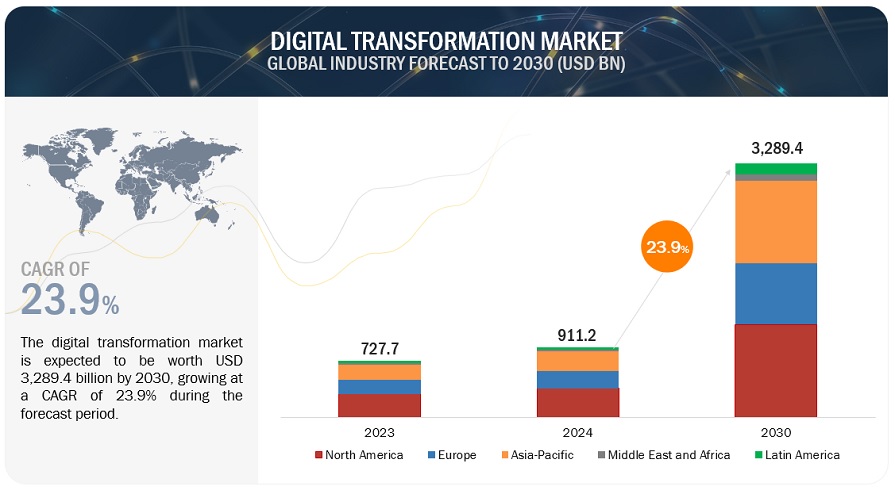

[365 Pages Report] The global Digital Transformation Market size was accounted for $695.5 billion in 2023 and is projected to achieve a market size of $3,144.9 billion by 2030, projecting a CAGR of 24.1% from 2024 to 2030. The base year for estimation is 2022 and the size available for the years 2018 to 2030.

The growing trend of digitization and the rising need for optimal resource utilization is also expected to drive digital transformation industry growth.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Digital Transformation Market Growth Dynamics

Driver: Increasing usage of mobile devices and apps

The increasing insight of mobile devices and apps has revolutionized several aspects of modern life. Mobile devices have enabled constant connectivity, allowing people to access the internet and various digital services from anywhere at any time. This has transformed how individuals interact with information, services, and each other, leading to new business models and opportunities for organizations. Mobile devices provide tools and applications that increase productivity and efficiency. With the ability to access business applications, collaborate remotely, and manage tasks on the go, employees can be more productive and responsive to business needs.

Restraint: Lack of Data privacy and security concerns

Data privacy and security concerns pose significant restraints on digital transformation initiatives. As organizations increasingly leverage technology to streamline processes, enhance customer experiences, and drive innovation, the collection, storage, and analysis of vast amounts of sensitive data become inevitable. However, the potential risks associated with data breaches, unauthorized access, and misuse of personal information have raised concerns among consumers, regulatory bodies, and businesses themselves.

Opportunity: Implementing digital tools and technologies

Digital transformation presents a significant opportunity for organizations to revolutionize their operations by implementing digital tools and technologies. By leveraging innovative solutions such as cloud computing, artificial intelligence, big data analytics, and automation, companies can streamline processes, enhance efficiency, and gain a competitive edge. Digital tools enable seamless collaboration, remote work capabilities, and real-time data access, empowering employees to work more productively from anywhere. Furthermore, digital transformation opens doors to improved customer experiences through personalized interactions, faster response times, and tailored solutions.

Challenge: Legacy systems and outdated technologies

Digital transformation is dealing with legacy systems and outdated technologies. Many organizations still rely on legacy systems that have been in place for years or even decades, built on outdated technologies and architecture. These systems often lack compatibility with modern technologies and hinder the integration of new digital solutions. Upgrading or replacing these legacy systems requires careful planning, significant investments, and potential disruptions to ongoing operations.

Digital Transformation Industry Ecosystem

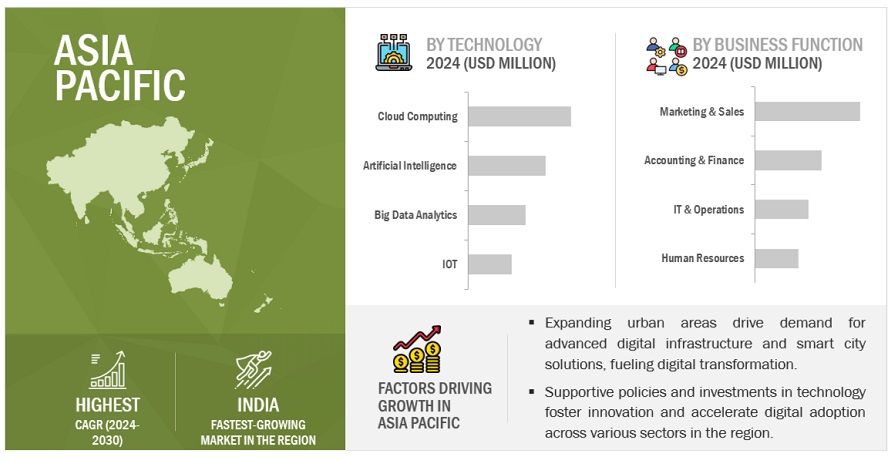

By Business Function, the marketing & sales segment is to grow at the largest market size during the forecast period.

