Voltage Regulators Market by Type (Ferroresonant and Tap Switching), by End-Users (Commercial, Industrial, and Residential) & by Region (Americas, Europe, Asia-Pacific, and the Middle East & Africa) - Global Trends & Forecast to 2019

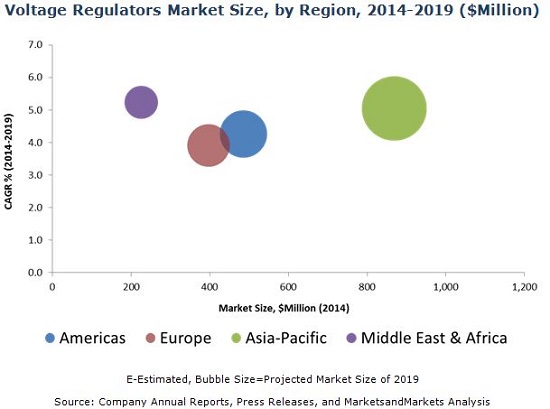

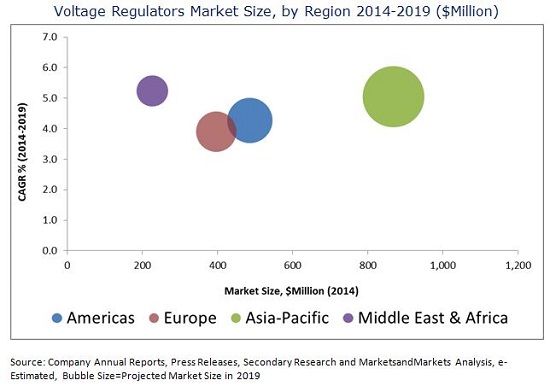

[212 Pages Report] Global voltage regulators market for power distribution is projected to grow from USD 1.9 Billion to USD 2.4 Billion at a CAGR of from 4.7% 2014 to 2019. Asia-Pacific was the single-largest market for voltage regulators in 2013 with 43.5% share, and is set to continue its dominance till 2019. The Middle East and Africa is projected to emerge as the fastest growing market during the forecast period, exhibiting a CAGR of 5.2% from 2014 to 2019, followed by Asia-Pacific at 5.0% and the Americas at 4.3% during the same period.

Global voltage regulators market has been segmented on the basis of type, end-users, and region, in terms of value. The market segments by type include ferroresonant and tap-switching voltage regulators, by end-users include commercial, industrial, and residential, and by region include Americas, Europe, Asia-Pacific, and the Middle East and Africa. The regional segment has been further divided into country-wise segmentation which includes the U.S., Brazil, the U.K., Germany, China, India, Saudi Arabia, South Africa, and others.

Voltage regulators used in power distribution play a crucial role in maintaining reliable power supply voltages across distribution lines irrespective of the fluctuating line and load conditions. This market is primarily driven by increasing power demand, expanding power distribution networks, and the need to provide reliable power supply with high efficiency. Replacement and upgrading of aged power distribution networks across countries in Europe and North America will provide attractive opportunities for the voltage regulators market in future.

This report also provides an analysis of key companies and competitive analysis of developments recorded in the industry during the past three years. Market drivers, restraints, opportunities, burning issues, and latest industry trends of the market have been discussed in detail. The leading players in the market such as Siemens AG (Germany), ABB Ltd. (Switzerland), General Electric (U.S.), Maschinenfabrik Reinhausen (Germany), Eaton Corporation (U.S.), Howard Industries (U.S.), Toshiba Corporation (Japan), Basler Electric (U.S.), J. Schneider Elektrotechnik GmbH (Germany) and others, have been profiled in this report.

In 2014, Asia-Pacific is estimated to be the largest market for voltage regulators, and is projected to remain so till 2019. The key players in this market undertake various contracts and agreements (including joint ventures, collaborations, and partnerships) as well as mergers and acquisitions to increase their share in the market. The leading voltage regulators supplier companies are expanding rapidly in fast-growing markets such as Asia-Pacific, the Middle East and Africa, and South America by opening new sales and service channels, expanding manufacturing capacities, and establishing specialized R&D centers.

Scope of the Report

This report focuses on the voltage regulators market, which has been segmented on the basis of type, end-user, and region.

