Electronic Cartographic (Marine) Market by Solution (ECDIS, ENC, Integration & Support), by Vessel Type (Commercial, Defense, Offshore, Others), by Application (Navigation, Fleet Management, Safety, Data Analytics), by End User (OEMs, Ship Operators, Naval Forces), and by Region — Global Forecast to 2035

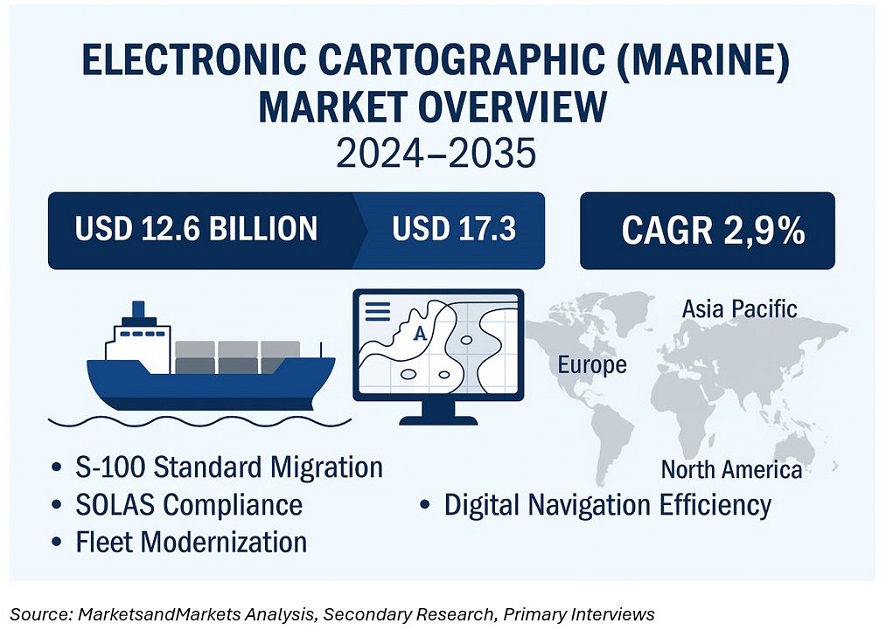

The electronic cartographic (marine) market is transforming digitally as the world’s fleets transition toward next-generation charting standards and integrated bridge systems. The global market size is estimated at USD 12.6 billion in 2024 and projected to reach USD 17.3 billion by 2035, growing at a CAGR of 2.9% during the forecast period.

Growth in this market is primarily driven by continuous upgrades to Electronic Chart Display and Information Systems (ECDIS), increasing availability of Electronic Navigational Charts (ENCs), and growing regulatory focus on navigation safety and data interoperability. The International Maritime Organization (IMO) and the International Hydrographic Organization (IHO) have finalized key elements of the S-100 Universal Hydrographic Data Model, which will govern electronic chart standards for the next decade. This modernization catalyzes software and service demand across commercial and defense fleets.

Unlike the earlier growth cycle centered on first-time ECDIS carriage installations, the current phase is characterized by software-led modernization, data management, and integration with digital twins and voyage optimization platforms. As vessel operators seek greater situational awareness, cost efficiency, and regulatory compliance, demand for advanced, interoperable charting and analytics solutions continues to expand globally.

Market Dynamics

Drivers

The market’s evolution reflects a combination of regulatory compliance and operational optimization. The full enforcement of SOLAS Regulation V/19 has standardized ECDIS carriage across commercial vessels, while the 2029 mandate for S-100 readiness in new ECDIS units is accelerating replacement programs. In parallel, expanding hydrographic data infrastructure—supported by national hydrographic offices and defense agencies—has improved ENC coverage and quality, encouraging digital adoption even among small fleets.

The shift toward real-time route monitoring and data analytics has further strengthened the case for electronic cartography. Integrating weather, bathymetry, and AIS data layers enables predictive routing that reduces fuel consumption and enhances safety. These operational gains align with broader industry goals for decarbonization, helping shipowners meet CII and EEXI targets more efficiently.

