Electric Vehicle Communication Controller Market by System (EVCC and SECC), Charging Type (Wired and Wireless), Electric Vehicle Type (BEV and PHEV), Vehicle Type (Passenger Car and Commercial Vehicle), Region - Global Forecast to 2027

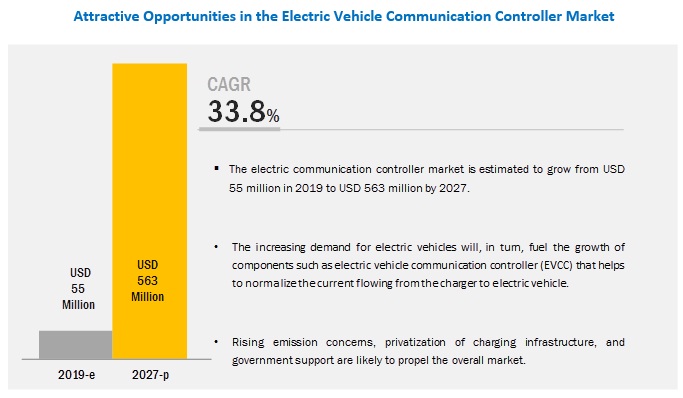

The electric vehicle communication controller market is projected to reach USD 563 million by 2027 from an estimated USD 55 million in 2019, at a CAGR of 33.8%. The growth of the controller market is driven by the increasing demand for electric vehicles. The evolution of high-power batteries necessitated the development of fast charging technologies. EVCC helps in the rapid charging of a vehicle with more reliability. Increasing demand for fast charging in the passenger vehicle segment is expected to drive the market for EVCC.

To know about the assumptions considered for the study, Request for Free Sample Report

Commercial vehicle segment is estimated to be the fastest growing electric vehicle communication controller market during the forecast period

The market for EVCC is expected to grow significantly in the commercial vehicle segment as these vehicles are used for transporting and delivering heavy loads over long distance and require high range and reliability. EVCC will play a crucial role in these vehicles as it will help in fast charging of the vehicle. Increasing sales of electric buses, particularly in China, has contributed to the growth of the electric bus segment. In the near future, several countries are expected to replace their existing fuel-based bus fleet with electric buses. The increasing trend of replacement of fossil fuel-based public transport fleet with electric buses will drive the growth of electric commercial vehicles during the forecast period.

Asia Pacific electric vehicle communication controller market is expected to register the highest growth during the forecast period

The Asia Pacific market is expected to witness the highest growth, followed by North America and Europe. It is also estimated to be the largest market during the forecast period. The region is home to some of the fastest developing economies of the world such as China and India. The governments of these developing economies have recognized the growth potential of the electric vehicle market and, hence, have taken different initiatives to attract major OEMs to manufacture electric vehicles in domestic markets. For instance, the Government of India, to increase the adoption of electric vehicles, has announced plans for financial support—a zero-rated goods and services tax (GST) for a window of 3 years for EVs and a scheme called Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME).

North America is expected to be the second-largest electric vehicle communication controller market during the forecast period

North America is expected to be the second-largest market, followed by Europe. It comprises developed countries such as the US and Canada. North America is a regional hub for many renowned OEMs known for delivering quality and high-performance vehicles. OEMs in North America such as Tesla and GM focus on the development of faster, cleaner, and high-performance electric vehicles. The US holds the largest market share in the North American electric vehicle sales. Top-selling electric vehicles in the US are Tesla Model S, Chevrolet Volt, Nissan Leaf, and Ford Fusion Energy PHEV. Various services offered by electric vehicle infrastructure providers have increased the adoption rate of electric vehicles in the US. These services have reduced range anxiety of electric vehicle owners. In the near future, many initiatives by governments and policymakers are expected to boost the demand for electric vehicles, which, in turn, will boost the electric vehicle communication controller market in the region.

