Electric Boats Market by End Use (Recreational Boats, Commercial Boats, Military & Law Enforcements Boats), Boat Power (< 5kW, 5-30kW, >30kW), Boat Size (< 20ft, 20-50ft, >50ft), Power Source, Hull Design and Region - Global Forecast to 2030

Update: 10/22/2024

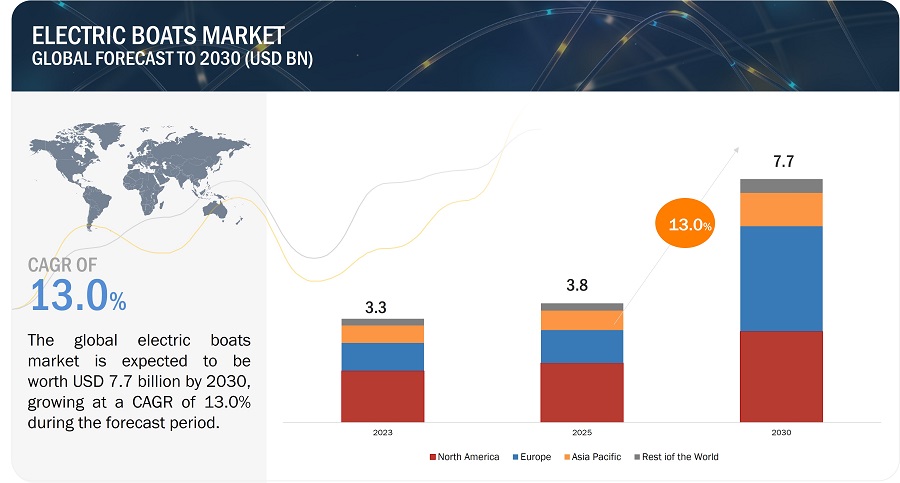

The Electric Boats Market size is projected to grow from USD 3.3 Billion in 2023 to USD 7.7 Billion by 2030, at a CAGR of 13.0% from 2023 to 2030. The growth in Electric Boats Industry is driven by technological advancements in boats and electrical systems, environmental concerns, and changing consumer preferences.

Electric Boats Market Forecast to 2030

To know about the assumptions considered for the study, Request for Free Sample Report

Electric boats Market Dynamics

Driver: Clean and green boating solutions

Environmental sustainability drives the electric boat market, as customers increasingly prioritize eco-friendly transportation options. Industry stakeholders should focus on promoting clean and green boating solutions. This encapsulates the need to raise awareness about the environmental benefits of electric boats, such as their zero emissions and reduced impact on marine ecosystems. It involves educating boaters and the public about the importance of transitioning to electric propulsion systems to mitigate air and water pollution, minimize noise disturbances, and protect fragile aquatic environments. Collaborative efforts among electric boat manufacturers, regulators, environmental organizations, and boating communities are essential to drive the adoption of electric boats and create a more sustainable boating industry. Additionally, initiatives to develop and support sustainable practices, such as recycling programs for batteries and environmentally friendly disposal methods, further contribute to the clean and green ethos of the electric boat market.

The use of electric and hybrid boats for inland water transportation like the movement of people and goods on rivers, canals, lakes, and other inland waterways can be a clean and green boating solution. Electric and hybrid boats produce zero or significantly lower emissions compared to conventional fuel-powered vessels, reducing the environmental impact of inland water transportation.

Restraints: Limited availability and high cost of batteries

The production capacity of high-performance batteries suitable for electric boats is still relatively limited compared to the demand. The global supply chain for large-scale lithium-ion batteries, which are commonly used in electric boats, is currently constrained. This limited availability can result in challenges for boat manufacturers to secure an adequate supply of batteries to meet market demand. The scarcity of batteries can lead to delays in production and potential bottlenecks in the supply chain, hindering the widespread adoption of electric boats.

Batteries constitute a significant portion of the overall cost of electric boats. The high cost of batteries is primarily attributed to the complexity of manufacturing and the limited scale of production. The cost of materials, such as lithium-ion cells, electrode materials, and other components, can also contribute to the high price tag. The high upfront cost of batteries adds to the overall cost of electric boats, making them more expensive compared to traditional fuel-powered boats. This can be a deterrent for potential buyers, especially those who prioritize upfront affordability.

Opportunity: Potential for battery charging via renewable energy sources

The electric boat market presents a significant opportunity for charging batteries via renewable energy sources. One of the key advantages of electric boats is their compatibility with renewable energy generation, such as solar, wind, and hydroelectric power. As the world shifts towards a greener and more sustainable future, leveraging renewable energy sources for charging electric boat batteries aligns perfectly with this trajectory. By tapping into renewable energy, electric boat owners can charge their batteries using clean and abundant sources of power. Solar panels installed on boat decks or nearby charging stations can harness the energy from the sun, while wind turbines positioned strategically can capture wind energy for charging purposes. Additionally, hydroelectric power generated from rivers, tidal currents, or waves can also be utilized to charge electric boat batteries.

The electric yacht market is experiencing growth as environmental sustainability becomes a priority for customers seeking eco-friendly transportation. A key factor driving the electric yacht market is educating the public and boating community about the positive effects of transitioning to electric propulsion systems. Initiatives within the electric yacht market that support sustainable practices, such as battery recycling programs and environmentally friendly disposal methods, further enhance its clean and green reputation. The electric yacht market is thus shaped by a commitment to eco-conscious yachting solutions, which respond to the increasing consumer and industry interest in reducing the environmental footprint of boating. This overall will help grow to electric boats market.

