Automatic Identification System Market by Class (Class A, Class B, & AIS Base Stations), Platform (Vessel-Based, and Onshore-Based), Application (Fleet Management, Vessels Tracking, Maritime Security, Other Applications), and Geography - Global Forecasts & Analysis 2025–2036

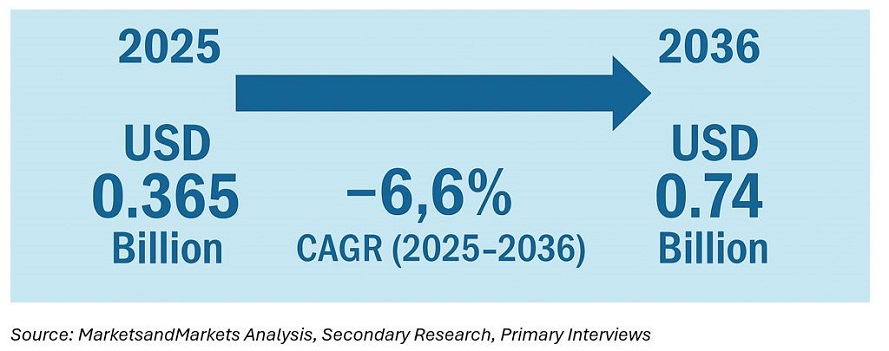

The automatic identification system market continues to expand as maritime regulators reinforce carriage requirements, satellite operators close historical coverage gaps, and port authorities lean on AIS data for safety, capacity, and emissions initiatives. Using 2025 as the base, the automatic identification system market is estimated at about USD 0.365 billion and is projected to reach approximately USD 0.74 billion by 2036, implying a ~6.6% CAGR (2025–2036). The starting point reflects a midpoint across recent public pages that cluster around USD 310–410 million for 2025; the growth rate aligns with the ~6–7% to 2030, while the forecast extends to 2036.

In recent years, adoption has been driven by three overlapping forces. First, regulatory compliance: Class A carriage under SOLAS remains the backbone for commercial ships, while Class B equipage expands among fishing and workboats; national authorities such as the USCG specify which vessels must carry a Type-approved Class A AIS. Second, satellite AIS (S-AIS) has matured, enabling global tracking and data fusion with terrestrial networks, which matters for high-latitudes and blue-water routes. Third, the transition from basic AIS messaging to VDES (AIS 2.0) is underway, adding two-way VHF data channels and opening room for richer e-Navigation services at sea and in ports. Collectively these forces sustain a durable mid-single-digit growth path while increasing the software and data value layered over the transponder sale.

Market definition and regulatory Framework

For this page, the automatic identification system market covers shipborne transponders (Class A and Class B), AIS receivers/antennas, Aids-to-Navigation (AtoN) and base-station equipment, terrestrial and satellite AIS data services, and operational software/analytics used by ports, VTS centers, fleet operators, and maritime authorities. Class definitions and onboard operational guidance are codified by the IMO; the USCG maintains national carriage and equipment approval requirements; the ITU/IALA documents the technical evolution into VDES, which protects AIS channels while adding VHF data exchange capacity. These references underpin most procurement and certification decisions globally. (wwwcdn.imo.org)