Key Market Players

The global electric vehicle communication controller market is dominated by major players such as LG Innotek (South Korea), Tesla (US), BYD Auto (China), Schneider Electric (France), and ABB (Switzerland). These companies have strong distribution networks at a global level. In addition, these companies offer an extensive product range in this market. These companies have adopted strategies such as new product developments, collaborations, and contracts & agreements to sustain their market position. Companies such as Tesla and BYD have anticipated the growth potential of the market. Thus, in July 2016, Tesla opened its Gigafactory in Nevada, US. It is one of the biggest battery manufacturing plants for EV batteries in terms of capacity. Tesla built it, keeping in mind the future demand for EVs. Tesla also acquired Grohmann Engineering, a world-renowned engineering company in Prum, Germany. The company has planned to increase vehicle production from 100,000 units to 500,000 units per year by 2018. Chinese leader, BYD signed a cooperation agreement with ENEL (Italy), which is a multinational power company and a leading integrated player in the world’s power industry. The partnership is expected to boost electrified mobility and energy storage. These developments will help the companies to grow exponentially in the near future.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2027 |

|

Forecast units and value |

Volume (‘000 units) and value (USD Million) |

|

Segments covered |

Vehicle Type, System Type, Electric Vehicle Type, Charging Type, and Region |

|

Geographies covered |

Asia Pacific, Europe, and North America |

|

Companies Covered |

LG Innotek (South Korea), Tesla (US), BYD Auto (China), Schneider Electric (France), and ABB (Switzerland) |

This research report categorizes the given market based on vehicle type, system type, electric vehicle type, charging type, and region.

On the basis of system, it has been segmented as follows:

- EVCC

- SECC

On the basis of charging type, the given electric vehicle communication controller market has been segmented as follows:

- Wired

- Wireless

On the basis of electric vehicle type, the electric vehicle communication controller market has been segmented as follows:

- BEV

- PHEV

On the basis of vehicle type, the electric vehicle communication controller market has been segmented as follows:

- Passenger Car

- Commercial Vehicle

On the basis of region, the electric vehicle communication controller market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

North America

- US

- Canada

-

Europe

- Austria

- Denmark

- France

- Germany

- Netherlands

- Norway

- Spain

- Sweden

- Switzerland

- United Kingdom

Recent Developments

-

In March 2019, Tesla unveiled V3 Supercharging, the next step in the growth of Tesla’s Supercharger network. V3, which is born from Tesla’s experience building the world’s largest grid-connected batteries, enables vehicles to charge faster than any other electric vehicle on the electric vehicle communication controller market today.

Critical Aspects:

- Electric vehicle manufacturers have partnered with charging solution providers for technology sharing. How will this transform the overall electric vehicle communication controller market?

- How will fast-paced developments in passenger cars and commercial vehicles by leading manufacturers change the dynamics of this electric vehicle communication controller market?

- The industry is focusing on automated technology. Which are the leading companies working on automated technology, and what organic and inorganic strategies have been adopted by them?

- The report includes an analysis of your competition that includes major players in this electric vehicle communication controller market. The major players are Efacec (Portugal), Engie (France), Ficosa (Spain), and Vector (New Zealand), among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Electric Vehicle Communication Controller Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Electric Vehicle Communication Controller Market Size Estimation

2.4.1 Bottom-Up Approach

2.5 electric vehicle communication controller Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the EV Communication Controller Market

4.2 Market, By Region

4.3 Market, By Vehicle Type

4.4 Market, By System

4.5 Market, By EV Type

5 Electric Vehicle Communication Controller Market Overview (Page No. - 33)

5.1 Introduction

5.2 electric vehicle communication controller Market Dynamics

5.2.1 Drivers

5.2.1.1 Government Incentives and Support Toward Electric Vehicles

5.2.1.2 Heavy Investments By Automakers in Evs

5.2.2 Restraints

5.2.2.1 Lack of Standardization in Charging Infrastructure

5.2.3 Opportunities

5.2.3.1 Increasing Demand for Wireless Charging Safety and Convenience

5.2.3.2 Use of Vehicle-To-Grid (V2g) EV Charging Stations for Electric Vehicles

5.2.4 Challenges

5.2.4.1 Developing Fail-Safe Electric Vehicle Components

5.2.4.2 Stringent Rules for Installation of Charging Stations

6 EV Communication Controller Market, By System (Page No. - 39)

6.1 Introduction

6.2 Research Methodology

6.3 EV Communication Controller (EVCC)

6.3.1 Demand for Higher Range in Electric Vehicle has Boosted the Demand for EV Communication Controller

6.4 Supply Equipment Communication Controller (SECC)

6.4.1 Increasing Demand for Safety While Fast Charging is Estimated to Increase the Demand for SECC

6.5 Key Primary Insights

7 Electric Vehicle Communication Control Market, By Charging Type (Page No. - 45)

7.1 Introduction

7.2 Research Methodology

7.3 Wired Charging (Plug-In)

7.3.1 Multiple Type of Charging Standards Across the Globe has Impacted the Demand for EVCC in Positive Way

7.4 Wireless Charging (Inductive Charging)

7.4.1 Factors Such as Convenience While Charging Will Boost the Market for Wireless Charging and Subsequently for the Communication Controller Market