Challenge: Inadequate charging infrastructure

The inadequate charging infrastructure presents a significant challenge for the electric boat market. Unlike conventional boats that can refuel at widely available fuel stations, electric boats rely on dedicated charging infrastructure to recharge their batteries. However, the current charging infrastructure for electric boats is limited and not as widespread as fueling stations. This lack of infrastructure restricts the range and usability of electric boats, particularly for long-distance or extended-duration trips. It also poses challenges for boat owners who may not have easy access to charging facilities, limiting their ability to recharge conveniently. Additionally, the limited availability of charging stations can lead to congestion and potential delays when multiple electric boat owners try to access the same charging point. To foster the growth of the electric boat market, there needs to be significant investment and development of a robust charging infrastructure that covers popular boating destinations and ensures convenient and reliable charging options for electric boat owner.

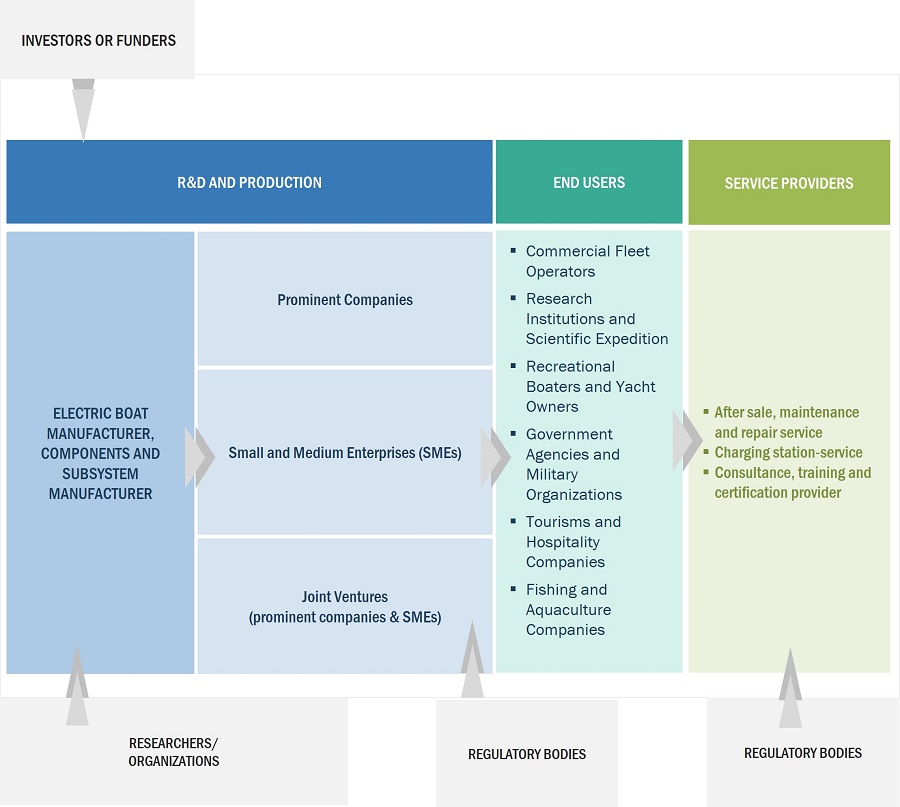

Electric Boats Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of electric boats. These companies have established a strong foothold in the market through diversified product portfolios, advanced technologies, and robust global sales and marketing networks. The prominent companies are Brunswick Corporation (US), Groupe Beneteau (France), Greenline Yachts (Slovenia), Candela (Sweden), and Silent Yachts (Austria). Commercial Passenger vessel operators, Cargo and tanker operators, defense organizations, private watercraft users, fishing organizations, oil and gas exploration companies, and research companies are some of the major consumers of electric boats.

Recreational Boat Segment to dominate market share during the forecast period

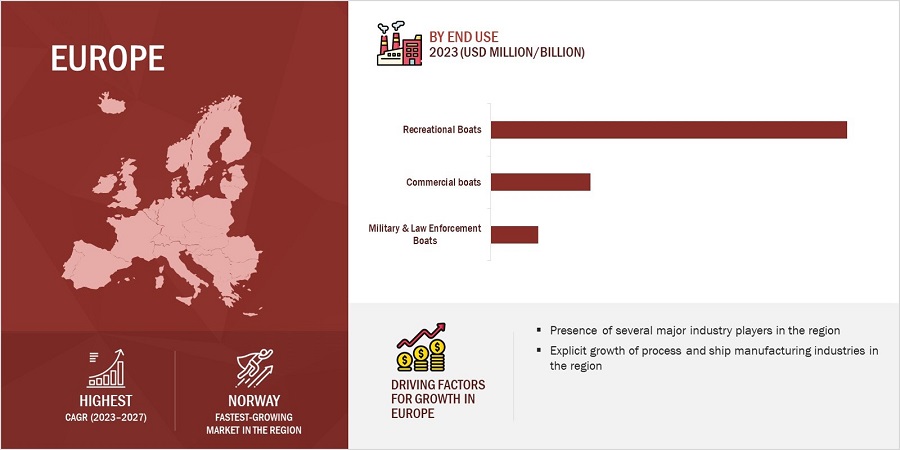

Based on End Use, the Electric boats Market has been segmented into Recreational boats, Commercial Boats, amd Military & Law enforcements boats. Recreational boats Segment is witnessing large market share during the forecast period. Recreational boaters are becoming more conscious of the environmental impact of their activities. Electric boats offer a greener alternative with zero emissions, allowing boaters to enjoy the water while minimizing their carbon footprint. Electric boats also provide a quieter and more serene boating experience compared to traditional gasoline-powered boats.

>30kW segment is expected grow the highest during the forecast period

Based boat power, >30 kW segment to witness highest growth in the electric boats market. Advances in battery technology, such as higher energy density and faster charging capabilities, have made it more feasible to develop electric propulsion systems with sufficient power output for larger boats. This has reduced the limitations that were previously associated with electric propulsion for higher-power applications.

The < 20 ft segment is to witness largest market share during the forecast period

Based on boat size, < 20 boat size segment witnessing largest market share during forecast period. Smaller electric boats are often well-suited for use on urban waterways, lakes, and calm coastal areas where shorter distances are common. These boats are ideal for activities such as sightseeing, leisure cruising, and short trips. Their compact size and maneuverability make them convenient for navigating tight spaces and shallow waters, which are frequently found in these environments.