On the basis of type

- Ferroresonant

- Tap-switching

On the basis of End-user

- Commercial

- Industrial

- Residential

On the basis of Region

- Americas

- Europe

- Asia-Pacific

- Middle East & Africa

Below segments can be provided on additional customization

Application

- Pole & Platform Mounted

- Pad Mounted

- Substation

Phase

- Single Phase

- Three Phase

Voltage

- 2.5-7.6

- 11-15

- 19-22

- 33&above

Global voltage regulators market for power distribution is projected to grow from USD 1.9 Billion to USD 2.4 Billion at a CAGR of from 4.7% 2014 to 2019. Increasing expenditure on power transmission and distribution infrastructure by utilities, along with growing demand for electricity from industrial and domestic sectors are some of the key drivers of voltage regulators market across the world.

With continuing industrialization in the fast-growing economies of Asia-Pacific, the Middle East and Africa and South America, there has been heavy spending on the construction of electrical power infrastructure, generating demand for voltage regulators. The migration of populations from rural to urban areas which comes along industrialization is stimulating demand for electricity consumption across these economies, leading to expansion of existing power distribution networks.

The global voltage regulators market based on type includes the segments of Ferroresonant and Tap-switching voltage regulators. The market on the basis of end-users has been segmented into commercial, industrial, and residential. Regional segments include the Americas, Europe, Asia-Pacific, and the Middle East & Africa, along with information for important countries in each region, such as the U.S., Brazil, the U.K., Germany, China, India, Japan, Saudi Arabia, U.A.E., South Africa, and others.

This report provides a detailed analysis of key companies and competitive analysis of developments recorded in the industry during the past three years. Market drivers, restraints, opportunities, burning issues, and latest industry trends of the market have been discussed in detail. The leading players in the market such as Siemens AG (Germany), ABB Ltd. (Switzerland), General Electric (U.S.), Maschinenfabrik Reinhausen (Germany), Eaton Corporation (U.S.), Howard Industries (U.S.), Toshiba Corporation (Japan), Basler Electric (U.S.), J. Schneider Elektrotechnik GmbH (Germany), and others have been profiled in this report.

Asia-Pacific is estimated to be the largest market for voltage regulators in the world during 2014, and is expected to remain dominant through to 2019. The key players of the global voltage regulators market undertake various contracts and agreements (including joint ventures, collaborations, and partnerships) to increase their share in the market. The leading companies are expanding rapidly in fast-growing markets such as Asia-Pacific, the Middle East, Africa, and South America by opening new sales and service facilities and expanding manufacturing capacity.

The Middle East and Africa is projected to emerge as the fastest growing market during the forecast period, growing at a CAGR of 5.2%, followed by the Asia-Pacific and the Americas at growth rates of 5.0% and 4.3% during the forecast period, respectively.

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodoloy (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand Side Analysis

2.2.2.1 Increasing Electricity Generation

2.2.2.2 Increasing Use of Renewable Sources for Electricity Generation

2.3 Market Size Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 35)

4 Premium Insights (Page No. - 41)

4.1 Asia-Pacific: the Largest Market in the Next Five Years for Distribution Voltage Regulators

4.2 Distribution Voltage Regulators Market, By Type, 2013

4.3 Asia-Pacific Distribution Voltage Regulator Market Size, 2013

4.4 Asia-Pacific Distribution Voltage Regulator Market in 2019, By Type

4.5 Market Size Growth During Forecast Period

4.6 Market Growth of Tap-Switching Distribution Voltage Regulators, 2014-2019

4.7 Distribution Voltage Regulators Market: Developed vs Developing Nations

4.8 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 50)

5.1 Market Evolution

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By End-User

5.2.3 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Compulsion of Voltage Regulation