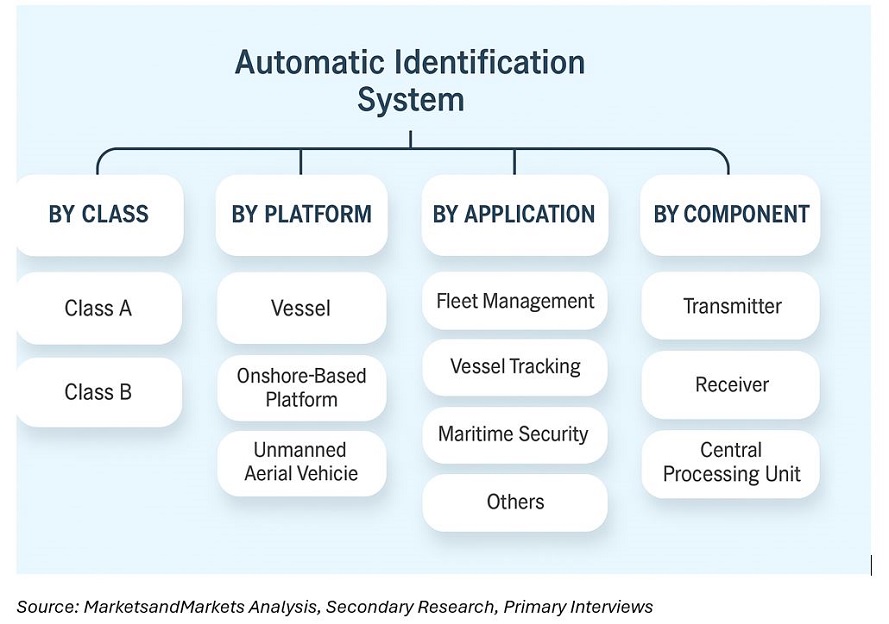

Segmentation analysis

By component, the market spans shipborne transponders and receivers, ancillary antennas and power/UPS, AtoN and base-station gear for coastal and port networks, and the rapidly growing layer of software and data services that ingest AIS/S-AIS feeds for traffic, risk, and environmental use cases. Hardware remains the largest absolute revenue pool today, yet software and analytics are expanding faster as authorities monetize situational awareness and compliance dashboards. Evidence from operator portfolios shows steady shipments of Class A/IIIB units and rising subscriptions for fused terrestrial/satellite feeds.

By class and link, Class A systems dominate value on SOLAS vessels operating internationally, while Class B provides smaller craft and workboats with visibility and collision-avoidance functions absent mandatory carriage. AtoN and base-stations remain crucial for coastal coverage and message relays, and S-AIS increases reach across oceans, fjords, and polar tracks where terrestrial towers are sparse. The VDES layer will add two-way VHF data channels—initially complementing AIS and gradually enabling e-Navigation services—without displacing the core collision-avoidance role of AIS.

By application, fleet operators use AIS data for voyage safety and anti-collision, compliance and security monitoring, VTS/port call optimization, fishing activity tracking, and environmental surveillance. Ports and maritime authorities rely on fused feeds for congestion management, anchorage control, and incident response; satellite providers market AIS for open-ocean domain awareness and search-and-rescue support where line-of-sight towers cannot reach. Public trackers and authority briefs show these use cases scaling in tandem with trade growth and with analytics that detect risky behavior such as spoofing or dark activity.

By end-user, commercial shipping retains the largest installed base; fishing and offshore services continue to equip for safety and traceability; coast guards and navies integrate AIS into multi-sensor maritime domain awareness; and ports/VTS authorities remain recurring buyers of base-stations, AtoN units, and software, often funded under modernization or resilience programs. The mix varies by region: Asia’s cargo hubs emphasize throughput visibility; Europe layers AIS into emissions and safety corridors; North America continues steady replacements driven by compliance and analytics upgrades.

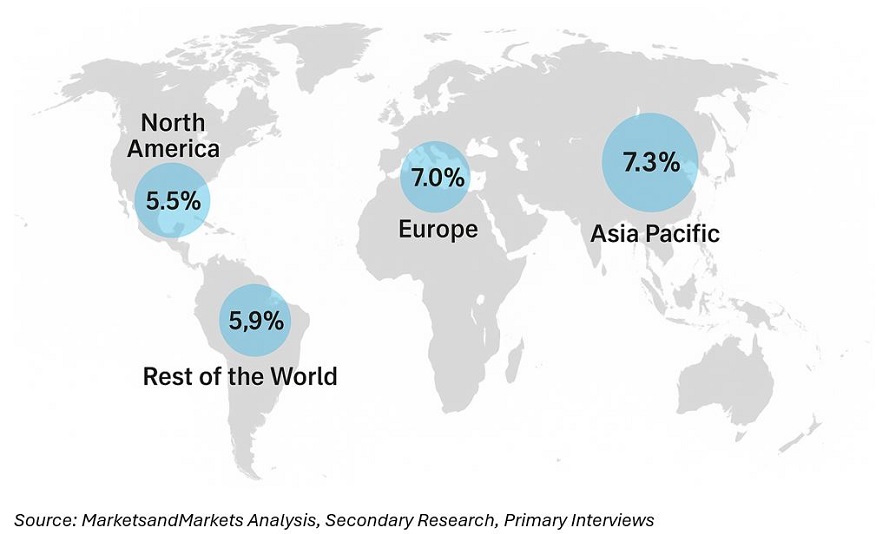

Regional outlook

North America maintains a high share on the strength of stringent carriage enforcement, resilient coastal networks, and a large commercial fleet; procurement is steady and replacement-led. Europe shows balanced growth, pairing safety with environmental and security use cases; regional initiatives sustain base-station and analytics demand from the North Sea to the Med. Asia–Pacific is the fastest-growing region, reflecting container-hub density, fishing-fleet equipage, and coastal coverage expansion from India through ASEAN into North Asia; S-AIS fills blue-water gaps across extensive trade lanes. Latin America and Middle East & Africa continue to add AtoN/base-stations at primary gateways and build out coastal chains to feed VTS and coast-guard centers; satellite data offers an efficient path to wide-area awareness over long coastlines.