Europe is projected to witness the highest growth during the forecast period.

Europe leads the Electric boats Market due presence of key players, boat manufacturers, and component manufacturers, which are a few factors expected to drive the growth of the Electric boats Market in the region. These players invest in developing technological advanced electric boating solutions to improve efficiency and reliability. Major manufacturers and suppliers of Electric boats in this region include Groupe Beneteau (France), Greenline Yachts (Slovenia), Candela (Sweden), and Silent Yachts (Austria).

Electric Boats Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Electric Boat Industry Companies: Top Key Market Players

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size

|

USD 3.3 Billion in 2023

|

|

Projected Market Size

|

USD 7.7 Billion by 2030

|

|

Growth Rate

|

CAGR of 13.0%

|

|

Market size available for years |

2019-2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2030 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

End Use, Boat Power, Boat Size |

|

Geographies Covered |

North America, Europe, Asia-Pacific, Rest of the World |

|

Companies Covered |

Brunswick Corporation (US), Groupe Beneteau (France), Greenline Yachts (Slovenia), Candela (Sweden), and Silent Yachts (Austria). |

Electric Boats Market Highlights

This research report categorizes the Electric Boats Market based on End Use, Boat Power, Boat Size and Region

|

Segment |

Subsegment |

|

By End Use |

|

|

By Boat power |

|

|

By Boat Size |

|

|

By Region |

|

Recent Developments

- In May 2023, Mercury Marine and JJE Partner to Expand Avator Electric Product Line. Mercury Marine, a division of Brunswick Corporation, and JJE, an electrified propulsion leader, have announced a partnership to expand the Avator electric product line to higher power applications. The new partnership will allow Mercury Marine to introduce higher power electric motors and systems, up to 50 kW

- In August 2022, Polestar and Candela have joined forces in a significant partnership aimed at accelerating the adoption of electric boats on a mass scale. The collaboration involves Polestar, the Swedish electric car manufacturer, providing advanced battery and charging systems for Candela's innovative hydrofoiling speedboats, marking a pivotal moment for electrification in the maritime industry.

- In July 2022, As part of their strategic collaboration, Beneteau will directly procure E-Motion™ 180E powertrains from Vision Marine. While specific order commitments have not been disclosed, the well-established relationship between the two companies serves as a significant endorsement of advanced technology. This partnership presents a promising revenue avenue for Vision Marine's flagship E-Motion™ 180E electric propulsion system, known for its versatility to be installed on a wide range of boats spanning from 18 to 29 feet in size.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Electric boats Market?

The Electric boats Market is being driven by the increasing environmental concerncs and the need for reduced emissions.

What are the key sustainability strategies adopted by leading players operating in the Electric boats Market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Electric boats Market. The major players include Brunswick Corporation (US), Groupe Beneteau (France), Greenline Yachts (Slovenia), Candela (Sweden), and Silent Yachts (Austria). These players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market.

What are the new emerging technologies and use cases disrupting the Electric boats Market?

Some of the major emerging technologies and use cases disrupting the market include high-energy batteries and research to find the adoption of hydrogen fuel cells. Recreational boating manufacturers are already incorporating solar panels to drive their boats and are finding ways to use renewable energy sources to drive low-load vessels.

Who are the key players and innovators in the ecosystem of the Electric boats Market?

The key players in the Electric boats Market include Brunswick Corporation (US), Groupe Beneteau (France), Greenline Yachts (Slovenia), Candela (Sweden), and Silent Yachts (Austria).

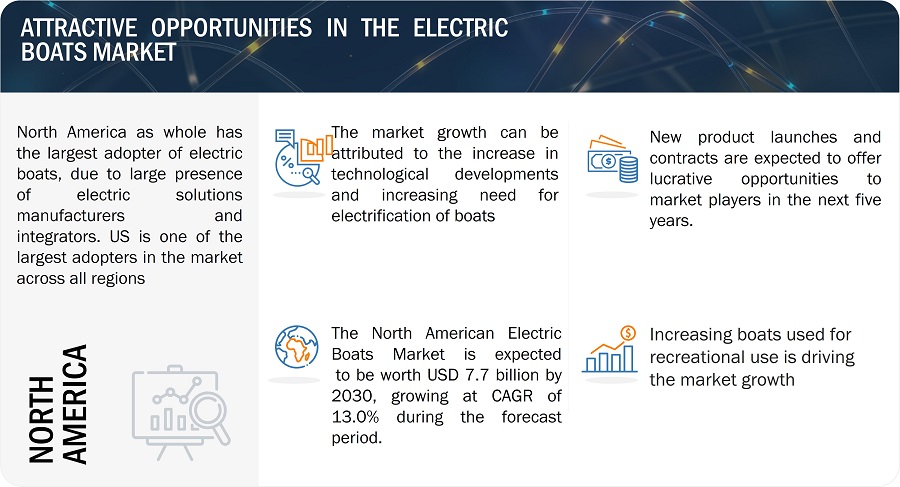

Which region is expected to hold the highest market share in the Electric boats Market?