5.3.1.2 Increasing Power Demand

5.3.2 Restraint

5.3.2.1 High Capital Investment

5.3.3 Opportunities

5.3.3.1 Replacements/Upgrade of Aged Distribution Networks

5.3.3.2 Urge to Increase the Efficiency of Distribution Grids

5.3.4 Challenge

5.3.4.1 Non-Uniform Standards

6 Industry Trends (Page No. - 59)

6.1 Value Chain Analysis

6.2 Porters Five Forces Analysis

6.2.1 Threat of New Entrants

6.2.1.1 Common Technology

6.2.1.2 No Specific Assets Required

6.2.2 Threat of Substitutes

6.2.2.1 Similar Product Available

6.2.3 Bargaining Power of Suppliers

6.2.3.1 Low Cost of Switching Supplier

6.2.3.2 Non-Concentration of Suppliers

6.2.4 Bargaining Power of Buyers

6.2.4.1 Low Product Differentiation

6.2.4.2 Concentration of Buyers in the Market

6.2.5 Intensity of Competitive Rivalry

6.2.5.1 Many Equally Sized Competitors

7 Distribution Voltage Regulator Market, By End-User (Page No. - 66)

7.1 Introduction

7.2 Industrial

7.2.1 Americas

7.2.2 Europe

7.2.3 Asia-Pacific

7.2.4 Middle East & Africa

7.3 Commercial

7.3.1 Americas

7.3.2 Europe

7.3.3 Asia-Pacific

7.3.4 Middle East & Africa

7.4 Residential

7.4.1 Americas

7.4.2 Europe

7.4.3 Asia-Pacific

7.4.4 Middle East & Africa

8 Distribution Voltage Regulator Market, By Type (Page No. - 88)

8.1 Introduction

8.2 Tap-Switching

8.2.1 Americas

8.2.2 Europe

8.2.3 Asia-Pacific

8.2.4 Middle East & Africa

8.3 Ferroresonant

8.3.1 Americas

8.3.2 Europe

8.3.3 Asia-Pacific

8.3.4 Middle East & Africa

9 Distribution Voltage Regulator Market, By Region (Page No. - 104)

9.1 Introduction

9.2 Americas

9.2.1 U.S.

9.2.2 Canada

9.2.3 Brazil

9.3 Europe

9.3.1 U.K.

9.3.2 France

9.3.3 Germany

9.3.4 Russia

9.4 Asia-Pacific

9.4.1 China

9.4.2 India

9.4.3 Australia

9.4.4 Japan

9.4.5 South Korea

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

10 Competitive Landscape (Page No. - 148)

10.1 Overview

10.2 Market Share Analysis

10.3 Competitive Situation & Trends

10.4 Contracts & Agreements (Including Partnerships/Joint Ventures/Collaborations)

10.5 Mergers & Acquisitions

10.6 Expansions

10.7 New Product Launches

11 Company Profiles (Page No. - 160)

11.1 Introduction

11.2 Siemens AG

11.2.1 Business Overview

11.2.2 Product Portfolio

11.2.3 Developments, 2010-2014

11.2.4 Siemens AG: SWOT Analysis

11.2.5 MnM View

11.3 General Electric Company

11.3.1 Business Overview

11.3.2 Product Portfolio

11.3.3 Recent Developments, 2013-2015

11.3.4 General Electric Company: SWOT Analysis

11.3.5 MnM View

11.4 Howard Industries, Inc.

11.4.1 Business Overview

11.4.2 Product Portfolio

11.4.3 Developments, 2013

11.4.4 Howard Industries, Inc.: SWOT Analysis

11.4.5 MnM View

11.5 Eaton Corporation PLC.

11.5.1 Business Overview

11.5.2 Product Portfolio

11.5.3 Developments, 2012-2015

11.5.4 SWOT Analysis: Eaton Corporation PLC.

11.5.5 MnM View

11.6 ABB Ltd.

11.6.1 Business Overview

11.6.2 Products

11.6.3 Recent Developments

11.6.4 SWOT Analysis: ABB Ltd.

11.6.5 MnM View

11.7 Maschinenfabrik Reinhausen GmbH (MR)

11.7.1 Business Overview

11.7.2 Products & Services

11.7.3 Recent Developments

11.7.4 Maschinenfabrik Reinhausen GmbH: SWOT Analysis

11.7.5 MnM View

11.8 Toshiba Corporation

11.8.1 Business Overview

11.8.2 Products

11.8.3 Developments

11.8.4 SWOT Analysis

11.8.5 MnM View

11.9 Basler Electric Company

11.9.1 Business Overview

11.9.2 Products & Services

11.9.3 Recent Developments

11.10 Schweitzer Engineering Laboratories, Inc. (Sel)

11.10.1 Business Overview

11.10.2 Products & Services

11.10.3 Recent Developments

11.11 J. Schneider Elektrotechnik GmbH

11.11.1 Business Overview

11.11.2 Products & Services

11.11.3 Recent Developments

11.12 SL Industries, Inc.

11.12.1 Business Overview

11.12.2 Products & Services

11.12.3 Recent Developments

11.13 Belotti S.R.L.

11.13.1 Business Overview

11.13.2 Products

11.13.3 Developments

11.14 Daihen Corporation

11.14.1 Business Overview

11.14.2 Products

11.14.3 Developments

11.15 Tebian Electric Apparatus Co. Ltd.

11.15.1 Business Overview

11.15.2 Products

11.15.3 Developments

11.16 Utility Systems Technologies Inc.

11.16.1 Business Overview

11.16.2 Products

11.16.3 Developments

12 Appendix (Page No. - 209)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (78 Tables)

Table 1 The Compulsion of Voltage Regulation and Increasing Power Demand are Propelling the Growth of the Distribution Voltage Regulator Market