Competitive landscape

The automatic identification system market blends established marine-electronics suppliers with satellite-data specialists and focused OEMs. Saab TransponderTech and KONGSBERG supply shipborne/Class A and coastal systems into civil and defence programs; SRT Marine and Alltek Marine (AMEC) remain visible in global AIS transponders; Furuno, Jotron, ComNav, Garmin (following its Vesper acquisition) and McMurdo/Orolia address segments across commercial and leisure; satellite AIS is anchored by ORBCOMM and Spire (which absorbed exactEarth) with analytics partners and value-added resellers serving ports and authorities. Early VDES activity—documented by IALA/VDES Alliance updates—shows vendors preparing two-way data services that complement AIS rather than replace it.

Sustainability box

AIS-enabled visibility supports fuel- and time-saving port calls, anchorage optimization, and route compliance that reduce unnecessary loitering and emissions. As satellite coverage and analytics improve, authorities can detect and deter behaviors that threaten safety, fisheries, and marine ecosystems, while shipowners use historical AIS data to benchmark carbon-intensity indicators (CII) and improve fleet scheduling. The emerging VDES layer creates capacity for targeted messages—ice charts, environmental advisories, e-Navigation updates—that further cut avoidable miles and waiting time.

Outlook and Key Statistics

2025: ~USD 0.365 billion

2036: ~USD 0.74 billion

CAGR (2025–2036): ~6.6%

FAQs

What is the role of AIS vs VDES? AIS remains the universal collision-avoidance and identification layer carried by SOLAS ships; VDES extends AIS with two-way VHF data channels for e-Navigation and value-added services. Near-term deployments complement AIS rather than displace it.

Which classes are growing fastest?

Class A anchors revenue due to mandatory carriage on larger commercial vessels; Class B expands fastest by unit count across fishing, workboats, and leisure, particularly where national programs incentivize equipage. Regulatory guidance distinguishes capabilities and use contexts clearly.

Where does satellite AIS fit?

S-AIS closes open-ocean gaps and blends with terrestrial networks to give ports, coast guards, and shippers end-to-end visibility. Growth tracks LEO constellation upgrades and analytics demand for domain awareness and compliance.

Who are representative vendors today?

Saab, KONGSBERG, SRT Marine, AMEC, and Furuno/Jotron/ComNav/Garmin lead device supply; ORBCOMM and Spire drive satellite AIS and data services; several firms in the VDES Alliance are preparing two-way data offerings.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Study Scope

1.2.1 Geographic Scope

1.2.2 Markets Covered

1.2.3 Periodization Considered for the AIS Market

1.3 Currency & Pricing Considered for the AIS Market

1.4 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Demand-Side Analysis

2.2.1.1 Growth of World Merchant Fleet

2.2.1.2 Piracy Operations on Major Sea Routes

2.2.2 Supply-Side Indicators

2.2.2.1 Advancement in Marine Navigation Technology

2.2.2.2 AIS Reducing Marine Hazards

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the AIS Market

4.2 Automatic Identification System Market Growth, By Region

4.3 Automatic Identification System Market: Emerging vs. Matured Economies

4.4 Life Cycle Analysis, By Region, 2014

4.5 European AIS Market, 2014

5 Market Overview (Page No. - 33)

5.1 Automatic Identification System Market Definition

5.2 Automatic Identification System Market Segmentation

5.3 AIS Market Dynamics

5.3.1 Drivers

5.3.1.1 Better Navigation and Maritime Traffic Management

5.3.1.2 Enhanced Coastal Surveillance

5.3.2 Restraint

5.3.2.1 Range and Reporting Capabilities (Vessel and Onshore Application)

5.3.3 Opportunitie

5.3.3.1 Increasing Government Involvement

5.3.4 Challenge

5.3.4.1 AIS Data Manipulation Practices (AIS Cyber Security)

6 Industry Trends (Page No. - 38)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.4 Porter’s Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