7.5 Key Primary Insights

8 Electric Vehicle Communication Control Market, By Electric Vehicle Type (Page No. - 51)

8.1 Introduction

8.2 Research Methodology

8.3 Battery Electric Vehicle (BEV)

8.3.1 Increasing Range Per Charge and Battery Capacity in the BEV Will Drive the Market for EVCC

8.4 Plug-In Hybrid Electric Vehicle (PHEV)

8.4.1 Longer Range Provide By PHEV Will Drive the Market for EVCC for PHEVs in Coming Future

8.5 Key Primary Insights

9 EV Communication Controller Market, By Vehicle Type (Page No. - 57)

9.1 Introduction

9.2 Research Methodology

9.3 Passenger Car (PC)

9.3.1 PC is Estimated Account for the Highest Market Share of EVCC Market By Vehicle Type

9.4 Commercial Vehicles (CV)

9.4.1 Increasing Usage of Electric Buses Across the Globe Will Drive the Market for EVCC in Commercial Vehicle

9.5 Key Primary Insights

10 EV Communication Controller Market, By Region (Page No. - 63)

10.1 Introduction

10.2 Asia Pacific

10.2.1 China

10.2.1.1 China to Hold the Largest Market Size in Globally for EVCC Market

10.2.2 India

10.2.2.1 Government Initiative to Adopt the Electric Vehicle Will Boost the Market for EVCC in India

10.2.3 Japan

10.2.3.1 Innovative Electric Vehicle From Companies Such as Honda, Nissan and Mitsubishi Will Drive the Electric Vehicle Communication Controller Market for EVCC in Japan

10.2.4 South Korea

10.2.4.1 Growing Electric Vehicle Charging Infrastructure Will Drive the Demand for EV Communication Controller Market

10.3 Europe

10.3.1 France

10.3.1.1 Strong Focus on Emission Reduction in the Country Will Drive the Market for Electric Vehicle and Subsequently for the EVCC

10.3.2 Germany

10.3.2.1 Germany to Lead the European Electric Vehicle Communication Market

10.3.3 Netherlands

10.3.3.1 Plan to Phase Out All Ice Vehicle By 2035 is Driving the Demand for EV Communication Controller Market in Netherland

10.3.4 Norway

10.3.4.1 Highest Pev Percentage Sales in the World Will Boost the Market for EVCC in Norway

10.3.5 Sweden

10.3.5.1 Strong EV Infrastructure Will Boost the Demand

10.3.6 UK

10.3.6.1 Second Largest Car Manufacturer in Europe is Estimated to Have Significant Market Share in European EVCC Market

10.3.7 Denmark

10.3.7.1 Multiple Subsidies to Electric Vehicle Owner Will Impact the EVCC Market Significantly in Denmark

10.3.8 Austria

10.3.8.1 Government Initiative for Electric Vehicle Sales Will Boost the Market for EVCC in Austria

10.3.9 Spain

10.3.9.1 EVCC Market is Estimated to Grow at the Highest CAGR for Europe Region, During the Forecast Period

10.3.10 Switzerland

10.3.10.1 Switzerland to Grow at the Significant CAGR for EVCC Market, During the Forecast Period

10.4 North America

10.4.1 Canada

10.4.1.1 Subsidies and Tax Exemptions on Electric Vehicle Will Play A Major Role in the Growth for EV Communication Controller Market in Canada