Restraints

Despite widespread adoption, high costs associated with ECDIS upgrades, licensing, and crew training remain barriers for smaller operators. Cybersecurity vulnerabilities, interoperability challenges between legacy bridge systems, and uneven global ENC coverage also hinder seamless implementation.

Opportunities

Emerging opportunities stem from the convergence of AI-driven navigation analytics, cloud-based ENC delivery, and fleet-wide chart management systems. Adopting S-102 bathymetric grids and S-104 water-level products under the S-100 framework will open new revenue streams for data providers and integration specialists. Furthermore, as regional shipyards in Asia and Europe integrate ECDIS into digital shipbuilding workflows, OEM partnerships will expand across lifecycle support and performance monitoring services.

Market Segmentation

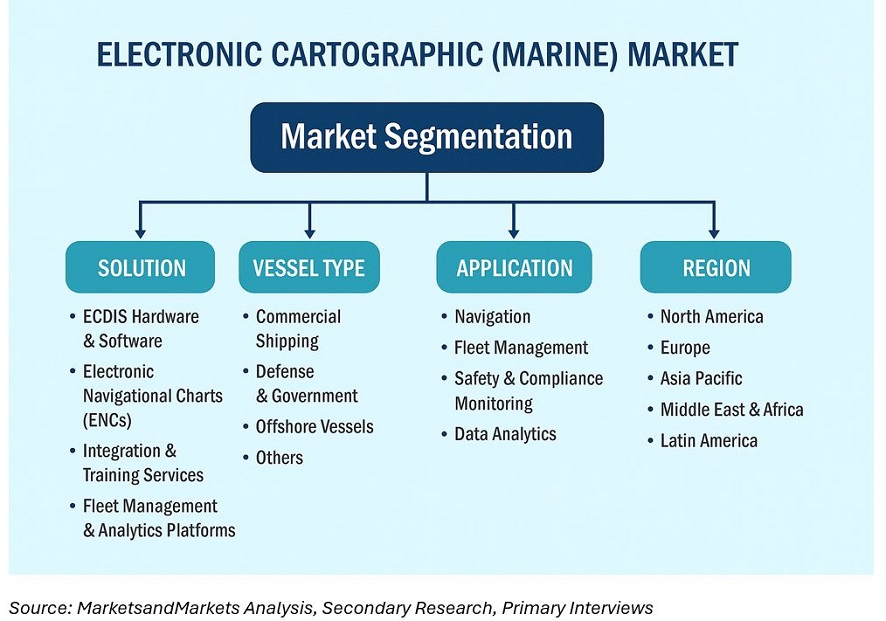

By Solution

The solution segment includes ECDIS hardware and software, Electronic Navigation Charts (ENCs), integration and training services, and fleet management and analytics platforms.

- ECDIS systems form the market's core, comprising type-approved hardware compliant with IEC 61174 and IMO MSC.232(82) standards. Demand for S-100-capable ECDIS units is expected to accelerate post-2028 as new installations require interoper

- ENC services account for a rising recurring revenue share through subscription-based updates and multi-fleet enterprise licensing. The increasing digitization of hydrographic datasets has expanded ENC coverage to more than 90 % of global commercial routes.

- Integration and training services—covering installation, certification, bridge integration, and crew familiarization—represent a significant secondary revenue stream, particularly among OEMs and regional distributors.

- Fleet analytics platforms leverage cartographic data for route optimization, predictive maintenance, and emissions benchmarking, marking a growing frontier for value creation.

By Vessel Type

Demand patterns differ by vessel class. Commercial shipping remains the largest segment, driven by cargo carriers, tankers, and passenger ships adhering to SOLAS regulations. The defense and government segment is expanding steadily through naval modernization programs and integrated command systems. Offshore vessels utilize ECDIS and ENC tools for precise positioning during exploration, cable-laying, and wind-farm operations. The other category, including high-end leisure and research vessels, is adopting ECDIS solutions tailored for simplified operation and high-definition chart layers.