6.5 Technology Trends

7 AIS Market Analysis, By Class (Page No. - 44)

7.1 Introduction

7.1.1 Class A AIS

7.1.2 Class B AIS

7.1.3 AIS Base Stations

8 AIS Market Analysis, By Platform (Page No. - 48)

8.1 Introduction

8.1.1 Vessel-Based Platform

8.1.2 Onshore-Based Platform

9 AIS Market Analysis, By Application (Page No. - 51)

9.1 Introduction

9.1.1 Fleet Management

9.1.2 Vessel Tracking

9.1.3 Maritime Security

9.1.4 Other Applications

10 Satellite AIS (S-AIS) (Page No. - 55)

10.1 Satellite AIS (SAIS)

11 Geographic Analysis (Page No. - 57)

11.1 Introduction

11.2 North America

11.2.1 North America: AIS Market Size, By Class

11.2.2 North America: AIS Market Size, By Platform

11.2.3 North America: AIS Market Size, By Application

11.2.4 U.S.

11.2.4.1 U.S.: AIS Market Size, By Class

11.2.4.2 U.S.: AIS Market Size, By Platform

11.2.4.3 U.S.: AIS Market Size, By Application

11.2.5 Canada

11.2.5.1 Canada: AIS Market Size, By Class

11.2.5.2 Canada: AIS Market Size, By Platform

11.2.5.3 Canada: AIS Market Size, By Application

11.3 Europe

11.3.1 Europe: AIS Market Size, By Country

11.3.2 Europe: AIS Market Size, By Class

11.3.3 Europe: AIS Market Size, By Platform

11.3.4 Europe: AIS Market Size, By Application

11.3.5 U.K.

11.3.5.1 U.K.: AIS Market Size, By Class

11.3.5.2 U.K.: AIS Market Size, By Platform

11.3.5.3 U.K.: AIS Market Size, By Application

11.3.6 Germany

11.3.6.1 Germany: AIS Market Size, By Class

11.3.6.2 Germany: AIS Market Size, By Platform

11.3.6.3 Germany: AIS Market Size, By Application

11.3.7 France

11.3.7.1 France: AIS Market Size, By Class

11.3.7.2 France: AIS Market Size, By Platform

11.3.7.3 France: AIS Market Size, By Application

11.3.8 Russia

11.3.8.1 Russia: AIS Market Size, By Class

11.3.8.2 Russia: AIS Market Size, By Platform

11.3.8.3 Russia: AIS Market Size, By Application

11.4 APAC

11.4.1 APAC: Automatic Identification System Market Size, By Country

11.4.2 APAC: AIS Market Size, By Class

11.4.3 APAC: AIS Market Size, By Platform

11.4.4 APAC: AIS Market Size, By Application

11.4.5 China

11.4.5.1 China: Automatic Identification System Market Size, By Class

11.4.5.2 China: AIS Market Size, By Platform

11.4.5.3 China: AIS Market Size, By Application

11.4.6 India

11.4.6.1 India: Automatic Identification System Market Size, By Class

11.4.6.2 India: AIS Market Size, By Platform

11.4.6.3 India: AIS Market Size, By Application

11.4.7 Japan

11.4.7.1 Japan: Automatic Identification System Market Size, By Class

11.4.7.2 Japan: AIS Market Size, By Platform

11.4.7.3 Japan: AIS Market Size, By Application

11.4.8 South Korea

11.4.8.1 South Korea: Automatic Identification System Market Size, By Class

11.4.8.2 South Korea: AIS Market Size, By Platform

11.4.8.3 South Korea: AIS Market Size, By Application

11.5 Middle East

11.5.1 Middle East: Automatic Identification System Market Size, By Country

11.5.2 Middle East: AIS Market Size, By Class

11.5.3 Middle East: AIS Market Size, By Platform

11.5.4 Middle East: AIS Market Size, Application

11.5.5 UAE

11.5.5.1 UAE: Automatic Identification System Market Size, By Class

11.5.5.2 UAE: AIS Market Size, By Platform

11.5.5.3 UAE: AIS Market Size, By Application

11.5.6 Saudi Arabia

11.5.6.1 Saudi Arabia: Automatic Identification System Market Size, By Class

11.5.6.2 Saudi Arabia: AIS Market Size, By Platform

11.5.6.3 Saudi Arabia: AIS Market Size, By Application

11.6 Rest of the World (RoW)

11.6.1 RoW: AIAutomatic Identification System Market Size, By Country

11.6.2 RoW: AIS Market, By Class