10.4.2 US

10.4.2.1 US to Hold the Largest Market Size in North American Market

11 Competitive Landscape (Page No. - 88)

11.1 Overview

11.2 Competitive Situation & Trends

11.2.1 New Product Launch

11.2.2 Supply Contract

11.2.3 Agreement/Partnership/Joint Venture

11.2.4 Expansions

11.2.5 Acquisition

11.3 Competitive Leadership Mapping

11.3.1 Visionary Leaders

11.3.2 Innovators

11.3.3 Dynamic Differentiators

11.3.4 Emerging Companies

11.4 Strength of Product Portfolio

11.5 Business Strategy Excellence

12 Company Profiles (Page No. - 98)

(Business Overview, Products Offered, Recent Developments & SWOT Analysis View)*

12.1 LG Innotek

12.2 Tesla

12.3 BYD Auto

12.4 Schneider Electric

12.5 ABB

12.6 Ficosa

12.7 Bosch

12.8 Vector

12.9 Siemens

12.10 Efacec

12.11 Engie

12.12 Mitsubishi Electric

12.13 Other Key Players

12.13.1 North America

12.13.1.1 Leviton

12.13.1.2 Blink Charging

12.13.1.3 Clippercreek

12.13.1.4 Semaconnect

12.13.1.5 Webasto

12.13.1.6 Opconnect

12.13.1.7 Evgo

12.13.1.8 Volta

12.13.1.9 EV Safe Charge

12.13.1.10 Chargepoint

12.13.1.11 Pulse Charge

12.13.2 Europe

12.13.2.1 New Motion B.V

12.13.2.2 Alfen

12.13.2.3 Allego

12.13.2.4 Ionity

12.13.2.5 Wallbox

12.13.2.6 Heliox

12.13.2.7 Spark Horizon

12.13.2.8 BP Chargemaster

12.13.2.9 Pod Point

12.13.2.10 ECOG

*Details on Business Overview, Products Offered, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 126)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (72 Tables)

Table 1 Currency Exchange Rates (Per 1 USD)

Table 2 Global Tax Subsidies for Electric Vehicles

Table 3 Wireless Charging vs. Plug-In Charging

Table 4 EV Communication Controller Market, By System, 2017–2027 (Thousand Units)

Table 5 Market, By System, 2017–2027 (USD Thousand)

Table 6 EVCC: Market, By Region, 2017–2027 (Thousand Units)

Table 7 EVCC: Market, By Region, 2017–2027 (USD Thousand)

Table 8 SECC: Market, By Region, 2017–2027 (Thousand Units)

Table 9 SECC: Market, By Region, 2017–2027 (USD Thousand)

Table 10 Market, By Charging Type, 2017–2027 (Thousand Units)

Table 11 Market, By Charging Type, 2017–2027 (USD Thousand)

Table 12 Wired Charging (Plug-In): Market, By Region, 2017–2027 (Thousand Units)

Table 13 Wired Charging (Plug-In): Market, By Region, 2017–2027 (USD Thousand)

Table 14 Wireless Charging (Inductive Charging): Market, By Region, 2017–2027 (Units)

Table 15 Wireless Charging (Inductive Charging): Market, By Region, 2017–2027 (USD Thousand)

Table 16 EV Communication Controller Market, By EV Type, 2017–2027 (Thousand Units)

Table 17 Market, By EV Type, 2017–2027 (USD Thousand)

Table 18 Battery Electric Vehicle (BEV): Market, By Region, 2017–2027 (Thousand Units)

Table 19 Battery Electric Vehicle (BEV): Market, By Region, 2017–2027 (USD Thousand)

Table 20 Plug-In Hybrid Electric Vehicle (PHEV): Market, By Region, 2017–2027 (Thousand Units)

Table 21 Plug-In Hybrid Electric Vehicle (PHEV): Market, By Region, 2017–2027 (USD Thousand)

Table 22 Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 23 EV Communication Controller Market, By Vehicle Type, 2017–2027 (USD Thousand)

Table 24 Passenger Car: EV Communication Controller Market, By Region, 2017–2027 (Thousand Units)

Table 25 Passenger Car: EV Communication Controller Market, By Region, 2017–2027 (USD Thousand)

Table 26 Commercial Vehicle: EV Communication Controller Market, By Region, 2017–2027 (Thousand Units)

Table 27 Commercial Vehicle: EV Communication Controller Market, By Region, 2017–2027 (USD Thousand)

Table 28 EV Communication Controller Market, By Region, 2017–2027 (Thousand Units)

Table 29 Market, By Region, 2017–2027 (USD Thousand)

Table 30 Asia Pacific: Market, By Country, 2017–2027 (Thousand Units)

Table 31 Asia Pacific: Market, By Country, 2017–2027 (USD Thousand)

Table 32 China: Market, By EV Type, 2017–2027 (Thousand Units)

Table 33 China: Market, By EV Type, 2017–2027 (USD Thousand)

Table 34 India: Market, By EV Type, 2017–2027 (Thousand Units)