The Electric boats Market in North America is projected to hold the highest market share during the forecast period due to North America having the largest demand for recreational boating in the world.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Emergence of green boating solutions- Development of innovative electric boat technologies- Booming maritime tourism and surface water sport industry- Improved electric boat range and performance- Cost efficiency of electric and hybrid boatsRESTRAINTS- Shortage of raw materials- Limited availability and high cost of batteriesOPPORTUNITIES- Development of high-powered batteries- Potential for battery charging via renewable energy sources- Advancements in marine electronics and controlCHALLENGES- Inadequate charging infrastructure- Technological limitations

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 VALUE CHAIN ANALYSISRAW MATERIALSRESEARCH AND DEVELOPMENTCOMPONENT MANUFACTURINGOEMSEND USERSAFTER-SALES SERVICES

-

5.5 ECOSYSTEM MAPPINGPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- 5.7 TRADE DATA ANALYSIS

-

5.8 TECHNOLOGY ANALYSISLITHIUM-SULFUR BATTERIES (LI-S)HYDROGEN FUEL CELLSHIGH ENERGY DENSITY ELECTROCHEMICAL STORAGE

- 5.9 TARIFF AND REGULATORY LANDSCAPE

- 5.10 AVERAGE SELLING PRICE ANALYSIS

- 5.11 VOLUME DATA

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY ADVANCEMENTS IN ELECTRIC BOATS MARKETBATTERY TECHNOLOGYELECTRIC PROPULSION SYSTEMSCHARGING INFRASTRUCTURESMART TECHNOLOGIES AND CONNECTIVITY

-

6.3 EMERGING TECHNOLOGY TRENDS IN ELECTRIC BOAT MANUFACTURING3D PRINTINGARTIFICIAL INTELLIGENCEPREDICTIVE MAINTENANCE

- 6.4 SUPPLY CHAIN ANALYSIS

-

6.5 USE CASE ANALYSISUSE CASE 1: RISING ENTHUSIASM FOR BOATING DRIVES US ECONOMYUSE CASE 2: COLUMBIAN NAVY'S COTENERGY BOAT PROVIDES ECO-FRIENDLY AND ADAPTABLE CAPABILITIES FOR COASTAL OPERATIONSUSE CASE 3: SEABUBBLES ELECTRIC HYDROFOIL WATER TAXI PROVIDES EFFICIENT TRANSPORTATION SERVICES BETWEEN LAKES IN FRANCE USING INNOVATIVE FLYING TECHNOLOGY

-

6.6 PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 RECREATIONAL BOATSCRUISING BOATS- Growing use of cruising boats in leisure travel and ecotourism to drive marketSPEEDBOATS- Increasing use in water sports to drive market

-

7.3 COMMERCIAL BOATSPASSENGER/CREW FERRY BOATS- Need for safe and comfortable transportation to drive marketFISHING BOATS- Increasing use of electric boats for inshore and nearshore fishing to drive marketTUG & WORKBOATS- Increasing use of electric boats in offshore wind farms and aquaculture to drive marketOTHER COMMERCIAL BOATS

-

7.4 MILITARY AND LAW ENFORCEMENT BOATSPATROL BOATS- Increasing use in stealth patrolling to drive marketATTACK/COMBAT BOATS- Increasing use due to agility and stealth to drive market

- 8.1 INTRODUCTION

-

8.2 HYDROFOIL DESIGNINCREASING USE DUE TO REDUCED DRAG AND SMOOTHER FLOW TO DRIVE MARKET

-

8.3 CONVENTIONAL SINGLE HULL DESIGNINCREASED RETROFITTING OF TRADITIONAL HULL BOATS WITH ELECTRIC PROPULSION TO DRIVE MARKET

-

8.4 MULTIHULL DESIGNINCREASED STABILITY AND REDUCED DRAG OFFERED BY MULTIHULL DESIGNS TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 <5 KWINCREASING RECREATIONAL BOATING IN CALM WATERS TO DRIVE MARKET

-

9.3 5–30 KWINCREASED ADOPTION OF ELECTRIC BOATS FOR RECREATIONAL USE AND COMMERCIAL TRANSPORTATION TO DRIVE MARKET

-

9.4 >30 KWINCREASE IN OCEAN BOATING WITH SUSTAINABLE ELECTRIC BOATS TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 <20 FEETGROWING INLAND WATER TOURISM AND COMMERCIAL TRANSPORTATION TO DRIVE MARKET

-

10.3 20–50 FEETINCREASING DEMAND FOR COMPACT AND ECO-FRIENDLY BOATS TO DRIVE MARKET

-

10.4 >50 FEETRISING MARITIME TOURISM TO DRIVE MARKET

- 11.1 INTRODUCTION

-

11.2 BATTERY-POWERED BOATSDEVELOPMENT IN BATTERY TECHNOLOGIES TO DRIVE MARKET

-

11.3 SOLAR-POWERED BOATSUNINTERRUPTED ENERGY SUPPLY, ENHANCED OPERATIONAL DISTANCE, AND LESSER RELIANCE ON CONVENTIONAL SYSTEMS TO DRIVE MARKET

-

11.4 HYBRID-POWERED BOATSDEMAND FOR ECOFRIENDLY BOATS AND BETTER RANGE TO DRIVE MARKET

-

12.1 INTRODUCTIONRECESSION IMPACT ANALYSIS

-

12.2 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Recreational sea transport, international and domestic trade, and oil & gas exploration operations to drive marketCANADA- Increasing recreational boating, fishing, tourism, and transportation to drive market

-

12.3 EUROPEPESTLE ANALYSIS: EUROPENORWAY- Implementation of IMO 2020 rules to drive adoption of hybrid and electric-driven propulsionGREECE- Increase in ecotourism and island-hopping activities to drive marketNETHERLANDS- Government backing for zero-emission vessels to drive marketFINLAND- Increasing focus on green marine technologies to drive marketDENMARK- Stringent environmental regulations and rising eco-consciousness to drive marketGERMANY- Upgrades to ship equipment to drive marketREST OF EUROPE

-

12.4 ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Modernization of inland waterway transportation and emphasis on green and sustainable transportation to drive marketJAPAN- Technological advancements and innovation to drive marketNEW ZEALAND- Ecotourism and awareness of sustainable marine transportation to drive marketSOUTH KOREA- Implementation of ECA regulations to drive marketINDIA- Green investments, initiatives, and incentives in maritime industry to drive marketREST OF ASIA PACIFIC

-

12.5 REST OF THE WORLDPESTLE ANALYSIS: REST OF THE WORLDMIDDLE EAST & AFRICA- Increasing installation of superchargers at smaller ports to drive marketLATIN AMERICA- Eco-friendly policies of various governments to drive market