11.6.3 RoW: AIS Market Size, By Platform

11.6.4 RoW: AIS Market Size, By Application

11.6.5 Brazil

11.6.5.1 Brazil: Automatic Identification System Market Size, By Class

11.6.5.2 Brazil: AIS Market Size, By Platform

11.6.5.3 Brazil: AIS Market Size, By Application

11.6.6 South Africa

11.6.6.1 South Africa: Automatic Identification System Market Size, By Class

11.6.6.2 South Africa: AIS Market Size, By Platform

11.6.6.3 South Africa: AIS Market Size, By Application

12 Competitive Landscape (Page No. - 92)

12.1 Overview

12.2 Market Share Analysis, AIS Market

12.3 Competitive Scenario

12.4 Contracts

12.5 New Product Launches

12.6 Partnerships & Agreements

12.7 Other Developments

13 Company Profiles (Page No. - 97)

13.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

13.2 SAAB AB

13.3 Furuno Electric Co. Ltd.

13.4 Exactearth

13.5 Orbcomm Inc.

13.6 Kongsberg Gruppen ASA

13.7 L-3 Communication Holdings Inc.

13.8 Japan Radio Company Ltd.

13.9 True Heading AB

13.10 Garmin International

13.11 CNS Systems AB

13.12 Transas Marine Limited

13.13 Comnav Marine

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 119)

14.1 Discussion Guide

14.2 Introducing RT: Real-Time Market Intelligence

14.3 Available Customizations

14.4 Related Reports

List of Tables (107 Tables)

Table 1 Market Drivers

Table 2 Restraints

Table 3 Market Opportunity

Table 4 Challenges

Table 5 Automatic Identification System Market Size, Class A AIS By Region, 2012–2020 ($Million)

Table 6 AIS Market Size, Class B AIS By Region, 2012–2020 ($Million)

Table 7 Automatic Identification System Market Size, AIS Base Stations, By Region 2012-2020 ($Million)

Table 8 AIS Market Size, Vessel-Based Platform, By Region 2012-2020, ($Million)

Table 9 AIS Market Size, Onshore-Based Platform, By Region2012-2020, ($Million)

Table 10 AIS Market Size, Fleet Management Application, By Region, 2012-2020, ($Million)

Table 11 AIS Market Size, Vessel Tracking Application, By Region2012-2020, ($Million)

Table 12 AIS Market Size, Maritime Security Application, By Region 2012-2020, ($Million)

Table 13 AIS Market Size , Other Applications, By Region, 2012-2020, ($Million)

Table 14 Satellite-Based AIS Market, By Region 2012-2020, ($Million)

Table 15 Various Satellite Equipped With AIS Payloads

Table 16 Automatic Identification System Market Size, By Region, 2012–2020 ($Million)

Table 17 North America: AIS Market Size, By Class, 2012–2020 ($Million)

Table 18 North America: AIS Market Size, By Platform, 2012–2020 ($Million)

Table 19 North America: AIS Market Size, By Application, 2012–2020 ($Million)

Table 20 U.S.: Automatic Identification System Market Size, By Class, 2012–2020 ($Million)

Table 21 U.S.: AIS Market Size, By Platform, 2012–2020 ($Million)

Table 22 U.S.: AIS Market Size, By Application, 2012–2020 ($Million)

Table 23 Canada: Automatic Identification System Market Size, By Class, 2012–2020 ($Million)

Table 24 Canada: AIS Market Size, By Platform, 2012–2020 ($Million)

Table 25 Canada: AIS Market Size, By Application, 2012–2020 ($Million)

Table 26 Europe: AIS Market Size, By Country, 2012–2020 ($Million)

Table 27 Europe: AIS Market Size, By Class, 2012–2020 ($Million)

Table 28 Europe: AIS Market Size, By Platform, 2012–2020 ($Million)

Table 29 Europe: AIS Market Size, By Application, 2012–2020 ($Million)

Table 30 U.K.: Automatic Identification System Market Size, By Class, 2012–2020 ($Million)

Table 31 U.K.: AIS Market Size, By Platform, 2012–2020 ($Million)

Table 32 U.K.: AIS Market Size, By Application, 2012–2020 ($Million)