By Application

The navigation segment dominates usage, encompassing voyage planning, real-time positioning, and chart visualization—the fleet management sub-segment leverages centralized chart databases for synchronized updates across multiple vessels. Safety and compliance monitoring applications integrate navigational alerts, restricted-area overlays, and cybersecurity modules. A smaller but fast-growing data analytics sub-segment links electronic chart data with performance metrics for voyage efficiency and predictive safety insights.

By End User

Among end users, OEMs and shipbuilders lead in system integration, embedding ECDIS units into bridge systems at the design stage. Ship operators and fleet owners represent the most extensive installed base, driving recurring ENC subscription revenue. Naval forces and coastguards increasingly rely on secure, encrypted cartographic systems for tactical navigation and surveillance operations, often in partnership with national hydrographic offices.

Regional Analysis

The electronic cartographic (marine) market is geographically diverse, with adoption shaped by fleet age, regulatory enforcement, and hydrographic coverage.

North America

North America maintains a leading position through defense investment and commercial compliance. The United States and Canada are early adopters of S-100-ready systems, supported by the strong presence of OEMs such as Honeywell, Northrop Grumman, and Lockheed Martin MS2 Marine Systems.

Europe

Europe remains a technology hub for maritime navigation systems, home to established players such as Wärtsilä Voyage, Transas, and Kongsberg Gruppen. EU programs for e-Navigation and digital port management continue to stimulate system upgrades across Northern and Western Europe.

Asia Pacific

Asia Pacific is projected to record the fastest growth through 2035, underpinned by expanding merchant fleets in China, Japan, South Korea, and India, and rising shipbuilding activity in Southeast Asia. Government-funded hydrographic initiatives and regional ECDIS manufacturing and training centers further reinforce the region’s growth outlook.

Middle East & Africa

Fleet expansion by Gulf carriers and offshore energy operators sustains steady adoption of electronic cartographic systems. In Africa, the modernization of port authorities and navigation aids in South Africa and Egypt is generating downstream demand for ENC distribution and integration support.

Latin America

Latin America is an emerging market driven by naval modernization and coastal surveillance projects in Brazil and Mexico. The region’s adoption of cloud-based ENC update systems enables smaller fleets to transition from paper to digital charts economically.

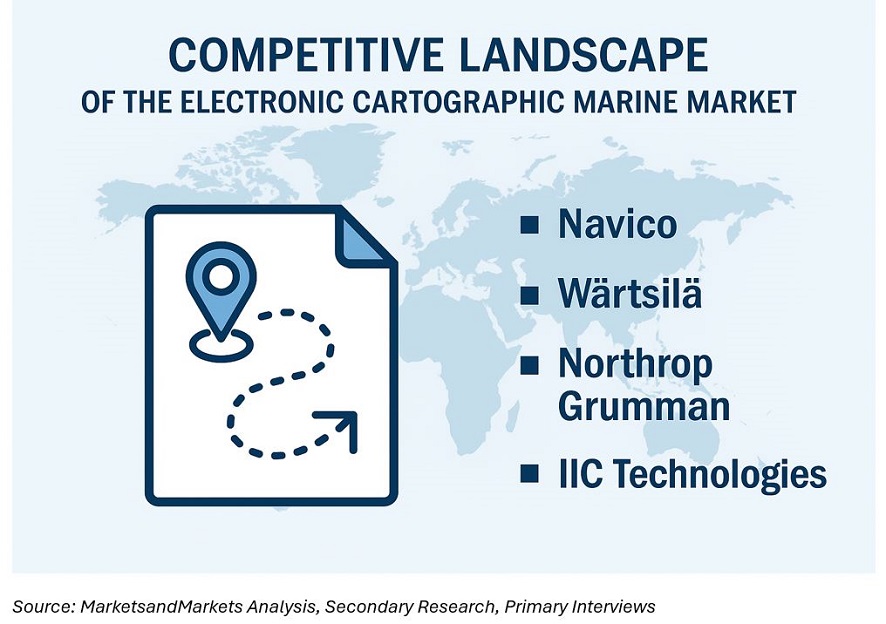

Competitive Landscape

The competitive environment comprises global OEMs, hydrographic data publishers, and specialized system integrators. Major participants include Wärtsilä Voyage, Kongsberg Gruppen, Navico Group, Northrop Grumman Corporation, Transas Marine (Wärtsilä), Tokyo Keiki Inc., IHO-aligned ENC providers, and regional distributors such as ChartWorld and SevenCs GmbH.