Table 2 Lack of Industry Professionals Restrain Market Growth

Table 3 Reclamation & Redevelopment of Oilfield & Growing Subsea Operation are Opportunities for the Distribution Voltage Regulator Market

Table 4 Absence of Uniform Standards is A Challenge

Table 5 Distribution Voltage Regulator Market Size, By End-User, 20122019 ($Million)

Table 6 Industrial Distribution Voltage Regulator Market Size, By Region, 20122019 ($Million)

Table 7 Americas: Industrial Distribution Voltage Regulator Market Size, By Countries, 20122019 ($Million)

Table 8 Europe: Industrial Distribution Voltage Regulator Market Size, By Countries, 20122019 ($Million)

Table 9 Asia-Pacific: Industrial Distribution Voltage Regulator Market Size, By Countries, 20122019 ($Million)

Table 10 Middle East & Africa: Industrial Distribution Voltage Regulator Market Size, By Countries, 20122019 ($Million)

Table 11 Commercial Distribution Voltage Regulator Market Size, By Region, 20122019 ($Million)

Table 12 Americas: Commercial Distribution Voltage Regulator Market Size, By Countries, 20122019 ($Million)

Table 13 Europe: Commercial Distribution Voltage Regulator Market Size, By Countries, 20122019 ($Million)

Table 14 Asia-Pacific: Commercial Distribution Voltage Regulator Market Size, By Countries, 20122019 ($Million)

Table 15 Middle East & Africa: Commercial Distribution Voltage Regulator Market Size, By Countries, 20122019 ($Million)

Table 16 Residential Distribution Voltage Regulator Market Size, By Region, 20122019 ($Million)

Table 17 Americas: Residential Distribution Voltage Regulator Market Size, By Countries, 20122019 ($Million)

Table 18 Europe: Residential Distribution Voltage Regulator Market Size, By Countries, 20122019 ($Million)

Table 19 Asia-Pacific: Residential Distribution Voltage Regulator Market Size, By Countries, 20122019 ($Million)

Table 20 Middle East & Africa: Residential Distribution Voltage Regulator Market Size, By Countries, 20122019 ($Million)

Table 21 Distribution Voltage Regulator Market Size, By Type, 2012-2019 ($Million)

Table 22 Tap-Switching Distribution Voltage Regulator Market Size, By Region, 2012-2019 ($Million)

Table 23 Americas: Tap-Switching Distribution Voltage Regulator Market Size, By Country, 2012-2019 ($Million)

Table 24 Europe: Tap-Switching Distribution Voltage Regulator Market Size, By Country, 2012-2019 ($Million)

Table 25 Asia-Pacific: Tap-Switching Distribution Voltage Regulator Market Size, By Country, 2012-2019 ($Million)

Table 26 Middle East & Africa: Tap-Switching Distribution Voltage Regulator Market Size, By Country, 2012-2019 ($Million)

Table 27 Ferroresonant Distribution Voltage Regulator Market Size, By Region, 2012-2019 ($Million)

Table 28 Americas: Ferroresonant Distribution Voltage Regulator Market Size, By Country, 2012-2019 ($Million)

Table 29 Europe: Ferroresonant Distribution Voltage Regulator Market Size, By Country, 2012-2019 ($Million)

Table 30 Asia-Pacific: Ferroresonant Distribution Voltage Regulator Market Size, By Country, 2012-2019 ($Million)

Table 31 Middle East & Africa: Ferroresonant Distribution Voltage Regulator Market Size, By Country, 2012-2019 ($Million)

Table 32 Distribution Voltage Regulator Market Size, By Region, 2012-2019 ($Million)

Table 33 Americas: Voltage Regulators Market Size, By Country, 2012-2019 ($Million)

Table 34 Americas: Market Size, By End-User, 2012-2019 ($Million)

Table 35 Americas: Market Size, By Type, 2012-2019 ($Million)

Table 36 U.S.: Voltage Regulators Market Size, By End-User, 2012-2019 ($Million)

Table 37 U.S.: Market Size, By Type, 2012-2019 ($Million)

Table 38 Canada: Voltage Regulators Market Size, By End-User, 2012-2019 ($Million)

Table 39 Canada: Market Size, By Type, 2012-2019 ($Million)