Table 33 Germany: Automatic Identification System Market Size, By Class, 2012–2020 ($Million)

Table 34 Germany: AIS Market Size, By Platform, 2012–2020 ($Million)

Table 35 Germany: AIS Market Size, By Application, 2014–2020 ($Million)

Table 36 France: AIS Market, By Class, 2012-2020, ($Million)

Table 37 France: AIS Market Size, By Platform, 2012-2020, ($Million)

Table 38 France: AIS Market Size, By Application, 2012-2020, ($Million)

Table 39 Russia: AIS Market Size, By Class, 2012–2020 ($Million)

Table 40 Russia: AIS Market Size, By Platform, 2012–2020 ($Million)

Table 41 Russia: AIS Market Size, By Application, 2012–2020 ($Million)

Table 42 APAC: AIS Market Size, By Country, 2012–2020 ($Million)

Table 43 APAC: AIS Market Size, By Class, 2012–2020 ($Million)

Table 44 APAC: AIS Market Size, By Platform, 2012–2020 ($Million)

Table 45 APAC: AIS Market Size, By Application, 2012–2020 ($Million)

Table 46 China: AIS Market Size, By Class, 2012–2020 ($Million)

Table 47 China: AIS Market Size, By Platform, 2012–2020 ($Million)

Table 48 China: AIS Market Size, By Application, 2012–2020 ($Million)

Table 49 India: AISMarket Size, By Class, 2012–2020 ($Million)

Table 50 India: AIS Market Size, By Platform, 2012–2020 ($Million)

Table 51 India: AIS Market Size, By Application, 2012–2020 ($Million)

Table 52 Japan: AIS Market Size, By Class, 2012–2020 ($Million)

Table 53 Japan: AIS Market Size, By Platform, 2012–2020 ($Million)

Table 54 Japan: AIS Market Size, By Application, 2012–2020 ($Million)

Table 55 South Korea: AIS Market Size, By Class, 2012-2020, ($Million)

Table 56 South Korea: AIS Market Size, By Platform, 2012-2020, ($Million)

Table 57 South Korea: AIS Market Size, By Application, 2012–2020 ($Million)

Table 58 Middle East: AIS Market Size, By Country, 2012–2020 ($Million)

Table 59 Middle East: AIS Market Size, By Class, 2012–2020 ($Million)

Table 60 Middle East: AIS Market Size, By Platform, 2012–2020($Million)

Table 61 Middle East: AIS Market Size, By Application, 2012–2020 ($Million)

Table 62 UAE: AIS Market Size, By Class, 2012–2020 ($Million)

Table 63 UAE: AIS Market Size, By Platform, 2014–2020 ($Million)

Table 64 UAE: AIS Market Size, By Application, 2014–2020 ($Million)

Table 65 Saudi Arabia: AIS Market Size, By Class, 2012–2020 ($Million)

Table 66 Saudi Arabia: AIS Market Size, By Platform, 2012–2020 ($Million)

Table 67 Saudi Arabia: AIS Market, By Application, 2012–2020 ($Million)

Table 68 RoW: AIS Market Size, By Country, 2012–2020 ($Million)

Table 69 RoW: AIS Market, By Class, 2012–2020 ($Million)

Table 70 RoW: AIS Market Size, By Platform, 2012–2020 ($Million)

Table 71 RoW: AIS Market Size, By Application, 2012–2020 ($Million)

Table 72 Brazil: AIS Market Size, By Class, 2012–2020 ($Million)

Table 73 Brazil: AIS Market Size, By Platform, 2014–2020 ($Million)

Table 74 Brazil: AIS Market Size, By Application, 2012–2020 ($Million)

Table 75 South Africa: AIS Market Size, By Class, 2012–2020 ($Million)

Table 76 South Africa: AIS Market Size, By Platform, 2012–2020 ($Million)

Table 77 South Africa: AIS Market Size, By Application, 2012–2020 ($Million)