Competition increasingly revolves around S-100 compliance, user-interface design, and integration capability rather than hardware differentiation. Vendors are expanding value-added services, including remote diagnostics, chart management portals, and cyber-secured ENC delivery.

Sustainability and Compliance Insight

Adopting electronic cartographic systems directly supports environmental goals by enabling voyage optimization, route deviation reduction, and real-time fuel tracking. Optimized routing using ECDIS and ENC overlays can reduce fuel burn by 2–5 %, simultaneously lowering CO2 emissions and operating costs. In addition, digitization minimizes paper chart waste and logistics overhead. OEMs are aligning product design with IMO’s GreenVoyage2050 and ISO 14001 guidelines, developing lower-power ECDIS hardware and lifecycle-sustainable data services.

Key Market Trends and Future Outlook

- S-100 Implementation Momentum (2029–2035): The transition to S-100 will create a multi-year replacement cycle for legacy ECDIS units and software platforms, with interoperability driving vendor partnerships.

- Integration of AI and Big Data: Fusing navigational and performance data through AI analytics will redefine value creation, enabling predictive navigation and accident-avoidance modeling.

- Cybersecurity and Remote Updates: Rising cyber-risk exposure increases demand for ECDIS hardening, encrypted ENC updates, and blockchain-based chart validation.

- Cloud and Enterprise Solutions: Fleet operators are adopting cloud-enabled chart management platforms for synchronized updates, reducing manual data handling and compliance risk.

- Decarbonization Alignment: Electronic chart systems are integrated with carbon-accounting dashboards and emissions monitoring software to support sustainability reporting.

Forecast Summary (2024–2035)

|

Year |

Market Size (USD Billion) |

CAGR (2024–2035) |

|

2024 |

12.6 |

|

|

2030 |

15.0 |

|

|

2035 |

17.3 |

2.9 % |

The electronic cartographic (marine) market has matured beyond initial regulatory compliance to become a strategic enabler of operational safety, efficiency, and sustainability. As fleets migrate toward S-100-ready ECDIS and advanced ENC data models, the sector will experience a steady upgrade-driven growth trajectory through 2035. Vendors combining hydrographic data expertise, digital integration capabilities, and cloud-based service portfolios are best positioned to capture the evolving opportunity landscape.

Frequently Asked Questions (FAQs)

Q1. What is the size of the electronic cartographic (marine) market?

The market is valued at approximately USD 12.6 billion in 2024 and projected to reach USD 17.3 billion by 2035.

Q2. Which solutions lead the market?

ECDIS hardware and software dominate, followed by ENC licensing, integration, and training services.

Q3. What is the fastest-growing regional market?

Asia Pacific is expected to record the highest CAGR, supported by expanding shipbuilding capacity and hydrographic modernization.

Q4. Which standard will define the next generation of ECDIS systems?

The IHO S-100 framework, with product specifications S-101 (ENC), S-102 (bathymetry), and S-104 (water levels), will govern interoperability by 2029.

Q5. How does electronic cartography support sustainability?

Optimized routing and digital charting can reduce voyage fuel consumption by up to 5 %, contributing directly to fleet decarbonization goals.