- 13.1 INTRODUCTION

- 13.2 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2022

-

13.3 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 13.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

13.5 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 13.6 COMPETITIVE BENCHMARKING

-

13.7 COMPETITIVE SCENARIODEALSEXPANSIONS

-

14.1 KEY PLAYERSBRUNSWICK CORPORATION- Business overview- Products offered- Recent developments- MnM viewGROUPE BENETEAU- Business overview- Products offered- Recent developments- MnM viewGREENLINE YACHTS- Business overview- Products offered- MnM viewCANDELA TECHNOLOGY AB- Business overview- Products offered- Recent developments- MnM viewSILENT YACHTS- Business overview- Products offered- Recent developments- MnM viewBOOTE MARIAN GMBH- Business overview- Products offered- Recent developmentsX SHORE- Business overview- Products offered- Recent developmentsDUFFY ELECTRIC BOAT COMPANY- Business overview- Products offeredSAY CARBON YACHTS- Business overview- Products offeredQ YACHTS- Business overview- Products offeredRUBAN BLEU- Business overview- Products offered- Recent developmentsFRAUSCHER- Business overview- Products offered- Recent developmentsPURE WATERCRAFT- Business overview- Products offered- Recent developmentsNAVALT- Business overview- Products offeredINGENITY ELECTRIC- Business overview- Products offered- Recent developmentsQUADROFOIL D.O.O.- Business overview- Products offered

-

14.2 OTHER PLAYERSFOUR WINNSCALLBOATSTORQEEDO GMBHSALONA YACHTSOCEANVOLTELWOOD BOATS OYEVOY ASAZIMUT YACHTSCOSMOPOLITAN YACHTSALFASTREET MARINE

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 ELECTRIC BOATS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD CONVERSION RATES

- TABLE 3 LIST OF PUBLICATIONS AND ORDER BOOKS OF SHIPYARDS/COMPONENT SUPPLIERS/REGULATORY PUBLICATIONS

- TABLE 4 LIST OF MAGAZINES/PRESS RELEASES/NEWSLETTERS

- TABLE 5 LIST OF KEY PRIMARY SOURCES

- TABLE 6 PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 ELECTRIC BOATS MARKET: ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 8 COUNTRY-WISE IMPORTS, 2018–2022 (UNITS)

- TABLE 9 COUNTRY-WISE EXPORTS, 2018–2022 (UNITS)

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 13 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 14 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 15 AVERAGE SELLING PRICE OF ELECTRIC BOATS, BY BOAT TYPE (USD THOUSAND)

- TABLE 16 ELECTRIC BOATS MARKET, BY BOAT TYPE, 2019–2022 (UNITS)

- TABLE 17 ELECTRIC BOATS MARKET, BY BOAT TYPE, 2023–2030 (UNITS)

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING ELECTRIC BOATS, BY END USE (%)

- TABLE 19 KEY BUYING CRITERIA FOR ELECTRIC BOATS, BY END USE

- TABLE 20 ELECTRIC BOATS MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 21 MARINE ELECTRIC VEHICLE MARKET: KEY PATENTS

- TABLE 22 ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 23 ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 24 ELECTRIC BOATS MARKET, BY RECREATIONAL BOATS, 2019–2022 (USD MILLION)

- TABLE 25 ELECTRIC BOATS MARKET, BY RECREATIONAL BOATS, 2023–2030 (USD MILLION)

- TABLE 26 ELECTRIC BOATS MARKET, BY COMMERCIAL BOATS, 2019–2022 (USD MILLION)

- TABLE 27 ELECTRIC BOATS MARKET, BY COMMERCIAL BOATS, 2023–2030 (USD MILLION)

- TABLE 28 ELECTRIC BOATS MARKET, BY MILITARY AND LAW ENFORCEMENT BOATS, 2019–2022 (USD MILLION)

- TABLE 29 ELECTRIC BOATS MARKET, BY MILITARY AND LAW ENFORCEMENT BOATS, 2023–2030 (USD MILLION)

- TABLE 30 ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 31 ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 32 ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 33 ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 34 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 35 ELECTRIC BOATS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 ELECTRIC BOATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 37 NORTH AMERICA: ELECTRIC BOATS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 38 NORTH AMERICA: ELECTRIC BOATS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 39 NORTH AMERICA: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 40 NORTH AMERICA: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 41 NORTH AMERICA: ELECTRIC BOATS MARKET, BY RECREATIONAL BOATS, 2019–2022 (USD MILLION)

- TABLE 42 NORTH AMERICA: ELECTRIC BOATS MARKET, BY RECREATIONAL BOATS, 2023–2030 (USD MILLION)

- TABLE 43 NORTH AMERICA: ELECTRIC BOATS MARKET, BY COMMERCIAL BOATS, 2019–2022 (USD MILLION)

- TABLE 44 NORTH AMERICA: ELECTRIC BOATS MARKET, BY COMMERCIAL BOATS, 2023–2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: ELECTRIC BOATS MARKET, BY MILITARY AND LAW ENFORCEMENT BOATS, 2019–2022 (USD MILLION)

- TABLE 46 NORTH AMERICA: ELECTRIC BOATS MARKET, BY MILITARY AND LAW ENFORCEMENT BOATS, 2023–2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 48 NORTH AMERICA: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 50 NORTH AMERICA: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 51 US: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 52 US: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 53 US: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 54 US: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 55 US: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 56 US: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 57 CANADA: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 58 CANADA: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 59 CANADA: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 60 CANADA: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 61 CANADA: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 62 CANADA: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 63 EUROPE: ELECTRIC BOATS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 64 EUROPE: ELECTRIC BOATS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 65 EUROPE: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 66 EUROPE: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 67 EUROPE: ELECTRIC BOATS MARKET, BY RECREATIONAL BOATS, 2019–2022 (USD MILLION)

- TABLE 68 EUROPE: ELECTRIC BOATS MARKET, BY RECREATIONAL BOATS, 2023–2030 (USD MILLION)