Table 78 Contracts, 2013-2014

Table 79 New Product Launches, 2010-014

Table 80 Partnerships, Agreements, Joint Ventures & Collaborations,2012-2014

Table 81 Other Developments, 2013-2014

Table 82 SAAB AB: Products

Table 83 SAAB AB: Recent Developments. 2012

Table 84 Furuno Electric Co., Ltd.: Products

Table 85 Furuno Electric Company: Recent Developments, 2013

Table 86 Exactearth: Products

Table 87 Exactearth: Recent Developments, 2012-2014

Table 88 Orbcomm Inc: Products

Table 89 Orbcomm Inc: Recent Developments, 2014

Table 90 Kongsberg Gruppen: Products

Table 91 Kongsberg Gruppen: Recent Developments, 2014

Table 92 L-3 Communication Holdings Ltd: Products

Table 93 L-3 Communication Holdings Ltd: Recent Developments

Table 94 Japan Radio Company Ltd: Products

Table 95 Japan Radio Company Ltd.: Recent Developments

Table 96 True Heading: Products

Table 97 True Headings: Recent Developments

Table 98 Garmin International: Products

Table 99 Garmin International: Recent Developments

Table 100 CNS Systems: Products

Table 101 Transas Marine: Products

Table 102 Transas Marine: Recent Developments

Table 103 Comnav Marine: Products

Table 104 Percentage Share AIS Market, By AIS Class (2014-2020)

Table 105 Percentage Share AIS Market, By Platform (2014-2020)

Table 106 Table 3:- Percentage Share AIS Market, By Application (2014-2020)

Table 107 Percentage Share AIS Market, By Region

List of Figures (45 Figures)

Figure 1 Global AIS Market Classification

Figure 2 AIS Market: Research Design

Figure 3 World Merchant Fleet, 2011–2014 (Units)

Figure 4 World Seaborne Trade, 2006 – 2010

Figure 5 Piracy Operations Major Sea Routes, 2006–2010

Figure 6 Advancements in Marine Navigation Technology

Figure 7 Marine Hazards, 2002–2013

Figure 8 Bottom-Up Approach

Figure 9 Top-Down Approach

Figure 10 Assumptions & Limitations

Figure 11 AIS Market Share, By Region, 2014

Figure 12 AIS Market Size, By Region, 2012–2020 ($Million)

Figure 13 AIS Market Size, By Class, 2012–2020 ($Million)

Figure 14 AIS Market Size, By Platform, 2012–2020 ($Million)

Figure 15 AIS Market Size, By Application, 2012–2020 ($Million)

Figure 16 Rise in Market Opportunities for AIS, 2014–2020

Figure 17 APAC: Fastest-Growing AIS Market

Figure 18 Emerging Economies are Projected to Dominate the Growth of the AIS Market

Figure 19 Middle East & Asia-Pacific: Emerging Markets

Figure 20 AIS Market Segmentation

Figure 21 Value Chain Analysis (2014): Major Value is Added During Production & Assembly Phase of the AIS Manufacturing

Figure 22 Supply Chain Analysis: AIS Market

Figure 23 Porter’s Five Forces Analysis

Figure 24 Satellite-Based AIS Layout

Figure 25 Geographic Snapshot: AIS Market, 2014–2020

Figure 26 North America: U.S. & Canada’s Growing Interest in the Artic Will Push AIS Market

Figure 27 Europe: Home to Major Shipbuilding and Shipping Companies of Western World

Figure 28 APAC: Increased Investments on Maritime Sector Developments By Major Emerging Economies

Figure 29 Middle East: Determined Maritime Development Projects Will Fuel the Growth of AIS Market

Figure 30 Companies Adopted New Product Launches and Collaborations as the Key Growth Strategy Over the Last Four Years

Figure 31 AIS Market Share, By Key Players, 2013

Figure 32 AIS Market Share: New Product Launch Was the Key Strategy Adopted By Market Players, 2011–2014

Figure 33 Geographic Revenue Mix of Top 4 Market Players

Figure 34 SAAB AB: Company Snapshot

Figure 35 SAAB AB: SWOT Analysis

Figure 36 Furuno Electric Co. Ltd.: Company Snapshot

Figure 37 Furuno Electric Co. Ltd.: SWOT Analysis

Figure 38 Orbcomm Inc.: Company Snapshot

Figure 39 Orbcomm Inc.: SWOT Analysis

Figure 40 Kongsberg Gruppen ASA: Company Snapshot

Figure 41 Kongsberg Gruppen: SWOT Analysis

Figure 42 L-3 Communications Holdings: Company Snapshot

Figure 43 L-3 Communication Holdings Ltd: SWOT Analysis

Figure 44 .Japan Radio Company Ltd.: Company Snapshot

Figure 45 True Heading AB: Company Snapshot

Growth opportunities and latent adjacency in Automatic Identification System Market