Table Of Contents

1 Introduction (Page No. - 18)

1.1 Objectives

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Market Crackdown and Data Triangulation

1.5.2 Key Data Points Taken From Secondary Sources

1.5.3 Key Data Points Taken From Primary Resources

1.5.4 General Assumptions Made For the Report

1.5.5 Key Secondary Resources

2 Executive Summary (Page No. - 33)

3 Market Overview (Page No. - 35)

3.1 Market Definition

3.2 Market Overview

3.3 Market Segmentation

3.3.1.1 Electronic Cartography Marine Market Segmentation

3.3.1.2 Electronic Cartography Aviation Market Segmentation

3.4 Market Dynamics

3.4.1 Electronic Cartography Marine Market Dynamics

3.4.1.1 Drivers

3.4.1.1.1 Safety At Sea and Protection to the Environment

3.4.1.1.2 official Requirements Set By the IMO (International Maritime Organisation)

3.4.1.1.3 Need For Greater Accuracy and Constant Updating of Charts

3.4.1.1.4 Ability to Access the Enc Data

3.4.1.2 Impact Analysis For Drivers

3.4.1.3 Restraints

3.4.1.3.1 Lack of Expertise

3.4.1.3.2 Acceptance of the Electronic Navigation Systems and Charts

3.4.1.3.3 Requirement of Specialized Training

3.4.1.4 Impact Analysis For Restraints

3.4.1.5 Challenges

3.4.1.5.1 Positioning and Updating the Systems

3.4.1.5.2 Regulations and Policies

3.4.1.5.3 High Costs

3.4.1.5.4 Authenticity and Security of the Data

3.4.1.5.5 Mode of Communication When At Sea

3.4.1.6 Opportunities

3.4.1.6.1 Growth in the Maritime Industry of the Emerging Economies

3.4.1.6.2 Enc Data Globe Coverage Quality of the Enc Data

3.4.1.6.3 Specialized Training Programs

3.4.2 Electronic Cartography Marine Market Dynamics

3.4.2.1 Drivers

3.4.2.1.1 Increasing the Safety and Efficiency of Navigation

3.4.2.1.2 Need For Constant Updating of Charts and Access to the Navigation Database

3.4.2.1.3 Increase in Demand of Aircrafts

3.4.2.1.4 Need For Fuel Efficient Systems

3.4.2.2 Impact Analysis For Drivers

3.4.2.3 Restraints

3.4.2.3.1 Late Deliveries of Aircrafts

3.4.2.3.2 Slow Economic Growth of the Major Countries

3.4.2.4 Impact Analysis For Restraints

3.4.2.5 Challenges

3.4.2.5.1 the Multi Function Displays Used in the Flight Management Displays

3.4.2.5.2 Complexity of the Systems

3.4.2.6 Opportunities

3.4.2.6.1 Growth in the Aviation Industry of the Emerging Economies

3.4.2.6.2 Technological Developments to Improve the Functionality of the Systems

4 Trend Analysis (Page No. - 53)

4.1 Market Trends

4.1.1 Increase in Demand For Electronic Charts

4.1.2 Spending on Enc Data Production Is Set to Increase

4.1.3 Development of Retrofit Systems

4.2 Industry Trends

4.2.1 Need For A Common Electronic Charts Platform

4.2.2 Strategic Partnerships Between System and Charts Manufacturers

4.3 Technology Trends

4.3.1 Merging of Enc Data With Data From Other Navigation Systems

4.3.2 Development of Electronic Chart Display Systems With Reduced Complexity

4.3.3 Development of the Nextgen Systems

4.3.4 Development of Synthetic Vision Displays

5 Global Electronic Cartography Market Share Analysis (Page No. - 61)

5.1 Introduction

5.2 Electronic Cartography Revenue Analysis,

5.3 Application Analysis

5.3.1 EC Marine Market, By Application

5.3.2 EC Aviation Market, By Application

5.4 Component Analysis