Table 40 Brazil: Voltage Regulators Market Size, By End-User, 2012-2019 ($Million)

Table 41 Brazil: Market Size, By Type, 2012-2019 ($Million)

Table 42 Europe: Voltage Regulators Market Size, By Country, 2012-2019 ($Million)

Table 43 Europe: Market Size, By End-User, 2012-2019 ($Million)

Table 44 Europe: Market Size, By Type, 2012-2019 ($Million)

Table 45 U.K.: Voltage Regulators Market Size, By End-User, 2012-2019 ($Million)

Table 46 U.K.: Market Size, By Type, 2012-2019 ($Million)

Table 47 France: Voltage Regulators Market Size, By End-User, 2012-2019 ($Million)

Table 48 France: Voltage Regulators Market Size, By Type, 2012-2019 ($Million)

Table 49 Germany: Voltage Regulators Market Size, By End-User, 2012-2019 ($Million)

Table 50 Germany: Voltage Regulators Market Size, By Type, 2012-2019 ($Million)

Table 51 Russia: Voltage Regulator Market Size, By End-User, 2012-2019 ($Million)

Table 52 Russia: Voltage Regulators Market Size, By Type, 2012-2019 ($Million)

Table 53 Asia-Pacific:Voltage Regulators Market Size, By Country, 2012-2019 ($Million)

Table 54 Asia-Pacific: Voltage Regulators Market Size, By End-User, 2012-2019 ($Million)

Table 55 Asia-Pacific: Voltage Regulators Market Size, By Type, 2012-2019 ($Million)

Table 56 China: Voltage Regulators Market Size, By End-User, 2012-2019 ($Million)

Table 57 China: Voltage Regulators Market Size, By Type, 2012-2019 ($Million)

Table 58 India: Voltage Regulators Market Size, By End-User, 2012-2019 ($Million)

Table 59 India: Voltage Regulators Market Size, By Type, 2012-2019 ($Million)

Table 60 Australia: Voltage Regulators Market Size, By End-User, 2012-2019 ($Million)

Table 61 Australia: Voltage Regulators Market Size, By Type, 2012-2019 ($Million)

Table 62 Japan: Voltage Regulators Market Size, By End-User, 2012-2019 ($Million)

Table 63 Japan: Voltage Regulators Market Size, By Type, 2012-2019 ($Million)

Table 64 South Korea: Voltage Regulators Market Size, By End-User, 2012-2019 ($Million)

Table 65 South Korea: Voltage Regulators Market Size, By Type, 2012-2019 ($Million)

Table 66 Middle East & Africa: Voltage Regulators Market Size, By Country, 2012-2019 ($Million)

Table 67 Middle East & Africa: Voltage Regulators Market Size, By End-User, 2012-2019 ($Million)

Table 68 Middle East & Africa: Voltage Regulators Market Size, By Type, 2012-2019 ($Million)

Table 69 Saudi Arabia: Voltage Regulators Market Size, By End-User, 2012-2019 ($Million)

Table 70 Saudi Arabia: Voltage Regulators Market Size, By Type, 2012-2019 ($Million)

Table 71 UAE: Voltage Regulators Market Size, By End-User, 2012-2019 ($Million)

Table 72 UAE: Voltage Regulators Market Size, By Type, 2012-2019 ($Million)

Table 73 South Africa: Voltage Regulators Market Size, By End-User, 2012-2019 ($Million)

Table 74 South Africa: Voltage Regulators Market Size, By Type, 2012-2019 ($Million)

Table 75 Contracts & Agreements (Including Partnerships/Joint Ventures/Collaborations), 20112015

Table 76 Mergers & Acquisitions, 2011-2015

Table 77 Expansions, 2014

Table 78 New Product Launches, 2012-2015

List of Figures (62 Figures)

Figure 1 Markets Covered: Global Distribution Voltage Regulator Market

Figure 2 Distribution Voltage Regulator Market: Research Design

Figure 3 Breakdown of Primary Sources: By Company Type, Designation, and Region

Figure 4 Electricity Generation Capacity has Increased By Nearly 15% in the Last Five Years

Figure 5 Renewable Sources to Account for 31% of the Total Electricity Generation By 2035

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation Methodology

Figure 9 Global Spending on Transmission & Distribution Equipment, 2014-2020

Figure 10 Snapshot: Market for Industrial End-Users is Expected to Grow at the Highest Rate During the Forecast Period

Figure 11 Middle East & Africa and Asia-Pacific are the Most Promising Markets

Figure 12 ABB Ltd. is the Most Active Company in Signing Contracts and Agreements (Including JVS/Partnerships/Collaborations)