Automation tools and platforms play a vital role in digital transformation, enabling marketers to automate repetitive tasks, streamline workflows, and personalize customer interactions at a scale. Marketing automation includes lead generation, email marketing, content management, social media scheduling, and customer segmentation, among others. During the forecast period, the marketing and sales segment is anticipated to grow at the largest market size for the digital transformation market.

By Technology, the cloud computing segment is to grow at the largest market size during the forecast period.

Digital transformation in cloud computing is a paradigm shift that revolutionizes how businesses operate by leveraging cloud-based technologies and services to streamline processes, enhance scalability, and drive innovation. It encompasses migrating traditional on-premises infrastructure and applications to the cloud, adopting cloud-native architectures and services, and utilizing data analytics and artificial intelligence to unlock valuable insights. This transformation empowers organizations to achieve greater operational efficiency, cost savings, and agility while enabling seamless collaboration, improved customer experiences, and the ability to rapidly adapt to evolving market demands. During the forecast period, the cloud computing segment is anticipated to grow at the largest market size for the digital transformation market.

North America to account for the largest market size during the forecast period

By region, North America has the highest adoption rate for digital transformation solutions. The increasing reliance on technology and the need for organizations to stay competitive in a rapidly evolving digital landscape are significant drivers. Businesses are embracing digital solutions to optimize processes, enhance customer experiences, and gain data-driven insights. During the forecast period, North America is anticipated to register the largest market size.

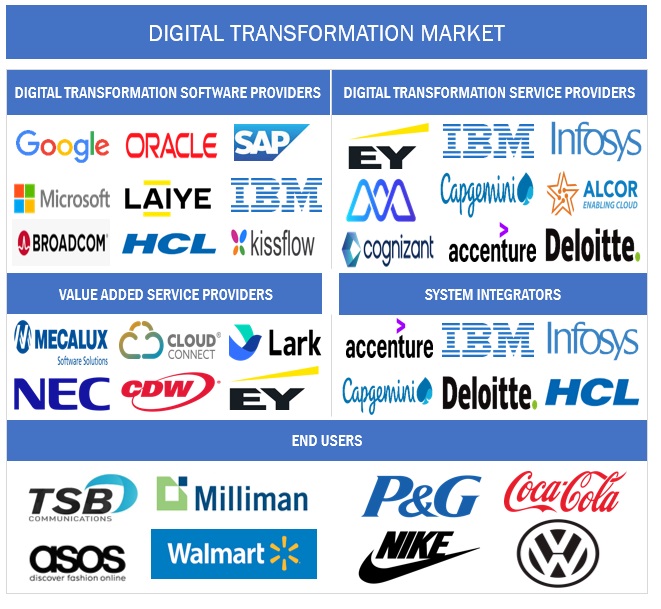

Key Digital Transformation Market Players

The digital transformation industry vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global digital transformation market include Microsoft (US), SAP (Germany), Baidu (China), Adobe Systems (US), Alibaba (China), IBM (US), Google (US), Marlabs (US), Salesforce (US), Broadcom (US), Equinix (US), Oracle (US), Hewlett Packard Enterprise (US), HCL Technologies (India), EY (UK), Cognizant (US), Accenture (Ireland ), Tibco Software (US), Alcor Solutions (US), Smartstream (US), Yash Technologies (US), Interfacing (US), Kissflow (India), eMudhra (India), ProcessMaker (US), Process Street (US), Happiest Minds (India), Scoro (UK), Dempton Consulting Group (Canada), Brillio (US), Aexonic Technologies (India), CloudAngles (US), Magnetar IT (England), Scitara (US), Intrinsic (US), and Soundful (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2030 |

|

Forecast units |

USD Million/Billion |

|

Segments Covered |

By Offering, Technology, Business Function, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Microsoft (US), SAP (Germany), Baidu (China), Adobe Systems (US), Alibaba (China), IBM (US), Google (US), Marlabs (US), Salesforce (US), Broadcom (US), Equinix (US), Oracle (US), Hewlett Packard Enterprise (US), HCL Technologies (India), EY (UK), Cognizant (US), Accenture (Ireland ), Tibco Software (US), Alcor Solutions (US), Smartstream (US), Yash Technologies (US), Interfacing (US), Kissflow (India), eMudhra (India), ProcessMaker (US), Process Street (US), Happiest Minds (India), Scoro (UK), Dempton Consulting Group (Canada), Brillio (US), Aexonic Technologies (India), CloudAngles (US), Magnetar IT (England), Scitara (US), Intrinsic (US), and Soundful (US). |

This research report categorizes the Digital Transformation Market based on offering, technology, business function, vertical, and region.