5.4.1 Electronic Cartography Marine (Commercial) Market, By Components

5.4.1.1 EC Marine (Commercial) Components Market, By Systems

5.4.1.2 EC Marine (Commercial) Components Market, By Charts

5.4.2 EC Aviation Market, By Components

5.4.2.1 EC Aviation Components Market, By Systems

6 Electronic Cartography Market, Geographic Analysis (Page No. - 85)

6.1 North America

6.2 APAC

6.3 Middle East

6.4 Europe

6.5 Africa

6.6 Latin America

7 Market Analysis By Country (Page No. - 116)

7.1 U.S.

7.2 Russia

7.3 China

7.4 Japan

7.5 India

7.6 Australia

7.7 U.K.

7.8 Germany

7.9 France

7.10 Brazil

8 Competitive Landscape (Page No. - 141)

8.1 Overview

8.2 Geographical Analysis

8.3 Competitive Analysis

8.4 Recent Industry Developments, Competitive Situation and Trends

8.4.1 Recent Industry Developments, Competitive Situation and Trends

9 Company Profiles (Page No. - 146)

9.1 Honeywell

9.1.1 Overview

9.1.2 Products and Services

9.1.3 Strategies and Insights

9.1.4 Developments

9.1.5 MNM View

9.1.5.1 Company Review

9.1.5.2 SWOT Analysis

9.2 Thales

9.2.1 Overview

9.2.2 Products and Services

9.2.3 Strategies and Insights

9.2.4 Developments

9.2.5 MNM View

9.2.5.1 Company Review

9.2.5.2 SWOT Analysis

9.3 Jeppesen

9.3.1 Overview

9.3.2 Products and Services

9.3.3 Strategies and Insights

9.3.4 Developments

9.3.5 MNM View

9.3.5.1 Company Review

9.3.5.2 SWOT Analysis

9.4 Universal Avionics

9.4.1 Overview

9.4.2 Products and Services

9.4.3 Strategies and Insights

9.4.4 Developments

9.5 Rockwell Collins

9.5.1 Overview

9.5.2 Products and Services

9.5.3 Strategies and Insights

9.5.4 Developments

9.5.5 MNM View

9.5.5.1 Company Review

9.5.5.2 SWOT Analysis

9.6 Transas Marine

9.6.1 Overview

9.6.2 Products and Services

9.6.3 Strategies and Insights

9.6.4 Developments

9.7 Northrop Grumman

9.7.1 Overview

9.7.2 Products and Services

9.7.3 Strategies and Insights

9.7.4 Developments

9.7.5 MNM View

9.7.5.1 Company Review

9.7.5.2 SWOT Analysis

9.8 Navionics

9.8.1 Overview

9.8.2 Products and Services

9.8.3 Strategies and Insights

9.8.4 Developments

9.9 Garmin

9.9.1 Overview

9.9.2 Products and Services

9.9.3 Strategies and Insights

9.9.4 Developments

9.9.5 MNM View

9.9.5.1 Company Review

9.9.5.2 SWOT Analysis

9.10 IIC Technologies

9.10.1 Overview

9.10.2 Products and Services

9.10.3 Strategies and Insights

9.10.4 Developments

List of Tables (62 Tables)

Table 1 General Assumptions, Terminologies, and Application Keynotes

Table 2 Key Secondary Resources

Table 3 Electronic Cartography Market, By Size, 2013–2020 ($ Million)

Table 4 EC Market Size, 2013-2020 ($ Million)

Table 5 EC Market Size, By Application, 2013-2020 ($ Million)

Table 6 EC Marine Market Size, By Application, 2013-2020 ($ Million)

Table 7 EC Aviation Market Size, By Application, 2013-2020 ($ Million)

Table 8 EC Marine (Commercial) Market Size, By Components, 2013-2020 ($ Million)

Table 9 EC Marine (Commercial) Market Size, By Systems, 2013-2020 ($ Million)

Table 10 EC Marine (Commercial) Market Size, By Charts, 2013-2020 ($ Million)

Table 11 EC Aviation Market Size, By Components, 2013-2020 ($ Million)

Table 12 EC Aviation Market Size, By Charts, 2013-2020 ($ Million)

Table 13 EC Aviation Market Size, By Systems, 2013-2020 ($ Million)