- TABLE 69 EUROPE: ELECTRIC BOATS MARKET, BY COMMERCIAL BOATS, 2019–2022 (USD MILLION)

- TABLE 70 EUROPE: ELECTRIC BOATS MARKET, BY COMMERCIAL BOATS, 2023–2030 (USD MILLION)

- TABLE 71 EUROPE: ELECTRIC BOATS MARKET, BY MILITARY AND LAW ENFORCEMENT BOATS, 2019–2022 (USD MILLION)

- TABLE 72 EUROPE: ELECTRIC BOATS MARKET, BY MILITARY AND LAW ENFORCEMENT BOATS, 2023–2030 (USD MILLION)

- TABLE 73 EUROPE: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 74 EUROPE: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 75 EUROPE: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 76 EUROPE: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 77 NORWAY: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 78 NORWAY: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 79 NORWAY: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 80 NORWAY: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 81 NORWAY: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 82 NORWAY: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 83 GREECE: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 84 GREECE: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 85 GREECE: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 86 GREECE: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 87 GREECE: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 88 GREECE: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 89 NETHERLANDS: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 90 NETHERLANDS: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 91 NETHERLANDS: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 92 NETHERLANDS: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 93 NETHERLANDS: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 94 NETHERLANDS: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 95 FINLAND: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 96 FINLAND: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 97 FINLAND: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 98 FINLAND: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 99 FINLAND: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 100 FINLAND: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 101 DENMARK: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 102 DENMARK: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 103 DENMARK: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 104 DENMARK: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 105 DENMARK: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 106 DENMARK: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 107 GERMANY: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 108 GERMANY: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 109 GERMANY: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 110 GERMANY: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 111 GERMANY: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 112 GERMANY: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 113 REST OF EUROPE: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 114 REST OF EUROPE: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 115 REST OF EUROPE: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 116 REST OF EUROPE: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 117 REST OF EUROPE: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 118 REST OF EUROPE: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: ELECTRIC BOATS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 120 ASIA PACIFIC: ELECTRIC BOATS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 121 ASIA PACIFIC: ELECTRIC BOATS MARKET, BY END USE, 2019–2022(USD MILLION)

- TABLE 122 ASIA PACIFIC: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: ELECTRIC BOATS MARKET, BY RECREATIONAL BOATS, 2019–2022 (USD MILLION)

- TABLE 124 ASIA PACIFIC: ELECTRIC BOATS MARKET, BY RECREATIONAL BOATS, 2023–2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: ELECTRIC BOATS MARKET, BY COMMERCIAL BOATS, 2019–2022 (USD MILLION)

- TABLE 126 ASIA PACIFIC: ELECTRIC BOATS MARKET, BY COMMERCIAL BOATS, 2023–2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: ELECTRIC BOATS MARKET, BY MILITARY AND LAW ENFORCEMENT BOATS, 2019–2022 (USD MILLION)

- TABLE 128 ASIA PACIFIC: ELECTRIC BOATS MARKET, BY MILITARY AND LAW ENFORCEMENT BOATS, 2023–2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 130 ASIA PACIFIC: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022(USD MILLION)

- TABLE 132 ASIA PACIFIC: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 133 CHINA: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 134 CHINA: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 135 CHINA: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022(USD MILLION)

- TABLE 136 CHINA: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 137 CHINA: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 138 CHINA: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 139 JAPAN: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 140 JAPAN: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 141 JAPAN: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 142 JAPAN: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 143 JAPAN: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022(USD MILLION)

- TABLE 144 JAPAN: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 145 NEW ZEALAND: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 146 NEW ZEALAND: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 147 NEW ZEALAND: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 148 NEW ZEALAND: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 149 NEW ZEALAND: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 150 NEW ZEALAND: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 151 SOUTH KOREA: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 152 SOUTH KOREA: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 153 SOUTH KOREA: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 154 SOUTH KOREA: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 155 SOUTH KOREA: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 156 SOUTH KOREA: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 157 INDIA: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 158 INDIA: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 159 INDIA: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 160 INDIA: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 161 INDIA: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 162 INDIA: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 169 REST OF THE WORLD: ELECTRIC BOATS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 170 REST OF THE WORLD: ELECTRIC BOATS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 171 REST OF WORLD: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 172 REST OF WORLD: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 173 REST OF THE WORLD: ELECTRIC BOATS MARKET, BY RECREATIONAL BOATS, 2019–2022 (USD MILLION)

- TABLE 174 REST OF THE WORLD: ELECTRIC BOATS MARKET, BY RECREATIONAL BOATS, 2023–2030 (USD MILLION)

- TABLE 175 REST OF THE WORLD: ELECTRIC BOATS MARKET, BY COMMERCIAL BOATS, 2019–2022 (USD MILLION)

- TABLE 176 REST OF THE WORLD: ELECTRIC BOATS MARKET, BY COMMERCIAL BOATS, 2023–2030 (USD MILLION)

- TABLE 177 REST OF WORLD: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022(USD MILLION)

- TABLE 178 REST OF WORLD: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 179 REST OF WORLD: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 180 REST OF WORLD: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 187 LATIN AMERICA: ELECTRIC BOATS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 188 LATIN AMERICA: ELECTRIC BOATS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 189 LATIN AMERICA: ELECTRIC BOATS MARKET, BY BOAT POWER, 2019–2022 (USD MILLION)

- TABLE 190 LATIN AMERICA: ELECTRIC BOATS MARKET, BY BOAT POWER, 2023–2030 (USD MILLION)

- TABLE 191 LATIN AMERICA: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 192 LATIN AMERICA: ELECTRIC BOATS MARKET, BY BOAT SIZE, 2023–2030 (USD MILLION)

- TABLE 193 COMPANY PRODUCT FOOTPRINT

- TABLE 194 COMPANY END USE FOOTPRINT

- TABLE 195 COMPANY REGION FOOTPRINT

- TABLE 196 ELECTRIC BOATS MARKET: KEY STARTUP/SME

- TABLE 197 ELECTRIC BOATS MARKET: DEALS, JUNE 2020–JUNE 2023

- TABLE 198 ELECTRIC BOATS MARKET: EXPANSIONS, JUNE 2022–JUNE 2023

- TABLE 199 BRUNSWICK CORPORATION: COMPANY OVERVIEW

- TABLE 200 BRUNSWICK CORPORATION: PRODUCTS OFFERED?