By Offering:

- Solutions

- Services

Digital Transformation Market By Technology:

- Cloud Computing

- Big Data & Analytics

- Blockchain

- Cybersecurity

- AI

- IoT

Digital Transformation Market By Business Function:

- Accounting & Finance

- Information Technology

- Human Resources

- Marketing & Sales

By Vertical:

- BFSI

- Retail & eCommerce

- IT/ITES

- Healthcare, Life Sciences & Pharmaceuticals

- Government & Defense

- Media & Entertainment

- Manufacturing

- Energy & Utilities

- Telecommunications

- Education

- Agriculture

- Automotive, Transportation, & Logistics

Digital Transformation Market By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Poland

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia & New Zealand

- South Korea

- ASEAN Countries

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Israel

- Turkey

- Qatar

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

Recent Developments in Digital Transformation Industry:

- In May 2023, SAP collaborated with IBM and announced that IBM Watson technology would be embedded into SAP solutions to offer new AI-driven insights and automation. It also helps to fuel innovation and create more efficient and effective user experiences across the SAP solution portfolio.

- In April 2023, Epic announced expanding its strategic collaboration with Microsoft to incorporate generative AI into healthcare. This collaboration will leverage the capabilities of Azure OpenAI Service and Epic's renowned electronic health record (EHR) software to bring the benefits of AI to the healthcare sector.

- In April 2023, the Norwegian Institute of Bioeconomy Research collaborated with Oracle and selected its Autonomous Database and AI functionalities on the Oracle Cloud Infrastructure (OCI) to gain deeper insights into the forest value chain and enhance long-term sustainability practices.

- In April 2023, Google announced the launch of a new AI that enables Claims Acceleration Suite to streamline health insurance prior authorization and claims processing. By utilizing the newly developed Claims Data Activator, this solution aims to alleviate administrative burdens and reduce costs for health plans and providers.

- In March 2023, SAP announced the SAP Datasphere solution, the next generation of its data management portfolio to provide customers with quick access to data that is ready for business use across the data landscape.

Frequently Asked Questions (FAQ):

What is digital transformation?

Digital transformation is the outcome of changes that occur with the application of digital technologies. The use of digital transformation across business and organizational activities, processes, competencies, and business models leverages the changes and opportunities of a mix of digital technologies and their impact on society. Digital transformation helps enterprises improve the customer experience, optimize the workforce, enhance operational activities, and transform the products and services of the organization.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Poland, Spain, and Italy in the European region.

Which are key verticals adopting digital transformation solutions and services?

Key verticals adopting digital transformation solutions and services include BFSI, retail and eCommerce, healthcare, life sciences & pharmaceuticals, government & defense, media & entertainment, IT/ITeS (Information Technology/ Information Technology Enabled Services), energy & utilities, telecommunication, and manufacturing, education, agriculture, and Automotive, Transportation, and Logistics.

The key drivers supporting the growth of the digital transformation market include Increasing spending on marketing and advertising activities by enterprises, changing the landscape of customer intelligence, and the proliferation of customer channels.

The key drivers supporting the growth of the digital transformation market include Increasing spending on marketing and advertising activities by enterprises, changing the landscape of customer intelligence, and the proliferation of customer channels.

Who are the key vendors in the digital transformation market?

The key vendors in the global digital transformation market include Microsoft (US), IBM(US), SAP(Germany), Oracle (US), Google (US), Baidu (China), HPE(US), Adobe (US), Alibaba (China), HCL Technologies (India), Broadcom(US), Equinix(US), Salesforce (US), Tibco(US) and Marlabs (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