Table 14 EC Market Size, By Geography, 2013-2020 ($ Million)

Table 15 North America: Electronic Cartography Market Size, 2013-2020 ($ Million)

Table 16 North America: Marine Market Size, By Application, 2013-2020 ($ Million)

Table 17 North America: Aviation Market Size, By Application, 2013-2020 ($ Million)

Table 18 APAC: Electronic Cartography Market Size, 2013-2020 ($ Million)

Table 19 APAC: Marine Market Size, By Application, 2013-2020 ($ Million)

Table 20 APAC: Aviation Market Size, By Application, 2013-2020 ($ Million)

Table 21 Middle East: Electronic Cartography Market Size, 2013-2020 ($ Million)

Table 22 Middle East: Marine Market Size, By Application, 2013-2020 ($ Million)

Table 23 Middle East: Aviation Market Size, By Application, 2013-2020 ($ Million)

Table 24 Europe: Electronic Cartography Market Size, 2013-2020 ($ Million)

Table 25 Europe: Marine Market Size, By Application, 2013-2020 ($ Million)

Table 26 Europe: Aviation Market Size, By Application, 2013-2020 ($ Million)

Table 27 Africa: Electronic Cartography Market Size, 2013-2020 ($ Million)

Table 28 Africa: Marine Market Size, By Application, 2013-2020 ($ Million)

Table 29 Africa: Aviation Market Size, By Application, 2013-2020 ($ Million)

Table 30 Latin America: Electronic Cartography Market Size, 2013-2020 ($ Million)

Table 31 Latin America: Marine Market Size, By Application, 2013-2020 ($ Million)

Table 32 Latin America: Aviation Market Size, By Application, 2013-2020 ($ Million)

Table 33 U.S.: Electronic Cartography Market Size, 2013-2020 ($ Million)

Table 34 U.S.: Marine Market Size, 2013-2020 ($ Million)

Table 35 U.S.: Aviation Market Size, 2013-2020 ($ Million)

Table 36 Russia: Electronic Cartography Market Size, 2013-2020 ($ Million)

Table 37 Russia: Marine Market Size, 2013-2020 ($ Million)

Table 38 Russia: Aviation Market Size, 2013-2020 ($ Million)

Table 39 China: Electronic Cartography Market Size, 2013-2020 ($ Million)

Table 40 China: Marine Market Size, 2013-2020 ($ Million)

Table 41 China: Aviation Market Size, 2013-2020 ($ Million)

Table 42 Japan: Electronic Cartography Market Size, 2013-2020 ($ Million)

Table 43 Japan: Marine Market Size, 2013-2020 ($ Million)

Table 44 Japan: Aviation Market Size, 2013-2020 ($ Million)

Table 45 India: Electronic Cartography Market Size, 2013-2020 ($ Million)

Table 46 India: Marine Market Size, 2013-2020 ($ Million)

Table 47 India: Aviation Market Size, 2013-2020 ($ Million)

Table 48 Australia: Electronic Cartography Market Size, 2013-2020 ($ Million)

Table 49 Australia: Marine Market Size, 2013-2020 ($ Million)

Table 50 Australia: Aviation Market Size, 2013-2020 ($ Million)

Table 51 U.K.: Electronic Cartography Market Size, 2013-2020 ($ Million)

Table 52 U.K.: Marine Market Size, 2013-2020 ($ Million)

Table 53 U.K.: Aviation Market Size, 2013-2020 ($ Million)

Table 54 Germany: Electronic Cartography Market Size, 2013-2020 ($ Million)

Table 55 Germany: Marine Market Size, 2013-2020 ($ Million)

Table 56 Germany: Aviation Market Size, 2013-2020 ($ Million)

Table 57 France: Electronic Cartography Market Size, 2013-2020 ($ Million)

Table 58 France: Marine Market Size, 2013-2020 ($ Million)

Table 59 France: Aviation Market Size, 2013-2020 ($ Million)

Table 60 Brazil: Electronic Cartography Market Size, 2013-2020 ($ Million)