- TABLE 201 BRUNSWICK CORPORATION: DEALS

- TABLE 202 GROUPE BENETEAU: COMPANY OVERVIEW

- TABLE 203 GROUPE BENETEAU: PRODUCTS OFFERED?

- TABLE 204 GROUPE BENETEAU: DEALS

- TABLE 205 GREENLINE YACHTS: COMPANY OVERVIEW

- TABLE 206 GREENLINE YACHTS: PRODUCTS OFFERED?

- TABLE 207 CANDELA TECHNOLOGY AB: COMPANY OVERVIEW

- TABLE 208 CANDELA TECHNOLOGY AB: PRODUCTS OFFERED?

- TABLE 209 CANDELA TECHNOLOGY AB: DEALS

- TABLE 210 SILENT YACHTS: COMPANY OVERVIEW

- TABLE 211 SILENT YACHTS: PRODUCTS OFFERED?

- TABLE 212 SILENT YACHTS: OTHERS

- TABLE 213 BOOTE MARIAN GMBH: COMPANY OVERVIEW

- TABLE 214 BOOTE MARIAN GMBH: PRODUCTS OFFERED?

- TABLE 215 BOOTE MARIAN GMBH: DEALS

- TABLE 216 X SHORE: COMPANY OVERVIEW

- TABLE 217 X SHORE: PRODUCTS OFFERED?

- TABLE 218 X SHORE: DEALS

- TABLE 219 DUFFY ELECTRIC BOAT COMPANY: COMPANY OVERVIEW

- TABLE 220 DUFFY ELECTRIC BOAT COMPANY: PRODUCTS OFFERED?

- TABLE 221 SAY CARBON YACHTS: COMPANY OVERVIEW

- TABLE 222 SAY CARBON YACHTS: PRODUCTS OFFERED?

- TABLE 223 Q YACHTS: COMPANY OVERVIEW

- TABLE 224 Q YACHTS: PRODUCTS OFFERED?

- TABLE 225 RUBAN BLEU: COMPANY OVERVIEW

- TABLE 226 RUBAN BLEU: PRODUCTS OFFERED?

- TABLE 227 RUBAN BLEU: DEALS

- TABLE 228 FRAUSCHER: COMPANY OVERVIEW

- TABLE 229 FRAUSCHER: PRODUCTS OFFERED?

- TABLE 230 FRAUSCHER: DEALS

- TABLE 231 PURE WATERCRAFT: COMPANY OVERVIEW

- TABLE 232 PURE WATERCRAFT: PRODUCTS OFFERED?

- TABLE 233 PURE WATERCRAFT: DEALS

- TABLE 234 PURE WATERCRAFT: OTHERS

- TABLE 235 NAVALT: COMPANY OVERVIEW

- TABLE 236 NAVALT: PRODUCTS OFFERED?

- TABLE 237 INGENITY ELECTRIC: COMPANY OVERVIEW

- TABLE 238 INGENITY ELECTRIC: PRODUCTS OFFERED?

- TABLE 239 INGENITY ELECTRIC: DEALS

- TABLE 240 QUADROFOIL D.O.O.: COMPANY OVERVIEW

- TABLE 241 QUADROFOIL D.O.O.: PRODUCTS OFFERED?

- TABLE 242 FOUR WINNS: COMPANY OVERVIEW

- TABLE 243 CALLBOATS: COMPANY OVERVIEW

- TABLE 244 TORQEEDO GMBH: COMPANY OVERVIEW

- TABLE 245 SALONA YACHTS: COMPANY OVERVIEW

- TABLE 246 OCEANVOLT: COMPANY OVERVIEW

- TABLE 247 ELWOOD BOATS OY: COMPANY OVERVIEW

- TABLE 248 EVOY AS: COMPANY OVERVIEW

- TABLE 249 AZIMUT YACHTS: COMPANY OVERVIEW

- TABLE 250 COSMOPOLITAN YACHTS: COMPANY OVERVIEW

- TABLE 251 ALFASTREET MARINE: COMPANY OVERVIEW

- FIGURE 1 ELECTRIC BOATS MARKET SEGMENTATION

- FIGURE 2 ELECTRIC BOATS MARKET: RESEARCH METHODOLOGY MODEL

- FIGURE 3 ELECTRIC BOATS MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 ELECTRIC BOATS MARKET: DATA TRIANGULATION

- FIGURE 7 RECREATIONAL BOATS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 <5 KW SEGMENT TO HAVE LARGEST MARKET SHARE IN 2023

- FIGURE 9 EUROPE TO LEAD ELECTRIC BOATS MARKET DURING FORECAST PERIOD

- FIGURE 10 INCREASING USAGE OF ELECTRIC BOATS FOR RECREATION TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 11 RECREATIONAL BOATS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 <20 FEET SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 MARKET IN NORWAY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 ELECTRIC BOATS MARKET DYNAMICS

- FIGURE 15 COMMON LITHIUM-ION BATTERIES WITH KEY FEATURES

- FIGURE 16 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 17 ELECTRIC BOATS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 18 ELECTRIC BOATS MARKET: ECOSYSTEM MAPPING

- FIGURE 19 REVENUE SHIFT FOR PLAYERS IN ELECTRIC BOATS MARKET

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING ELECTRIC BOATS, BY END USE