Table 35 India: Market, By EV Type, 2017–2027 (USD Thousand)

Table 36 Japan: Market, By EV Type, 2017–2027 (Thousand Units)

Table 37 Japan: Market, By EV Type, 2017–2027 (USD Thousand)

Table 38 South Korea: Market, By EV Type, 2017–2027 (Thousand Units)

Table 39 South Korea: Market, By EV Type, 2017–2027 (USD Thousand)

Table 40 Europe: Market, By Country, 2017–2027 (Thousand Units)

Table 41 Europe: Market, By Country, 2017–2027 (USD Thousand)

Table 42 France: Market, By EV Type, 2017–2027 (Thousand Units)

Table 43 France: Market, By EV Type, 2017–2027 (USD Thousand)

Table 44 Germany: Market, By EV Type, 2017–2027 (Thousand Units)

Table 45 Germany: Market, By EV Type, 2017–2027 (USD Thousand)

Table 46 Netherlands: Market, By EV Type, 2017–2027 (Thousand Units)

Table 47 Netherlands: Market, By EV Type, 2017–2027 (USD Thousand)

Table 48 Norway: Market, By EV Type, 2017–2027 (Thousand Units)

Table 49 Norway: Market, By EV Type, 2017–2027 (USD Thousand)

Table 50 Sweden: Market, By EV Type, 2017–2027 (Thousand Units)

Table 51 Sweden: Market, By EV Type, 2017–2027 (USD Thousand)

Table 52 UK: Market, By EV Type, 2017–2027 (Thousand Units)

Table 53 UK: Market, By EV Type, 2017–2027 (USD Thousand)

Table 54 Denmark: Market, By EV Type, 2017–2027 (Thousand Units)

Table 55 Denmark: Market, By EV Type, 2017–2027 (USD Thousand)

Table 56 Austria: Market, By EV Type, 2017–2027 (Thousand Units)

Table 57 Austria: Market, By EV Type, 2017–2027 (USD Thousand)

Table 58 Spain: Market, By EV Type, 2017–2027 (Thousand Units)

Table 59 Spain: Market, By EV Type, 2017–2027 (USD Thousand)

Table 60 Switzerland: Market, By EV Type, 2017–2027 (Thousand Units)

Table 61 Switzerland: Market, By EV Type, 2017–2027 (USD Thousand)

Table 62 North America: Market, By Country, 2017–2027 (Thousand Units)

Table 63 North America: Market, By Country, 2017–2027 (USD Thousand)

Table 64 Canada: Market, By EV Type, 2017–2027 (Thousand Units)

Table 65 Canada: Market, By EV Type, 2017–2027 (USD Thousand)

Table 66 US: EV Communication Controller Market, By EV Type, 2017–2027 (Thousand Units)

Table 67 US: Market, By EV Type, 2017–2027 (USD Thousand)

Table 68 New Product Launch, 2016–2018

Table 69 Supply Contract, 2017–2018

Table 70 Joint Venture/Partnership, 2016–2019

Table 71 Expansions, 2016–2018

Table 72 Acquisition, 2016–2017

List of Figures (43 Figures)

Figure 1 EV Communication Controller Segmentation

Figure 2 EV Communication Controller Market: Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Electric Vehicle Communication Controller Market Size Estimation Methodology for the Market: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology for the Supply Equipment Communication Controller Market: Bottom-Up Approach

Figure 7 Data Triangulation

Figure 8 Market: Market Dynamics

Figure 9 BEV Segment to Hold the Largest Share in Market, 2019 vs. 2027 (USD Thousand)

Figure 10 Commercial Vehicle Segment to Witness the Highest Growth in Market, 2019 vs. 2027 (USD Thousand)

Figure 11 Increasing Government Incentives and Support for Electric Vehicle is Expected to Drive the Demand for EV Communication Controller

Figure 12 Asia Pacific is Estimated to Account for the Largest Share of Market (USD Thousand)

Figure 13 Passenger Car Segment is Estimated to Lead the EV Communication Controller Market, By Vehicle Type, 2019 vs. 2027 (USD Thousand)

Figure 14 EVCC System is Estimated to Account for the Largest Market Share, By System, 2019 vs. 2027 (USD Thousand)

Figure 15 BEV is Estimated to Grow at the Highest CAGR During the Forecast Period, 2019 vs. 2027 (USD Thousand)