Table 61 Brazil: Marine Market Size, 2013-2020 ($ Million)

Table 62 Brazil: Aviation Market Size, 2013-2020 ($ Million)

List of Figures (53 Figures)

Figure 1 Electronic Cartography Marine Market

Figure 2 EC Aviation Market

Figure 3 EC Marine Market Stakeholders

Figure 4 EC Aviation Market

Figure 5 Market Research Methodology

Figure 6 Electronic Cartography Market: Market Size Estimation

Figure 7 EC Market: Data Triangulation

Figure 8 Drivers and Restraints of EC Marine Market

Figure 9 Impact Analysis For Drivers

Figure 10 Impact Analysis For Restraints

Figure 11 Drivers and Restraints of EC Aviation Market

Figure 12 Impact Analysis For Drivers

Figure 13 Impact Analysis For Restraints

Figure 14 Electronic Cartography Market: Technology Roadmap

Figure 15 Segmentation of EC Market, By Application

Figure 16 EC Market Size, By Application, 2013-2020

Figure 17 EC Marine Market, By Application, 2013-2020

Figure 18 EC Aviation Market, By Application, 2013-2020

Figure 19 Segmentation of Electronic Cartography Market, By Components

Figure 20 EC Marine (Commercial) Market, By Components, 2013-2020

Figure 21 EC Marine (Commercial) Market, By Ecdis Systems, 2013-2020

Figure 22 EC Marine (Commercial) Market, By Rcds Systems, 2013-2020

Figure 23 EC Marine (Commercial) Market, By Pays Licensing Mode For Charts, 2013-2020

Figure 24 EC Marine (Commercial) Market, By Direct Licensing Mode For Charts, 2013-2020

Figure 25 Electronic Cartography Aviation Market, By Systems, 2013-2020

Figure 26 EC Market, By Geography, 2013-2020

Figure 27 North America: Electronic Cartography Marine Market, By Application, 2013-2020

Figure 28 North America: EC Aviation Market, By Application, 2013-2020

Figure 29 APAC: Electronic Cartography Marine Market, By Application, 2013-2020

Figure 30 APAC: EC Aviation Market, By Application, 2013-2020

Figure 31 Middle East: Electronic Cartography Marine Market, By Application, 2013-2020

Figure 32 Middle East: EC Aviation Market, By Application, 2013-2020

Figure 33 Europe: Electronic Cartography Marine Market, By Application, 2013-2020

Figure 34 Europe: EC Aviation Market, By Application, 2013-2020

Figure 35 Africa: Electronic Cartography Marine Market, By Application, 2013-2020

Figure 36 Africa: EC Aviation Market, By Application, 2013-2020

Figure 37 Latin America: Electronic Cartography Marine Market, By Application, 2013-2020

Figure 38 Latin America: EC Aviation Market, By Application, 2013-2020

Figure 39 Regional Percentage Split of Electronic Cartography Market, 2014

Figure 40 Country Wise Percentage Split of EC Market, 2014

Figure 41 Electronic Cartography Market: Market Share Analysis, By Company

Figure 42 Honeywell Inc.: Company Snapshot

Figure 43 Honeywell Inc.: SWOT Analysis

Figure 44 Thales: Company Snapshot

Figure 45 Thales: SWOT Analysis

Figure 46 Jeppesen: Company Snapshot

Figure 47 Jeppesen: SWOT Analysis

Figure 48 Rockwell Collins: Company Snapshot

Figure 49 Rockwell Collins: SWOT Analysis

Figure 50 Northrop Grumman: Company Snapshot

Figure 51 Northrop Grumman: SWOT Analysis

Figure 52 Garmin: Company Snapshot

Figure 53 Garmin: SWOT Analysis

Growth opportunities and latent adjacency in Electronic Cartographic (Marine) Market

We design, develop, produce, and commercialize maps and charts for the outdoors. We need to know more about the market dynamics, growth potential, as well as the competitive landscape. Thank you.