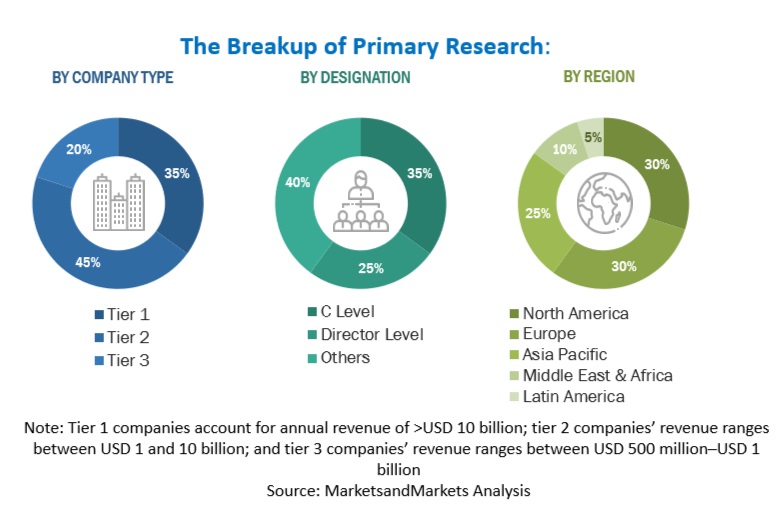

The research study involved the use of extensive secondary sources, directories, as well as several journals and magazines such as the Institute of Electrical and Electronic Engineers IoT Journal, International Journal of Data Science and Analytics, and IoT Magazine to identify and collect the information useful for a comprehensive market research study on the digital transformation market. The primary sources were mainly industry experts from the core and related industries, preferred digital transformation solution providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, as well as assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, and certified publications and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, product development/innovation teams, related key executives from digital transformation solution vendors, SIs, professional service providers, industry associations, and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

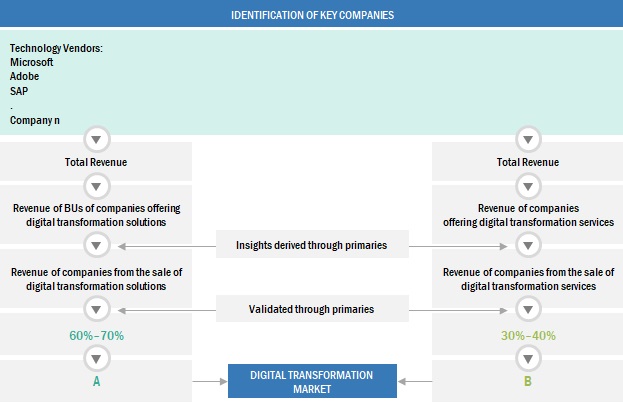

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global digital transformation market and various other dependent subsegments. The research methodology used to estimate the market size included the following details: the key players not limited to IBM, Microsoft, SAP, Oracle, Adobe, and Google in the market were identified through extensive secondary research, and their revenue contribution in the respective regions were determined through primary and secondary research. The entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on digital transformation solutions based on some of the key use cases. These factors for the digital transformation industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Top-Down Approach

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the global digital transformation market was prepared. The revenue contribution of all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated on the basis of its products/solutions by technology, service, and application. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Information Officers (CIOs), Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Bottom-Up Approach

In the bottom-up approach, the adoption of digital transformation solutions among different end users in key countries with respect to their regions that contribute the most to the market share was identified. For cross-validation, the adoption of digital transformation solutions and services among different industries, along with different use cases with respect to their regions, was identified and extrapolated. In addition, weightages were given to the use cases identified in different regions for the market size calculation.

Based on these numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the digital transformation market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socioeconomic analysis of each country, strategic vendor analysis of major digital transformation providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall digital transformation market size and its segments’ market size were determined and confirmed using the study.

To know about the assumptions considered for the study, Request for Free Sample Report

Definition

According to Salesforce, digital transformation is the process of using digital technologies to create new or modify existing business processes, culture, and customer experiences to meet changing business and market requirements. This reimagining of business in the digital age is digital transformation.

Stakeholders

- Digital Transformation Solution Providers

- Independent Software Vendors (ISVs)

- Investors and Venture Capitalists (VCs)

- Managed Service Providers

- Support And Maintenance Service Providers

- System Integrators (Sis)/Migration Service Providers

- Value-added Resellers (VARs) and Distributors

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To determine and forecast the digital transformation market by offering, business function, technology, vertical, and region, and analyze the various macroeconomic and microeconomic factors that affect market growth.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key market players and provide a comparative analysis on the basis of their business overviews, regional presence, product offerings, business strategies, and key financials, and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as acquisitions; expansions; new product launches and product enhancements; agreements, collaborations, and partnerships; and R&D activities in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the North American digital transformation market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Latin American market

- Further breakup of the Middle East & Africa market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Transformation Market

The report will provides a road map analysis to the upcoming developments in the Market for next 4-5 years with 360 analysis of the Digital Transformation Market landscape with deep-dive data market sizing, growth projections, adoptions rates across the end user segments with COVID-19 impact. It also maps the entire ecosystem of this market (including all adjacent and related markets) for the last few years and have worked closely with all the key players in the industry.

I would like to know more about the latest growing trends in the Industrial Cybersecurity market.