Figure 16 Market: Market Dynamics

Figure 17 Market, By System, 2019 vs. 2027 (Thousand Units)

Figure 18 Market, By Charging Type, 2019 vs. 2027 (USD Thousand)

Figure 19 Market, By Electric Vehicle, 2019 vs. 2027 (Thousand Units)

Figure 20 Commercial Vehicle Segment is Expected to Grow at the Highest CAGR During the Forecast Period (2019–2027)

Figure 21 Market, By Region, 2019 vs. 2027 (Thousand Units)

Figure 22 Asia Pacific: Market Snapshot

Figure 23 Europe: Market, By Country, 2019 vs. 2027 (USD Thousand)

Figure 24 North America: Market Snapshot

Figure 25 Companies Adopted Supply Contract as the Key Growth Strategy, 2015–2019

Figure 26 EV Communication Controller Market: Competitive Leadership Mapping, 2018

Figure 27 LG Innotek: Company Snapshot

Figure 28 LG Innotek: SWOT Analysis

Figure 29 Tesla: Company Snapshot

Figure 30 Tesla: SWOT Analysis

Figure 31 BYD: Company Snapshot

Figure 32 BYD: SWOT Analysis

Figure 33 Schneider Electric: Company Snapshot

Figure 34 Schneider Electric: SWOT Analysis

Figure 35 ABB: Company Snapshot

Figure 36 ABB: SWOT Analysis

Figure 37 Ficosa: Company Snapshot

Figure 38 Bosch: Company Snapshot

Figure 39 Vector: Company Snapshot

Figure 40 Siemens: Company Snapshot

Figure 41 Efacec: Company Snapshot

Figure 42 Engie: Company Snapshot

Figure 43 Mitsubishi Electric: Company Snapshot

The study involved 4 major activities in estimating the current electric vehicle communication controller market size of the controller market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been used to identify and collect information useful for an extensive commercial study of the global electric vehicle communication controller market. These include company annual reports/presentations, press releases, industry association publications [for example, publications of electric charging equipment OEMs, Canadian Automobile Association (CAA), country-level automotive associations and trade organizations, and the US Department of Transportation (DOT)], electric vehicles and charging solutions magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical articles.

Primary Research

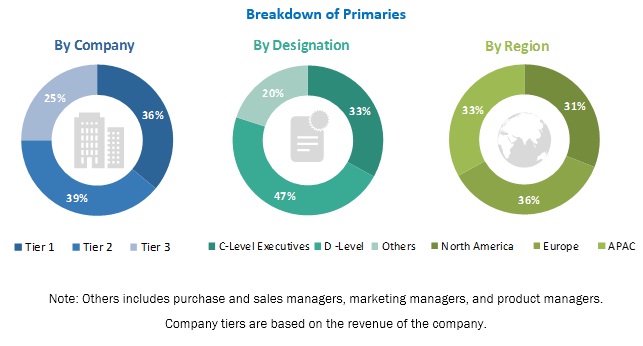

Extensive primary research has been conducted after acquiring an understanding of the electric vehicle communication controller market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across 3 major regions, namely, Asia Pacific, Europe, and North America. Approximately 23% and 77% of primary interviews have been conducted from the demand- and supply-side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the total electric vehicle communication controller market size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and electric vehicle communication controller markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall electric vehicle communication controller market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides.

Report Objectives

- To segment and forecast the electric vehicle communication controller market in terms of volume (‘000 units) and value (USD Million).

- To define, describe, and forecast the controller market based on vehicle type, application type, electric vehicle type, charging technology type, and region

- To segment and forecast the controller market by electric vehicle type (BEV and PHEV)

- To segment and forecast the market by system (EVCC and SECC)

- To segment and forecast the controller market by charging technology type (wired chargers and wireless chargers)

- To segment and forecast the market by vehicle type (passenger car and commercial vehicle)

- To forecast the market size with respect to key regions, namely, North America, Europe, and Asia Oceania

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze controller markets with respect to individual growth trends, future prospects, and contribution to the total market

Available Customizations

With the given electric vehicle communication controller market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- EVCC Market, By Charging type at country level

-

Company Information

- Profiling of Additional Market Players (Up to 5)

Growth opportunities and latent adjacency in Electric Vehicle Communication Controller Market

How can Arias Motors become your business representative for the Dominican Republic, Haity and some other islands in the Caribbean.