Figure 13 Attractive Market Opportunities for Distribution Voltage Regulators

Figure 14 Distribution Voltage Regulators Market Share (Value), By Country, 2013

Figure 15 Tap-Swiching Type Dominated the Distribution Voltage Regulators Market in 2013

Figure 16 Industrial End-Users Generated the Most Demand for Distribution Voltage Regulators

Figure 17 Tap-Switching Distribution Voltage Regulators are Expected to Continue to Their Domination Over the Asia-Pacific Market in 2019

Figure 18 Demand From Industrial End-Users Will Drive the Growth of Voltage Regulator Market During 2014-2019

Figure 19 Middle East & Africa Will Be the Fastest Growing Market of Tap-Switching Distribution Voltage Regulators During the Forecast Period

Figure 20 Distribution Voltage Regulators Market Size, By Major Countries, 2014-2019 ($Million)

Figure 21 Middle-East & Africa is the Fastest Growing Market During the Forecast Period

Figure 22 Distribution Voltage Regulator is Increasingly Becoming A Part of Integrated Energy Management Systems

Figure 23 Market Segmentation of Distribution Voltage Regulators

Figure 24 Segmentation of the Voltage Regulators Market, By Type

Figure 25 Segmentation of the Voltage Regulators Market, By End-User

Figure 26 Segmentation of the Distribution Voltage Regulators Market, By Region

Figure 27 Market Dynamics of Distribution Voltage Regulator

Figure 28 Value Chain Analysis: Major Value is Added During Operation & After-Sales Phase

Figure 29 Porters Five Forces Analysis: Intensity of Competitive Rivalry is High in the Voltage Regulator Market

Figure 30 Voltage Regulators Market Share (Value), By End-User, 2013

Figure 31 Market for Industrial End-Users is Expected to Grow at the Fastest Pace, 20142019

Figure 32 Distribution Voltage Regulator Market Share (Value), Industrial End-Users, By Regional Share, 2013

Figure 33 Distribution Voltage Regulator Market Share (Value), Commercial End-Users, By Regional Share, 2013

Figure 34 Residential Distribution Voltage Regulator Market (Value), By Regional Share, 2013

Figure 35 Distribution Voltage Regulator Market Share (Value), By Type, 2013

Figure 36 Tap-Switching Market to Grow at the Highest Rate During the Forecast Period

Figure 37 Tap-Switching Distribution Voltage Regulator Market Share (Value), By Region, 2013

Figure 38 Ferroresonant Distribution Voltage Regulator Market Share (Value), By Region, 2013

Figure 39 Distribution Voltage Regulator Market Share (Value), By Region, 2013

Figure 40 Regional Snapshot Growth Rate of Distribution Voltage Regulator Market in Important Countries, 2014-2019

Figure 41 Asia-Pacific and the Americas are Expected to Be the Top Two Largest Markets in the Next Five Years

Figure 42 Siemens and ABB Ltd. are the Most Active Players, Utilizing All Possible Growth Strategies

Figure 43 Eaton Corporation Grew at the Highest Rate During 2010-2013

Figure 44 Battle for Market Share: Contracts & Agreements is the Key Growth Strategy

Figure 45 Distribution Voltage Regulator Market Share (Value), By Key Player, 2013

Figure 46 The Largest Number of Developments in 2014 Were Related to Contracts & Agreements

Figure 47 Regional Revenue Mix of the Top 5 Market Players

Figure 48 Siemens: Company Snapshot

Figure 49 General Electric Company: Company Snapshot

Figure 50 Howard Industries Inc.: Company Snapshot

Figure 51 Eaton Corporation PLC.: Company Snapshot

Figure 52 ABB Ltd.: Company Snapshot

Figure 53 Maschinenfabrik Reinhausen GmbH: Company Snapshot

Figure 54 Toshiba Corporation: Company Snapshot

Figure 55 Basler Electric: Company Snapshot

Figure 56 Schweitzer Engineering Laboratories, Inc.: Company Snapshot

Figure 57 J. Schneider Elektrotechnik GmbH: Company Snapshot

Figure 58 SL Industries Inc. : Company Snapshot

Figure 59 Belotti: Company Snapshot

Figure 60 Daihen Corporation: Company Snapshot

Figure 61 Tebian Electric Apparatus: Company Snapshot

Figure 62 Utility Systems Technologies Inc.: Company Snapshot

Growth opportunities and latent adjacency in Voltage Regulators Market