- FIGURE 21 KEY BUYING CRITERIA FOR ELECTRIC BOATS, BY END USE

- FIGURE 22 SUPPLY CHAIN ANALYSIS

- FIGURE 23 RECREATIONAL BOATS SEGMENT TO DOMINATE DURING FORECAST PERIOD

- FIGURE 24 >30 KW SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 <20 FT SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 26 NORTH AMERICA ESTIMATED TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 27 NORTH AMERICA: ELECTRIC BOATS MARKET SNAPSHOT

- FIGURE 28 EUROPE: ELECTRIC BOATS MARKET SNAPSHOT

- FIGURE 29 CO2 EMISSIONS FROM DOMESTIC SHIPPING IN NORWAY

- FIGURE 30 ASIA PACIFIC: ELECTRIC BOATS MARKET SNAPSHOT

- FIGURE 31 REST OF THE WORLD: ELECTRIC BOATS MARKET SNAPSHOT

- FIGURE 32 REVENUE ANALYSIS OF LEADING PLAYERS IN ELECTRIC BOATS MARKET, 2022

- FIGURE 33 ELECTRIC BOATS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 34 ELECTRIC BOATS MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 35 BRUNSWICK CORPORATION: COMPANY SNAPSHOT

- FIGURE 36 GROUPE BENETEAU: COMPANY SNAPSHOT

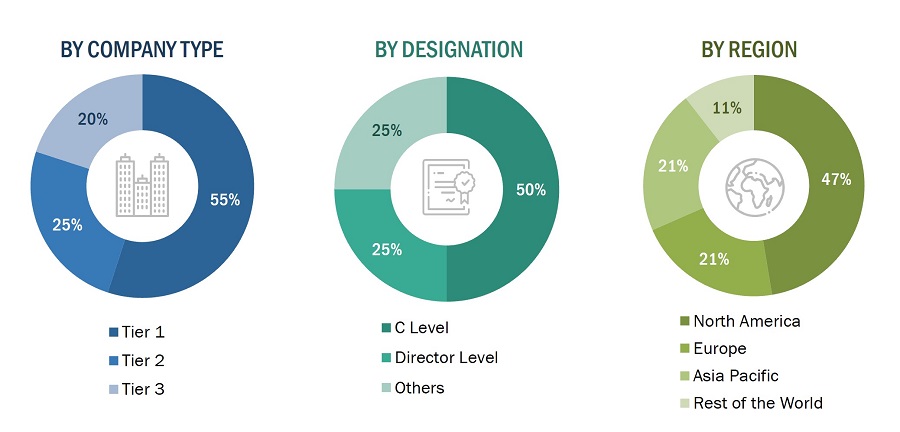

The study involved four major activities in estimating the current market size for the Electric Boats Market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulator databases.

Primary Research

The Electric Boats Market comprises several stakeholders, such as raw material providers, Electric boats manufacturers and electrical system providers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in electric maritime vessels. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

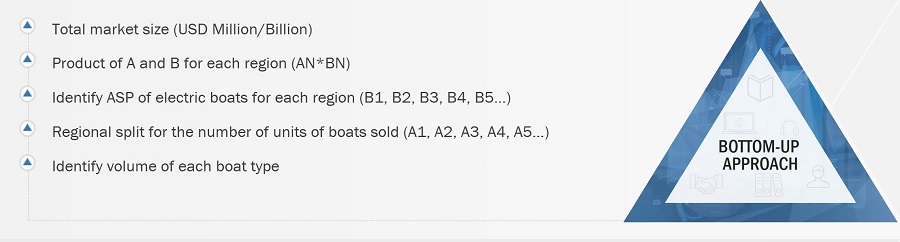

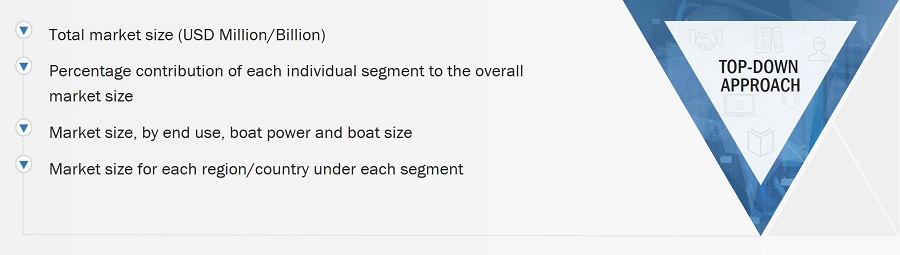

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Electric Boats Market . These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market size estimation methodology: Bottom-up Approach

The market sizing was undertaken from the demand side. The market was sized based on the year-on-year growth of newly built boats and retrofitted electric boats.

Market size estimation methodology: Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the market segmentation) acquired through percentage splits from secondary and primary research. For the calculation of specific market segments, the size of the most appropriate, immediate parent market was used to implement the top-down approach. The bottom-up approach was also implemented to validate the revenue obtained for various market segments.

- Companies supplying electric boats, as well as components, were included in the report.

- The total revenue of these companies was identified through their annual reports and other authentic sources. In cases where annual reports were not available, company earnings were estimated based on the number of employees, press releases, and any publicly available data.

- Company revenue was calculated based on the various operating segments.

- All publicly available company contracts related to electric boats were mapped and summed up.

- Based on these parameters (contracts, agreements, partnerships, joint ventures, product matrix, secondary research), the share of electric ships in each segment was estimated.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the Electric Boats Market .

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the Electric Boats Market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World, along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, and expansions.

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Market Definition

A battery contains one or more cells that convert chemical energy directly into electrical energy. The primary electrical system in a vessel or boat incorporates one or more batteries. These batteries are used to power up the electrical system and to start the auxiliary power unit and the engines. A boat with a length under 70 feet and a lower range can be considered a vessel. An electric boat refers to a boat entirely driven by battery power.

Market Stakeholders

- Battery Manufacturers

- Subcomponent Manufacturers

- Technology Support Providers

- Research Bodies

- System Integrators

- Boat Manufacturers

- Commercial Vessel Operators

- Defense Organizations.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 6)

Growth opportunities and latent adjacency in Electric Boats Market